How Did PVH Corporation Perform in 3Q16?

PVH Corporation (PVH) has a market cap of $8.5 billion. It fell 0.08% to close at $105.94 per share on November 30, 2016.

Dec. 2 2016, Updated 8:05 a.m. ET

Price movement

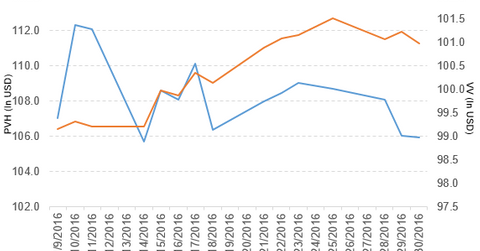

PVH Corporation (PVH) has a market cap of $8.5 billion. It fell 0.08% to close at $105.94 per share on November 30, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -2.3%, -0.94%, and 44.1%, respectively, on the same day.

PVH is trading 1.6% below its 20-day moving average, 2.5% below its 50-day moving average, and 7.3% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.04% of its holdings in PVH. The YTD price movement of VV was 9.6% on November 30.

The market caps of PVH’s competitors are as follows:

Performance of PVH in 3Q16

PVH Corporation (PVH) reported 3Q16 total revenues of $2.24 billion, a rise of 3.7% compared to total revenues of $2.16 billion in 3Q15. Revenues of its Calvin Klein and Tommy Hilfiger segments rose 9.5% and 4.5%, respectively, and revenue of its Heritage Brands segment fell 8.0% in 3Q16 compared to 3Q15.

The company’s gross profit margin expanded 220 basis points and its EBIT[1. earnings before interest and taxes] margin narrowed 290 basis points in 3Q16 compared to 3Q15.

Its net income and EPS (earnings per share) fell to $126.2 million and $1.56, respectively, in 3Q16 compared to $221.9 million and $2.67, respectively, in 3Q15. It reported non-GAAP EPS of $2.60 in 3Q16, a fall of 2.3% compared to 3Q15.

PVH’s cash and cash equivalents rose 79.1%, and its inventories fell 5.5% during 3Q16 and 4Q15.

Projections

PVH Corporation has made the following projections for fiscal 2016:

- PVH projects revenue growth of ~2% based on a GAAP basis and ~3% on a constant currency basis. It projects revenue growth of its Calvin Klein, Tommy Hilfiger, and Heritage Brands businesses of 6%, 4%, and -9%, respectively, on a GAAP basis.

- PVH projects net interest expense of ~$117 million.

- The company expects non-GAAP EPS in the range of $6.70–$6.75, which includes negative impact of foreign currency exchange rates of ~$1.65 per share.

- PVH projects an effective tax rate in the range of 18%–18.5%.

PVH made the following projections for 4Q16:

- revenue growth between -1%–1% on a constant currency basis

- net interest expense of $31 million

- non-GAAP EPS in the range of $1.13–$1.18, which includes the negative impact of foreign currency exchange rates of $0.23 per share

- effective tax rate in the range of 14%–17%

In the final part of this series, we’ll discuss GoPro (GPRO).