BTC iShares U.S. Regional Banks ETF

Latest BTC iShares U.S. Regional Banks ETF News and Updates

Financials Must-know: Determining a bank’s value

The first challenge is that banks are highly regulated and any change in regulations has a huge impact on the valuation of a bank—the second challenge is that it’s difficult to determine cash flow for a bank because both debt and reinvestment are difficult to calculate.

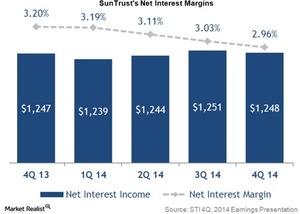

Why SunTrust Has Lower Net Interest Margins

SunTrust Bank’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in net interest margin.