Phillips 66 Partners LP

Latest Phillips 66 Partners LP News and Updates

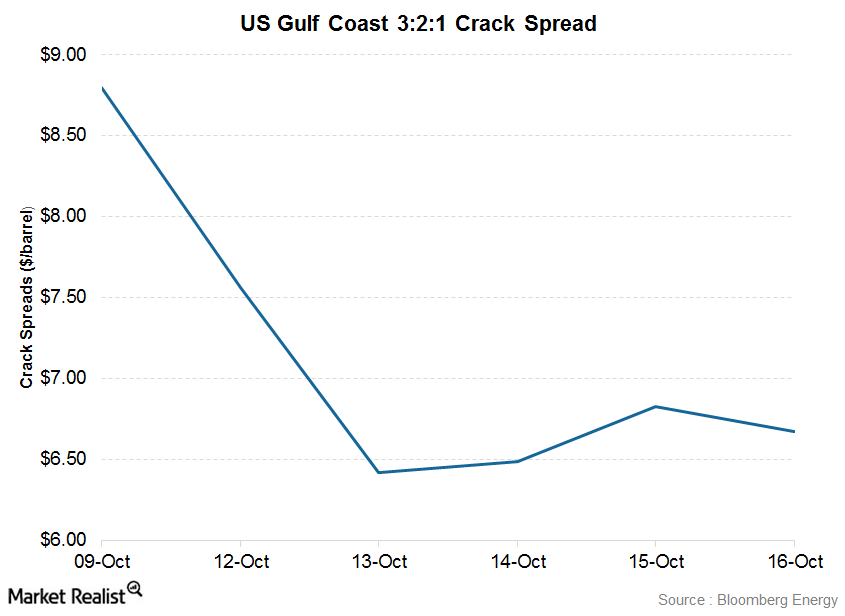

Overview of US Gulf Coast 3:2:1 Crack Spread

Crack spreads usually fall when crude oil prices (USO) increase by more than product prices, or when product prices fall more than crude oil prices.

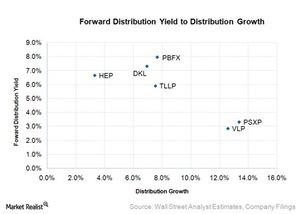

How Does Phillips 66 Partners’ Valuation Compare to Its Peers’?

Phillips 66 Partners’ forward distribution yield of 3.3%, owing to its fee-based revenues, consistent distribution growth, and strong coverage ratio.

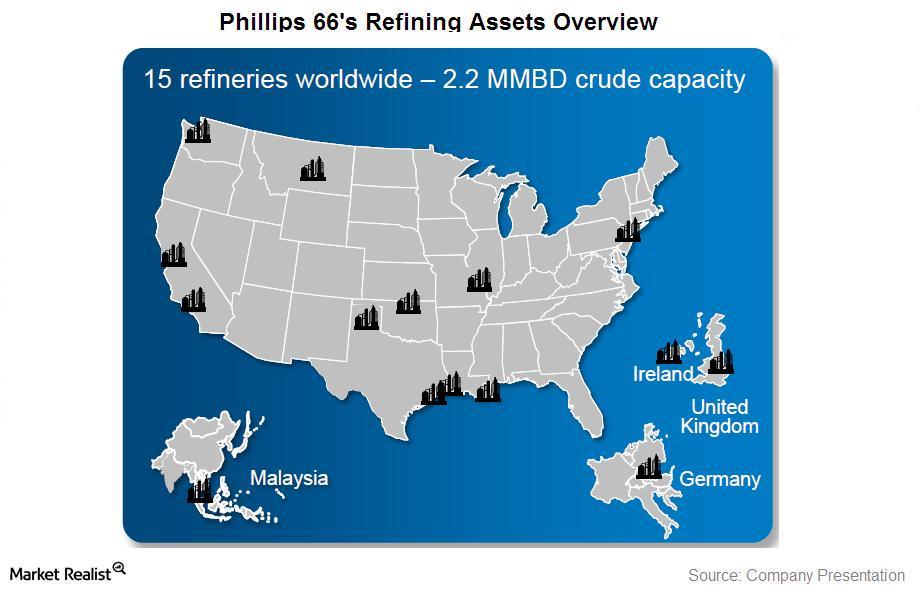

Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

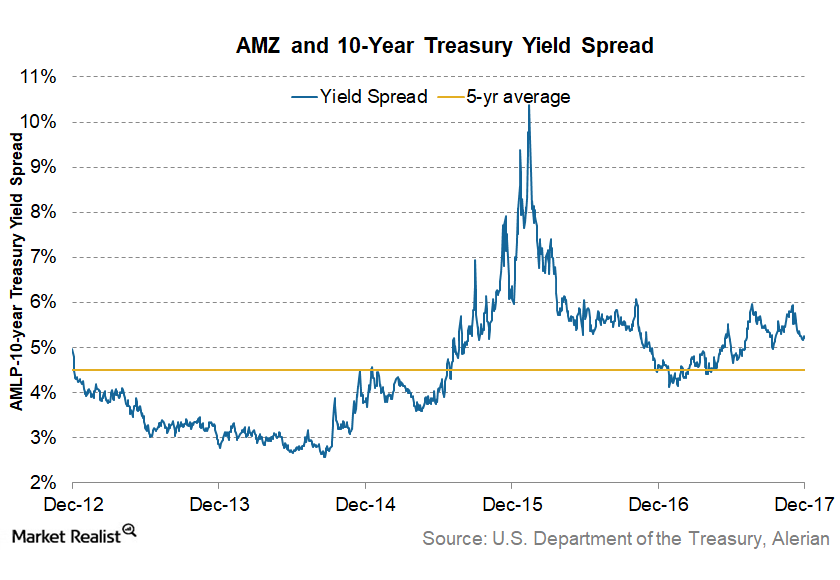

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

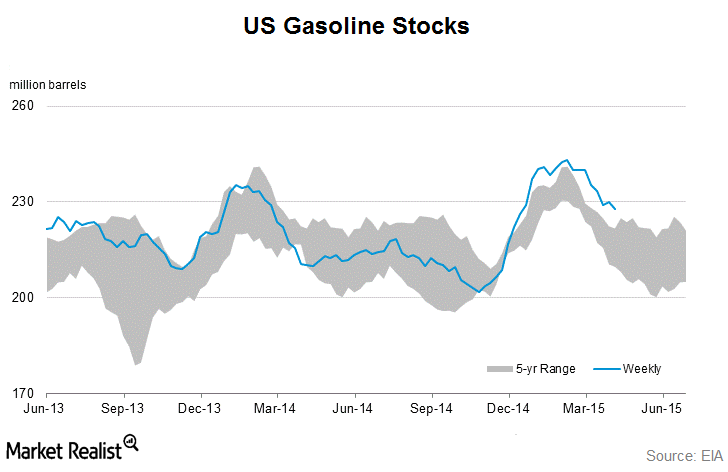

Gasoline Inventories Returned to Downtrend Last Week

Gasoline demand increased from ~8.61 MMbpd to ~8.91 MMbpd last week. Gasoline inventories remain outside the five-year range despite the draw in inventories reported on Wednesday.

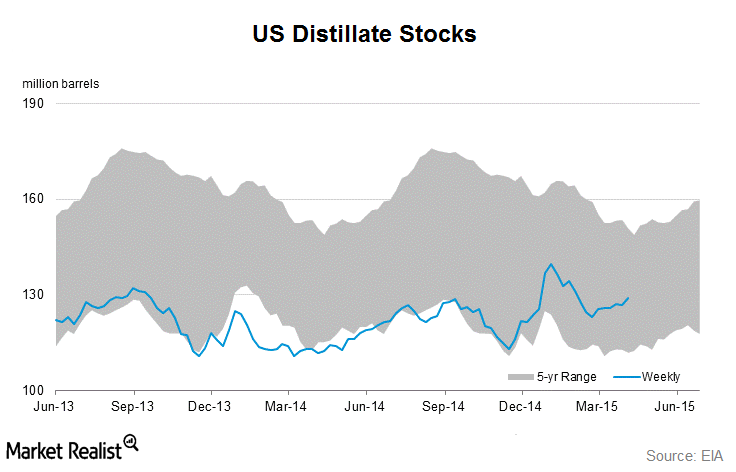

Distillate Inventories Increased Last Week

Distillate demand drives crude demand and crude prices. So, energy investors watch distillate inventories closely.

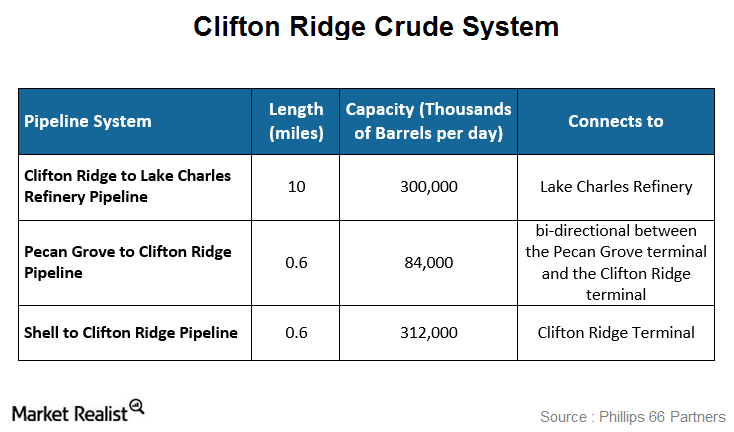

Phillips 66 Partners: The Clifton Ridge crude system

The Clifton Ridge crude system is made up of three pipelines and two terminals. It supports the Lake Charles refinery in Westlake, Louisiana.

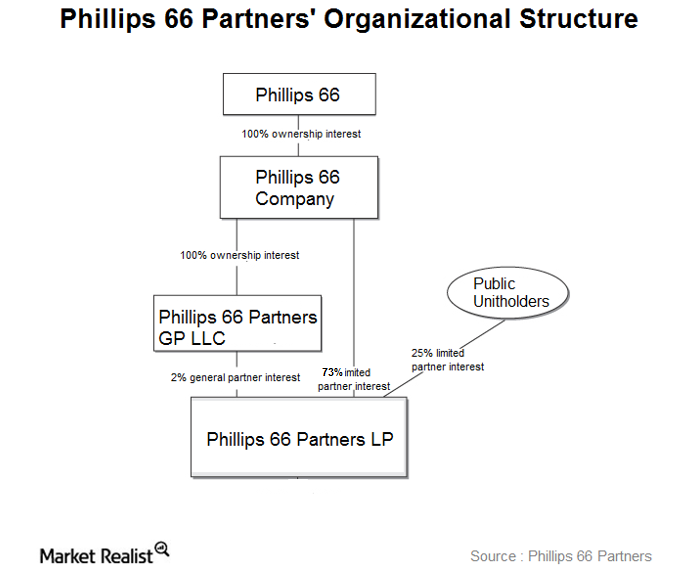

Business overview: Phillips 66 Partners

Phillips 66 Partners (PSXP) is a master limited partnership formed by Phillips 66 (PSX). PSXP operations are integral to PSX refineries.