Rekha Khandelwal, CFA

Rekha Khandelwal, CFA, covers mainly energy stocks and macroeconomic analysis. She has been writing for Market Realist since 2014.

Stocks and investments are Rekha's passions. Playing with complex data to draw meaningful insights excites her, and she loves everything about managing finances. A go-getter, she believes in hands-on problem-solving.

Rekha has more than ten years of experience in financial research, stock analysis, financial planning, asset allocation strategies, and portfolio management. She has earned a master’s in finance and is a CFA Charter holder. She also loves traveling and reading in her spare time.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rekha Khandelwal, CFA

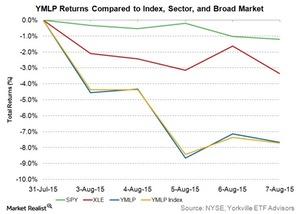

Why Did the YMLP ETF Fall Last Week?

The Yorkville High Income MLP ETF (YMLP) dropped 7.69% in the week ended August 7. The broad-market SPDR S&P 500 ETF (SPY) dropped 1.2%.

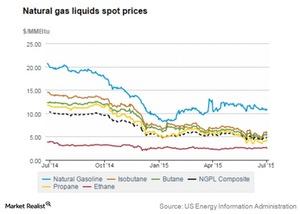

Why the Natural Gas-NGL Price Spread Impacts Energy MLPs

Natural gas processing MLPs typically benefit when the price of NGLs is high relative to natural gas.

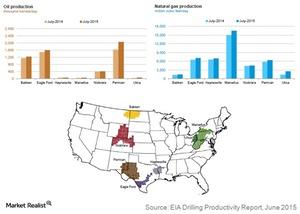

Must-Know: The 7 Regions for Oil and Gas Production in the US

The EIA (Energy Information Administration) monitors seven key tight oil and gas regions in the US.

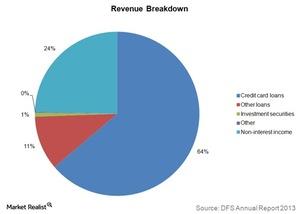

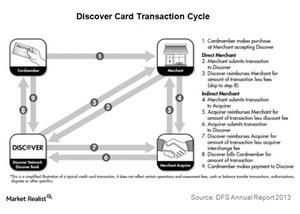

What investors should know about Discover Financial Services

Discover Financial Services (DFS) is a direct bank and electronic payment services company in the US. It offers an array of banking products.

Analyzing Discover Financial’s business segments

Discover Financial Services (DFS) has two operating segments: Direct Banking and Payment Services. Payment Services is comparatively small.

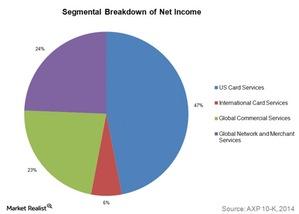

American Express and Its Four Operating Segments

Of the four American Express segments, the Global Network and Merchant Services segment has shown the highest growth over the last two years.

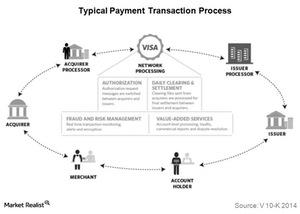

What Happens When You Swipe a Visa Card?

Visa’s open-loop payments network connects and manages the exchange of information between issuers and acquirers.

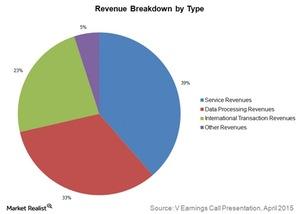

How Does Visa Make Money?

Visa’s operating revenues primarily come from service, data processing, and international transaction revenues.

MasterCard: The World’s Second Largest Payment Processing Company

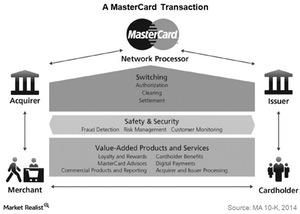

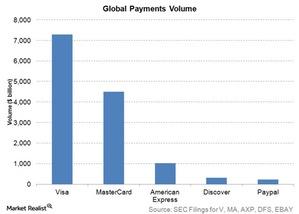

MasterCard enables consumers and businesses to use electronic modes of payment instead of cash and checks. MasterCard’s payment network is the second largest in the world, behind industry leader Visa.

Understanding MasterCard’s Credit and Debit Products

MasterCard’s digital platform MasterPass streamlines the retail sale and purchase process for the consumer and the merchant.

MasterCard Operates in an Intensely Competitive Payments Industry

Cash and checks constitute ~85% of the retail payment transactions worldwide. However, electronic payment methods are increasingly replacing cash and check payments globally.

How MasterCard Generates Its Revenue

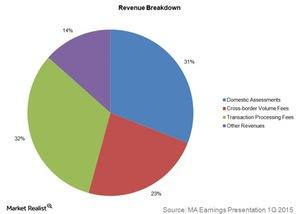

MasterCard’s revenue sources include transaction processing fees, as well as fees for fraud-prevention products and services.

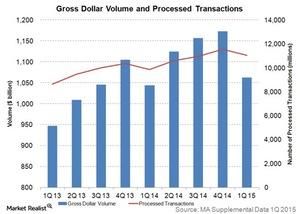

Why Growth in MasterCard’s Gross Dollar Volume is Important

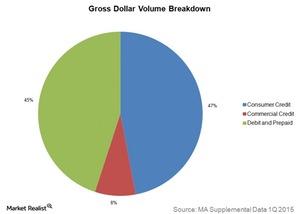

The US accounts for 32% of MasterCard’s total gross dollar volume. The Asia-Pacific, Middle East, and Africa contribute 31%, and Europe accounts for 27% of the total volume.

MasterCard Does Not Look Overvalued Compared to Historical Levels

MasterCard focuses on growth in its core business of credit, debit, prepaid offerings, and processed transactions. It seeks to diversify its customer base, including smaller merchants and consumers who still use cash and checks.

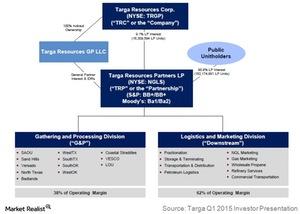

Targa Resources: A Midstream Energy MLP

Targa Resources Partners is a midstream energy MLP formed in 2006. The company is expanding its operations into gathering crude oil and transporting petroleum products.

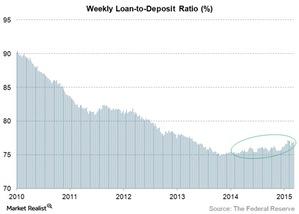

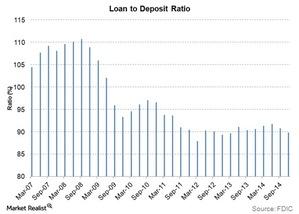

Loan-to-Deposit Ratio Moves in the Right Direction for Banks

The ideal loan-to-deposit ratio for a bank depends on the bank’s business model. Some banks that focus on core banking, like U.S. Bancorp (USB), have high loan-to-deposit ratios.

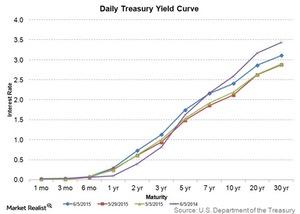

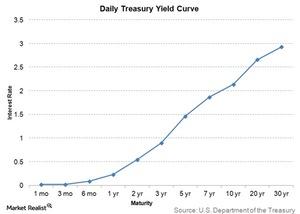

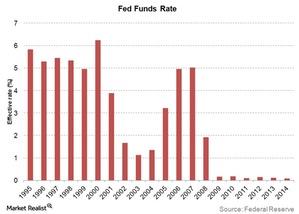

Banks Set to Profit from Steepening Yield Curve

The yield curve has steepened a bit compared to where it was a week or even a month ago. Investors should consider the yield curve slope an indicator of bank performance.

Why Does a Flattened Yield Curve Hurt Banks?

Banks benefit from a steeper yield curve, which allows banks to lend on higher long-term rates and borrow on lower short-term rates. This boosts banks’ margins.

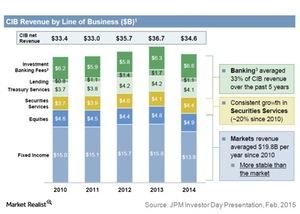

How J.P. Morgan Ranks in Corporate and Investment Banking

In the US, J.P. Morgan competes with Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS), the leading players in investment banking.

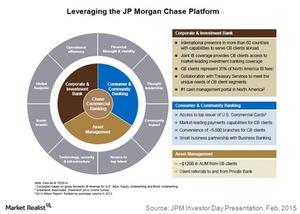

J.P. Morgan: Commercial Banking and Firm-Wide Synergies

J.P. Morgan Commercial Banking clients can access the Consumer and Community Banking segment’s commercial credit cards, payments services, and branch network.

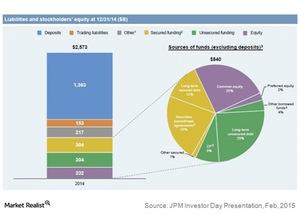

J.P. Morgan and Its Diversified Funding Sources

Banks like US Bancorp (USB) and Wells Fargo (WFC) have an advantage over J.P. Morgan in terms of debt rating. Both banks secure higher ratings.

J.P. Morgan Looks to Deepen Customer Relationships

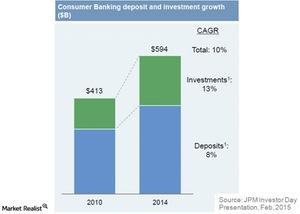

The number of J.P. Morgan active mobile customers has more than tripled since 2010. As a result, the bank is adapting its digital capabilities.

J.P. Morgan’s 4 Operating Segments

Consumer and Community Banking is the biggest of J.P. Morgan’s four segments. Corporate and Investment Banking follows, with 34% of revenues.

J.P. Morgan: The Banking Giant

In this series, you’ll learn what value J.P. Morgan holds for its shareholders, about its various businesses, and how it compares with other big banks.

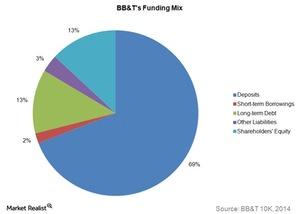

Why BB&T Has Low Funding Costs Compared to Its Peers

Deposits are the cheapest funding source. Since deposits fund a major chunk of BB&T’s assets, the overall funding costs are low.

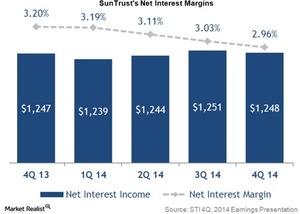

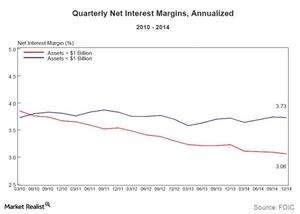

Why SunTrust Has Lower Net Interest Margins

SunTrust Bank’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in net interest margin.

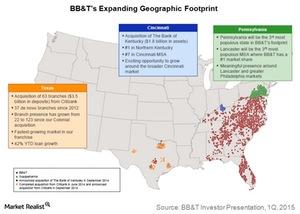

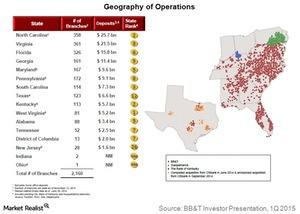

BB&T to Expand Its Footprint in Ohio and the Mid-Atlantic Region

BB&T’s Susquehanna acquisition will significantly expand BB&T’s Mid-Atlantic footprint. The deal is valued at ~$2.5 billion. It will close in the second half of 2015.

Why Is the Loan-to-Deposit Ratio Declining for US Banks?

The industrywide loan-to-deposit ratio has declined over the last few years, largely due to the increase in non-interest-bearing bank deposits.

Why Are Interest Rates at an All-time Low?

The quantitative easing policy adopted by the Federal Reserve at the end of 2008 to boost economic growth included a drastic reduction in interest rates.

Why Lower Funding Costs Impact Net Interest Margins

Lower funding costs determine a bank’s net interest margin. A bank has funding cost advantage when it pays less interest on borrowed funds and deposits.

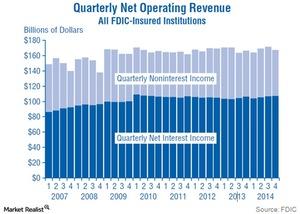

Why Is Interest Income Important to Banks?

Interest income typically contributes more than 60% to a bank’s total operating income.

BB&T’s Residential Mortgage Banking Segment Faces Headwinds

BB&T’s (BBT) Residential Mortgage Banking segment retains and services mortgage loans originated by the Community Banking segment.

BB&T Corporation Is a Leading Bank in the Southeast Region

BB&T Corporation (BBT) is a financial holding company. It conducts its operations primarily through its bank subsidiary—Branch Bank.

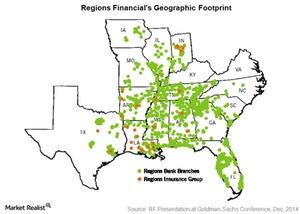

What investors should know about Regions Financial Corporation

Regions Financial Corporation is a leading regional bank in the southeastern US. It’s the 17th largest bank in the US—based on assets.

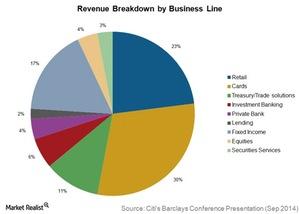

Citigroup: Number 3 US bank has $1.9 trillion in assets

Citigroup provides a broad range of financial products and services, including consumer banking, corporate and investment banking, among other things.