Hi-Crush Partners LP

Latest Hi-Crush Partners LP News and Updates

How Do These MLPs Look in 2018?

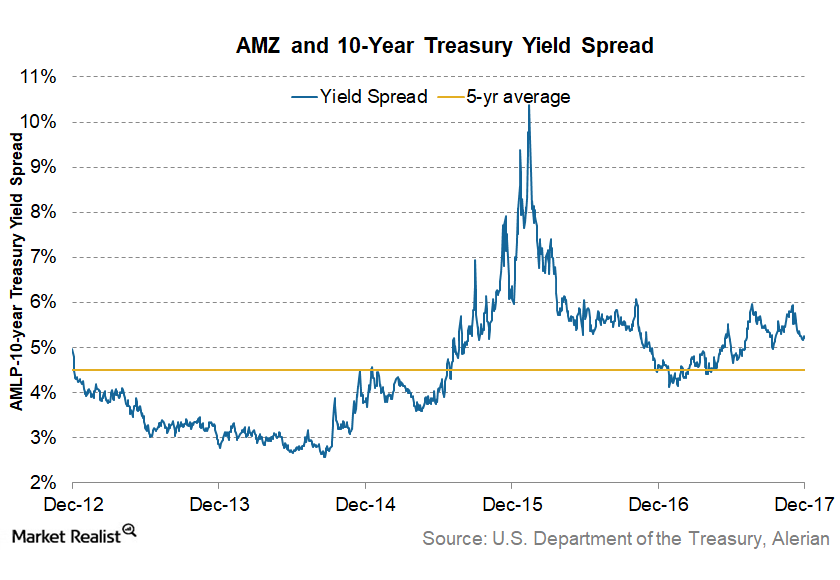

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

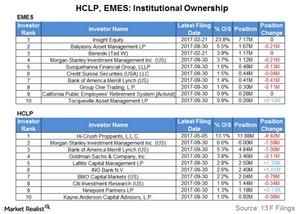

Why Institutional Investors Seem Bearish on HCLP and EMES

Balyasny Asset Management, Morgan Stanley Investment Management, and Bank of America Merrill Lynch sold net 0.83 million Emerge Energy Services (EMES) shares from their positions, according to the latest filings.

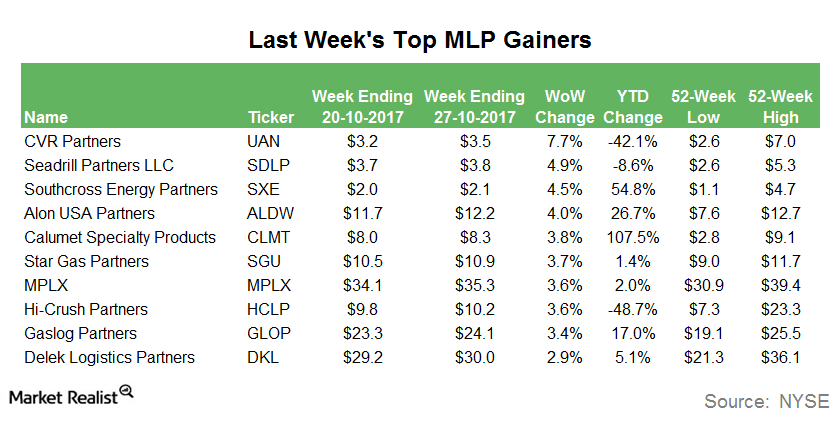

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.

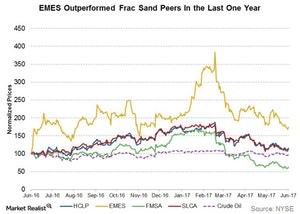

What’s ahead for Frac Sand Producers?

Frac sand producers Emerge Energy Services (EMES) and Hi-Crush Partners (HCLP) rose nearly 44% and 16%, respectively, over the last 12-month period.