Allergan plc

Latest Allergan plc News and Updates

Teva Can Benefit by Acquiring Allergan Generics

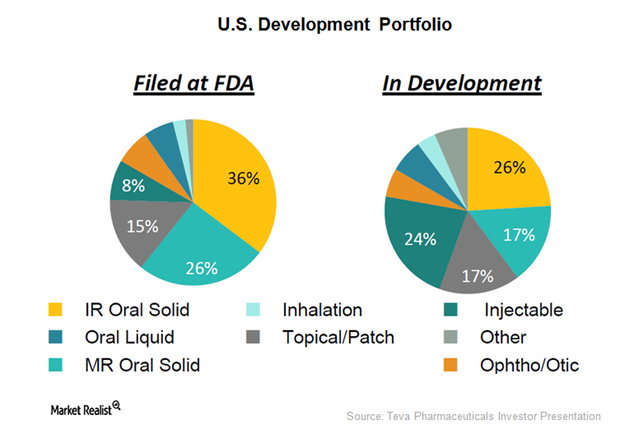

The combined Teva–Allergan generics entity should have approximately 320 Abbreviated New Drug Applications (or ANDAs), including 110 first-to-file ANDAs (or FTF) in the US.

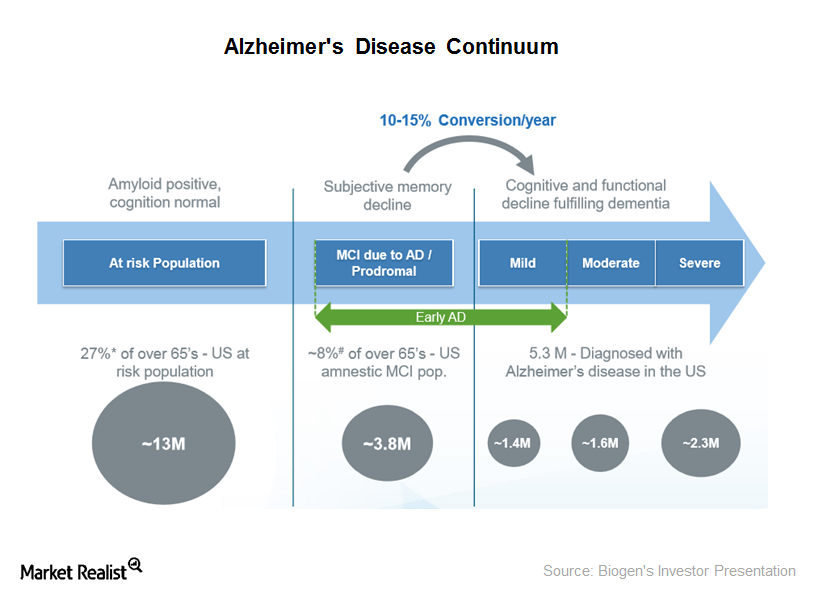

Biogen’s Experimental Alzheimer Therapy: Limited 2Q15 Success

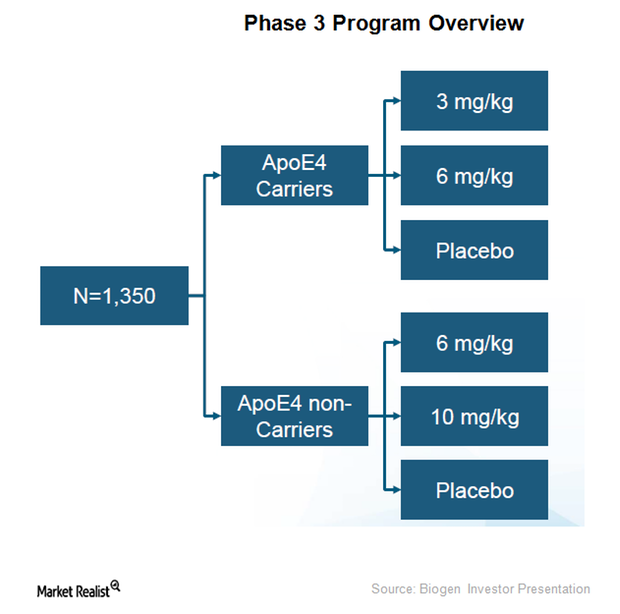

On July 22, 2015, Biogen (BIIB) released data from a Phase 1b study, also called the PRIME Study, that looked at the effectiveness of its investigational Alzheimer’s drug, BIIB037.

Teva Pharmaceutical: Earnings Trends and Recent Developments

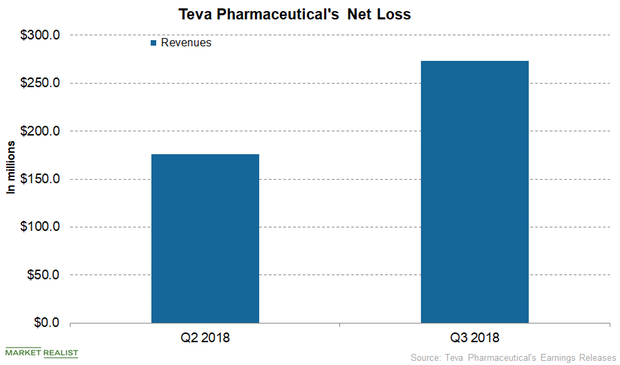

Teva Pharmaceutical’s net income and diluted EPS in the first nine months of 2018 amounted to $541.0 million and $0.53, respectively.Healthcare Farallon Capital adds a new position in Covidien

Ireland-based Covidien is a global healthcare leader that offers innovative medical technology solutions and patient care products to providers.

Why Pershing Square initiated a position in Platform Specialty Products

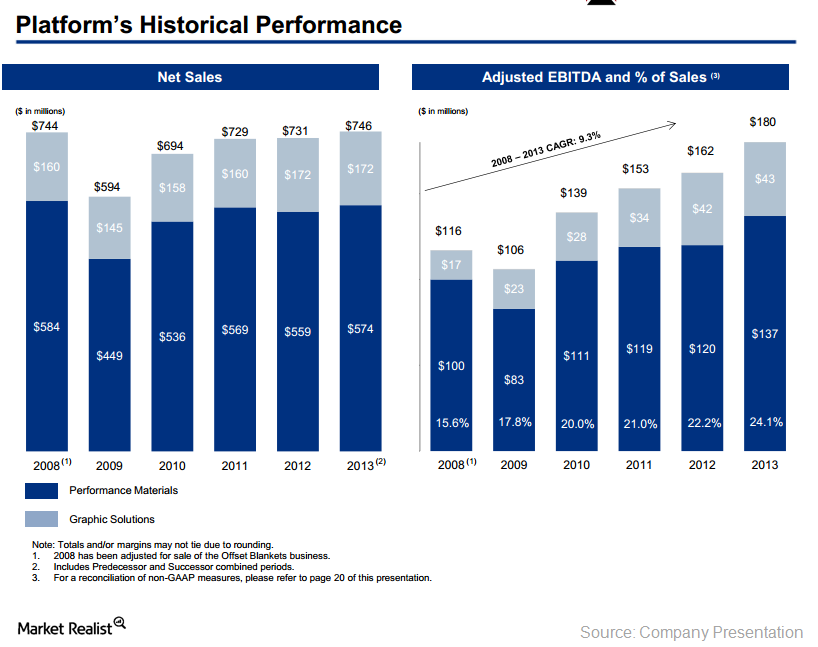

Pershing Square disclosed a new position in Platform Specialty Products (PAH) that accounts for 7.58% of Pershing Square’s 1Q14 portfolio.

This Space Presents a Market Opportunity for Valeant

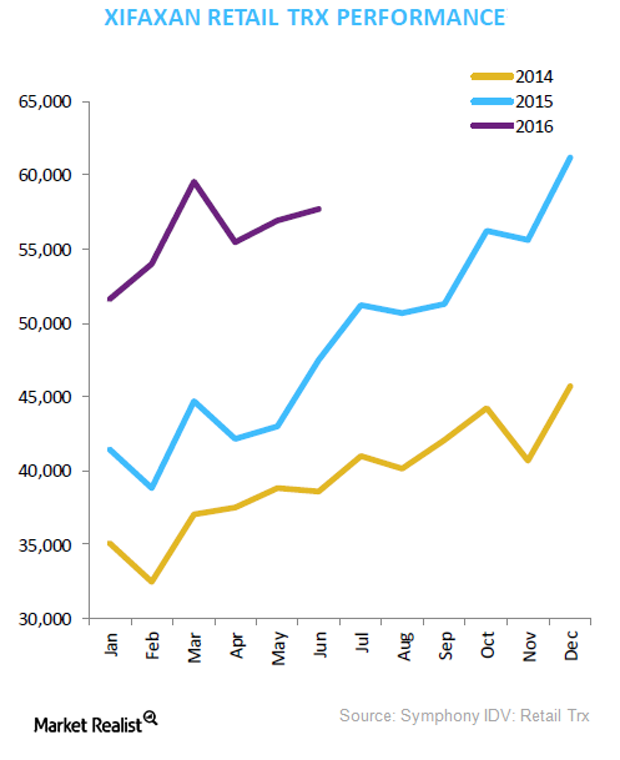

In Valeant’s 2Q16 earnings, Xifaxan reported a year-over-year (or YoY) increase in monthly prescriptions of about 28.0%.

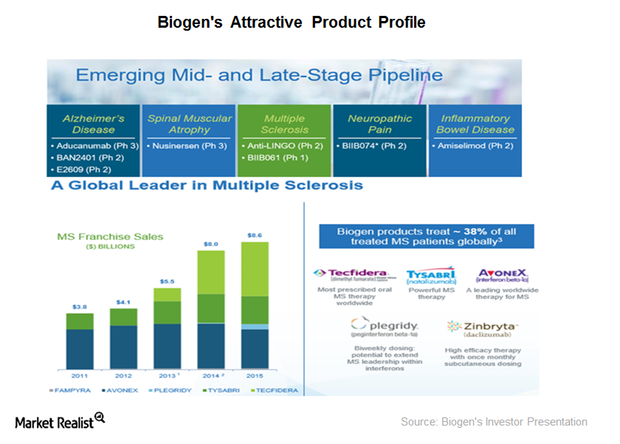

What’s behind Biogen Buyout Rumors?

Since early August 2016, there have been rumors of a likely buyout of Biogen (BIIB) by one of the many interested suitors in the biotechnology industry.

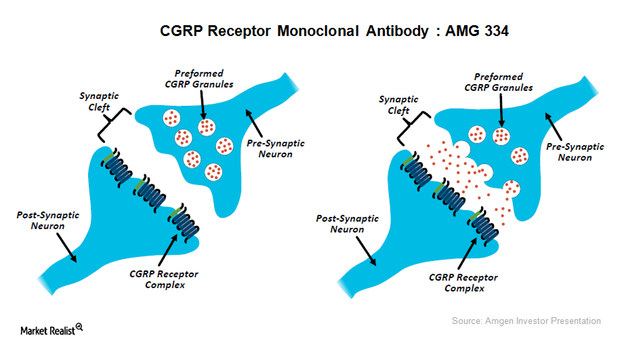

Entering Migraine Market Won’t Be Easy for Novartis, Amgen

Novartis (NVS) and Amgen (AMGN) recently announced that the CGRP inhibitor therapy, AMG 334, reported positive results in a Phase 2 clinical trial as a therapy for preventing chronic migraine.

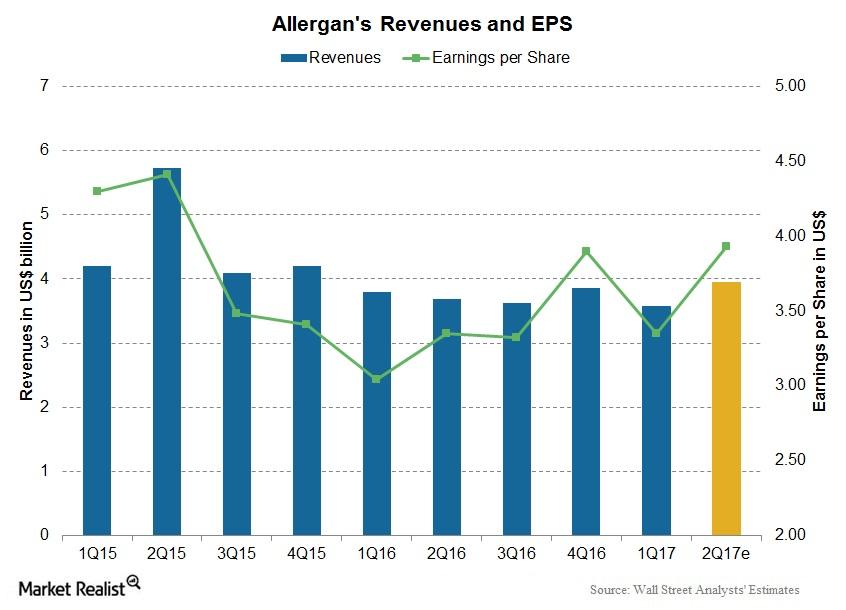

Allergan’s 1Q18 Earnings: Analysts’ Estimates

Allergan (AGN) plans to release its 1Q18 earnings on April 30. Wall Street expect AGN’s earnings per share to reach $3.36.

An Easier Way to Understand the Pharma Industry

In 2018, the global pharmaceutical industry stood at $1.2 trillion, and experts expect $1.5 trillion by 2023. Here’s everything investors need to know.

Bill Gross: Top Stock Picks with High Dividend Yields

On October 18, CNBC reported Bill Gross top picks. His top stock picks were Annaly Capital (NLY), Invesco (IVZ) and Allergan (AGN).

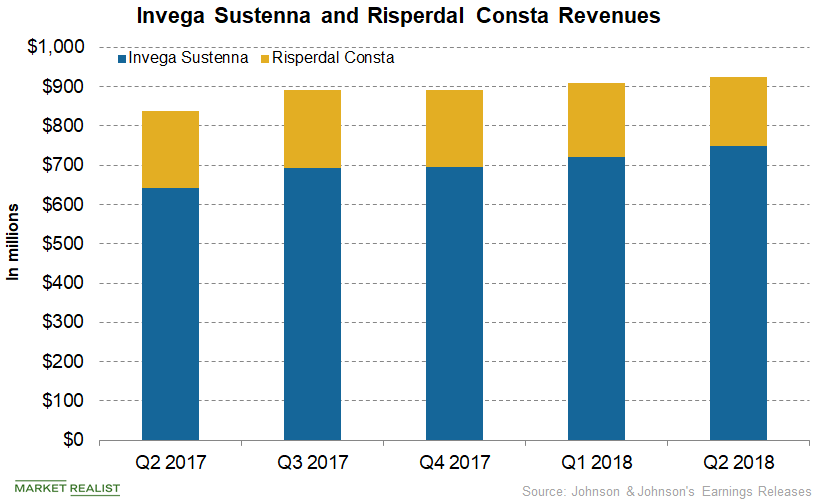

How JNJ’s Invega Sustenna and Risperdal Consta Performed

Johnson & Johnson’s (JNJ) Invega Sustenna, Xeplion, Trinza, and Trevicta combined witnessed solid growth in the third quarter.

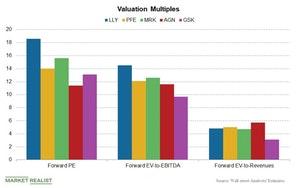

Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

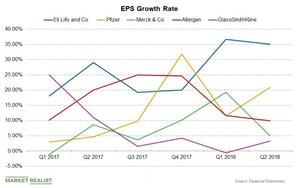

A Review of Pharma Stocks’ EPS Growth Rates

In this article, we’ll compare the EPS growth rates of Eli Lilly (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

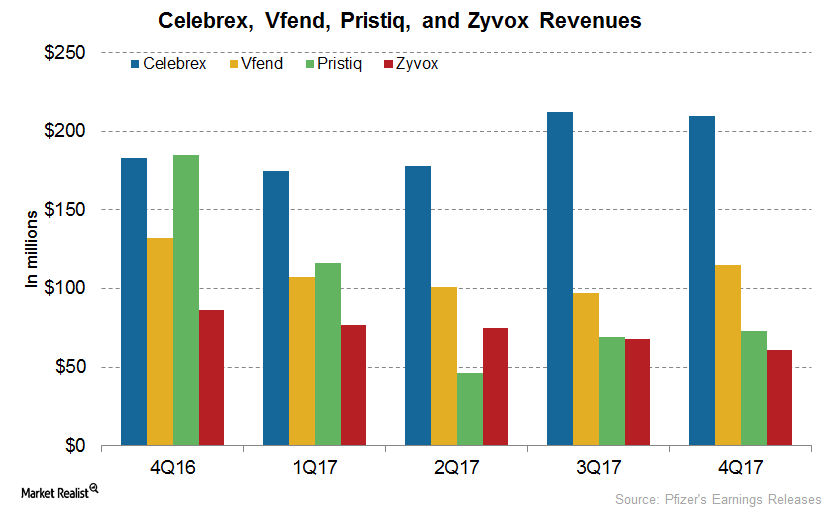

How Pfizer’s Peri-LOE Products Performed in 2017

Pfizer’s (PFE) Peri-LOE products refer to those products that lost patient protection recently or are expected to lose patient protection soon.

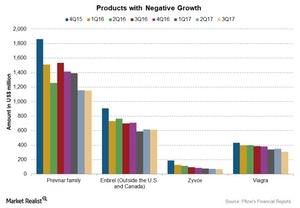

Pfizer’s 4Q17 Estimates: Products with Lower Sales

In Pfizer’s (PFE) portfolio, a few of the products reported a lower sales trend due to competition from other products in the markets.

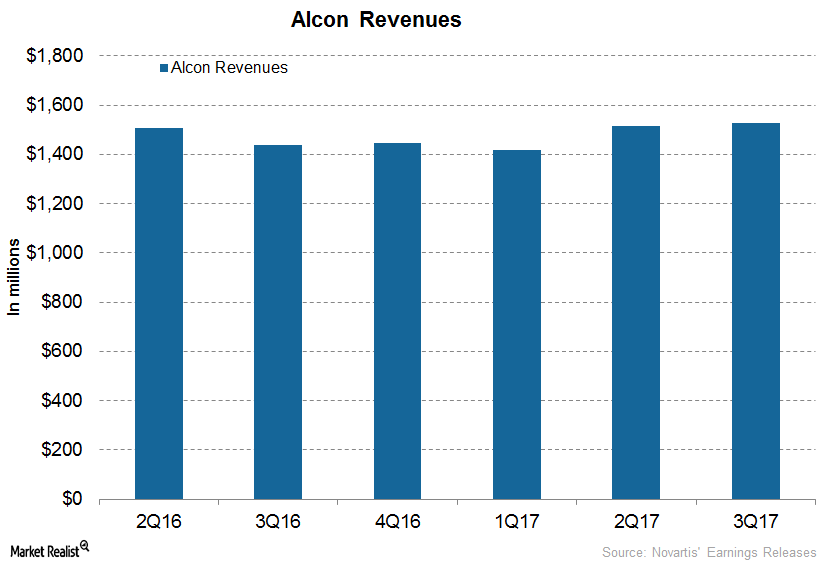

What to Expect for Novartis’s Subsidiary Alcon in 2018

In 1Q17, 2Q17, and 3Q17, Novartis’s (NVS) subsidiary Alcon generated revenues of $1.4 billion, $1.5 billion, and $1.5 billion, respectively.

Johnson & Johnson’s Revenue Estimates for 4Q17

Johnson & Johnson’s (JNJ) Pharmaceutical segment contributes more than 45% to total revenues. In 4Q17, it’s expected to report growth in operating revenues.

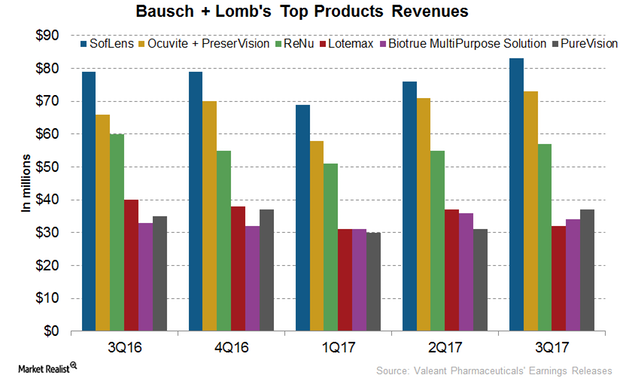

How Did Bausch + Lomb’s Top Products Perform in 3Q17?

In 3Q17, Valeant Pharmaceuticals’ Bausch + Lomb’s Soflens generated revenues of $83 million, which was ~5% higher on a YoY basis and ~9% higher QoQ.

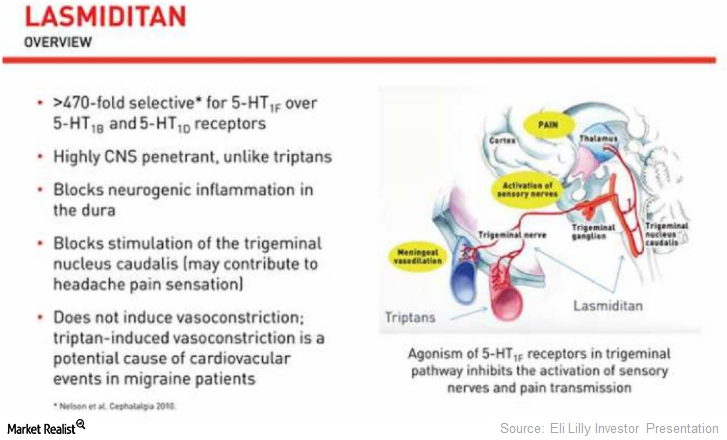

What Will Help Eli Lilly Build a Stronger Migraine Portfolio?

In September, Eli Lilly presented the results of its phase-3 Spartan trial, in which Lasmiditan demonstrated significant progress in the treatment of migraines.

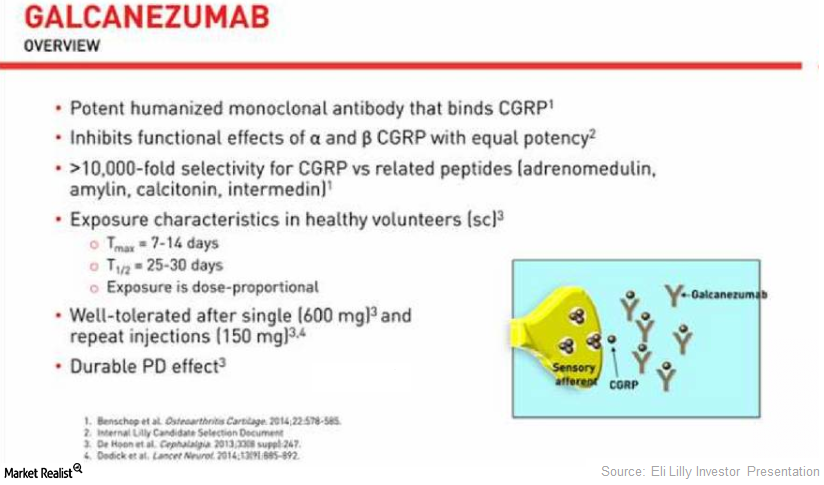

This Could Be Eli Lilly’s Long-Term Growth Driver

In September 2017, Eli Lilly announced that a 12-month open-label study showed a positive safety and tolerability profile of Galcanezumab for migraines.

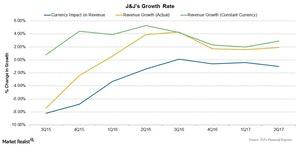

These Factors Affected Johnson & Johnson’s Revenues in 2Q17

Johnson & Johnson (JNJ) reported a 2.9% increase in its revenues at constant exchange rates in 2Q17.

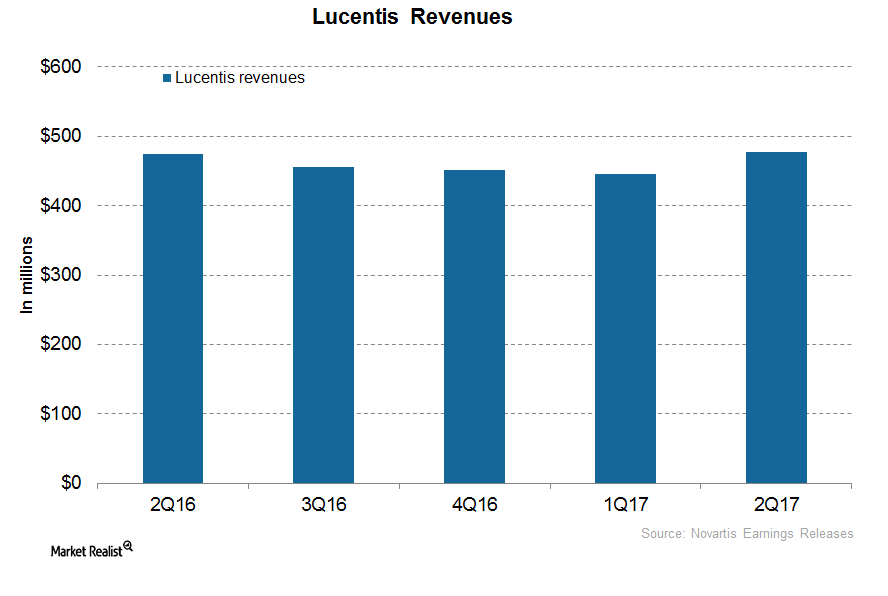

How Is Novartis’s Lucentis Positioned after 1H17?

In 1H17, Novartis’s (NVS) Lucentis reported revenues of around $922 million, which is a ~1% decline on a year-over-year (or YoY) basis.

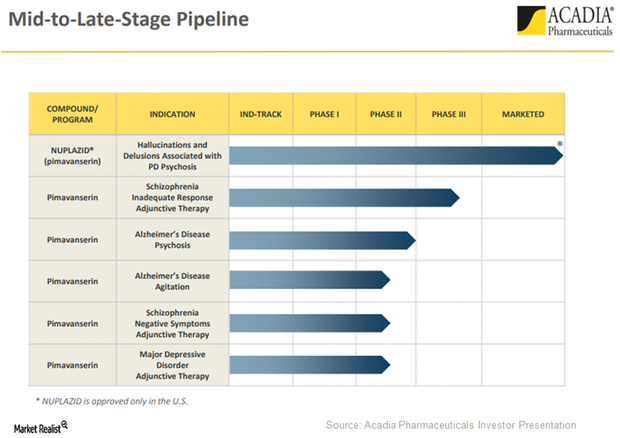

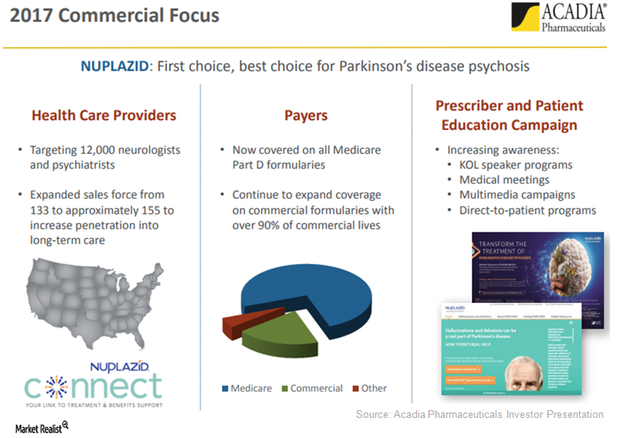

Nuplazid for Long-Term Care: Revenue Driver for Acadia?

Acadia Pharmaceuticals (ACAD) plans to focus on long-term care (or LTC) facilities to boost Nuplazid’s adoption in the Parkinson’s disease (or PD) psychosis indication.

Nuplazid Sees Increasing Physician Intent to Prescribe in 2017

Acadia Pharmaceuticals’ (ACAD) commercial teams have been carrying out promotional efforts to create awareness for Nuplazid among physicians with the intent to have them prescribe the drug.

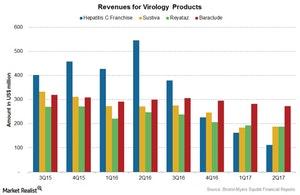

Bristol-Myers Squibb’s Virology Products in 2Q17

Bristol-Myers Squibb’s (BMY) virology products portfolio includes products for the treatment of chronic virus infections.

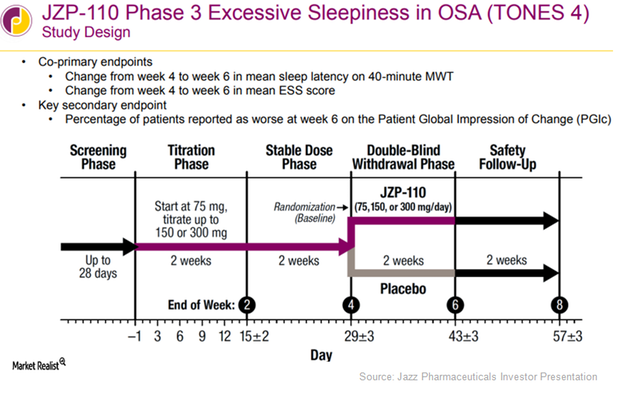

Inside the Efficacy of JAZZ’s JZP-110 in Obstructive Sleep Apnea Trials

This trial demonstrated the efficacy and safety of JAZZ’s JZP-110 in both the MWT and sleep latency tests at all dosages at the end of weeks 4 and 12.

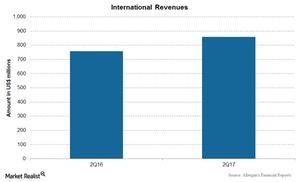

How Allergan’s International Segment Performed in 2Q17

Allergan’s (AGN) international business includes total revenues from the sales of branded products as well as aesthetics products outside the US markets.

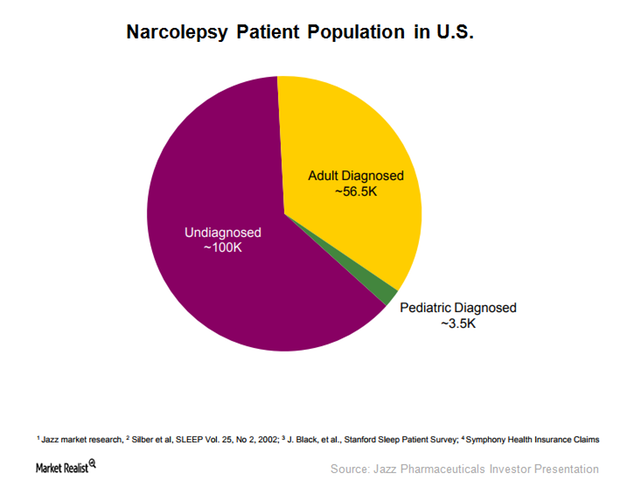

This Alone Could Boost Xyrem’s Addressable Market in 2018

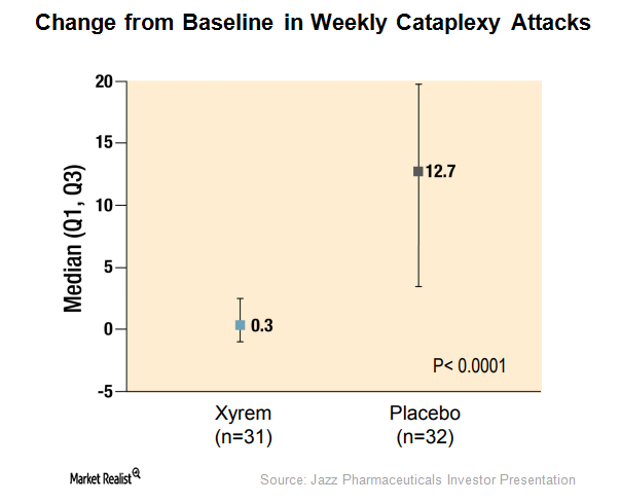

To expand Xyrem’s addressable market, JAZZ has been evaluating the efficacy of Xyrem in pediatric narcolepsy patients with cataplexy and excessive sleepiness.

Behind Xyrem’s Solid Demand Trends in 2017

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Xyrem reported revenues of ~$298 million, which represented a YoY (year-over-year) growth of ~6% and sequential growth of ~9%.

Behind Allergan’s Business Segments and Revenues

Allergan’s (AGN) business has undergone several changes over the past few years due to acquisitions and divestitures.

A Look at Allergan’s Performance in 2Q17

Allergan Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International. Stock price performance Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017. […]

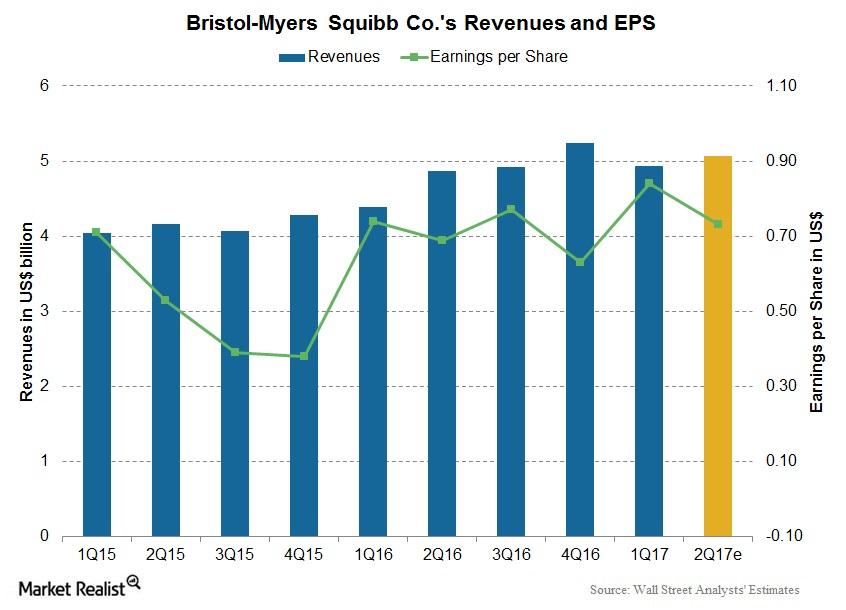

How Bristol-Myers Squibb Stock Has Performed in 2Q17

A look at Bristol-Myers Squibb Headquartered in New York City, Bristol-Myers Squibb (BMY) is an American pharmaceutical company that develops innovative medicines in various therapeutic areas, including cardiovascular, neuroscience, immunoscience, oncology, and virology. Stock price performance While Bristol-Myers Squibb’s stock price has risen ~3.8% in 2Q17, it had fallen ~5.4% year-to-date as of July 7, […]

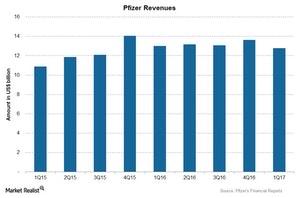

A Look at Pfizer’s Revenue for 1Q17

Pfizer (PFE) reported a 2.0% fall in 1Q17 revenues to ~$12.8 billion, with a 1.0% operational fall in revenues and a 1.0% negative impact of foreign exchange.

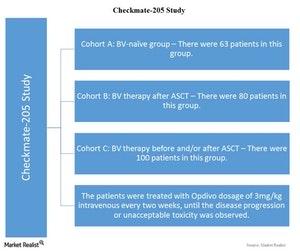

Data from the Checkmate-205 Study Evaluating Opdivo

Follow-up data were released from the Checkmate-205 study. It evaluated long-term effects of PD-1 inhibitors in patients with classical Hodgkin Lymphoma.

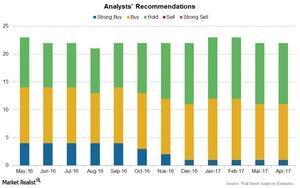

Analysts’ Ratings and Recommendations for Pfizer

Wall Street analysts expect Pfizer’s (PFE) top line to rise 0.6% to ~$13.1 billion in 1Q17. Its earnings per share are expected to be $0.67 in the quarter.

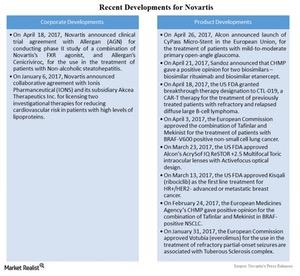

Novartis’s 1Q17 Earnings: Recent Developments

On January 6, 2017, Novartis announced the collaborative agreement with Ionis Pharmaceuticals (IONS) and its subsidiary Akcea Therapeutics.

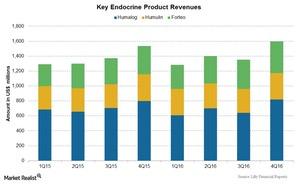

Eli Lilly’s 1Q17 Estimates for Humalog, Other Endocrine Products

Eli Lilly’s (LLY) human pharmaceutical segment contributes ~85.0% to Lilly’s total revenues.

Teva Has a Targeted Strategy to Expand in Major Growth Markets

In Russia, Teva Pharmaceutical has created a strong portfolio of about 300 products and has been extensively developing its research pipeline.

Market Cheers FDA’s Fast Tracking of BIIB’s Alzheimer’s Treatment

The U.S. Food and Drug Administration (or FDA) recently awarded the fast track status to aducanumab following the positive results of Biogen’s pre-clinical research.

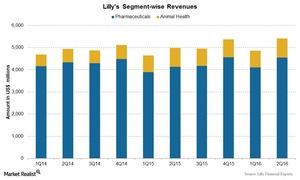

How Are Eli Lilly’s Business Segments Performing?

Eli Lilly and Co.’s (LLY) overall business is classified into two business segments—Human Pharmaceuticals and Animal Health.

What Is Allergan’s Inorganic Growth Strategy?

Actavis acquired Allergan in March 2015, and the company changed its name from Actavis to Allergan (AGN).

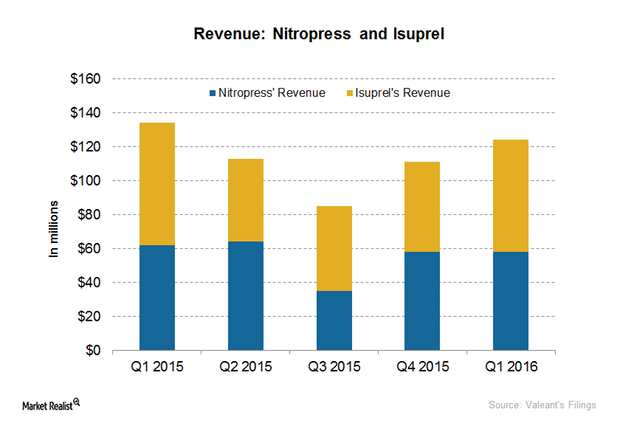

The Facts behind the Valeant Drug Pricing Controversy

Valeant Pharmaceuticals International (VRX) significantly raised the prices of two of its heart drugs—Nitropress and Isuprel—which caused a controversy and an outrage.

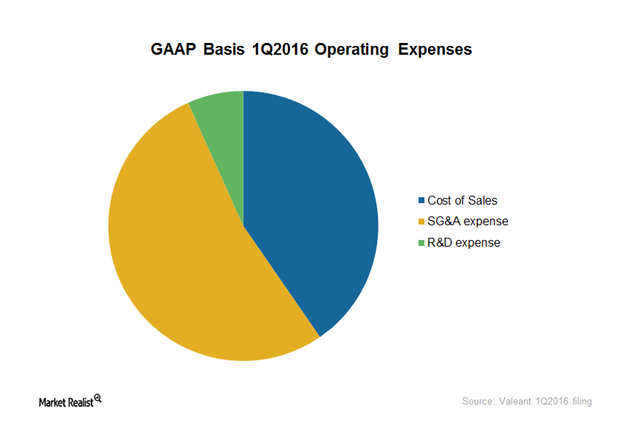

What’s behind Valeant’s Operating Expenses?

Valeant’s major operating expenses include cost of sales, SG&A (selling, general, and administrative) expenses, and R&D (research and development) costs.

What Happened in the Valeant-Philidor Controversy?

Valeant’s (VRX) controversies started with Philidor, a specialty pharmacy company that was accused of altering doctor’s prescriptions so it could sell more of Valeant’s costly drugs.

What’s Allergan’s Growth Strategy?

Allergan’s new industry model, “growth pharma,” is based on identifying five characteristics that boost company growth and differentiate it from its peers.

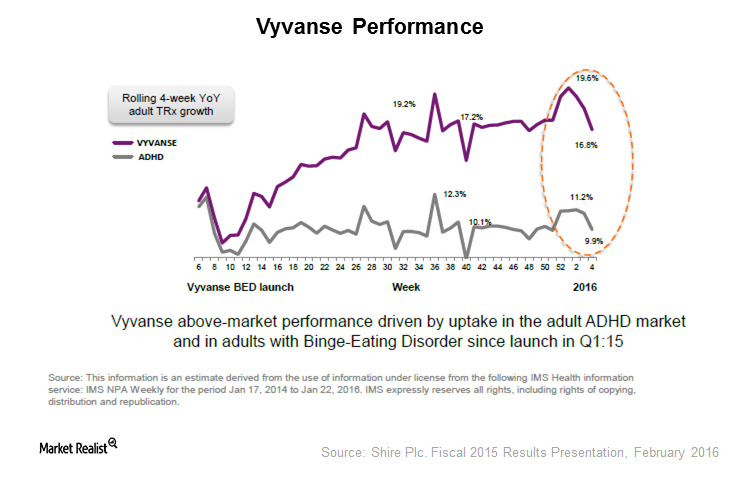

What’s Happening with a Generic Version of Vyvanse?

Vyvanse, Shire’s (SHPH) key drug, earned $1.7 billion in 2015, a 21% annual growth. Analysts expect Vyvanse to add $1.9 billion and $2.1 billion to Shire’s top line in 2016 and 2017.

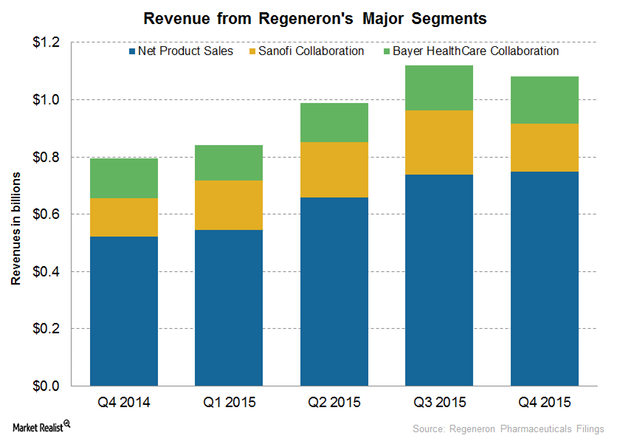

Regeneron Pharmaceuticals’ Major Revenue Sources in 4Q15

Regeneron Pharmaceuticals (REGN) earns revenue from net product sales, collaboration, and technology licenses.

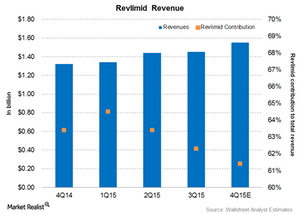

Revlimid Continues to Drive Celgene’s Revenue

Revlimid (lenalidomide) is one of Celgene’s (CELG) main revenue drivers. It had revenues of $1.4 billion in 3Q15, excluding the adverse impact of foreign exchange fluctuations.

Pfizer-Allergan Deal: Pfizer Will Combine with Allergan

On November 23, two of the big pharmaceutical companies—Pfizer and Allergan—announced the biggest merger transaction ever in pharmaceuticals.