iShares US Medical Devices

Latest iShares US Medical Devices News and Updates

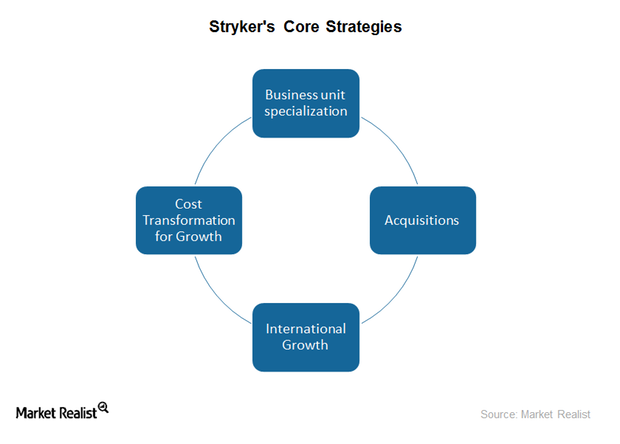

How Are Stryker’s Core Strategies Working Toward Its Growth?

Stryker (SYK) registered strong 3Q16 earnings on October 27, 2016. The company’s reported earnings exceeded analysts’ estimates.

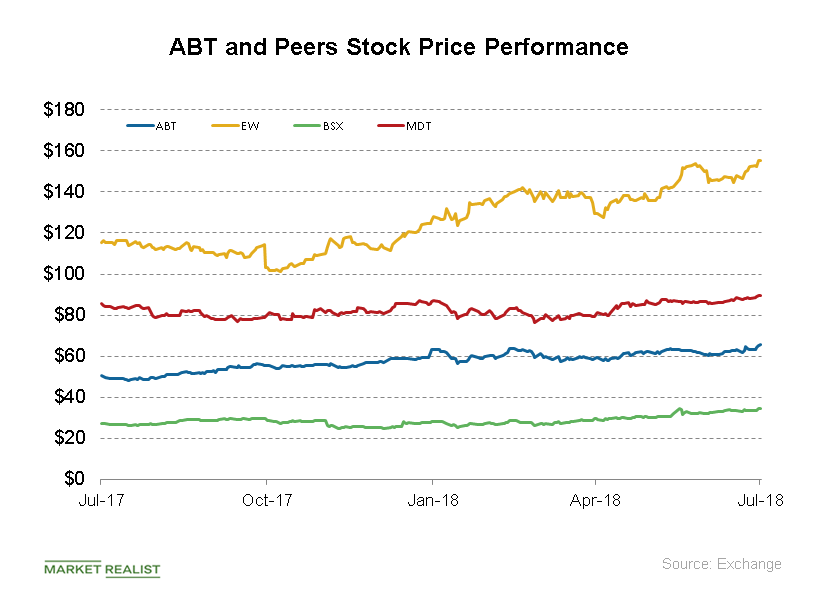

Abbott Laboratories’ Stock Price Performance in July

Year-to-date, ABT stock has risen 12.8%. Over the last month, the stock has returned ~4.0%.

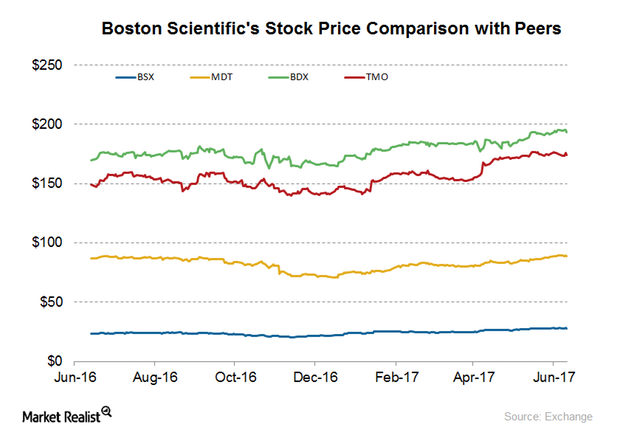

How Has Boston Scientific Stock Performed Recently?

Boston Scientific (BSX) was trading at $27.9 on June 29, 2017.

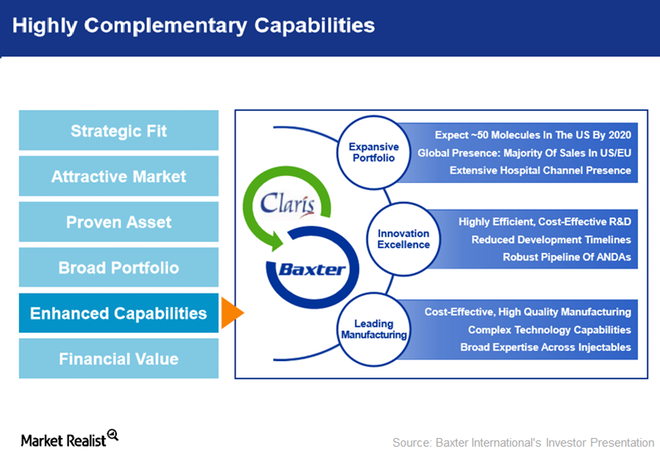

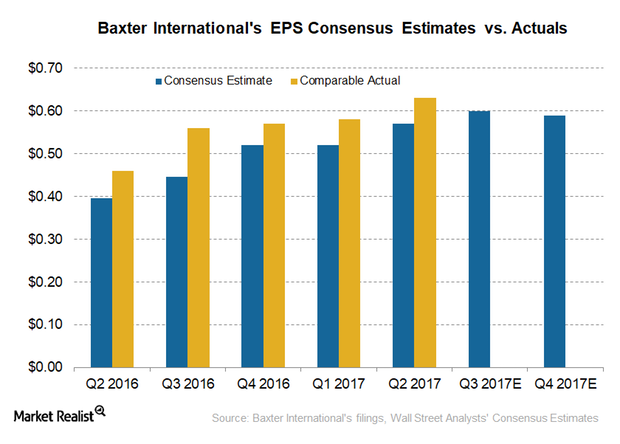

Effect of Claris Injectables Acquisition on Baxter’s 2017 Growth

On July 27, 2017, Baxter International (BAX) completed the acquisition of Claris Injectables, which is expected to help expand and strengthen Baxter’s core capabilities.

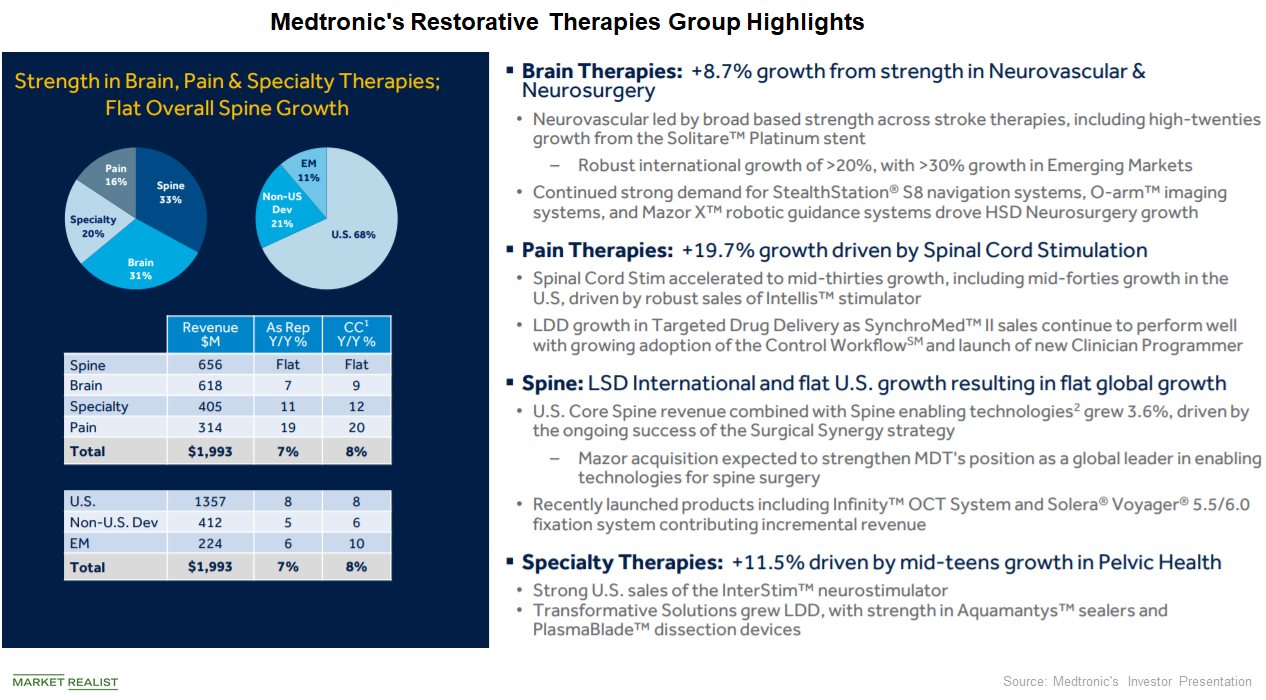

How Does Medtronic’s Restorative Therapies & Diabetes Group Look?

Medtronic’s Restorative Therapies Group consists of Spine, Brain, Specialty and Pain therapies.

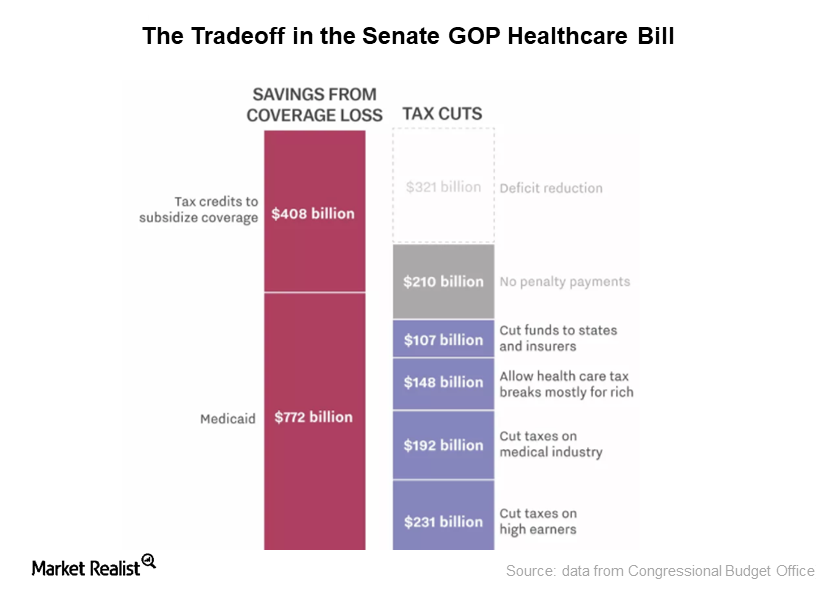

How the Corporate Tax Rate Cut Could Affect R&D in the Medtech Industry

The repeal of the tax deduction for high medical expenses may reduce the number of taxpayers opting for costly medical technologies and services.

Inside Baxter International’s Stock Price Performance

On September 7, 2017, BAX stock closed at $62.84 per share. It has a 50-day moving average of $61.15 and a 200-day moving average of $57.14.

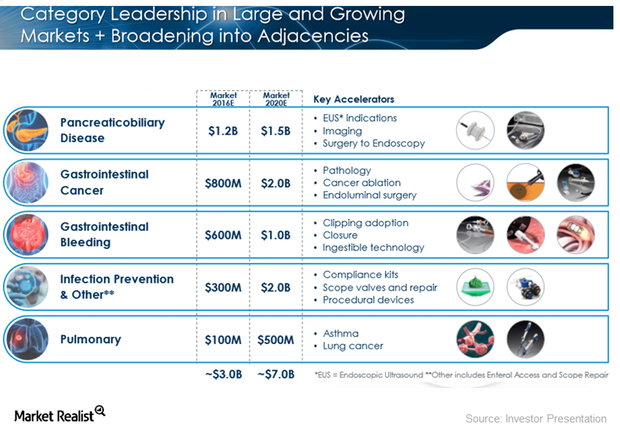

Boston Scientific Is Accelerating Category Leadership Strategy

Boston Scientific (BSX) currently has a global market opportunity of $40.0 billion, which is expected to grow to $50.0 billion by fiscal 2020.

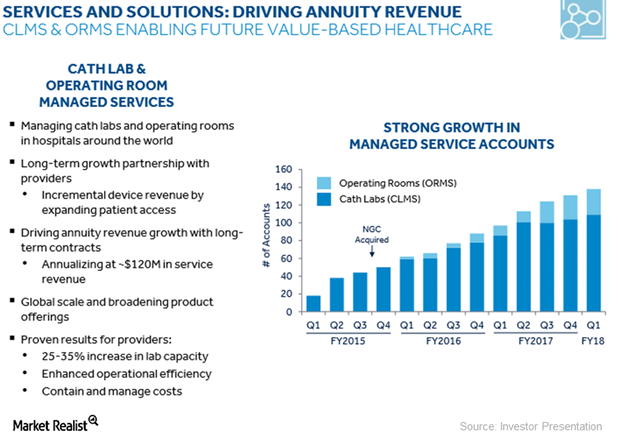

How Medtronic Is Accelerating Its Economic Value Growth Strategy

Medtronic’s (MDT) Hospital Solutions segment registered double-digit growth in fiscal 1Q18.

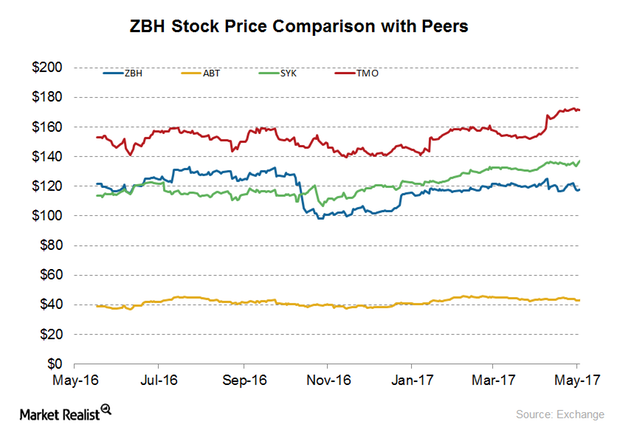

How Zimmer Biomet Stock Has Performed Recently

Zimmer Biomet Holdings (ZBH) was trading at $118.40 on May 30, 2017. It has a 50-day moving average of $119.70 and a 200-day moving average of $114.20.

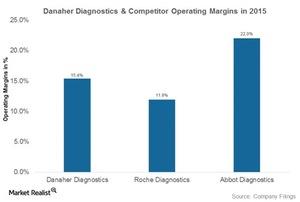

How Danaher Diagnostics Fares against Its Competition

Danaher’s Diagnostics unit had operating margins of 15.4% in 2015 and 17.2% in 1H16.

Understanding the Skeleton of Danaher’s Life Sciences Business

Customers in the Danaher life sciences business generally look at how the technology offered by a company can fit into their workflows.

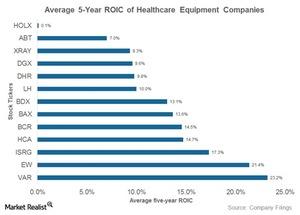

How Are Danaher’s Returns Compared to Its Industry Peers’?

Danaher’s ROIC fell steadily from 15.5% in 2006 to 8.5% in 2015, indicating that it has probably had fewer high return reinvestment opportunities since then.

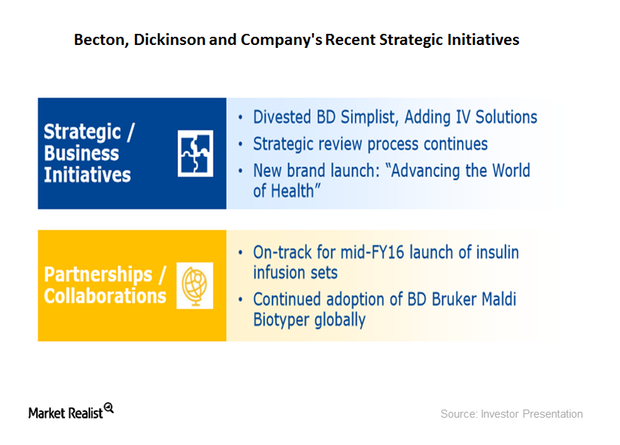

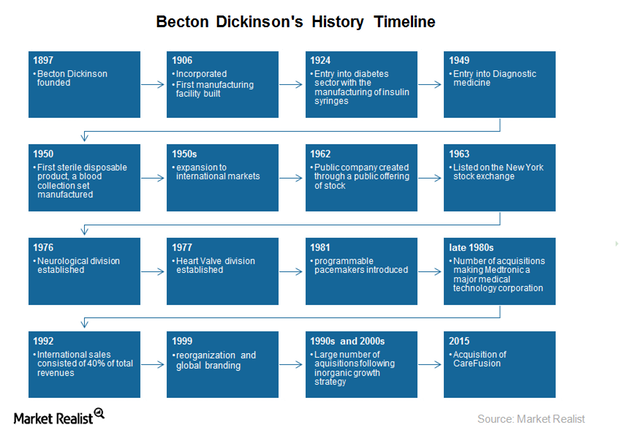

Behind Becton Dickinson’s Strategic Restructuring and Business Consolidation

To better position itself amid the changing medical device environment, Becton Dickinson has come to focus on restructuring and business model evolution.

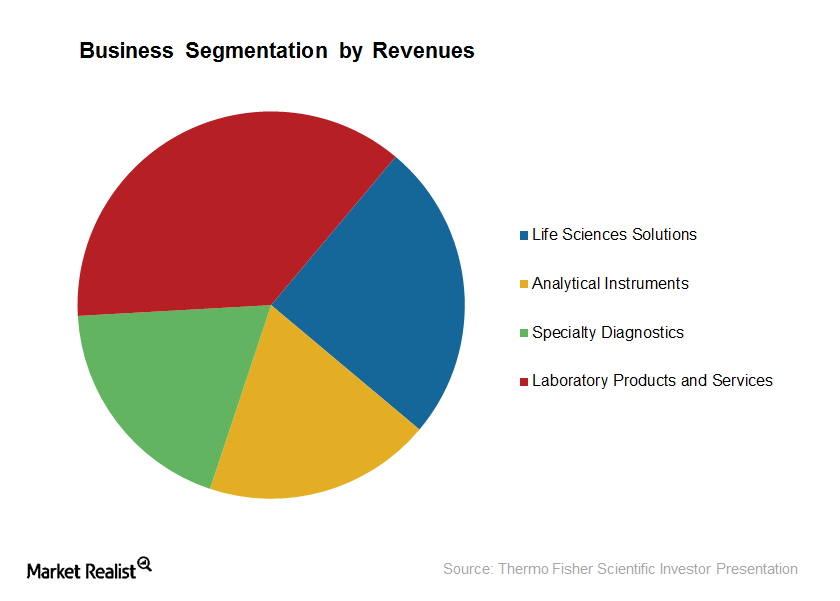

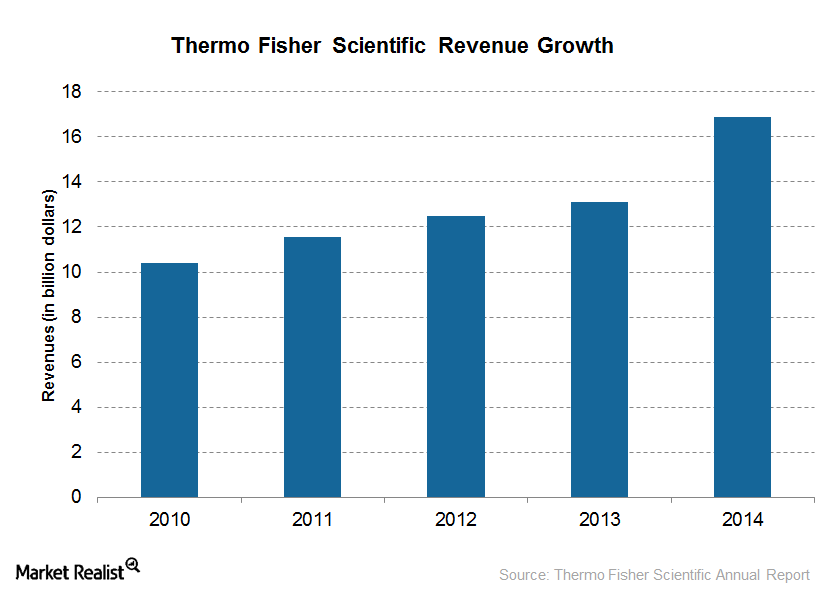

An Overview of Thermo Fisher Scientific’s Business Model

Thermo Fisher Scientific (TMO) has made a number of acquisitions over the years, resulting in the expansion of the company’s product portfolio with the inclusion of a number of premium brands.

Thermo Fisher Scientific: A Leading Medical Technology Company

Thermo Fisher Scientific (TMO) is one of the leading medical technology companies in the world, providing a broad portfolio of laboratory equipment and services.

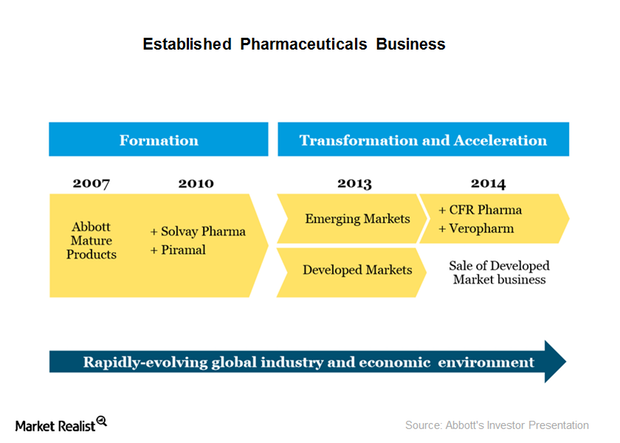

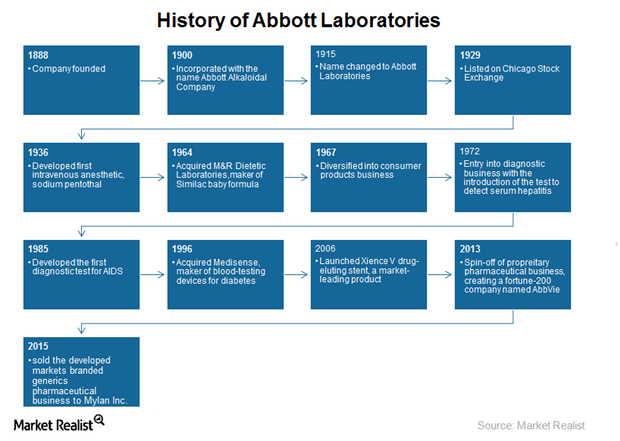

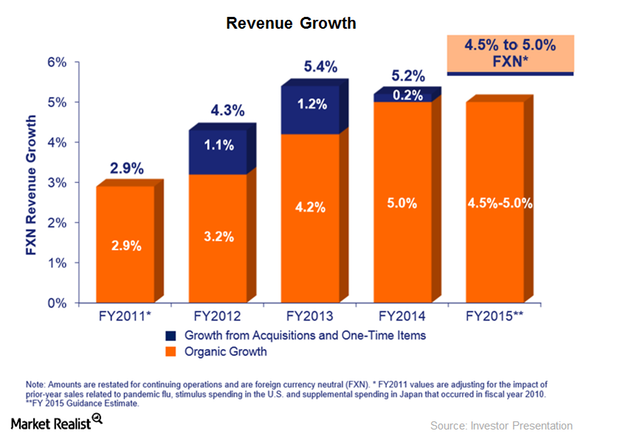

A Key Look at Abbott Laboratories’ Acquisitions and Divestments

Inorganic growth through acquisitions has led to the expansion of Abbott Laboratories across geographies and to the broadening of its product portfolio.

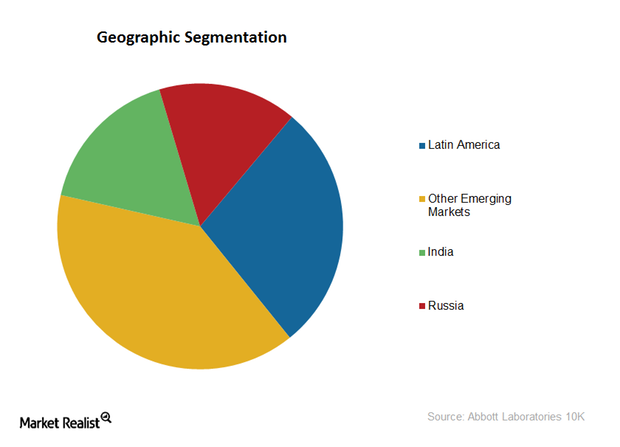

Established Pharmaceuticals Segment of Abbott Laboratories

Abbott’s Established Pharmaceuticals segment is a consumer-oriented segment with a consumer mix of around 75% self-pay consumers and 25% third-party payers.

A Look at Becton, Dickinson and Company’s Valuation

Becton, Dickinson and Company is one of the five biggest medical device companies in the United States.

Introducing Abbott Laboratories, a Leading Global Healthcare Company

Abbott Laboratories operates across more than 150 countries, employs over 73,000 people, and is the global leader in the nutrition subsector.

Becton, Dickinson and Company’s Acquisitions and Collaborations

Becton, Dickinson and Company’s (BDX), or BD’s, growth strategy includes acquisitions and collaborations.

Becton, Dickinson and Company: A Leading Global Medical Device Company

Becton, Dickinson and Company, or BD, headquartered in Franklin Lakes, New Jersey, is one of the leading medical technology companies in the United States.

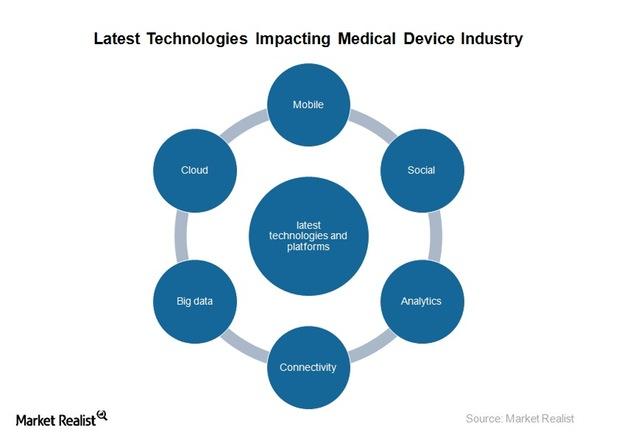

Why Technology Is a Key Driver in the US Medical Device Industry

Traditionally, the United States has been home to the most advanced technological inventions in the medical device industry.

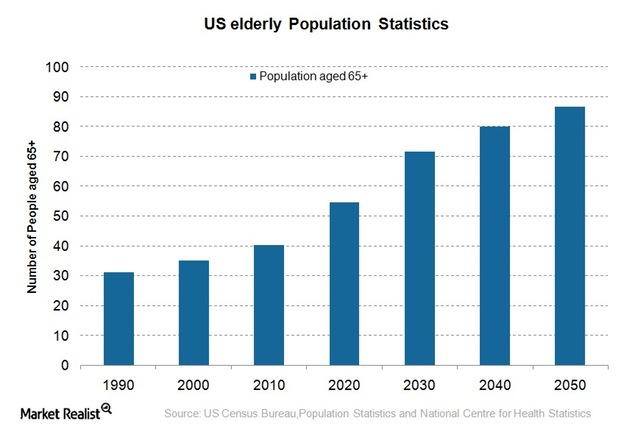

How Economic and Demographic Factors Affect Medical Device Industry

Though the medical device sector displays significant resilience towards changes in the economic environment, economic factors do impact short-term demand substantially.

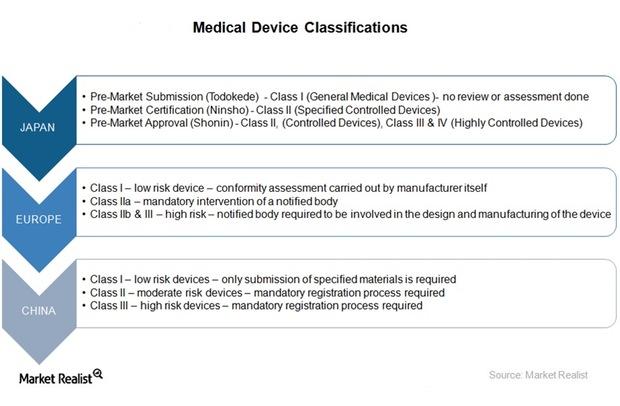

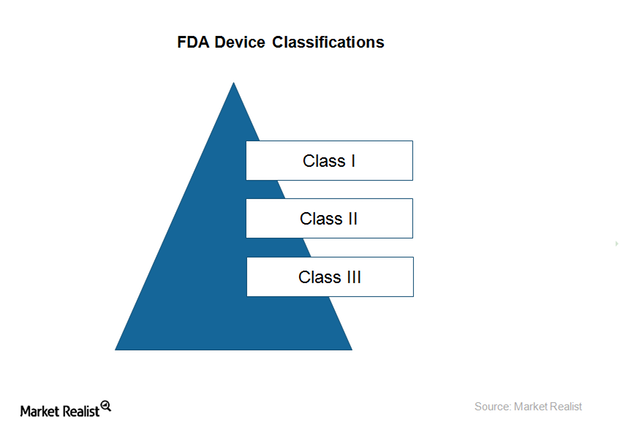

What Are the Medical Device Approval Processes in Major Markets?

In most countries, the approval process varies across different categories of devices classified as per their risk profiles.

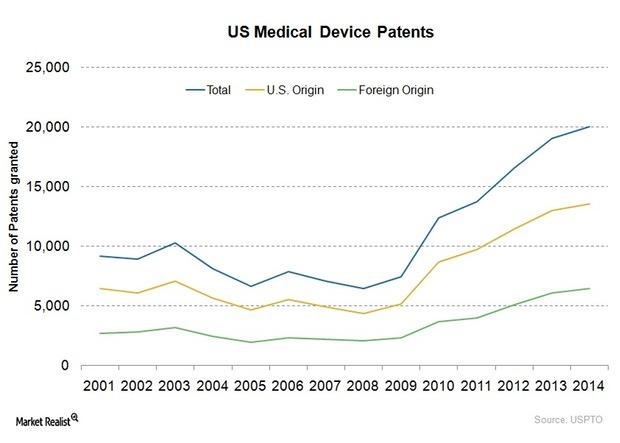

Why Are Patents Necessary for Medical Device Companies?

Medical device companies are driven by innovation and inventions that involve high research and development (or R&D) costs.

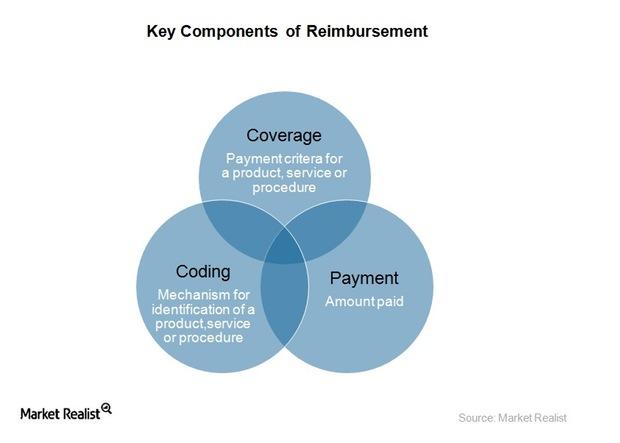

How Reimbursement Models Impact the Medical Device Industry

Coverage, coding, and payment are essential elements to obtaining adequate reimbursement for a new medical device.

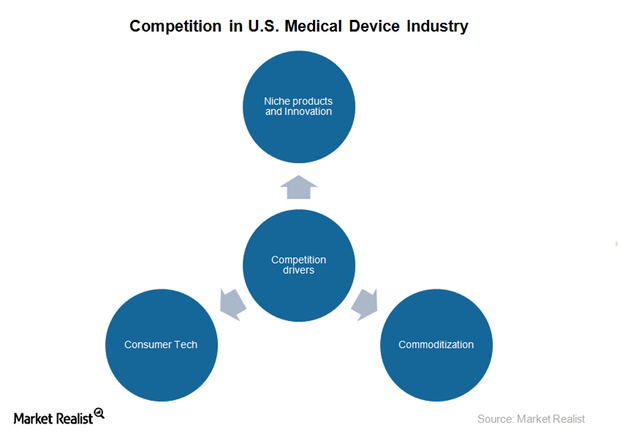

Analyzing the Competitive Landscape of the Medical Device Industry

The medical device industry in the US consists of a few big players and a large number of small and medium enterprises.

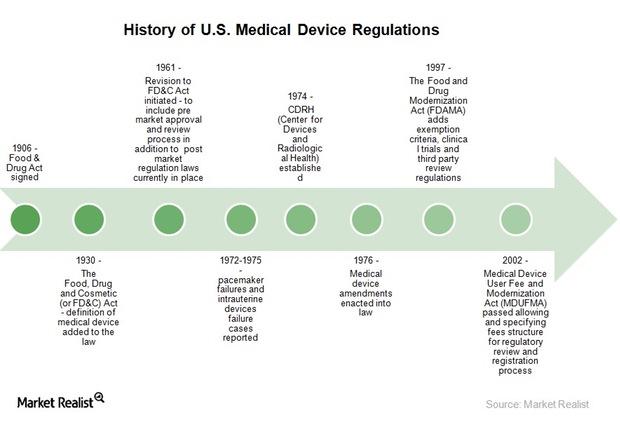

How Does the FDA Classify Medical Devices?

Medical devices are classified as per the level of control required by the Food, Drug, and Cosmetic Act (or FD&C Act).

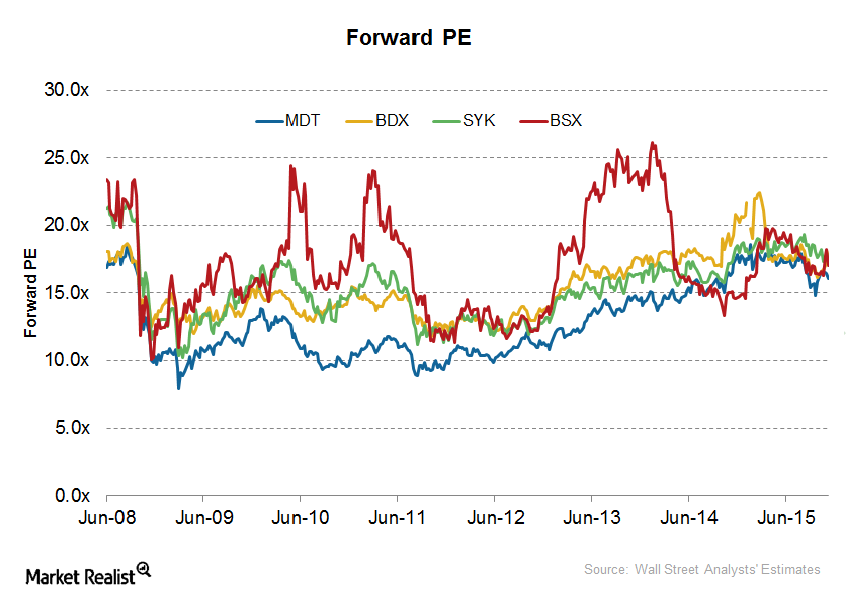

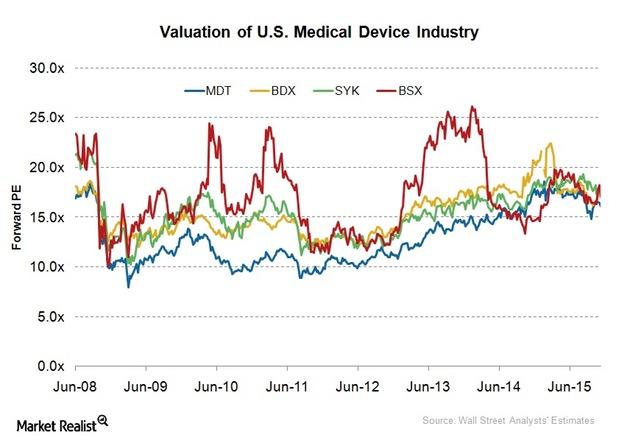

How Is the US Medical Device Industry Valued?

The US medical device industry has rebounded sharply since its 2008 decline, and it is trading at a high PE of 21.9x.

How Do Commodity Prices Impact the Medical Device Industry?

Medical device manufacturers source various medical components and parts from suppliers in order to assemble or develop medical devices.

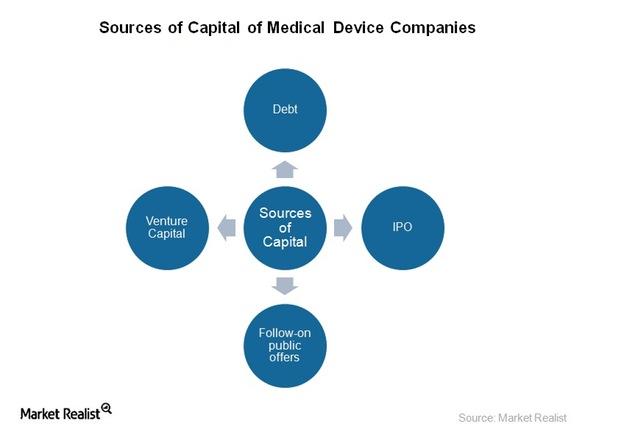

What Are the Major Sources of Capital for Medical Device Companies?

Venture capital is one of the major sources of capital for the US medical device industry.

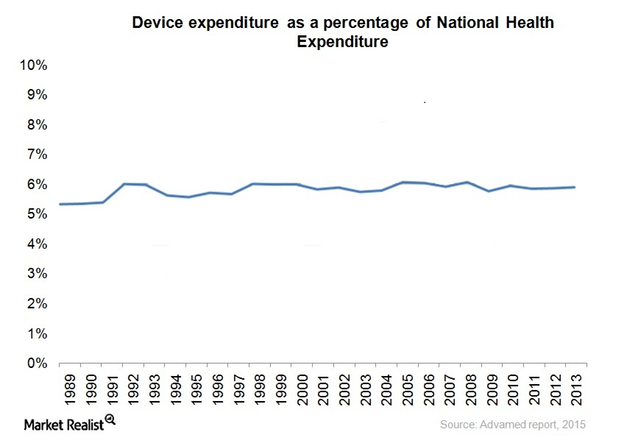

Analyzing Cost Structure for Medical Device Companies

As per the US Census, spending on medical devices in the US has been constant for over a decade between 2005 to 2015.

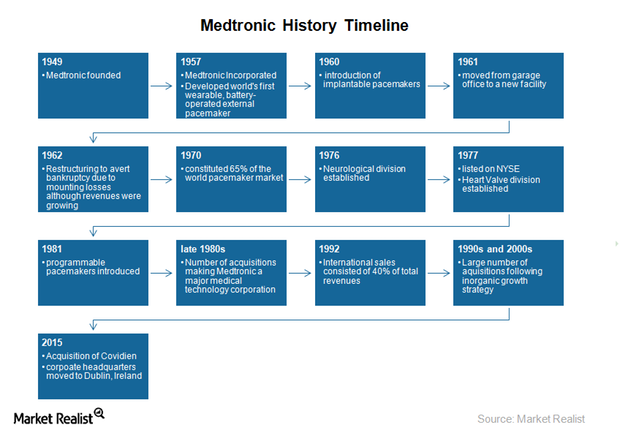

Introducing Medtronic, a Leading Medical Device Company

Headquartered in Minnesota, Medtronic is the world’s largest pure-play medical device company, with operations in 160 countries and over 85,000 employees.

Key Regulations that Affect Medical Device Companies

The US Food and Drug Administration’s Center for Devices for Radiological Health (or USFDA/CDRH) regulates the medical device industry in the United States.

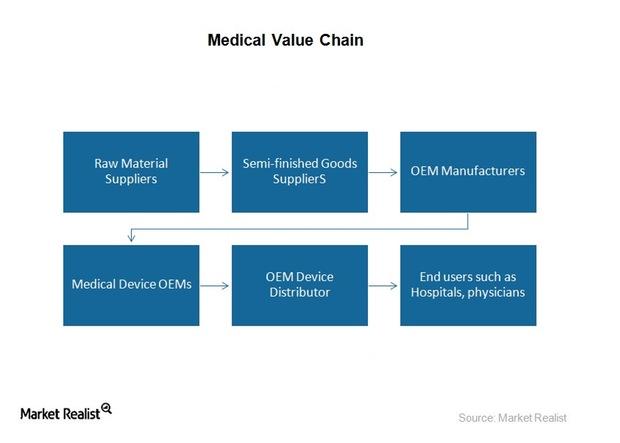

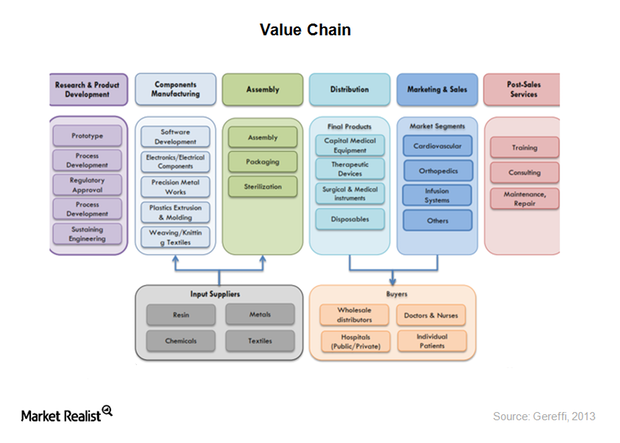

Analyzing Value Chain and Business Models in Medical Device Industry

The US medical device industry has been working on traditional business models based on R&D and innovation where physicians have been the target audience.

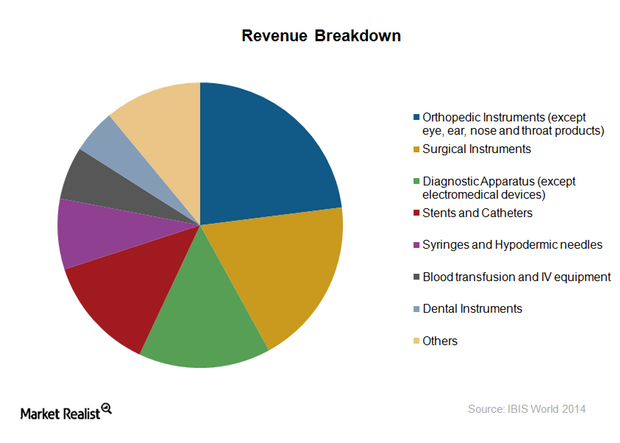

How Is the Medical Device Industry Segmented?

The US medical devices industry can be categorized according to the field of medicine in which a device is used.

A Must-Read Overview of the Medical Device Industry

The US medical device market is projected to grow at a compound annual growth rate of 6.1% between 2014 and 2017.