Meera Shawn

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Meera Shawn

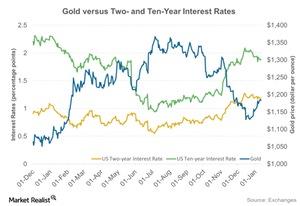

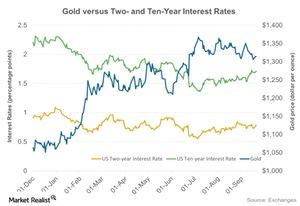

How Interest Rates Are Impacting Precious Metals

Many of the recent changes in precious metals have been determined by changes in the interest rates offered on US Treasuries.

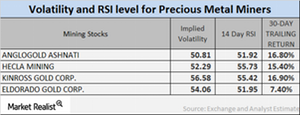

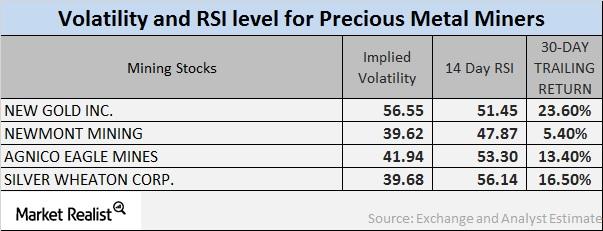

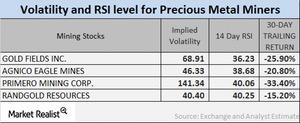

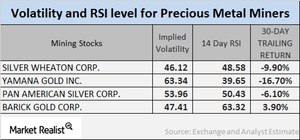

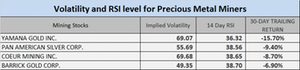

What the Latest Volatility and RSI Numbers Indicate

It’s important to monitor the implied volatilities of large mining stocks as well as their RSI levels, particularly after changes in precious metal prices.

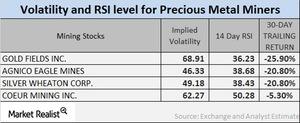

Reading the Volatility Numbers for Mining Stocks

It’s important to monitor the implied volatilities and RSI levels of large mining stocks, particularly in the wake of the changes in precious metal prices.

How GDP Numbers Impacted Gold and the Dollar

The reason behind the fall of the dollar on Friday, January 27, 2017, was lower-than-expected GDP numbers. The DXY ended the day 0.10% higher.

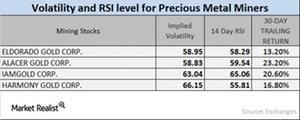

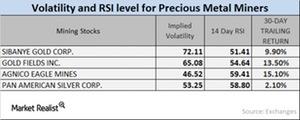

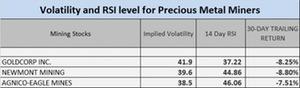

Where Are Mining Stocks’ RSI Numbers and Volatility Pointing?

The trailing 30-day returns of most mining companies are positive due to precious metals’ diminishing safe-haven appeal.

Reading the Volatility and RSI Levels for Miners

Precious metal mining stocks are known to closely track the performance of their respective precious metals. Mining stocks often show more volatility than metals.

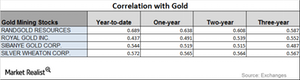

Understanding the Correlation of Mining Stocks in 2017

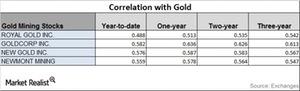

Precious metal prices have been falling since Trump won the US Presidential election on November 8, 2016. Mining stocks quickly followed suit.

Volatility among the Miners in 2017

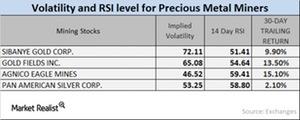

Sibanye Gold, Gold Fields, Agnico-Eagle Mines, and Pan American Silver had RSI levels of 51.4, 54.6, 59.4, and 58.8, respectively.

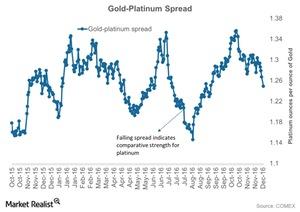

Analyzing the Gold-Platinum Ratio in 2017

The gold-platinum spread was ~1.2 on January 11, 2017. Platinum’s RSI (relative strength index) was 38.

Reading the Movement in the Gold-Palladium Spread

The gold-platinum spread was approximately 1.6 on January 11, 2017. Its RSI (relative strength index) was as low as 40.

Why Mining Stocks Are Seeing Rising RSI Levels

In this part, we’ll look at the implied volatilities of large mining stocks and their RSI levels in the wake of precious metal prices.

What’s the Correlation between Mining Stocks and Gold?

Mining companies that have high correlations with gold include Agnico Eagle Mines (AEM), Alacer Gold (ASR), Alamos Gold (AGI), and AngloGold Ashanti (AU).

What Are Miners’ Volatility and RSI Levels?

Precious-metal-based funds such as the ProShares Ultra Silver (AGQ) and the Direxion Daily Gold Miners (NUGT) have seen a revival in their price during the last month.

Analyzing Silver’s January Technicals

Among the other precious metals trading on the COMEX, silver shares for March expiration maintained an almost flat end to the day on January 11, 2017.

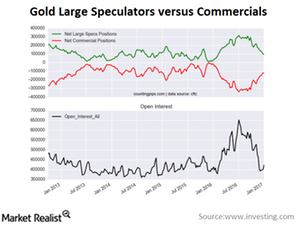

Reading Speculators’and Hedgers’ Positions in Gold

Large speculators and traders continued to reduce their bullish net positions in gold futures markets last week for the eighth consecutive week.

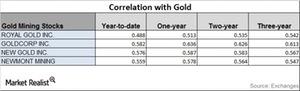

How Mining Stocks Reacted to Plummeting Metals

Mining companies that have high correlations to gold include Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM).

What Were Mining Stocks’ Correlations during December?

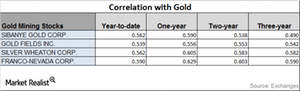

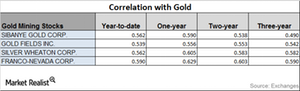

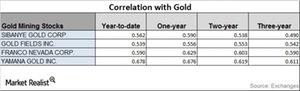

Precious metals had a great start to 2016. Franco-Nevada’s correlation rose from an ~0.59 three-year correlation to an ~0.63 one-year correlation.

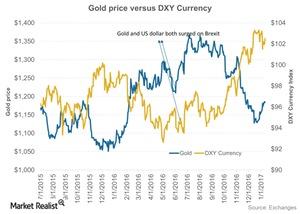

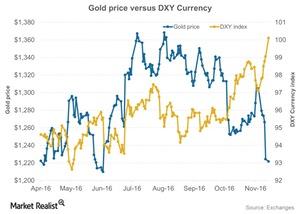

US Dollar Played on Gold in 2016

The correlation between gold and the US Dollar Index is -0.36. It means that about 36.0% of the time, gold and the dollar move in opposite directions.

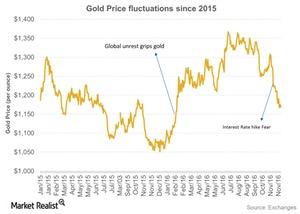

Why Did Gold Fluctuate in 2016?

Gold prices for February expiration fell on the last trading day of the year. Gold fell 0.53% and closed at $1,152 per ounce on December 30, 2016.

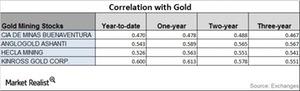

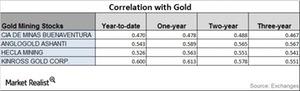

Analyzing Mining Stocks’ Correlation in 2016

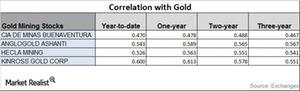

Mining companies that have high correlations with gold include Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

Analyzing Upward and Downward Correlations among Miners

Precious metals had a great start to 2016, but they’ve been falling since Donald Trump won the US presidential election. As a result, mining stocks have also been falling.

How Are Miners and Gold Correlated?

The substantial returns of most mining companies have been due to safe-haven bids that boosted gold and other precious metals.

Reading the Correlation of the Mining Stocks

Mining stocks and gold Although precious metals were doing well at the beginning of 2016, it’s important to know which mining stocks overperformed and underperformed precious metals. Precious metal prices have been falling since Donald Trump won the US presidential election on November 8, 2016. As a result, mining stocks have also been falling. Mining […]

Which Mining Stocks Have Highest Correlation to Gold?

Mining companies that have high correlations with gold include Cia de Minas Buenaventura (BVN), AngloGold Ashanti (AU), Hecla Mining (HL), and Kinross Gold (KGC).

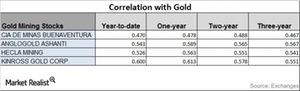

How Has the Gold-Silver Ratio Trended in 2016?

Gold and silver have been strong for the past few days. However, silver has substantially outperformed gold year-to-date.

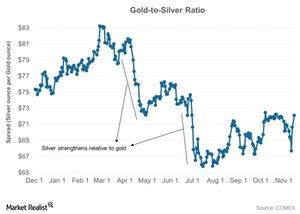

Commercial and Non-Commercial Positions in Silver Are Falling

Silver-based mining funds like the Global X Silver Miners Fund (SIL) have been negatively impacted by the drop in silver prices.

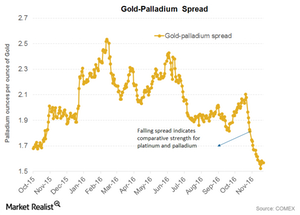

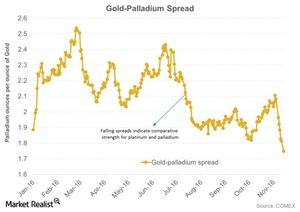

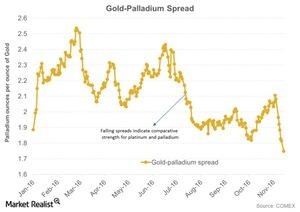

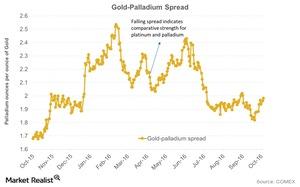

Why the Gold-Palladium Spread Is Falling Drastically

Palladium has seen a YTD rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

Which Mining Stock Is Most Correlated to Gold?

Mining companies that have high correlations with gold include Sibanye Gold (SBGL), Gold Fields (GFI), Silver Wheaton (SLW), and Franco-Nevada (FNV).

How Palladium Outperformed Gold: The Gold-Palladium Spread

Palladium has seen a year-to-date rise of a whopping 32.5%, which is higher than the rise in platinum, silver, and gold. Earlier, palladium was underperforming its precious metal peers.

Analyzing the Correlation of Mining Stocks

Mining companies that have high correlations with gold include Alamos Gold (AGI), First Majestic Silver (AG), B2Gold (BTG), and Royal Gold (RGLD).

What’s Affecting the Gold-Palladium Spread?

Palladium has seen a year-to-date rise of 24.9%, which is higher than the increase in platinum, silver, and gold.

What Do Mining Stocks’ Technicals Indicate?

Many of the fluctuations in precious metals have been a result of speculation about the Federal Reserve’s interest rate stance.

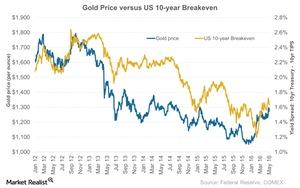

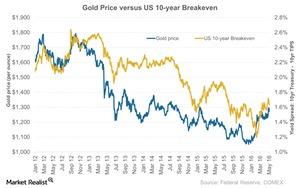

Will Gold Keep a Close Watch on Inflation Numbers?

Donald Trump’s recent victory is shining a light on the possibility of a rise in inflation and how such a rise could work for gold.

Where Is the Gold-Palladium Spread Headed?

The gold-palladium spread has seen its ups and downs over the past few months. But the United Kingdom’s Brexit vote resulted in some strength for palladium.

Reading the RSI Levels and Volatilities of Mining Companies

Many of the fluctuations in precious metals have been determined by the Federal Reserve’s interest rate stance. These variations play on precious metals funds.

Are Inflation Concerns Likely to Boost Gold’s Performance?

The difference between yields on ten-year US notes and similar-maturity TIPS, a gauge of price expectations, expanded to as much as 1.7% last Tuesday.

Fed’s Hawkish Stance: Why It Impacted Precious Metals

Last week was rough for precious metals. Gold, silver, platinum, and palladium all fell. Gold had the biggest weekly fall in about three years.

Why Are Precious Metals Showing Weakness?

Gold broke its key level of $1,300 per ounce on Tuesday, October 4, 2016. But investors are seeing gold’s 200-day moving average of $1,258 per ounce as a resistance level.Macroeconomic Analysis How Has the US Dollar Affected Platinum Prices?

The current weakness in the rand made it fall to all-time lows against the US dollar in early 2016 but has helped mining companies.

Rising Volatility Continues to Affect Miners’ Stocks

The precious metals price correction that happened on September 2, 2016, extended to September 6. How did equities and funds respond?

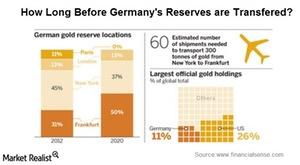

Why Germany Is Pulling Back on Gold

Since 2013, Germany has resorted to the gold repatriation plan, which aims to transfer ~673 metric tons from foreign storage back to Germany by 2020.

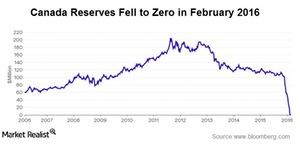

Why Canada Cut Its Gold Reserves

Canada is the only G7 nation that does not hold at least 100 tons of gold in its reserves. Its holdings rank it last of 100 central banks—behind Albania.

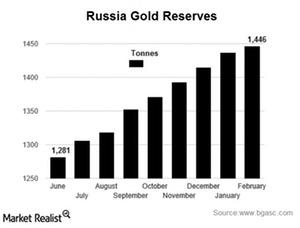

Is Russia Another Gold Stacker?

In January 2016, Russia’s central bank bought almost 22 tons of gold worth ~$800 million—the eleventh month in a row that it bought large gold volumes.

How Did the Rebound in the US Dollar Impact Gold?

The US dollar rebounded on Tuesday, August 2, after losing on Friday due to weak US economic data. The US dollar rose by 0.15% against world currencies.

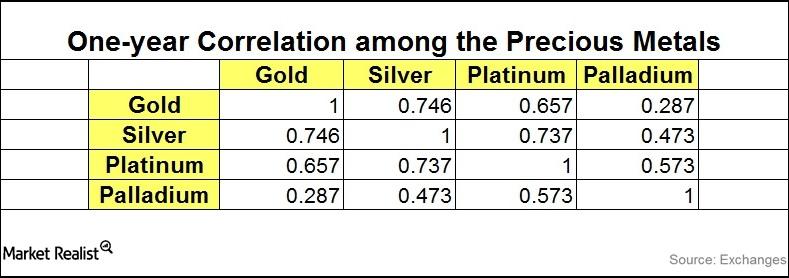

What Does the Precious Metal Correlation Suggest?

Gold and silver have a strong correlation close to 75%. This suggests that about 75% of the time, a fall in gold prices leads to a fall in silver prices.

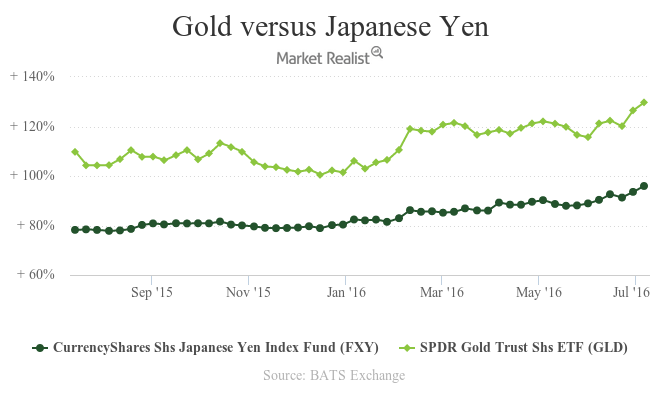

How Did the Japanese Yen Correlate with Gold?

The falling equity market took down the Japanese stock markets too.

Why Mining Stocks Are Rising post-Brexit

Friday was important. Gold rose to a two-year high due to additional haven bids on the Brexit referendum.

How Much Can Brexit Affect the Precious Metals?

Brexit could send jitters around the globe, and investors may jump to safe-haven assets such as gold and silver, which have risen 21.2% and 25.6%, respectively, on a YTD (year-to-date) basis.

Why Hedge Funds Liquidated Some of Their Gold

Hedge funds increased their bets on gold as prices fell after gold’s gains in 1Q16. However, hedge funds and money managers curbed their bets on gold as it fell steadily in May.

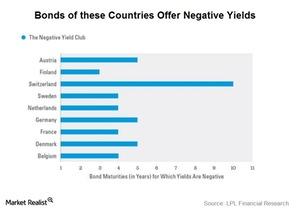

How Are Negative Interest Rates Affecting Gold?

Negative interest rates around the globe, along with overall economic concerns, are adding to the unrest in the Market.