How Does Phillips 66 Partners’ Valuation Compare to Its Peers’?

Phillips 66 Partners’ forward distribution yield of 3.3%, owing to its fee-based revenues, consistent distribution growth, and strong coverage ratio.

Dec. 4 2020, Updated 10:53 a.m. ET

Phillips 66 Partners’ forward yield

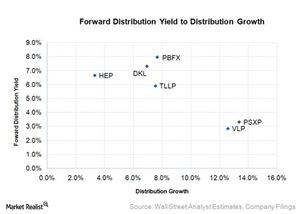

Phillips 66 Partners’ (PSXP) forward distribution yield of 3.3% is ~2.8 percentage points lower compared to the average of forward yields for Delek Logistics Partners (DKL), PBF Logistics (PBFX), Holly Energy Partners (HEP), Valero Energy Partners (VLP), and Tesoro Logistics (TLLP). Forward distribution yield is calculated as the estimated distribution per share for the current fiscal year divided by the market price per share.

Phillips 66 Partners’ fee-based revenues, consistent distribution growth, and strong coverage ratio contribute to its lower yields.

Phillips 66 Partners’ expected distribution growth

Over the next year, Phillips 66 Partners is expected to have an annual distribution growth of 13.4%. In comparison, Valero Energy Partners, Delek Logistics, PBF Logistics, Holly Energy Partners, and Tesoro Logistics are expected to have annual distribution growths of 12.6%, 6.9%, 7.7%, 3.3%, and 7.5%, respectively.

PSXP’s and VLP’s higher expected distribution growths possibly justify their relatively lower forward yields. The above graph compares the forward distribution yields of the six logistics MLPs to their expected distribution growths.

PSXP’s EV/EBITDA multiple

Phillips 66 Partners’ EV/EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) ratio, using a trailing-12-month EBITDA, is 36.2. In comparison, the ratios for Valero Energy Partners, Delek Logistics, PBF Logistics, Holly Energy Partners, and Tesoro Logistics are 25.1, 11.9, 11.8, 13.5, and 14.4, respectively.

Phillips 66 Partners’ forward EV/EBITDA multiple is 15.7. The forward ratio is based on the estimates for the current fiscal year’s EBITDA. This indicates that high EBITDA growth is expected to continue in 4Q15. PSXP forms ~0.5% of the Global X MLP & Energy Infrastructure ETF (MLPX).

The EV/EBITDA ratio can be misleading when you’re trying to understand the unit valuation of limited partner units. This is because the entire EBITDA in the EV/EBITDA ratio calculation may not be available to limited partners.

Phillips 66 Partners has IDRs (incentive distribution rights) in its structure. Currently, it operates in the highest distribution tier with a 50% split. This split means that its general partner gets 50% of incremental cash flows above $0.24 distribution per unit.

Despite entering into the highest tier in 1Q14, PSXP has managed to consistently raise distributions every quarter thanks to a strong inventory and a stream of drop-down assets from its sponsor Phillips 66 (PSX).