Miners: Correlation Trends in August 2017

Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation.

Aug. 7 2017, Updated 3:05 p.m. ET

Mining stocks

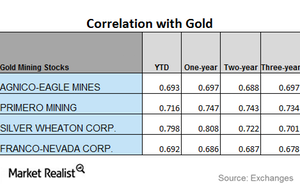

It’s essential crucial for investors to analyze how mining companies’ daily inconstancies relate to the metals they mine. In this part, we selected Agnico-Eagle Mines (AEM), Primero Mining (PPP), Silver Wheaton (SLW), and Franco-Nevada (FNV) for correlation analysis.

The Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR) are also closely correlated to gold. SGOL and SIVR had risen 10.1% and 4.2%, respectively on a year-to-date basis

Correlation trends

Among the above miners, Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation. Primero and Silver Wheaton have seen an upward trend in their correlations, while the other two miners have seen a mix of upward and downward trends in their correlations with gold.

Remember, an upward-scaling correlation symbolizes that price fluctuations in gold could cause mining stocks to move in the same direction. A dropping correlation suggests that the mining stock returns might diverge from what’s happening with the metal’s price.

Silver Wheaton’s correlation has risen from a three-year correlation of ~0.70 and a one-year correlation of ~0.81 with gold. A correlation of ~0.81 suggests that the share price has moved alongside gold ~81% of the time in the past year. However, such as correlation can move in different directions at different times.