Market Vectors® Pharmaceutical ETF

Latest Market Vectors® Pharmaceutical ETF News and Updates

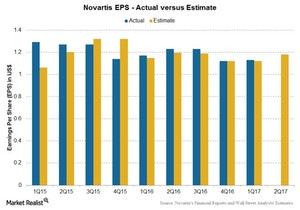

Novartis’s 2Q17 Earnings: Analyst Estimates

Novartis is set to release its 2Q17 earnings on July 18, 2017. Analysts estimate EPS (earnings per share) of $1.18 and revenues of $12.3 billion.

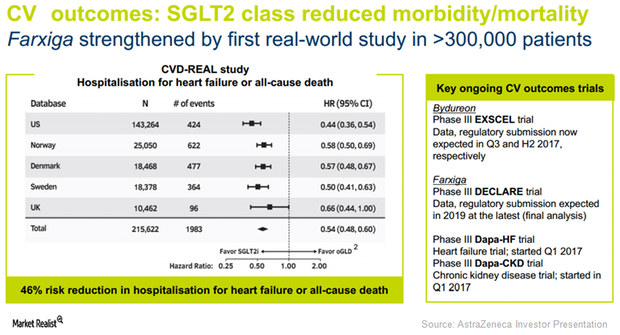

Farxiga Could See Robust Demand in International Markets in 2017

In 1Q17, AstraZeneca’s (AZN) Farxiga reported sales of $42 million in emerging markets, which equals year-over-year growth of ~100% on a reported basis.

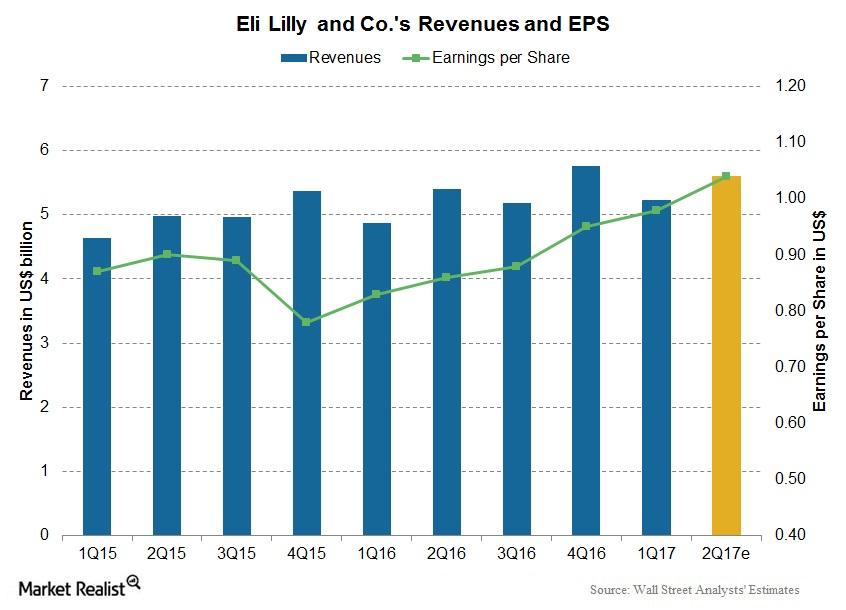

What We Can Expect from Eli Lilly and Company in 2Q17

A look at Eli Lilly and Company Headquartered in Indianapolis, Indiana, Eli Lilly and Company (LLY) is a US pharmaceutical company focused on human pharmaceuticals and animal health. Stock price performance Eli Lilly’s stock price has fallen ~4.4% in 2Q17. However, the stock price had risen 10.9% year-to-date as of July 7, 2017. Analysts’ recommendations Wall […]

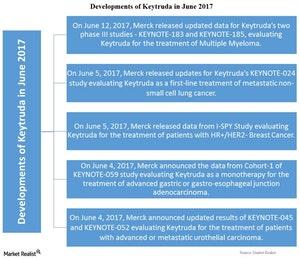

Keytruda’s Developments in June 2017

On June 12, 2017, Merck released updated data for Keytruda’s two phase III studies—KEYNOTE-183 and KEYNOTE-185—which evaluate Keytruda in combination with other drugs for the treatment of multiple myeloma.

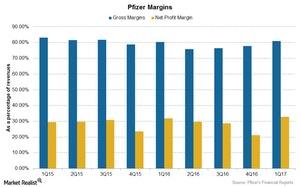

Pfizer’s Profitability in 1Q17

Pfizer’s gross margin for 1Q17 was 81.0%, a 0.70% rise compared to 80.3% in 1Q16.

Analyzing Bristol-Myers Squibb’s Valuation on June 20

As of June 20, 2017, Bristol-Myers Squibb was trading at a forward PE multiple of ~18.0x—compared to the industry average of 16.0x.

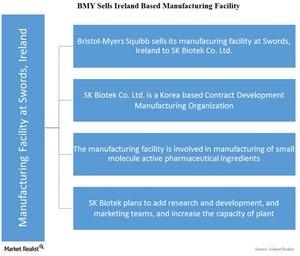

SK Biotek to Acquire Manufacturing Facility in Swords, Ireland

In its press release on June 16, 2017, Bristol-Myers Squibb (BMY) announced that it entered into a definitive purchase agreement with SK Biotek.

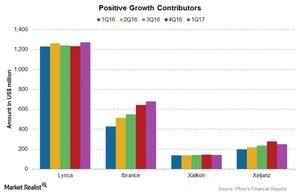

What Drove Pfizer in 1Q17?

Growth drivers for Pfizer (PFE) include products contributing to operational growth, such as BMP2, Celebrex, Ibrance, Lyrica, and Xeljanz.

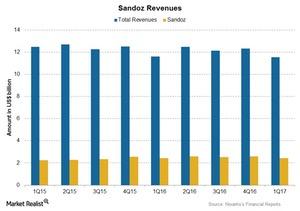

Inside Novartis’s Generics Business Now

Sandoz is also a leader in differentiated generics. Its contribution made up ~21% of Novartis’s total revenues in 1Q17.

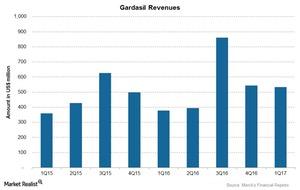

Gardasil and Merck’s Vaccines Business in 1Q17

Gardasil is Merck’s (MRK) leading vaccine franchise. Total sales for Gardasil in 1Q17 were $532.0 million, a ~41.0% rise over $378.0 million in 1Q16.

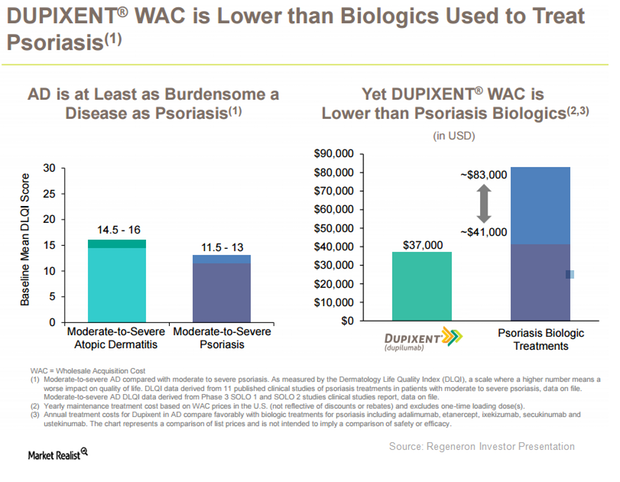

Dupixent Expected to Be a Solid Addition to Regeneron’s Portfolio

On March 28, 2017, the FDA approved Regeneron (REGN) and Sanofi’s (SNY) Dupixent for the treatment of patients with moderate-to-severe eczema or atopic dermatitis (or AD).

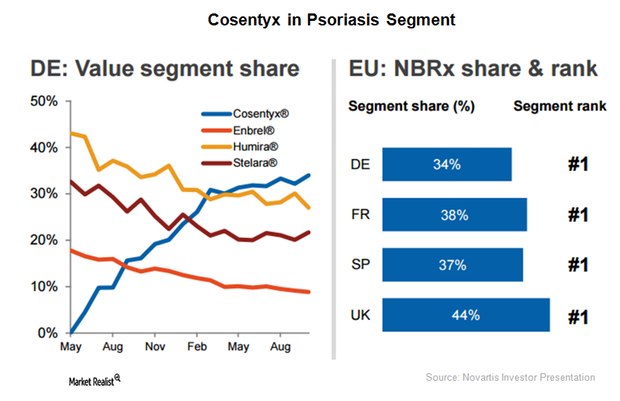

Cosentyx Enjoys Solid Demand as Psoriasis Therapy in Europe

In 2016, Novartis’s (NVS) Cosentyx surpassed its closest competitor, Eli Lilly’s (LLY) Taltz, in number of total weekly prescriptions in the US market.

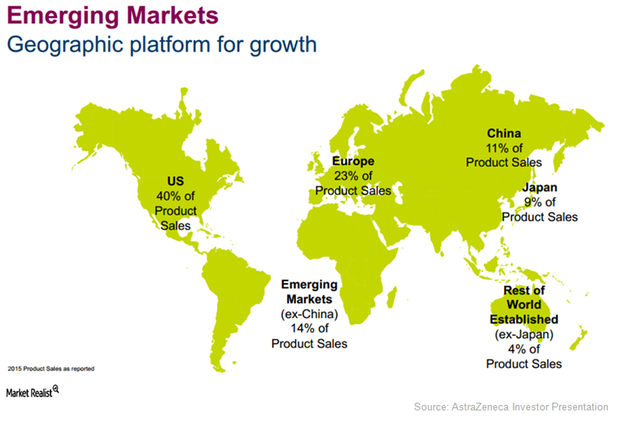

Emerging Markets Expected to Be AstraZeneca’s Key Growth Driver

For 2016, AstraZeneca (AZN) reported revenues of about $5.8 billion for its emerging markets business, which is a YoY (year-over-year) rise of about 6.0%.

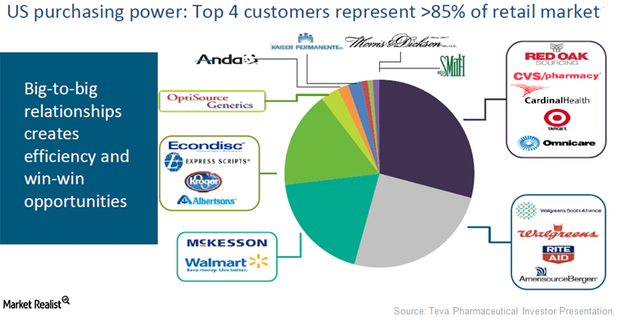

Teva Is Well Positioned for New Trends in the US Generic Market

Because of its drug portfolio, manufacturing operations, and customer relationships, Teva expects to benefit from new trends in the US generic market.

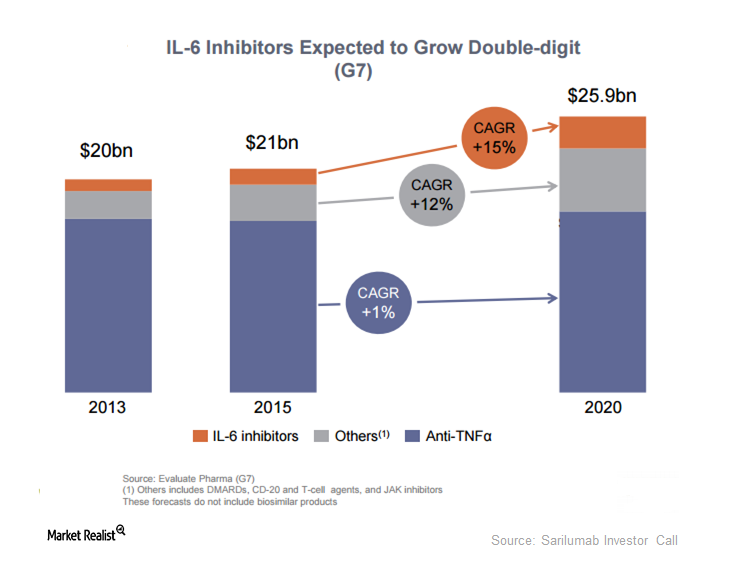

2016’s Estimated Product Launches: LixiLan, Sarilumab, Lixisenatide

LixiLan indicated for type 2 diabetes is a combination of Lantus and lixisenatide. Lantus is Sanofi’s most frequently prescribed diabetes drug.

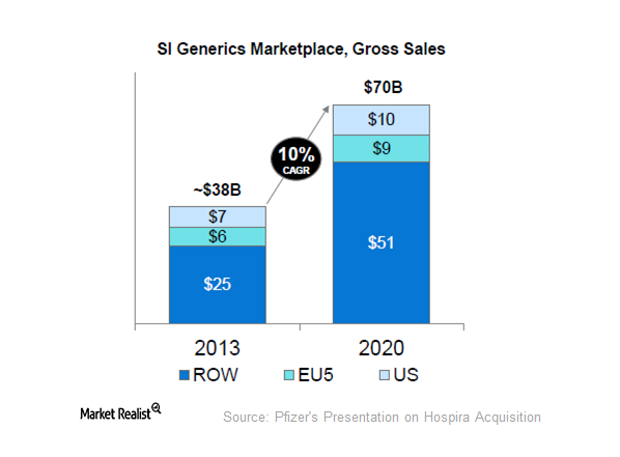

Pfizer’s Hospira Deal: Catching Up a Year Later

On September 13, 2015, Pfizer (PFE) completed its acquisition of Hospira for $17 billion.

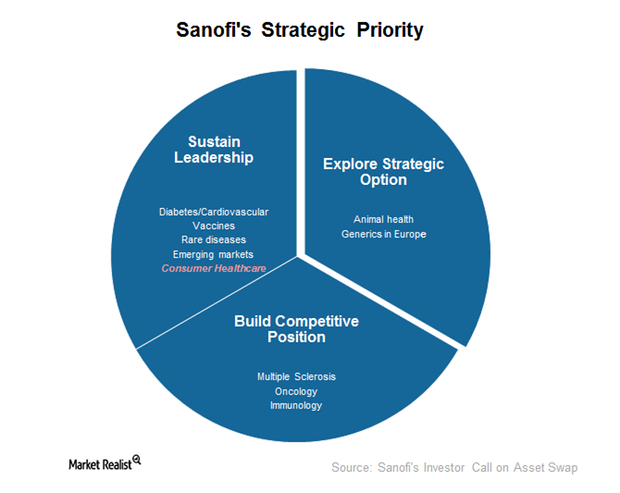

Understanding Sanofi’s Strategic Priority

As of June 30, 2016, the animal health business was Sanofi’s operating segment. It will remain an operating segment until the transaction closes.

Why Are Revenues from Pfizer’s Rare Disease Portfolio Falling?

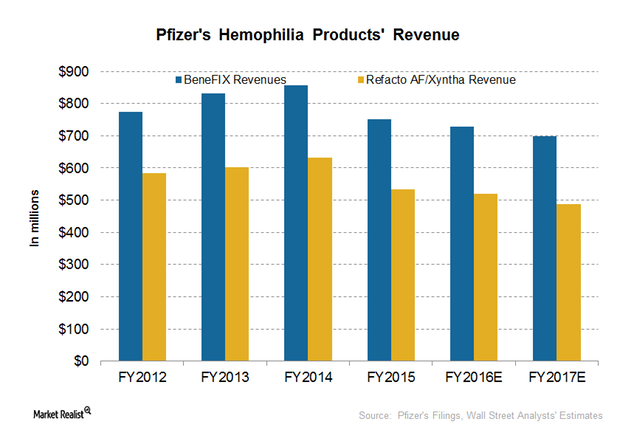

BeneFIX, the major contributor to Pfizer’s (PFE) Rare Disease portfolio, is indicated for hemophilia B. During the first six months, the drug earned $367 million.

Why Pfizer’s Enbrel Faces a Sales Decline

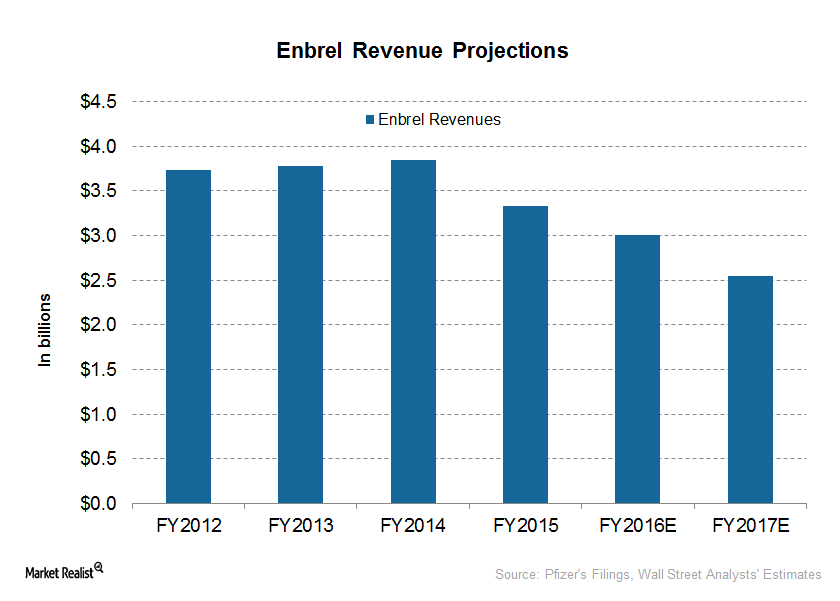

Wall Street analysts expect Enbrel to earn $3 billion and $2.5 billion from the sale outside US and Canada in fiscal 2016 and 2017, respectively.

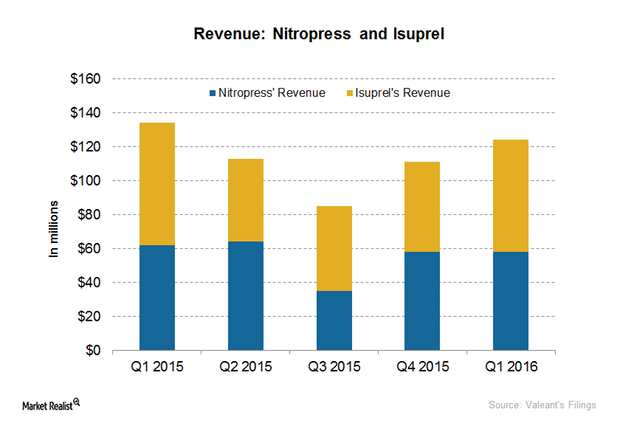

The Facts behind the Valeant Drug Pricing Controversy

Valeant Pharmaceuticals International (VRX) significantly raised the prices of two of its heart drugs—Nitropress and Isuprel—which caused a controversy and an outrage.

What’s Novartis’s New Structure?

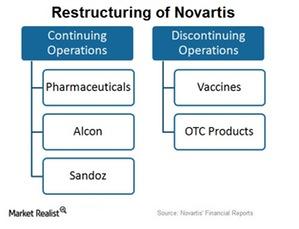

Novartis (NVS) has restructured its entire business into two parts: continuing operations and discontinuing operations.

What Risks Does Novartis Face?

Novartis is exposed to legal risks, including patent litigations, other product-related litigation, commercial litigation, government investigations, and prohibition rules.

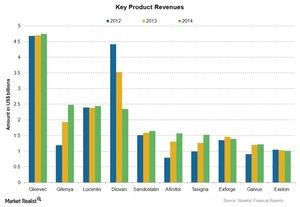

Which Products Contribute the Most to Novartis’s Revenues?

Novartis (NVS) has recorded direct product sales of over $1 billion for each of its ten pharmaceutical products in the last year.

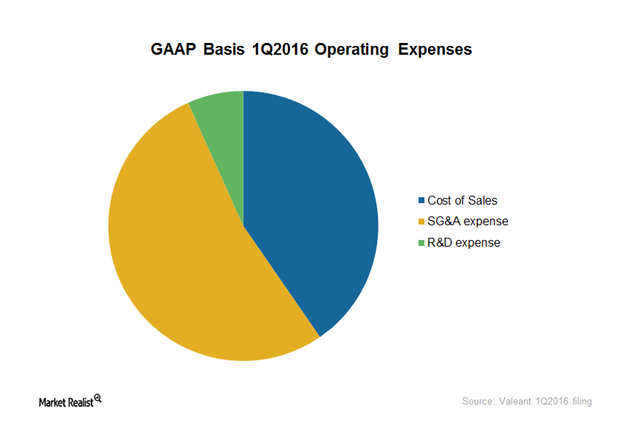

What’s behind Valeant’s Operating Expenses?

Valeant’s major operating expenses include cost of sales, SG&A (selling, general, and administrative) expenses, and R&D (research and development) costs.

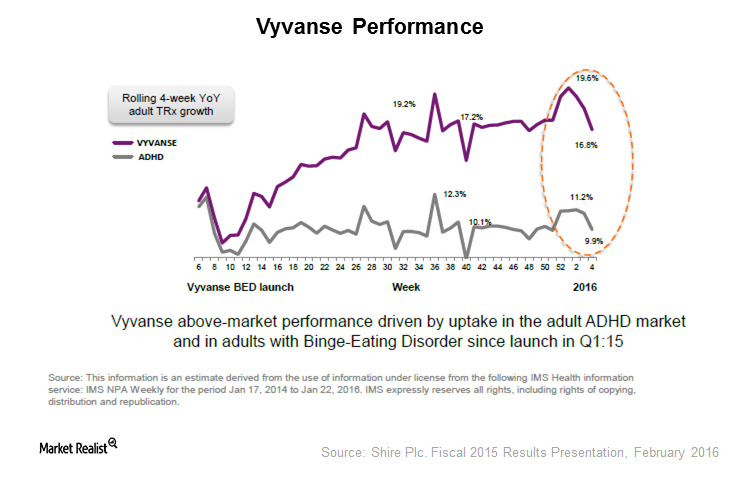

What’s Happening with a Generic Version of Vyvanse?

Vyvanse, Shire’s (SHPH) key drug, earned $1.7 billion in 2015, a 21% annual growth. Analysts expect Vyvanse to add $1.9 billion and $2.1 billion to Shire’s top line in 2016 and 2017.

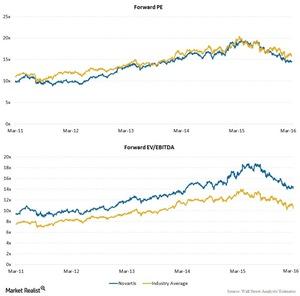

What Are Novartis’s Valuation Multiples?

Based on the last five-year multiple range of ~9x to ~20x, Novartis’s current valuation is neither high nor low.

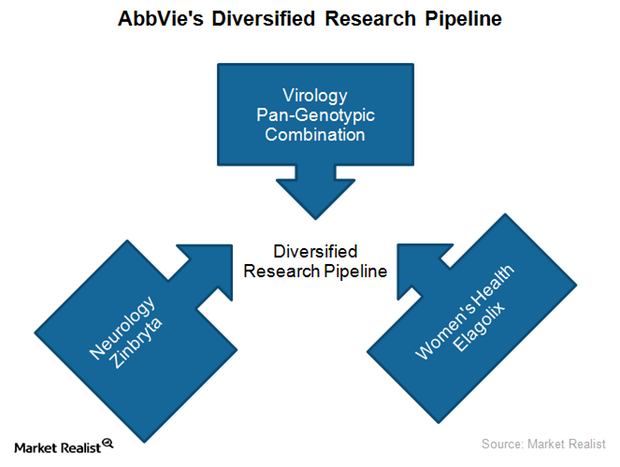

AbbVie’s Therapies in Virology, Neurology, and Women’s Health

In addition to its Oncology and Immunology segments, AbbVie is focused on launching innovative therapies in its Virology, Neurology, and Women’s Health segments.

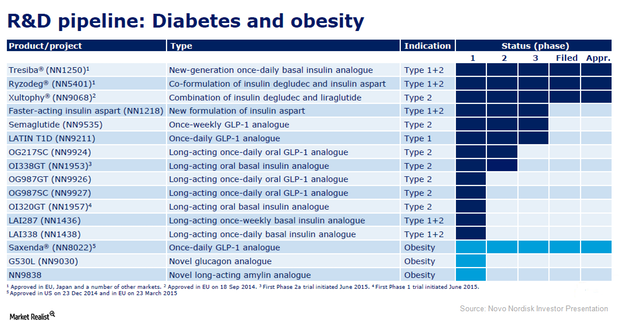

Novo Nordisk’s Innovative Research and Development Pipeline

Novo Nordisk’s research and development pipeline includes three late-stage insulin studies of faster-acting insulin aspart, semaglutide, and LATIN T1D.

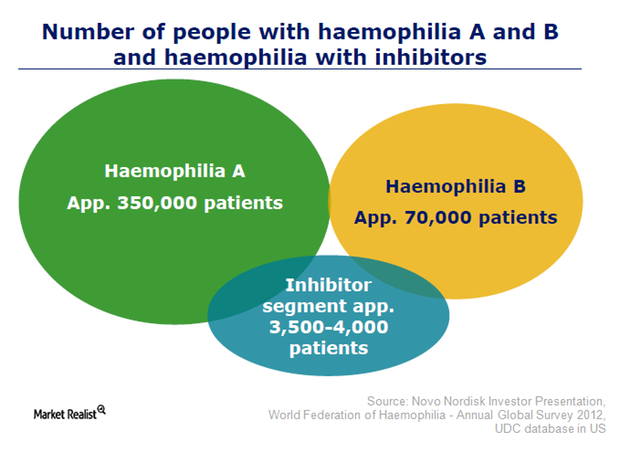

Novo Nordisk Plans to Pursue Leadership in Hemophilia Market

Novo Nordisk is pursuing leadership in the hemophilia market with its new drugs as well as a few investigational hemophilia drugs in its late-stage research pipeline.

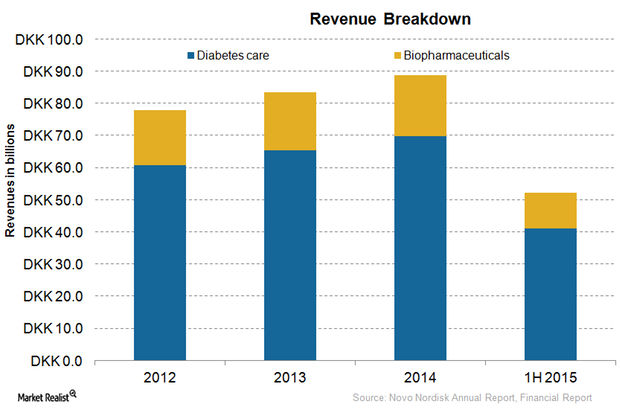

Novo Nordisk’s Business Model: An Overview

Novo Nordisk’s (NVO) business model includes a portfolio in areas such as diabetes, hemophilia, and growth hormones. In the first half of 2015, diabetes care accounted for 78.6% of its total revenues.

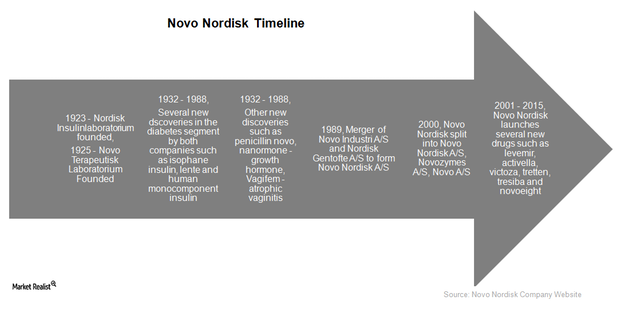

Novo Nordisk: An Investor’s Guide to a Leading Biotech Company

Novo Nordisk (NVO) is a leader in diabetes care with 90 years of experience coupled with a strong workforce of 39,700 in 75 countries around the world.

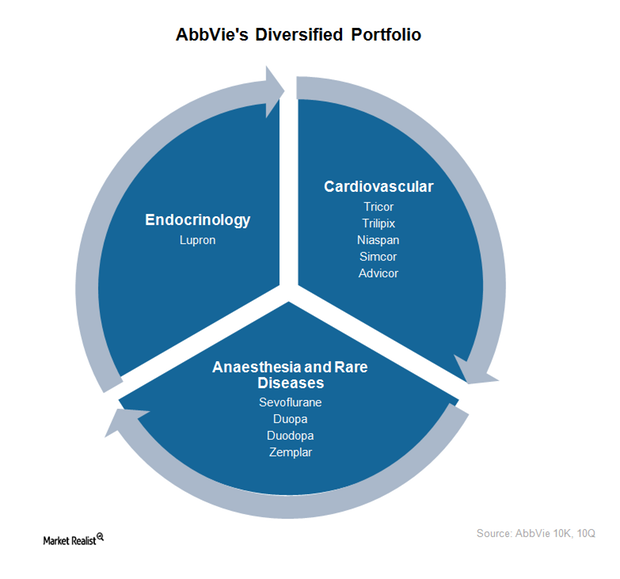

AbbVie’s Endocrinology, Cardiovascular, and Rare Disease Segments

AbbVie has a diversified offering of drugs for the treatment of conditions related to endocrinology, cardiovascular, and rare disease.

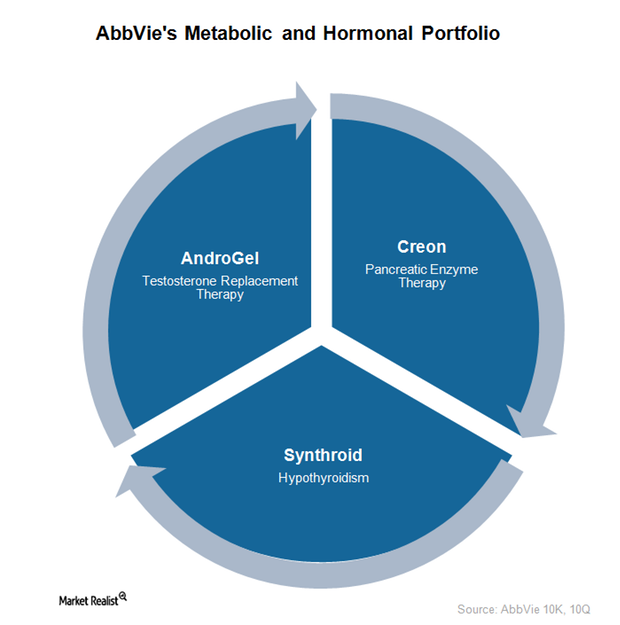

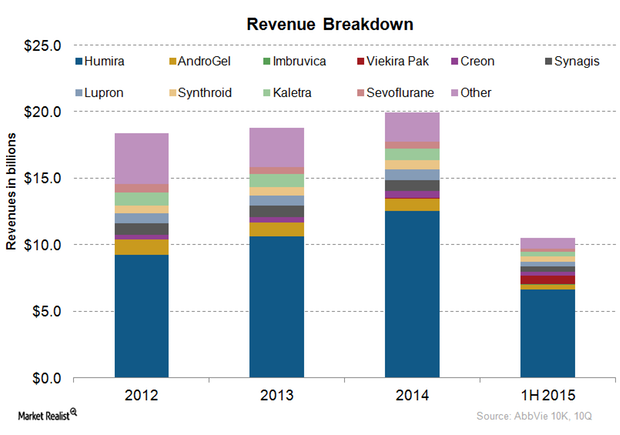

AbbVie Has a Strong Metabolic and Hormonal Portfolio

AbbVie’s metabolic and hormonal portfolio offers drugs such as AndroGel, Creon, and Synthroid to address various medical conditions.

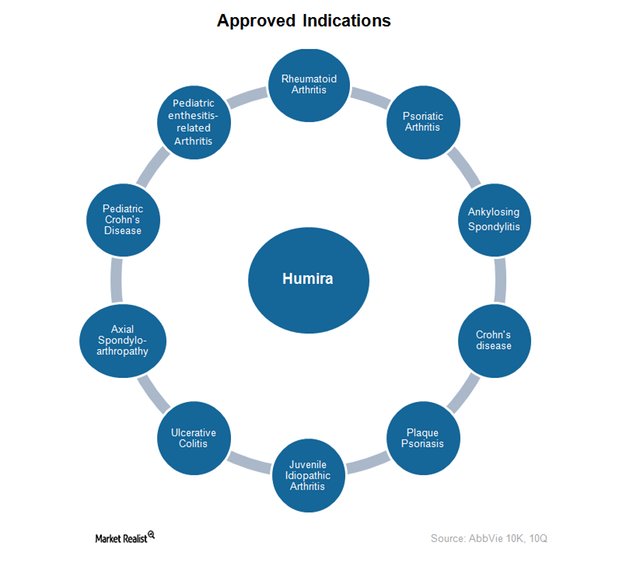

Humira Continues to Dominate AbbVie’s Revenues

Since Humira’s launch in the US market in 2002, Abbott Laboratories and its spin-off AbbVie have aggressively expanded the drug’s approved indications.

An Overview of AbbVie’s Business Model

AbbVie’s business model involves generating revenues through the sale of pharmaceutical products, which target some of the world’s most serious diseases.

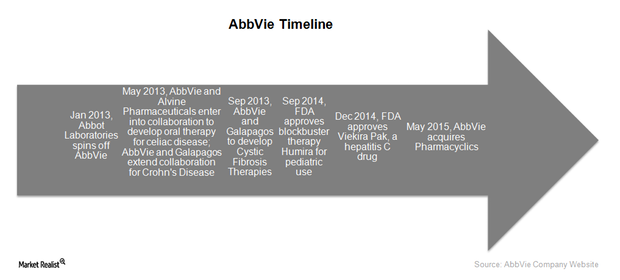

AbbVie: An Investor’s Look at a Leading Biotechnology Company

With a market capitalization of $100.7 billion, AbbVie is a major US biopharmaceutical company. AbbVie competes with Amgen, Gilead Sciences, and Bristol-Myers Squibb .