Vanguard Consumer Discretionary ETF

Latest Vanguard Consumer Discretionary ETF News and Updates

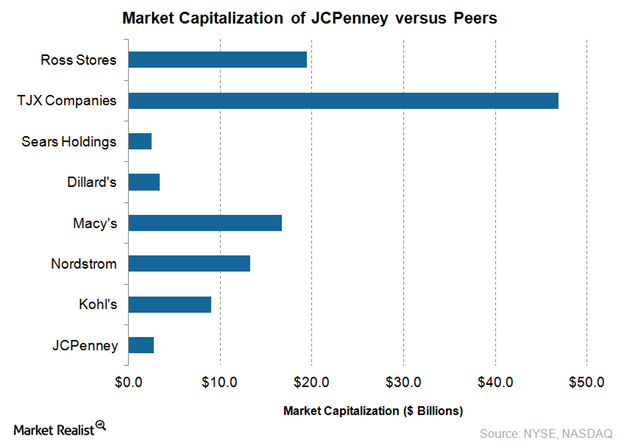

JCPenney: Insight into Its Roller Coaster Journey

This series on JCPenney will provide insight into the company’s business and its turnaround strategy, key growth initiatives, stock price movement, and valuation.

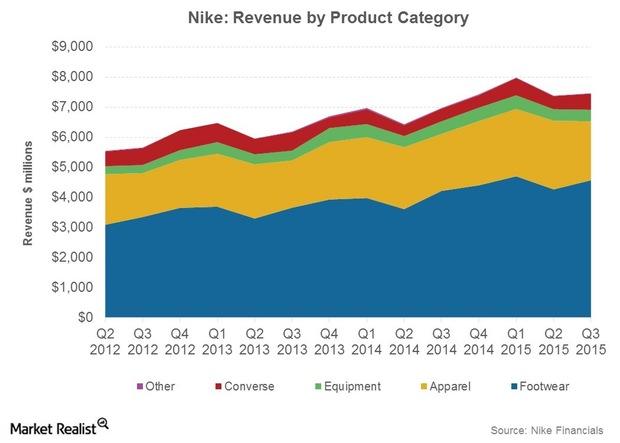

Nike Still Dominates Athletic Footwear in 1Q15

US dollar sales of athletic footwear rose 8% in the first quarter of 2015. Nike was the most dominant brand by far with a market share of 62%.

Must-know: Top auto industry ETFs for investors

The First Trust NASDAQ Global Auto ETF (CARZ) is the most traded auto-focused ETF. The three-year return for the ETF is 48.32%. YTD, CARZ provided a return of 2.23%.

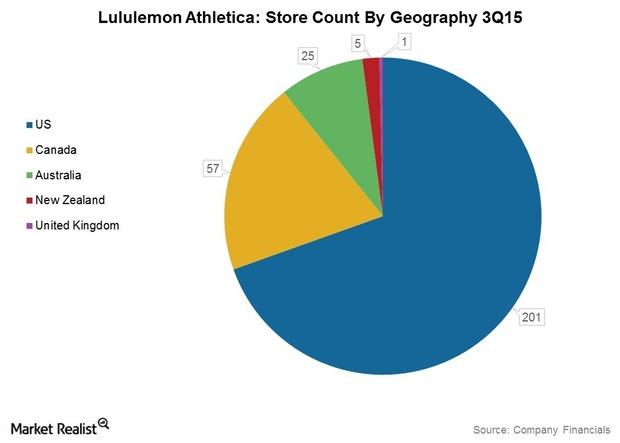

Analyzing Lululemon’s Revenues By Geographical Segment

The company grew its revenues at a compound annual growth rate of more than 35% over the past five years to come in at $1.6 billion in fiscal 2014.

Skechers: Achieving Growth through Diverse Product Development

Since the launch of its first line in 1992, Skechers has diversified into several new lines, targeting different demographics and different activities.

Six Flags Entertainment: An overview of the largest theme park

Six Flags Entertainment Corp. (SIX) is the world’s largest regional theme park company with $1.1 billion in revenue and 18 parks across North America.

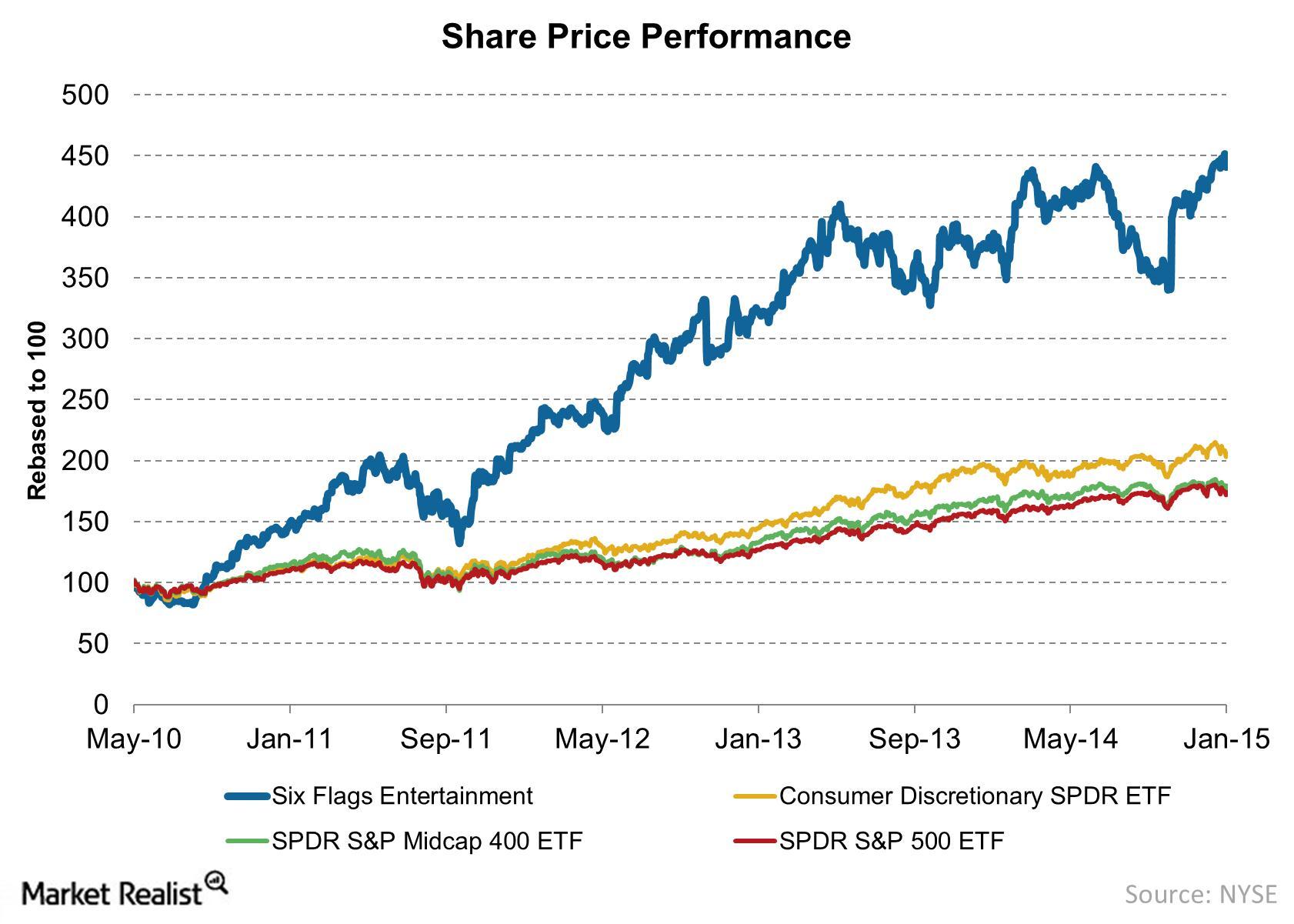

Share price performance for Six Flags since bankruptcy recovery

Six Flags’ share price on May 10, 2010, reflects $7.36 per share, the price of new common stock upon the company’s emergence from bankruptcy.

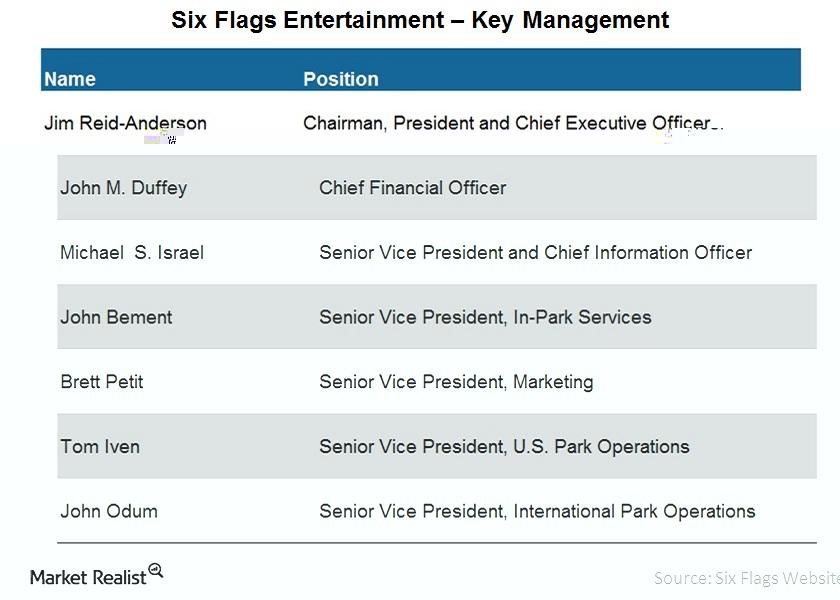

A brief overview of Six Flags’ management

Six Flags’ management plays a vital role in shaping the company and leading it in the desired direction. This article reviews three management positions.

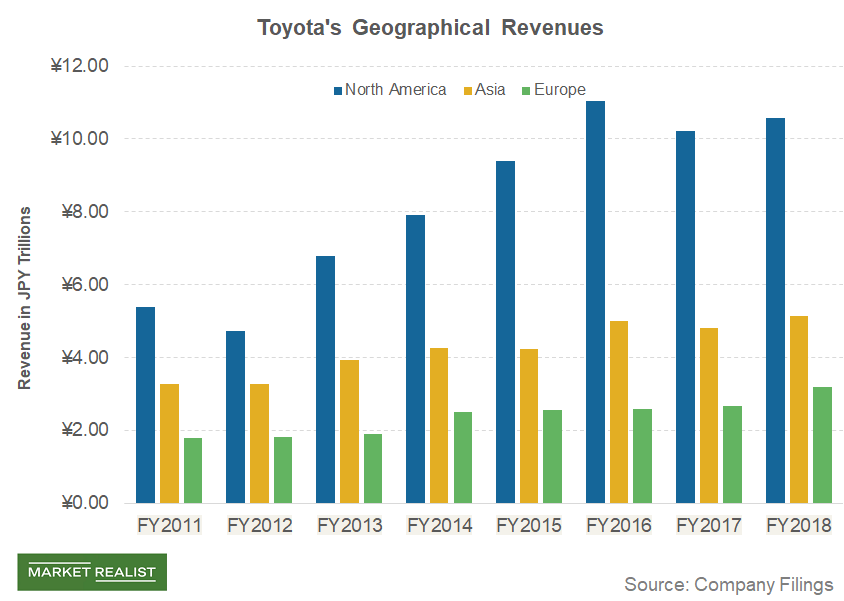

A Look at Toyota’s Fiscal 2018 Revenue from North America

Toyota Motor’s (TM) vehicle sales in North America fell 1.1% YoY (year-over-year) to 2.8 million units in fiscal 2018.

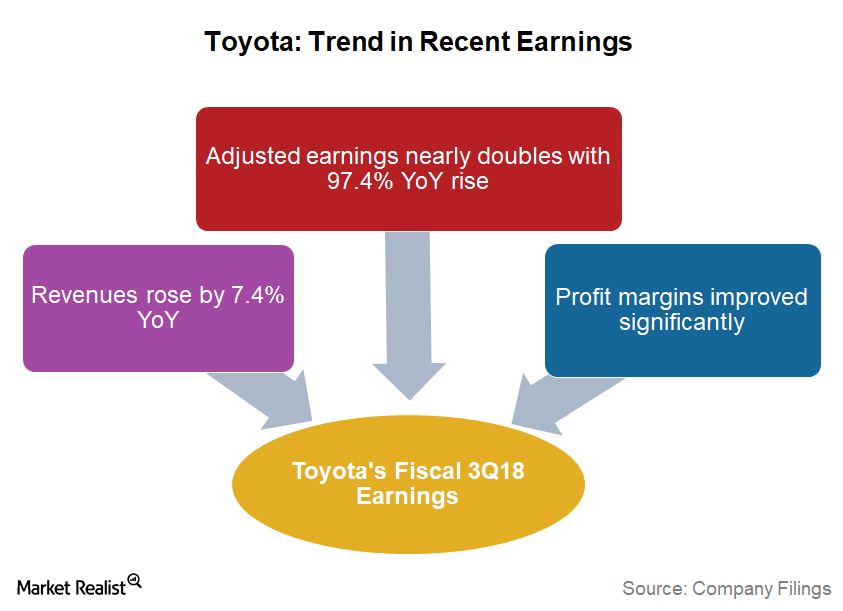

Analyzing Toyota’s Recent Financial Performance

In its fiscal 3Q18 (which ended December 31, 2018), Toyota’s adjusted earnings rose 97.4% year-over-year to ~315 JPY (or Japanese yen).

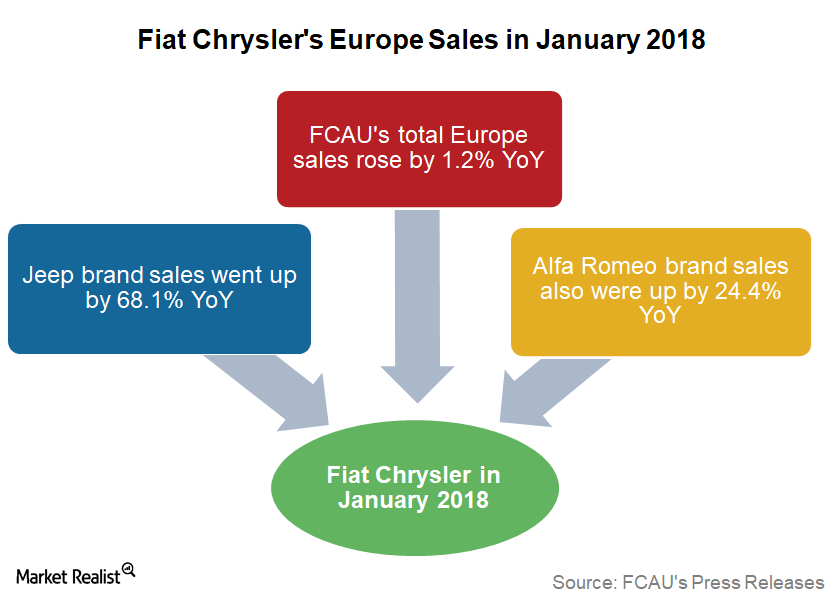

Fiat Chrysler’s European Sales Rose in January 2018

In January 2018, Fiat Chrysler Automobiles’ (FCAU) total European sales reached ~85,000 vehicle units.

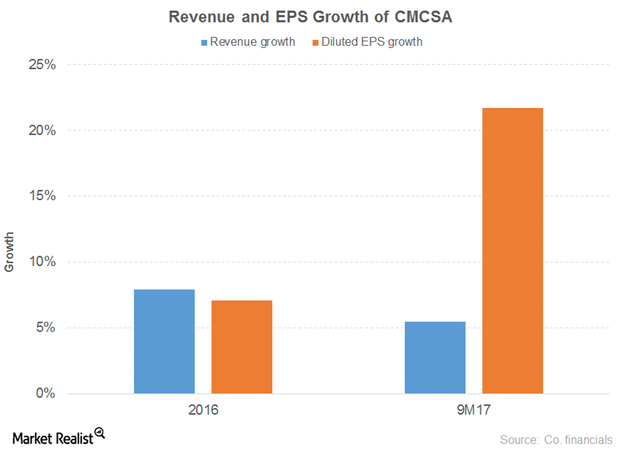

A Look at Comcast’s Strategy

Comcast’s (CMCSA) revenue grew 8% and 5% in 2016 and 9M17, respectively. The broadcast of the Rio Olympics in 3Q16 drove the 2016 numbers.

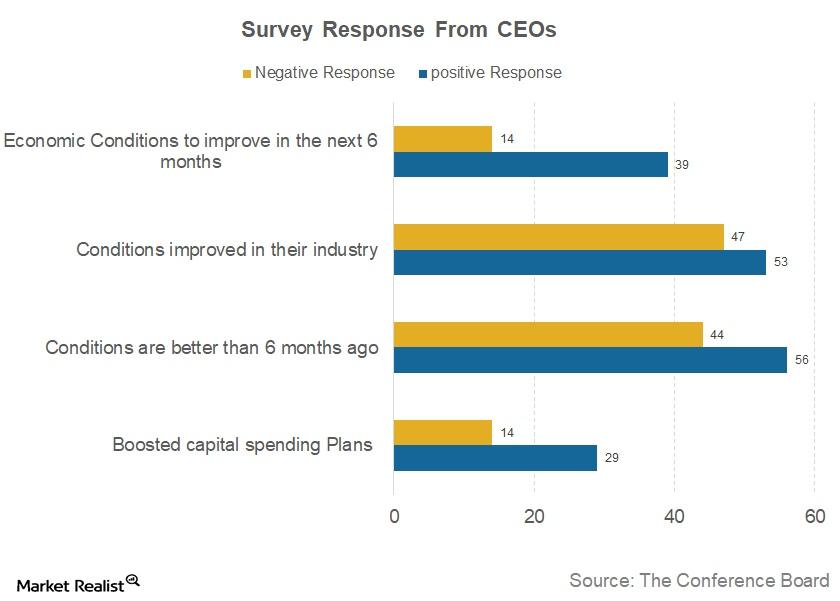

How Does CEO Confidence Index Assess US and Global Economies?

The Conference Board CEO Confidence Survey is a quarterly report based on a survey that collects responses from approximately 100 CEOs who represent a variety of industries.

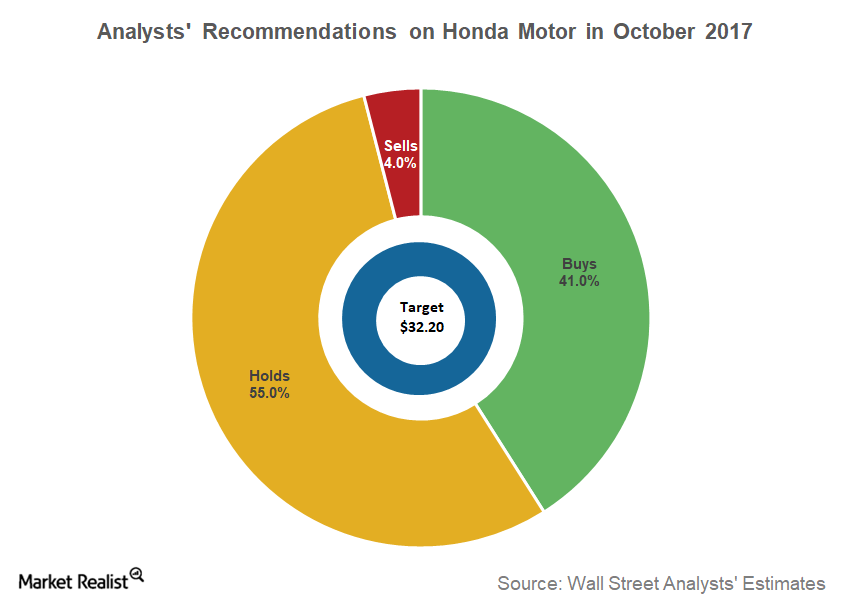

What Do Analysts Recommend for Honda Motor in October 2017?

According to analysts’ consensus data, 41% of analysts covering Honda Motor Company (HMC) gave it a “buy” recommendation on October 11.

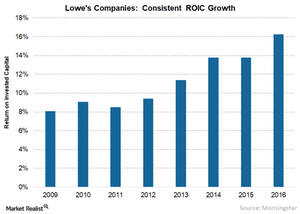

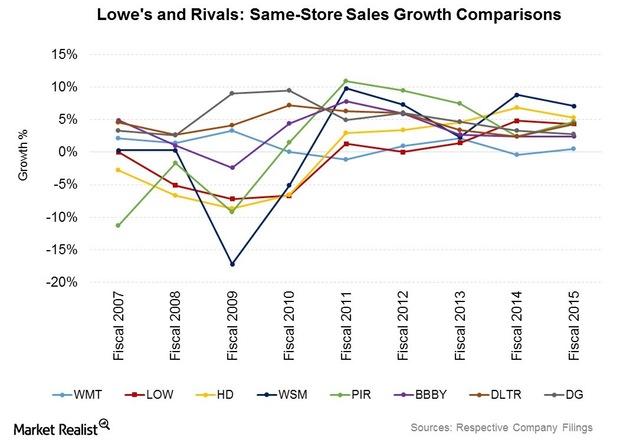

Lowe’s: Great Business Built on Logistics Strength

Lowe’s Companies (LOW) operates 2,129 home improvement and hardware stores in the United States, Canada, and Mexico.

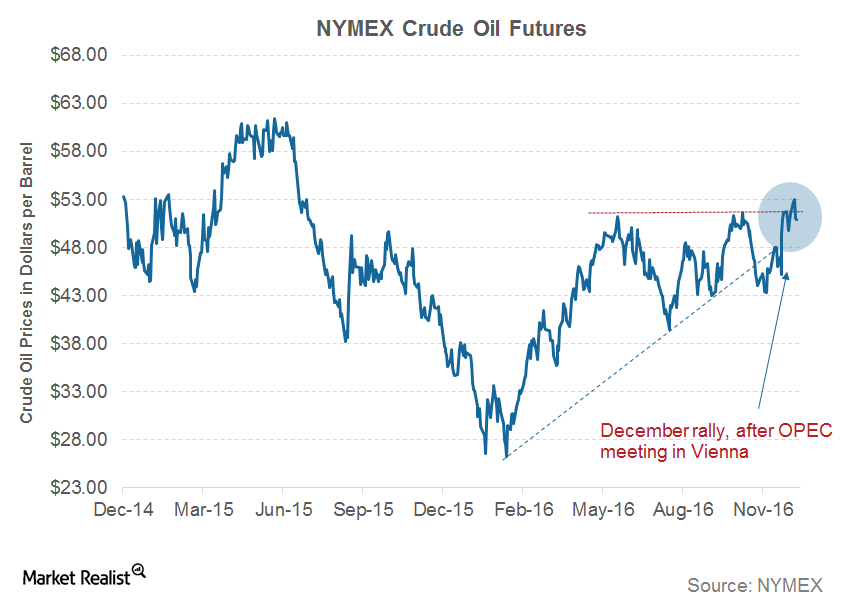

How the Recent Rise in Oil Prices Could Affect the Auto Industry

In November 2016, the WTI (West Texas Intermediate) crude oil prices traded on a bullish note after witnessing a 2.9% rise in the previous month.

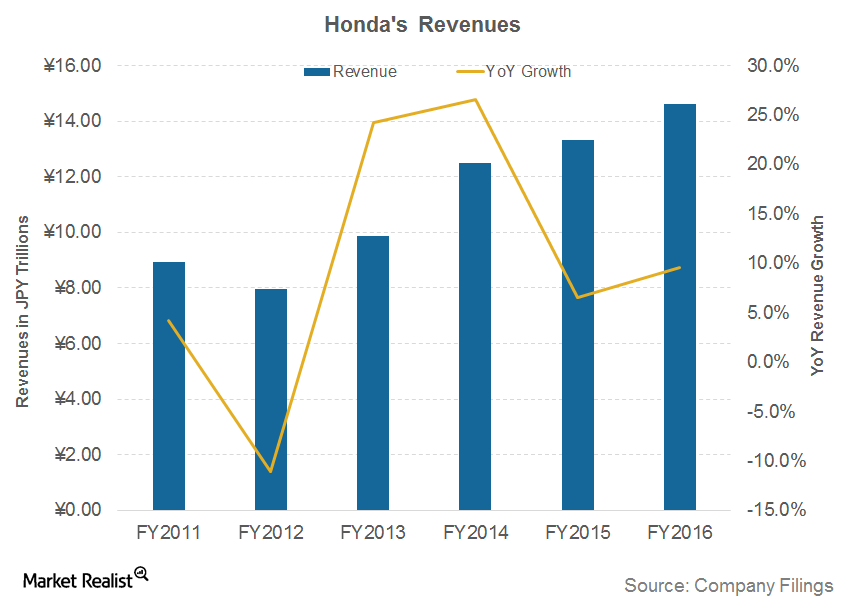

Analyzing Recent Trends in Honda’s Revenue

In fiscal 2016, Honda reported strong revenues of ~1.5 trillion Japanese yen, which is 9.6% higher than its revenues of ~1.3 trillion yen in fiscal 2015.

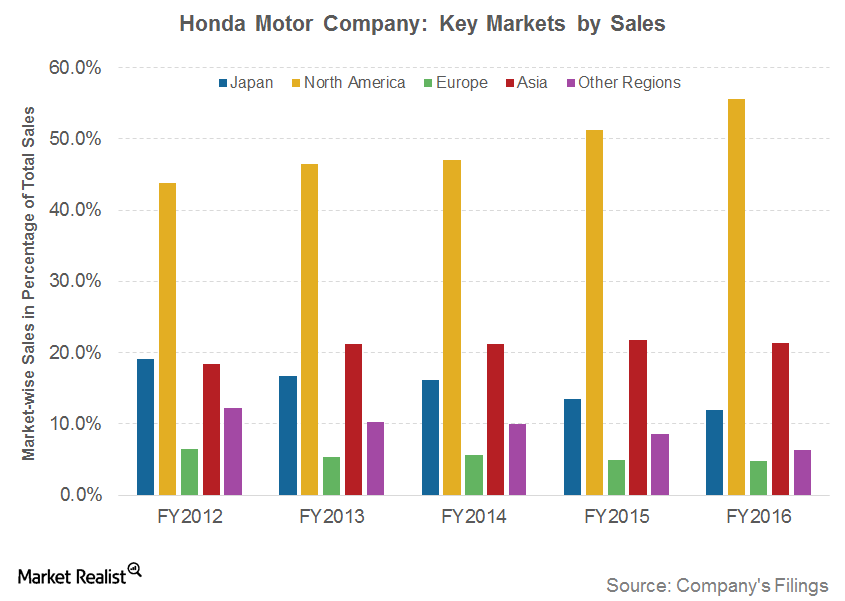

What Are the Key Markets for Honda Motor Company?

Honda’s sales from Japan have been declining lately due to slowing auto demand in the region. In fiscal 2016, 12% of the company’s total revenues were from its home market, much lower than 19% in fiscal 2012.

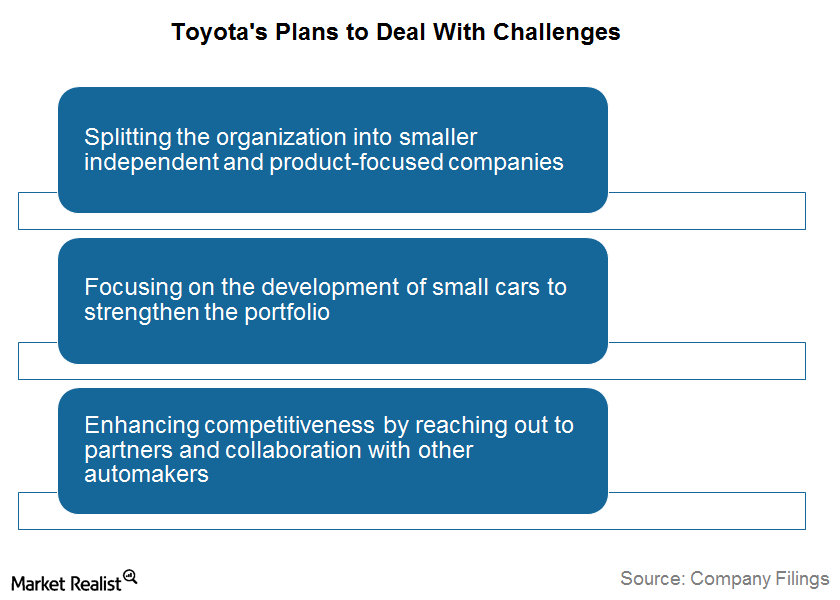

How Does Toyota Plan to Deal with Its Challenges?

With increasing environmental awareness across the globe, a delay in Toyota’s ability to deliver mainstream eco-friendly vehicles may restrict its future growth prospects.

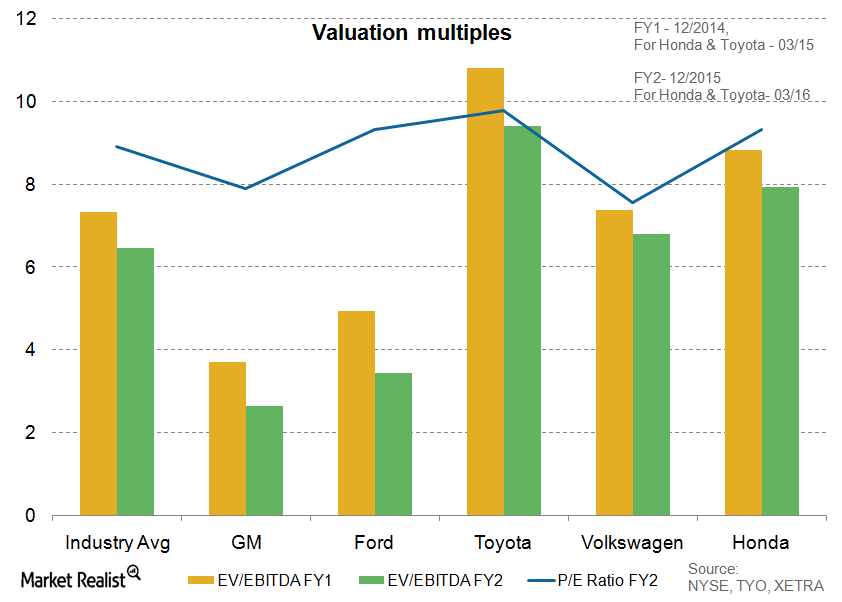

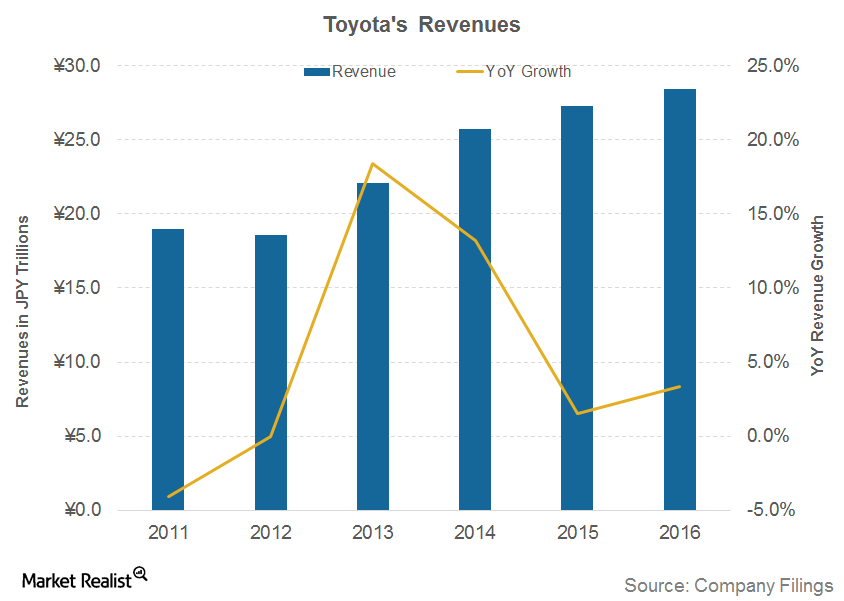

Analyzing Recent Trends in Toyota’s Revenue

According to a report published by Forbes in May 2015, Toyota was the eighth-largest company in the world by revenue. The company is not directly listed in the US, although its ADR is traded on the NYSE.

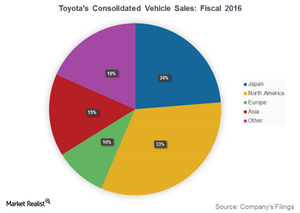

What Are the Key Markets for Toyota Motor Corporation?

Toyota (TM) has 53 overseas manufacturing companies in 28 countries and regions. Originally considered a regional auto manufacturer, Toyota has busted this myth by gaining a huge global market share, particularly in the US and Europe.

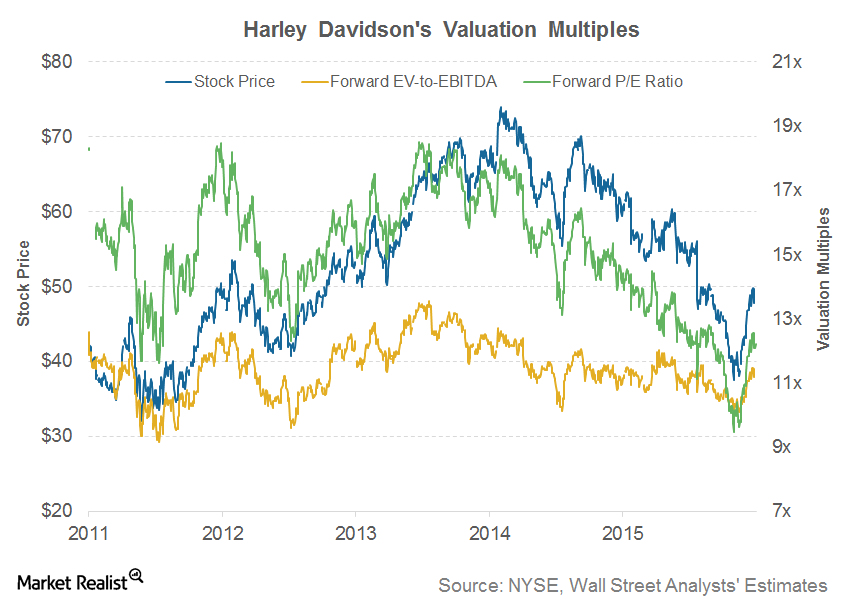

What Are Harley-Davidson’s Valuation Multiples?

As of March 29, 2016, Harley-Davidson’s forward EV/EBITDA multiple is 11x for the next 12 months.

What Is Harley-Davidson’s Marketing Strategy?

It’s important for investors to take a look at an automaker’s marketing strategy to understand how the company differentiates its strategy to market its offerings.

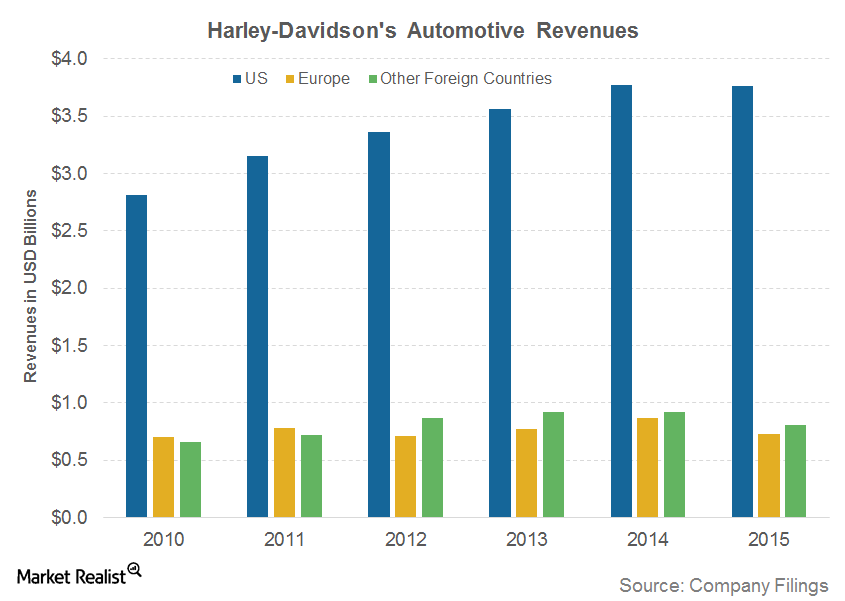

What Are the Key Geographical Markets for Harley-Davidson?

In 2015, the company shipped ~95,000 motorcycles outside the US. Australia, Mexico, and Canada are also some of the other key markets for Harley-Davidson motorcycles.

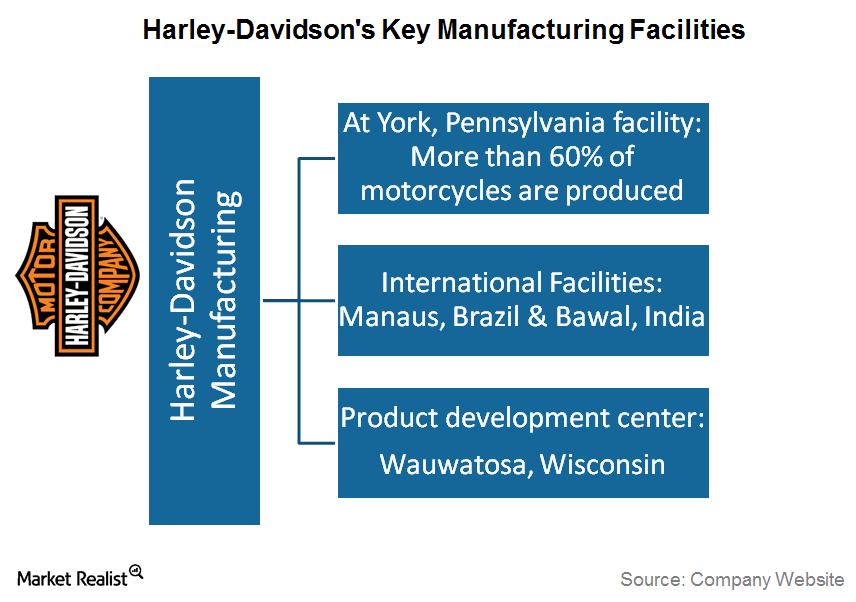

Where Are Harley-Davidson Motorcycles Manufactured?

Most of Harley-Davidson’s (HOG) manufacturing and assembly plants are located in the US.

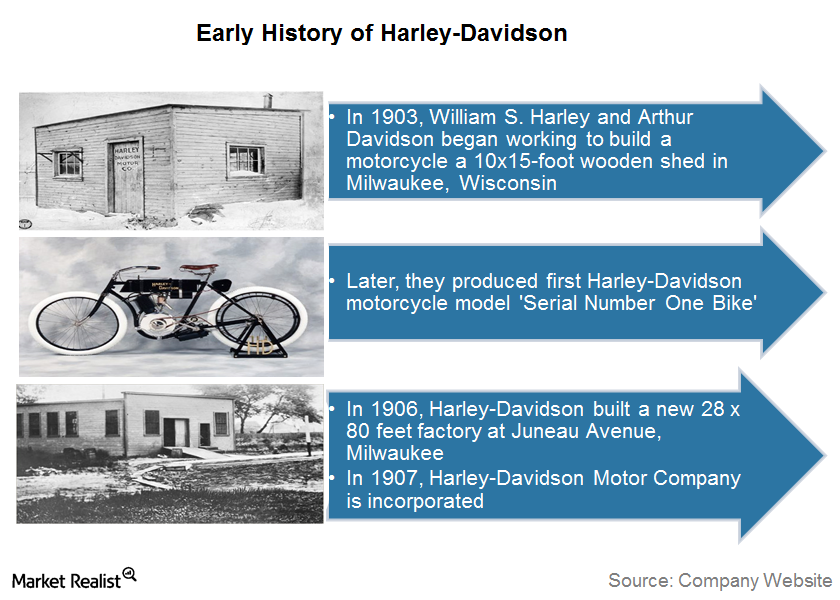

The Early History of Harley-Davidson: The Motorcycle Pioneer

Harley-Davidson has become a synonym for power, passion, and class among motorcycle enthusiasts around the world.

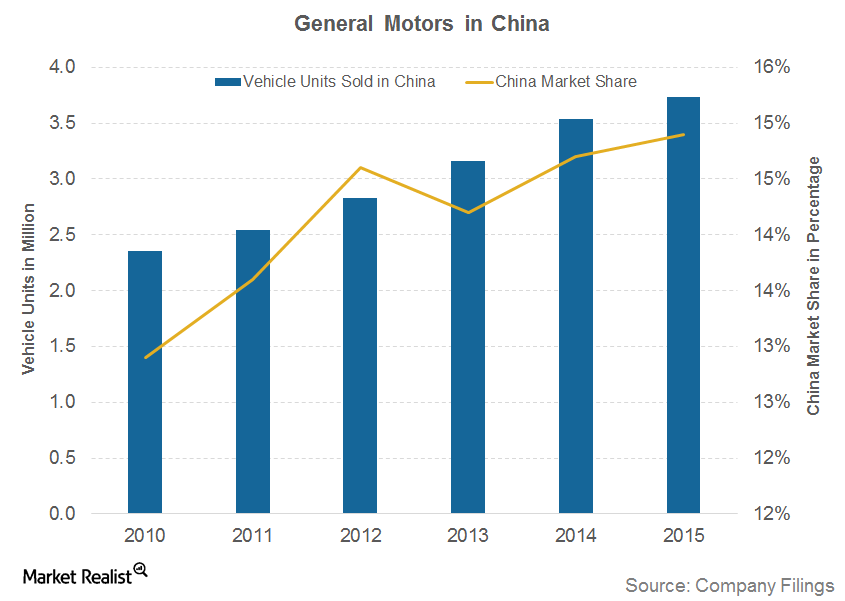

General Motors Continues to Rule the Chinese Auto Market

In 2015, GM remained at the top in the Chinese auto market, with the largest market share of 14.9%. This was higher than its share of 14.7% in 2014.

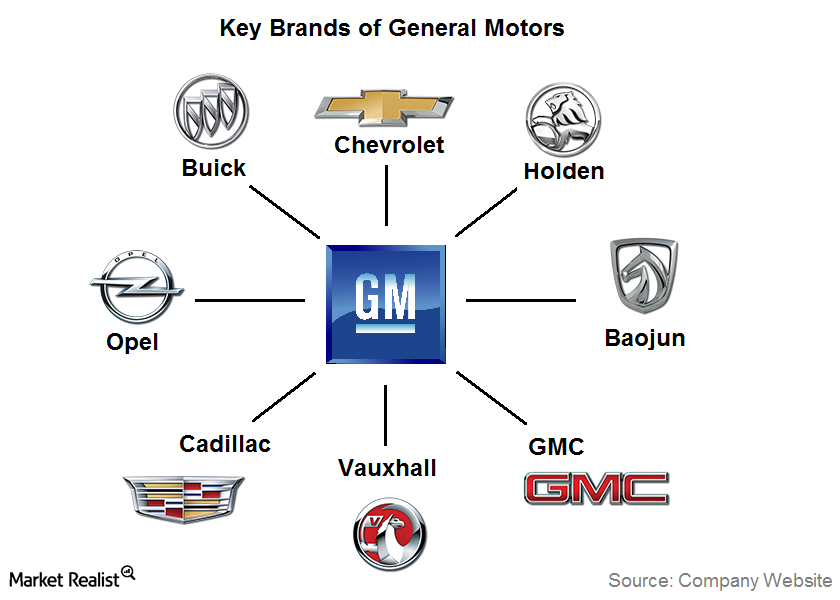

Key Brands Under General Motors’ Umbrella

Cadillac is the most popular luxury car brand in General Motors’ portfolio. It was established with the foundation of the Cadillac Automobile Company.

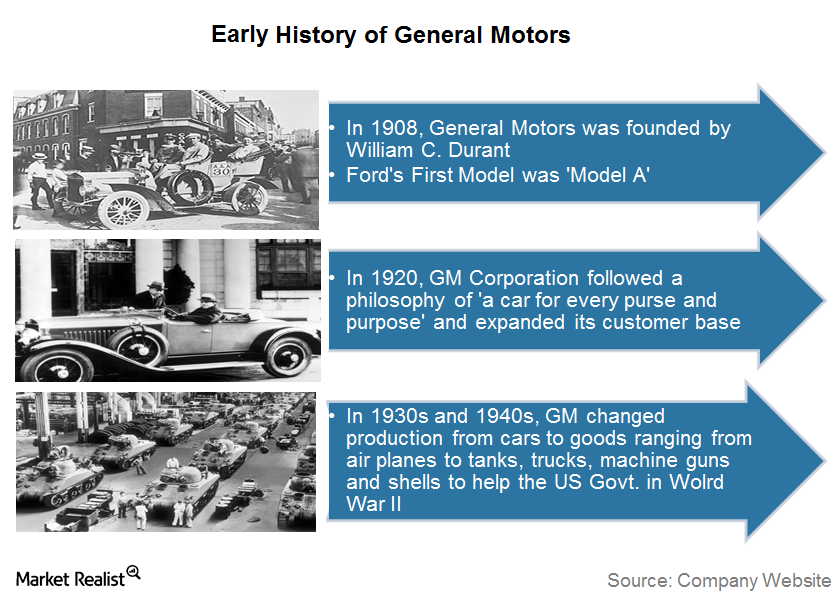

General Motors: The Beginning of the US Auto Giant

General Motors (GM) is the largest American automaker. The company was founded in the year 1908 by William C. Durant.

Can the Samsonite-Tumi Merger Get Antitrust Approval?

Samsonite will need to file for merger approval under the Hart-Scott-Rodino Antitrust Improvements Act. The companies will need to file for Canadian antitrust approval.

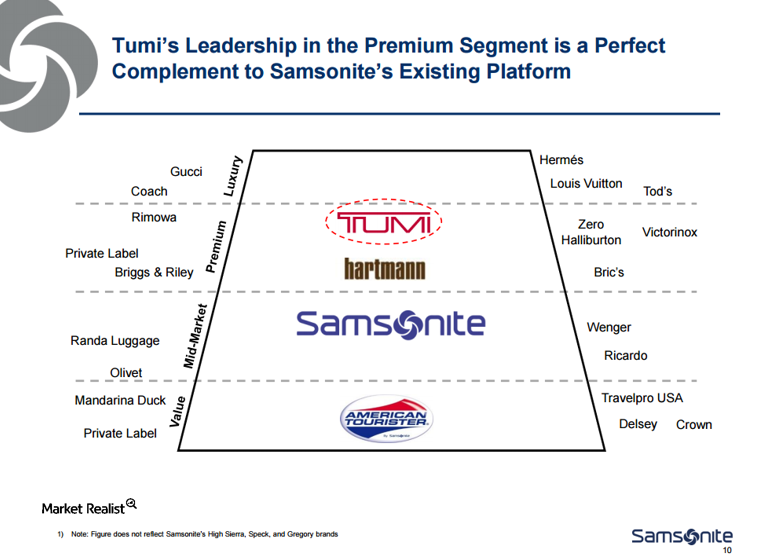

What’s the Rationale for the Samsonite-Tumi Transaction?

Hong Kong-based Samsonite is buying luxury brand Tumi (TUMI) in a $1.8 billion deal. Samsonite is mainly known as a utilitarian luggage company.

Assembly Line Innovation Helped Ford Outpace the Competition

Ford’s assembly line innovation allowed it to reduce the price of its Model T to $350 from $850 and to produce a vehicle within 90 minutes.

What Are Lowe’s Strengths and Weaknesses?

Lowe’s (LOW) is one of the largest and oldest big box retailers around. It’s been publicly listed since 1961.

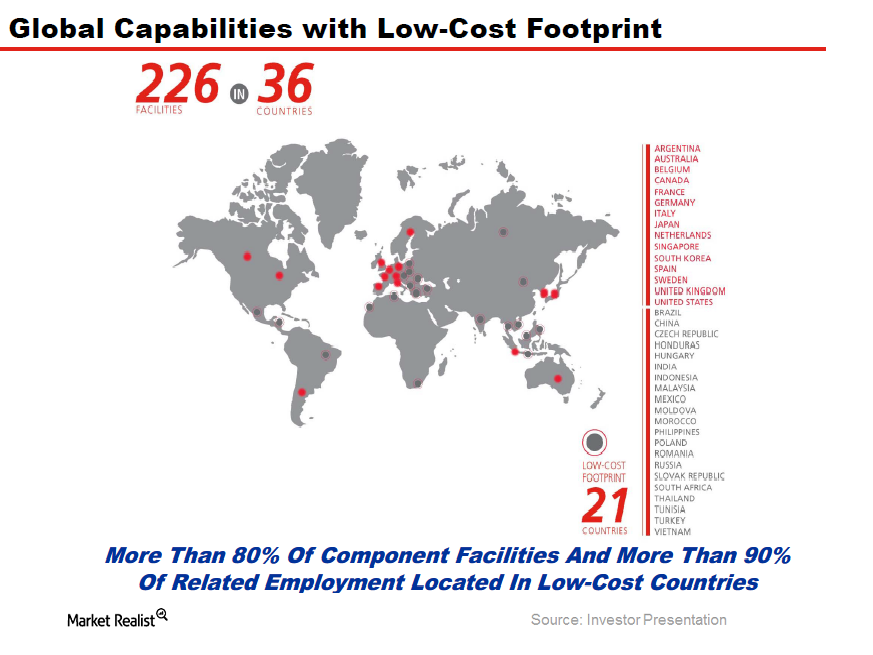

How Lear became one of the largest automotive parts suppliers

Lear (LEA) is one of the largest automotive parts suppliers with FY14 revenues of $17.7 billion.