VF Corp

Latest VF Corp News and Updates

How Did PVH Corporation Perform in 3Q16?

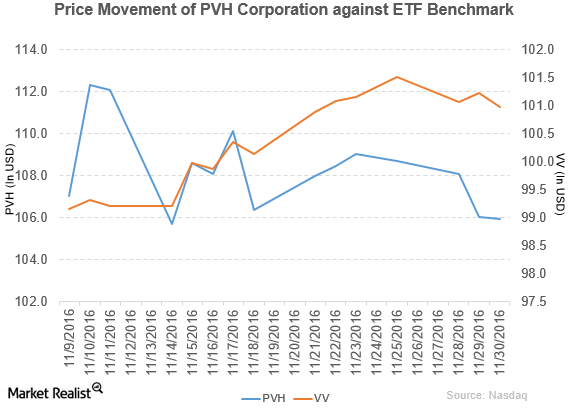

PVH Corporation (PVH) has a market cap of $8.5 billion. It fell 0.08% to close at $105.94 per share on November 30, 2016.

How Did Ralph Lauren Perform in 2Q17?

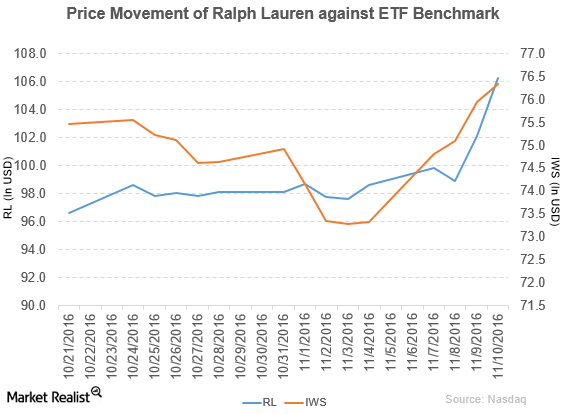

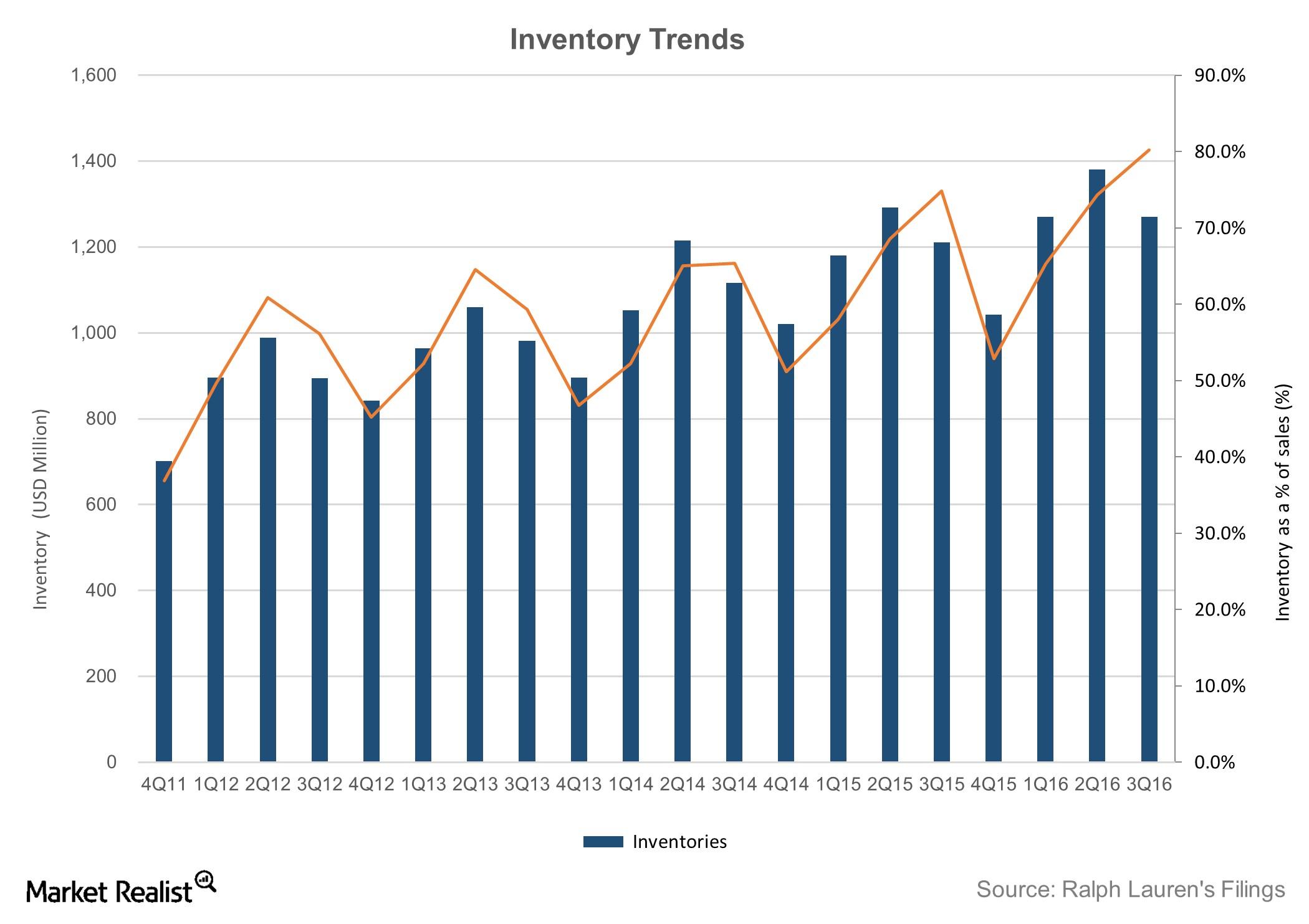

Ralph Lauren (RL) reported fiscal 2Q17 net revenues of ~$1.8 billion, a fall of 7.6% compared to net sales of ~$2.0 billion in fiscal 2Q16.

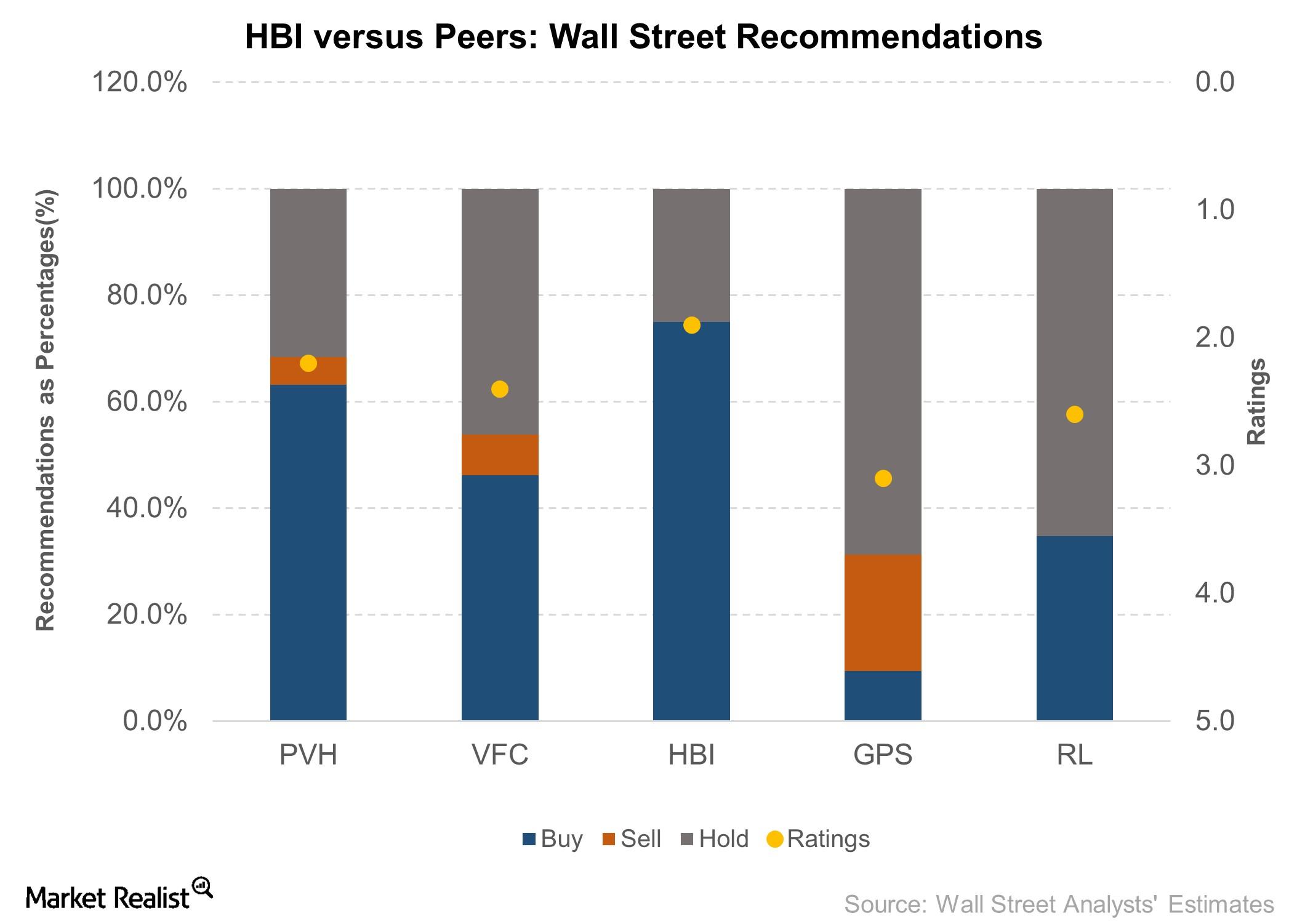

What Does Wall Street Expect from HBI for the Rest of 2016?

Hanesbrands updated its 2016 full-year outlook while reporting its third quarter results.

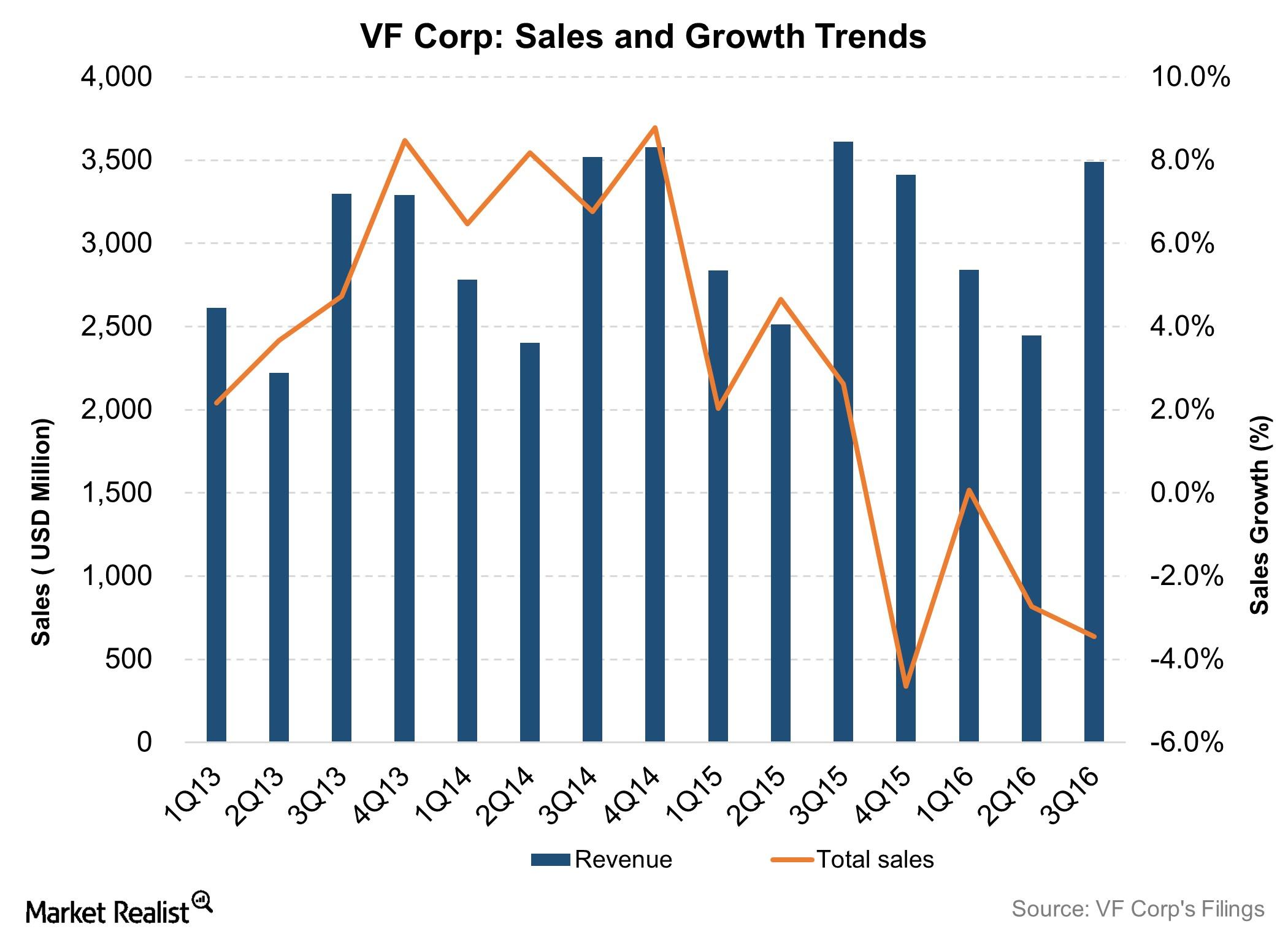

Weakness in North America Offset VFC’s International Gains

As in the last several quarters, VF’s (VFC) international business remained firm during the third quarter.

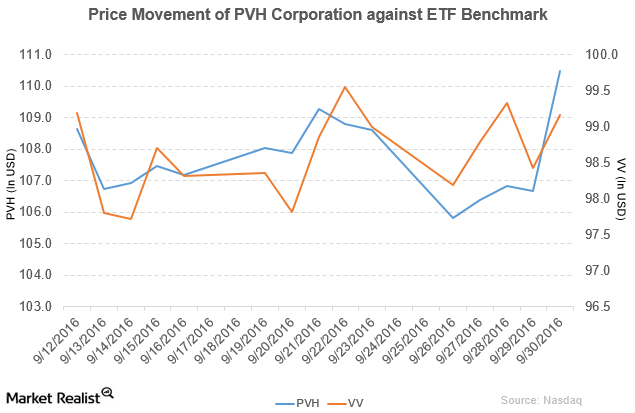

Guggenheim Has Rated PVH Corporation a ‘Buy’

PVH Corporation (PVH) has a market cap of $8.9 billion. It rose 3.6% to close at $110.50 per share on September 30, 2016.

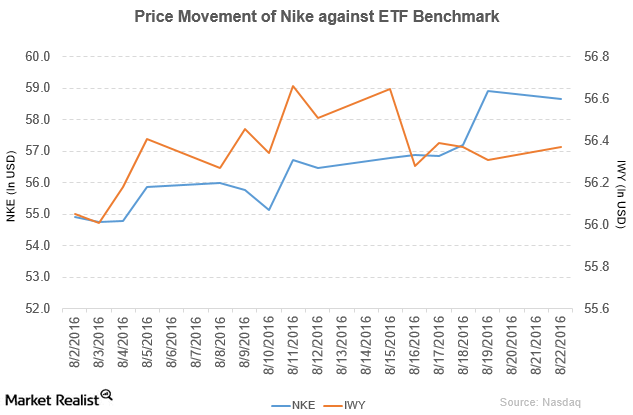

Why Did Nike Update Its Nike+ Run Club App?

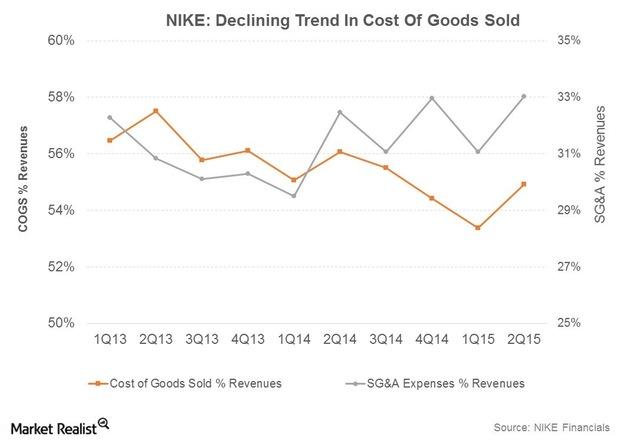

In fiscal 2016, Nike reported revenue of $32.4 billion—a rise of 5.9% year-over-year. The company’s gross profit margin rose by 0.43% in fiscal 2016.

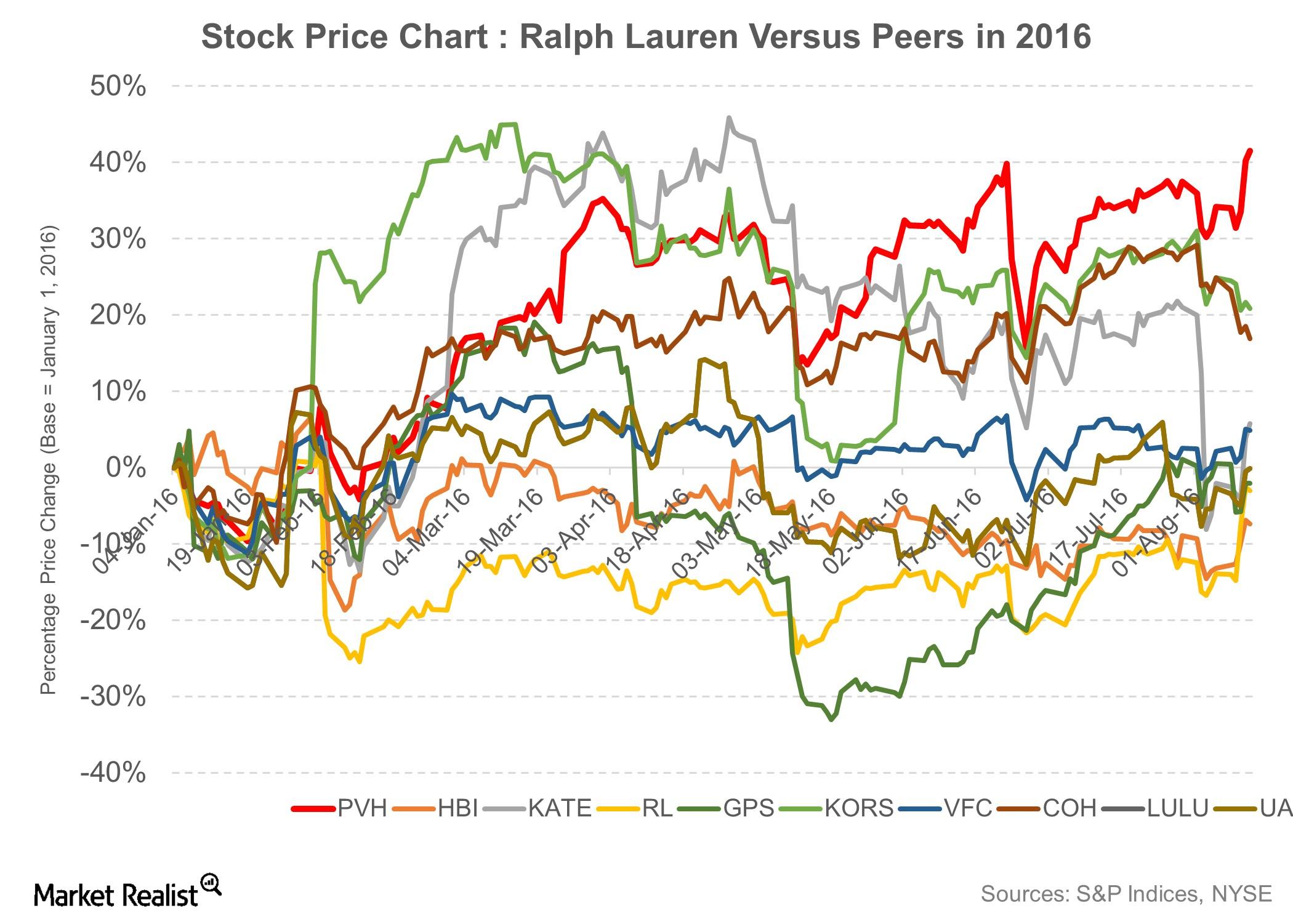

Better-than-Expected Earnings Support Falling Ralph Lauren Stock

Despite a decline in earnings, Ralph Lauren continues to hold $1.2 billion in cash and short-term investments on its balance sheet.

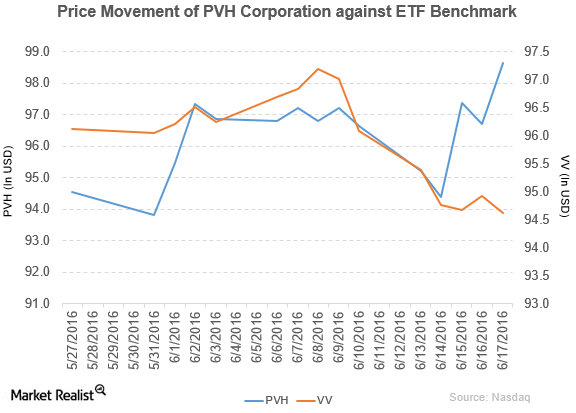

Why Did PVH Issue Senior Notes?

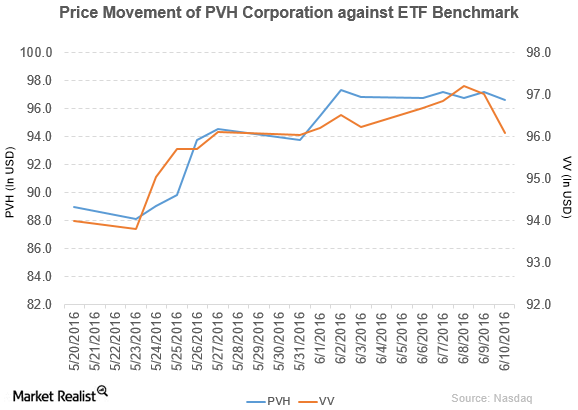

PVH (PVH) rose by 2.1% to close at $98.63 per share at the end of the third week of June 2016.

Why Did PVH Offer Senior Notes?

PVH Corporation (PVH) has a market cap of $7.8 billion. It fell by 0.58% to close at $96.65 per share on June 10, 2016.

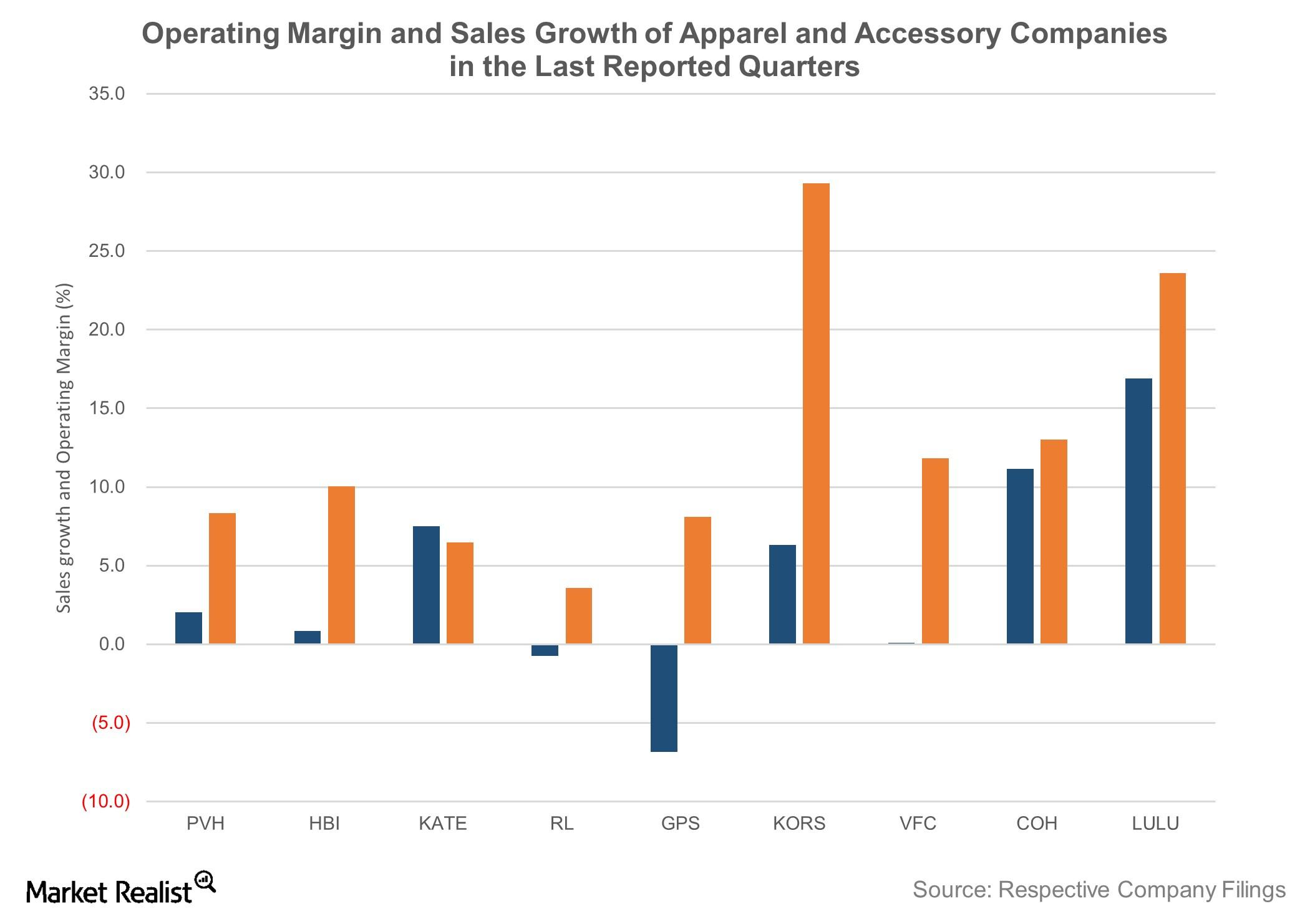

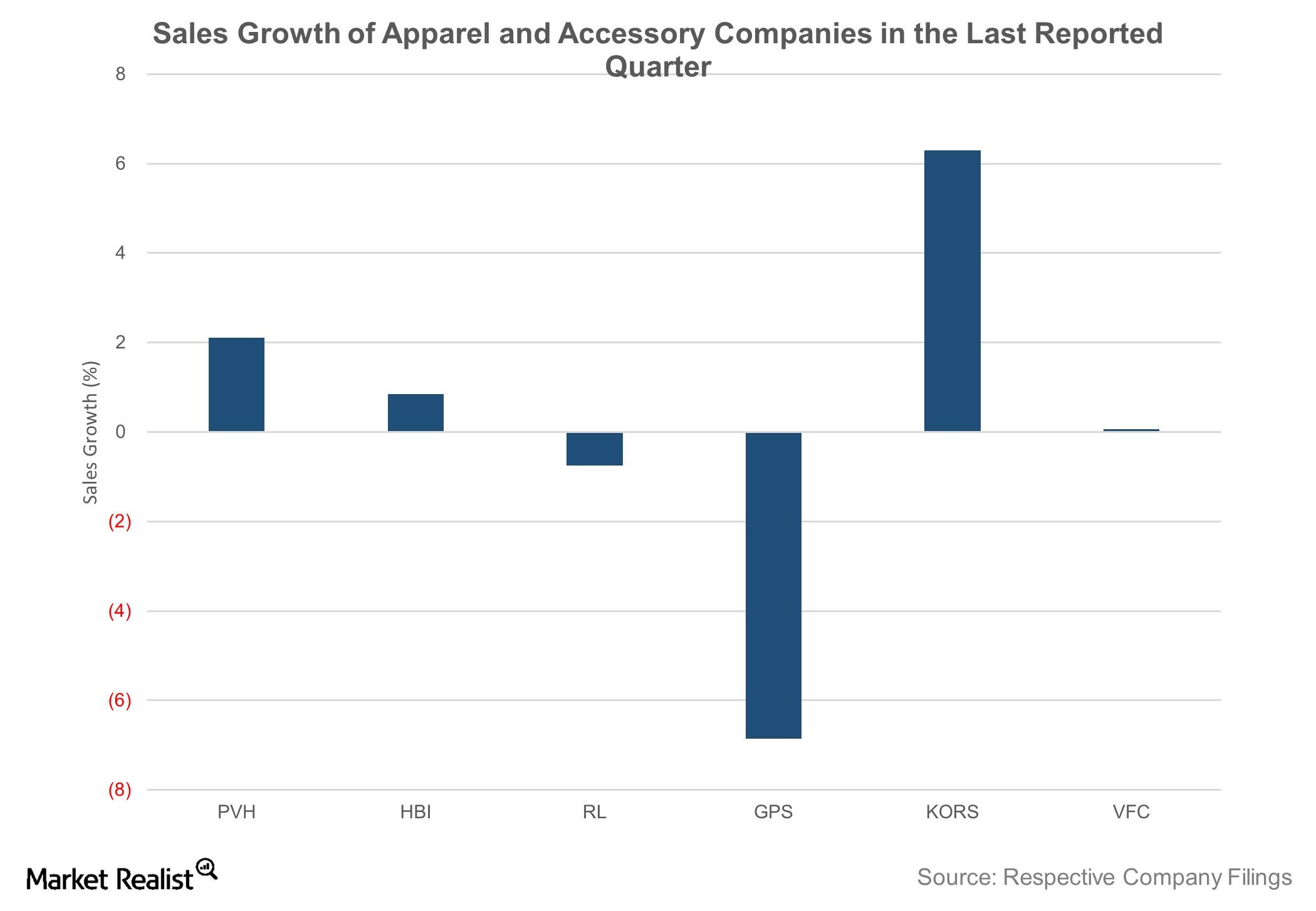

How Calvin Klein and Tommy Hilfiger Gave PVH a Strong 1Q16

Phillips-Van Heusen (PVH) posted $1.9 billion in revenue for fiscal 1Q16. That’s a 2.1% YoY increase on a GAAP basis.

PVH Delivered a Solid 4Q15 on Strong Calvin Klein Performance

PVH Corp. (PVH) registered a 2.1% year-over-year increase in its top line in fiscal 4Q15, which ended January 31, 2016, to $2.1 billion.

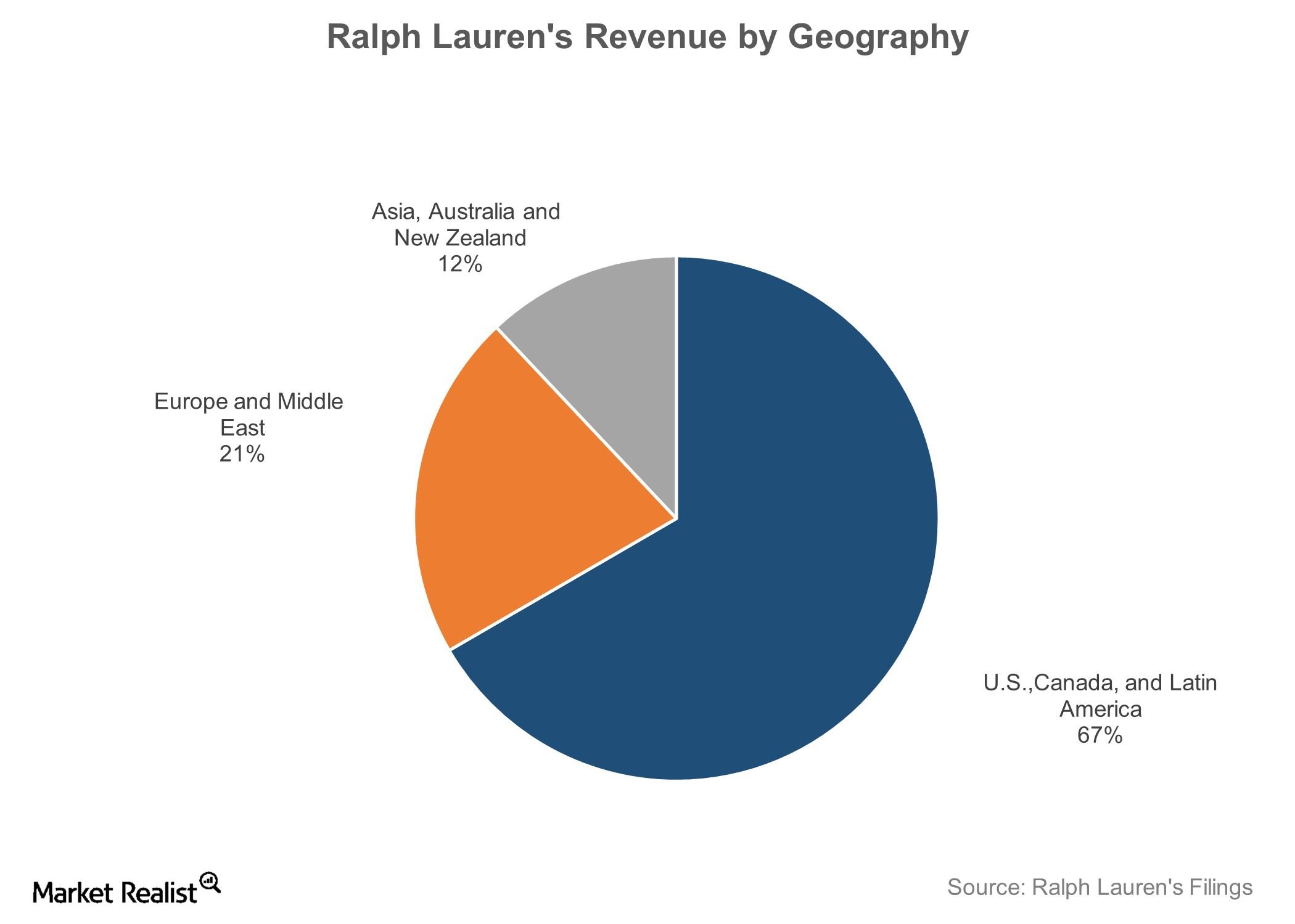

Ralph Lauren’s Strategies and Initiatives: The Story behind the Story

Ralph Lauren’s long-term strategies include expanding global presence, extending direct-to-consumer reach, and expanding apparel and accessory portfolio.

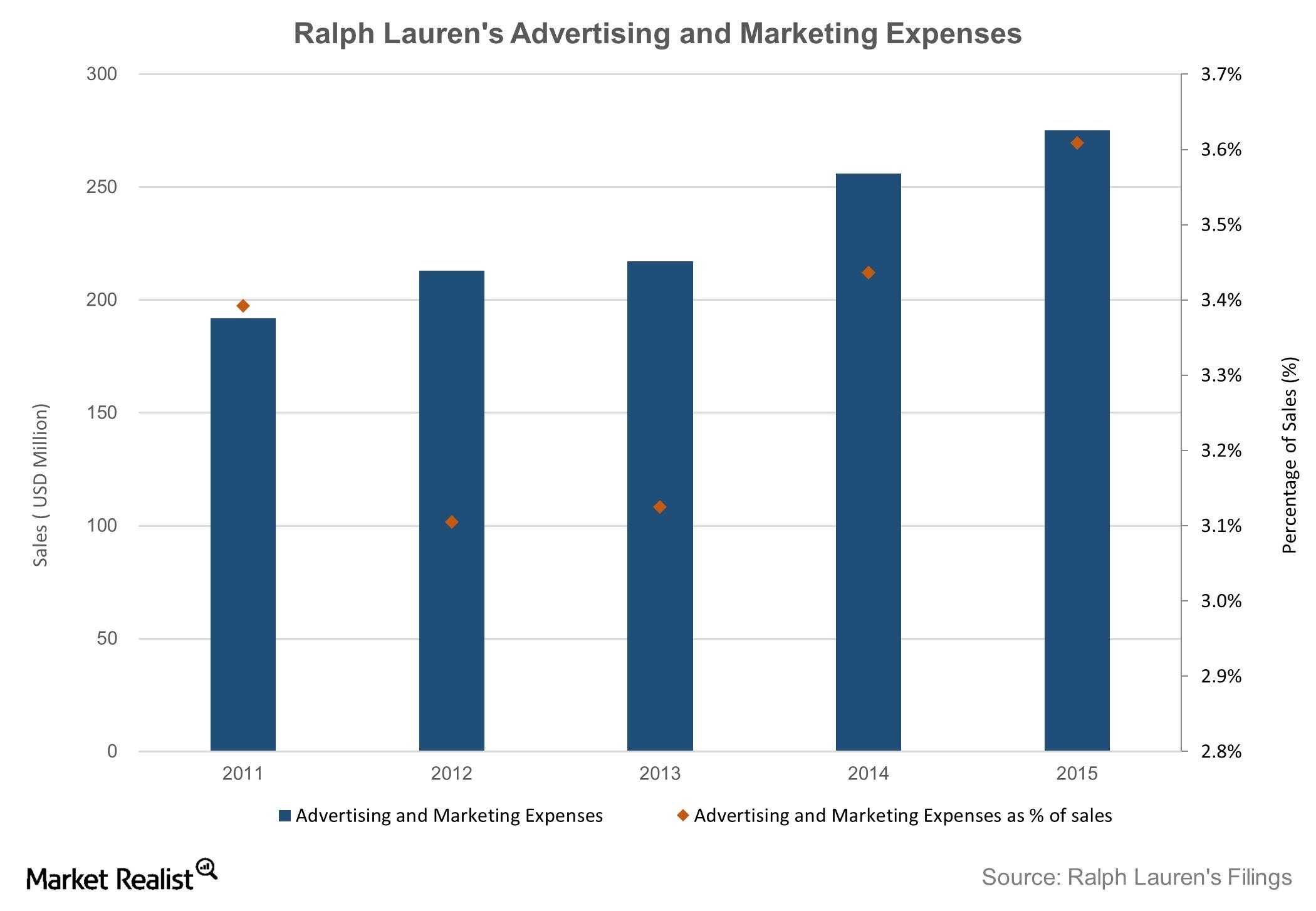

Understanding Ralph Lauren’s Marketing and Advertising Strategy

Ralph Lauren’s (RL) advertising programs are created and executed through the company’s in-house creative and advertising organization.

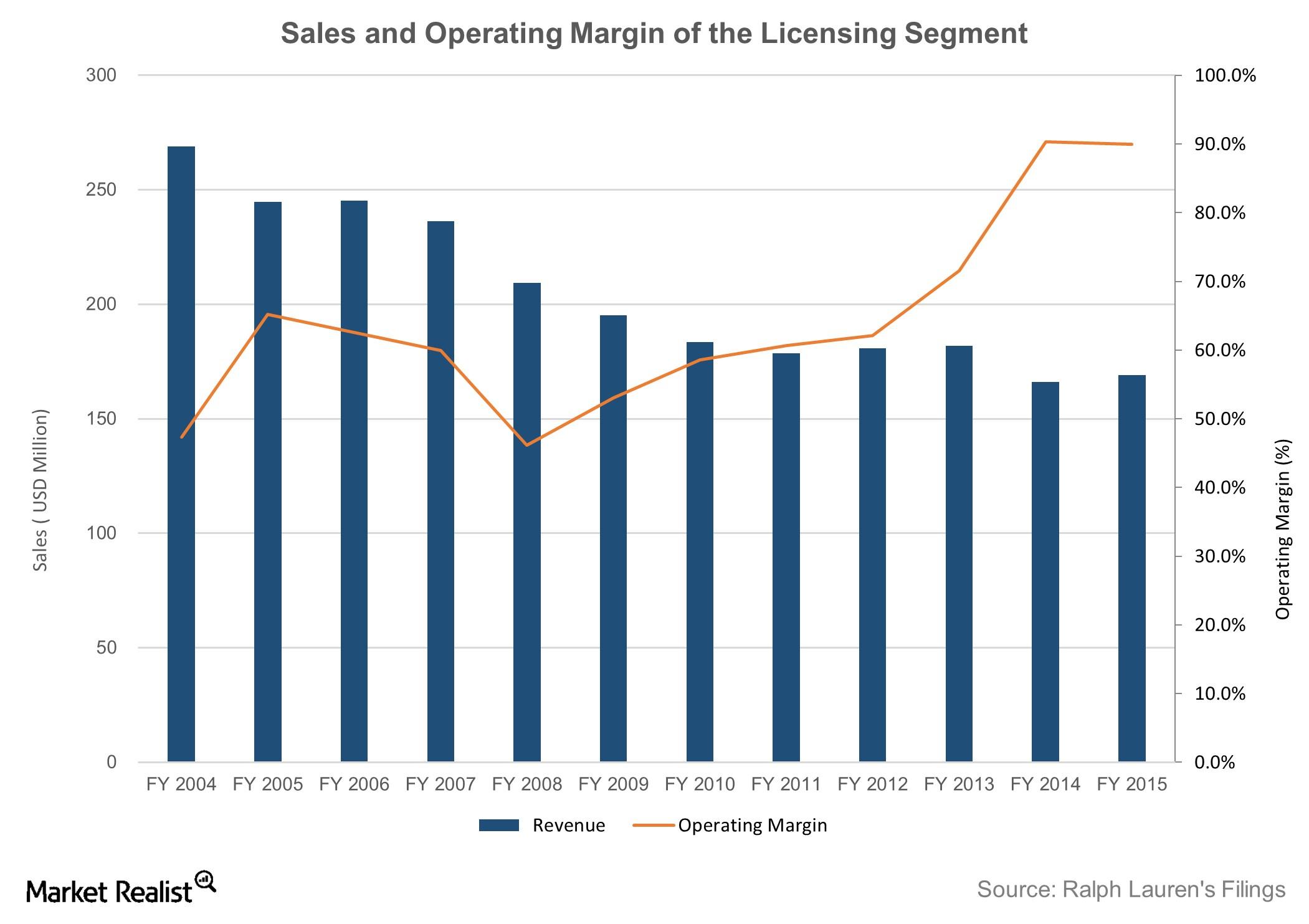

Inside Ralph Lauren’s Licensing Business

Ralph Lauren earns royalties from licensing the use of its trademarks or the right to operate stores to third parties for apparel, eyewear, and fragrances.

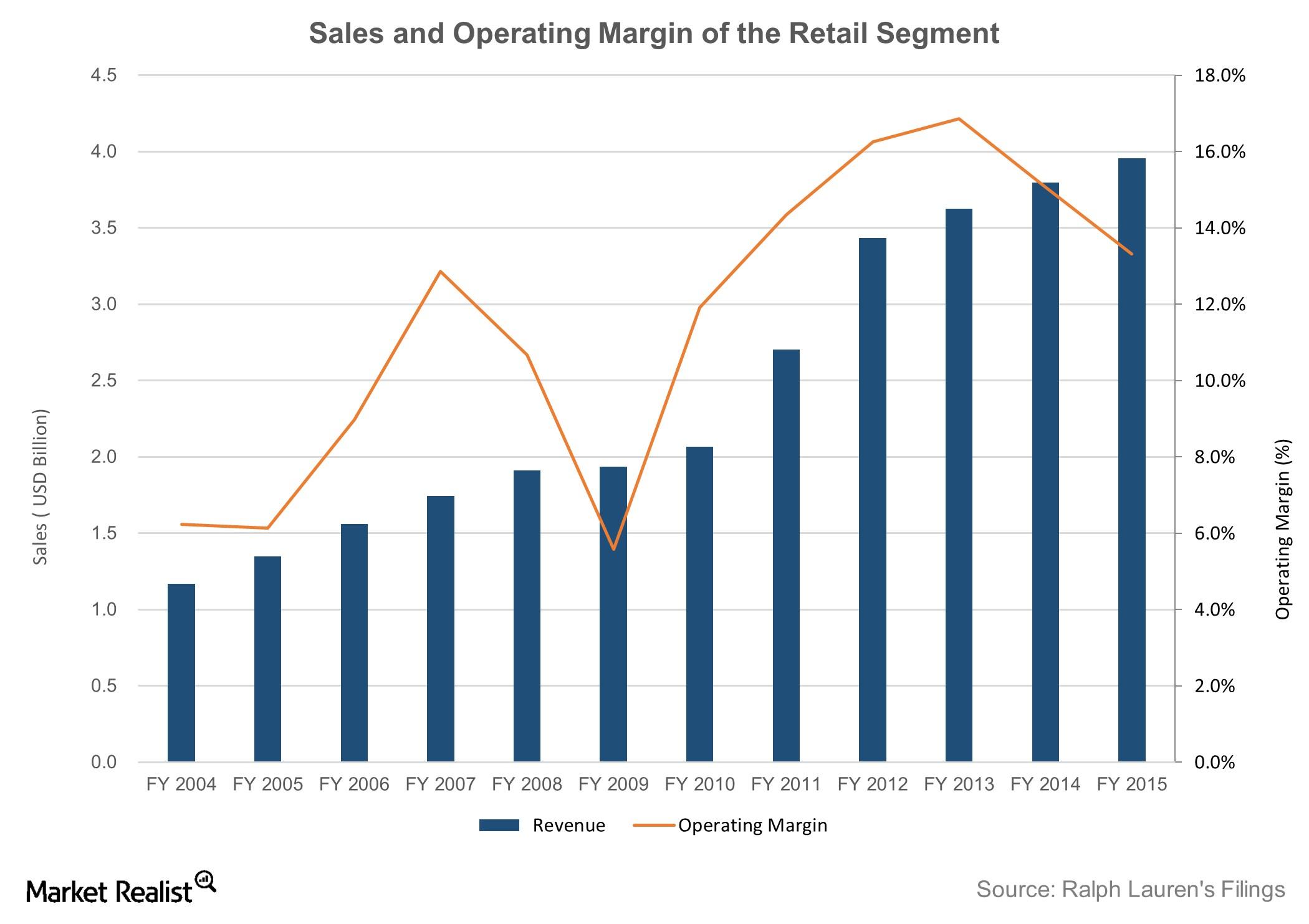

How Ralph Lauren’s Retail Channel Became the Biggest Revenue Generator

In retail, Ralph Lauren operated 143 Ralph Lauren stores, 64 Club Monaco stores, and 259 factory outlets at the end of fiscal 2015.

Ralph Lauren: Where It Began, What It Offers, and Who It’s up Against

Ralph Lauren was founded by Ralph Lauren in 1967 and offers apparel, accessories, home products, and fragrances under several well-known brand names.

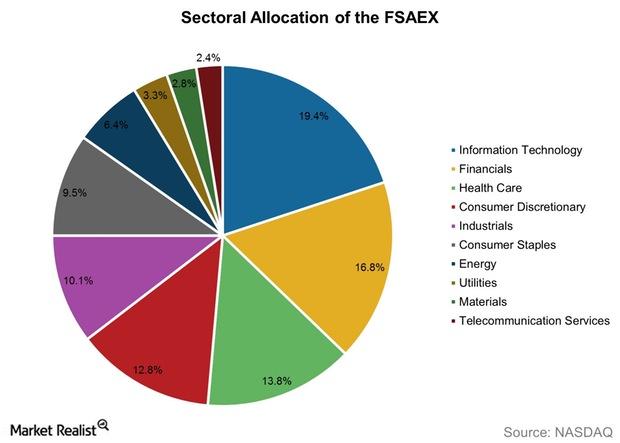

Fast Facts about the Fidelity Series All-Sector Equity Fund

The Fidelity Series All-Sector Equity Fund was founded in October 2008 and has an expense ratio of 0.67%. Shares of this fund are offered only to certain other Fidelity funds.

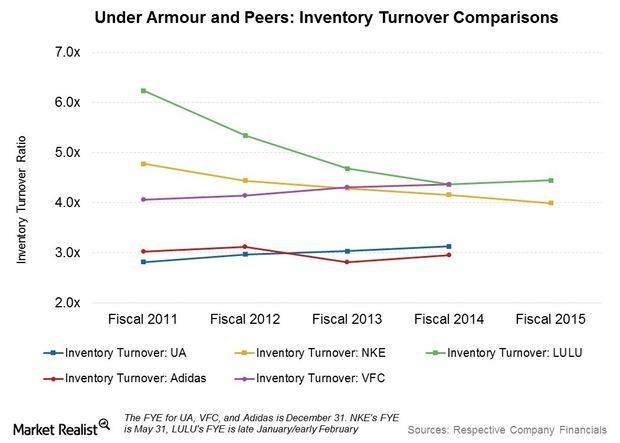

What’s Different about Under Armour’s Inventory Management?

Under Armour (UA) anticipates higher inventory growth over the next few quarters. It has made a number of changes on the inventory and supply chain side.

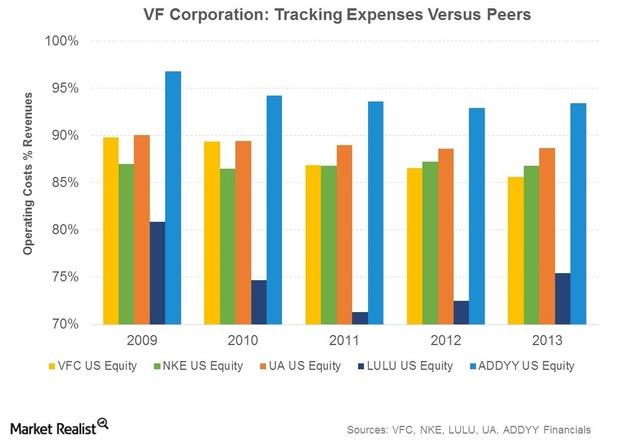

Reasons for NIKE’s Rising Profitability

NIKE is working to improve its profitability, as its margins trail industry peers such as Lululemon Athletica (LULU) and VF Corporation (VFC).

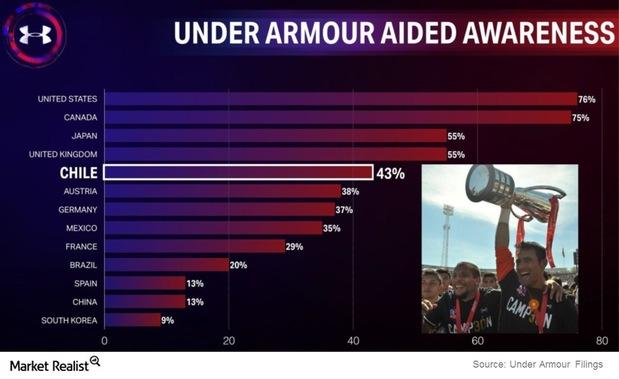

Why Under Armour Unveiled a Blueprint for International Expansion

Under Armour’s (UA) international operations are among its fastest-growing businesses.

Overseas Markets and Nike: Obstacles on the Leading Footwear Company’s Revenue Racetrack?

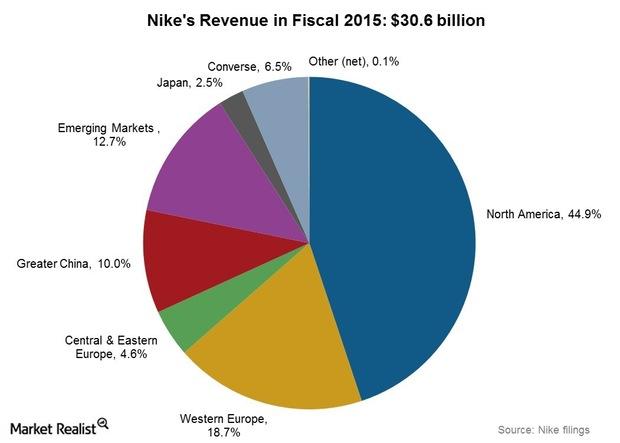

In fiscal 2015, Nike derived ~55% of its sales from overseas markets—18.7% from Western Europe, 12.7% from Emerging Markets, and 10% from Greater China.

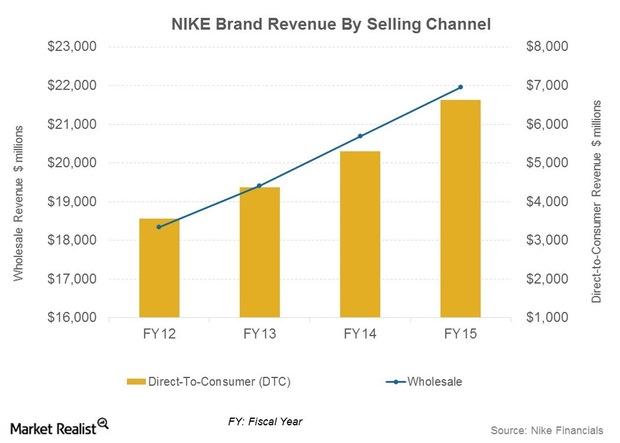

Why Nike Is Expanding Its Direct Retail Store Presence

Nike sales growth was fueled by new store openings, higher store comps, and growth in the e-commerce channel.

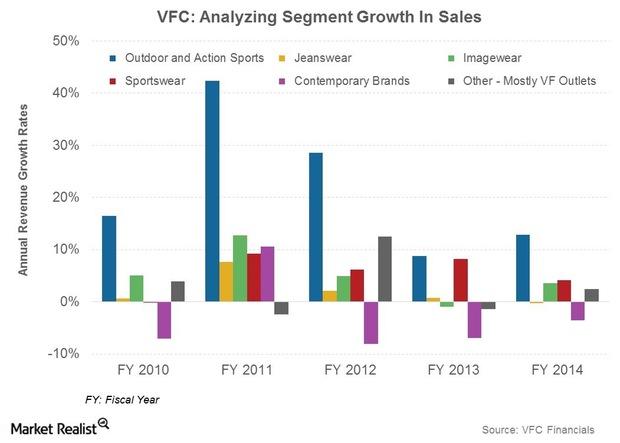

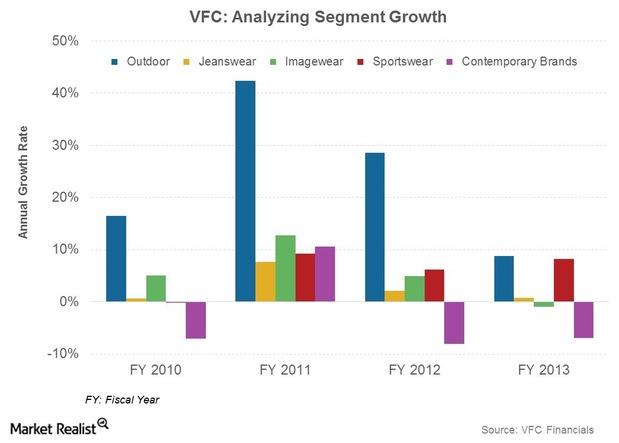

VF Corporation’s Big 3 And Other Brands In The Making

The company’s three major brands—The North Face, Vans, and Timberland—all reported double-digit growth rates in the quarter.

Shareholder Returns Analysis: Where VF Corp. Trumps Competitors

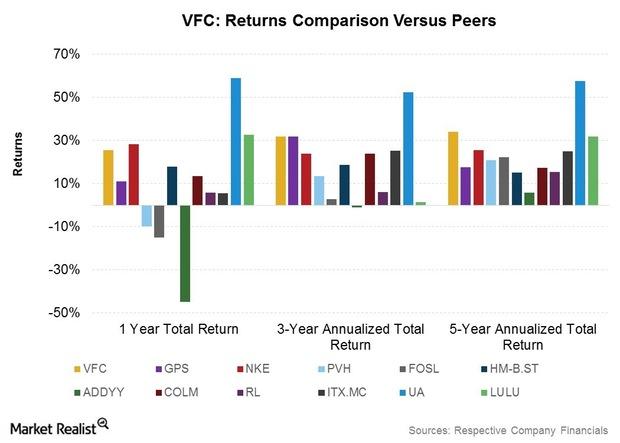

VFC’s total annualized returns to shareholders appear among the most consistent within its peer group for one-year, three-year, and five-year time periods.

Making It To VF Corp.’s $2-Billion Brand Club

The North Face became VFC’s first brand to achieve $2 billion in sales in 2013. Timberland revenues are expected to come in at ~$1.7 billion in 2014.

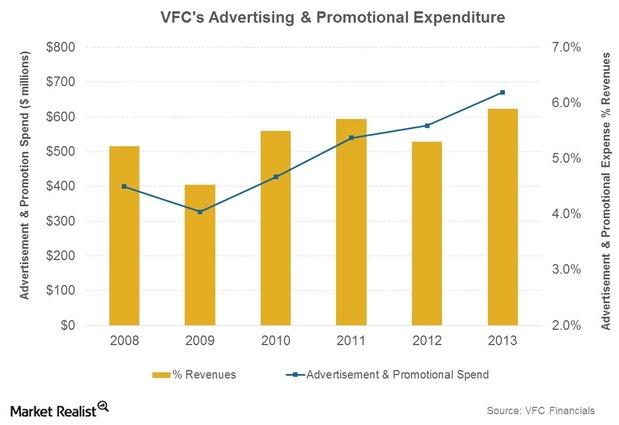

Discovering VF Corp.’s Marketing Edge

VFC’s marketing dollars are designed to get the most returns from its stores, other retailers (wholesale customers), and its e-commerce websites.

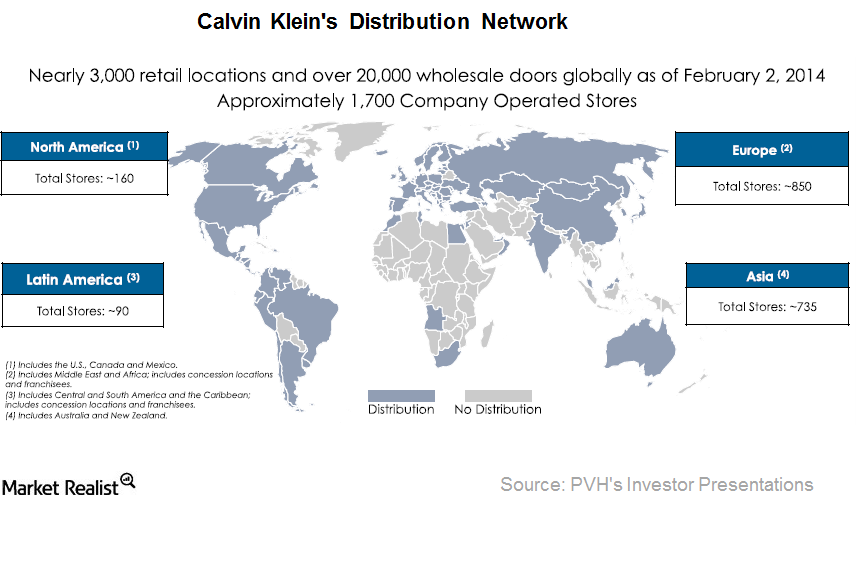

Analyzing the Calvin Klein business

Products sold under the Calvin Klein banner had gross revenue of $7.8 billion in 2013. Of the revenue, PVH reported $2.8 billion.

VF Corp.’s Location, Manufacturing, And Supply Chain Advantages

VFC manufactures ~27% of its products in facilities operated by the company. The company owns 28 manufacturing facilities.

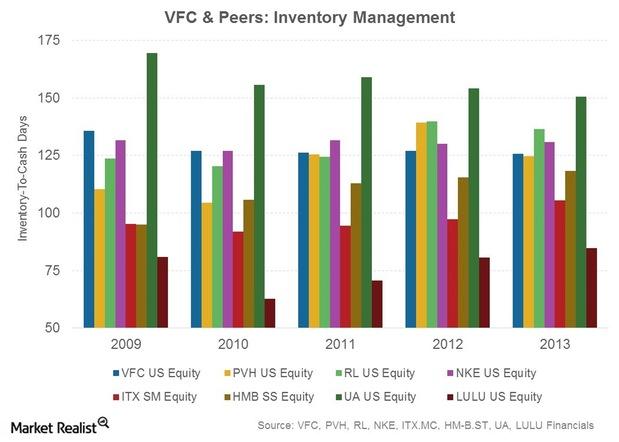

Inventory Management Is Critical Zone For VF Corp. And Its Peers

For fashion and apparel firms, inventory management, or tracking inventory levels, is critical. Inventory levels signify whether products are in demand or not.

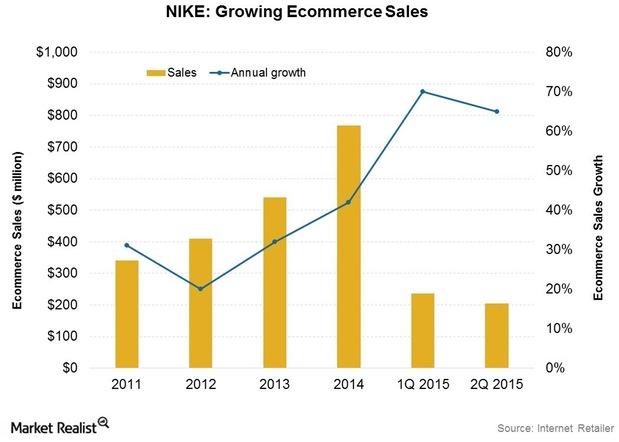

E-commerce: A Critical Growth Driver At NIKE

NIKE plans to grow DTC revenues to $8 billion by fiscal 2017, including e-commerce revenues of $2 billion. E-commerce grew 65% in 2Q15 to ~$205 million.

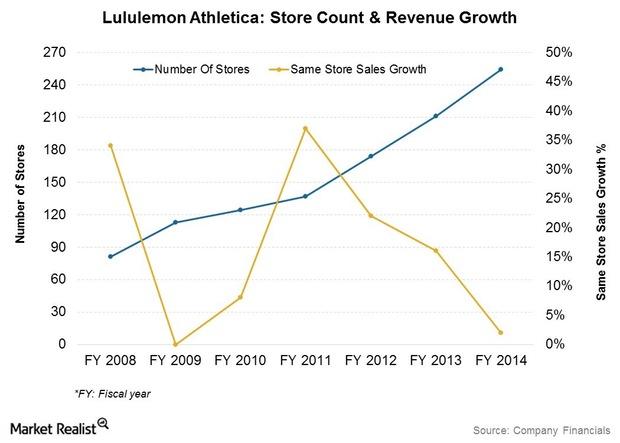

Why Lululemon Is Looking At A Global Store Footprint

LULU’s global store count was estimated at 289 at the end of 3Q15. Stores are company-owned, with most located in the US (201) and Canada (57).

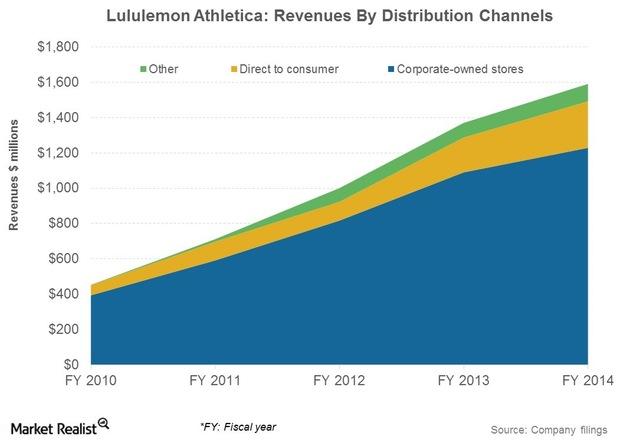

Why Lululemon’s Distribution Channels Are A Competitive Advantage

LULU’s sale through wholesale channels is much lower than its competitors VF Corporation, NIKE, and Under Armour. This is why LULU’s margins are higher.

Lululemon Supplier, Manufacturer, And Distribution Overview

Manufacturer base: There were about 35 manufacturers producing the company’s products as of the fiscal year ending February 2, 2014.

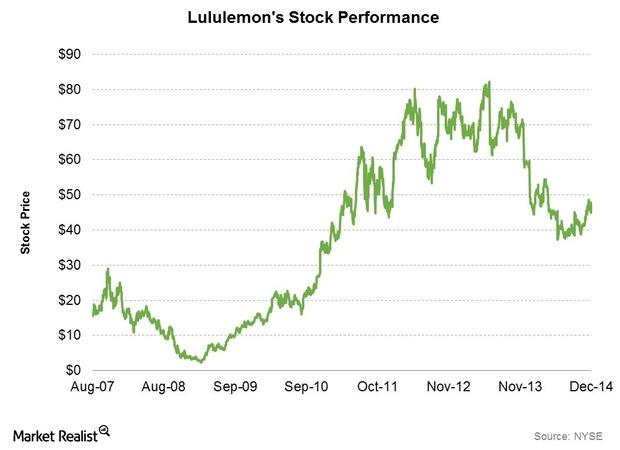

Lululemon Attempts To Reinvigorate Its Interrupted Growth Model

In this series, we’ll provide an overview of Lululemon Athletica, its financials (including its latest quarterly results), and its strategies.