Meera Shawn

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Meera Shawn

How Silver-Based Funds Plunged Their Way through April 2017

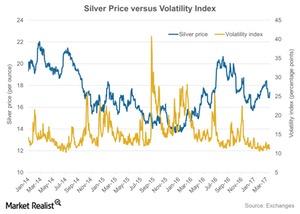

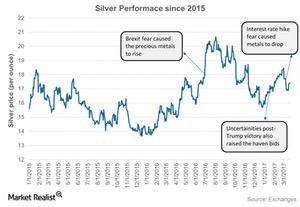

Precious metals were doing considerably well until the first half of April 2017. As investors’ risk appetites revived, haven assets slumped. Among these metals, silver has plummeted the most.

Will the Dollar Get Burned by Another Rate Hike?

While the US dollar has seen a decline in 2017, the increased possibility of a Fed rate hike in June could give the currency some breathing room.

Inside the Monthly Mining Correlations as of May 3

Metal investors have to study upward and downward trends as price change predictability can be affected by rises and falls in precious metal prices.

Global Tremors, the Dollar, and Gold in Early May

Geopolitical risks had been playing on haven bids for precious metals, but now, we may be seeing to be a temporary respite—however brief—from global worries.

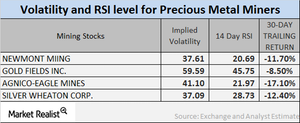

Reading the Mining Stocks’ Falling RSI Numbers

Newmont Mining, Silver Wheaton, Randgold, and Yamana have RSI levels of 45.5, 37.1, 41.2, and 43.0, respectively.

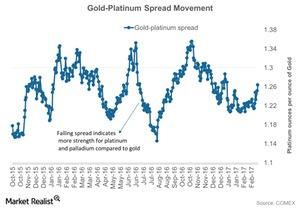

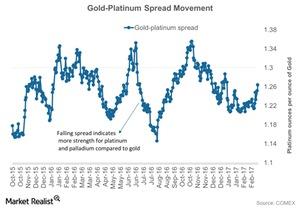

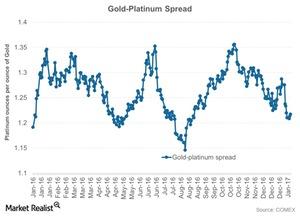

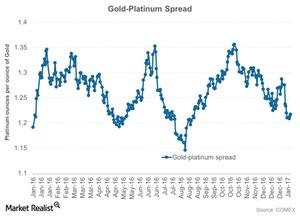

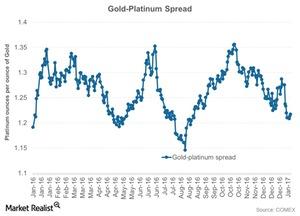

Platinum Is the Worst Performer So Far—Reading Its Spread

The gold-platinum spread was ~1.3 on April 26, 2017. The gold-platinum spread RSI on that day was 59.

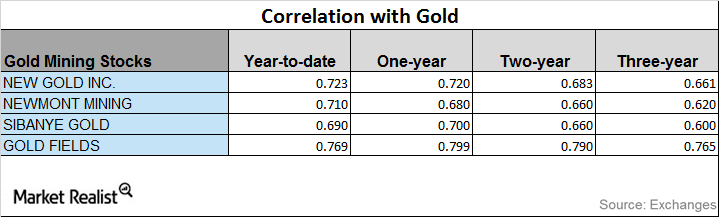

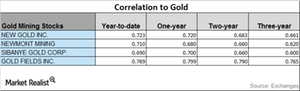

Correlation Trends of Miners to Gold

Among the leveraged mining funds, the Direxion Daily Gold Miners ETF (NUGT) and the Proshares Ultra Silver ETF (AGQ) have seen considerable losses over the past month.

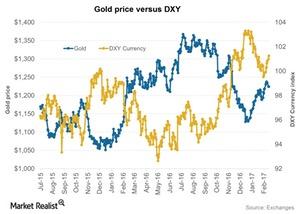

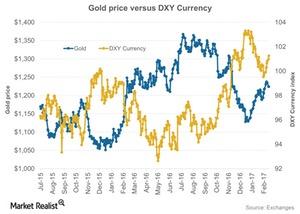

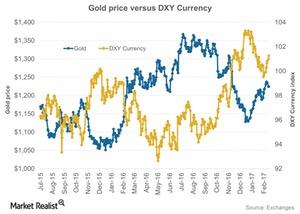

Gauging the Role of the US Dollar in the April 19 Fall of Precious Metals

Another important phenomenon that played on the fall of precious metals on Wednesday, April 19, was the upswing of the US dollar.

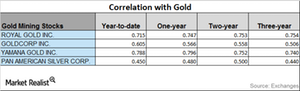

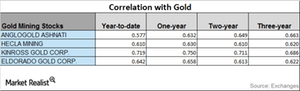

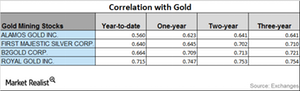

A Look at Mining Stocks’ Correlation with Gold in 2017

Mining stocks and precious metals As global tumult grips markets and investors are turning to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals. Stocks with a higher correlation with precious metals will likely be impacted more by global indicators that influence precious metals. The Direxion Daily […]

How Miners’ Correlations to Gold Are Trending

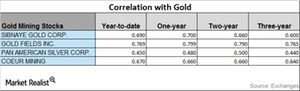

As global tumult grips markets and investors turn to mining stocks as safe havens, it’s crucial to understand which stocks are closely tied to precious metals.

Upcoming French Elections Could Impact Gold

Since the French elections are right around the corner, investors might start parking their money in safe-haven assets like gold.

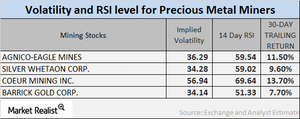

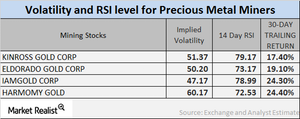

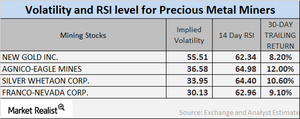

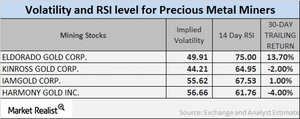

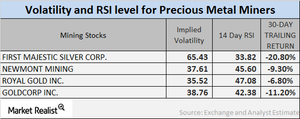

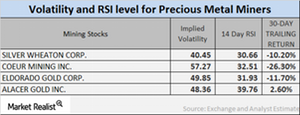

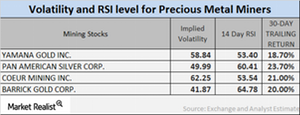

Behind Mining RSI Levels and Volatility Now

Leveraged mining funds including the Direxion Daily Gold Miners (NUGT) and the Proshares Ultra Silver (AGQ) saw big jumps in early 2017 due to the revival in precious metals.

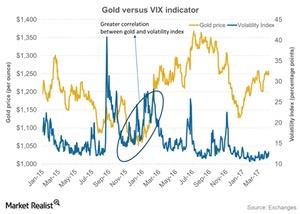

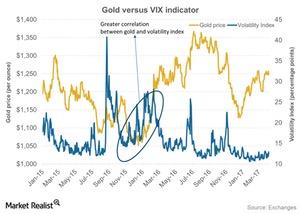

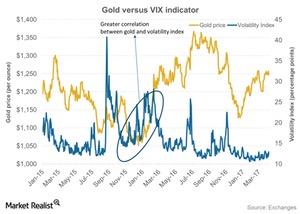

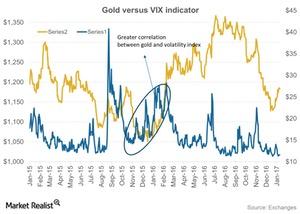

How VIX and Gold Could Walk Hand-in-Hand

On a 30-day trailing basis, gold, silver, platinum, and palladium have risen 6.8%, 1.7%, 3.3%, and 5.5%, respectively.

Is Surging Volatility Giving Gold a Backbone?

As the markets experienced unrest on Tuesday, April 11, gold touched its five-month high of $1,275.10 per ounce.

How Is Gold Fields’ Correlation with Gold Trending?

Turbulence in markets due to the viability of the Trump Administration, the upcoming French elections, and the Brexit vote caused precious metals to rise.

Analyzing the Volatility of Mining Stocks

As of April 6, 2017, the volatilities of New Gold (NGD), Agnico Eagle (AEM), Silver Wheaton (SLW), and Franco-Nevada (FNV) were 55.5%, 36.6%, 34%, and 30.1%, respectively.

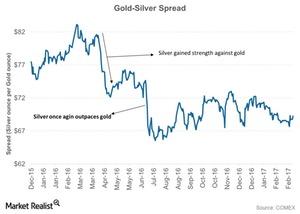

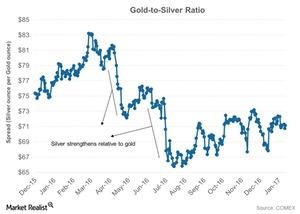

Analyzing the Gold-Silver Spread as Investors Await Further Cues

When analyzing the precious metals market, it’s important to take a look at the relationship between gold (SGOL) and silver (SIVR).

How Are Mining Stocks Performing at the Start of April 2017?

As of April 4, 2017, the volatilities of New Gold (NGD), Agnico Eagle Mines (AEM), Silver Wheaton (SLW), and Randgold Resources (GOLD) were 51.5%, 35.4%, 61.7%, and 54.1%, respectively.

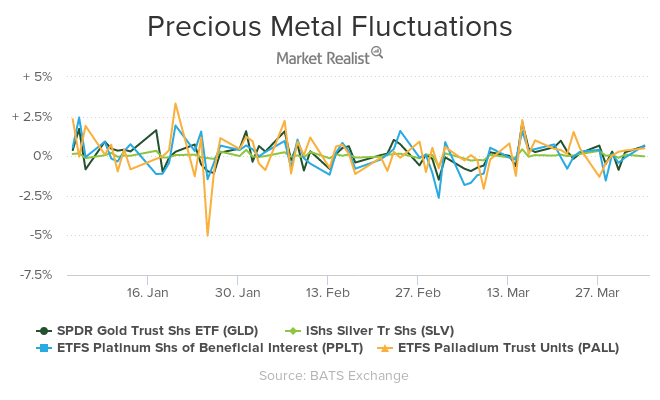

Reading the Performances of Precious Metals in 1Q17

Precious metals had a bright first quarter, which ended March 31, 2017. Gold rose about 8.4%, marking its best quarter in almost a year.

How Did Mining Stocks Correlate with Gold in March 2017?

Yamana’s correlation with gold has increased from a three-year correlation of ~0.74 to a one-year correlation of ~0.80.

Understanding Mining Stock Volatility in March

Now that mining companies have begun witnessing revivals from their losses earlier this year, it becomes crucial to examine the volatility figures and RSI.

Where’s the Platinum Spread Headed in 2017?

Among the four precious metals, platinum has been the worst-performing precious metal and has seen a year-to-date rise of only 5.8%.

Could Brexit and French Elections Move Precious Metals?

Overall sentiment in precious metals seems to be optimistic as global concerns keep piling up. There was unrest on Monday following the failure of the AHCA.

Mining Stock RSI levels: What the Indicators Suggest

NUGT and AGQ have seen YTD rises of 18.6% and 27.5%, respectively. But the volatility of such mining funds can be higher than that of precious metals.

Inside the Recent Role of Volatility in Gold

The volatility index may finally stop being stagnant and move upward, now that the fiasco of the GOP’s healthcare bill attempt failed to launch on March 24.

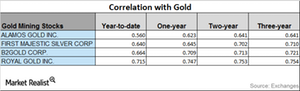

Analyzing the Correlation between Silver Prices and Miners

Mining funds such as the iShares MSCI Global Gold Min (RING) and the leveraged ProShares Ultra Gold (AGQ) have also seen significant correlations with their respective precious metals.

How Overall Economic Climate Affects Silver

The economic performance of the overall world market has a considerable impact on precious metals, especially gold and silver.

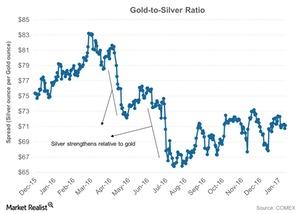

Where Is the Gold-Silver Ratio Headed?

When analyzing the precious metals market, it’s important to take a look at the relationship between gold and silver.

These Factors Have Been Driving Silver Prices

Silver has performed slightly better than gold and platinum on a year-to-date basis.

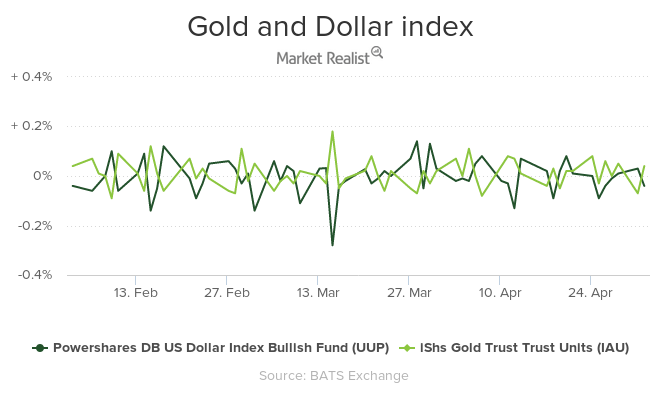

Understanding the Fall in the US Dollar and How Precious Metal Reacted

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low.

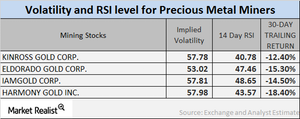

Reading Mining Companies’ Volatilities and RSI Levels

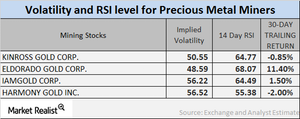

Mining companies’ volatilities are significant to the buying process. The mining shares we’ve selected in this article are Kinross Gold, Eldorado Gold, IAMGOLD, and Harmony Gold.

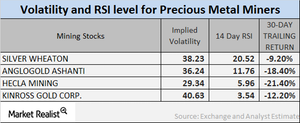

Analyzing Mining Stocks’ Volatility

As of March 15, the volatilities of Silver Wheaton, AngloGold Ashanti, Hecla Mining, and Kinross Gold were 38.2%, 36.2%, 29.3%, and 40.6%, respectively.

These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.

Are Miners Rebounding from Last Week’s Slump?

Monitoring the implied volatilities of large mining stocks is important. We should also watch their RSI (relative strength index) levels, particularly in the wake of changing precious metals prices.

What Scenarios Decide How Precious Metals Move?

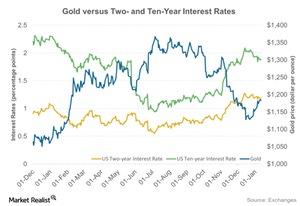

The directional move of the interest rate is a crucial determinant of the direction precious metals will take.

How Precious Metals Have Performed amid Volatility

Precious metal mining stocks are known to closely track the performances of precious metals.

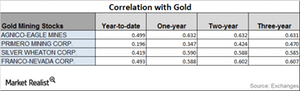

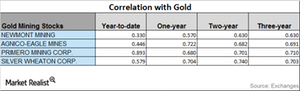

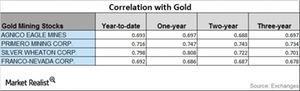

Mining Stocks: An Upward or Downward Correlation to Gold?

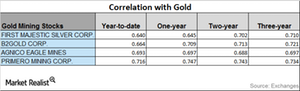

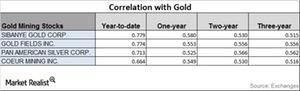

Agnico-Eagle Mines has the highest correlation to gold year-to-date. Primero Mining is the least correlated to gold.

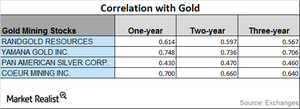

Analyzing the Upward-Downward Correlation of Precious Metals

Mining companies with high correlations to gold include Randgold Resources (GOLD), Yamana Gold (AUY), Pan American Silver (PAAS), and Coeur Mining (CDE).

A Look at the Gold-Platinum Ratio

The demand for platinum has been very fragile over the past few years due to concerns about sales of diesel-based vehicles.

Reading the Ups and Downs of the Gold-Silver Spread

The gold-silver spread was trading at 68.5 on February 23, 2017. The spread suggests that it took 68.5 ounces of silver to buy a single ounce of gold.

Mining Stocks and Gold Prices: Reading the Correlation

It’s important to understand which mining stocks have overperformed and underperformed precious metals.

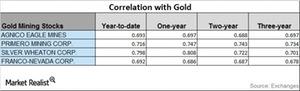

Analyzing the Correlations of Precious Metals Mining Stocks

Mining companies that have high correlations with gold include B2Gold (BTG), Royal Gold (RGLD), Agnico Eagle Mines (AEM), and Primero Mining (PPP).

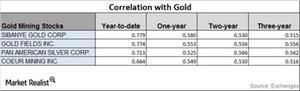

Reading the Correlation Movement of Mining Stocks

Sibanye Gold has the closest correlation to gold on a YTD basis among the four miners under review.

Where the Gold-Platinum Spread Is Headed

Platinum is known for its use in jewelry and as an autocatalyst for diesel-based automobile engines. The demand has been very fragile over the past few years.

Inside Gold’s Upward and Downward Correlation Trends

Precious metal prices have risen due to uncertainty since Donald Trump won the US presidential election.

How Miners’ Correlations Are Moving

Precious metals prices have risen from the ten-month lows they saw in December 2016. As a result, most mining stocks have also risen substantially.

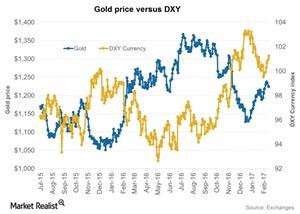

Why Gold and the US Dollar Are Moving in Opposite Directions

Gold prices tumbled on Tuesday, February 14, as the US dollar rose after the US Federal Reserve chair, Janet Yellen, seemed optimistic about raising interest rates.

How the Gold-Platinum Spread Could Move More

The demand for platinum has been very fragile over the past few years, affected by the reduced market forecast for sales of diesel-based vehicles.

Analyzing the Volatility of Miners in February 2017

Call implied volatility takes into account the changes in an asset’s price due to variations in the price of its call option.

How Are Mining Stocks Reacting in 2017?

The rate hike phenomenon in December 2016 played negatively for precious metals.