Global X MLP & Energy Infrastructure ETF

Latest Global X MLP & Energy Infrastructure ETF News and Updates

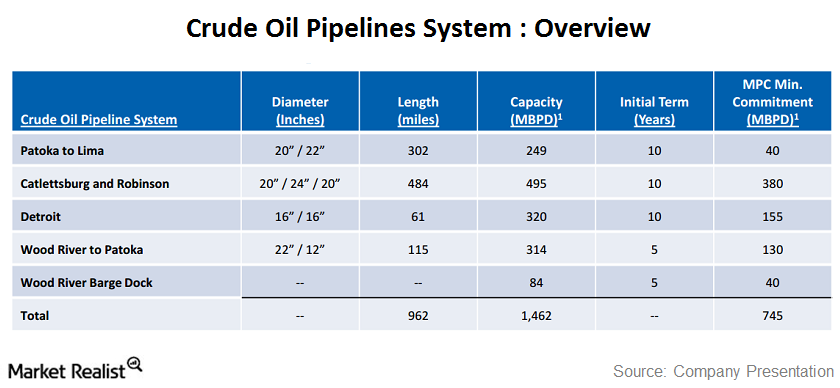

The MPLX crude oil pipeline system

MPLX crude pipelines are connected to supply hubs, and transport crude oil to Marathon Petroleum Corporation’s, or MPC’s, refineries and third parties.

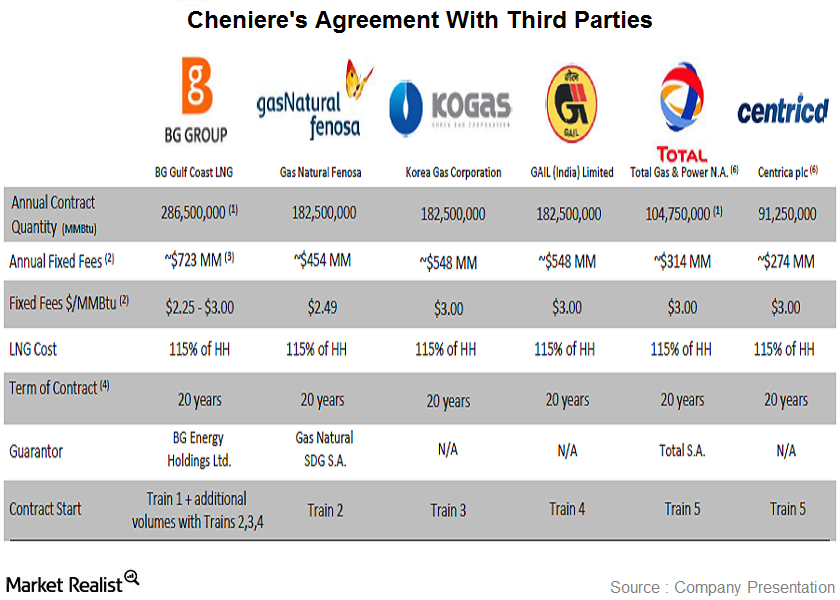

Overview of Cheniere’s sale and purchase contracts

Cheniere Energy, Inc.’s MLP company’s Sabine Pass liquefaction project has already secured four fixed-price, 20-year sales and purchase agreements with third parties.

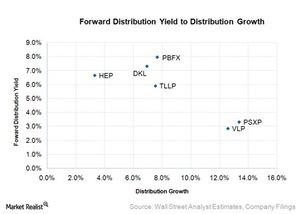

How Does Phillips 66 Partners’ Valuation Compare to Its Peers’?

Phillips 66 Partners’ forward distribution yield of 3.3%, owing to its fee-based revenues, consistent distribution growth, and strong coverage ratio.

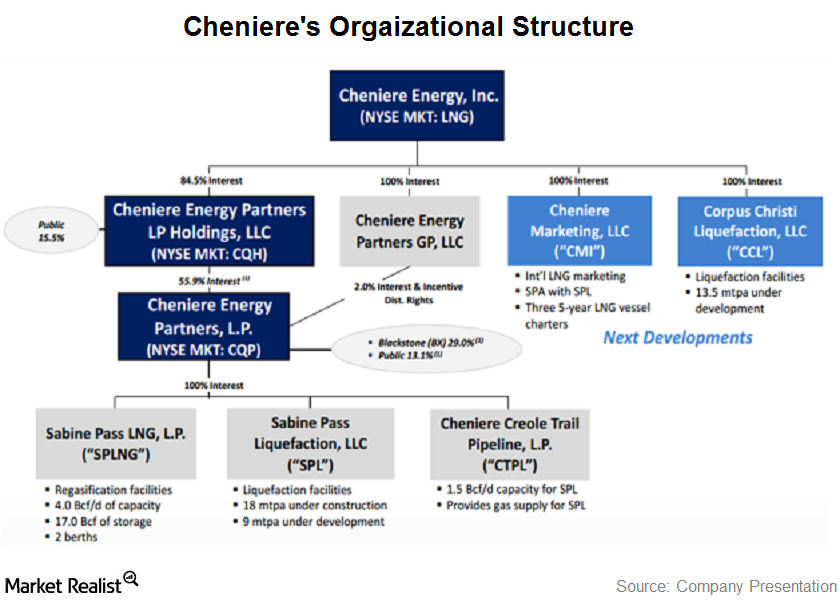

A must-know overview of Cheniere Energy

Cheniere Energy, Inc., is a Houston-based energy company engaged in the liquefied natural gas business.The Sabine Pass liquefaction project is one of the first projects to receive the necessary government permits to export liquefied natural gas.

Rose Rock Midstream: Top Midstream MLP Loser on August 25

Rose Rock Midstream (RRMS) was the top loser among midstream MLPs at the end of trading on Tuesday, August 25. It fell 4.71% in a single trading session.

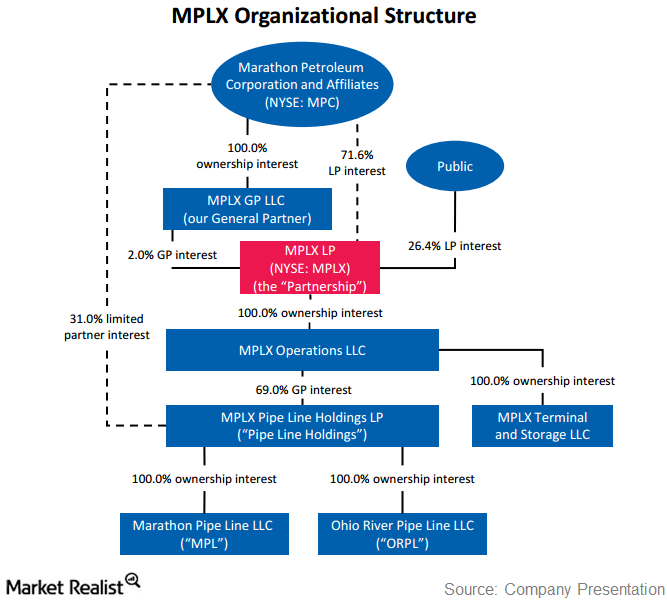

MPLX LP: The infrastructure link in Marathon Petroleum’s chain

Marathon Petroleum Corporation, or MPC, owns 100% of the MPLX general partnership, or GP, interests, as well as the incentive distribution rights.

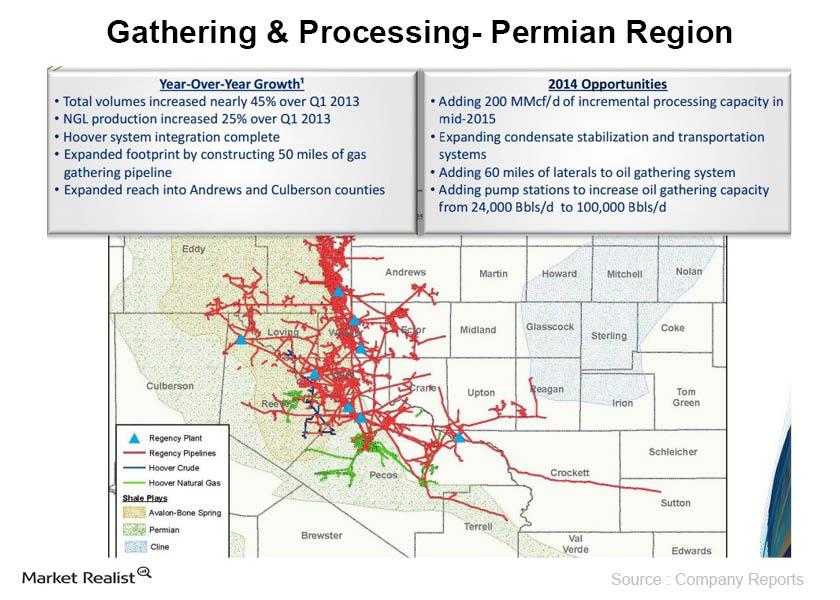

Overview: Regency’s growth projects in 2014

For the full year of 2014, Regency announced growth capex expenditures of $1.2 billion.

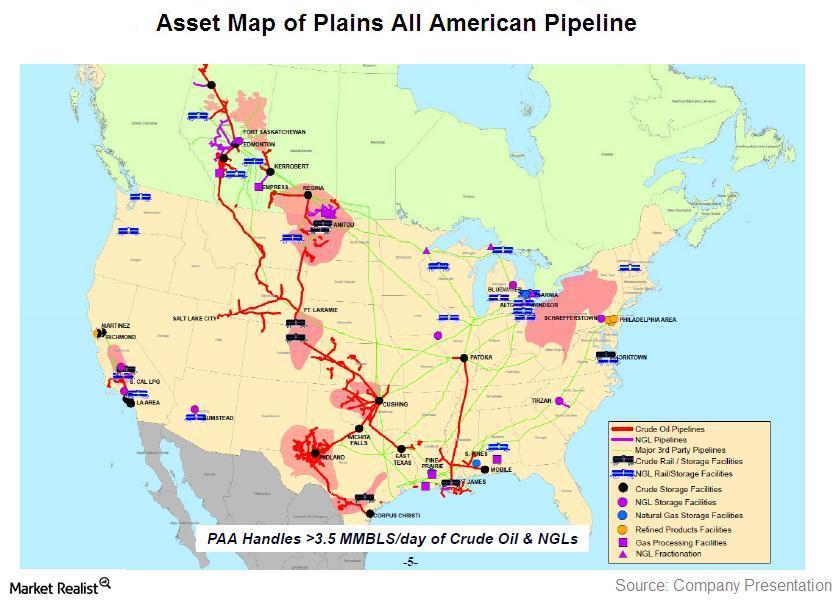

Overview: Plains All American Pipeline’s gas storage services

PAA’s storage facility falls under its supply and logistics segment, which is primarily a margin based segment, which makes it more volatile.

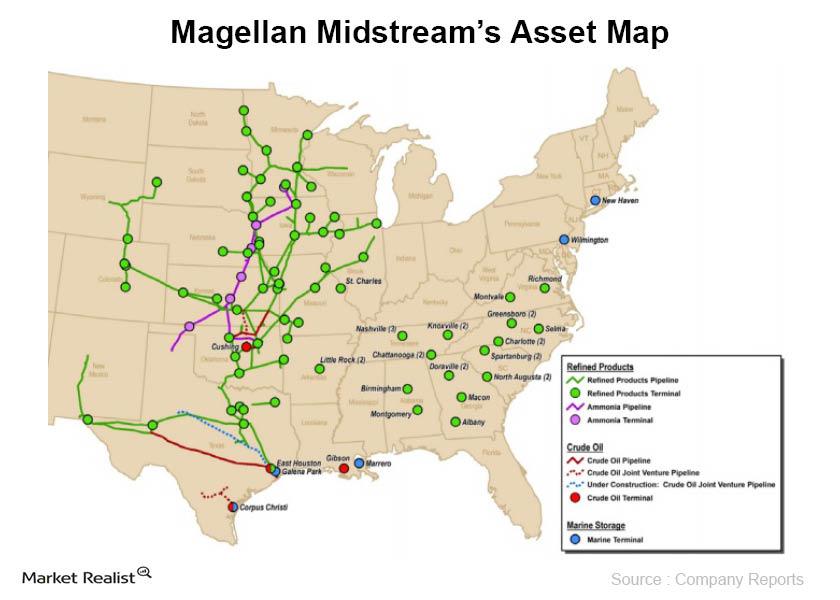

Overview: Magellan Midstream Partners L.P.

Magellan Midstream Partners L.P. (MMP), is a master limited partnership (or MLP) that owns and operates a diversified portfolio of energy infrastructure assets.

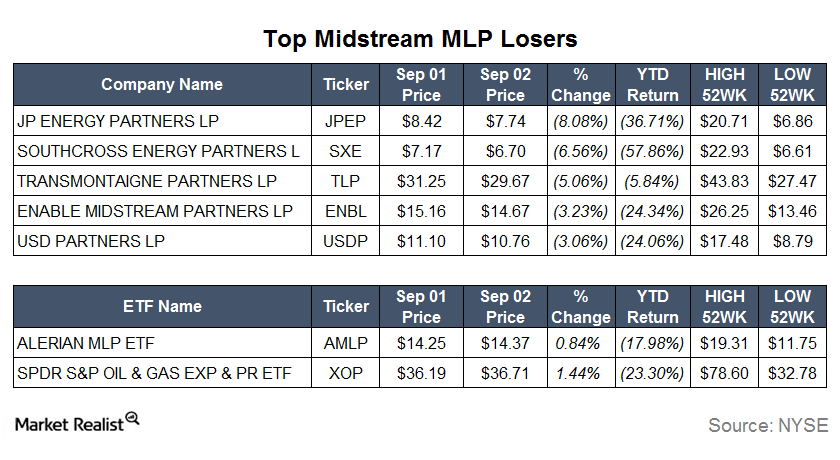

JP Energy Partners: Top Midstream MLP Loser on September 2

JP Energy Partners (JPEP) was the top loser among midstream MLPs at the end of trading on September 2, falling 8.08%. JPEP stock has been on a roller coaster ride for the past few days.

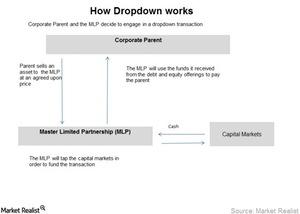

How Do Master Limited Partnerships Grow?

MLPs normally pay out all the available cash to the unit holders in the form of quarterly cash distribution. They hold only the maintenance capital expenditure.

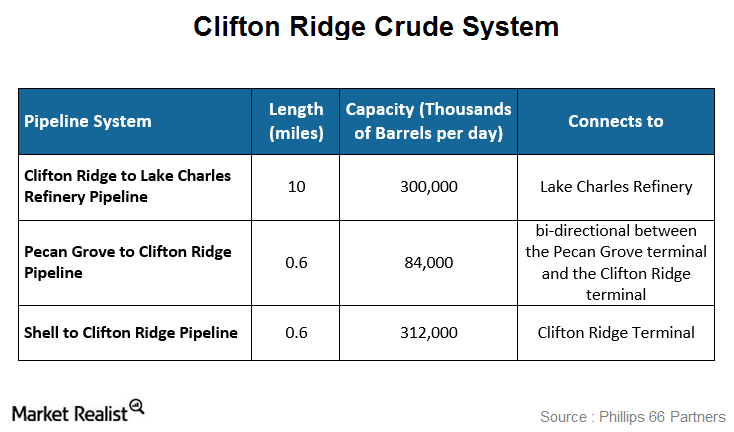

Phillips 66 Partners: The Clifton Ridge crude system

The Clifton Ridge crude system is made up of three pipelines and two terminals. It supports the Lake Charles refinery in Westlake, Louisiana.

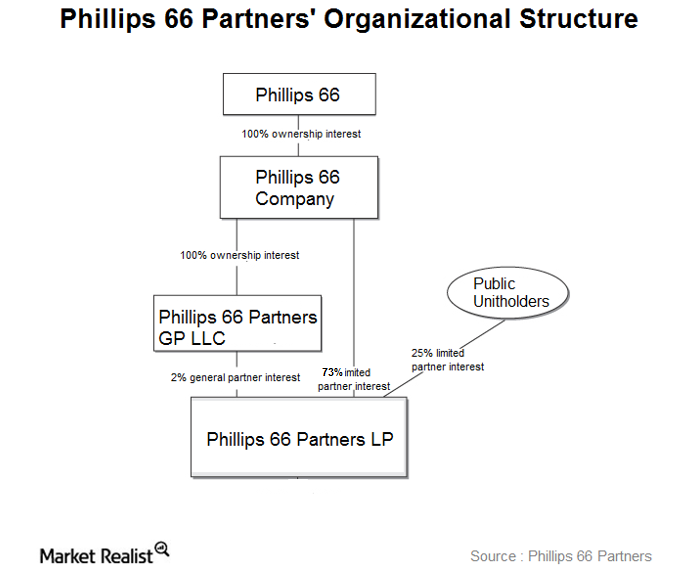

Business overview: Phillips 66 Partners

Phillips 66 Partners (PSXP) is a master limited partnership formed by Phillips 66 (PSX). PSXP operations are integral to PSX refineries.

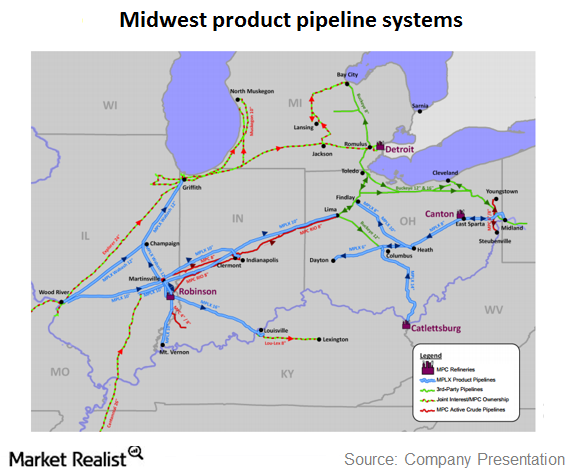

The MPLX Midwest product pipeline systems

Canton to East Sparta consists of two parallel pipelines that connect MPC’s Canton refinery with the MPLX East Sparta, Ohio, breakout tankage and station.

Must-know: An introduction to Plains All American Pipeline

Plains All American Pipeline L.P. (PAA) is a master limited partnership that operates in the midstream energy business.