Why SunTrust Has Lower Net Interest Margins

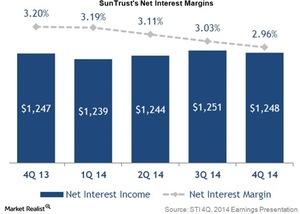

SunTrust Bank’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in net interest margin.

April 9 2015, Updated 12:47 p.m. ET

Net interest margins

Net interest income contributes around 60% of total operating income for SunTrust Bank (STI).

The net interest margin (or NIM) measures the difference between rates earned on interest-earning assets and the cost of funds. NIMs typically trend higher in an increasing interest rate environment. Banks raise the interest they charge for loans faster than they pay on deposits, giving an immediate boost to margins. A sustained low rate environment, on the other hand, affects NIMs negatively. You can learn more by reading How Are Lower Interest Rates Impacting Banks’ Margins?

Decline of NIM

STI’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in NIM. At 2.96%, NIM was down 24 basis points due to a drop in earning asset yields. The graph above shows SunTrust’s interest income and margins over the last five quarters.

Lower NIM

The 4Q14 NIM for BB&T (BBT) was 3.36%. Regions Financial (RF) and Wells Fargo (WFC) also had higher NIMs than STI at 3.17% and 3.04%, respectively. The average NIM for SunTrust’s peer banks for the same period was 3.04%.

STI’s NIM is marginally lower than the peer average. The NIM determines how effectively a bank is using its earning assets. The higher the ratio is, the better.

One of the contributing factors to SunTrust’s lower NIM is its comparatively lower deposit growth. Deposits are the cheapest funding source.

STI forms about 1.4% of the SPDR S&P Regional Banking ETF (KRE) and roughly 5.5% of the iShares US Regional Banks ETF (IAT).