Valero Energy Partners LP

Latest Valero Energy Partners LP News and Updates

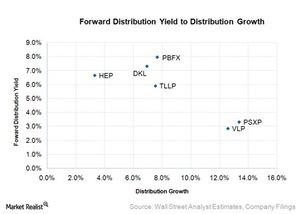

How Does Phillips 66 Partners’ Valuation Compare to Its Peers’?

Phillips 66 Partners’ forward distribution yield of 3.3%, owing to its fee-based revenues, consistent distribution growth, and strong coverage ratio.

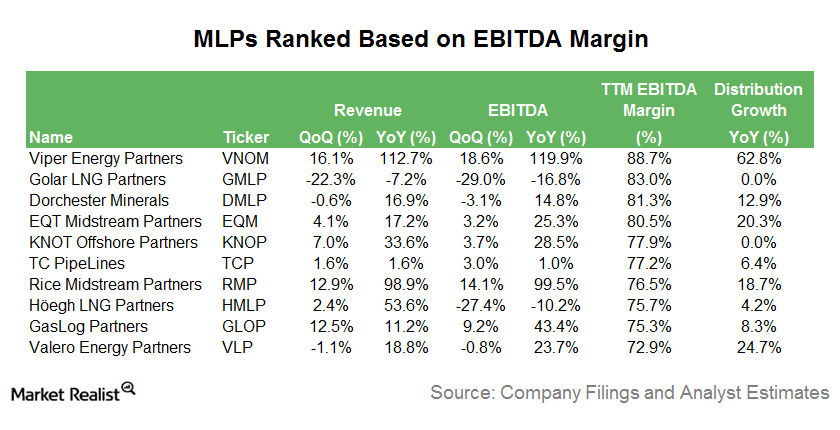

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

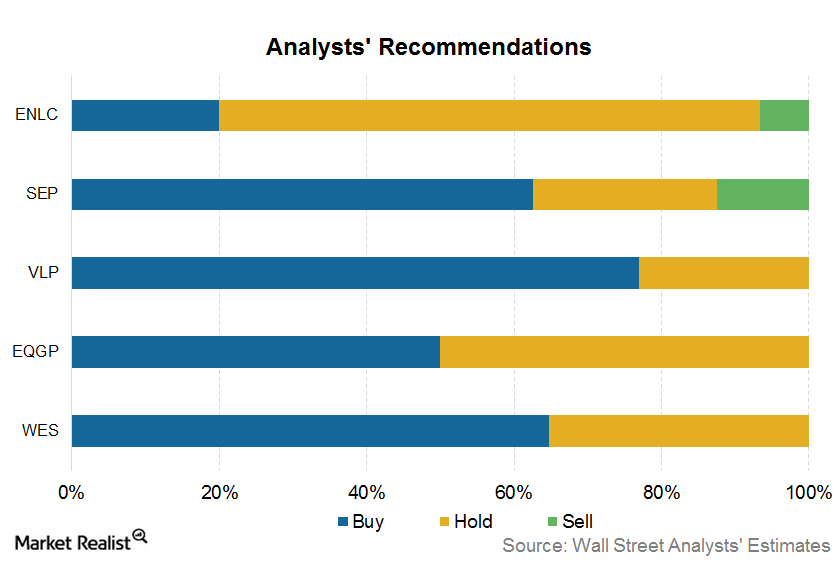

MLP Rating Updates Last Week

EnLink Midstream LLC (ENLC), the GP (general partner) of EnLink Midstream Partners (ENLK), was raised by UBS to a “buy.”