Ethane Prices Rose, Benefiting MLPs

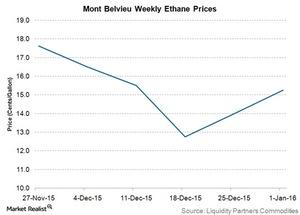

Mont Belvieu ethane prices rose 9% to $0.15 per gallon in the week ended January 1, 2016, from $0.14 per gallon in the previous week.

Jan. 4 2016, Published 12:03 p.m. ET

Ethane prices

Mont Belvieu ethane prices rose 9% to $0.15 per gallon in the week ended January 1, 2016, from $0.14 per gallon in the previous week. Ethane prices rose 10% the week before that. Low ethane prices combined with higher costs for storing and transporting ethane have resulted in ethane rejection. This means that producers leave ethane in the natural gas stream. Extracting ethane isn’t always economical when prices are low. The costs of storing and transporting ethane are higher than related costs for HGL (hydrocarbon gas liquids) products. Read What is ethane rejection and why is it important for energy MLPs? to learn more about ethane rejection.

The above graph shows weekly ethane prices over the past six weeks. Targa Resources Partners (NGLS), Tallgrass Energy Partners (TEP), and Summit Midstream Partners (SMLP) are some of the MLPs engaged in natural gas gathering and processing.

Key developments

Recent developments in the ethane market are expected to have a positive impact on MLPs involved in ethane projects. These include Sunoco Logistics Partners (SXL), Energy Transfer Partners (ETP), and Enterprise Products Partners (EPD).

One of the developments is higher ethane use from petrochemical companies. Lower ethane prices resulted in petrochemical companies using ethane more as a feedstock in place of naphtha. EPD forms ~1.5% of the Multi-Asset Diversified Income ETF (MDIV). MDIV invests nearly 17% of its portfolio in MLPs.

The EIA (U.S. Energy Information Administration) expects the increased use of ethane in petrochemical companies to continue. Ethane is used to produce ethylene, which is used to produce plastics. This trend should increase ethane demand. The above graph shows large ethylene plants under construction in the United States.

Ethane infrastructure

Ethane-related infrastructure, including plants to convert ethane to ethylene, has been developing in the United States. This development supports rising demand for petrochemical companies, which is positive for ethane demand. Eventually, this will be positive for prices. Some companies are investing in export terminals for ethane. There’s an attractive export market for ethane in Canada, Asia, and Europe.

Sunoco Logistics Partners’ Marcus Hook project can process, store, and distribute ethane to domestic and international markets. The initial operations in the project’s first phase have already started. Phase two should be completed by the end of 2016. Enterprise Products Partners is also working on a large ethane terminal in the Houston Ship Channel. EPD announced the completion of the final segment of its Aegis ethane pipeline on December 30, 2015.