Summit Midstream Partners LP

Latest Summit Midstream Partners LP News and Updates

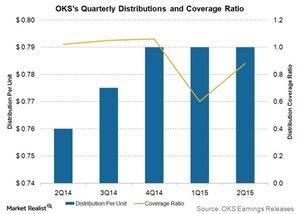

ONEOK Partners Reports Distribution Coverage Missed 2Q15 Target

Generally, MLPs with stable earnings target a distribution coverage ratio in the range of 1 to 1.1 times the distributable cash flow.

The Importance of the Distribution Coverage Ratio

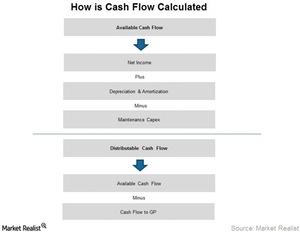

The distribution coverage ratio is the most important ratio for MLPs, as it highlights the cash available to the LP unit holders divided by the cash distributed to LP unit holders.