Why Institutional Investors Seem Bearish on HCLP and EMES

Balyasny Asset Management, Morgan Stanley Investment Management, and Bank of America Merrill Lynch sold net 0.83 million Emerge Energy Services (EMES) shares from their positions, according to the latest filings.

Dec. 22 2017, Updated 7:31 a.m. ET

Institutional activity in EMES

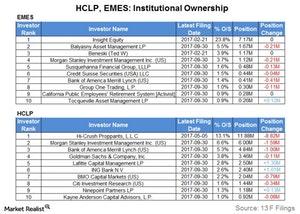

Balyasny Asset Management, Morgan Stanley Investment Management, and Bank of America Merrill Lynch sold net 0.83 million Emerge Energy Services (EMES) shares from their positions, according to the latest filings. Apart from Insight Equity—Emerge Energy’s sponsor—Balyasny Asset Management, Ted W. Beneski, and Morgan Stanley Investment Management are the three largest investors in EMES. They hold 5.5%, 3.9%, and 3.7%, respectively, of Emerge Energy Services’ outstanding shares.

As the table above shows, the top ten institutional investors in Emerge Energy collectively sold net 0.99 million shares from their positions.

Institutions selling HCLP

Morgan Stanley Investment Management, Bank of America Merrill Lynch, and Goldman Sachs & Company are the three largest institutional holders of Hi-Crush Partners (HCLP) shares. They hold 6.6%, 5.3%, and 3.8%, respectively, of HCLP’s outstanding shares.

The ten largest institutional owners of Hi-Crush Partners reduced net 10.3 million shares from their holdings in 3Q17. Together, the top ten investors own 40.3% of HCLP’s outstanding shares. A net reduction of 1.6 million shares by Morgan Stanley Investment Management is the largest position change. Hi-Crush Proppants LLC—Hi-Crush Partners’ sponsor—holds a 13.1% interest in HCLP. It sold 8.8 million HCLP shares, according to a May 5 filing.

Excluding the sale by Hi-Crush Proppants, the top nine investors in HCLP reduced their positions by net 1.5 million shares. These position changes likely indicate a bearish outlook for institutional investors in Hi-Crush Partners.

Next, let’s take a look at the recent changes in short interest in Hi-Crush Partners and Emerge Energy Services.