Kansas City Southern Inc

Latest Kansas City Southern Inc News and Updates

Five Key Railroad Stocks for Investors in 2021

Railroad stocks are a subsector all their own and many retail investors want in. What are some of the top railroad stocks in 2021?

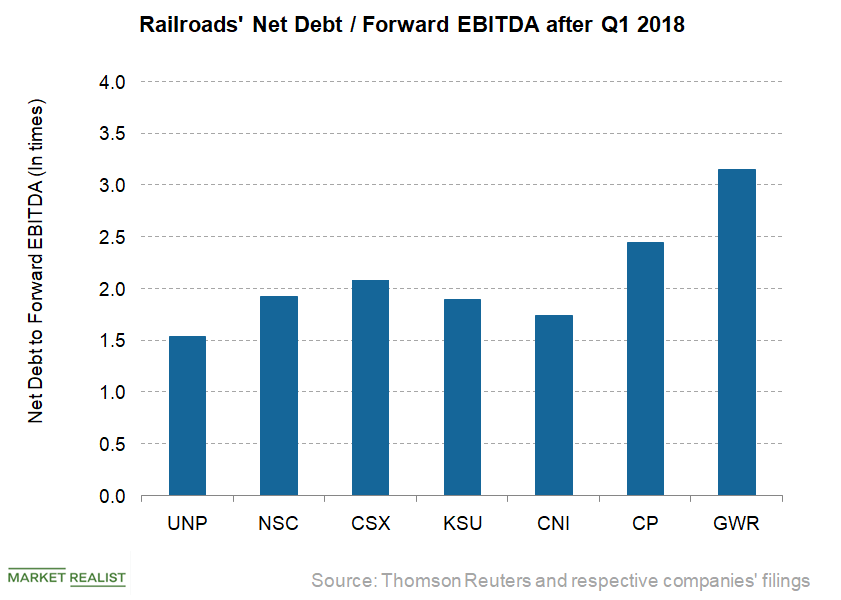

Evaluating Leverage Levels of Major Railroads after Q1 2018

As of March 31, Genesee & Wyoming (GWR) had a net debt-to-forward-EBITDA multiple of 3.2x, which was much higher than the industry average of 2.1x.

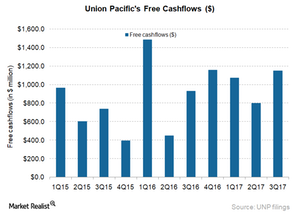

Can Union Pacific’s Free Cash Flows Support Its Higher Dividend?

Union Pacific had FCF of $3.02 billion in the first nine months of 2017, compared with $2.86 billion in the corresponding period of 2016.

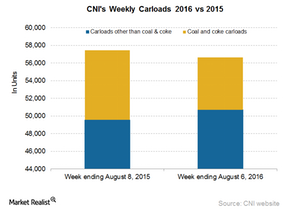

How Did Canadian National Measure up to Canadian Pacific in Carloads?

Canadian National recorded a 1.4% fall in total railcars in the week ended August 6, 2016, hauling ~57,000 railcars, compared to ~57,000 units one year ago.

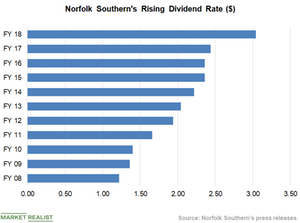

Norfolk Southern’s Aggressive Shareholder Return Plan

Norfolk Southern (NSC) has always tried to enhance shareholders’ wealth through dividend payments and share repurchases.

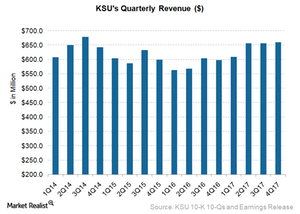

How Kansas City Southern Beat Revenue Estimate in 4Q17

In the fourth quarter 2017, Kansas City Southern (KSU) reported revenue of $660.4 million, exceeding analysts’ revenue estimates by 0.6%.

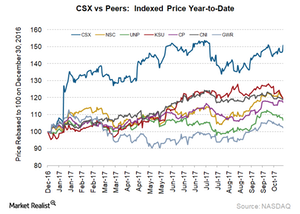

CSX’s 3Q17 Earnings Shine: Higher Freight Rates, Stock Up 2.6%

The eastern US rail freight carrier CSX (CSX) announced its 3Q17 earnings on October 17. The quarter marks the end of two full quarters under the leadership of Hunter Harrison.

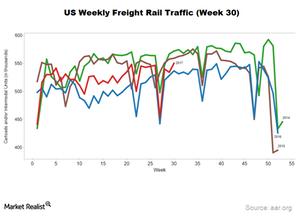

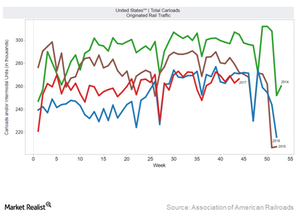

US Freight Rail Traffic Was a Mixed Bag in Week 30

The Association of American Railroads (or AAR) publishes North American rail freight (UNP) data every week.

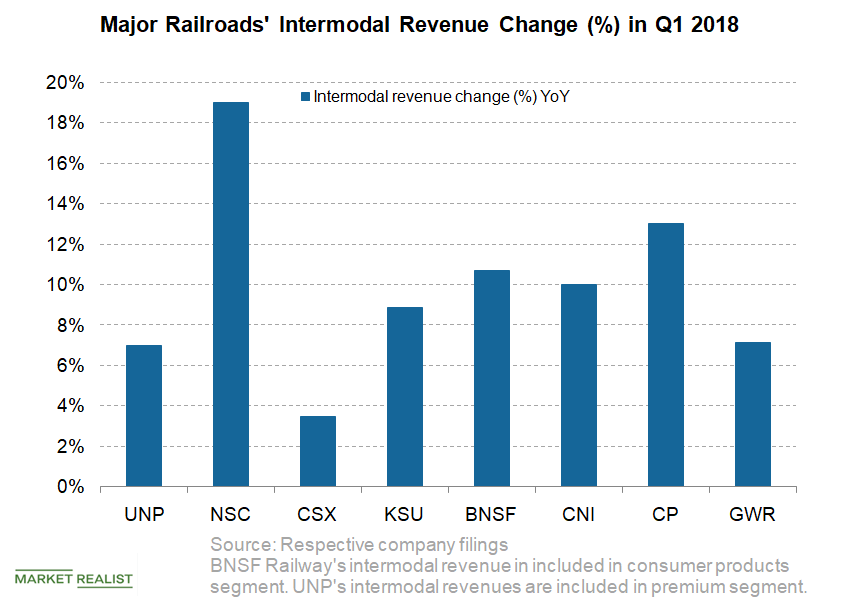

This Railroad Led in First-Quarter Intermodal Revenue Growth

Norfolk Southern (NSC), an Eastern US railroad, reported the highest intermodal revenue growth of 19% YoY among its peers in the first quarter.

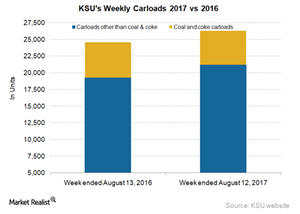

Kansas City Southern: Did Coal Push Volumes in Week 32?

Kansas City Southern (KSU), a US-Mexico railroad, is the smallest Class I railroad in the US.

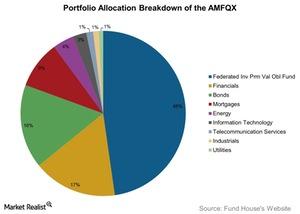

AMFQX: More Than 60% Exposure to Derivative Securities

AMFQX is an alternative mutual fund that seeks to generate positive absolute returns with a low correlation to the returns of broad stock and bond markets.

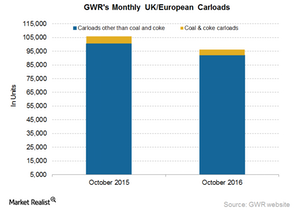

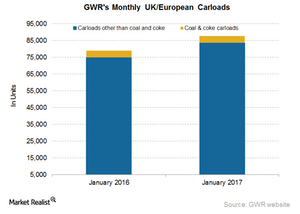

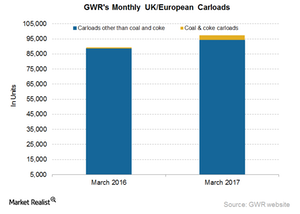

Why Genesee and Wyoming’s European Carloads Slumped in October

The decrease in the UK and European carloads in October was primarily due to the fall in coal and coke, mineral and stone, and intermodal carloads.

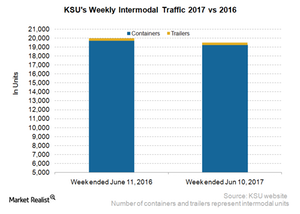

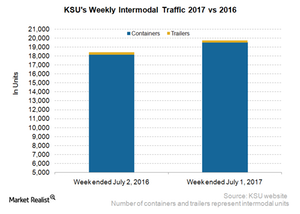

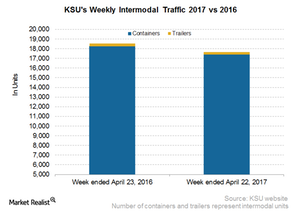

Kansas City Southern: Its Intermodal Volumes in Week 23

KSU’s trailer volumes fell 9.5% in week 23, whereas container traffic contracted by 2.4% in the same week.

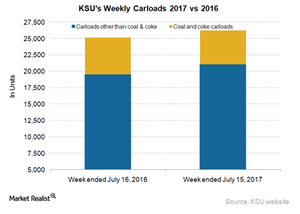

Why Kansas City Southern’s Freight Traffic Just Rose

Kansas City Southern reported a YoY (year-over-year) 4.4% rise in railcars in the week ended July 15, 2017.

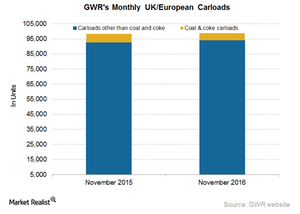

Why Genesee & Wyoming’s European Carloads Rose in November

Genesee & Wyoming’s (GWR) European carloads rose marginally 0.60% in November 2016. In the same period last year, GWR hauled 99,000 railcars.

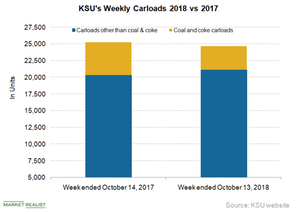

Kansas City Southern: Lowest Gainer in Week 41 Rail Traffic

In Week 41, Kansas City Southern (KSU) posted a 2.4% YoY (year-over-year) decline in carload traffic.

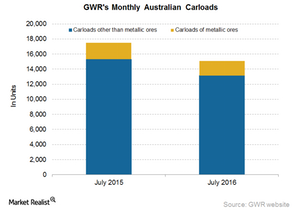

Why Did Genesee & Wyoming’s Australian Carloads Fall in July?

Genesee & Wyoming’s Australian carloads declined by 13.7% in July 2016, hauling more than 15,000 railcars, as compared to over 17,000 one year previously.

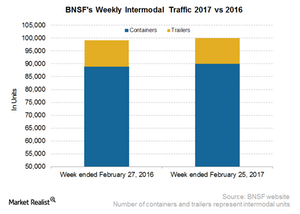

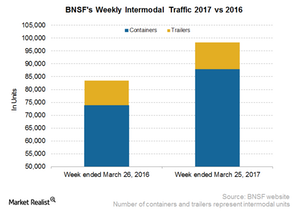

BNSF Railway’s Intermodal Volumes Matter

In the eighth week of 2017, BNSF’s overall intermodal traffic rose slightly by 0.8% YoY to ~100,000 containers and trailers.

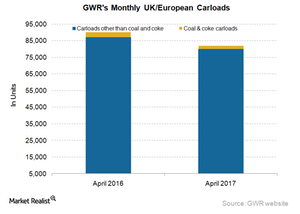

Reviewing GWR’s European Carloads in April 2017

Genesee & Wyoming’s (GWR) European carloads fell 9.1% YoY (year-over-year) in April 2017. GWR’s other-than-coal carloads fell 8.2% on a YoY basis in April 2017.

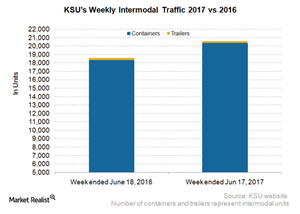

Behind Kansas City Southern’s Intermodal Growth amid Weak Trailers

Kansas City Southern (KSU) reported a 7.2% rise in its overall intermodal volumes of containers and trailers in the week ended July 1, 2017.

Inside GWR’s European Carload Rise in January

Genesee & Wyoming’s (GWR) European carloads rose 11.2% YoY in January 2017.

Kansas City Southern Outshines Its Peers in Q2

Kansas City Southern (KSU) stock opened nearly 3% higher on Friday after reporting better-than-expected second-quarter results.

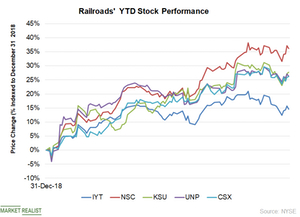

Railroad Stocks Have Outperformed in 2019

So far, railroad stocks have made a remarkable run in 2019. Most of the railroad stocks have outperformed the broader market returns.

Norfolk Southern: Investors’ Industry Favorite in 2019

Norfolk Southern (NSC) has been investors’ industry favorite since the beginning of 2019. The stock has risen 21.3% YTD.

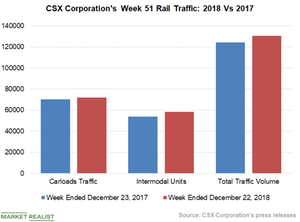

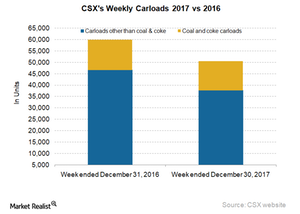

Strong Intermodal Growth Drove CSX’s Rail Traffic Higher

CSX reported strong rail traffic volume growth in week 51. The company’s freight rail traffic increased 5.1% YoY to 130,542 units in week 51.

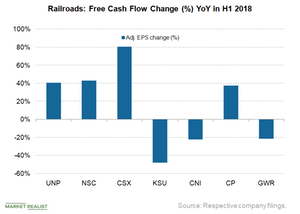

How Railroads’ Free Cash Flow Stacks Up

Free cash flow (or FCF) is an important metric in the railroad (FXR) industry.

How Union Pacific’s Dividend Has Varied Historically

On May 10, Western US rail freight giant Union Pacific (UNP) declared a quarterly cash dividend of $0.73 per share on its common stock.

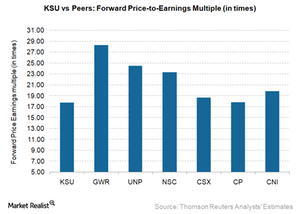

How Kansas City Southern Is Valued among Peers after 4Q17

KSU has the lowest PE ratio of 17.7x in the peer group, most likely due to the uncertainty of the NAFTA renegotiations.

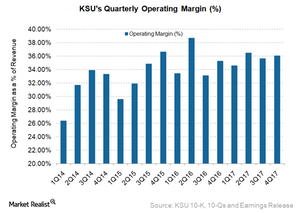

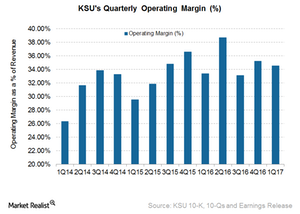

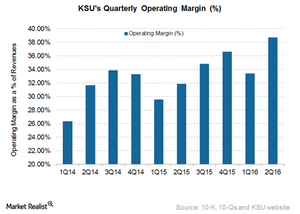

How Kansas City Southern Delivered on 4Q17 Operating Margins

In 4Q17, Kansas City Southern (KSU) reported an improvement of 80 basis points in its operating margin, which rose to 36% from 35.2% in 4Q16.

Commodities that Pulled Down CSX’s Carload Traffic in Week 52

Rail giant CSX (CSX) reported double-digit carload traffic loss in the 52nd week of 2017. The company’s carload traffic slumped 15.7% that week.

Week 44 Failed to Lift US Rail Freight Volumes

In the 44th week of 2017, total rail freight traffic in the United States recorded a ~0.9% fall. Overall volumes, including intermodal, decreased to ~539,000 units.

How Harvey Affected Kansas City Southern

Kansas City Southern’s network Kansas City Southern’s (KSU) US subsidiary caters to ten US states in the Midwest and Southeast. It also runs a rail route between Kansas City, Missouri, and multiple ports along the Gulf of Mexico in Texas, Louisiana, Alabama, and Mississippi. Among the major US Class I railroads, Kansas City remains hugely […]

Kansas City Southern: What Led Volume Rise in Week 34?

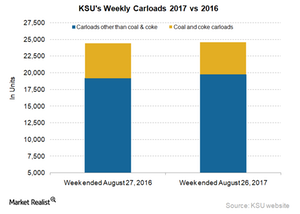

Kansas City Southern (KSU), the smallest Class I railroad, reported a marginal volume gain in the week ended August 26, 2017.

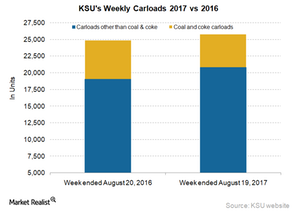

Kansas City Southern: Behind the Freight Volume Rise in Week 33

Kansas City Southern hauled ~26,000 railcars in the same week compared with close to 25,000 units in the week ended August 20, 2016.

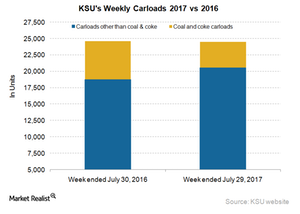

A Deep Dive into Kansas City Southern’s Shipments in Week 30

Kansas City Southern (KSU), the smallest Class I railroad in the US, also operates in Mexico.

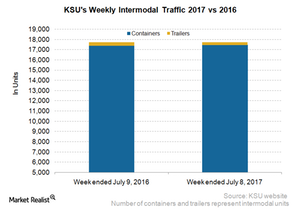

Inside Kansas City Southern’s Trailer Decline Last Week

In the week ended July 8, 2017, Kansas City Southern (KSU) reported a marginal loss in its total intermodal volumes (containers and trailers).

Diving into Kansas City Southern’s Week 25 Intermodal Data

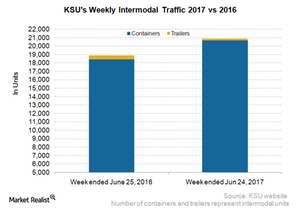

Kansas City Southern’s (KSU) total intermodal traffic in terms of containers and trailers rose 10.6% in the week ended June 24, 2017.

Kansas City Southern’s Containers Rose, Trailers Fell in Week 24

In week 24 of 2017, Kansas City Southern (KSU) saw its overall intermodal volumes rise 10.6%, unlike in the previous two weeks.

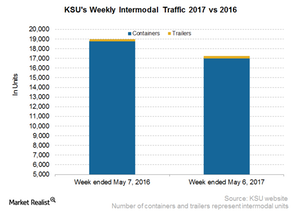

Kansas City Southern: Unfolding Its Intermodal Traffic in Week 18

In the week ended May 6, 2017, Kansas City Southern reported a year-over-year fall of 9.1% in its overall intermodal traffic.

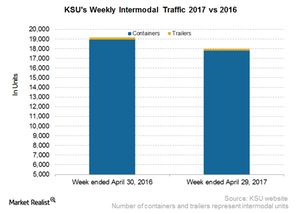

Kansas City Southern: A Look at Its Intermodal Traffic

Kansas City Southern’s intermodal traffic In the past few weeks, Kansas City Southern (Kansas City Southern), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow. In the week ended April 29, 2017, Kansas City Southern reported a YoY (year-over-year) fall of 6.1% in its overall intermodal traffic. Kansas City […]

Trailers Hurt Kansas City Southern’s Intermodal Volume in Week 16

In the past few weeks, Kansas City Southern (KSU), the smallest Class I railroad company in the United States, has seen its intermodal traffic slow.

Kansas City Southern’s Operating Margin Rose in 1Q17

Kansas City Southern (KSU) reported a 120-basis-point rise in its 1Q17 operating margin. KSU recorded 34.6% operating margin in 1Q17, compared to a 33.4% in 1Q16.

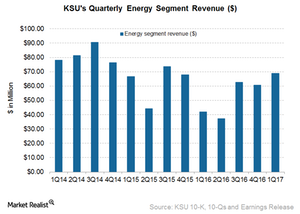

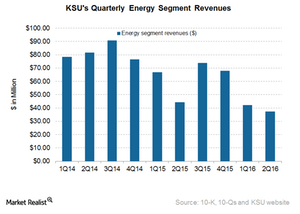

Why Kansas City Southern’s Energy Revenue Rose 64% in 1Q17

In this article, we’ll examine Kansas City Southern’s (KSU) Energy freight revenue in 1Q17. In the quarter, KSU’s Energy freight revenue was $69.0 million.

Analyzing Genesee & Wyoming’s European Carloads in March 2017

Genesee & Wyoming’s (GWR) European carloads rose to 9.0% YoY (year-over-year) in March 2017.

How BNSF’s Intermodal Volumes Compare in the 12th Week

In the 12th week of 2017, BNSF Railway’s (BRK-B) overall intermodal traffic rose 17.6% YoY to more than 98,000 containers and trailers.

Why Kansas City Southern’s Operating Margin Rose in 2Q16

Kansas City Southern (KSU) reported a 3% decline in 2Q16 revenues to $568.5 million on a YoY (year-over-year) basis.

Kansas City Southern’s Energy Segment Lost Its Sheen in 2Q16

Kansas City Southern’s Energy segment Previously, we discussed the revenue of Kansas City Southern’s (KSU) Agriculture & Minerals segment in 2Q16. Now, we’ll examine KSU’s Energy freight revenues in 2Q16. In the reported quarter, KSU’s Energy freight revenues came in at $37.2 million, down by 16% from $44.2 million in the same period last year. […]

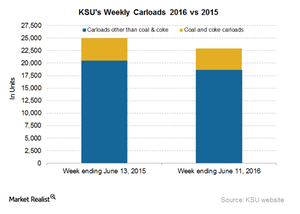

Kansas City Southern’s Carloads, and What They Have to Do with Mexico

In the week ending June 11, 2016, Kansas City Southern’s (KSU) total railcars declined by 8.1% YoY (year-over-year).

Porter’s 5 Forces: KSU’s Position in the US Freight Rail Industry

Competition with other railroads and other modes of transportation is subject to service rates, routes, service reliability, and quality. KSU faces the stiffest competition among the Class I railroads due to its relatively small size.

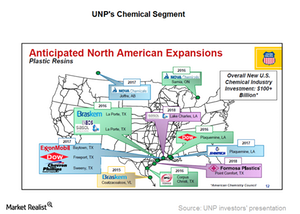

Union Pacific’s Chemical Freight Revenues: An Anticipated Mixed Bag in 2016

Union Pacific’s chemical freight carloads were down by 4% in 4Q15 compared to 4Q14. Petroleum products carloads were down by 18% during the same period.