Meera Shawn

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Meera Shawn

What Global Factors Are Affecting Silver?

Silver surged ~30% during the first few months of the year. However, the increased fear that the Federal Reserve will hike the interest rate pushed the precious metals lower.

What Is the Silver Supply and Demand Scenario?

In 2016, silver has outperformed its precious metal peers. Silver has risen about 19.6% on a year-to-date basis while gold has risen 18%.

Why Is JPMorgan Chase Positive on Gold?

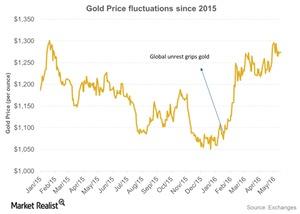

After seeing three straight years of losses, gold (GLD) performed extremely well at the beginning of 2016.

Two Yuan: What’s the Difference between CNY and CNH?

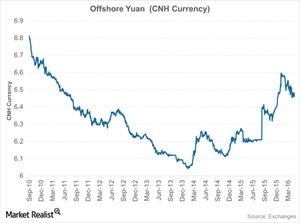

When understanding the Chinese markets and their prospects for internationalizing the yuan, it’s crucial to study both onshore and offshore yuan.

How Strong Is China’s Gold Demand?

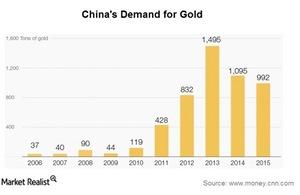

China’s love for gold is world famous, and demand had touched its peak in 2013 when gold experienced a steep price fall.

What’s Next for Gold Investors?

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold.

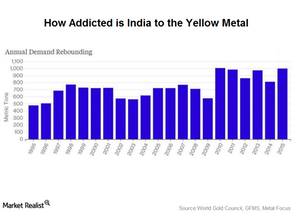

India’s Gold Demand May Touch 1000 Tonnes in 2015

The World Gold Council predicted that India’s gold demand in the October–December quarter would be muted. Gold imports shrank 36.5% to $3.53 billion in November.

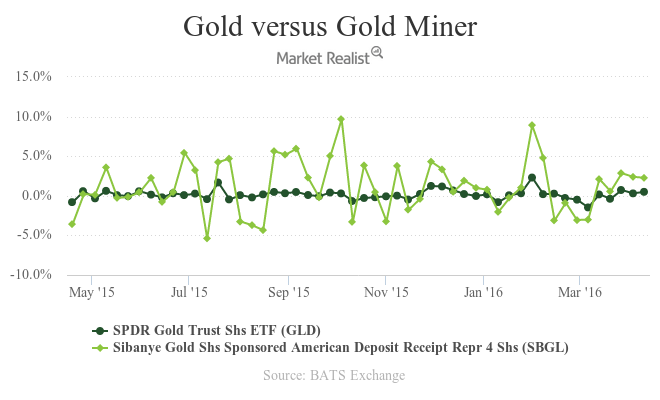

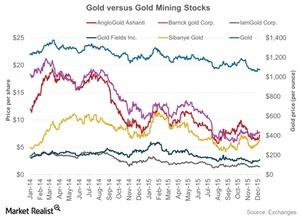

How the Gold Price Is Influencing Pure Gold Miners

In the precious metals mining industry, there are some stocks that to an extent follow the price and market sentiment of the precious metals.

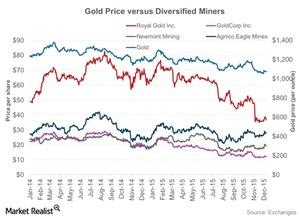

How Gold Prices Impact Diversified Miners

The term “diversified miners” refers to mining companies that are not into streamlined gold or silver mining, but also mine base metals.

2015 Has Been Hard on Mining Companies

2015 has been tough for miners, especially due to the price rout in the commodities market. The commodities market has fallen about 24.3% since the start of the year.

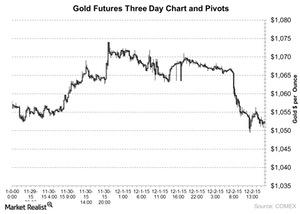

Gold Touched Its Lowest Levels in the Last Six Years on Wednesday

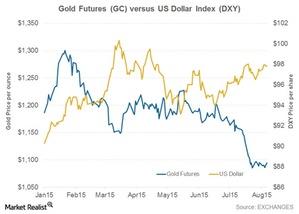

Gold futures trading on COMEX, the commodity division of the New York Mercantile Exchange, fell 0.91% on December 2, 2015. Also, platinum fell 0.36%.

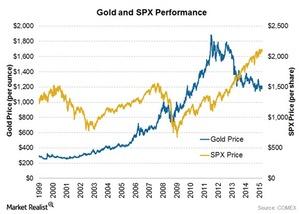

Gold’s Correlation to the Equity Markets

A look at gold and equity market performance demonstrates that a falling stock market isn’t necessarily a catalyst for a major rally in gold.

Did Strong Data Push Gold Prices South?

Gold prices don’t seem to have caught up with interest rate expectations, which have gone from 1.5% at the start of the year to about 0.5% today. The loosening monetary policy has probably worked in favor of gold.

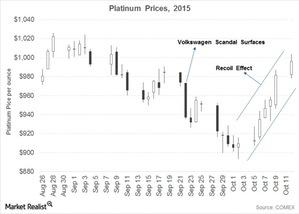

Analyzing the Coiled Spring Effect in Platinum Prices

After the VW scandal, platinum prices jumped to an almost two-week high, again entering the $1,000 territory after hitting a low of $893.4 on October 2.

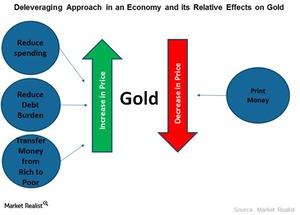

Reviewing an Economy and Its Effect on Gold Prices

Deleveraging can affect gold and other bullion prices, as well as exchange-traded funds such as the iShares Gold Trust ETF (IAU) and the iShares Silver Trust ETF (SLV).

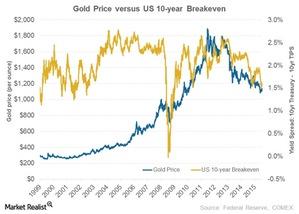

Inflation and Its Relationship to Gold Prices

Gold is a traditional hedge against inflation. Conditions that represent inflation include rising property prices, a rising stock market, and increasing asset values.

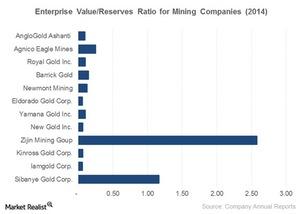

Analyzing the EV-to-Reserves Ratio for Tracking Miners

The EV-to-reserves ratio is good for the mining industry. “Enterprise value” reflects the company’s total value. “Reserves” refers to geologic reserves that the business owns.

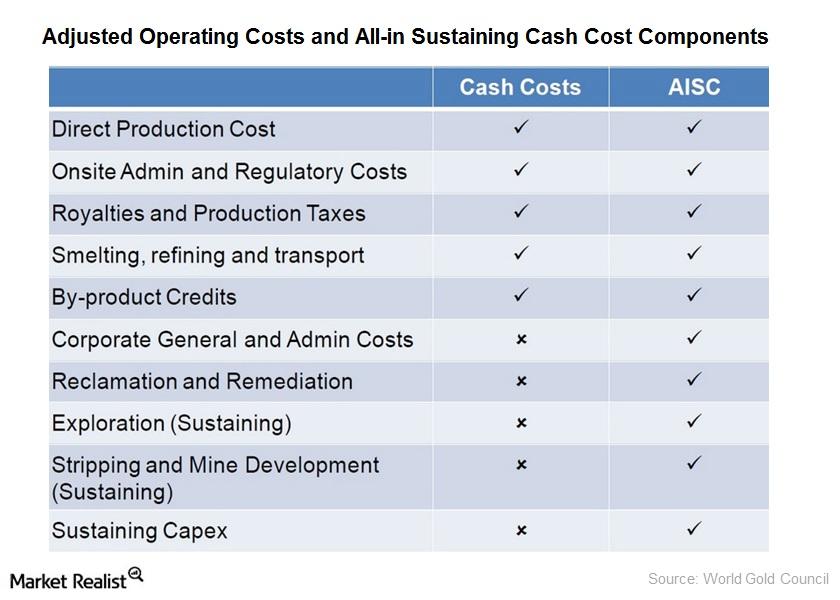

Key for Investors: Understanding Mining Cost Structures

The cash cost has been the dominant measure of the gold mining cost structure. It represents what the mine costs are for each ounce of gold.

Inflation Rates: How They’re Related to Precious Metals

With the looming fears of inflation reaching its target 2% level, the Fed is likely waiting for assertions from the economy.

Broad Commodities Market Sell-Off: Impact on Gold

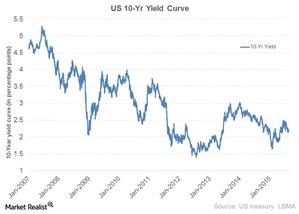

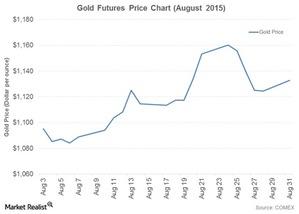

The benchmark US ten-year note yield fell by eight basis points, or 0.08%, to 1.96% as of Monday, August 24. Recent buying ended a bearish period in gold.

China’s Falling Stock Market Pushes Gold Upward

The turnaround from the direction that gold was headed during the last month has also supported silver prices. Silver fell marginally by 0.68% last month.

Gold Is Resilient to the Fed’s Likely Questionable Liftoff Move

With the confusing reviews from the Fed on Wednesday, gold on COMEX rose 2.20% on August 20 and closed at $1,153.20 per ounce. Silver for September expiry also rose.

Why Is the SPDR Gold Shares ETF (GLD) Losing Its Sheen?

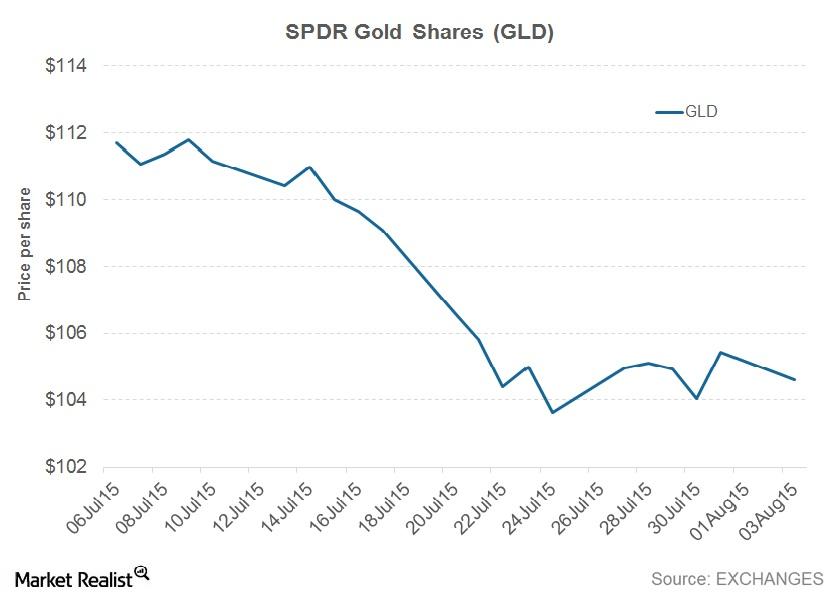

The SPDR Gold Shares ETF (GLD) is the world’s largest ETF. It’s also the highest-traded. Friday’s price for GLD was $104.39.

Do Falling Gold Prices Mean More Mergers Are in the Cards?

Gold touched its lowest level on July 24. Its price fell to $1,073.70. Miner ETFs have suffered more than gold prices themselves.