iShares US Healthcare

Latest iShares US Healthcare News and Updates

Understanding Bristol-Myers Squibb’s Other Segments

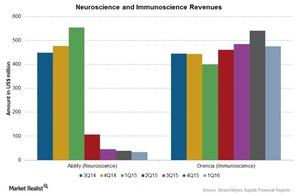

Sales from Bristol-Myers Squibb’s Neuroscience segment declined by 94% in 1Q16. Sales from the Immunoscience segment improved by ~18.7% in 1Q16 over 1Q15.

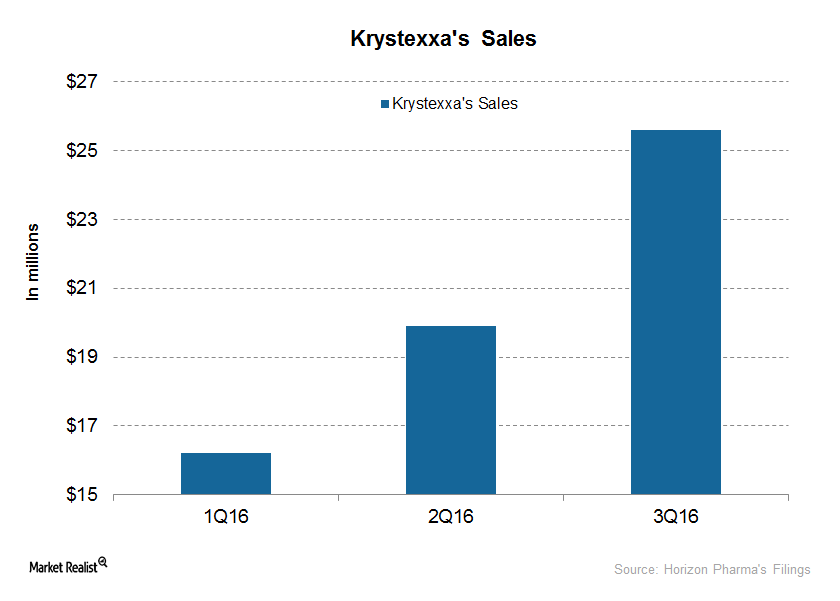

Revenue Drivers for Krystexxa, Horizon’s Orphan Biologic Drug

Horizon plans to drive Krystexxa through increased awareness and outreach, investing in its marketing and medical education as well as commercial infrastructure.

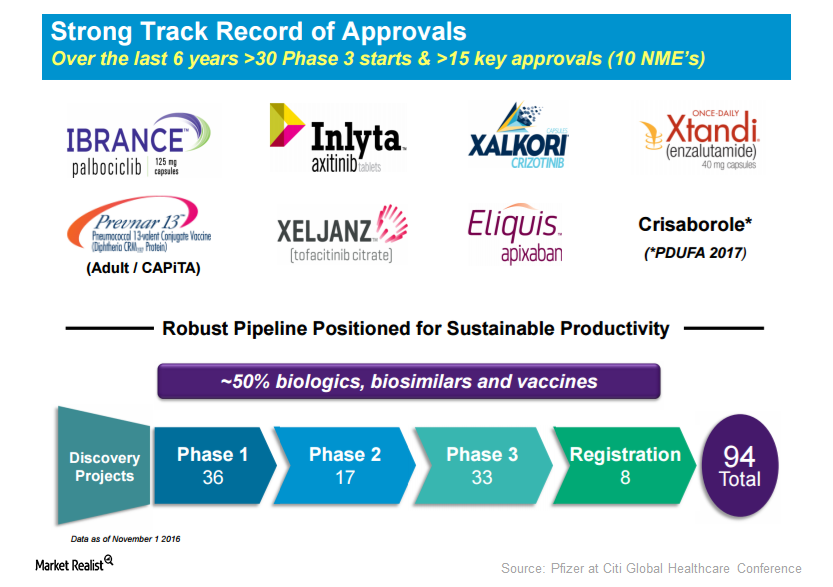

Pfizer Has Strong Track Record since 2010

As of November 1, Pfizer had ~94 projects in various development stages. More than 40% of these projects are in phase three or the registration phase.

Central Nervous System Is Key to Teva’s Specialty Medicines

Revenues for Teva’s (TEVA) Specialty Medicines segment grew by 2.1% to $8,560 million in 2014, from $8,388 million in 2013.

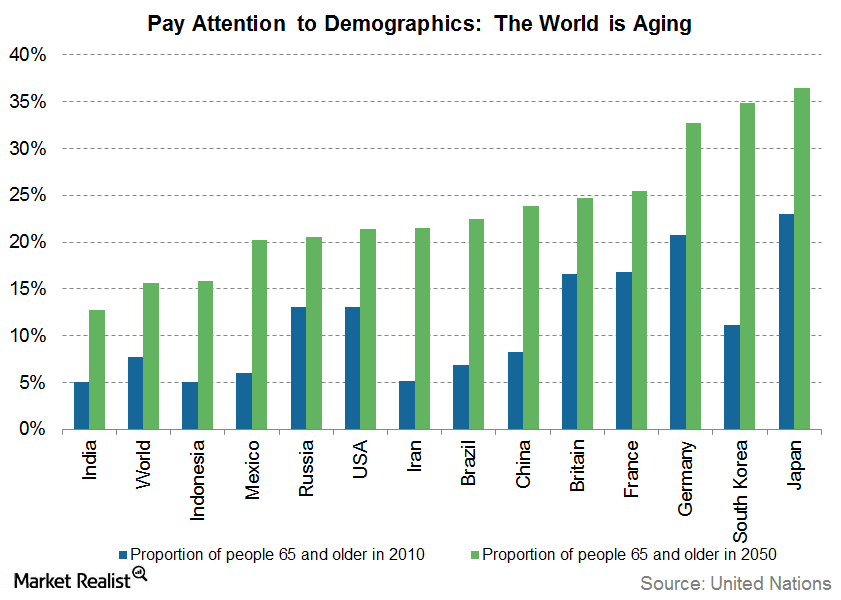

How Demographics Are Shaping Generic Drug Growth

The generic drugs industry is likely to sustain robust growth in the coming years, and demographics are a key piece of the puzzle! In fact, demographics are shaping generic drug growth in a huge way.

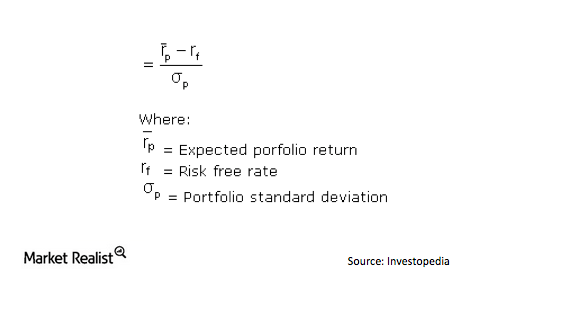

Why you should use the Sharpe ratio when investing in the medical device industry

What is a Sharpe ratio? A Sharpe ratio is a tool that measures the amount of returns for each unit of volatility that’s generated by a portfolio (higher returns and lower volatility equals more returns per unit of volatility). The measurement allows investors to analyze how much return they’re receiving from a portfolio in exchange for […]

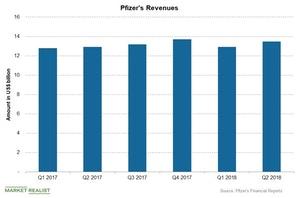

Pharma Stocks: Pfizer’s Revenue Trend and 2018 Estimates

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue.

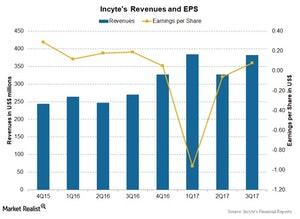

How’s Incyte’s Valuation in January 2018?

Analysts expect Incyte Corporation’s revenue to rise ~26.7% to $413.8 million in 4Q17 compared to $326.5 million in 4Q16.

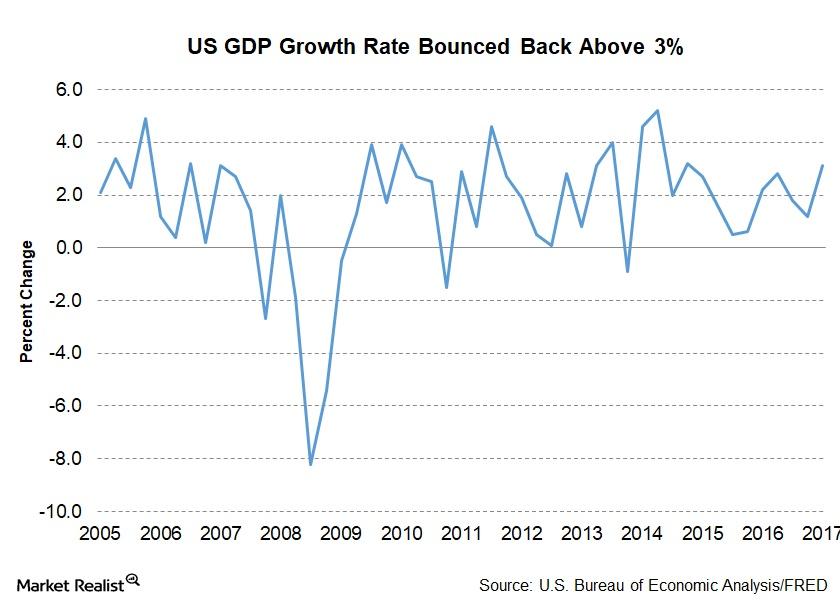

How the US Economy Performed in 2017

This year has been a year to watch the US economy. Hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher.

How the Medical Expense Tax Deduction Affects the Healthcare Industry

According to AARP, around 75% the population claiming these medical expense deductions from their income are 50 years or older.

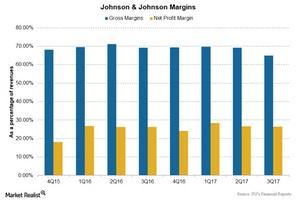

How Johnson & Johnson’s Profit Margins Trended in 3Q17

Johnson & Johnson (JNJ) reported revenues of $19.7 billion during 3Q17, a 10.3% increase as compared to revenues of $17.8 billion during 3Q16. However, the gross profit margins contracted in 3Q17.

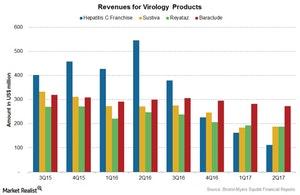

Bristol-Myers Squibb’s Virology Products in 2Q17

Bristol-Myers Squibb’s (BMY) virology products portfolio includes products for the treatment of chronic virus infections.

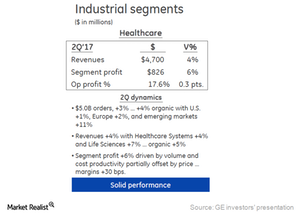

What Led the Rise in GE’s Healthcare Revenue in 2Q17?

GE’s Healthcare segment remained a top performer in 2Q17. Revenue-wise, this segment remained the third-largest contributor to GE’s total operating revenue of $28.0 billion.

Rising Costs Are a Major Issue in the Healthcare Sector

The US economy is dealing with rising healthcare costs. The national healthcare expenditure grew 5.8% to $3.2 trillion in 2015 or $9,990 per person.

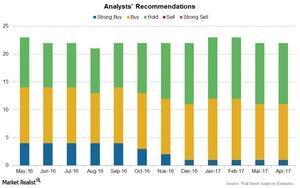

Analysts’ Ratings and Recommendations for Pfizer

Wall Street analysts expect Pfizer’s (PFE) top line to rise 0.6% to ~$13.1 billion in 1Q17. Its earnings per share are expected to be $0.67 in the quarter.

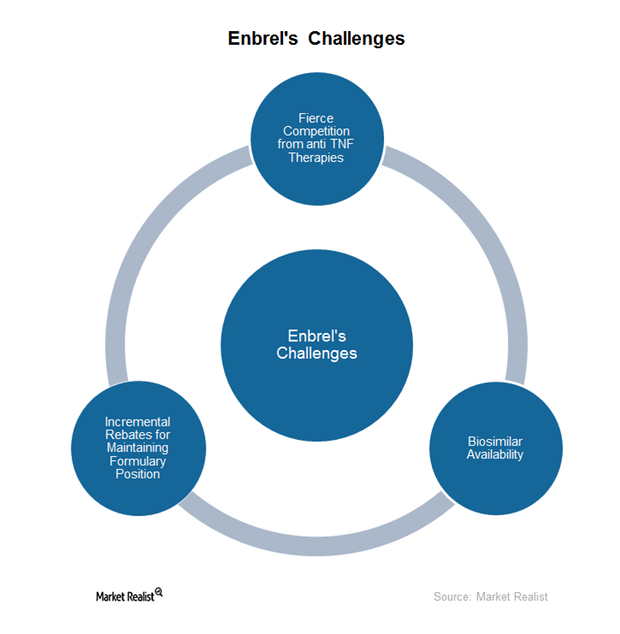

The Competitive Landscape for Enbrel

Amgen (AMGN) launched Enbrel in the US in 1998. It became a major success for Amgen in no time and recorded $5.4 billion sales in 2015.

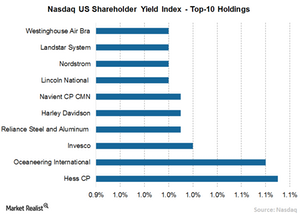

Shareholder Buyback: A Powerful Tool to Achieve Higher Income

What products single out specifically the share buyback companies?

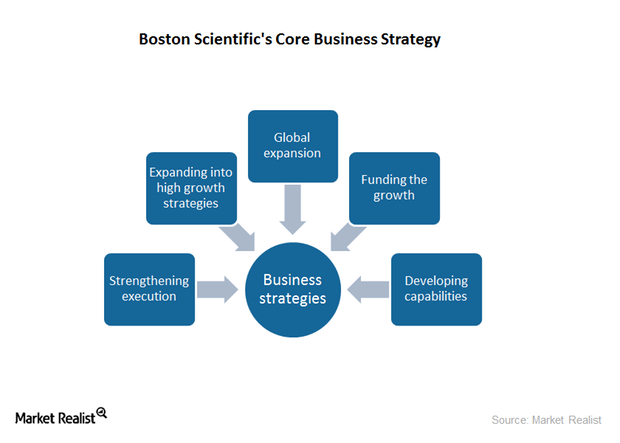

The Business Strategies Driving Boston Scientific’s Growth

Boston Scientific registered emerging market sales growth of approximately 13% in 2015, representing a steady growth in international markets.

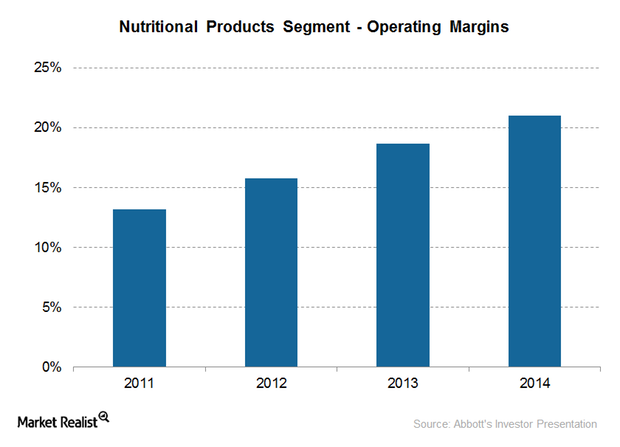

Why Abbott Laboratories Is a Leader in Nutritional Products

Abbott Laboratories’ Nutritional Products segment is the company’s leading segment, growing at a fast pace, with rapidly increasing margins and revenues.

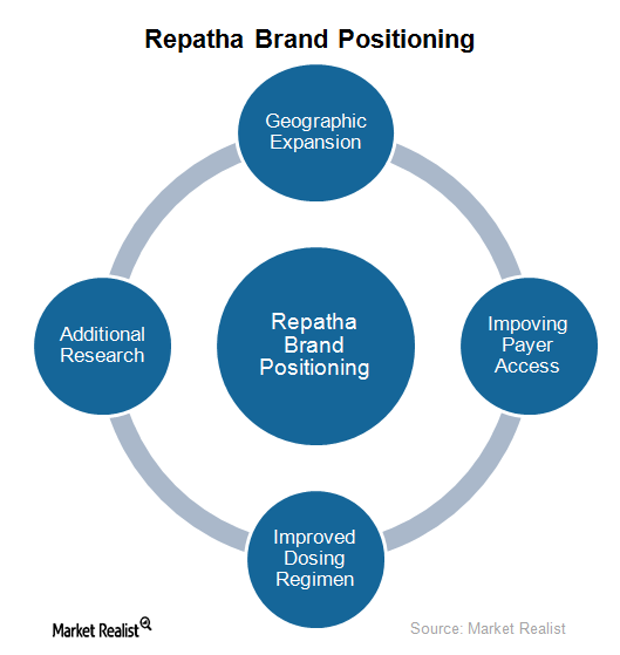

Why Did Amgen Implement Multi-Pronged Strategy for Repatha?

Amgen (AMGN) is expecting to strengthen Repatha’s brand position in the global cardiovascular market in 2016 through a multi-pronged strategy.

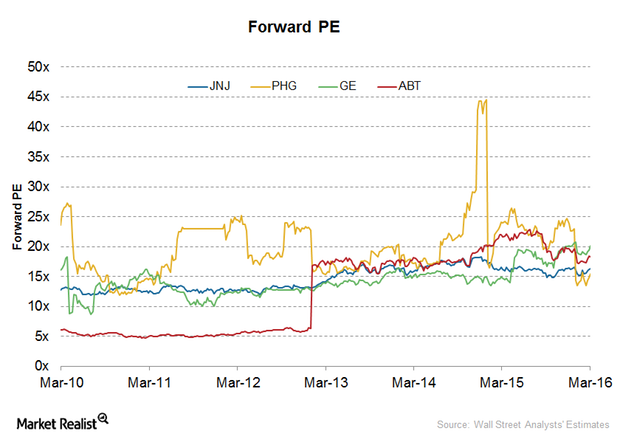

How Do Johnson & Johnson’s Valuations Compare to Peers?

On March 17, 2016, Johnson & Johnson (JNJ) was trading at a forward PE (price-to-earnings) multiple of ~16.5x compared to the industry average of ~19.6x.

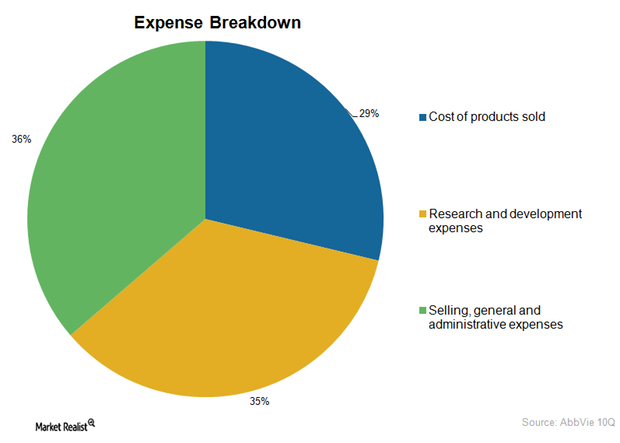

AbbVie’s Net Profit Margin Expected to Reach 29.8% in 4Q15

AbbVie (ABBV) has continued to improve its operational efficiency, which is expected to result in a net profit margin of 29.8%, a YoY increase of 6.3%. In 3Q15, AbbVie realized a net proft margin of 30.4%.

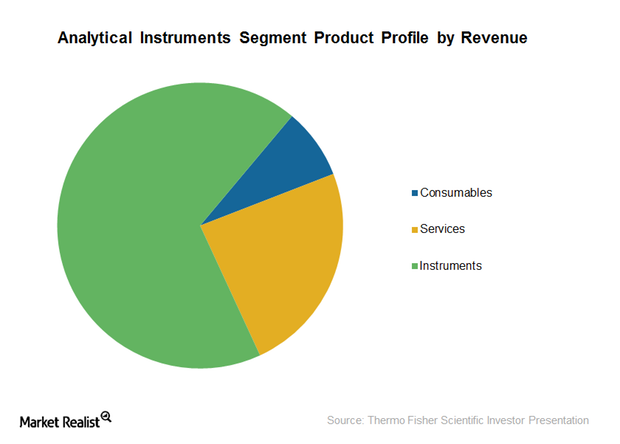

Thermo Fisher Scientific’s Analytical Instruments Business Segment

Thermo Fisher Scientific’s Analytical Instruments segment earned revenues of ~$3.3 billion in 2014, representing organic growth of around 4%.

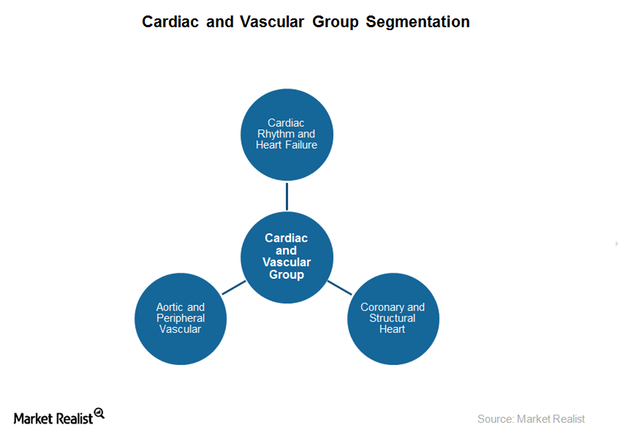

Evaluating Medtronic’s Cardiac and Vascular Devices Segment

Medtronic’s Cardiac and Vascular segment consists of Cardiac Rhythm and Heart Failure, Coronary and Structural Heart, and Aortic and Peripheral Vascular.

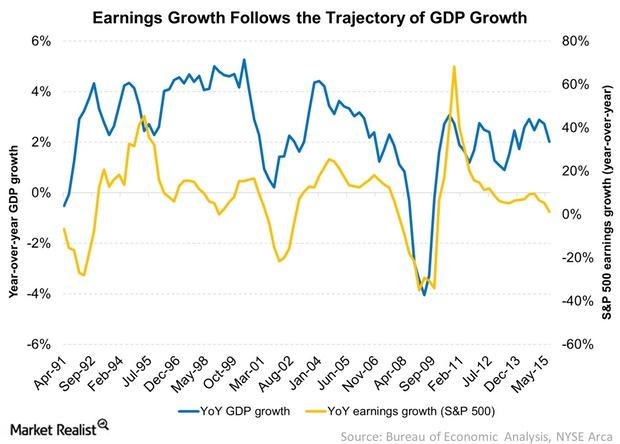

What’s the Biggest Driver of Earnings Growth?

Economic growth is the biggest driver of earnings growth. Earnings growth seems to follow the same trajectory of GDP growth.

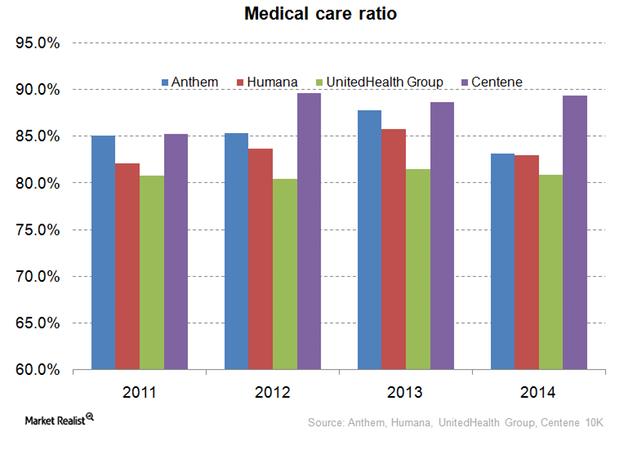

Medical Care Ratio – Centene Compared to Its Peers

For health insurance companies, the medical care ratio is the ratio of total money spent on healthcare claims to premiums earned—adjusted for tax and regulatory expenses.

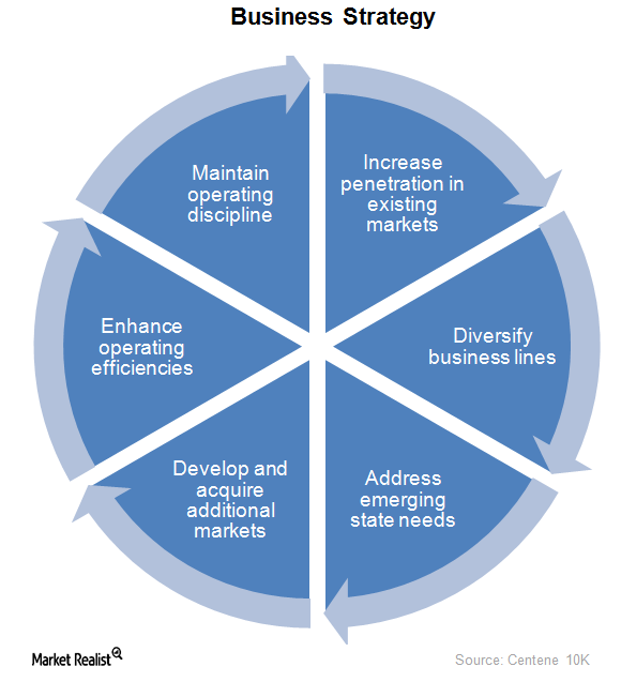

What’s Centene’s Business Strategy?

Centene’s business strategy focuses on improving the quality of its services. It provides services to the uninsured and underinsured population in 22 states in the US.

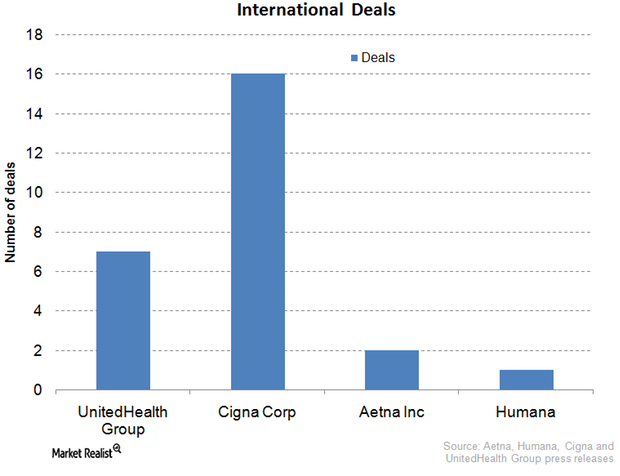

Cigna: International Expansion Key to Growth Strategy

International expansion is a hallmark of Cigna’s business. Cigna has inked deals in Turkey, Belgium, Brazil, Japan, Taiwan, Thailand, et cetera.

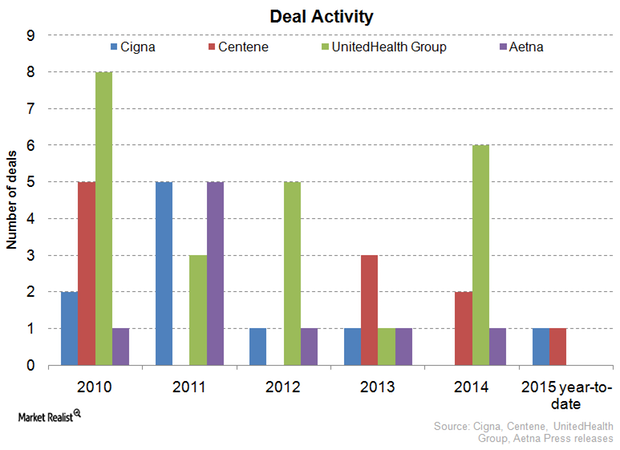

Cigna Diversifies Via Mergers and Acquisitions

Among Cigna’s major strategic mergers and acquisitions was HealthSpring, acquired in 2012 for a consideration of $3.8 billion.

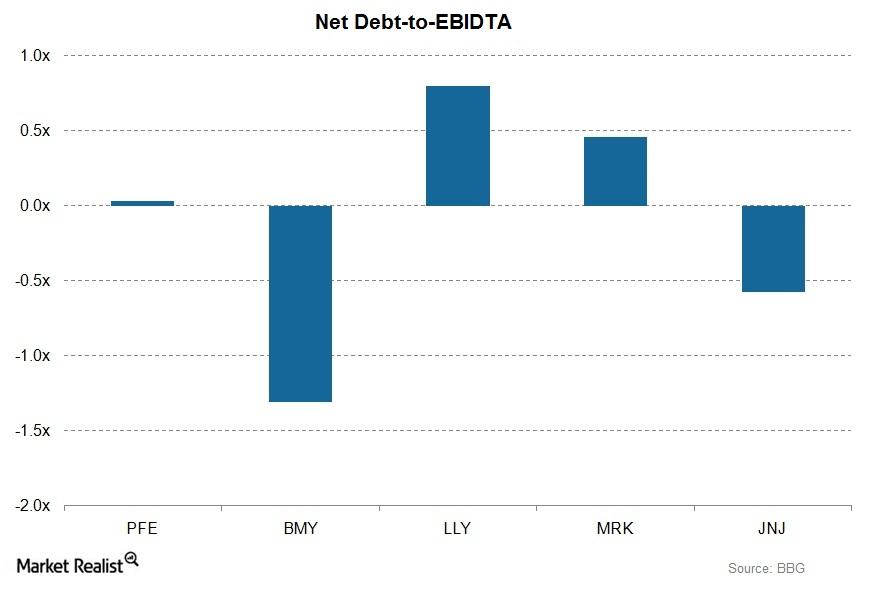

Why Pfizer’s Leverage Is Important to Investors

Leverage ratios determine the company’s ability to repay its debt. Leverage ratios directly affect the credit ratings. Pfizer has good credit ratings.

How Actavis Has Emerged through Mergers and Acquisitions

In October 2012, Actavis completed the acquisition of Actavis Group. In 2013, the company’s revenues outside the US increased to 29% from 16% in 2012.

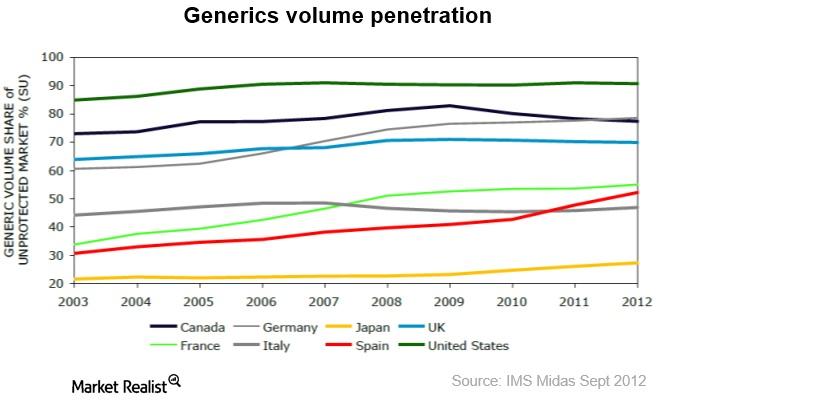

What’s Supporting Continued Growth in the Generics Market?

The global generics market was valued at $168 billion in 2013. From 2013 to 2018, it’s expected to grow at a CAGR of 11% to reach $283 billion.

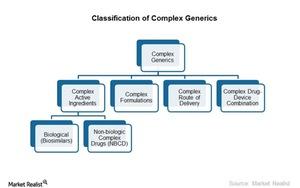

Complex Generics Are Attractive Due to High Margins

Complex generics are large and complex formulations or active ingredients used to treat chronic and life threatening diseases like cancer, Hepatitis C, and HIV.

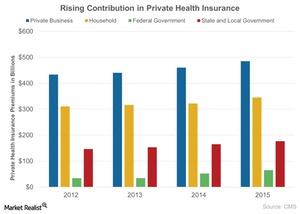

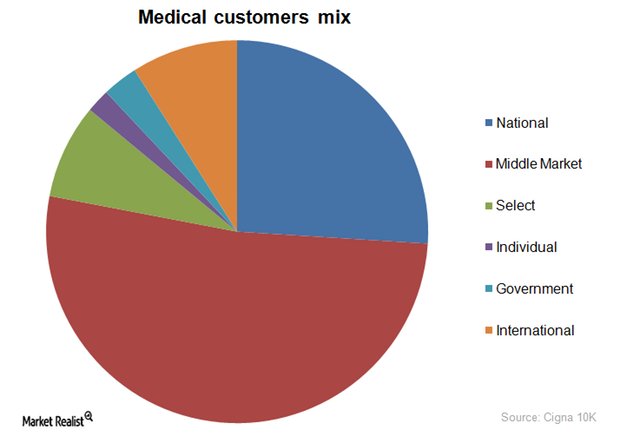

Cigna’s Customer Segments a Healthy Mix

Customer segments The players in the private health insurance industry (IYH) aim for a favorable enrollment mix to reduce taxes and other liabilities while at the same time generating sustainable profits. Accordingly, managed care organizations such as Humana (HUM), Aetna (AET), Anthem, Cigna (CI), and WellCare Health Plans (WCG) are increasingly focusing on government-sponsored and international enrollments to balance […]

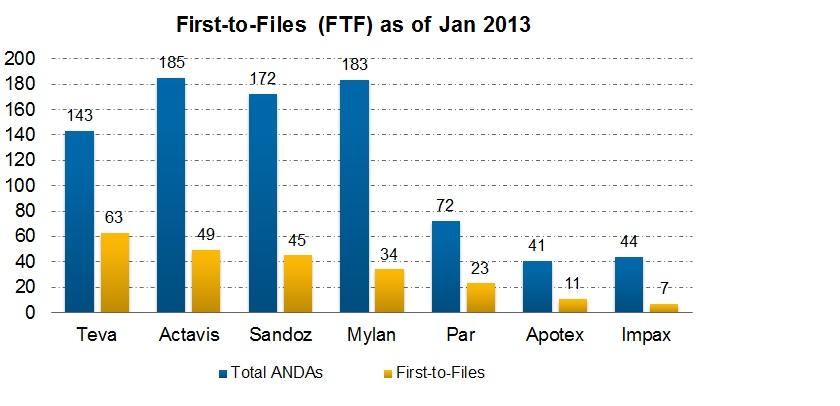

Is a Para IV Filing Rewarding for a Generic Company?

A generic company is rewarded for a Para IV filing. The first applicant to submit a substantially completed ANDA is given marketing exclusivity for 180 days.

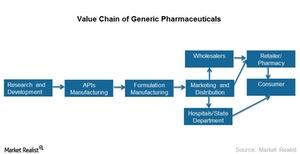

Generics Are Climbing up the Value Chain

Severe cost pressure can lead to the commoditization of generics. it’s important to adjust the value chain to achieve higher efficiencies, flexibility, and reliability.

Are Generics the Only Affordable Drugs?

Drugs are used to treat, cure, or prevent diseases. The drug market is broadly categorized into prescription drugs and OTC (over-the-counter) drugs.