Novo Nordisk A/S

Latest Novo Nordisk A/S News and Updates

Novo Nordisk Joins Eli Lilly in Lowering Insulin Prices

Who owns Novo Nordisk, the diabetes-focused healthcare company that's lowering insulin prices? Here's what we know about the company.

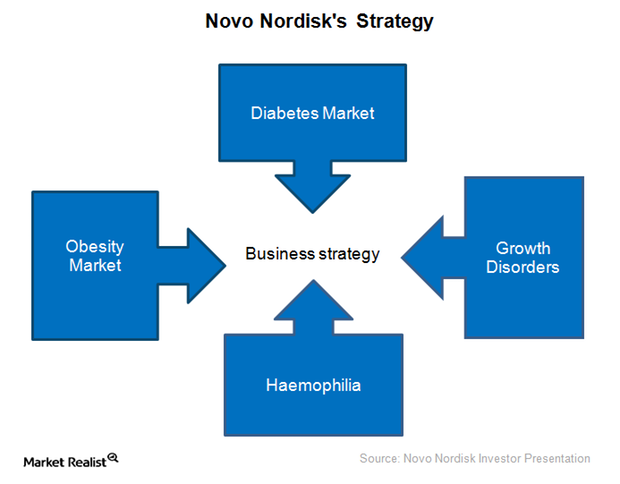

Novo Nordisk Is Focusing on These Strategic Areas in 2016

With 642 million people expected to suffer from diabetes globally by 2040, the disease is expected to offer multiple growth opportunities for Novo Nordisk.

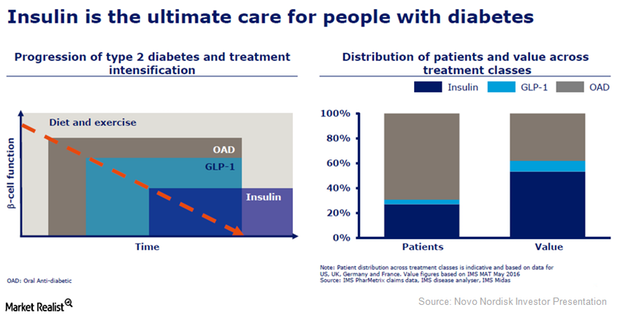

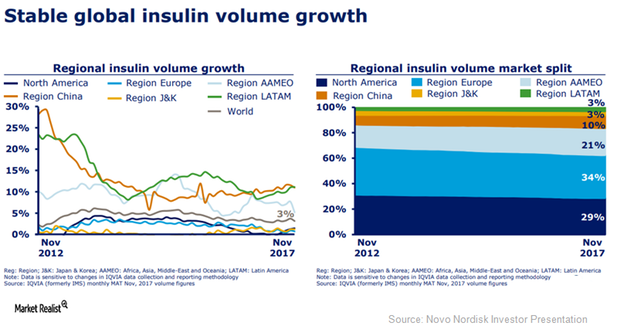

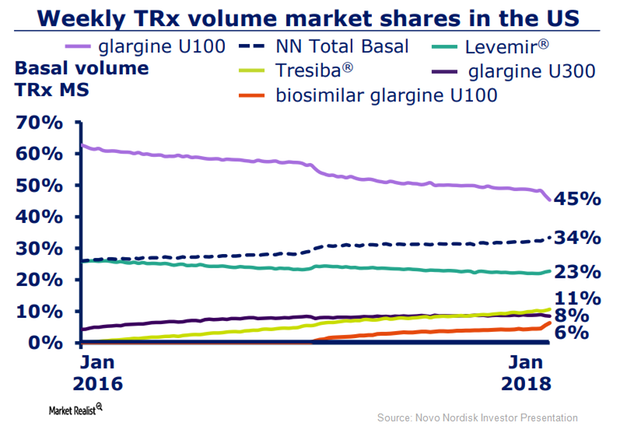

Novo Nordisk Continues to Be a Leader in the Global Insulin Market

Accounting for a ~46% market share, Novo Nordisk (NVO) is expected to continue to benefit from the positive trends in the global insulin market

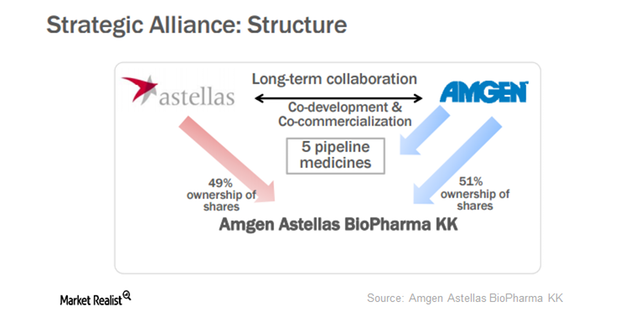

Multinational and Japanese Pharmaceuticals Should Build Alliances

The Japanese pharmaceuticals market is not very welcoming to foreign companies. Similarly, the Japanese population is quite loyal to domestic manufacturers.

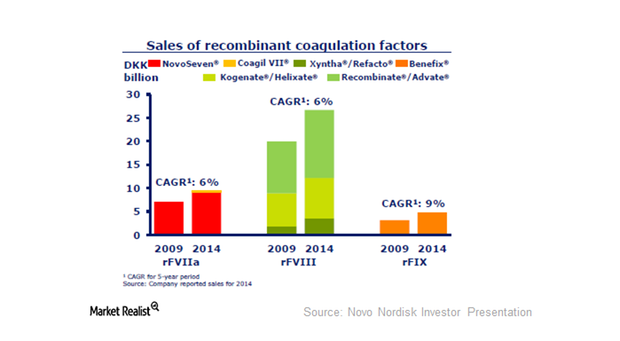

What Are the Current Treatment Options for Hemophilia?

Hemophilia treatment primarily includes factor replacement therapy and prolonged half-life therapy such as factor VIII or factor IX infusion.

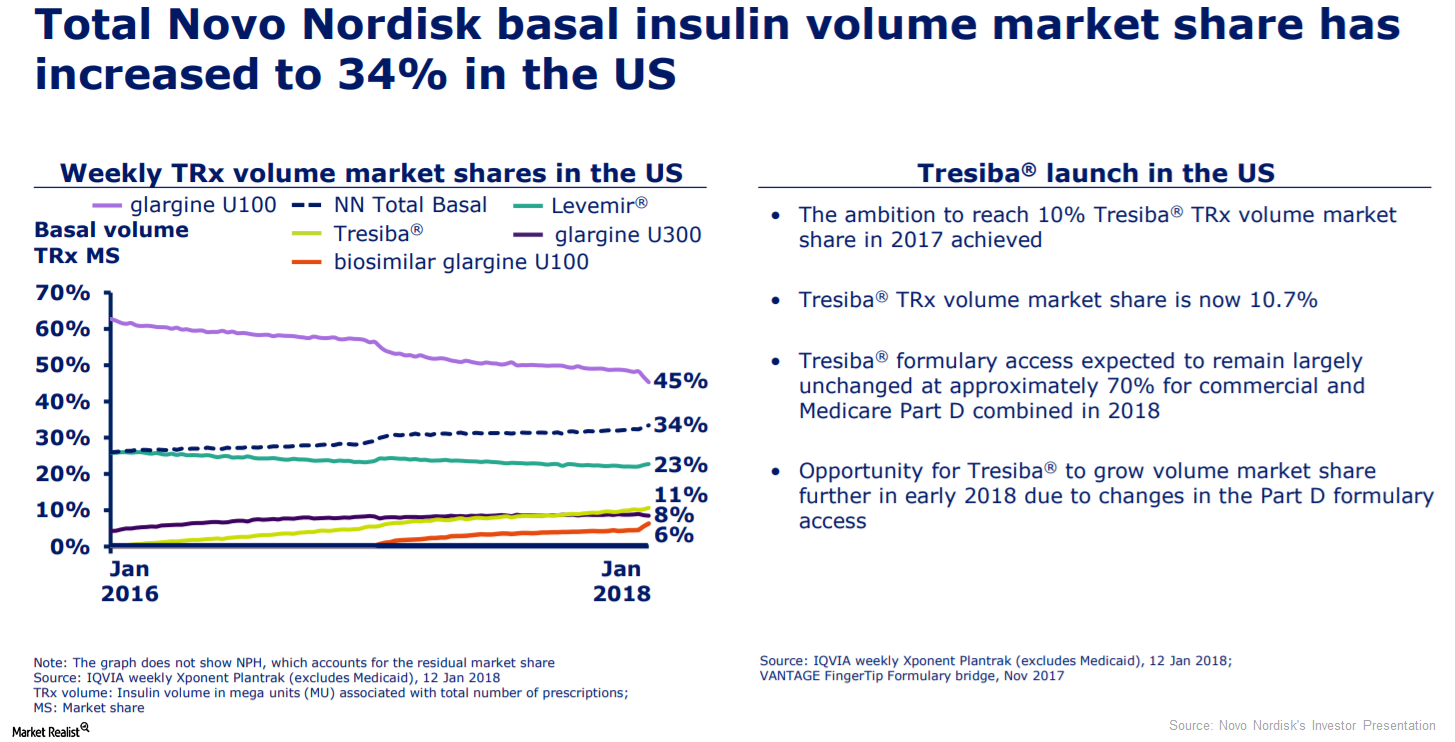

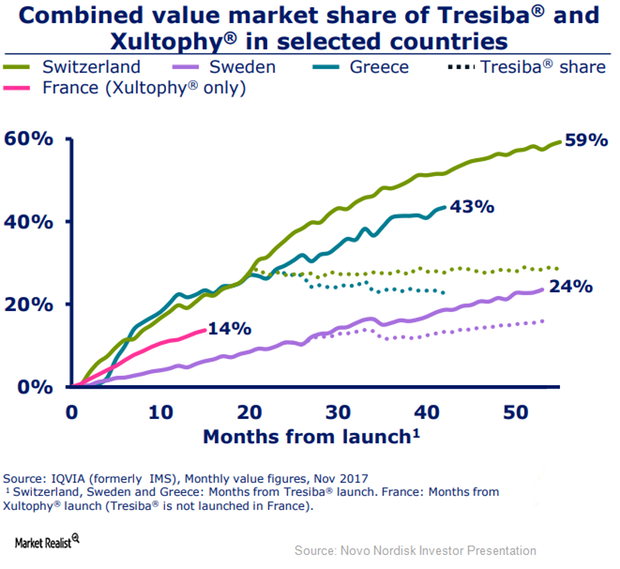

Tresiba Could Significantly Drive Novo Nordisk’s Revenue in 2018

In 4Q17, Novo Nordisk’s (NVO) Tresiba generated revenues of 1.9 billion Danish kroner, which is a ~48% YoY growth in local currencies.

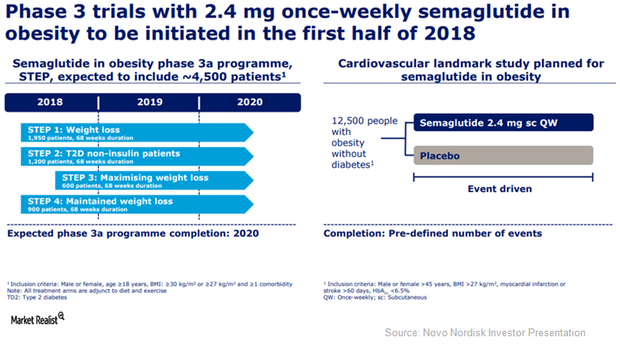

Semaglutide May Prove to Be an Effective Anti-Obesity Therapy

Novo Nordisk plans to initiate its Phase 3a program, STEP, to study the efficacy of 2.4 mg of semaglutide once per week in obesity indications in 1H18.

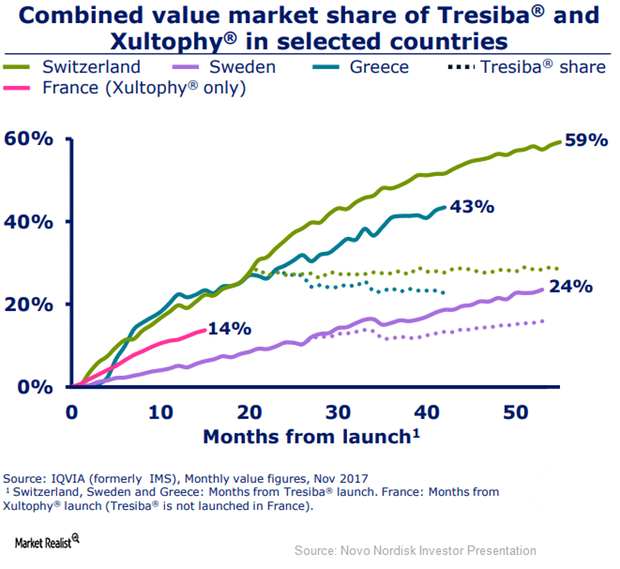

Label Expansion May Boost Xultophy’s Sales in 2018

In November 2017, Novo Nordisk (NVO) submitted an application to European regulatory authorities to update Xultophy’s label.

Xultophy May Prove a Strong Growth Driver for NVO in 2018

Novo Nordisk’s (NVO) Xultophy reported sales close to 729 million Danish kroner in 2017.

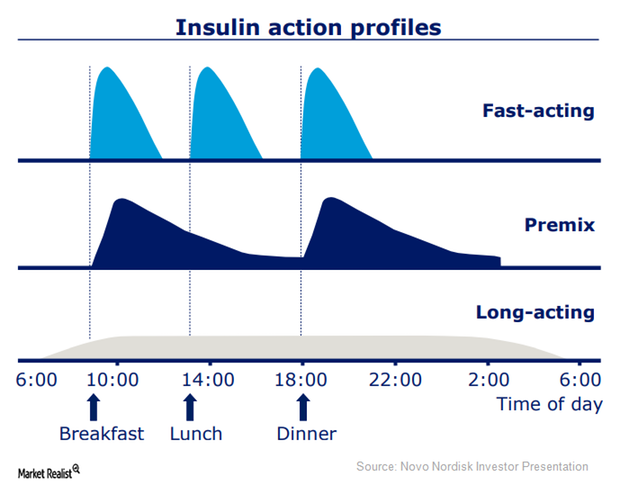

Novo Nordisk Has Developed a Portfolio of New-Generation Insulins

Novo Nordisk has been creating awareness about the risks of hypoglycemia and the benefits of Tresiba among general practitioners and primary care physicians.

Tresiba Emerged as a Blockbuster Therapy in 2017

In 2017, Novo Nordisk’s (NVO) basal insulin therapy, Tresiba, reported revenue of nearly 7.3 billion Danish kroner and attained blockbuster status.

Novo Nordisk Has a Broad Portfolio for Type 2 Diabetes Care

According to IQVIA, the global insulin market value grew at a compound average growth rate (or CAGR) of 16.8% from November 2012 to November 2017.

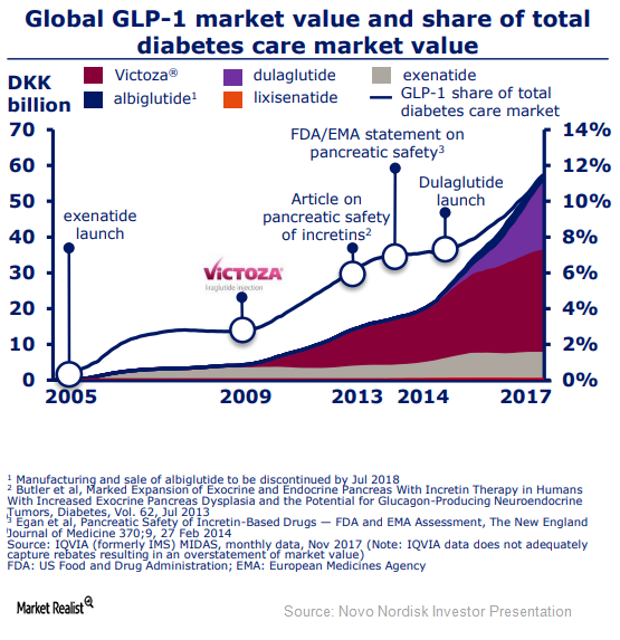

Victoza Continues to Lead in the GLP-1 Segment in 2018

In 3Q17, Novo Nordisk managed to update Victoza’s label in the United States and Europe.

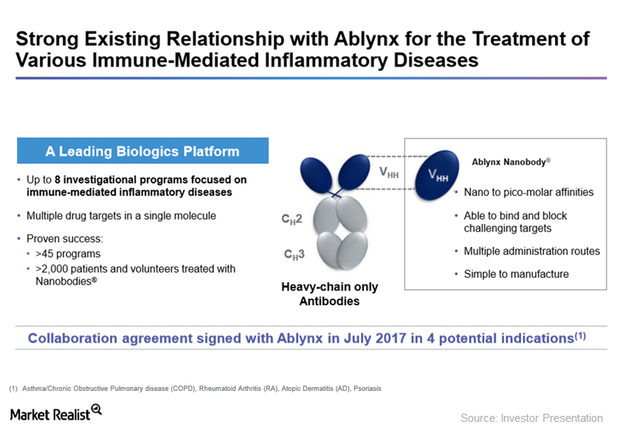

A Look at Ablynx and Sanofi’s Existing Partnership

On January 29, 2018, Sanofi (SNY) announced that it had agreed to acquire Ablynx (ABLX) for 3.9 billion euros.

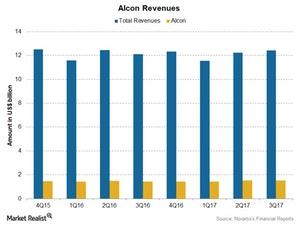

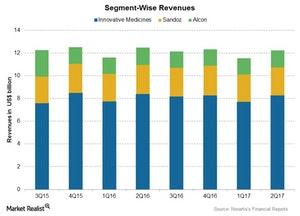

Reading the Estimates for Novartis’s Alcon in 4Q17

For 4Q17, Alcon is expected to report growth in revenues, driven by the increased demand for contact lenses and surgical products.

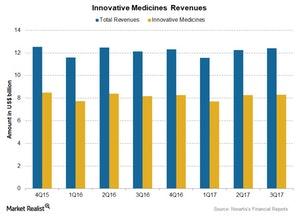

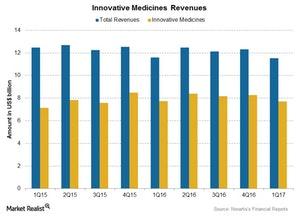

Behind Novartis’s 4Q17 Estimates: Innovative Medicines

The Innovative Medicines segment is expected to report growth in operating revenues for 4Q17.

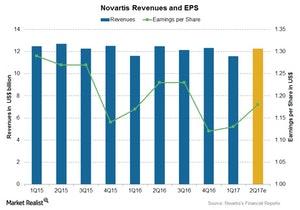

Behind Novartis’s 4Q17 Earnings: Why Some Expect Revenue Growth

Analysts expect Novartis’s revenues to rise ~3.9% to $12.8 billion in 4Q17, driven by growth in operating revenues across all three segments.

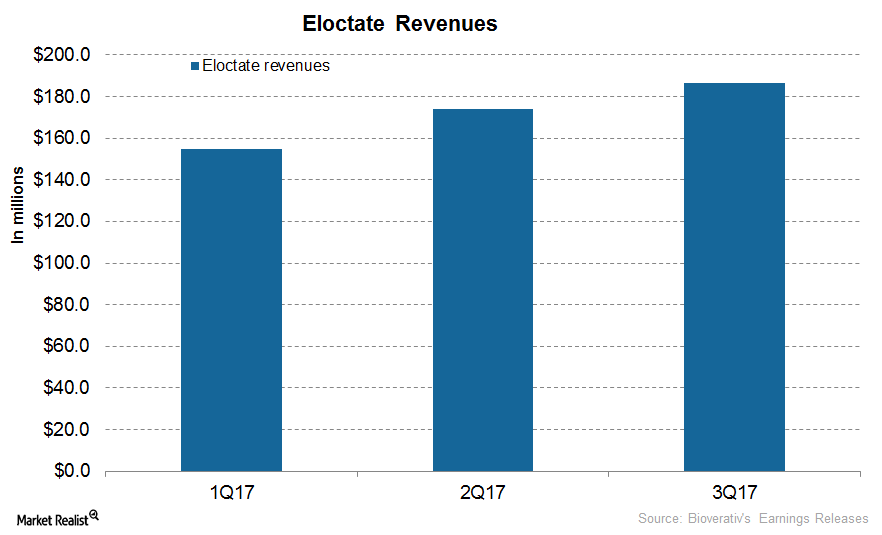

How Is Bioverativ’s Eloctate Positioned Now?

In 3Q17, Bioverativ’s (BIVV) Eloctate generated revenue of $186.3 million, reflecting a 41% rise on a year-over-year (or YoY) basis.

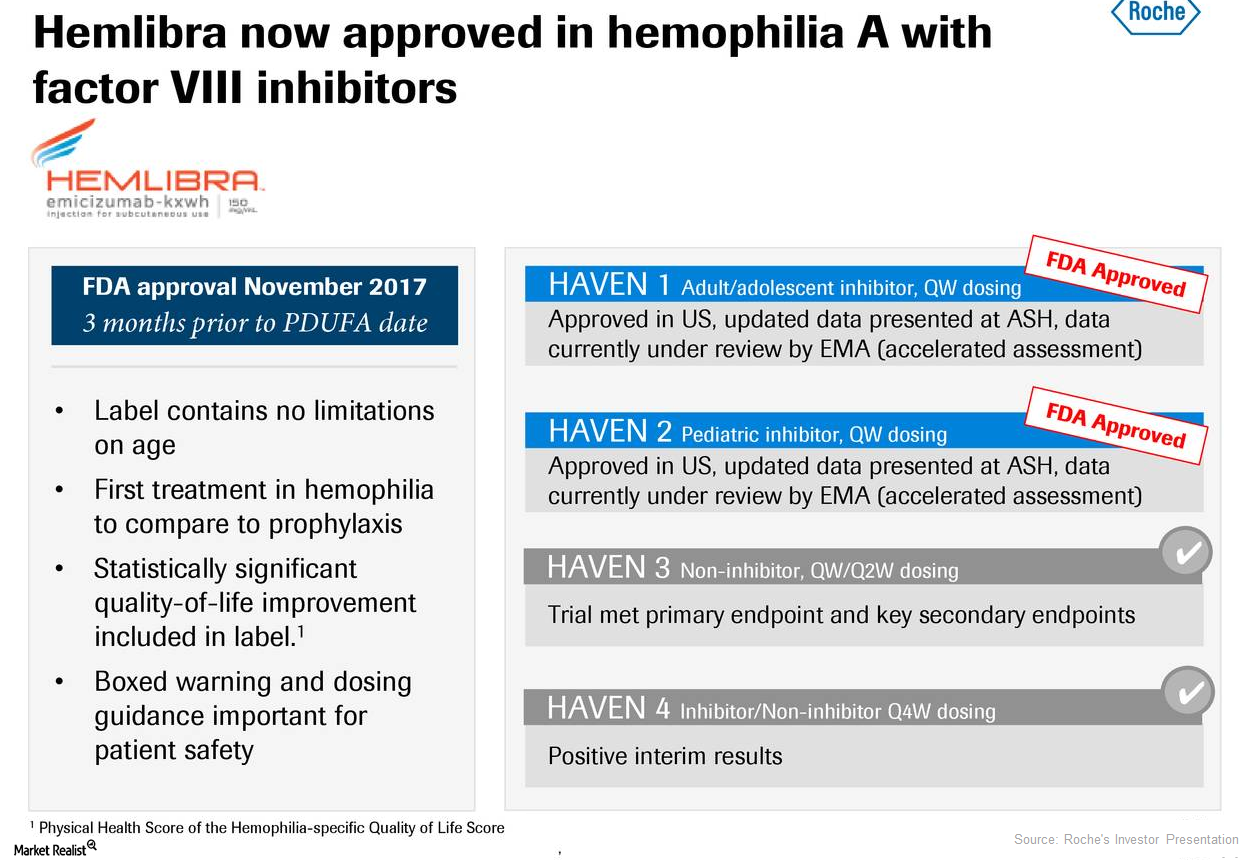

How Is Roche’s Hemlibra Positioned for 2018?

Roche’s (RHHBY) Hemlibra is used for the prevention and reduction of the frequency of bleeding episodes in individuals with hemophilia A with factor VIII inhibitors.

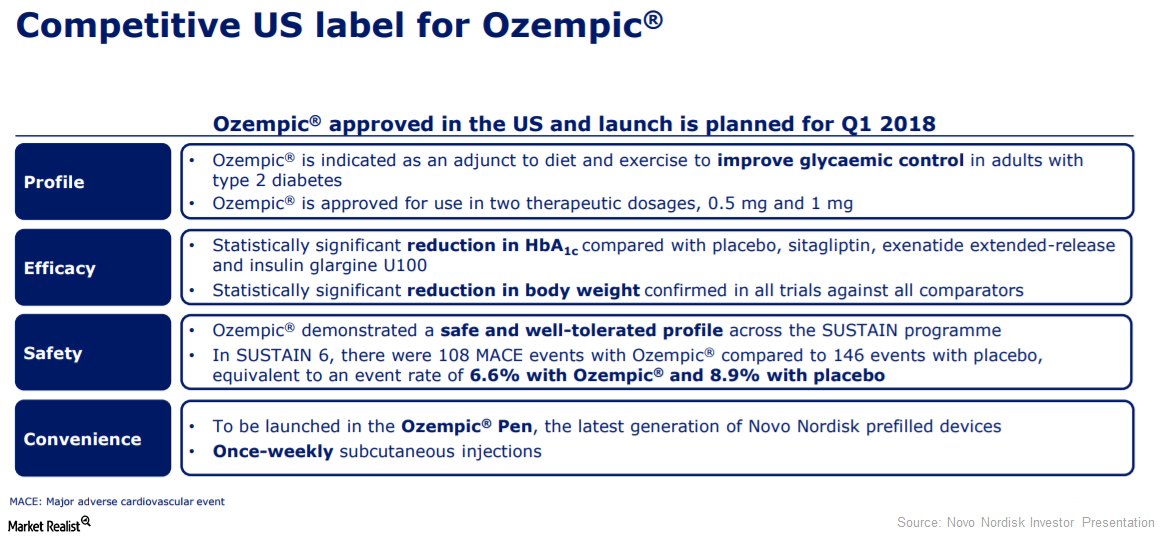

Ozempic Could Boost Novo Nordisk’s Revenue Growth in 2018

In December 2017, the U.S. FDA (Food and Drug Administration) approved Novo Nordisk’s (NVO) Ozempic as an addition to diet and exercise for the improvement of blood sugar levels in individuals with type two diabetes mellitus.

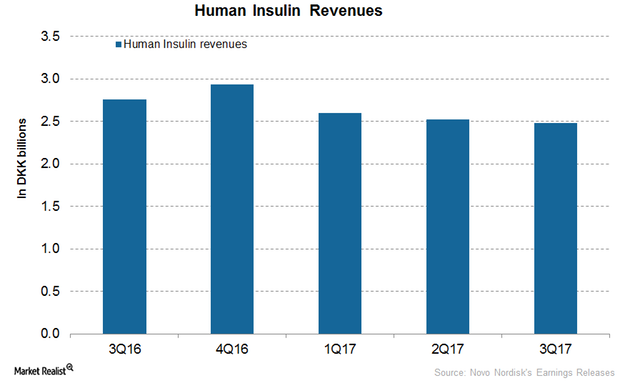

How Did Novo Nordisk’s NovoMix and Human Insulin Perform in 2017?

In 3Q17, Novo Nordisk’s (NVO) NovoMix reported revenues of 2.4 billion Danish krone (or DKK), which reflected ~1% growth on year-over-year (or YoY) basis.

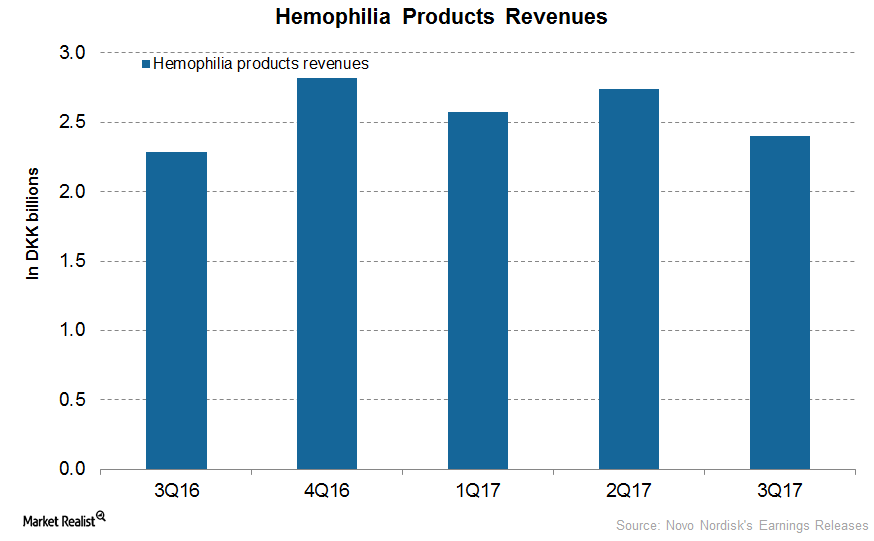

How Novo Nordisk’s Biopharmaceuticals Segment Performed in 3Q17

In 3Q17, Novo Nordisk’s (NVO) hemophilia segment reported revenues of 2.4 billion Danish krone (or DKK), a ~10% increase on a YoY basis.

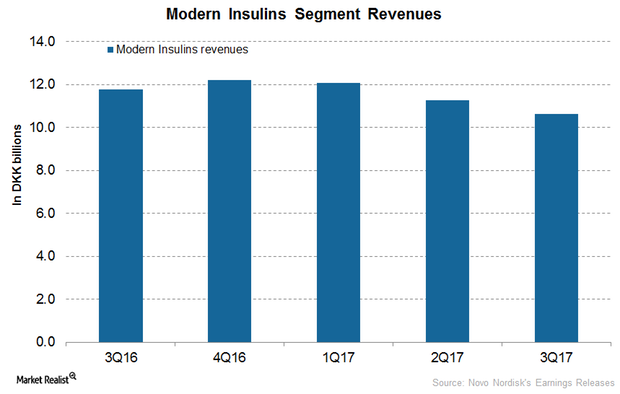

How Did Novo Nordisk’s Modern Insulin Segment Perform in 3Q17?

In 3Q17, Novo Nordisk’s (NVO) NovoRapid reported revenues of 5.0 billion Danish krone (or DKK), which reflected ~9% growth on year-over-year (or YoY) basis.

Novo Nordisk’s Xultophy, Ryzodeg, and Fiasp Could Boost Revenue Growth in 2018

Novo Nordisk’s (NVO) Xultophy (insulin degludec and liraglutide combination) is used as an addition to diet and exercise for improvement of blood sugar levels in adults with type-2 diabetes mellitus whose blood sugar level could not be controlled adequately with basal insulin.

How Is Novo Nordisk’s New Generation Insulin Segment Positioned after 3Q17?

In 3Q17, Novo Nordisk’s (NVO) new generation insulin generated revenues of 2.1 billion Danish krone (or DKK), which reflected ~93% growth on a year-over-year (or YoY) basis.

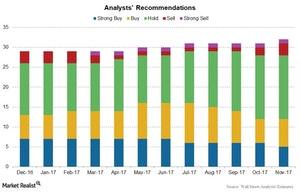

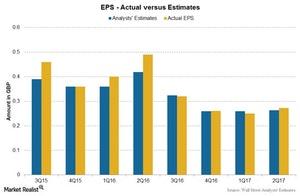

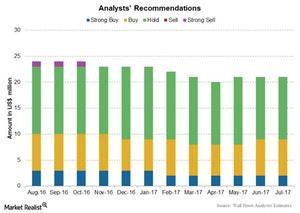

Analysts’ Recommendations for GlaxoSmithKline in November 2017

Wall Street analysts estimate that GlaxoSmithKline’s (GSK) top line could fall 0.8% to ~7.5 billion pounds in 4Q17.

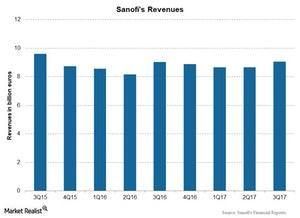

Behind Sanofi’s 3Q17 Revenue Growth

Sanofi (SNY) reported a growth of 4.7% in revenues at constant exchange rates to 9.05 billion euros, compared with 9.03 billion euros in 3Q16.

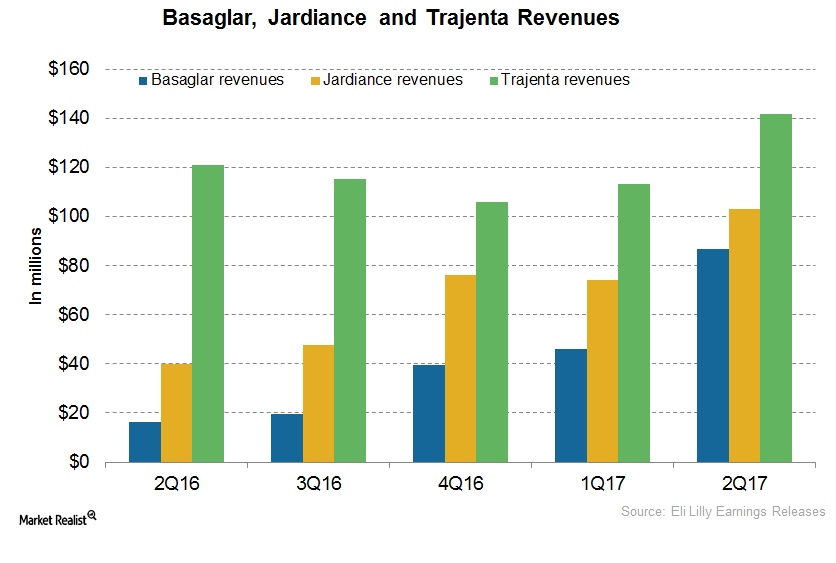

Why Eli Lilly’s Basaglar, Jardiance, and Trajenta Could Witness Steady Growth in 2018

In 1H17, Eli Lilly’s (LLY) Basaglar generated revenues of around $132.6 million, compared with $27.2 million in 1H16.

Xultophy Could Substantially Boost Novo Nordisk’s Revenue Growth

In the first half of 2017, Novo Nordisk’s (NVO) Xultophy generated revenues of DKK (Danish kroner) 284.0 million.

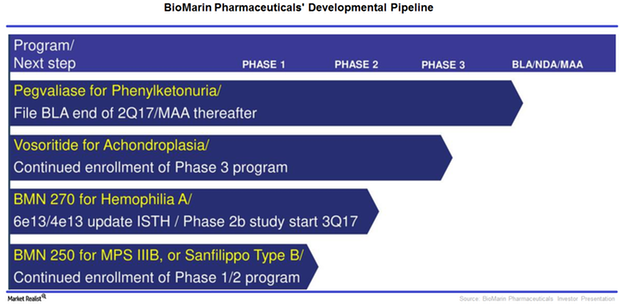

BioMarin’s Strong Pipeline Could Be a Long-Term Growth Driver

After success in the company’s phase 1/2 trial with BMN 270, an investigational gene therapy for hemophilia A, BioMarin Pharmaceuticals (BMRN) is expected to start phase 3 trials.

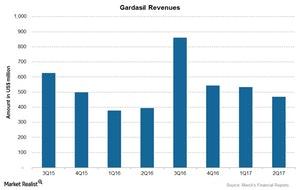

How Merck’s Gardasil and Other Human Vaccines Performed in 2Q17

Merck’s (MRK) Gardasil franchise includes vaccines for the prevention of certain strains of HPV infections that are sexually transmitted.

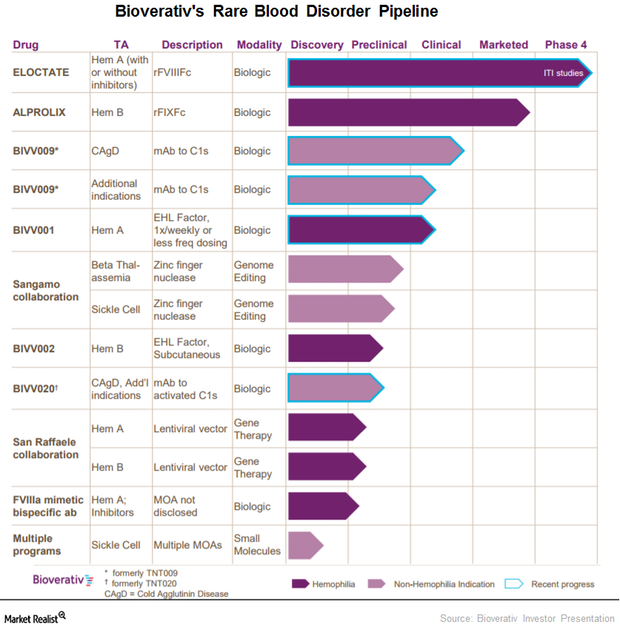

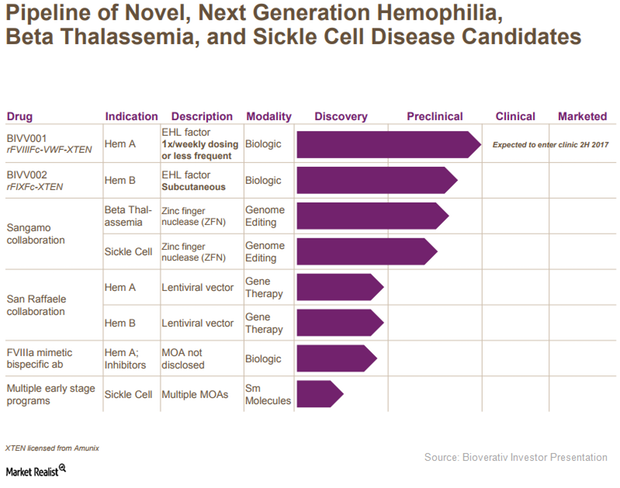

This Part of Bioverativ’s Pipeline Could Be a Major Long-Term Growth Driver

In June 2017, the FDA accepted Bioverativ’s investigative new drug application for BIVV001, a drug designed to treat prophylaxis from bleeding associated with hemophilia A.

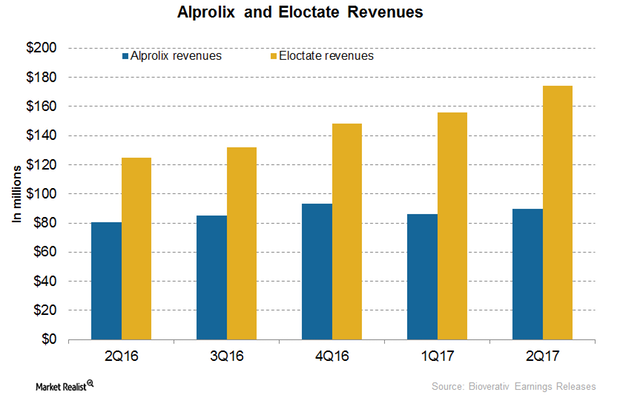

How Are Bioverativ’s Key Drugs Positioned after 2Q17?

In 2Q17, Bioverativ’s Alprolix generated revenues of ~$89.7 million, which represents ~12% growth YoY (year-over-year) and ~4% growth sequentially.

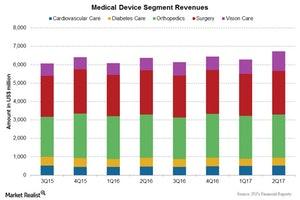

Johnson & Johnson’s Medical Devices Segment in 2Q17

Medical devices segment Johnson & Johnson’s (JNJ) medical devices segment reported revenue of $6.7 billion in 2Q17, a growth of 4.9% from the revenue of $6.4 billion reported in 2Q16. This figure included 5.9% growth in operating revenue, and was partially offset by a 1% foreign exchange impact. Cardiovascular care franchise The cardiovascular care franchise […]

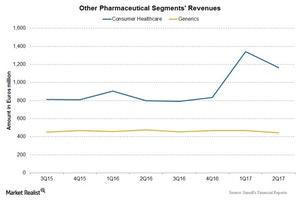

Sanofi’s General Medicines and Consumer Healthcare in 2Q17

General Medicines Sanofi’s (SNY) generic business contributed ~5.1% of its total revenue in 2Q17. The business reported revenue of 442 million euros in 2Q17, an 8% decrease from 2Q16. Revenue fell due to lower sales in US markets, European markets, and emerging markets. This fall was partially offset by the growth in the rest of […]

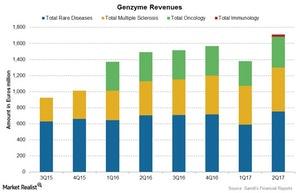

Sanofi Genzyme Continues Driving Revenue Growth in 2Q17

Sanofi Genzyme In 2Q17, Sanofi Genzyme (SNY) reported revenue growth of 13.5% to 1.7 billion euros. Considering a constant structure and constant exchange rates, the growth was 14.4%. Sanofi Genzyme, which includes product revenue from the multiple sclerosis, rare disease, oncology, and immunology franchises, reported a sales increase of ~14.6% to 1.7 billion euros. This rise was […]

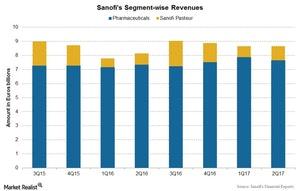

Sanofi’s Revenue Growth in 2Q17

Sanofi’s revenue in 2Q17 At constant exchange rates, Sanofi (SNY) reported revenue growth of ~5.5% between 2Q16 and 2Q17, with revenue rising to 8.7 billion euros from 8.1 billion euros. Structure of the group The above chart shows Sanofi’s segment-wise revenue over the last few quarters. In 2016, Sanofi reorganized itself into five business units: Sanofi […]

Pfizer’s Important Product Developments in 2Q17

Pfizer’s (PFE) innovative health business and essential health business are focusing on growth. To strengthen the innovative health business, the company is focusing on the development of new drugs…

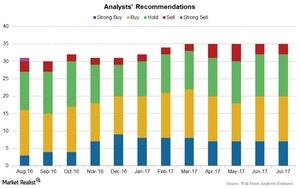

GlaxoSmithKline’s Valuations after Its 2Q17 Earnings

On July 28, 2017, GlaxoSmithKline (GSK) traded at a forward PE multiple of 13.4x, which is slightly lower than the industry average of 15.2x.

Bioverativ’s Research Pipeline May Boost Future Revenues

Bioverativ (BIVV) plans to improve compliance rates for hemophilia patients further by launching therapies with lower dosage frequency.

Analysts’ Recommendations for AstraZeneca in 2Q17

Wall Street analysts expect AstraZeneca’s top line to fall ~9.5% to $5.1 billion in 2Q17, compared to $5.6 billion in 2Q16. Its earnings per share are expected to be $0.42 in 2Q17.

Foreign Exchange Impacts Novartis’s Growth in 2Q17

In its earnings release on July 8, 2017, Novartis (NVS) reported flat revenues at constant currencies for 2Q17.

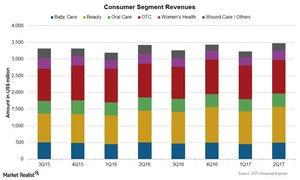

Johnson & Johnson: Consumer Products in 2Q17

The consumer segment Johnson & Johnson’s (JNJ) consumer segment revenue rose 1.7% to $3.5 billion in 2Q17, compared with $3.4 billion in 2Q16. This rise includes operational growth of 2.3%, which was offset by a 0.6% impact of foreign exchange. Baby care franchise The baby care franchise reported revenue of $494 million in 2Q17, a […]

Novartis’s 2Q17 Estimates: Innovative Medicines Segment

The overall contribution of Novartis’s (NVS) Innovative Medicines segment is ~67.0% of its total revenues.

Analysts Expect Novartis’s Revenues to Fall in 2Q17

Analysts expect Novartis’s (NVS) revenues to fall ~1.6% to $12.3 billion in 2Q17 due to the effects of the acquisition and divestiture of some of its products.

Analysts’ Latest Recommendations for Johnson & Johnson

Johnson & Johnson (JNJ) missed Wall Street analysts’ revenue estimates in 1Q17. It reported revenue of $17.8 billion in the quarter.

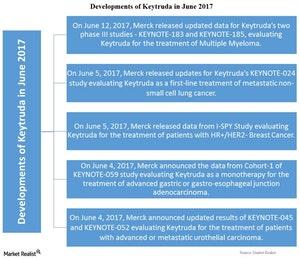

Keytruda’s Developments in June 2017

On June 12, 2017, Merck released updated data for Keytruda’s two phase III studies—KEYNOTE-183 and KEYNOTE-185—which evaluate Keytruda in combination with other drugs for the treatment of multiple myeloma.

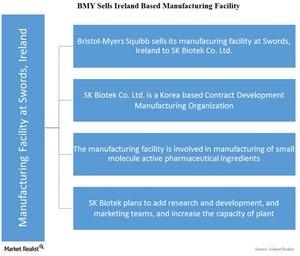

SK Biotek to Acquire Manufacturing Facility in Swords, Ireland

In its press release on June 16, 2017, Bristol-Myers Squibb (BMY) announced that it entered into a definitive purchase agreement with SK Biotek.

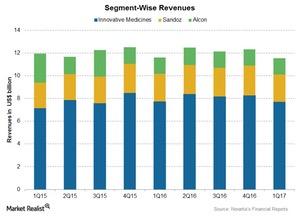

Inside Novartis’s Segment-Wise Performance in 1Q17

Novartis is largely exposed to currency risk, as ~50% of its total revenues are reported from international markets.

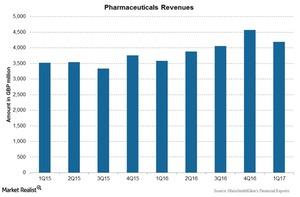

GlaxoSmithKline’s Pharmaceuticals Segment in 1Q17

The Pharmaceuticals segment reported an operational growth of 4.0% and a 13.0% positive impact of foreign exchange, resulting in a rise of 17.0% in revenues.