Sunoco Logistics Partners LP

Latest Sunoco Logistics Partners LP News and Updates

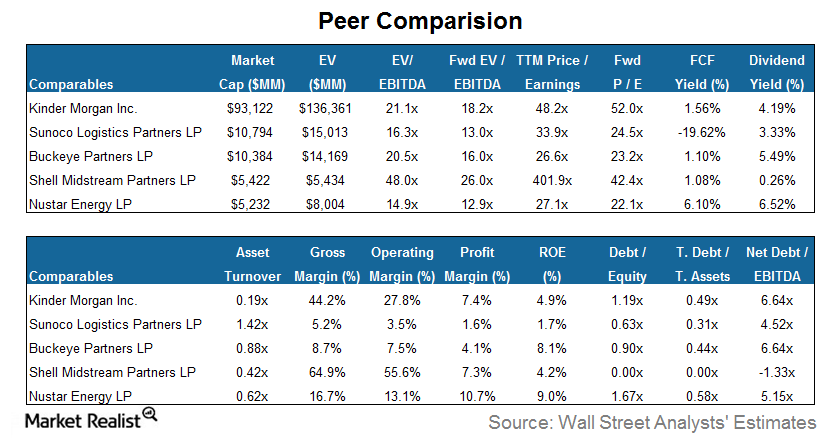

Why Sunoco Logistics Has the Lowest Profit Margins

Sunoco Logistics has the lowest profit margin and ROE among its peers. Its profit margin and ROE of 1.6% and 1.7%, respectively, are well below the group average.

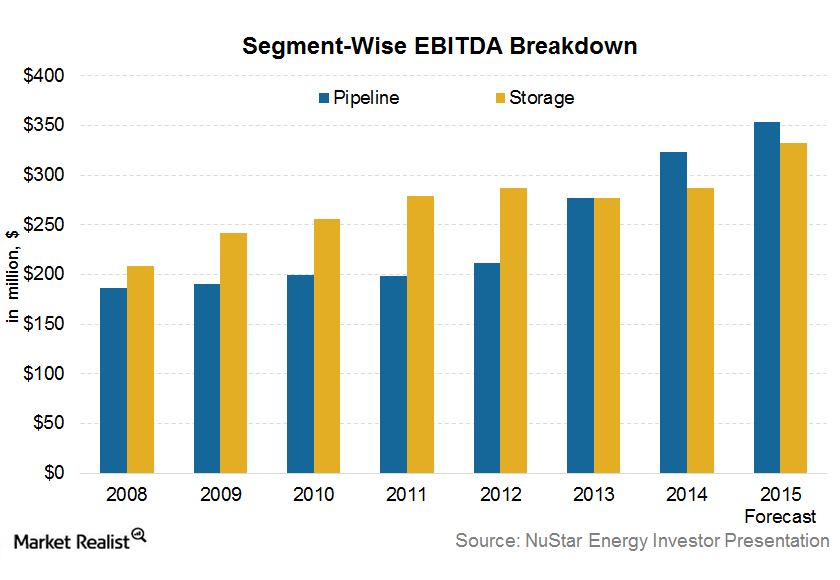

Pipeline Segment Will Drive NuStar Energy’s 4Q15 Performance

The pipeline segment is NuStar’s largest business segment in terms of the EBITDA. It accounted for 50% of the total segment EBITDA in the first nine months of 2015.

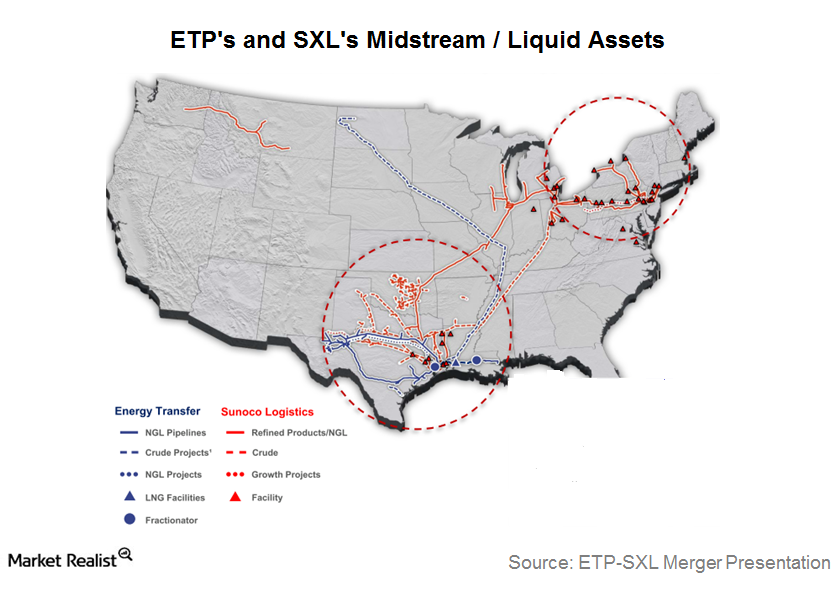

How Sunoco Logistics Could Benefit from Liquids Integration

SXL has remained bullish on its NGL growth story, which has been supported by strong NGL supply growth from the liquids-rich Marcellus and Utica Shales.

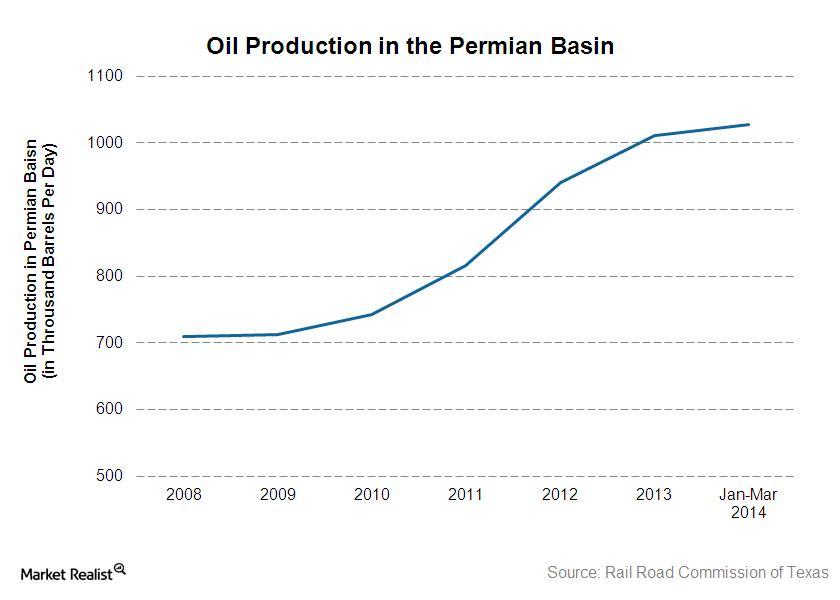

Why oil and natural gas production in the Permian should increase

According to the Energy Information Administration’s short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014.

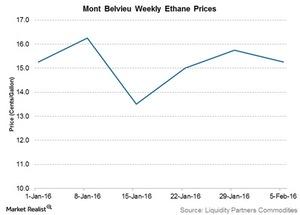

Ethane Prices Fall 3%: Impact on MLPs

Mont Belvieu ethane prices fell 3% to $0.15 per gallon in the week ending February 5, 2016. Ethane prices had risen 5% to $0.16 per gallon in the previous week.

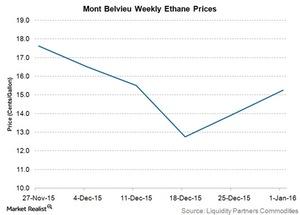

Ethane Prices Rose, Benefiting MLPs

Mont Belvieu ethane prices rose 9% to $0.15 per gallon in the week ended January 1, 2016, from $0.14 per gallon in the previous week.

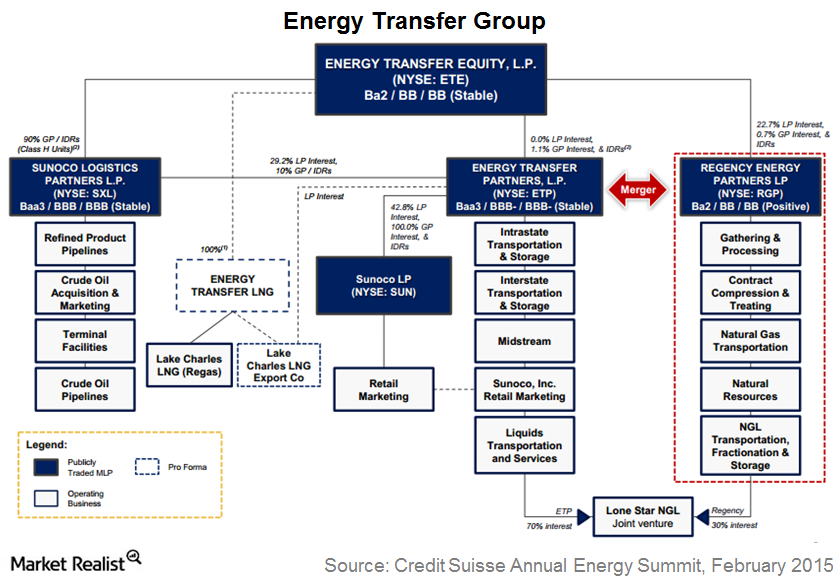

A Must-Know Overview of Energy Transfer Partners

Energy Transfer Partners (ETP) is one of the largest publicly traded master limited partnerships in the US in terms of equity market capitalization.

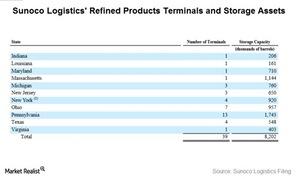

An Overview of Sunoco’s Terminals Facilities

Sunoco’s terminals facilities business operates crude oil, refined products, and natural gas liquids (or NGL) terminals.

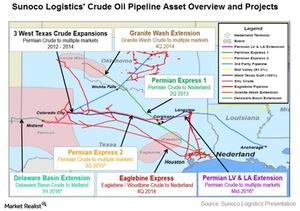

Crude Oil Pipeline Is a Major Segment for Sunoco Logistics

In the crude oil pipeline segment, Sunoco Logistics (SXL) runs 5,800 miles of crude oil pipelines and approximately 500 miles of crude oil gathering lines.

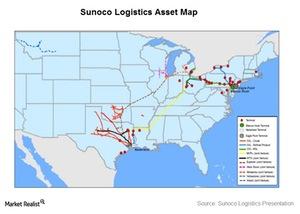

An Overview of Sunoco Logistics Partners

Sunoco Logistics Partners (SXL) is an energy midstream master limited partnership. It operates crude oil, natural gas, refined products, and natural gas liquids pipeline and terminal assets.