Rekha Khandelwal, CFA

Rekha Khandelwal, CFA, covers mainly energy stocks and macroeconomic analysis. She has been writing for Market Realist since 2014.

Stocks and investments are Rekha's passions. Playing with complex data to draw meaningful insights excites her, and she loves everything about managing finances. A go-getter, she believes in hands-on problem-solving.

Rekha has more than ten years of experience in financial research, stock analysis, financial planning, asset allocation strategies, and portfolio management. She has earned a master’s in finance and is a CFA Charter holder. She also loves traveling and reading in her spare time.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rekha Khandelwal, CFA

These 5 Refiners Make Half the Crude Oil in the US

The total refiners capacity in the US is around 18.8 million barrels per calendar day. The refinery utilization rate in 2018 was 93%.

Must-Know: The Top 10 Refineries in the US

US crude oil production has more than doubled since 2009 and grew by 1.1% over the last year. Currently, there are 133 operable refineries in the US.

An Overview of the S&P 500 Retailers

US retail sales grew by 3.5% in the first half of 2019. The retail sector of the S&P 500 Index includes 29 stocks representing a broad variety of retailers.

Must-Know: The World’s Top Online Retailers

Retailing has undergone a tremendous change over the last couple of decades. The brick-and-mortar model is giving way to online retailers.

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

An Overview of the Streaming Services Industry

The pace that internet video streaming has evolved is nothing short of revolutionary. Streaming is a serious threat to the cable TV industry.

An Overview of the US Banking Sector

The banking sector plays a pivotal role in our daily lives. This series explores the sector, its driving factors, and its key indicators and latest trends.

Smartphone Companies: Potential Drivers and Key Risks

In light of declining sales, smartphone companies are relying on 5G smartphone launches. 5G technology is expected to be nothing short of revolutionary.

Global Smartphone Companies: An Overview

The global smartphone industry is huge and is growing rapidly. GSMA Intelligence says 80% of mobile connections globally will be smartphones by 2025.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

Altria: What Will Drive Long-Term Growth?

Altria (MO) stock has dipped roughly 5% so far in 2019, underperforming the broader market. MO stock is trading about 10% above its 52-week low price.

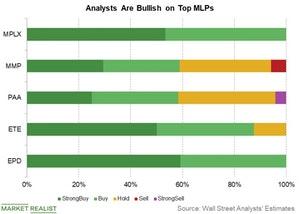

EPD, ETE, PAA, and MMP: What Do Analysts Recommend?

All of the analysts surveyed by Reuters covering Enterprise Products Partners (EPD) and MPLX (MPLX) rated the stocks as “buy.”

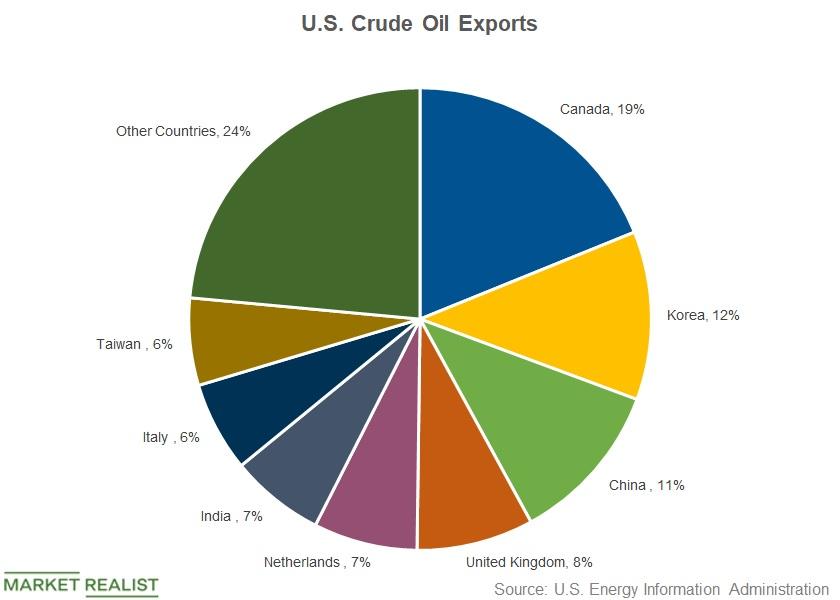

Where Does the United States Export Oil?

In this part, we’ll take a look at the top countries where the US exports its crude oil.

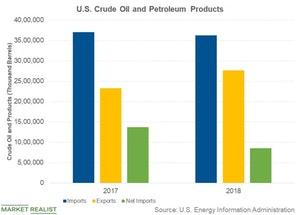

Why the United States Imports Oil

Several factors contributed to the rising crude oil exports in 2018.

Why the US Imposed Sanctions on Iran and Why They Matter

The United States first imposed restrictions on its activities with Iran in 1979, after the seizure of the US embassy in Tehran.

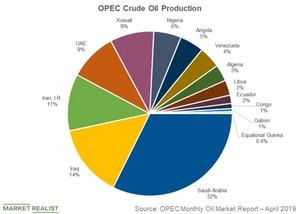

OPEC’s Role in World Oil Production

OPEC (the Organisation of the Petroleum Exporting Countries) aims to “coordinate and unify the petroleum policies of its Member Countries.”

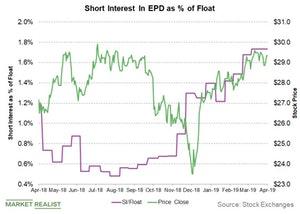

Recent Changes in Enterprise Products Partners’ Short Interest

The short interest in Enterprise Products Partners (EPD) stock rose from 24.9 million shares on March 15 to 25.7 million shares on March 29.

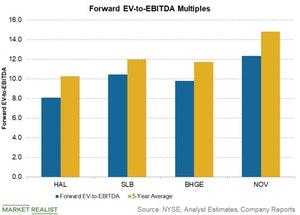

Why Is Halliburton’s Valuation Attractive?

Halliburton (HAL) is trading at a forward EV-to-EBITDA multiple of ~8.1x, which is lower than its five-year average multiple of 10.2x.

SLB, HAL, BHGE, and NOV: Analyzing the Revenue Trends

Halliburton (HAL) and National Oilwell Varco (NOV) recorded 16% revenue growth in 2018—compared to 2017.

Natural Gas Prices: What to Expect in 2019

The EIA expects US natural gas prices to average $2.89 per MMBtu in 2019. For 2020, the forecast is $2.92 per MMBtu.

Enbridge’s Line 3 Replacement Project Gets Delayed

On March 1, after the markets closed, Enbridge announced that it received a timeline for the permits for its Line 3 Replacement project.

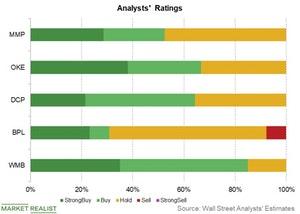

Key MLP and Midstream Rating Updates Last Week

On January 16, Barclays raised its rating for Williams Companies (WMB) from “equal weight” to “overweight.”

Will Crude Oil Prices Support Energy MLPs?

In the September Short-Term Energy Outlook report, the EIA expects WTI crude oil prices to average $67 per barrel in 2018 and $68 per barrel in 2019.

Gauging Institutional Investors’ Interest in Propane Companies

OppenheimerFunds, Energy Income Partners, and City National Rochdale hold 4.1%, 3.4%, and 1.6%, respectively, of AmeriGas Partners’ outstanding shares.

Richard Kinder: From Enron to Kinder Morgan

Currently, Richard Kinder owns nearly 11% of Kinder Morgan’s outstanding shares. The stock has underperformed the midstream sector.

USAC, CCLP: Will the Outperformance Continue?

USA Compression Partners, CSI Compressco, and Archrock Partners are up 11%, 32%, and 4%.

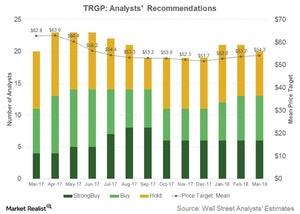

Are Wall Street Analysts Bullish on Targa Resources?

On March 23, 2018, Morgan Stanley cut its target price for Targa Resources (TRGP) from $53 to $51.

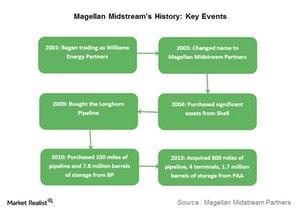

Magellan Midstream Partners: A Brief History

Magellan’s history Magellan Midstream Partners (MMP), which began trading in 2001, has grown through various asset acquisitions and expansion projects over the years. Magellan was formerly a part of Williams Companies (WMB). The company started trading as Williams Energy Partners in 2001, and changed its name to Magellan Midstream Partners in 2003. In 2004, the […]

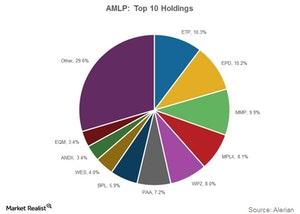

AMLP, AMZA, EMLP, MLPX: How Are They Different?

The Alerian MLP ETF (AMLP) invests only in infrastructure MLPs. Similarly, the Global X MLP ETF (MLPA) invests at least 80% of its assets in MLPs.

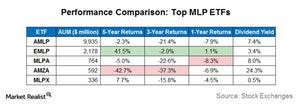

EMLP Generated the Highest Total Returns among the Top MLP ETFs

The First Trust North American Energy Infrastructure Fund (EMLP) generated total returns of 42% over a five-year period, the highest among the top five MLP ETFs that we are discussing in this series.

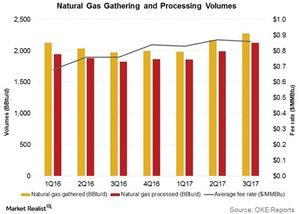

ONEOK’s Gas Gathering and Processing Fee Rates Increased

ONEOK’s Natural Gas Gathering and Processing segment’s gathered natural gas volumes rose to 2,278 BBtu/d in 3Q17—compared to 1,977 BBtu/d in 3Q16.

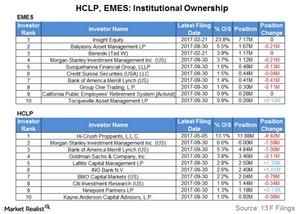

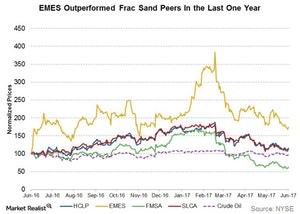

Why Institutional Investors Seem Bearish on HCLP and EMES

Balyasny Asset Management, Morgan Stanley Investment Management, and Bank of America Merrill Lynch sold net 0.83 million Emerge Energy Services (EMES) shares from their positions, according to the latest filings.

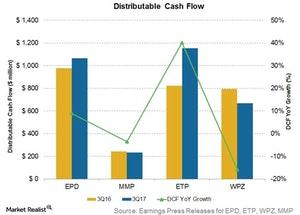

What’s behind ETP’s Strong Distributable Cash Flow Growth?

Energy Transfer Partners’ DCF rose 27.5% YoY to $1,049 million in 3Q17 compared to $823 million in 3Q16.

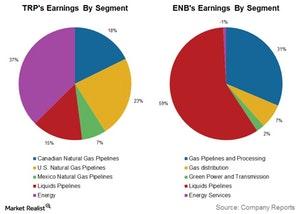

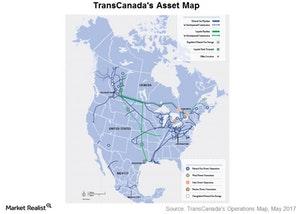

Enbridge and TransCanada’s Business Segments

With the completion of the merger with Spectra Energy in February 2017, Enbridge’s business mix has become more diversified.

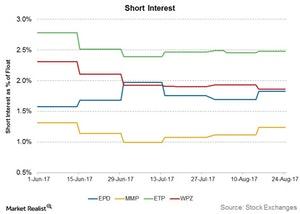

Short Interest in Enterprise Products and Magellan Rose Recently

The short interest as a percentage of float in Enterprise Products Partners’ (EPD) stock is 1.8%—higher than the 1.7% in mid-August.

TransCanada: An Overview of Assets and Operations

TransCanada (TRP) was founded more than 65 years ago, and its operations spread across seven Canadian provinces, 38 US states, and Mexico.

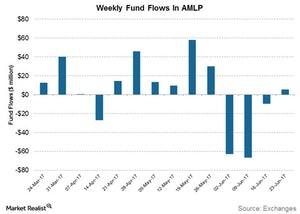

Take a Look at Fund Flows in MLP ETFs Last Week

After three weeks of negative flows, the Alerian MLP ETF (AMLP) witnessed a net inflow of $5.6 million for the week ended June 23, 2017.

What’s ahead for Frac Sand Producers?

Frac sand producers Emerge Energy Services (EMES) and Hi-Crush Partners (HCLP) rose nearly 44% and 16%, respectively, over the last 12-month period.

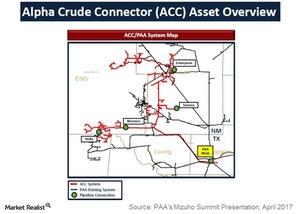

How Recent Acquisitions Have Enhanced PAA’s Permian Footprint

In February 2017, Plains All American Pipeline (PAA) closed the acquisition of a Permian Basin crude oil gathering system for $1.2 billion.

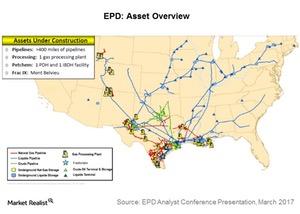

Enterprise Products Partners’ Extensive Asset Footprint

Enterprise Products Partners’ assets are connected to major US shale basins, every ethylene cracker in the US, and ~90% of refineries east of the Rockies.

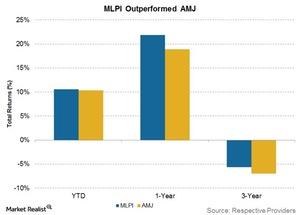

Why Did MLPI Outperform AMJ?

The ETRACS Alerian MLP Infrastructure Index ETN (MLPI) and the JPMorgan Chase Alerian MLP Index ETN (AMJ) are two of the largest MLP ETNs.

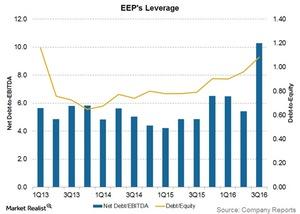

Is Enbridge Energy Partners’ Leverage a Concern?

Enbridge Energy Partners’ (EEP) debt-to-equity ratio is 1.1x. How do other midstream companies compare?

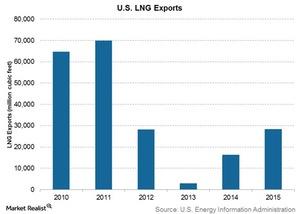

Must-Know: Key Upcoming LNG Export Terminals in the US

The LNG sector faces steep competition not only from other domestic terminals but also other countries in the international LNG market.

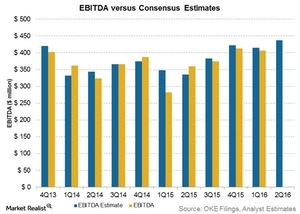

ONEOK Is Expected to Post Higher 2Q16 Earnings

ONEOK (OKE) and ONEOK Partners (OKS) are scheduled to report their 2Q16 results on August 2. Here’s what you need to know.

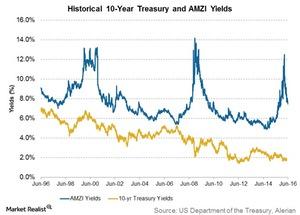

Analyzing the 10-Year Treasury and MLP Yields Spread

Generally, MLP yields move in the same direction as Treasury yields in the long term. MLP yields trade at a spread over Treasuries.

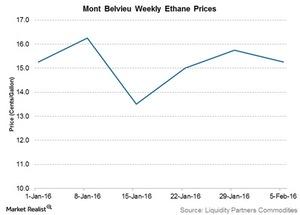

Ethane Prices Fall 3%: Impact on MLPs

Mont Belvieu ethane prices fell 3% to $0.15 per gallon in the week ending February 5, 2016. Ethane prices had risen 5% to $0.16 per gallon in the previous week.

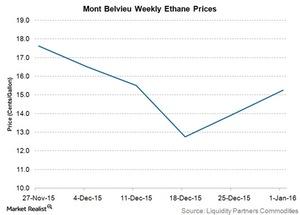

Ethane Prices Rose, Benefiting MLPs

Mont Belvieu ethane prices rose 9% to $0.15 per gallon in the week ended January 1, 2016, from $0.14 per gallon in the previous week.

ONEOK: Trading 57% below Its 50-Day Moving Average

ONEOK (OKE) is currently trading 57% below its 50-day moving average. It’s generally been trading below its 50-day moving average since mid-2014 when energy prices began falling.

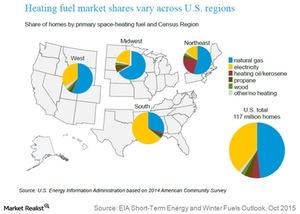

Propane: What’s Impacting Demand in the United States?

Propane demand for home heating purpose is directly affected by the severity of the winter. In any given region, colder-than-normal temperatures in the winter season tend to result in greater usage.

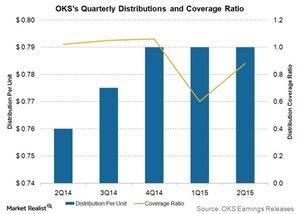

ONEOK Partners Reports Distribution Coverage Missed 2Q15 Target

Generally, MLPs with stable earnings target a distribution coverage ratio in the range of 1 to 1.1 times the distributable cash flow.