Invesco CurrencyShares Japanese Yen Trust

Latest Invesco CurrencyShares Japanese Yen Trust News and Updates

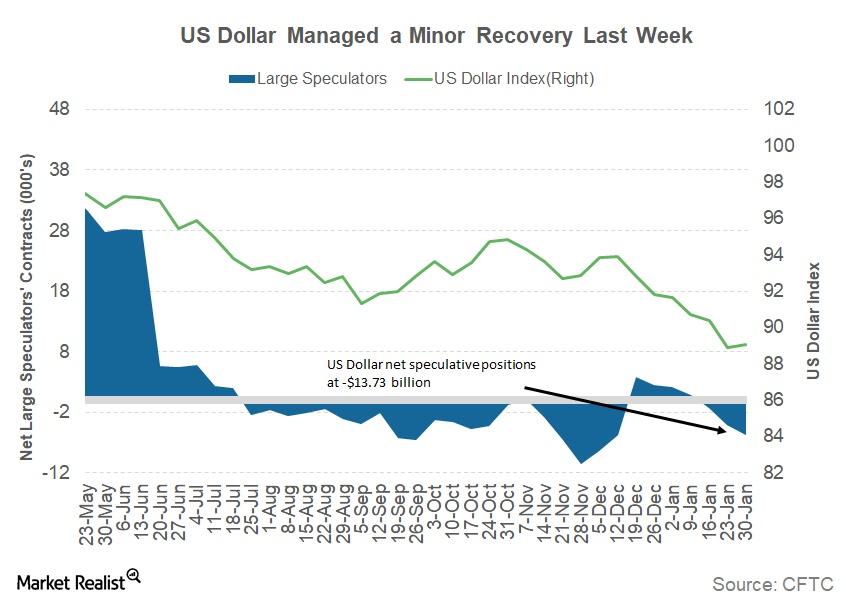

Have We Seen a Short-Term Bottom for the Dollar?

The US Dollar Index (UUP) managed to close in positive territory in the week ended February 8, 2018, after posting seven consecutive weekly losses.

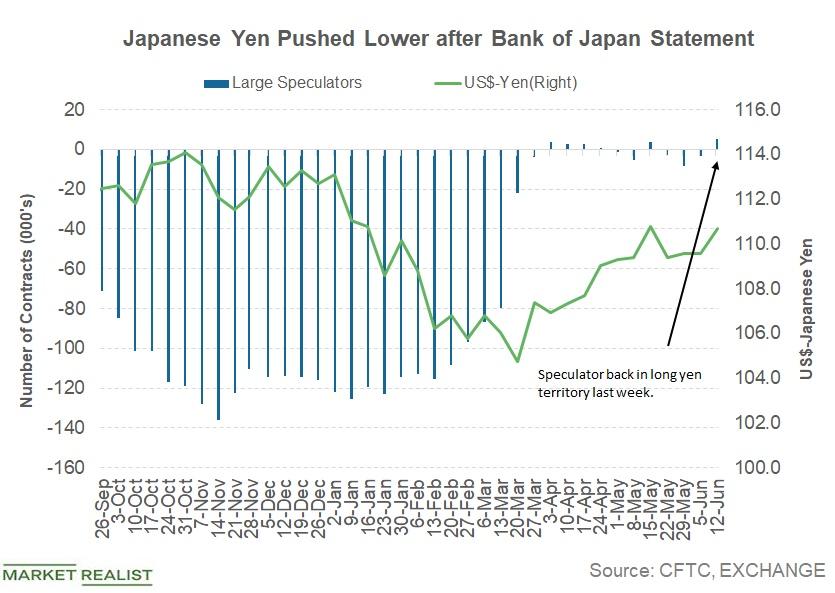

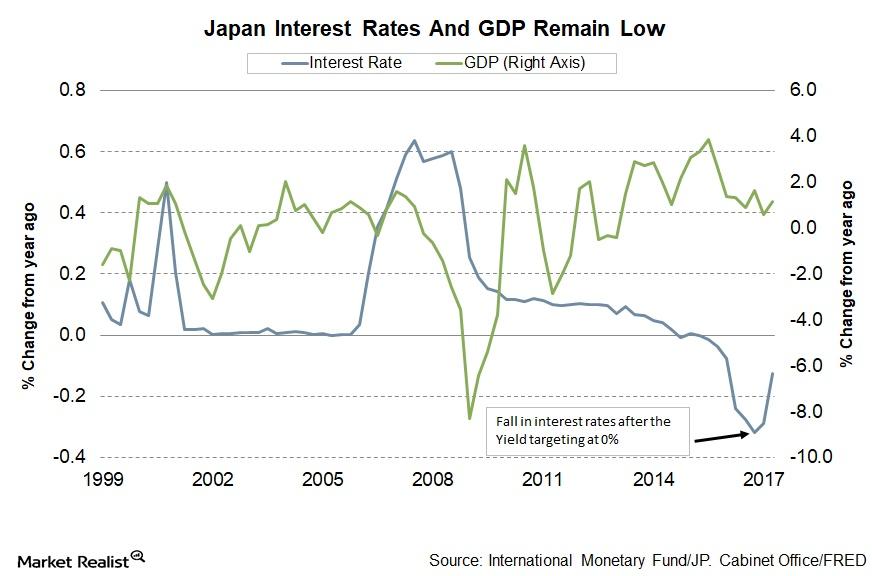

Analyzing the BoJ’s Monetary Policy Enhancement Measures

The BoJ’s monetary policy was the most awaited macro event this week. It was the first major central bank to expand its easing program after the Brexit vote.

Ripple Crosses $1 for the First Time on December 21

For the first time in history, the price of ripple has surpassed $1.

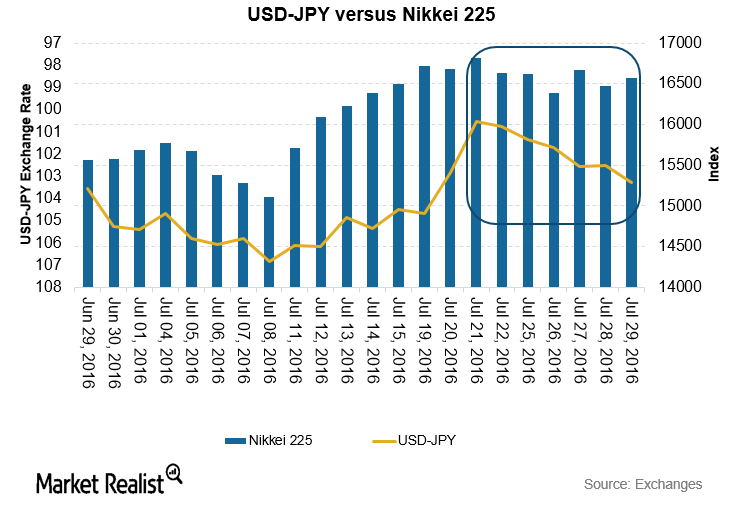

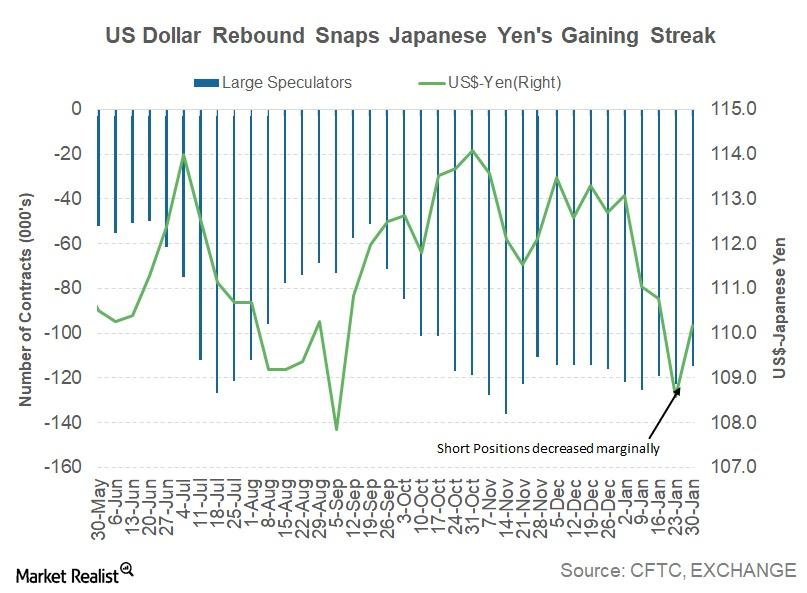

Why the Yen Depreciated against the Dollar

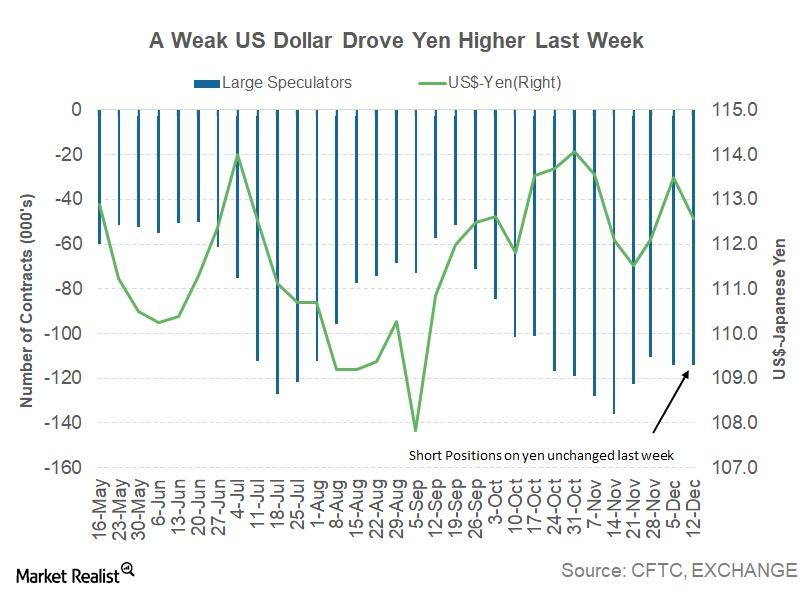

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67.

Why the Japanese Yen Depreciated against the Dollar Last Week

The Japanese yen (JYN) retracted against the US dollar last week as US dollar bulls tried to take control.

Could the Bank of Japan Drive the Yen Lower this Week?

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar.

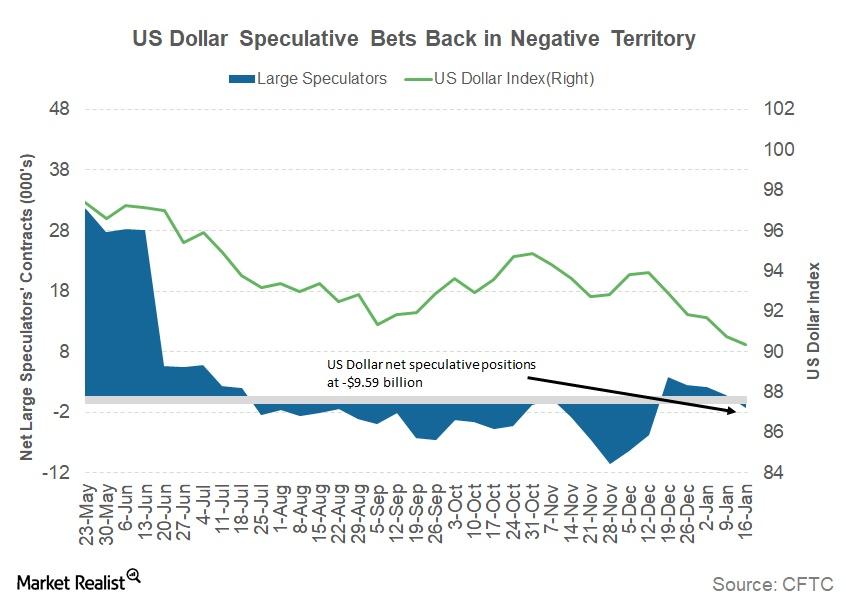

How the US Dollar Could React to a US Government Shutdown

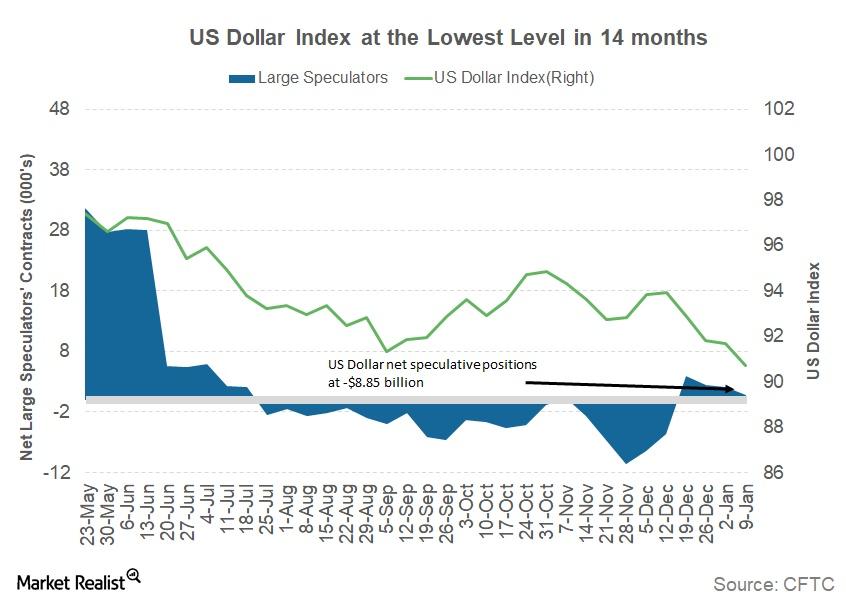

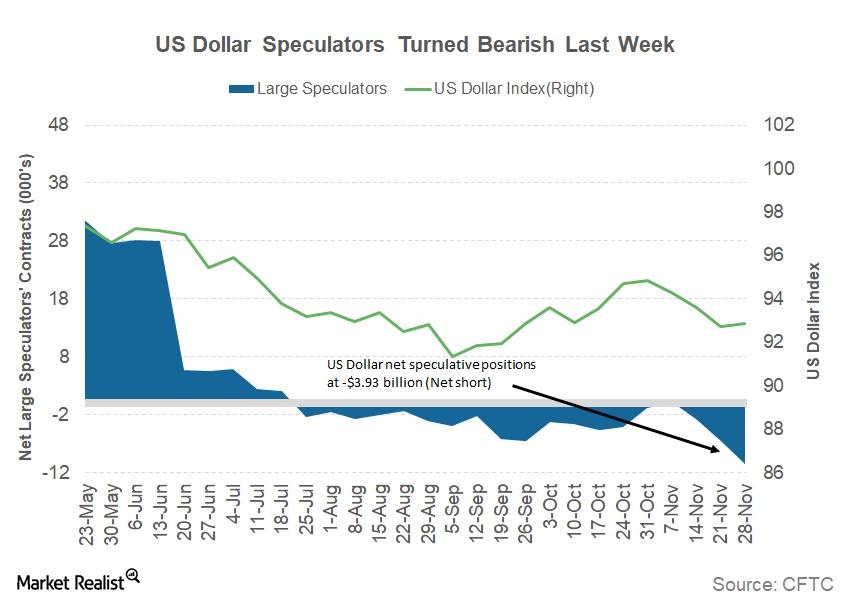

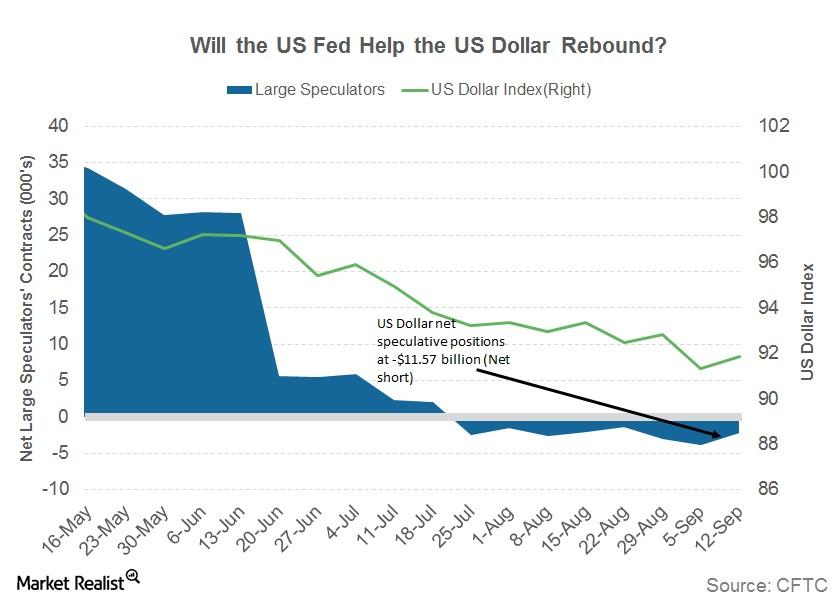

According to the January 19 Commitment of Traders report, released by the Chicago Futures Trading Commission, large speculators have turned bearish on the US dollar.

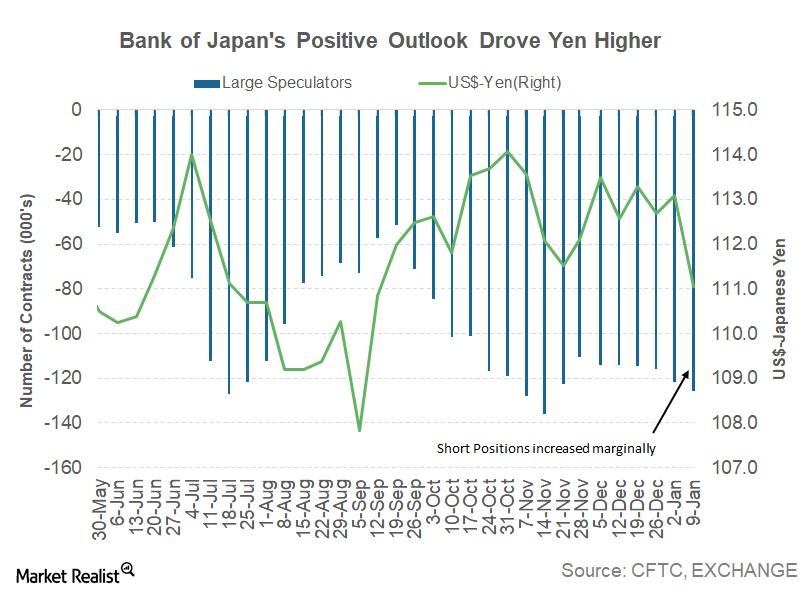

Why the Japanese Yen Finally Appreciated against the US Dollar

During the week ended January 12, the yen (FXY) closed at 111.04 against the US dollar (UUP), compared to 113.08 in the week ended January 5, appreciating by 1.8%.

Why the US Dollar Is Losing Its Appeal

The US Dollar Index (UUP) continued its decline, posting a fourth consecutive weekly loss during the week ended January 12.

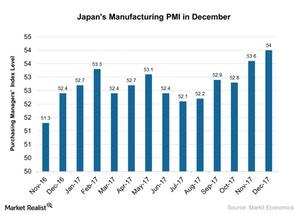

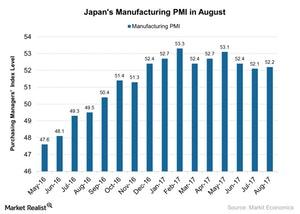

Why Japan’s Manufacturing Activity Improved in December 2017

Japan’s manufacturing activity in December Japan’s manufacturing PMI (purchasing managers’ index) improved in December 2017, rising to 54 from 53.6 in November 2017. Whereas the index was slightly below the preliminary market estimate of 54.2, it marked the strongest expansion in manufacturing activity since February 2014. The solid rise in Japan’s manufacturing PMI in December 2017 was mainly due […]

Can the Japanese Yen Rise against the US Dollar?

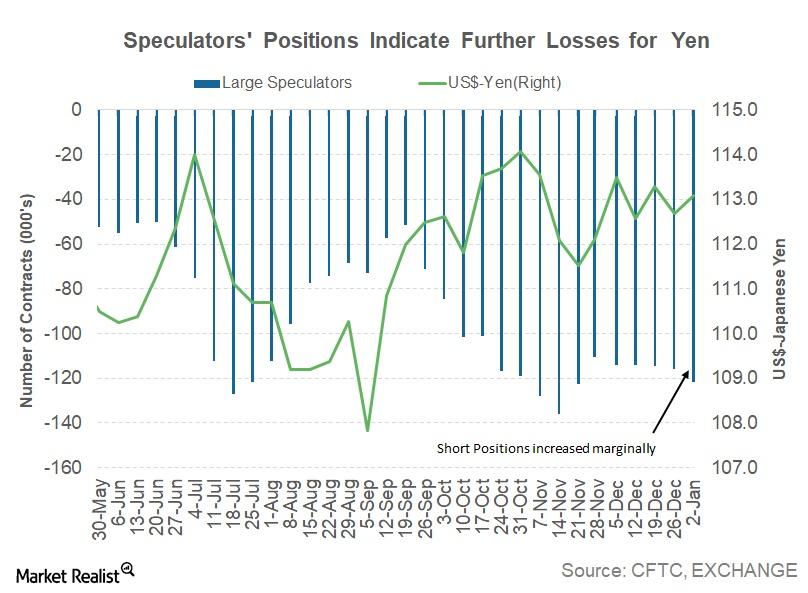

The Japanese yen (JYN) is the only currency that is unable to capture the weakness in the US dollar (UUP).

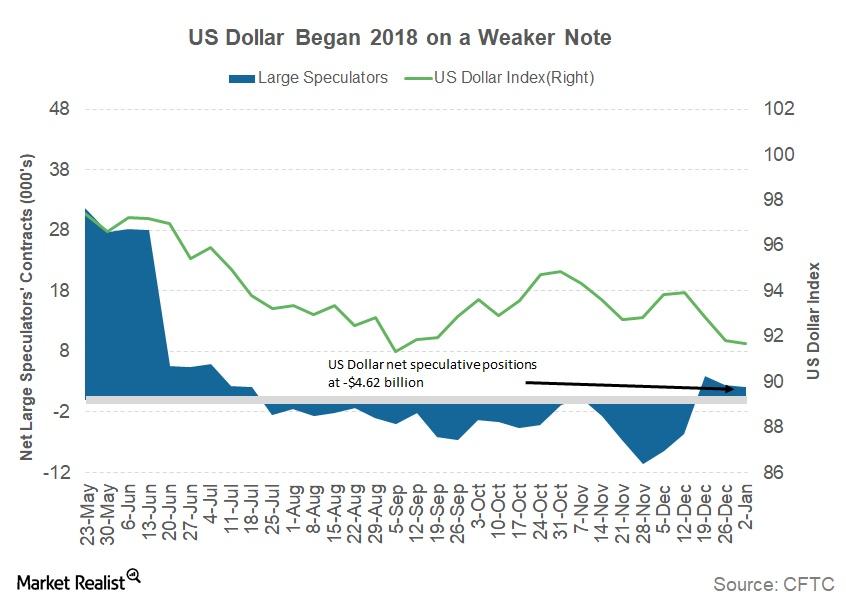

Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

How Could the US Dollar Fare in 2018?

The US dollar’s long-term outlook looks marginally better in 2018 than in 2017.

Can the US Dollar Gain Back Lost Ground This Week?

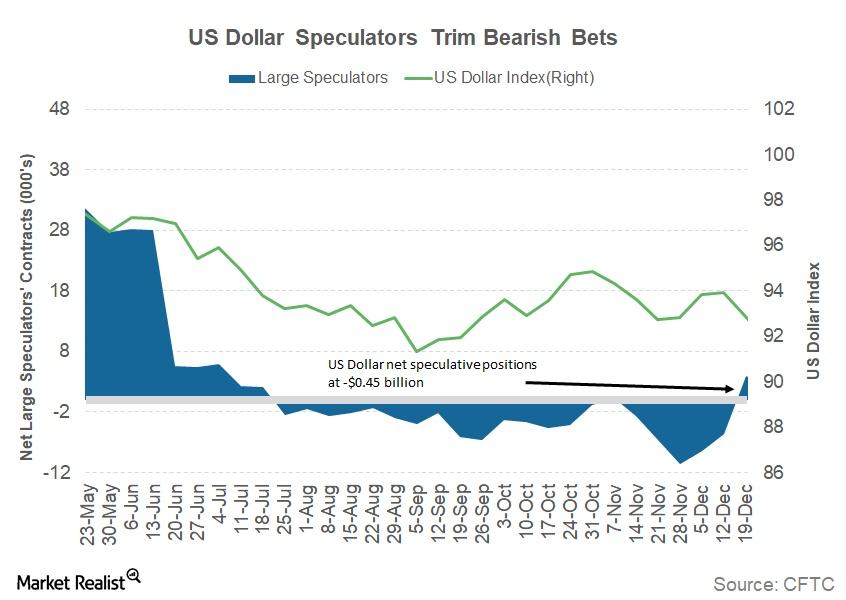

The US Dollar index (UUP) failed to capitalize last week on the optimism from Congress passing the US tax reform bill.

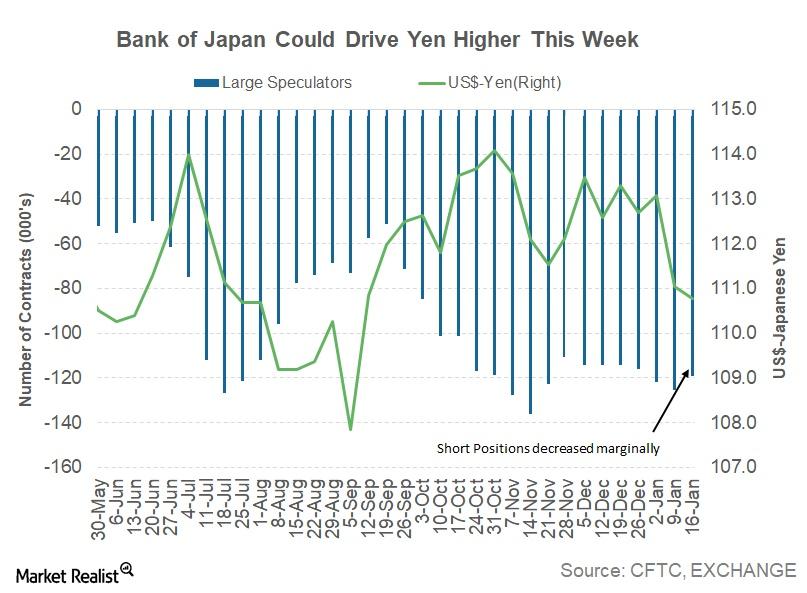

How the Bank of Japan Could Have an Impact on the Yen This Week

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

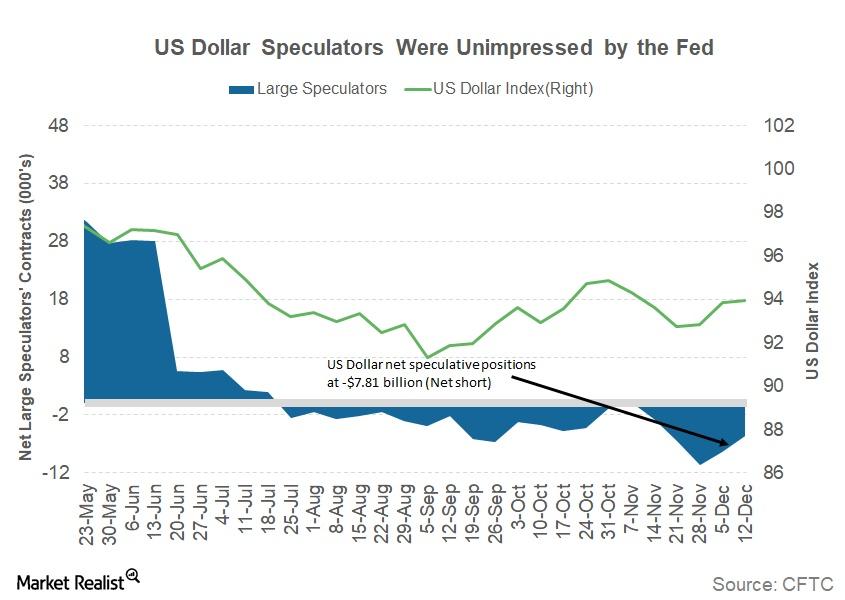

Why the US Dollar Resisted the Fed’s Latest Rate Hike

According to Reuters, the US dollar (USDU) net short positions increased to ~-$7.8 billion during the week ended December 15 compared to ~-$4.3 billion in the previous week.

Will the US Dollar Surge Higher after FOMC Meeting?

The US Dollar Index (UUP) continued its ascent against the other major currencies as investors positioned for a rate hike from the Fed and reacted to the increased possibility of tax reforms by the end of this year.

Will the US Dollar Surge on Tax Reform News?

The US Dollar Index (UUP) managed to close the week ending December 1 in positive territory with a gain of 0.14%.

Reasons behind a 3rd Weekly Loss for the US Dollar

The US Dollar Index (UUP) had another bad week as traders offloaded long dollar positions amid tax reform uncertainty last week.

Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

Will US Dollar Survive Tax Reform Uncertainty?

The US Dollar Index (UUP) lost steam last week after posting three consecutive weekly gains.

US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

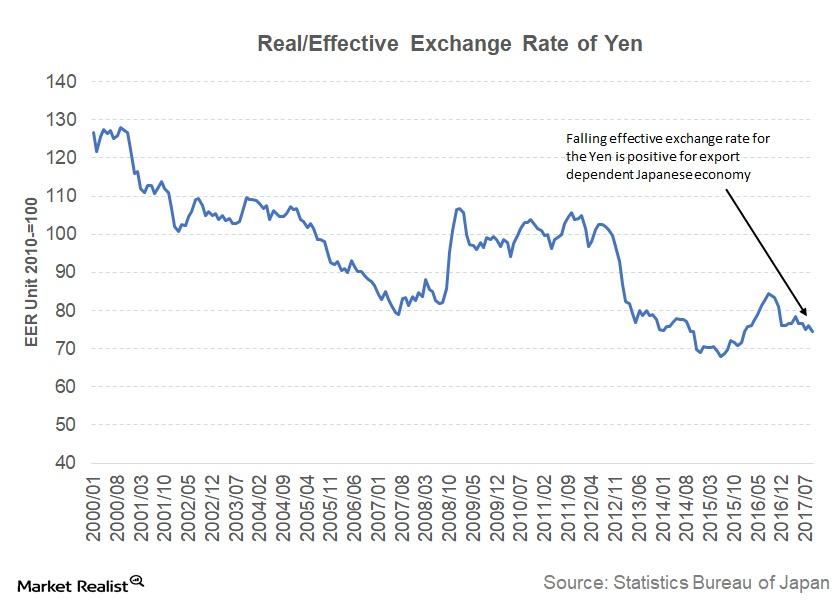

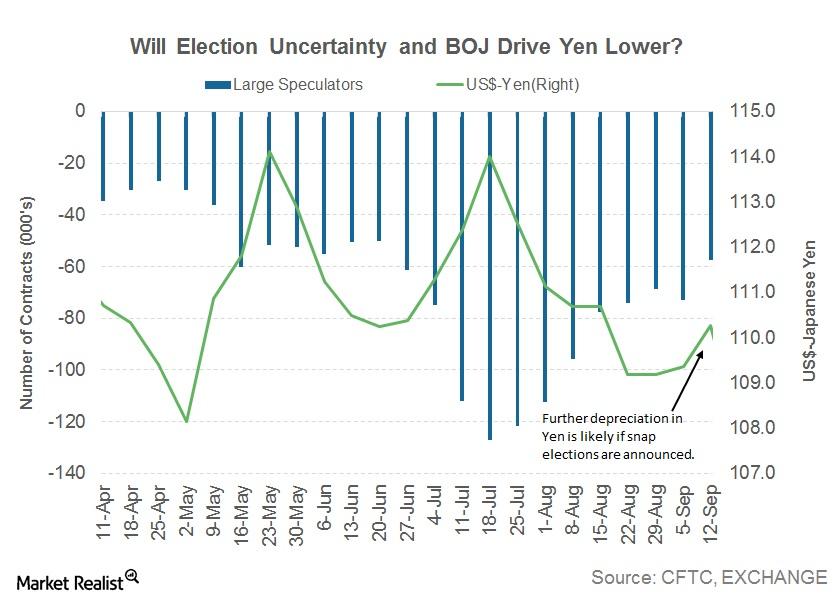

Japanese Yen Is Expected to Depreciate More

Since the Japanese election results, the Japanese yen has depreciated. The Bank of Japan is expected to continue the accommodative policy.

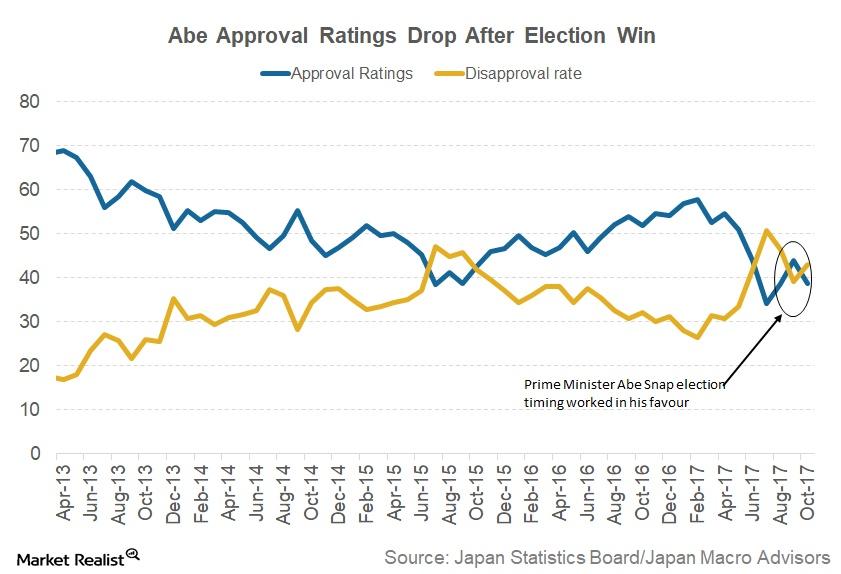

Why the Recent Election Results Are Positive for Japan

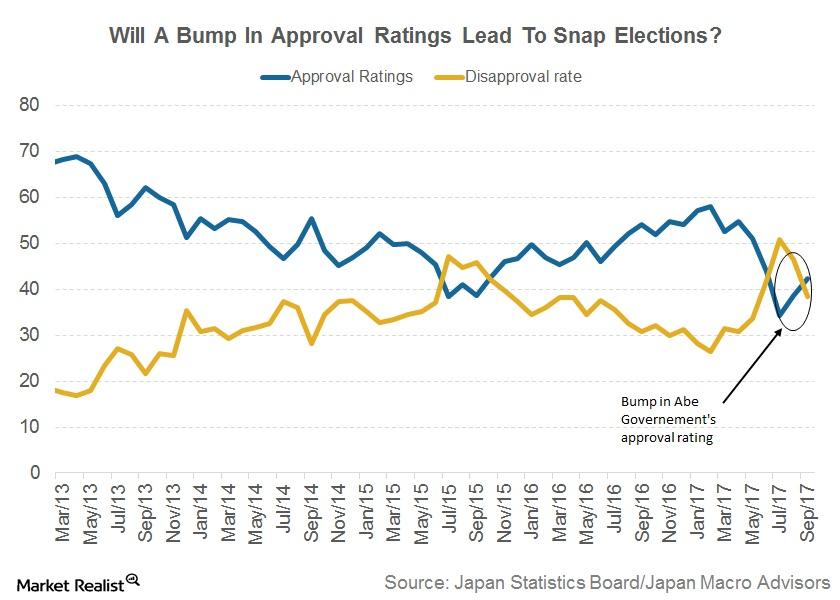

Japanese Prime Minister Shinzo Abe’s call for an early election worked in his favor. He called for a snap election to take advantage of his high ratings.

Bank of Japan: No Changes in the October Policy Meeting

At its October policy meeting, the Bank of Japan left its ultra-loose monetary policy unchanged. The decision was made by an 8-1 majority vote.

How the US Dollar Could React to November FOMC Meeting

The US Dollar Index (UUP) continued its ascent last week.

What to Expect from the US Dollar This Week

The US Dollar Index (UUP) has bounced back from the shallow low that it saw the previous week.

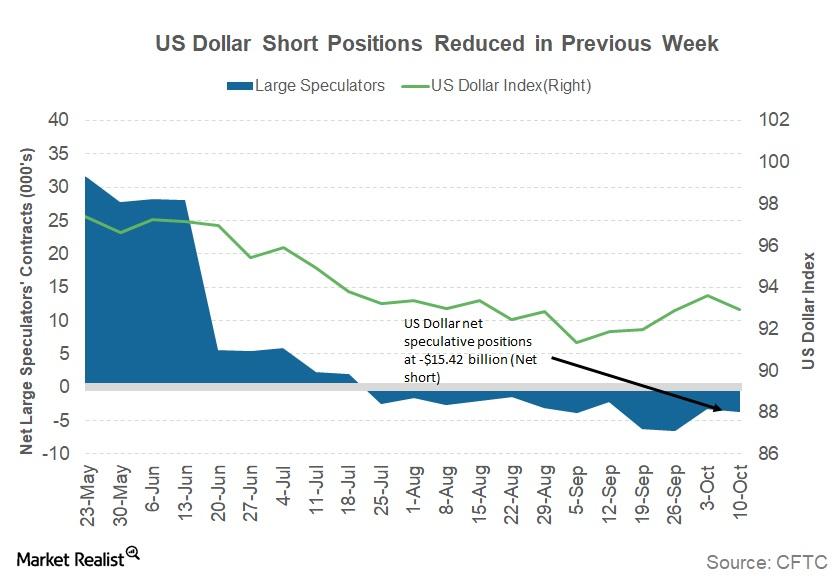

Has the US Dollar Rally Ended for Now?

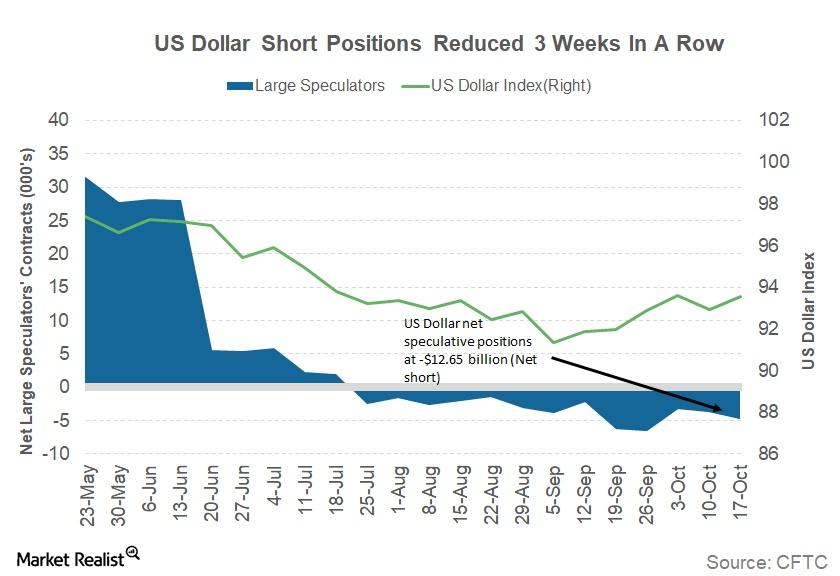

The US Dollar Index (UUP) turned lower again in last week after a surprise rally following the October jobs report on October 6.

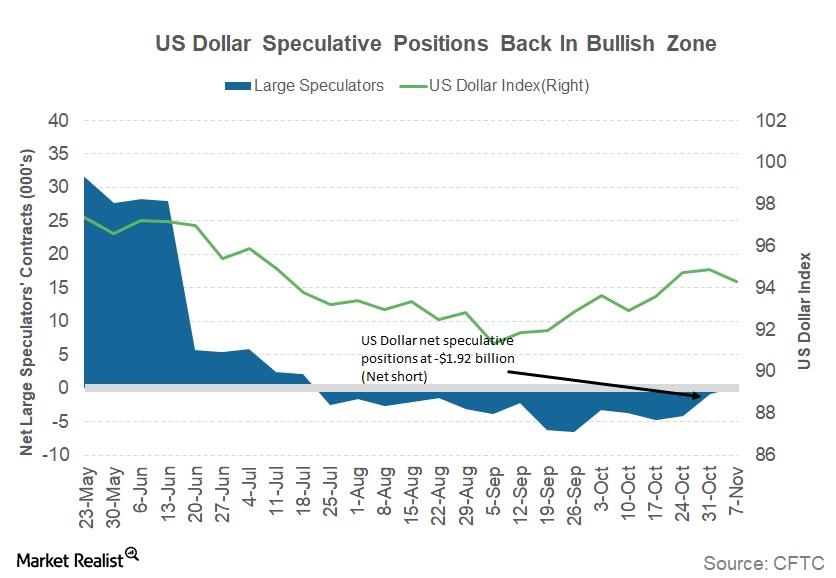

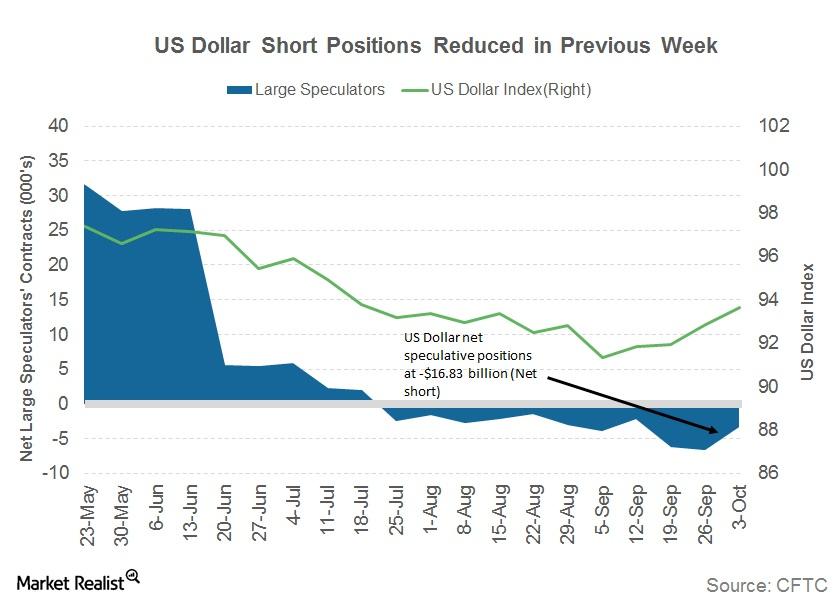

Are Investors Positioning for a US Dollar Rally?

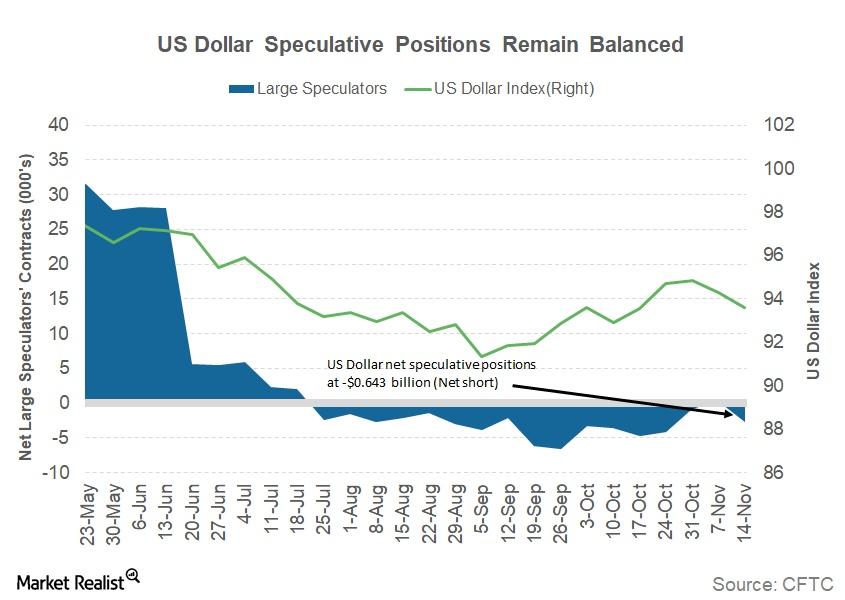

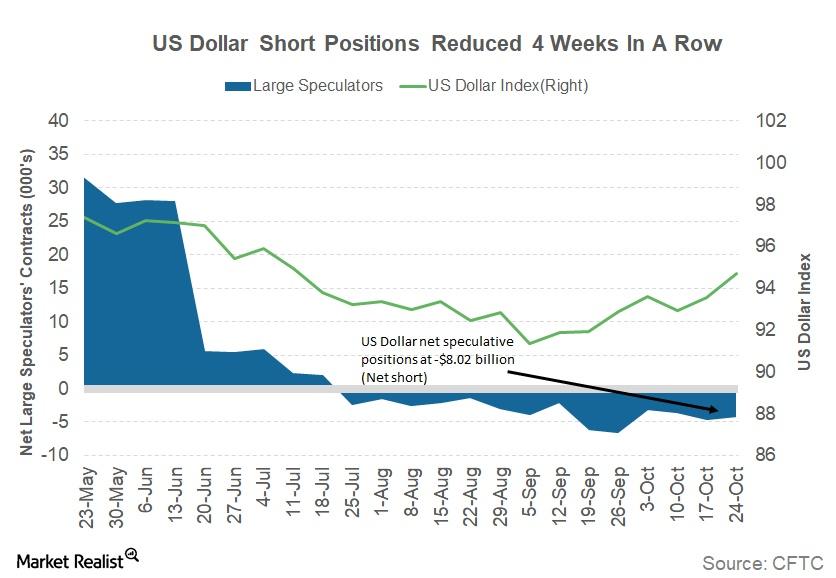

The US Dollar Index (UUP) closed at 93.64 last week, a gain of 0.82% and the fourth consecutive weekly rise. The dollar didn’t react to a loss of 33,000 jobs in September.

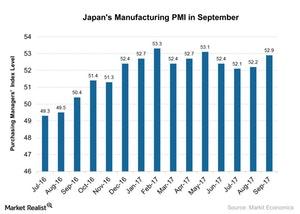

Insight into Japan’s Manufacturing in September 2017

Japan’s manufacturing PMI stood at 52.90 in September 2017, compared to 52.20 in August 2017. The PMI figure beat the preliminary market estimation of 52.5.

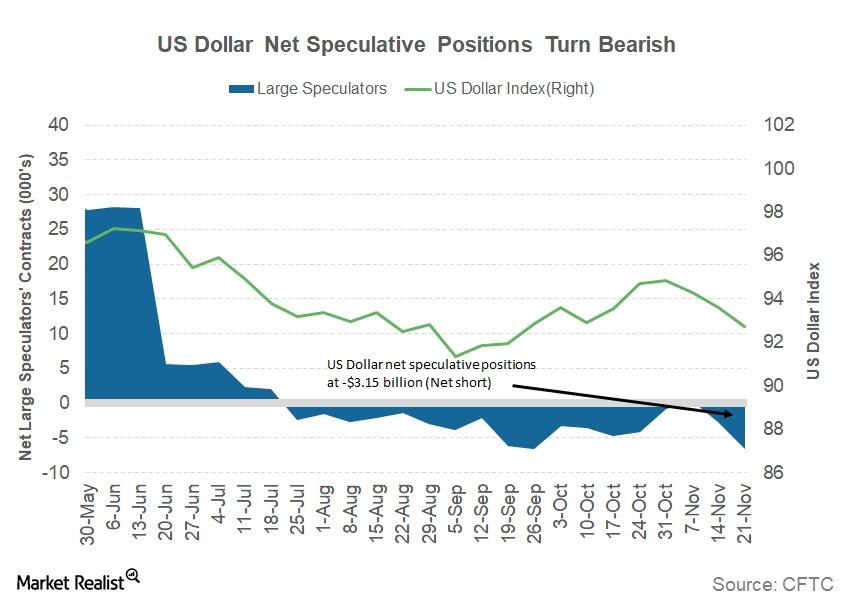

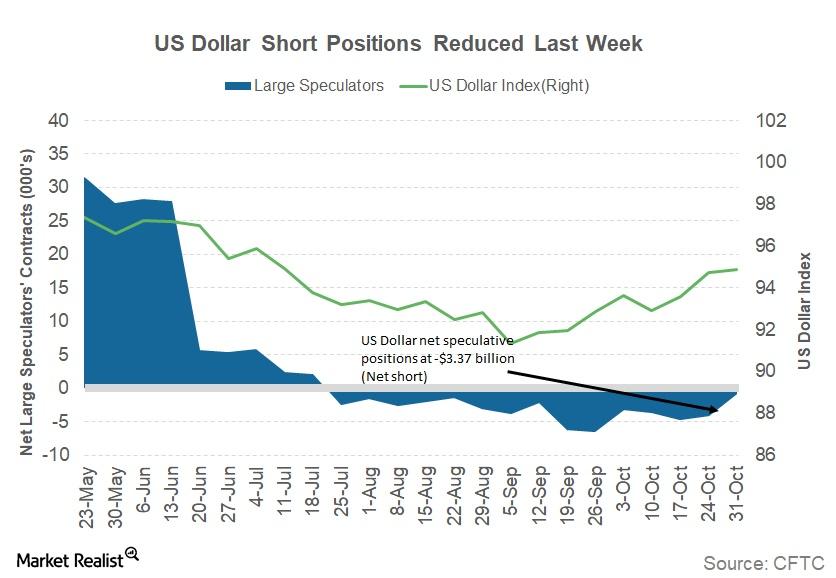

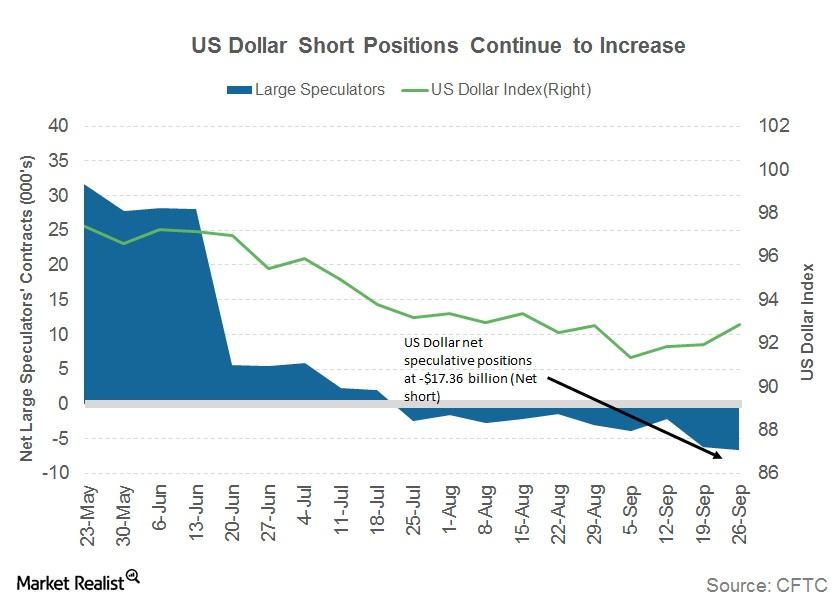

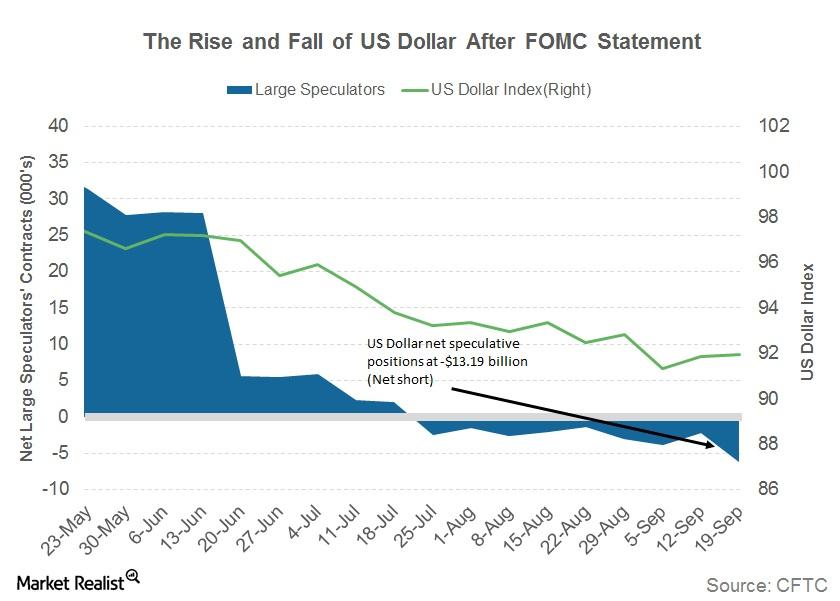

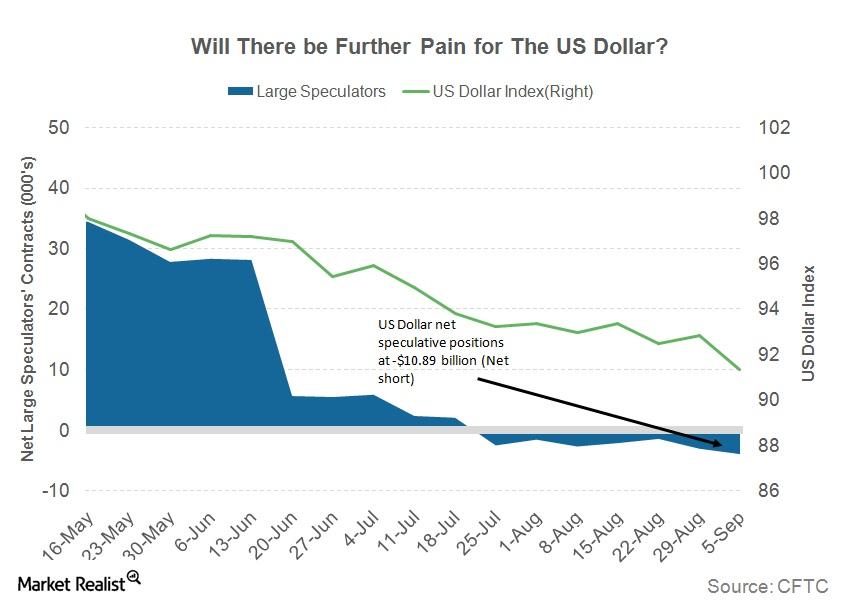

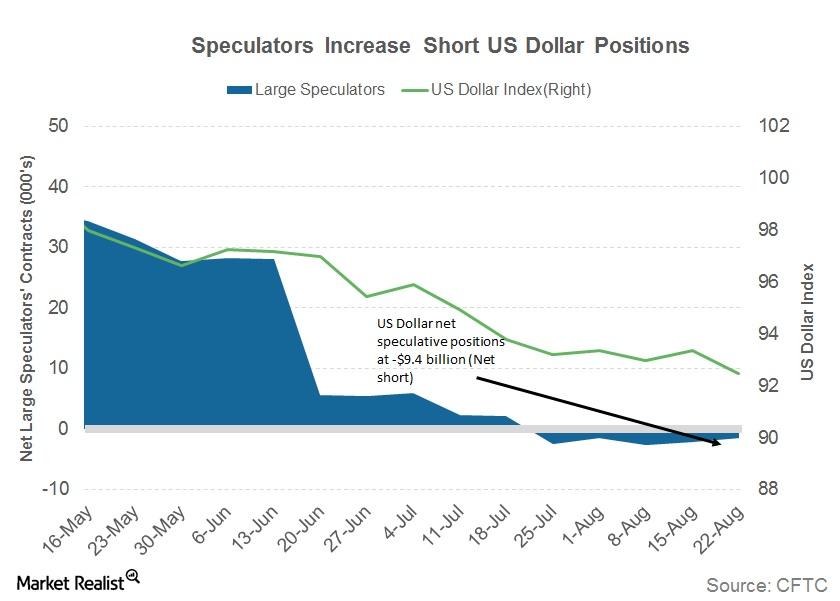

Why Speculators Continue to Bet against the US Dollar

The US Dollar Index (UUP) continued its rally last week, closing at 92.88 and posting a gain of 0.99% for the week.

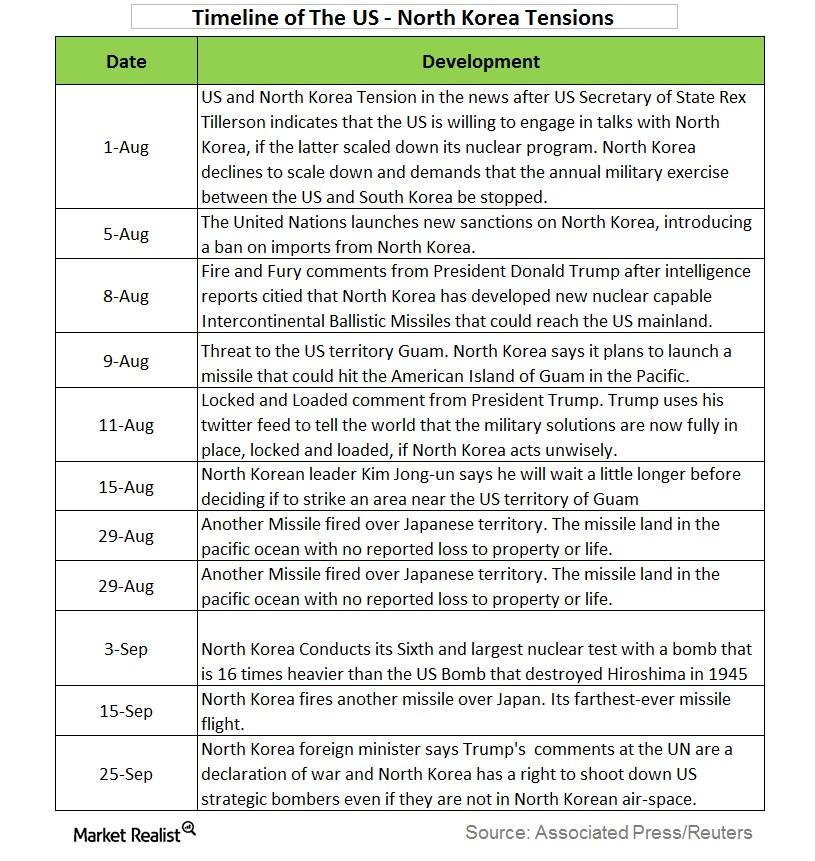

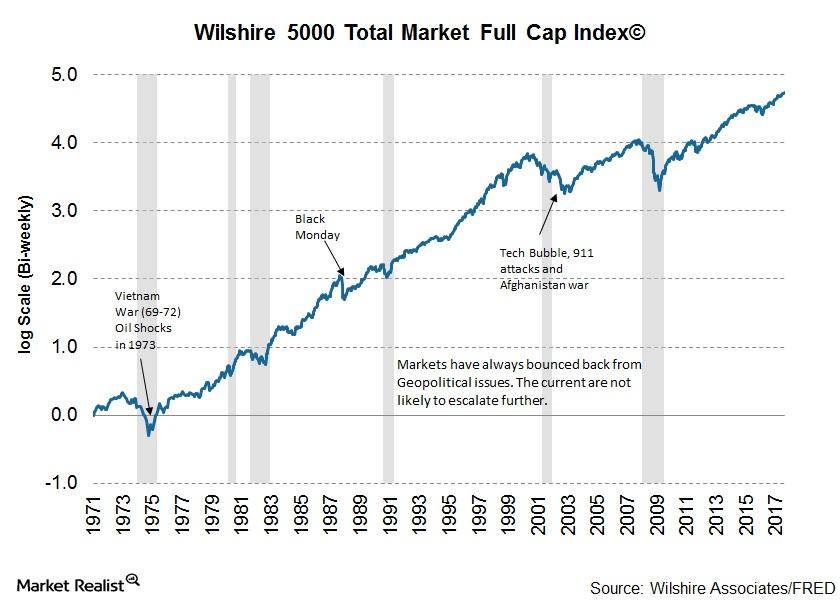

Effects of the North Korea–US Tension on Investors

Rising North Korea tensions In the last two months, tensions between the United and North Korea have continued to escalate, with both sides refusing to back down. North Korea has initiated a series of missile and nuclear tests, worsening tension in the region, and the US president has responded to these tests with strong warnings. […]

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

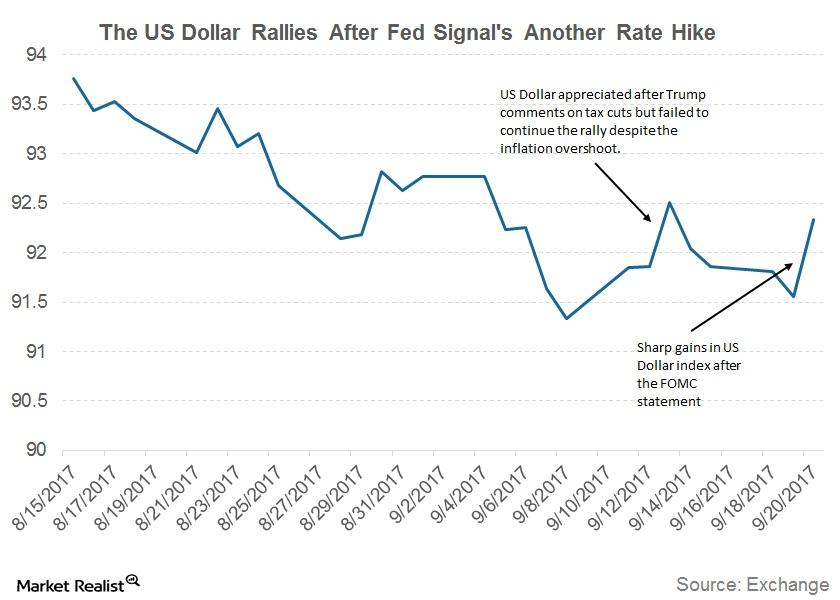

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

Bank of Japan Sees Rising Political Uncertainty as a Risk

According to news reports, Japanese Prime Minister Shinzo Abe could be calling for a snap election next month to capitalize on the increased approval ratings in August.

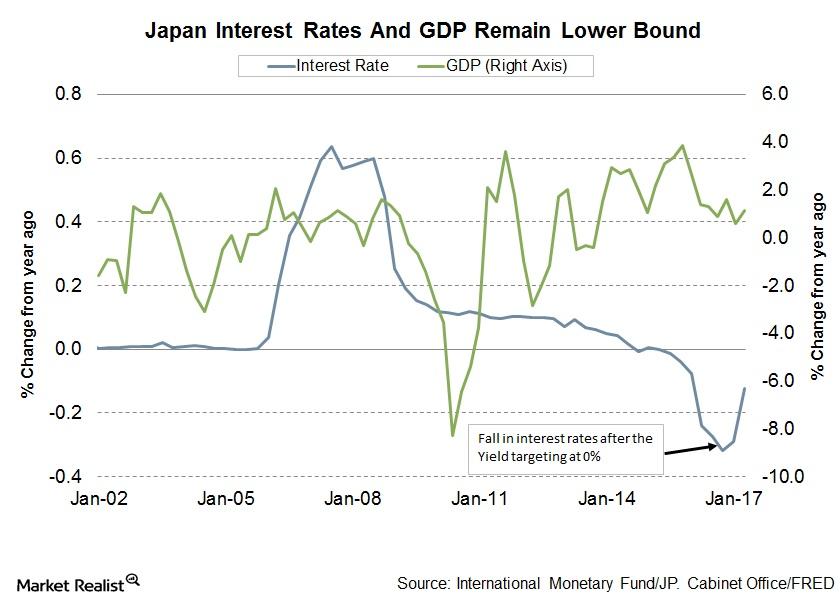

Update on the Bank of Japan’s September Policy Meeting

The Bank of Japan left its policy unchanged at its September meeting. By an 8–1 majority vote, the policy board decided to leave its policy and its QQE with a yield curve control unchanged.

Assessing the US Dollar’s Rally after the Latest Hawkish Fed Statement

The US dollar rallied after the latest FOMC (Federal Open Market Committee) meeting statement was released on September 20.

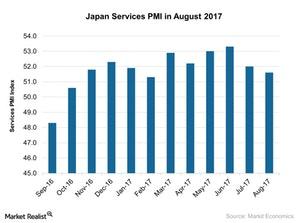

How Japan’s Service Activity Trended in August 2017

According to the latest report by Markit Economics, the Japan Services PMI (EWJ) (DXJ) stood at 51.6 in August 2017, compared with 52 in July 2017.

Will Election Uncertainty Drive the Japanese Yen Lower?

The Japanese yen (JYN) continued to depreciate against the US dollar last week.

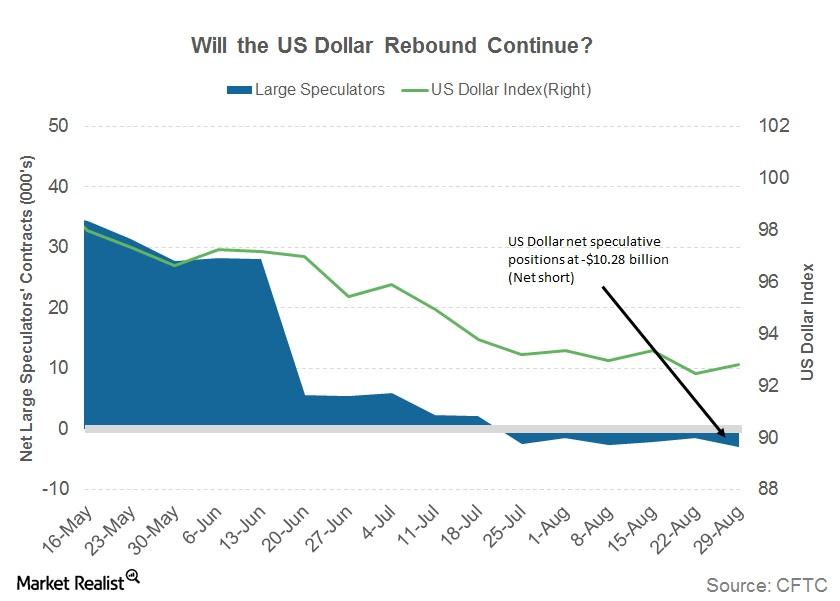

Why the US Dollar Saw a Sharp Rebound

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

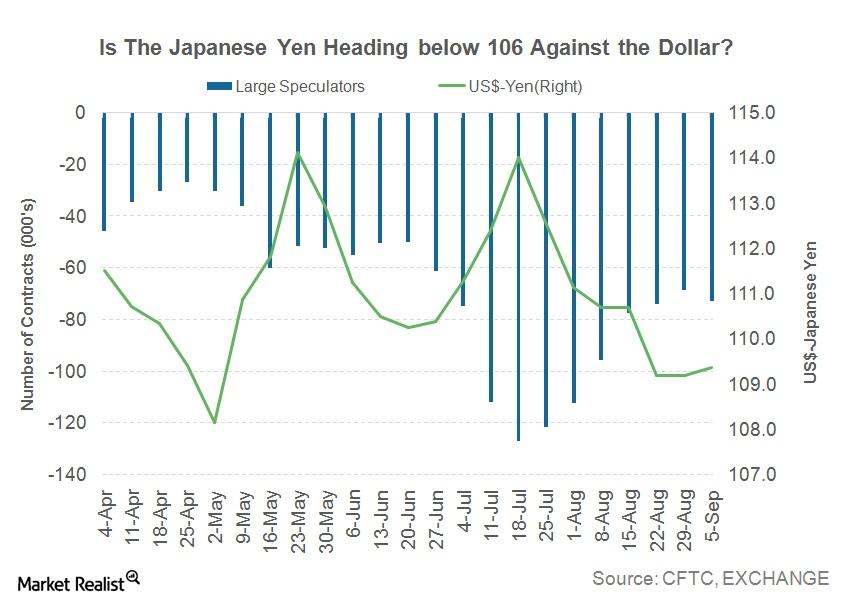

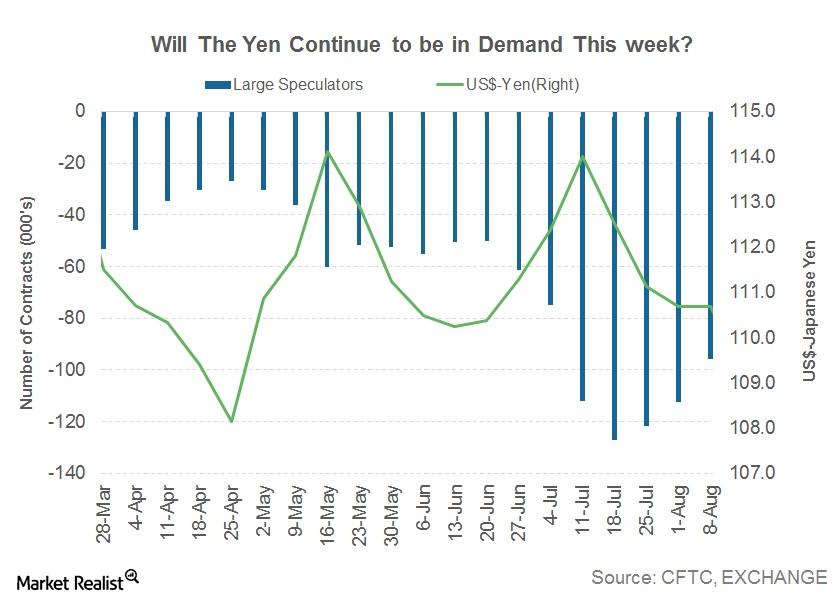

What Drove the Japanese Yen below 108 Last Week?

The Japanese yen gained ground against the US dollar last week, closing at 107.8 against the US dollar, which appreciated 0.56%.

Why the US Dollar Could Be Poised for Further Losses

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

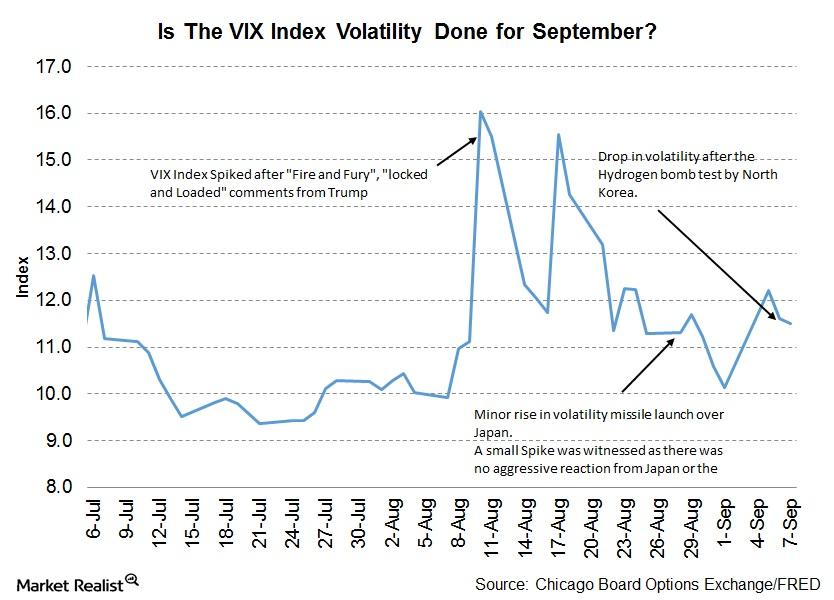

More Temporary Relief from North Korea Tensions?

This week volatility (VXX) has continued to stick to its trend of sudden spikes and then dropping immediately.

How Japan’s Manufacturing Activity Trended in August 2017

Japan’s manufacturing PMI stood at 52.2 in August 2017 as compared to 52.1 in July 2017.

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

Why the Euro Is Turning Out to Be a Preferred Safe Haven

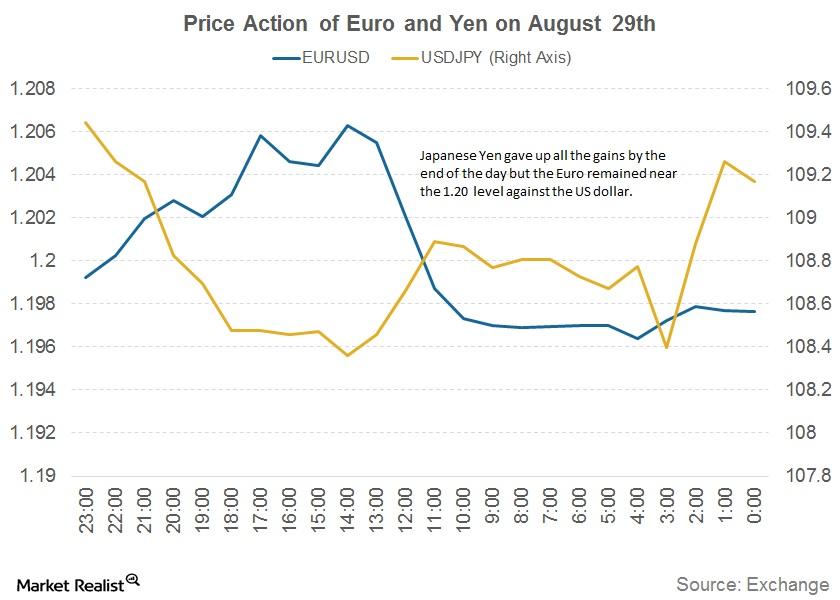

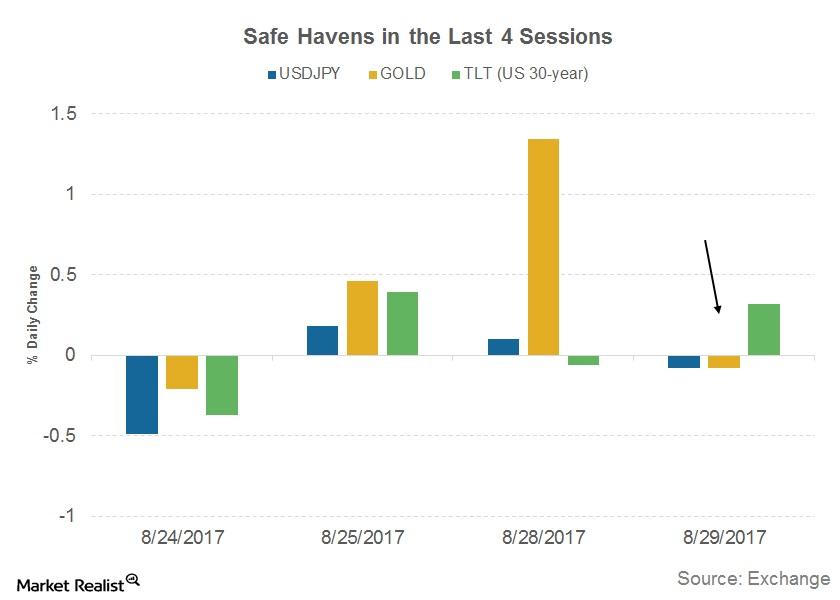

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

North Korea Tensions: Will Demand for Safe Havens Rise?

In the financial markets, there are a few financial assets whose demand increases dramatically in times of uncertainty.

Is the US Dollar Dying a Slow Death?

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

Washington or Wyoming: What Will Drive Markets This Week?

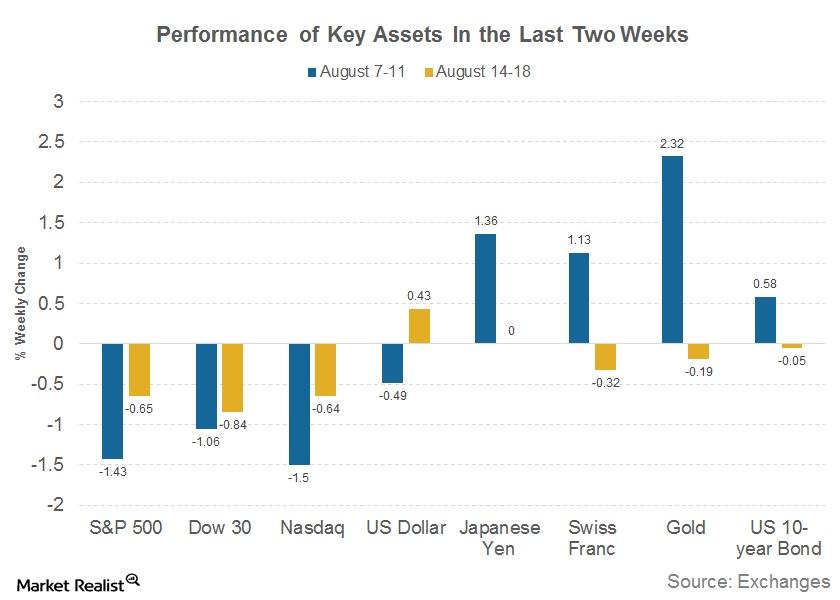

The last two weeks have been eventful for financial markets (SPY).

Will the Japanese Yen Appreciate Further This Week?

The Japanese yen (JYN) was back in demand as geopolitical tensions took center stage last week.

Do Financial Markets Have Another Tense Week Ahead?

Equity markets in the US and across the globe reported heavy losses as risk aversion set in.