Silver Wheaton Corp

Latest Silver Wheaton Corp News and Updates

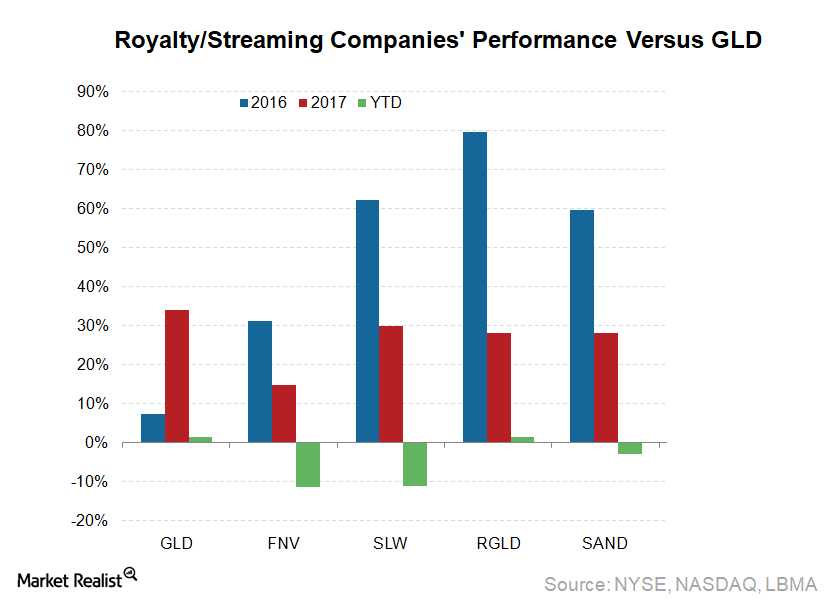

Could Royalty and Streaming Companies Stay Strong in 2018?

Royalty and streaming companies Royalty and streaming companies’ business model differs greatly from that of other precious metal miners (RING), mainly because royalty and streaming companies do not own mines. These companies make upfront payments to gain a right to a fixed percentage of future silver or gold mine production. Additional payments are then made […]

Gold Rose amid Increased Demand for Safe-Haven Assets

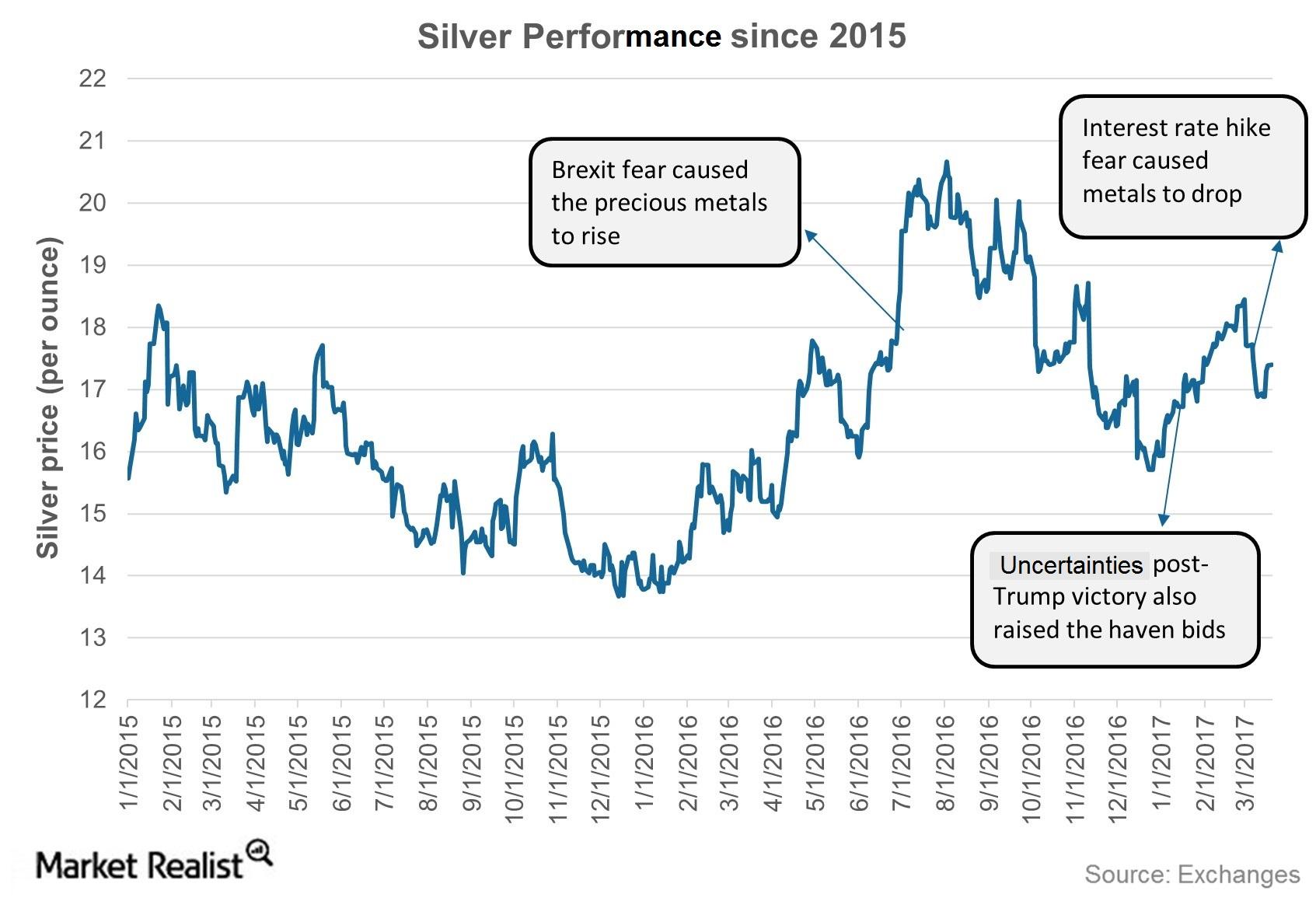

These economic concerns and monetary stimulus expectations have decreased the probability of an interest rate hike by the US Federal Reserve, and the chances of an interest rate hike in July dropped to zero.

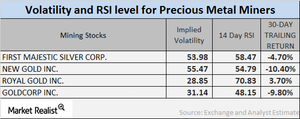

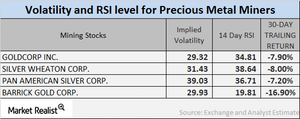

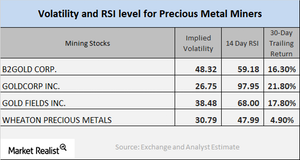

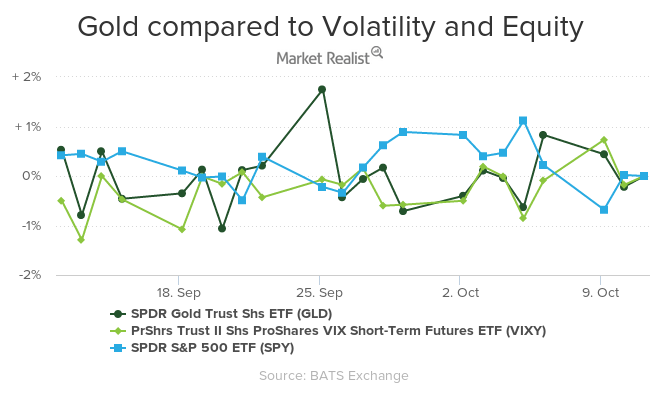

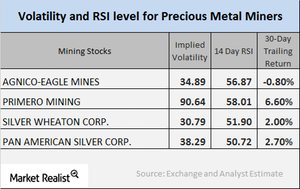

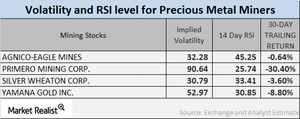

How Mining Stock Volatility Numbers Are Moving Now

First Majestic, New Gold, Agnico, and Silver Wheaton now have RSI scores of 60.5, 56.2, 57.6, 59.6, respectively.

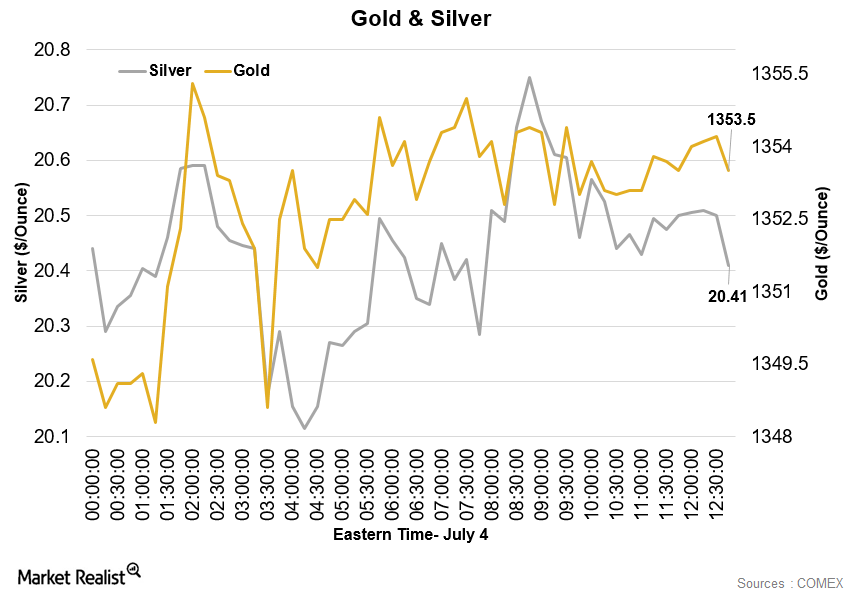

Copper Stabilizes While Gold Trades near Two-Year High

Copper prices stabilized on Monday, July 4, amid expectations of stimulus from central banks.

How Silver Prices Are Influencing Major Silver Miners

Mining companies like First Majestic Silver (AG), Silver Wheaton (SLW), Pan American Silver (PASS), Coeur Mining (CDE), and Hecla Mining (HL) are primarily into silver exploration.

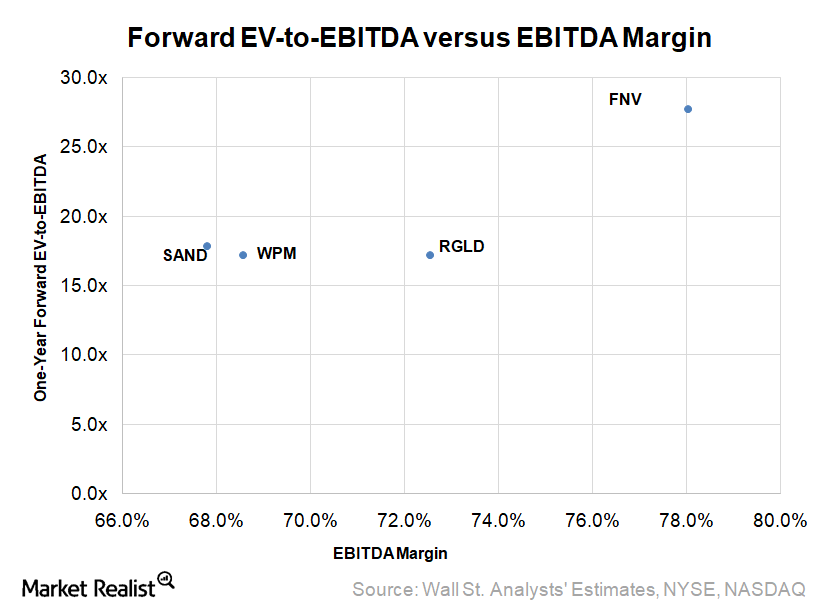

Why Valuation Multiples for Royalty and Streaming Companies Have Risen in 2017

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines.

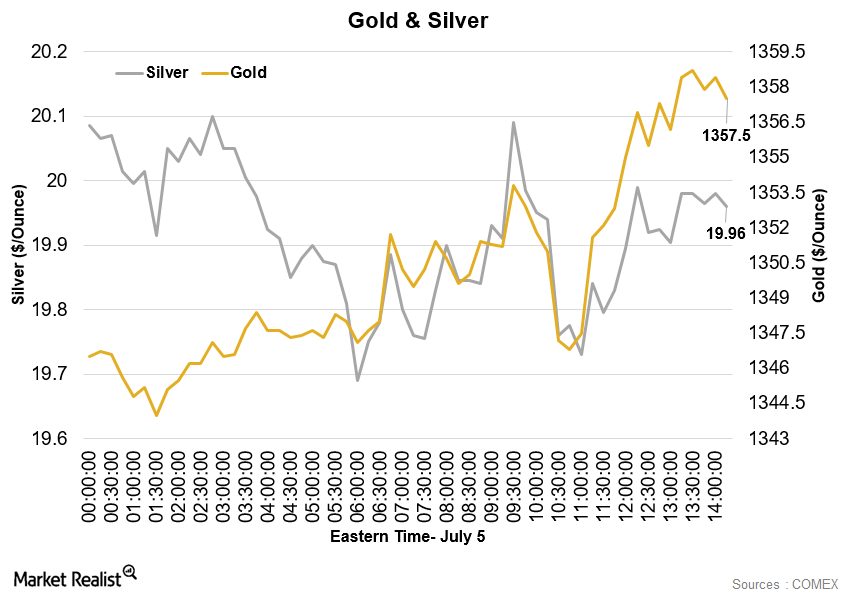

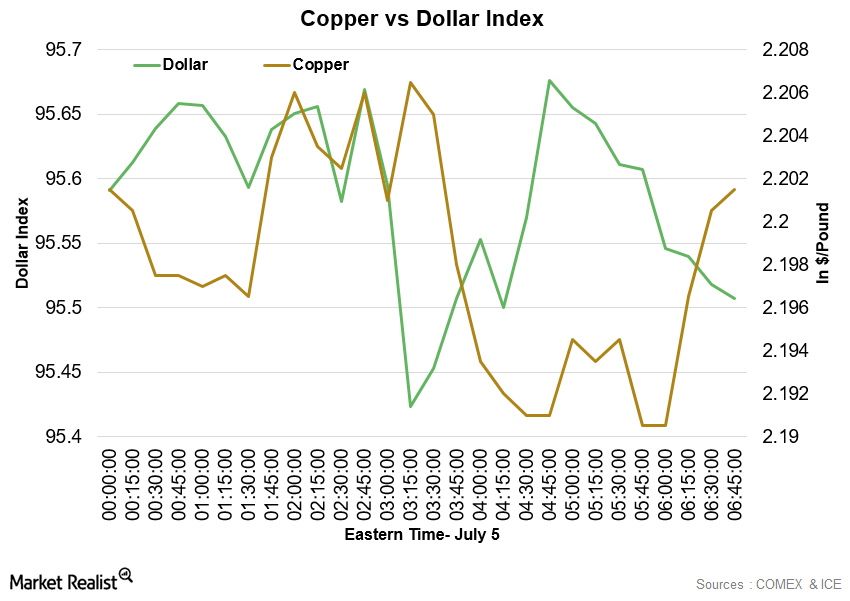

Copper Fell and Gold Stabilized on July 5

At 6:40 AM EST on July 5, the COMEX Copper futures contract for September delivery was trading at $2.2 per pound—a drop of 0.81%.

Mining Stocks Are Recovering from Their Slump

The Direxion Daily Gold Miners (NUGT) and the ProShares Ultra Silver (AGQ), both leveraged mining funds, both have recovered and jumped 19.4% and 24.9%, respectively, on a five-day trailing basis.

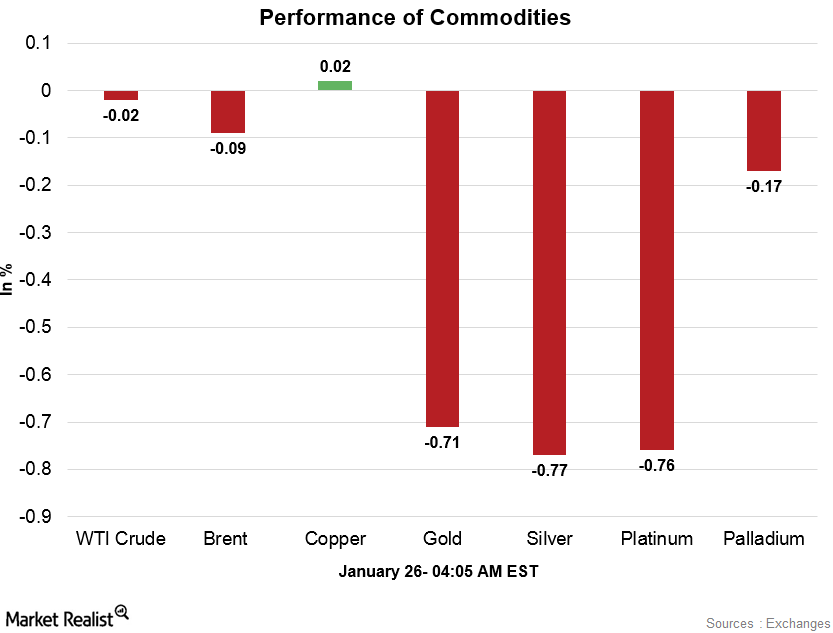

Commodities Are Strong in the Early Hours on January 26

At 4:00 AM EST on January 26, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $65.44 per barrel—a drop of 0.11%.

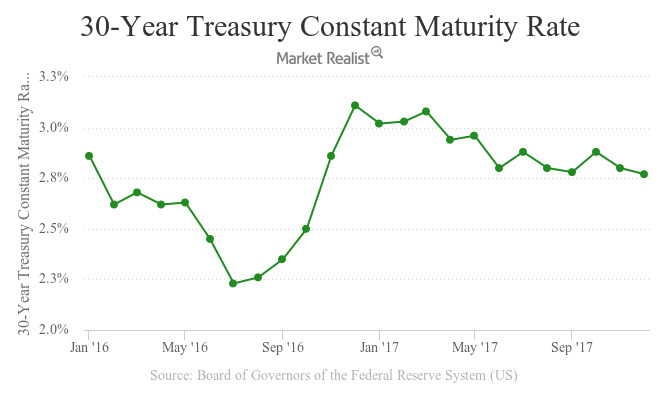

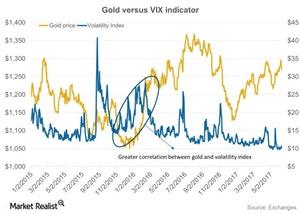

Is Gold Keeping Tabs on the US Interest Rate?

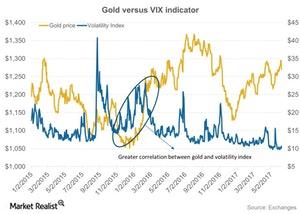

As we know, precious metals are closely tied to movements in US interest rates. Bonds and equities are both yield-bearing assets, so a rise in yields often causes a slump in demand for assets such as gold and silver.

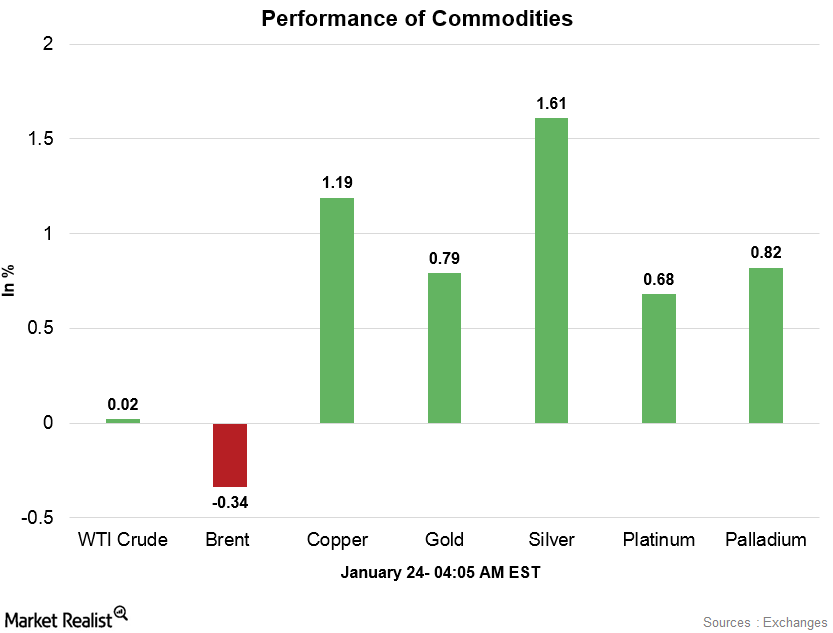

Commodities Are Strong Early on January 24

At 4:00 AM EST on January 24, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $64.50 per barrel—a gain of 0.05%.

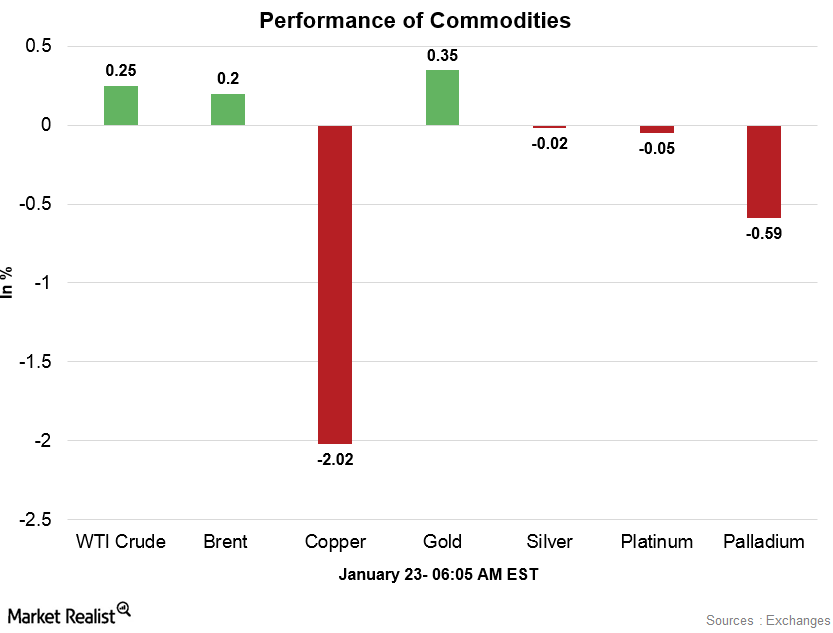

Analyzing Commodities in the Early Hours on January 23

At 5:55 AM EST on January 23, the West Texas Intermediate crude oil futures for March 2018 delivery were trading at $63.88 per barrel—a gain of 0.49%.

Reading the Performance of Mining Shares amid Surging Metals

On January 12, 2018, precious metals were once again on a rising streak, which also led to increasing prices for mining shares.

A Brief Analysis of Silver Miners in January 2018

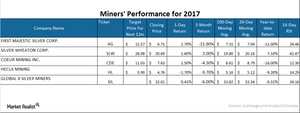

The target prices of the four miners we’re covering in this part are higher than their current trading prices, which could lead to an optimistic outlook on their prices.

How Mining Stocks Have Performed in January So Far

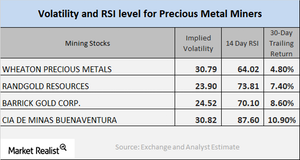

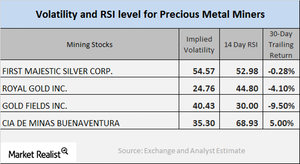

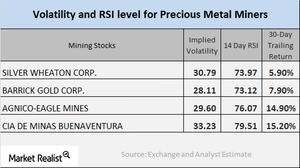

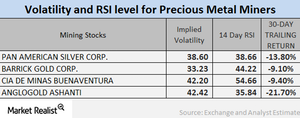

SLW, GOLD, ABX, and BVN have call implied volatilities of 30.8%, 23.9%, 24.5%, and 30.8%, respectively.

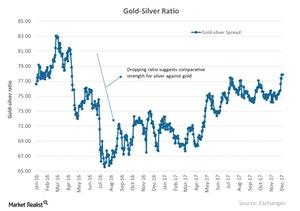

A Look at the Gold Spreads at the End of 2017

A gold-silver spread of 77.3 suggests that it requires almost 78 ounces of silver to buy a single ounce of gold.

A Quick Look at the Performance of Silver Miners in December 2017

Coeur Mining and Hecla Mining have seen a loss in their prices on a year-to-date basis, falling 17.9% and 24.0%, respectively.

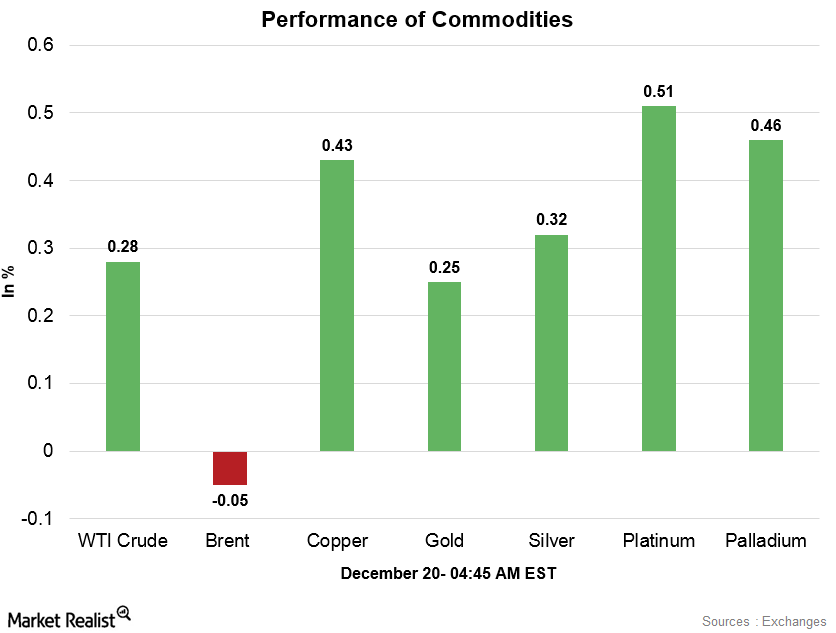

Commodities Are Strong in the Early Hours on December 20

Gold and silver are strong early on December 20. The lower global risk appetite and weak US dollar are supporting gold prices in the early hours.

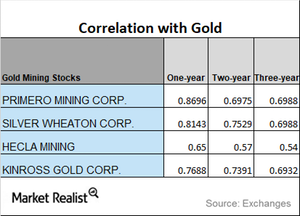

What Are Miners’ Correlation Trends?

Gold is the most dominant among the four precious metals. It’s important that investors analyze how miners are moving compared to precious metals.

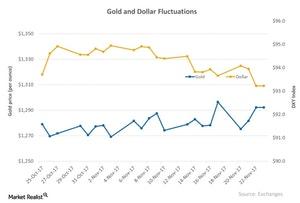

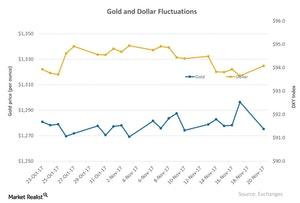

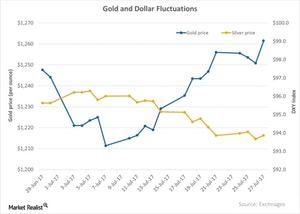

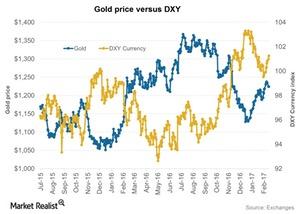

Is the Dollar-Gold Relationship Getting Stronger?

Precious metals have been closely associated with the movement of the US dollar over the last few months.

How the Higher Dollar Has Affected Precious Metals

Precious metal slump All four precious metals saw a down day on Monday, November 20. Gold fell 1.6% to $1,275.30 per ounce, after touching a one-month high on Friday, November 17. The fall in precious metals was most likely due to the rise in the US dollar. The US Dollar Index rose 0.45% on Monday. Gold, silver, platinum, […]

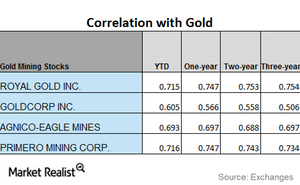

Mining Stocks: Understanding Correlation

When you look at mining stocks’ performance, it’s important to analyze their correlation with gold. These stocks typically take their directional cues from gold, which is the most dominant among precious metals.

A Quick Look at Miners’ Recent Performance

Precious metal miners saw mixed performance on Tuesday, November 14. Gold and silver saw an up-day while platinum and palladium were low.

A Look at Mining Stocks’ Price Movement

Mining stocks’ reaction On Tuesday, October 31, precious metal mining stocks fell, following precious metals. In this part of our series, we’ll look at the moving averages and returns of four key mining stocks: Silver Wheaton (SLW), Hecla Mining (HL), Alacer Gold (ASR), and IAMGOLD (IAG). Hecla Mining and Alacer Gold have fallen 9.9% and 10.3%, respectively, YTD […]

Silver Mining Stock Technicals as of Last Week

AG, CDE, and HL have shown YTD losses of 12%,16%, and 9.2%, respectively. The silver-based Global X Silver Miners Fund (SIL) has a YTD loss of 0.31%.

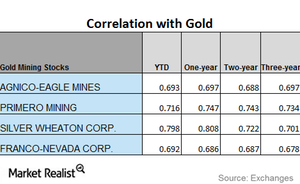

A Look at the Correlation Trends for Miners

Franco-Nevada and Silver Wheaton have seen an upward trend in their correlations with gold.

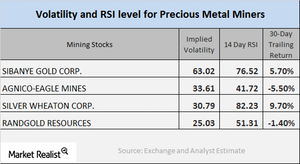

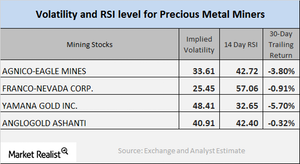

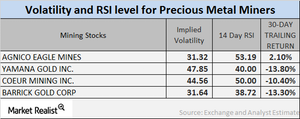

What Mining Stocks’ Implied Volatility Tells Us

As of October 24, 2017, Silver Wheaton (SLW), Yamana Gold (AUY), Barrick Gold (ABX), and AngloGold Ashanti (AU) had implied volatility readings of 30.8%, 48.4%, 29.1%, and 40.9%, respectively.

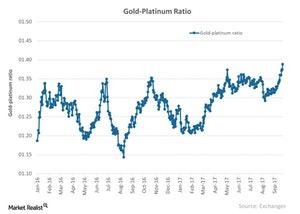

Platinum Ratio Analysis: Which Way Is Platinum Moving?

The gold-platinum spread was ~1.38 on October 23. The RSI (relative strength index) level for the gold-platinum spread is now at 93.9.

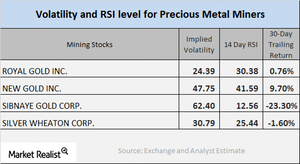

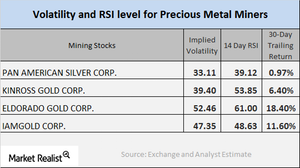

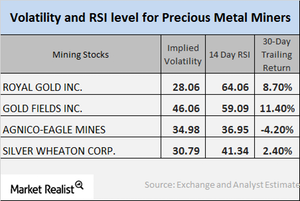

Mining Shares: RSI Numbers and Implied Volatility

As of October 19, Sibanye Gold, Agnico Eagle Mines, Silver Wheaton, and Randgold Resources had implied volatility readings of 63%, 33.6%, 30.8%, and 25%.

How Mining Stocks Are Reacting as of October 17

Despite the overall downturn among precious metals on Tuesday, October 17, precious metal mining stocks witnessed a mixed reaction that day.

Are Global Fears Controlling Precious Metals?

Ongoing worries in North Korea and political chaos in Washington have been crucial in boosting the prices of precious metals.

How Global Indicators Are Affecting Precious Metals

Gold reached its two-week high price of $1,294.5 an ounce on Tuesday, October 10, and ended the day at $1292.1 per ounce.

How Miners Correlate to Gold

Mining funds that have a strong relationship to precious metals are the Global X Silver Miners (SIL) and the VanEck Vectors Gold Miners (GDX).

Are North Korea Tensions Continuing to Affect Precious Metals?

All the four precious metals saw an up day on Monday, October 9, 2017.

Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

Analyzing Miners’ Technicals in September 2017

On September 22, 2017, First Majestic Silver, Goldcorp, Newmont Mining, and Silver Wheaton had volatilities of 49.1%, 26.7%, 23.5%, and 30.8%, respectively.

Analyzing the RSI Movements of Precious Metals

The price movement in precious metals is often closely traced by mining stocks. Before investors opt for mining stocks, they should analyze a few of the crucial technical details.

The Correlation Analysis of Miners through August 2017

Silver Wheaton has a three-year correlation of ~0.70 with gold and a year-to-date correlation of ~0.80.

Miners: Correlation Trends in August 2017

Silver Wheaton has the highest correlation with gold, while Franco-Nevada has the lowest correlation.

How the US Dollar Affected Gold

The US dollar has been on a downward swing over the past week.

Unpacking the Technical Indicators for Mining Stocks

Mining stocks have bounced back from the choppy markets we’ve seen over the past month. On July 20, most mining stocks saw upward movements in their prices.

How Has Miners’ Volatility Trended in July?

Mining stocks have bounced back from the choppy markets seen over the past week.

RSI Levels Have Fallen: Will Miners Rebound Soon?

Gold and silver-based funds such as SGOL and SIVR are impacted by changes in precious metal prices. They fell due to the fall in precious metals on Friday.

Insight into the Silver Market in June 2017

Silver has seen a five-day trailing loss of 2.6%, while gold and platinum fell 1.7% and 1.9%, respectively.

Mining Stocks’ Relative Strength Index Hits Rock Bottom

The rise and fall of precious metals also significantly impact mining-based leveraged funds like the Direxion Daily Gold Miners (NUGT) and Proshares Ultra Silver (AGQ).

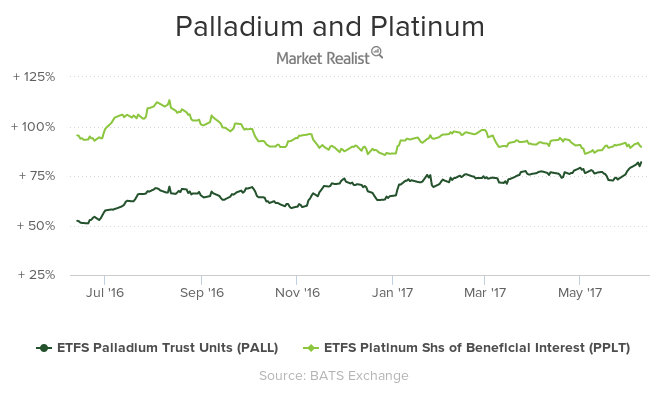

Palladium Skyrockets: A Look at What’s in Store Next

Although gold and silver had a down day on Friday, June 9, 2017, platinum and palladium rose about 0.23% and 1.2%, respectively.

Why RSI levels of Mining Shares Are Rising

On June 6, the implied volatilities of Alamos Gold, Primero Mining, Silver Wheaton, and Franco-Nevada were 51.1%, 90.6%, 30.8%, and 24.5%, respectively.

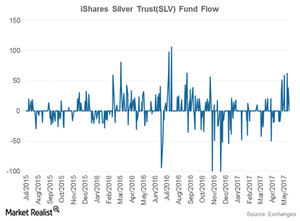

Reading the Fund Flows of the iShares Silver Trust

Over the past year, silver has been very volatile compared to the other three precious metals. Silver was the highest among precious metals in mid-April 2017.

What’s the Correlation between the Dollar and Gold in Last 5 Days?

One of the critical elements that plays on precious metals besides the overall market sentiment is the US dollar.

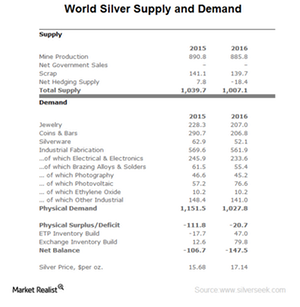

Analyzing Silver’s Fundamentals

When analyzing the performance of a metal, investors should look at its fundamentals. In this series, we’ll look at various metrics for silver and other precious metals.