Rekha Khandelwal, CFA

Rekha Khandelwal, CFA, covers mainly energy stocks and macroeconomic analysis. She has been writing for Market Realist since 2014.

Stocks and investments are Rekha's passions. Playing with complex data to draw meaningful insights excites her, and she loves everything about managing finances. A go-getter, she believes in hands-on problem-solving.

Rekha has more than ten years of experience in financial research, stock analysis, financial planning, asset allocation strategies, and portfolio management. She has earned a master’s in finance and is a CFA Charter holder. She also loves traveling and reading in her spare time.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rekha Khandelwal, CFA

The World’s Top 5 Smartphone Companies Ranked

Despite a global supply chain crisis and component shortages, a handful of companies continue to dominate the global smartphone industry.

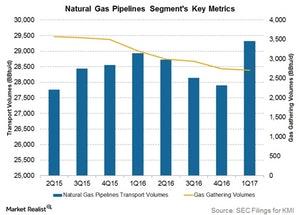

What to Expect from Kinder Morgan’s Gas Transport Volumes

Kinder Morgan’s (KMI) natural gas transport volumes grew 1.4% YoY (year-over-year) in 1Q17. The growth was driven by throughput on new projects.

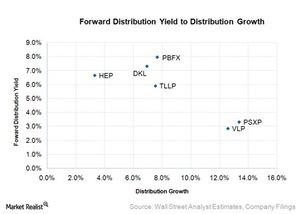

How Does Phillips 66 Partners’ Valuation Compare to Its Peers’?

Phillips 66 Partners’ forward distribution yield of 3.3%, owing to its fee-based revenues, consistent distribution growth, and strong coverage ratio.

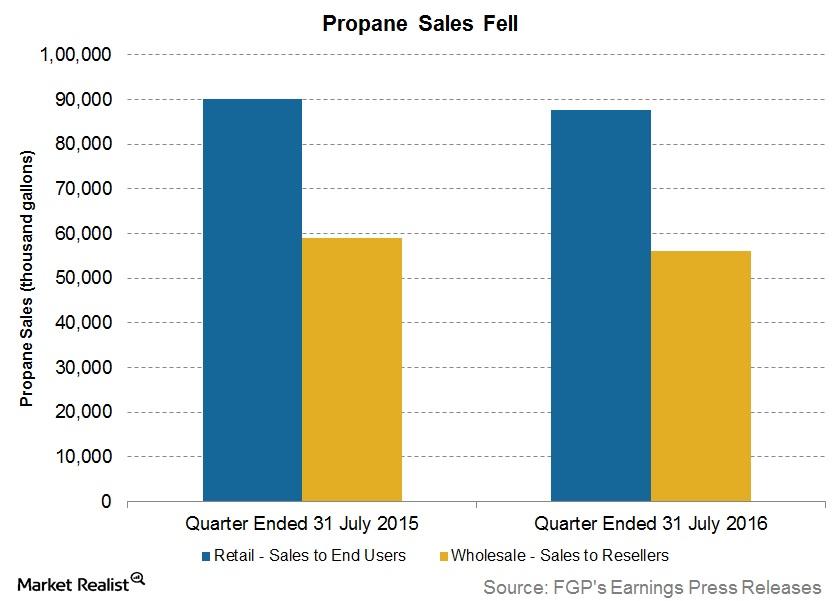

Three Analysts Upgraded Ferrellgas Partners in December 2016

On December 8, RBC Capital upgraded Ferrellgas Partners from “underperform” to “sector perform.” Piper Jaffray upgraded FGP from “underweight” to “neutral.”

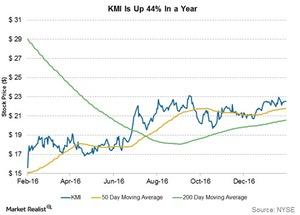

Will Kinder Morgan Stock Continue to Surge in 2017?

Kinder Morgan stock has risen 44% in the past year, as compared to Enterprise Products Partners’ 32% rise and ONEOK’s 162% rise.

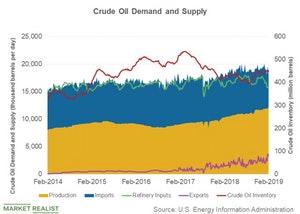

What Might Cap Rising Crude Oil Prices?

The US crude oil (USO) supply includes domestic production and imports. The supply gets consumed as inputs to refineries and exports.

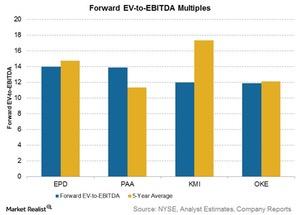

What Does Kinder Morgan’s Valuation Indicate?

Kinder Morgan (KMI) is currently trading at a forward EV-to-EBITDA multiple of nearly 12.0x.

Must-Know: World’s Top Oil Companies by Production

The US, Saudi Arabia, and Russia are the world’s top three crude oil producers. Let’s take a look at the world’s top oil players by production volumes.

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.

An Overview of US LNG Production and Exports

Investors may be seeing a lot of reports about rising US LNG (liquefied natural gas) exports. Let’s review the basics of LNG.

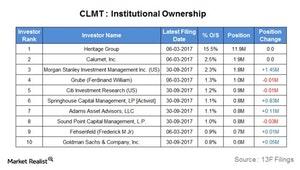

Are Institutional Investors Bullish on Calumet Specialty?

Heritage Group and Calumet are the top two investors in Calumet Specialty Products Partners (CLMT).

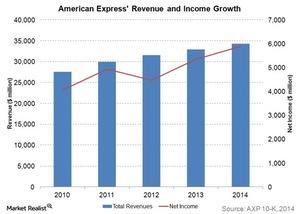

American Express: Opportunities Abound in a Challenging Market

Co-branding relationships are an important part of the American Express business model. The costs of renewing and extending these relationships is increasing.

McDonald’s Risks, Strengths, and Weaknesses

The restaurant industry is susceptible to a wide array of risks of macro and micro factors. As a huge global brand, McDonald’s faces several risks.

Why Energy Transfer Partners’ Earnings Are on the Rise

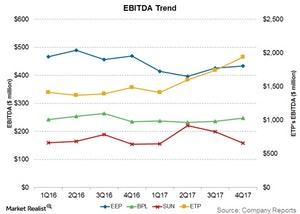

Energy Transfer Partners (ETP) reported adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) of $1.9 billion in 4Q17.

Why DPW Holdings Stock Soared Over 400% Yesterday

DPW Holdings stock soared over 400% on August 19 after the company announced the relaunching of online fintech portal MonthlyInterest.com.

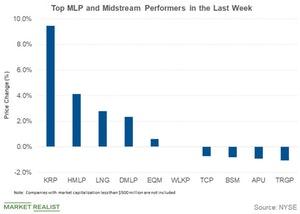

LNG and EQM: Which Midstream Companies Outperformed Last Week?

Cheniere Energy (LNG) was among the top midstream gainers last week. The stock rose 2.8% during the week.

Ferrellgas Partners’s Bridger Acquisition: What Went Wrong?

Ferrellgas Partners has terminated a ten-year transportation and logistics agreement with Jamex Marketing.

A Look at Beyond Meat Stock’s Key Indicators

Beyond Meat (BYND) stock fell 11.5% yesterday, seemingly on no major news. While BYND’s prospects look promising, its stock still experiences wild swings.

McDonald’s Global Presence and the Three-Legged Stool

McDonald’s, the world’s largest fast food chain, has over 38,000 restaurants across 120 countries. In 2018, it had approximately $21.0 billion in sales.

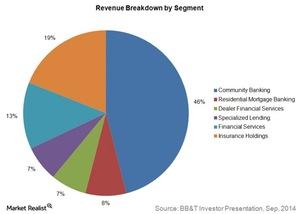

Analyzing BB&T Corporation’s 6 Operating Segments

BB&T Corporation’s (BBT) operations are divided into six business segments. Community Banking contributes 46% to the total revenue.

How Does BlackRock Make Money?

BlackRock, an investment management giant, had $7.0 trillion in AUM (assets under management) at the end of the third quarter.

Must-Know: What Is PEG Ratio and How Is It Used?

Investors use a bunch of metrics to determine if a stock is attractive. One such metric is the PEG or the price-to-earnings-to-growth ratio.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.

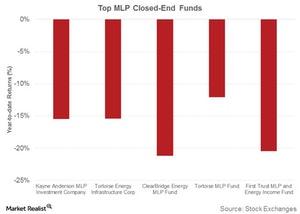

Analyzing the Top MLP Closed-End Funds in 1Q18

NTG invests primarily in MLPs and their affiliates. The fund has ~$1 billion of assets under management. NTG focuses on natural gas infrastructure MLPs.

KMI, WMB, and OKE: Understanding Their Key Business Focus

Kinder Morgan transports natural gas, refined petroleum, crude oil, condensate, CO2, and other products through its network of pipelines.

Understanding Banks’ Market and Reputational Risks

All banks face risks. Two key areas to understand are banks’ market risk and reputational risk. Here’s a summary of each type.

Understanding a Bank’s Operational and Business Risks

Banks experience operational risk in all daily bank activities, such as a check incorrectly cleared or a wrong order punched into a trading terminal.

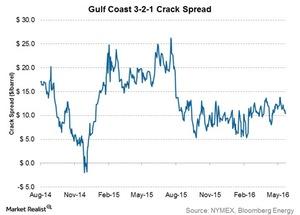

How a Fall in Crack Spreads Is Hurting Refining MLPs

The Gulf Coast 3-2-1 crack spread was $10.4 per barrel on June 16, 2016.

Must-Know: Enbridge’s Five Business Segments

Canadian energy giant Enbridge’s (ENB) operations are diverse. Enbridge accounts for roughly two-thirds of Canada’s crude oil exports to the US.

How McDonald’s Wages and Major Costs Stack Up

McDonald’s performance is sensitive to any changes in price levels—be it food, labor, or rent. So how much does it cost for McDonald’s to generate revenue?

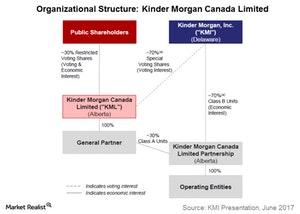

Must-Know: Kinder Morgan’s Canada Segment’s Structure

After KML’s IPO (initial public offering), Kinder Morgan retains ownership of nearly 70% of KML, with the remaining 30% owned by the public.

Why ONEOK Has Outperformed Its Peers in 2018

ONEOK (OKE) stock has risen ~21% so far in 2018, outperforming its peers in the midstream sector.

McDonald’s Supply Chain: A Must-Know for Investors

With over 38,000 restaurants, McDonald’s doesn’t make any of its products. Instead, it contracts with suppliers to meet its massive requirements.

The World’s Top Oil-Producing Countries

These are the countries who produce the most oil in the world as well how much they produce

2019 Oil and Gas Bankruptcies Paint Bleak Outlook

Haynes and Boone reported that 50 energy companies filed for bankruptcy in the first nine months of 2019, including 33 oil and gas producers.

What Berkshire Hathaway Really Does, Says Buffett

Berkshire Hathaway is a huge conglomerate with diverse operations. The company’s operations are complex, so let’s take an easy-to-understand approach.

Citigroup globally established in emerging markets

Citigroup’s exposure in emerging markets is mainly to investment-grade global multinationals through its institutional businesses.

Crude Oil Basics: Types of Crude Oil

Many think of crude oil as one single commodity that’s the same everywhere. But that isn’t the case. It actually has many different varieties.

Which Country Has the Most Oil?

Let’s take a look at the countries that own the most proven oil reserves and see why that matters for investors. You might find some surprises!

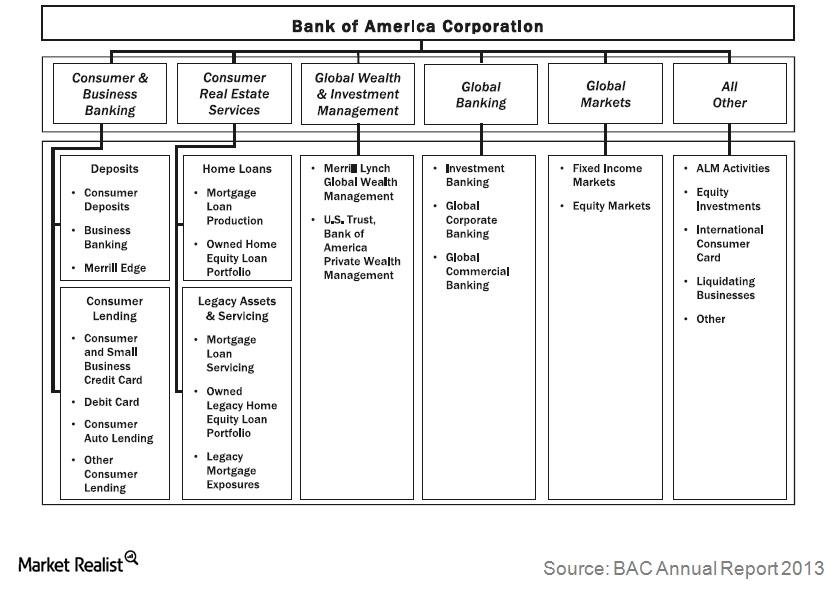

Bank of America’s six operating segments

Bank of America operates through five major segments. Its Consumer and Business Banking segment contributes a third of the bank’s total revenues.

How does Bank of America make money?

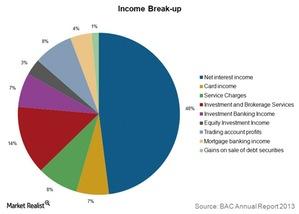

Net interest income contributes about half of Bank of America’s total income. Investment and brokerage services contribute the most to noninterest income.

Bank of America: The second-largest US banking operation

Bank of America Corporation’s (BAC) banking operations are the second-largest in the United States by assets.

Why consumer banking is important for Bank of America

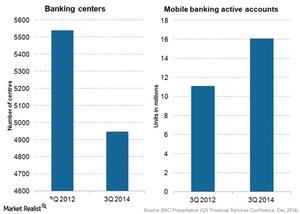

Consumer and Business Banking is Bank of America Corporation’s (BAC) largest segment. It contributes about a third of the bank’s total revenues.

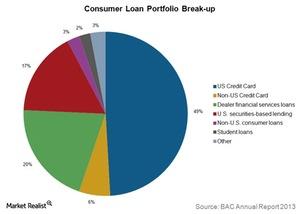

Card loans rule Bank of America’s consumer loan portfolio

Credit card loans account for more than half of Bank of America’s total consumer loan portfolio.

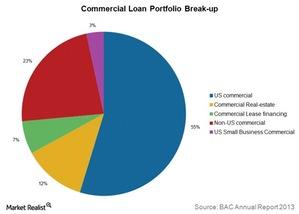

Why Bank of America’s commercial loan portfolio is diversified

In addition to assessing the credit profile of the borrower, Bank of America ensures that loans aren’t too concentrated by industry, geography, or customer.

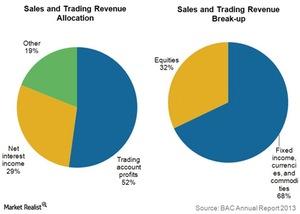

Bank of America’s Global Markets operations

Bank of America’s (BAC) Global Markets segment offers sales and trading services across asset classes to institutional clients.

The World’s Top Gold-Producing Countries

In 2018, 3,503 metric tons of gold were produced globally, 1.8% higher than in 2017. Let’s look at the world’s top gold-producing countries.

McDonald’s Menu Struggles to Shed Its Junk Food Rep

Despite health-related controversies, fast food companies such as McDonald’s maintain that they provide consumers with choice and convenience.

US GDP Shatters Expectations, Pessimists Run for Cover

The US GDP increased at an impressive rate of 1.9% for the third quarter. The growth beat the expectations of around 1.6% for the quarter.

Must-Know: Credit and Liquidity Risks in Banking

The top risks that every bank faces are credit risk and liquidity risk. We’ll look at the banks that managed this risk safely, and those that didn’t.