Meera Shawn

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Meera Shawn

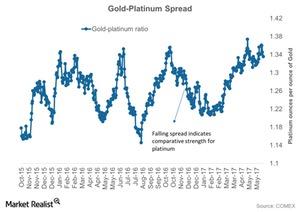

How Gold and Platinum Are Moving in Tandem

Like silver, platinum has industrial uses and has seen growing demand in China.

Reading the Correlation of Mining Shares

Monday, September 25, 2017, was a day of revival for mining shares as tensions in North Korea resurfaced.

Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

Analyzing Miners’ Technicals in September 2017

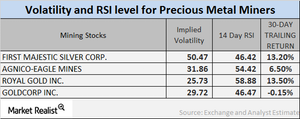

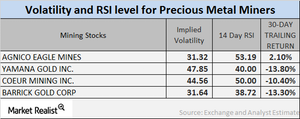

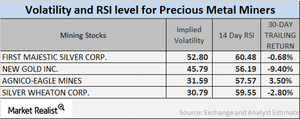

On September 22, 2017, First Majestic Silver, Goldcorp, Newmont Mining, and Silver Wheaton had volatilities of 49.1%, 26.7%, 23.5%, and 30.8%, respectively.

Precious Metals, Miners and the Scaling Dollar

Later in the day on September 20, after rising gold prices fell on the US Federal Reserve’s indication of one more interest rate hike in 2017.

Miners Followed Precious Metals Downhill on September 18

On September 18, Coeur Mining, Barrick Gold, Kinross Gold, and Eldorado Gold had volatilities of 42.3%, 26.4%, 40.8%, and 50.1%, respectively.

How Gold, Silver, and Mining Companies Performed on September 18

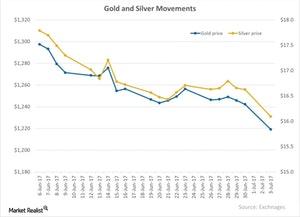

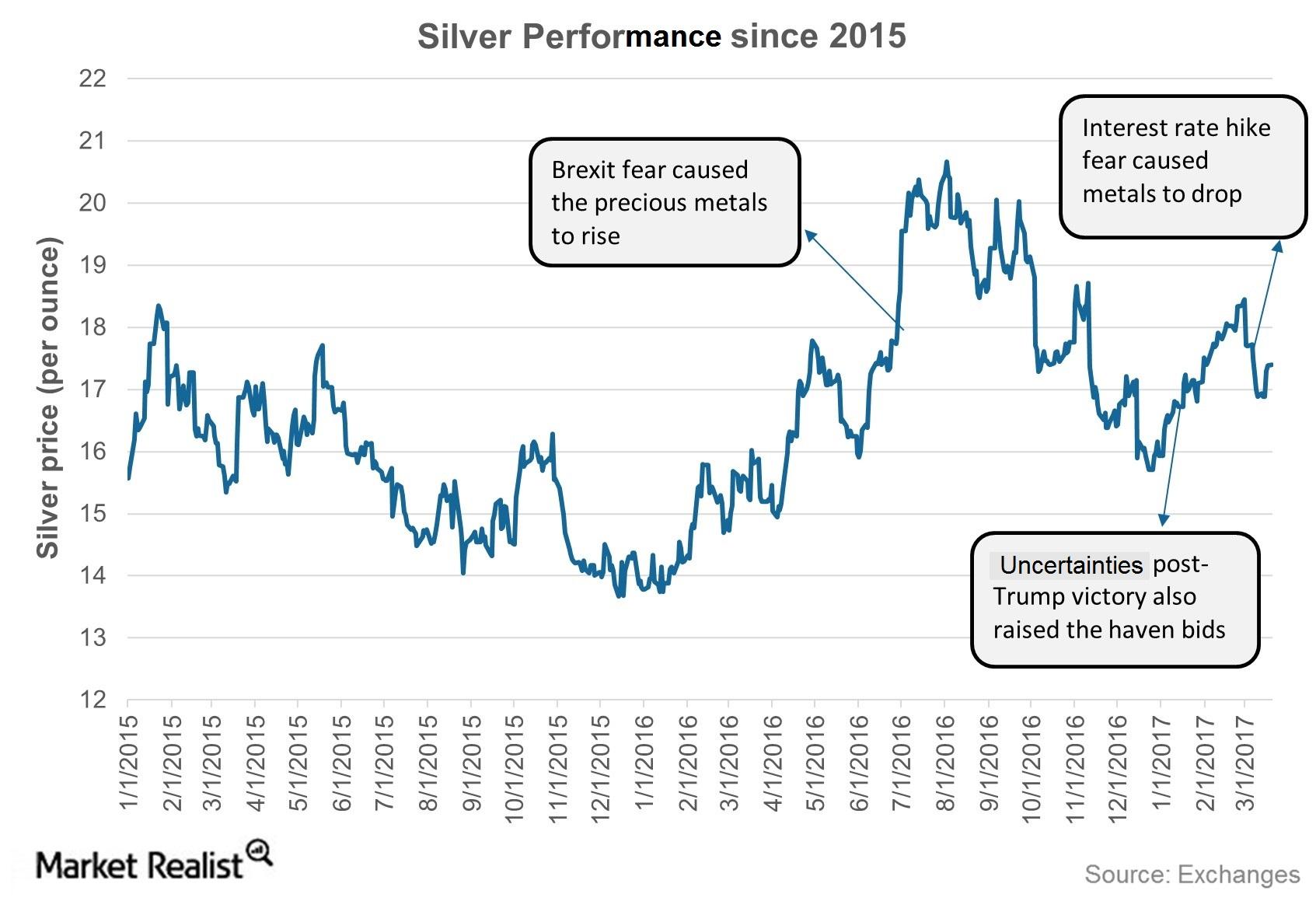

On September 18, gold fell 1.1% and closed at $1,306.90 per ounce. Of the precious metals, silver fell 3.1% and closed at $17.10 per ounce.

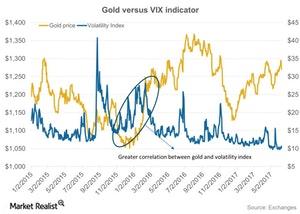

Why Most Mining Stocks Fell on Friday

Precious metal mining stocks follow trends in precious metals, and they’re a very volatile segment of the equity markets.

Analyzing the RSI Movements of Precious Metals

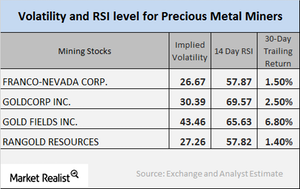

The price movement in precious metals is often closely traced by mining stocks. Before investors opt for mining stocks, they should analyze a few of the crucial technical details.

A Correlation Study of Mining Stocks in September 2017

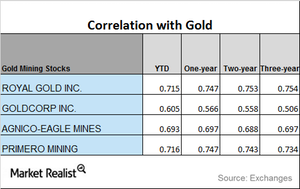

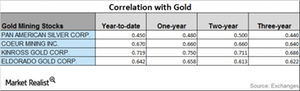

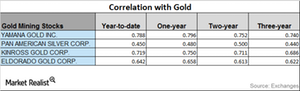

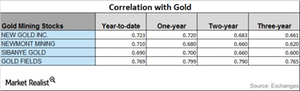

Among the four miners we’re looking at, Gold Fields has the highest correlation to gold on a YTD basis, while Sibanye Gold has the lowest correlation to gold.

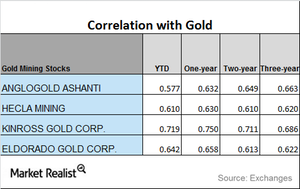

Reading Miners’ Correlation Trends

Mining stocks Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the […]

How North Korea Has Affected the Precious Metal Market

Precious metals have been buoyed by tension in North Korea. If North Korea does another missile test, it could prompt investors to move to haven assets such as gold, silver, Treasuries, and major currencies.

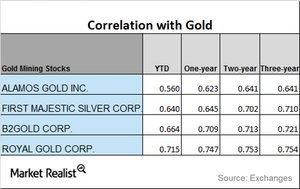

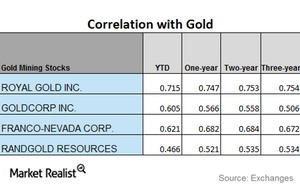

A Look at Mining Stocks’ Correlation with Gold

Miners’ correlation with gold In this part, we’ll look at mining stocks’ correlation with precious metals by comparing their price movement. Specifically, we’ll analyze Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD). The mining stocks have recovered in the past few weeks. The Direxion Daily Gold Miners Bull 3x Shares […]

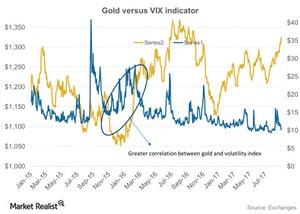

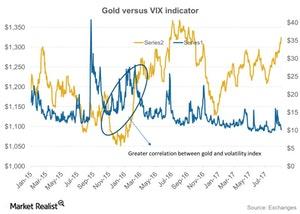

How Gold Is Coping amid Market Turmoil

Precious metals have maintained upward movement over the past month as geopolitical tensions hover.

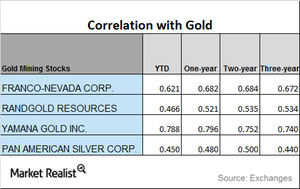

Reading the Correlation Analysis of Mining Shares in August 2017

Yamana Gold has the highest correlation with gold, while Pan American Silver has the lowest correlation.

The Correlation Analysis of Miners through August 2017

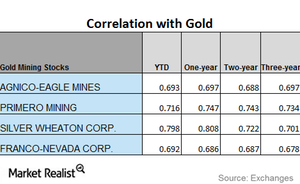

Silver Wheaton has a three-year correlation of ~0.70 with gold and a year-to-date correlation of ~0.80.

How Strongly Can North Korea Move the Precious Metals Market?

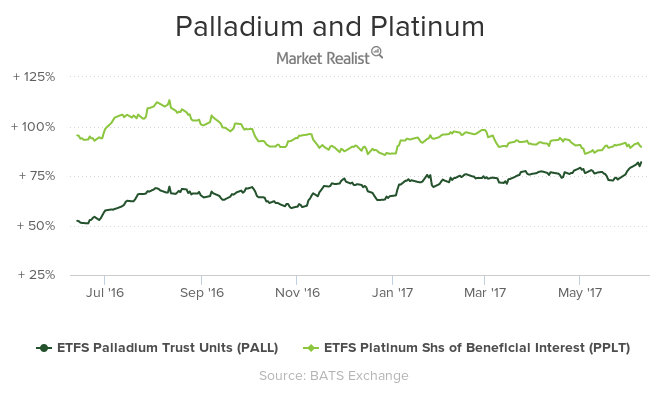

Gold futures for September expiration have risen ~3.9% over the past one-month period. Silver, platinum, and palladium have followed the same track as gold.

Miners: Correlation Trends in August 2017

Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation.

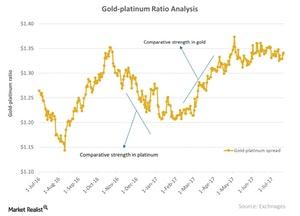

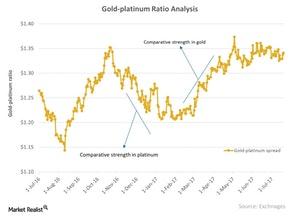

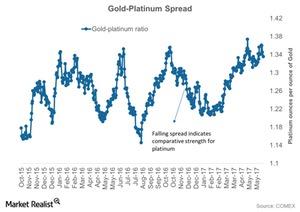

Platinum Market: Reading the Gold-Platinum Ratio

When reading the platinum market, it’s important to look at the relative performance of platinum and gold by using the gold-platinum ratio.

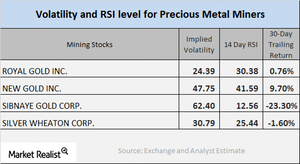

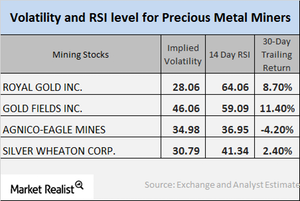

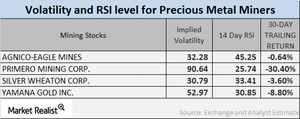

What Miners’ Technical Indicators Suggest

Most of the miners have seen an upswing in their prices over the past week.

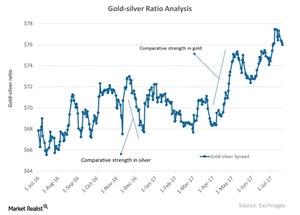

How the Gold-Silver Spread Is Trending

The gold-silver spread measures the price of one ounce of gold in relation to silver.

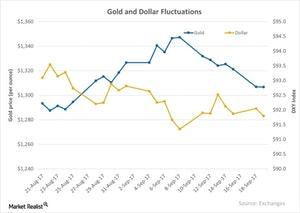

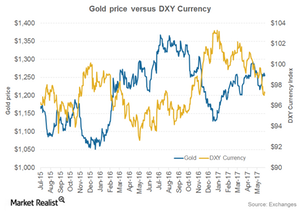

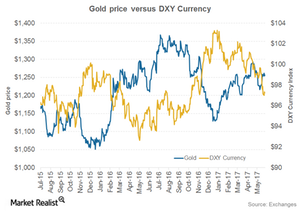

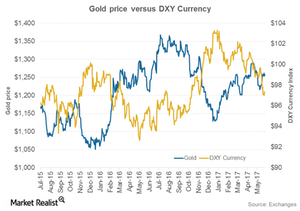

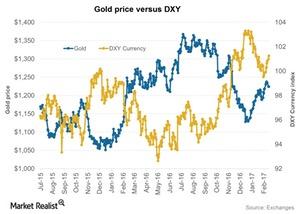

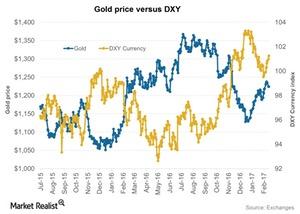

How the US Dollar Affected Gold

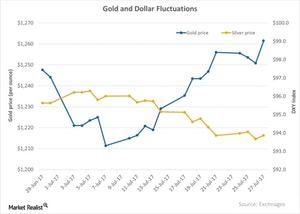

The US dollar has been on a downward swing over the past week.

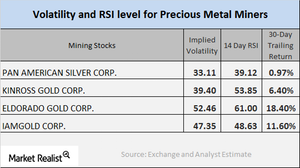

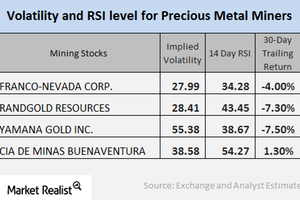

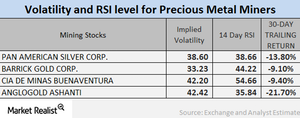

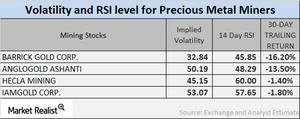

A Look at Volatilities for Precious Metal Miners

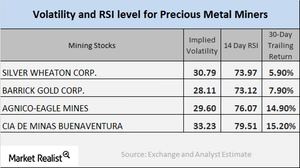

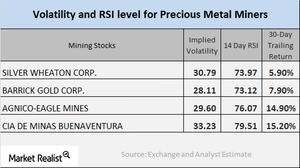

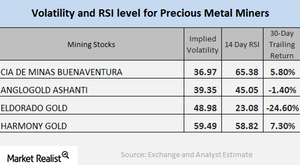

In this part of the series, we’ll look at some important technical indicators, including volatility figures and RSI levels for major miners.

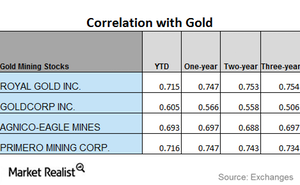

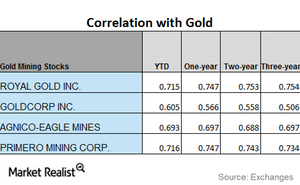

Analyzing Miners’ Correlation in July 2017

Royal Gold’s correlation fell from a three-year correlation of ~0.75 and a year-to-date correlation of ~0.72 with gold.

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

How the Euro Pushed the Dollar Lower and What It Meant for Gold

July 20, 2017, was an up day for the euro, which put downward pressure on the US dollar as represented by the U.S. Dollar Index (or DXY).

Have Miners’ Relative Strength Levels Revived?

In this article, we’ll look at some important technical indicators for Coeur Mining (CDE), Barrick Gold (ABX), Buenaventura (BVN), and AngloGold Ashanti (AU).

Gold-Platinum Ratio: Is Platinum a Long-Term ‘Buy’?

When reading the platinum market, it’s important to analyze the comparative performance of platinum and gold by using the gold-platinum ratio or spread.

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

How Precious Metals’ Slump Dragged Mining Shares and Funds Lower

Gold tumbled to an eight-week low on July 3, 2017. Gold futures for August delivery fell almost 1.9% to settle at $1,219.2 per ounce.

These Mining Companies Are Showing an Uptrend Correlation with Gold

When we try to interpret the performance of precious metals, it’s crucial to study the impact of metal price variations on mining shares.

Inside the Gold-Platinum Spread Now

The platinum industry is now headed for its third-straight year of surplus, likely due to the higher demand for petroleum-based cars.

Why Mining Stocks’ Relative Strength Levels Keep Falling

In this article, we’ll take a look at the variables that determine how attractive particular mining stocks or shares are or could become.

Insight into the Silver Market in June 2017

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

Mining Stocks’ Relative Strength Index Hits Rock Bottom

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

What’s the Volatility of Mining Stocks?

Though the precious metals survived the Fed’s interest rate hike, the miners took a hit. Most mining stocks saw a considerable down day on Wednesday.

Palladium Skyrockets: A Look at What’s in Store Next

Although gold and silver had a down day on Friday, June 9, 2017, platinum and palladium rose about 0.23% and 1.2%, respectively.

Barrick Gold’s and Other Miners’ Correlation with Gold

Metal stocks As we study the impact of global variables on precious metals and the mining sector, we should also analyze the relationship between mining stocks and gold. Correlational analysis can help us compare price movement in mining stocks and the metal. In this part of our series, we’ll examine New Gold’s (NGD), Newmont’s (NEM), Coeur […]

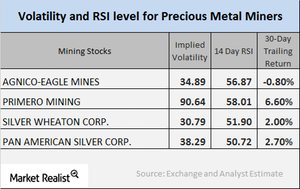

Why RSI levels of Mining Shares Are Rising

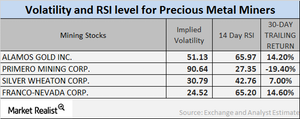

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

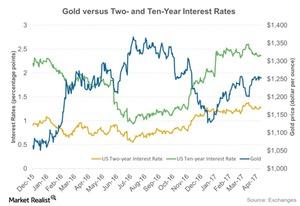

The Ups and Downs of the Dollar and Gold

On June 6, 2017, the US Dollar Index plunged to its lowest level in seven months, which helped dollar-denominated precious metals regain value.

What’s the Correlation between the Dollar and Gold?

The rise in gold on June 6 also boosted the other three precious metals. Silver futures for August delivery were 1.4% higher for the day and closed at $17.6 per ounce.

Are RSI Numbers Moving Away from or Close to Critical Levels?

Investors are constantly speculating about the impact on precious metals of a possible Fed rate hike in June. Let’s look at some 14-day RSI scores and implied volatility.

How Are the Correlations of Mining Stocks Moving?

Fears surrounding a potential upcoming interest rate hike took over precious metals recently, and they fell at the beginning of May 2017.

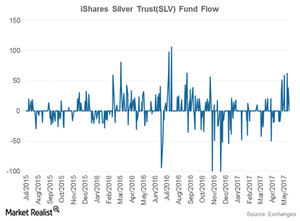

Reading the Fund Flows of the iShares Silver Trust

Over the past year, silver has been very volatile compared to the other three precious metals. Silver was the highest among precious metals in mid-April 2017.

Volatility for Precious Metal Miners: Movement Going Forward

The ETFS Physical Swiss Gold (SGOL) and the ETFS Physical Silver (SIVR) have risen 8.5% and 4.1%, respectively, on a year-to-date basis as of May 18, 2017.

Gold and Other Precious Metals Fell on May 18

Gold futures for June expiration fell 0.47% and ended May 18 at $1,252.8 per ounce. The call implied volatility in gold rose to 11.3%.

What’s the Correlation between the Dollar and Gold in Last 5 Days?

One of the critical elements that plays on precious metals besides the overall market sentiment is the US dollar.

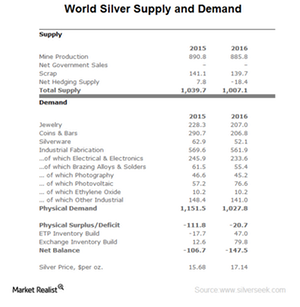

Analyzing Silver’s Fundamentals

When analyzing the performance of a metal, investors should look at its fundamentals. In this series, we’ll look at various metrics for silver and other precious metals.

How the Dollar’s Revival Is Impacting Precious Metals in May

The US Dollar Index, which prices the dollar against a basket of six major world currencies, has risen ~0.46% on a trailing-five-day basis.