BB&T Corp.

Latest BB&T Corp. News and Updates

US Banking Sector: Key Trends and Outlook

Changes in technology have reshaped the banking sector. Banks are increasingly collaborating with fintech firms to improve their customer service.

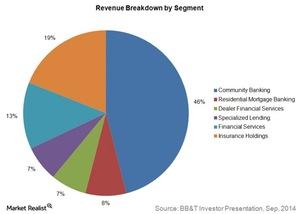

Analyzing BB&T Corporation’s 6 Operating Segments

BB&T Corporation’s (BBT) operations are divided into six business segments. Community Banking contributes 46% to the total revenue.

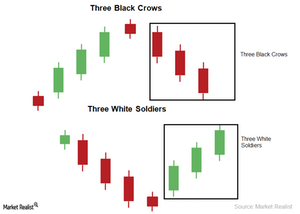

Three Black Crows And Three White Soldiers Candlestick Pattern

The Three White Soldiers candlestick pattern is also a reversal pattern. It forms at the bottom of a downtrend. The pattern has three candles. All three of the candles are long and bullish.

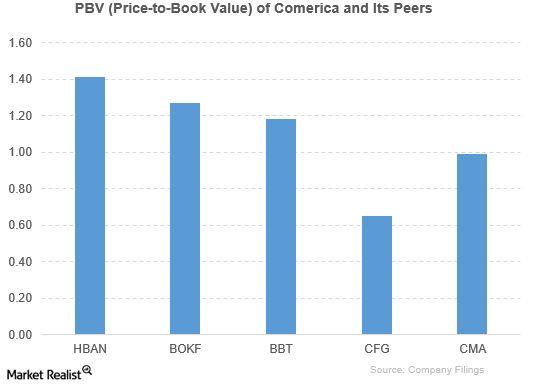

How Did Comerica Perform Compared to Its Peers?

The peers outperformed Comerica based on the PBV ratio. However, Comerica is way ahead of its peers based on the forward PE ratio.

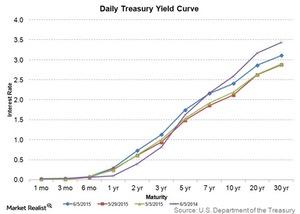

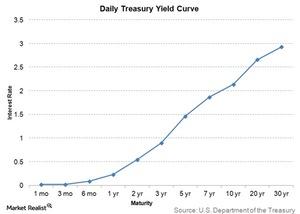

Banks Set to Profit from Steepening Yield Curve

The yield curve has steepened a bit compared to where it was a week or even a month ago. Investors should consider the yield curve slope an indicator of bank performance.

Why Does a Flattened Yield Curve Hurt Banks?

Banks benefit from a steeper yield curve, which allows banks to lend on higher long-term rates and borrow on lower short-term rates. This boosts banks’ margins.

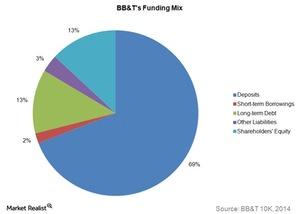

Why BB&T Has Low Funding Costs Compared to Its Peers

Deposits are the cheapest funding source. Since deposits fund a major chunk of BB&T’s assets, the overall funding costs are low.

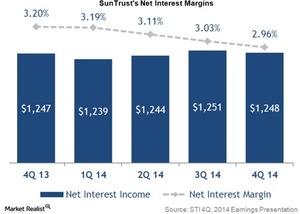

Why SunTrust Has Lower Net Interest Margins

SunTrust Bank’s net interest income in 2014 remained stable compared to 2013 as strong loan growth offset the decline in net interest margin.

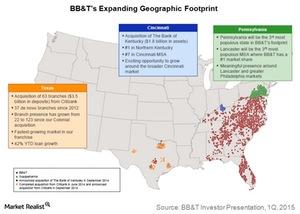

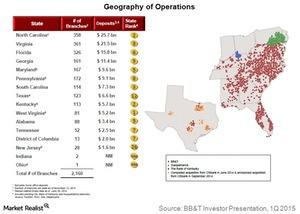

BB&T to Expand Its Footprint in Ohio and the Mid-Atlantic Region

BB&T’s Susquehanna acquisition will significantly expand BB&T’s Mid-Atlantic footprint. The deal is valued at ~$2.5 billion. It will close in the second half of 2015.

BB&T Corporation Is a Leading Bank in the Southeast Region

BB&T Corporation (BBT) is a financial holding company. It conducts its operations primarily through its bank subsidiary—Branch Bank.

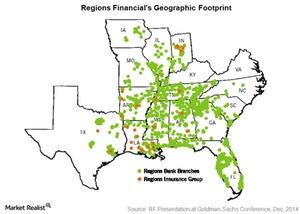

What investors should know about Regions Financial Corporation

Regions Financial Corporation is a leading regional bank in the southeastern US. It’s the 17th largest bank in the US—based on assets.