Meera Shawn

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Meera Shawn

Is Silver More Valuable as a Precious Metal or an Industrial Metal?

Silver has been falling over the past few years, despite surging demand for its industrial use. Fundamentally, silver seems to be strong due to rising demand and a year-over-year shortfall in its supply.

Yellen Wants to Keep Negative Rates on the Table, Helping Gold

When the Federal Reserve chair, Janet Yellen, testified to Congress on February 11, she affirmed the Fed’s consideration of negative interest rates. Under a negative interest rate scenario, investors would pay interest to the bank for holding their money.

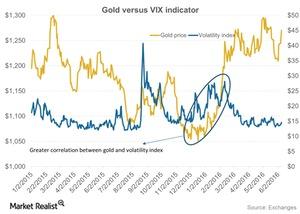

How Much Could Brexit and Volatility Control Gold?

Fears in the overall financial market about a Brexit, the possible exit of Britain from the European Union, have abated. This helped gold fall.

How Investor Appetite for Risk Impacts Precious Metals

Gold and silver have seen trailing-five-day losses of 0.9% and 2.7%, respectively. The reason behind the fall in the precious metals is the buoyancy of the equity markets and the gains in the US dollar.

How Do US Economic Numbers Play on Gold?

Economic data from the United States on Tuesday, July 21, 2016, on home starts and building permits affected gold and other precious metals to a certain extent.

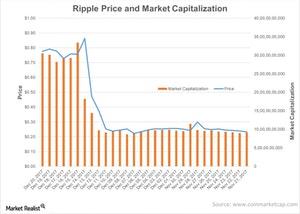

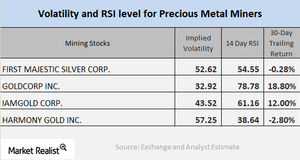

Ripple Crosses $1 for the First Time on December 21

For the first time in history, the price of ripple has surpassed $1.

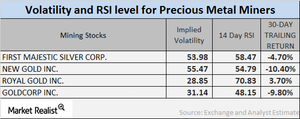

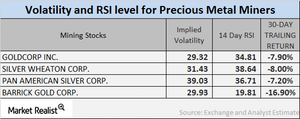

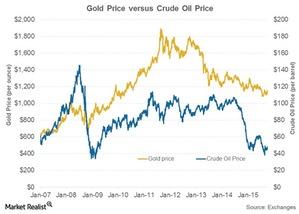

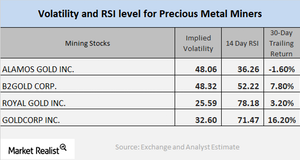

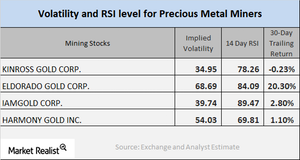

How Mining Stock Volatility Numbers Are Moving Now

First Majestic, New Gold, Agnico, and Silver Wheaton now have RSI scores of 60.5, 56.2, 57.6, 59.6, respectively.

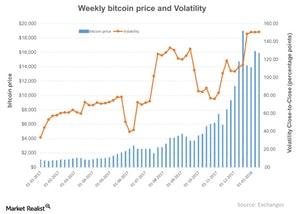

Bitcoin Retreats from Its 3-Week High of $17,712.40

Bitcoin prices touched a three-week high of $17,712.40 on January 6, 2018, and then fell. As of Monday, January 8, 2018, at 5:00 AM EST, it had a 24-hour fall of 5.4%.

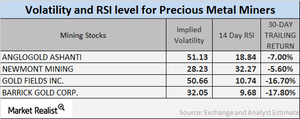

What Falling Miner RSI Levels Suggest

The RSI levels of our four select mining giants have all increased lately due to their higher stock prices.

How Silver Prices Are Influencing Major Silver Miners

Mining companies like First Majestic Silver (AG), Silver Wheaton (SLW), Pan American Silver (PASS), Coeur Mining (CDE), and Hecla Mining (HL) are primarily into silver exploration.

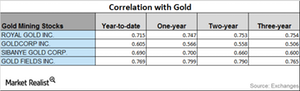

Which Stocks Are Uptrending in Their Correlations to Gold?

It’s expected that precious metal mining stocks will follow precious metals. So it’s crucial to know which stocks are closely associated with precious metals.

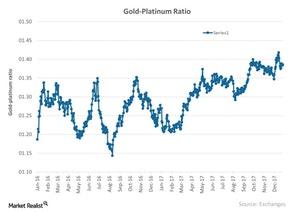

Platinum Touched Its Six-and-a-Half-Year Low in 2015

As automobile catalysts comprise ~44% of the demand for platinum, the Volkswagen scandal curbed the demand for diesel-fueled cars that use platinum as a catalyst. This pulled down the already depressed platinum and comparatively strengthened palladium.

Why Are Gold ETFs Losing Their Allure?

With declining gold prices, the most famous gold ETF, the SPDR Gold Shares ETF (GLD), has also lost its allure. It’s trading at lower volume.

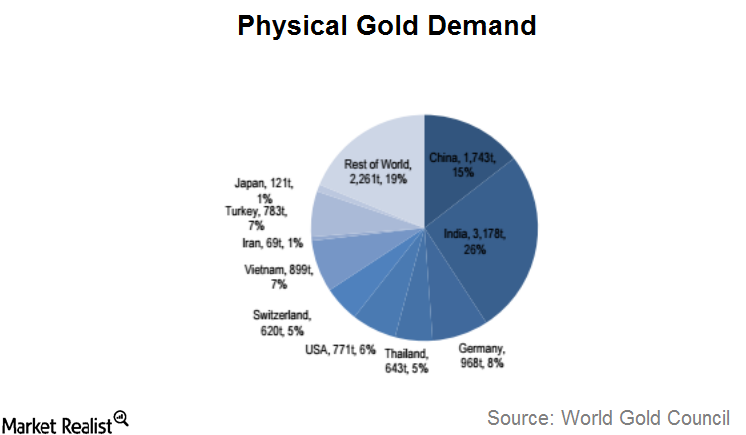

The Biggest Gold Buyer: India Is Back!

Indian jewelers have called off their 43-day strike, which began as a reaction to a 1% excise duty on gold jewelry.

How the Economic Sentiment Is Playing on Gold

During the past week, average hourly earnings, excluding the farming industry, were below analysts’ expectation of 0.10%.

Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

Will a Rate Hike Pull the Lid off Gold?

Though an increase in rates may initially dim the luster of the metal, after the hike, gold may soar, uninterrupted by looming fears.

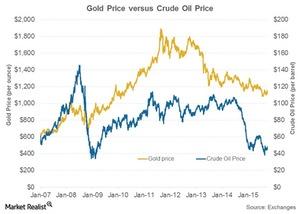

The Correlation between Gold and Oil

Oil is widely used in mining exploration, and a surge in oil prices may squeeze miners’ margins, leading to a fall in their share prices.

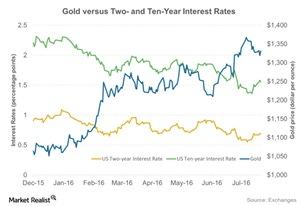

What’s the Impact of Interest Rates on Precious Metals?

Monetary policies have been crucial in determining the movement in precious metals.Materials Are Analysts Optimistic about Miners?

Despite the ongoing slump in the precious metals market, it seems that there could be hope going forward.

A Quick Look at the Technicals of the 4 Precious Metals

Gold’s price dipped 0.13% to $1,312.8 per ounce on May 9. The fall in gold was extended for a number of reasons.

The Most Crucial Element in the Precious Metals Downtrend

Gold ended the day almost flat on Wednesday, May 2, and closed at $1,304.90 per ounce.Miscellaneous How Is the Dollar Affecting Precious Metals?

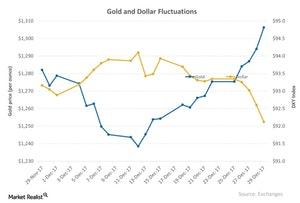

Besides ongoing geopolitical concerns, a crucial factor that gold keeps looking to for directional moves is the US dollar.

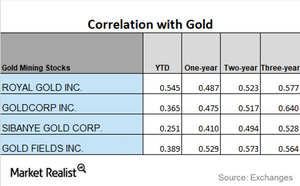

Comparing Mining Stocks’ Correlation with Gold

Mining stocks tend to move with gold prices. In this part, we’ll analyze the correlation between gold and four mining stocks.

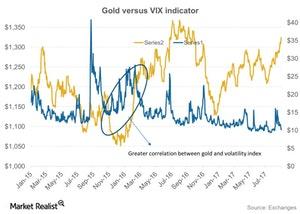

How Is the Volatility Index Impacting Gold?

Another critical factor that has been affecting the price movement of precious metals is overall market volatility.

Analyzing Miners’ Correlations with Gold in January 2018

In this part of the series, we’ll analyze the correlations of the movements of a group of mining stocks with gold.

Reading the Technicals and Price Movements of Mining Stocks

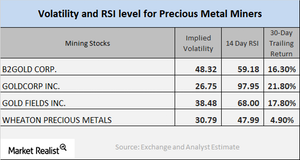

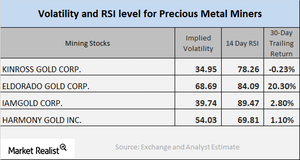

In this article, we’ll do a technical analysis of a few select mining stocks. When investing in mining stocks, it’s crucial to read their indicators.

How Is Bitcoin Faring after Last Week’s Slump?

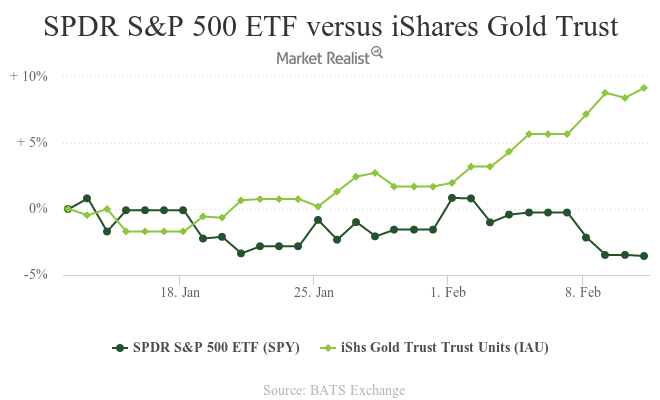

Investors (SPX-INDEX) around the world looked to gold (GLD) (IAU) for the rescue during the slump in bitcoin prices.

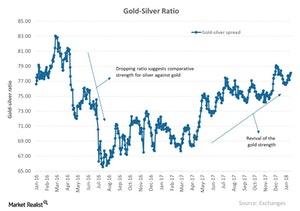

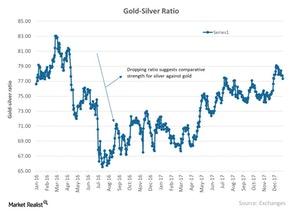

A Brief Analysis of the Gold-Silver Spread in January 2018

A quick look at the relationship between the two core precious metals, gold and silver, could also be helpful in the analysis of the overall precious metals market.

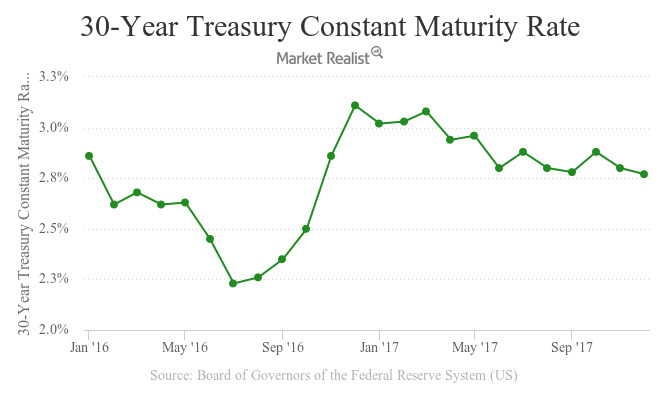

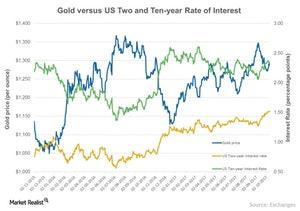

Is Gold Keeping Tabs on the US Interest Rate?

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

Analyzing the Technicals of Mining Stocks in January 2018

Most mining stocks have risen during the past month due to the revival in precious metals prices.

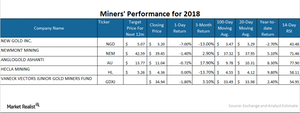

A Quick Look at the Precious Metals Revival, Miners’ Performances

Precious metals prices shot up on January 19, 2018, with concerns looming over the shutdown the of the US government.

What Miners’ Moving Averages Indicate

NGD and HL are both trading below their longer-term 100-day moving averages.

How Are Miners’ Correlations to Gold Trending?

Mining stocks tend to take their cues from gold.

Analyzing the Correlation of Gold to Miners in January 2018

First Majestic Silver saw correlation drop during the past three years. On a three-year basis, its correlation with gold was 0.57.

Reading the Performance of Mining Shares amid Surging Metals

On January 12, 2018, precious metals were once again on a rising streak, which also led to increasing prices for mining shares.

A Brief Analysis of Silver Miners in January 2018

The target prices of the four miners we’re covering in this part are higher than their current trading prices, which could lead to an optimistic outlook on their prices.

A Look at Miners’ Correlation Trends

AngloGold Ashanti has seen the highest correlation to gold in the past year, while Eldorado Gold has seen the lowest correlation.

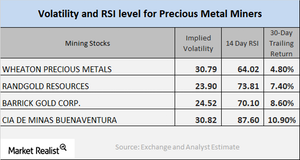

How Mining Stocks Have Performed in January So Far

SLW, GOLD, ABX, and BVN have call implied volatilities of 30.8%, 23.9%, 24.5%, and 30.8%, respectively.

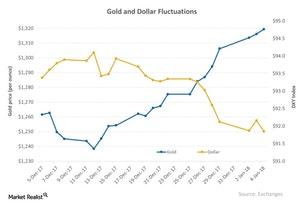

The Dollar and Its Relationship to Precious Metals

The US dollar rose 0.18% on Tuesday, January 9, 2018, which led to the lower price of spot gold (GLD) and silver.

Interest Rate versus Gold: Interest Rate Wins Again

Gold is a non-yield bearing asset that reacts negatively to rises in the interest rate.

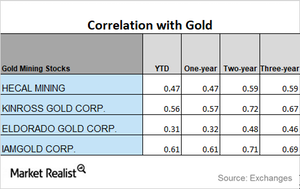

Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

How Do Miners’ Technical Details Look?

Most of the mining companies have risen during the past few weeks. The miners tend to move according to precious metal prices rather than the equities market in general.

What’s the 3-Year Correlation between Miners and Gold?

Gold is the most influential precious metal, and most miners follow its price trends.

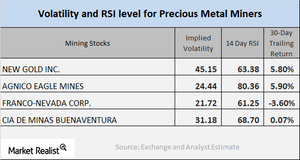

Mining Stocks Follow Precious Metals: Technical Insights

New Gold, Agnico-Eagle Mines, Franco-Nevada, and Cia de Minas Buenaventura have call-implied volatilities of 45.2%, 24.4%, 21.7%, and 31.2%, respectively.

Correlation Reading of Miners and Funds in the Last 3 Years

During the past year, IamGold has seen the highest correlation to gold, while Eldorado Gold has the lowest correlation.

Analyzing Precious Metals: Dollar Had Its Worst Year since 2003

Although most of the upswing in precious metals has been due to the rise in geopolitical risks in 2017, the dollar has been the most crucial factor.

Reading Key Mining Stock Technicals as of December

Most of the mining companies have increased during the past two weeks due to the rise of gold and silver.

Reading the Recent Gold-Silver Spread

Among these spreads, the gold-silver spread is the most talked about because it measures the number of silver ounces it takes to buy a single ounce of gold.

Understanding the Recent Gold-Platinum Cross Rate

When analyzing platinum markets, it’s important to compare the metal’s performance with that of gold, which is the most crucial of the precious metals.