Rajiv Nanjapla

Rajiv Nanjapla started working at Market Realist in 2015, covering the restaurant, home improvement, tobacco, and cannabis sectors. He has over seven years of experience in analyzing financial statements and writing financial research reports.

He also holds a post-graduate diploma in finance and operations. Prior to joining Market Realist, Rajiv worked with two other companies in various capacities.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rajiv Nanjapla

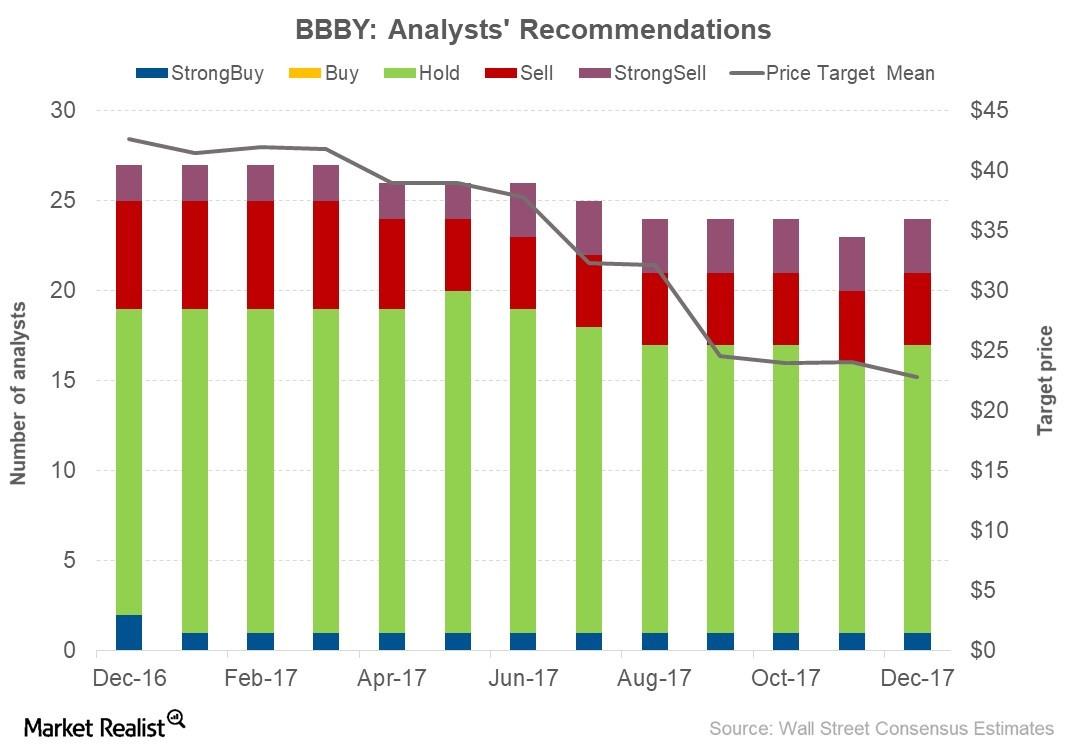

How Analysts Rate Bed Bath & Beyond after 3Q17 Earnings

As of December 21, 2017, Bed Bath & Beyond (BBBY) stock was trading at $21.50. That same day, analysts were expecting the stock to reach $22.78 in the next 12 months.

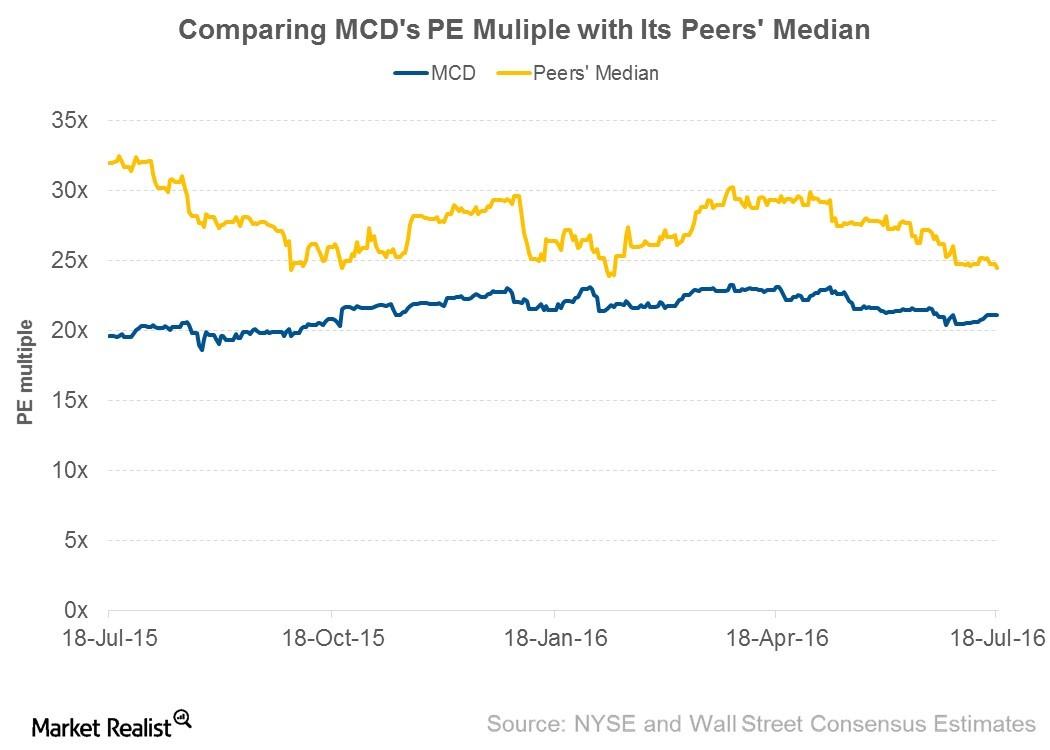

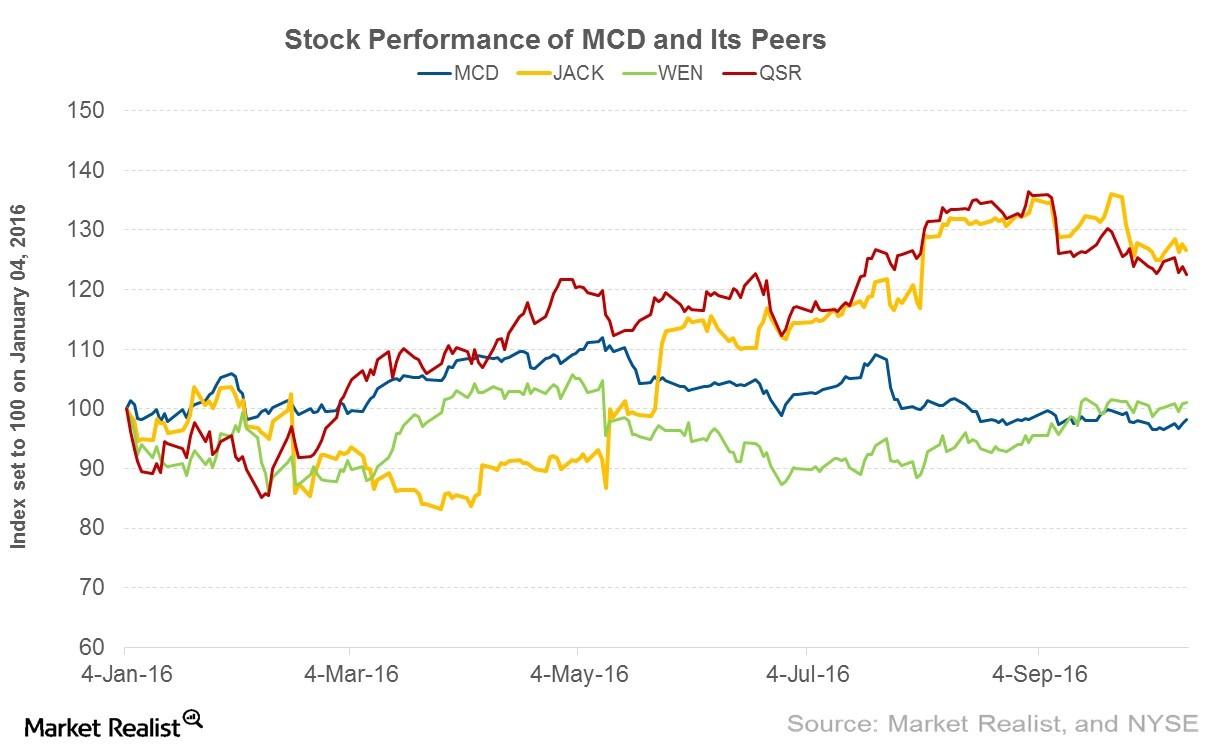

Can 2Q16 Results Drive McDonald’s Valuation Multiple Up?

Valuation multiple Investors should look at valuation multiples when deciding whether to enter or exit a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock. There are various multiples to evaluate a stock. In this article, we’ll use the PE (price-to-earnings) ratio due to its […]

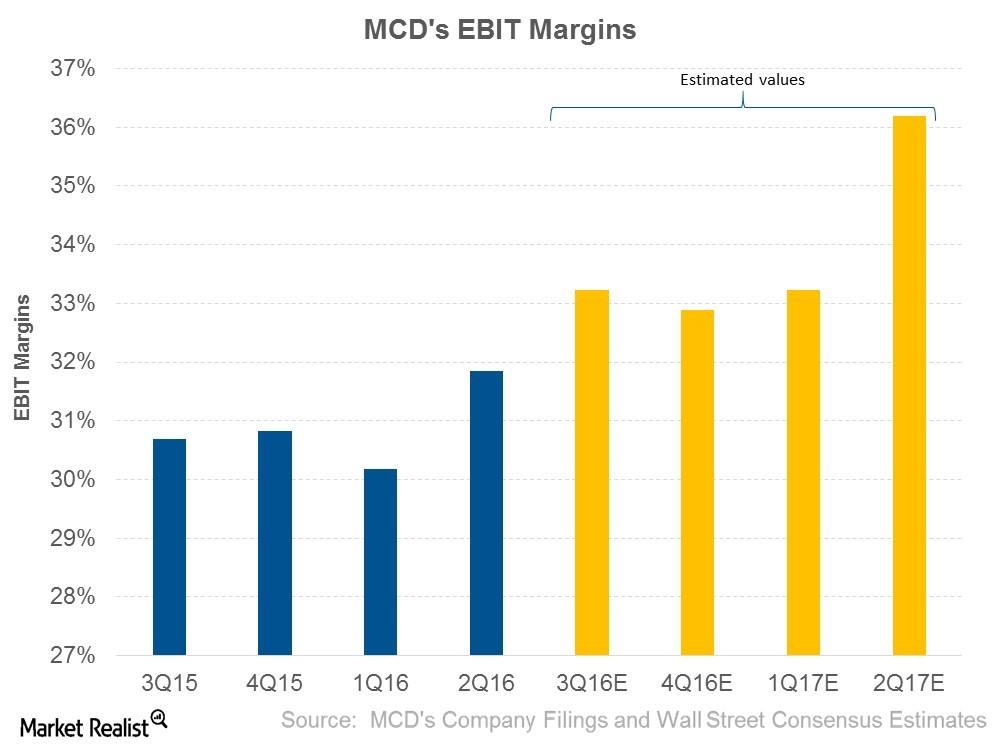

How Will McDonald’s Expand Its EBIT Margins?

Wall Street analysts are expecting McDonald’s (MCD) to post EBIT of $2.1 billion in 3Q16. This represents an EBIT margin of 33.2% compared to 30.7% in 3Q15.

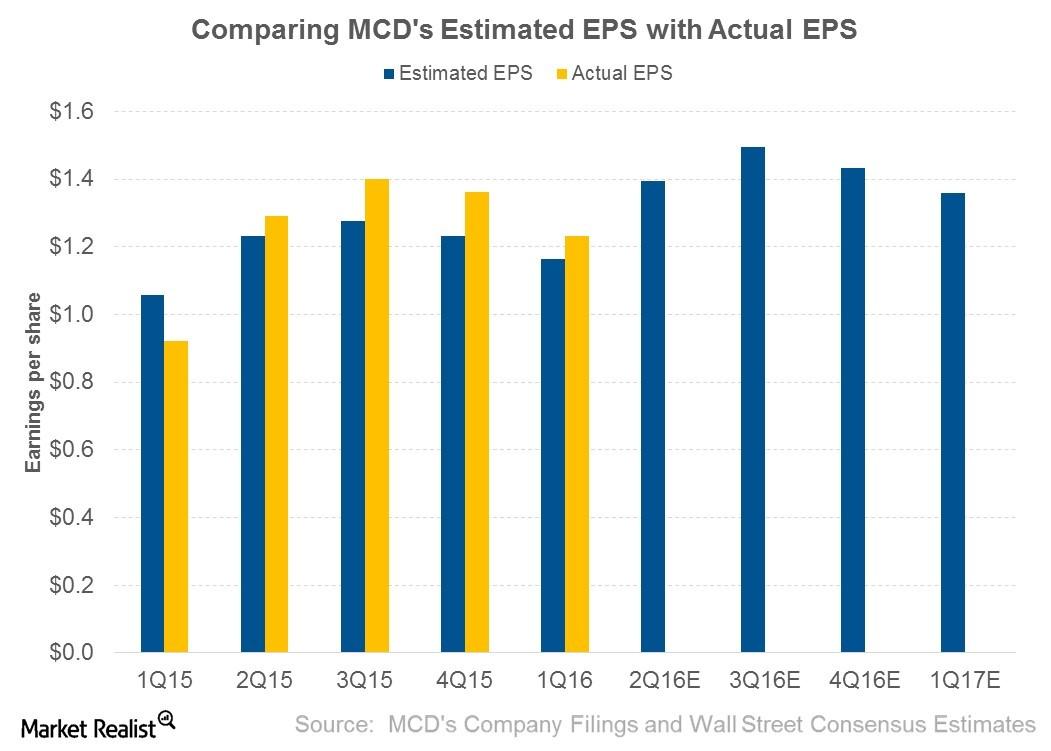

Will McDonald’s 2Q16 Earnings Beat Analysts’ Estimates?

So far in this series, we’ve discussed McDonald’s (MCD) estimated revenue, sources of revenue, and estimated EBIT (earnings before interest and tax) margins.

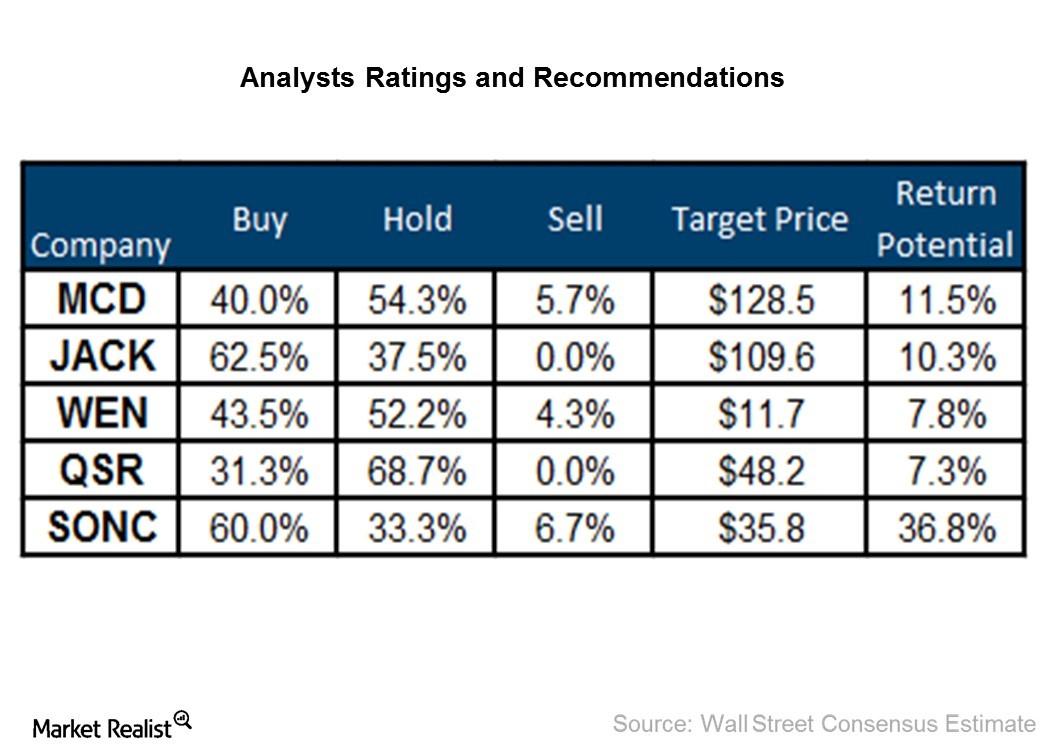

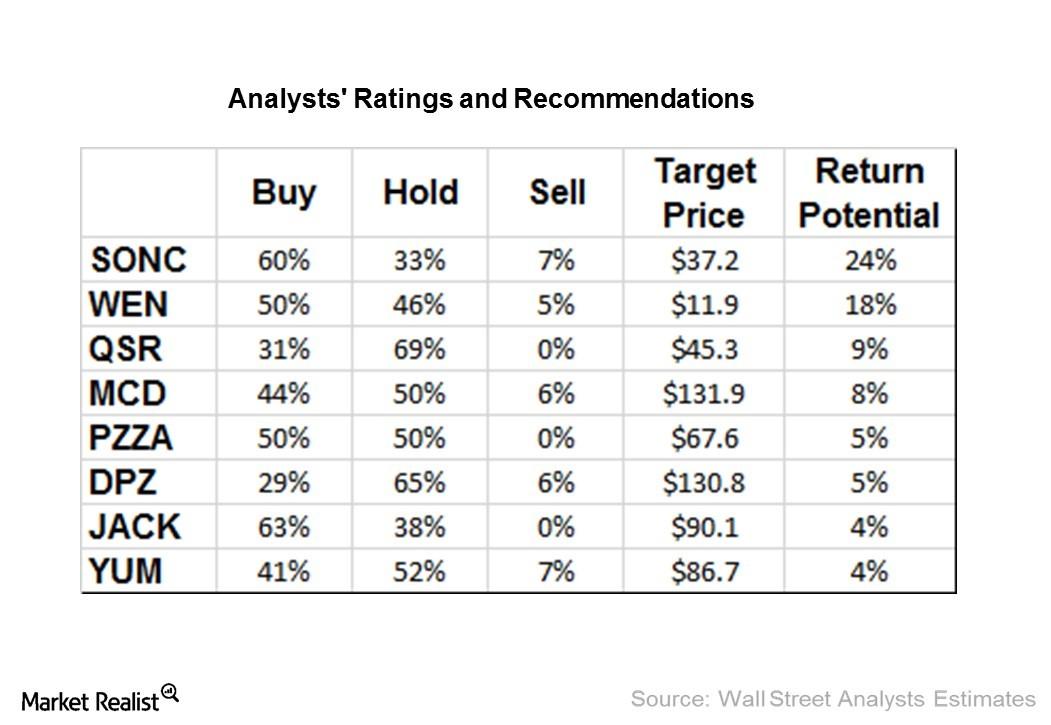

Which Fast Food Restaurants Do Analysts Favor?

Jack in the Box (JACK) and Restaurant Brands International (QSR) are analysts’ favorites among the companies we’ve reviewed in this series.

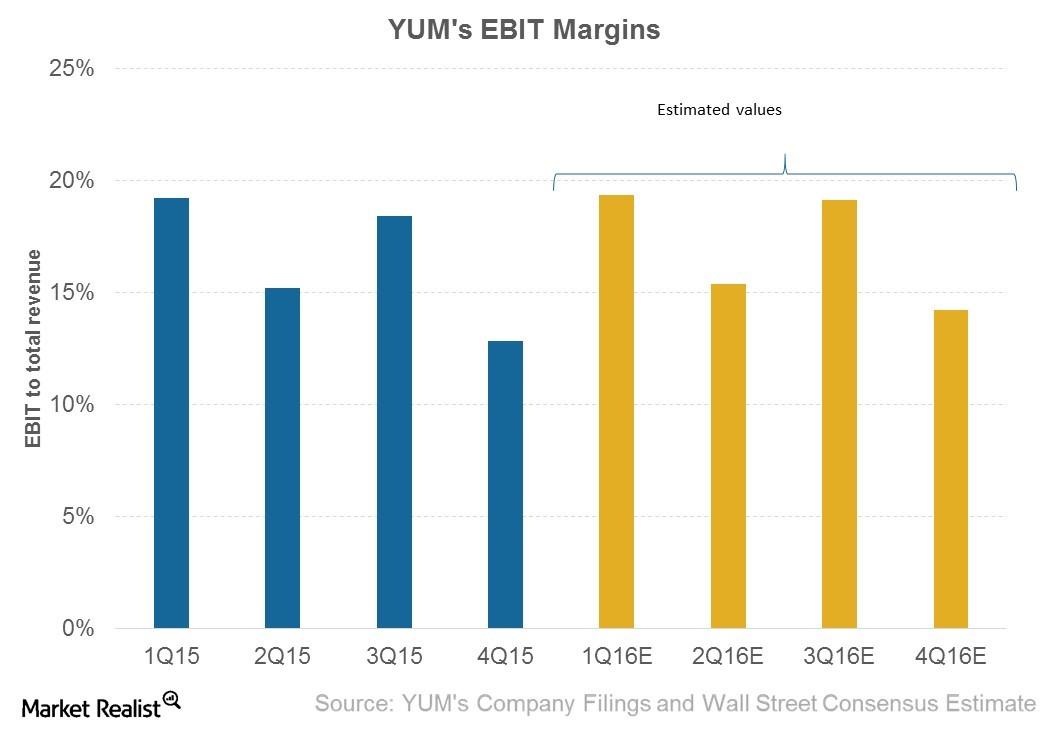

Could Yum! Brands’ Margins Increase in 1Q16?

With positive same-store sales growth expected in all three of YUM’s divisions, analysts are expecting the leverage to improve the company’s margins.

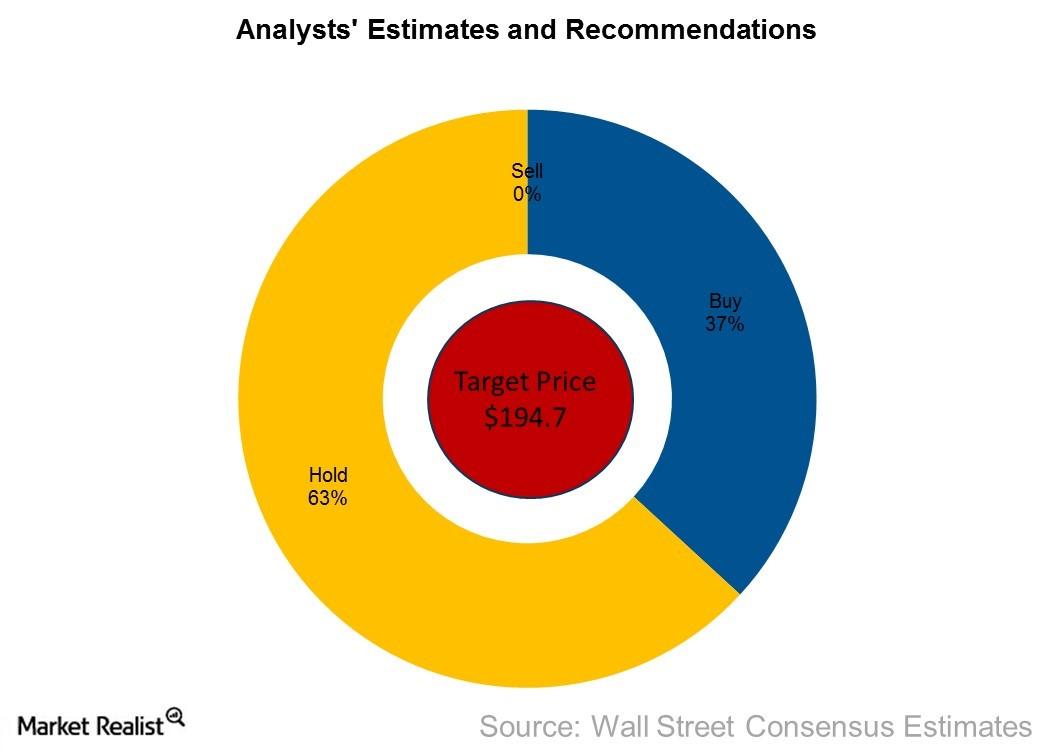

Why Analysts Say ‘Hold’ for Domino’s Stock ahead of Q1 Earnings

As of April 21, 2017, Domino’s Pizza (DPZ) was trading at $179.3. Domino’s stock price might have factored in the estimates we discussed in our previous articles.

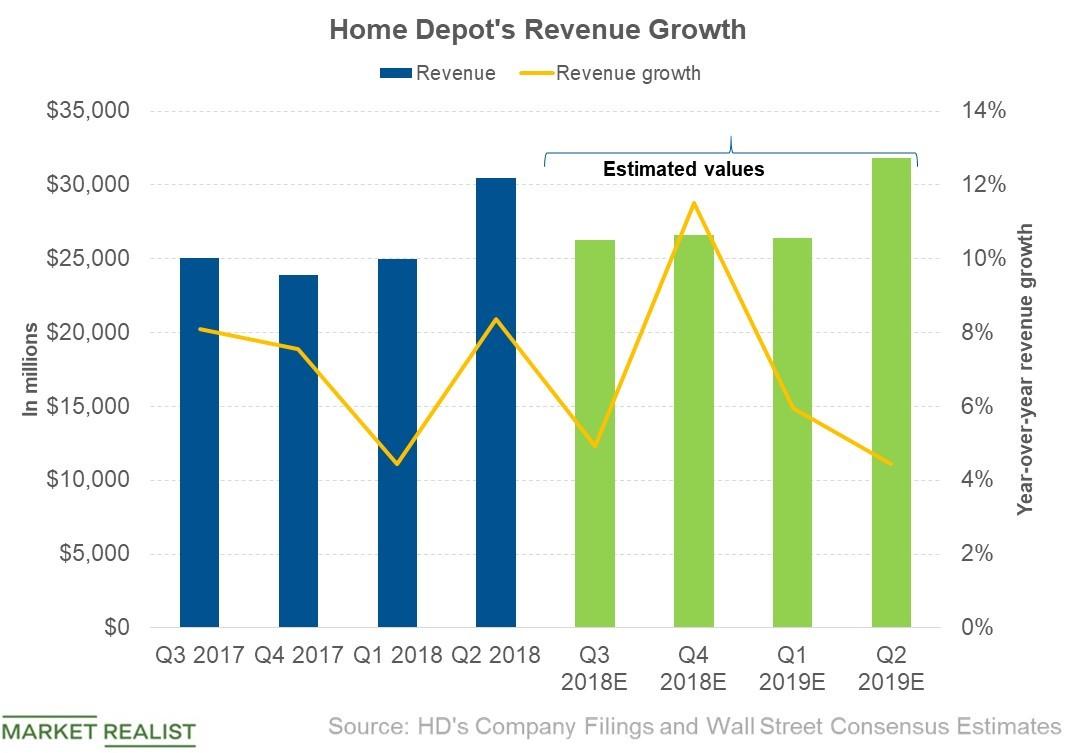

Why Analysts Expect Home Depot’s Revenue to Rise in Q3

Analysts expect Home Depot (HD) to post third-quarter revenue of $26.3 billion, a rise of 4.9% year-over-year.

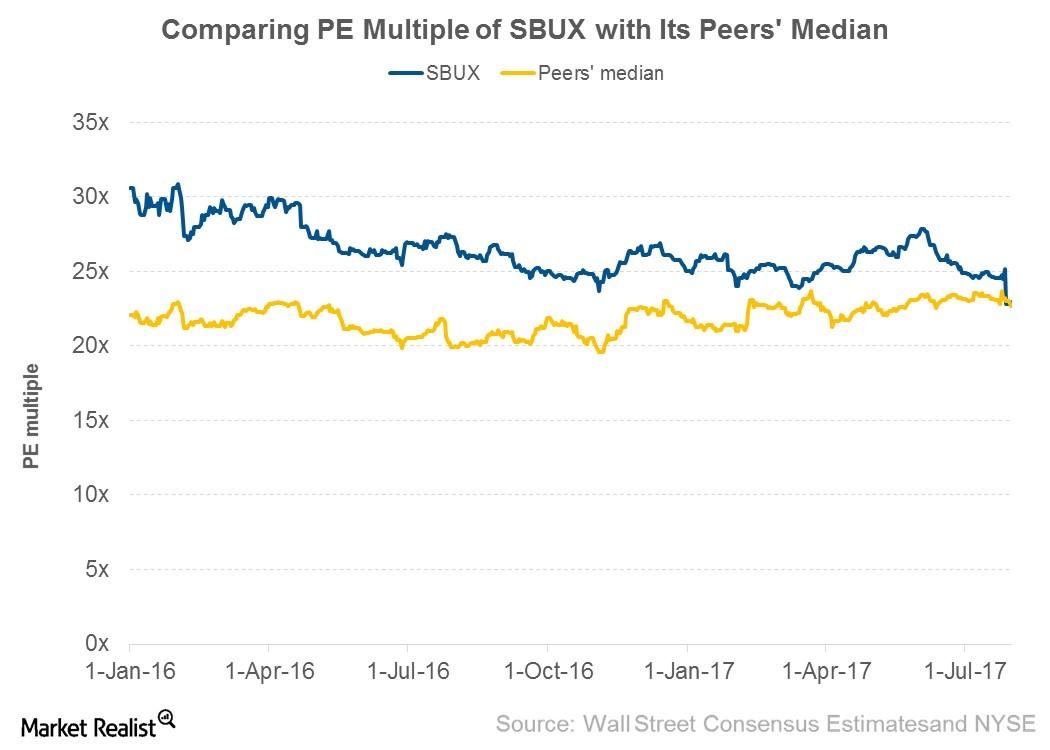

Weak Fiscal 3Q17 Sales Lower Starbucks’s Valuation Multiple

Valuation multiple We’ve used the forward PE (price-to-earnings) multiple for our analysis, due to its high visibility in Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for the next four quarters. Starbucks’s forward PE multiple Starbucks’ lower-than-expected SSSG (same-store sales growth) in fiscal 3Q17, lowering of […]

Can Investors Expect Momentum from McDonald’s 3Q16 Earnings?

McDonald’s (MCD) is scheduled to announce its 3Q16 results on October 21, 2016. As of October 13, 2016, it was trading at $115.40, a fall of 9.4% from July 25.

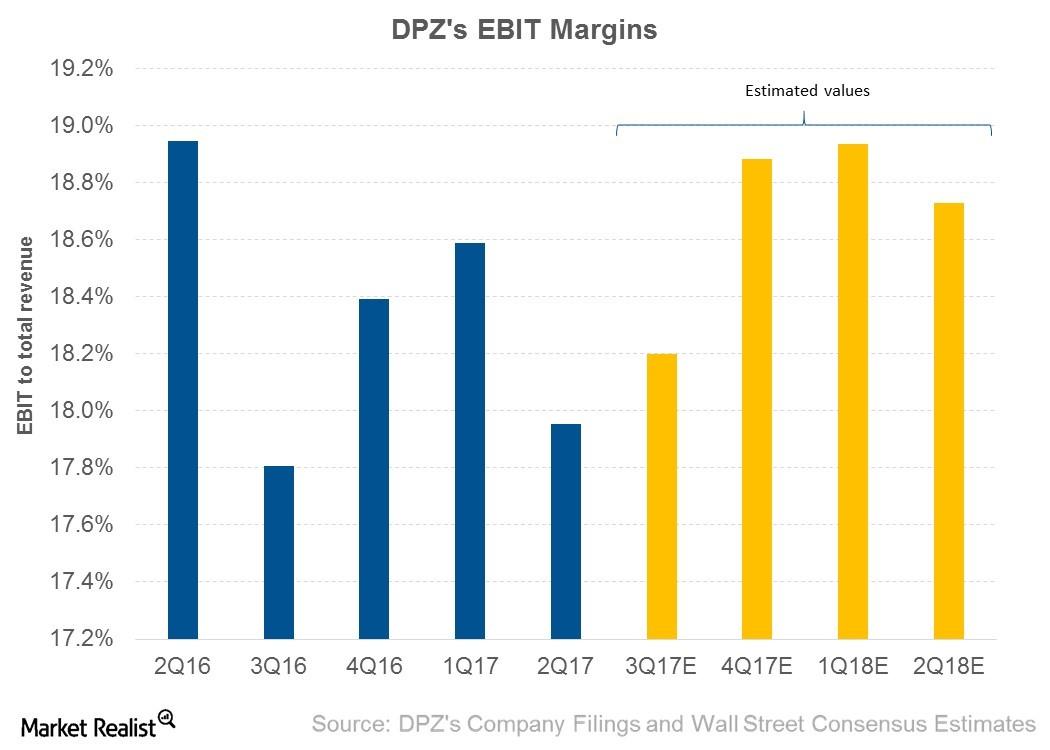

Why Did Domino’s EBIT Margin Decline in 2Q17?

For 2Q17, Domino’s (DPZ) posted EBIT (earnings before interest and tax) of $113.27 million, which represents an EBIT margin of 18.0%, compared with 18.9% in 2Q16.

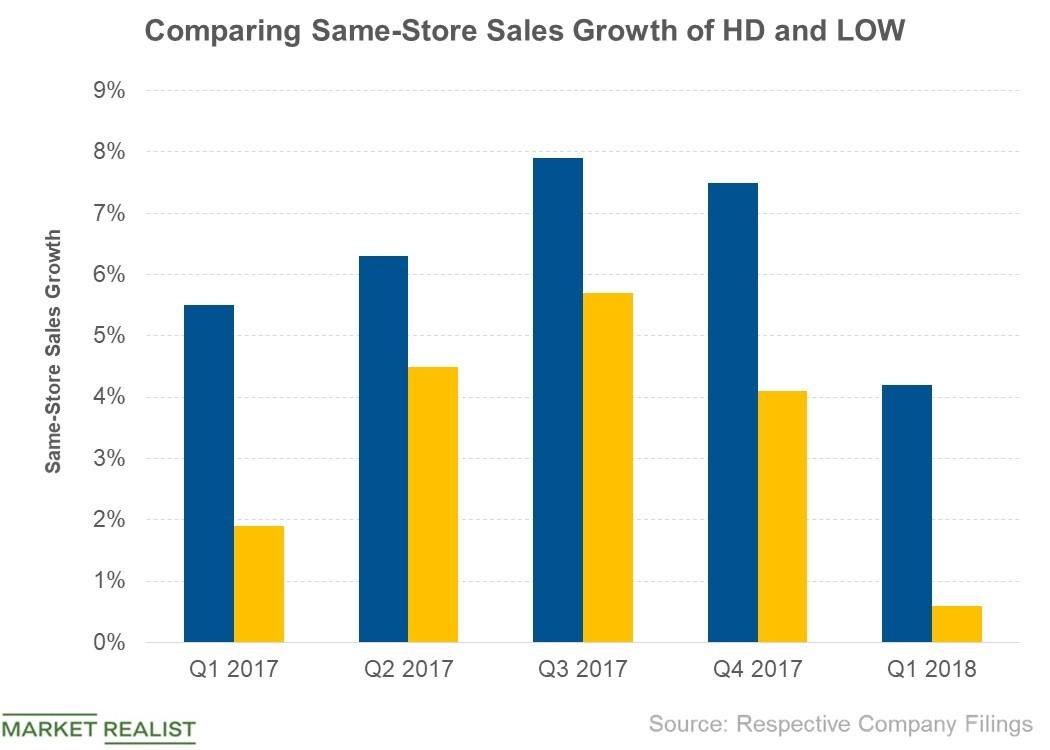

Why Both HD and LOW Failed to Meet Growth Estimates in Q1 2018

In the first quarter, Home Depot (HD) posted SSSG (same-store sales growth) of 4.2%, lower than analysts’ consensus expectation of 5.4%.

Philip Morris Stock Falls on Weak 3Q17 Earnings

Philip Morris International (PM) announced its 3Q17 earnings on October 19. The company posted adjusted EPS (earnings per share) of $1.27 on revenues of $7.47 billion.

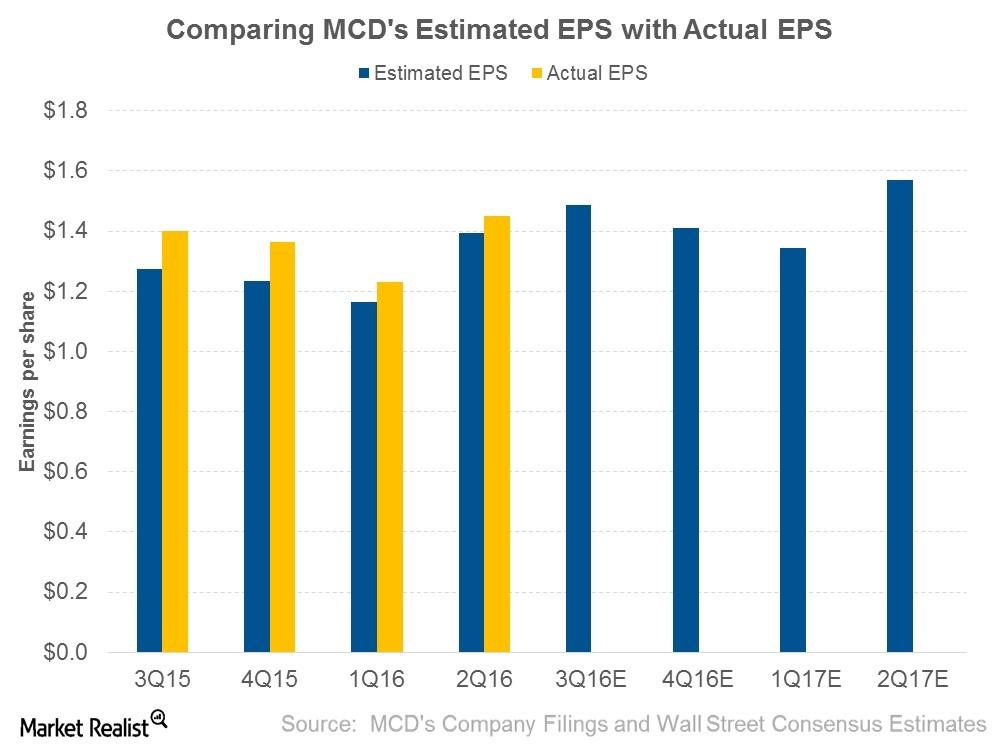

Can McDonald’s Beat Analysts’ Earnings Estimates Again in 3Q16?

In the last four quarters, McDonald’s has beaten analysts’ estimates. In 3Q16, analysts are expecting the company to post EPS of $1.48, a year-over-year rise of 6.1%.

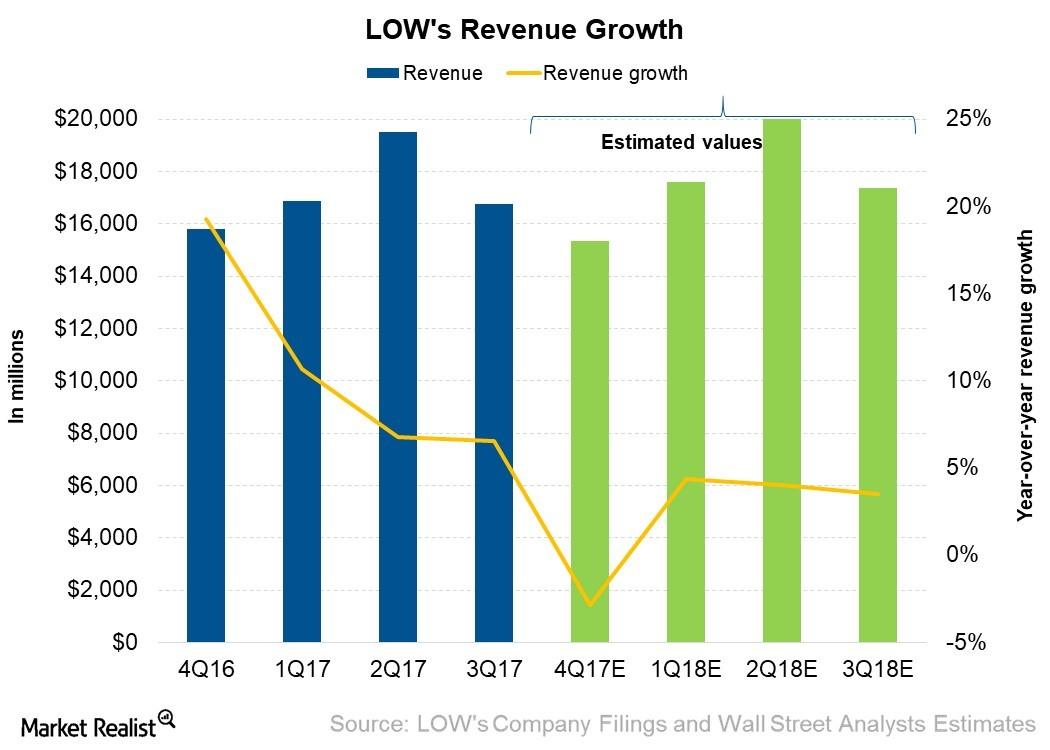

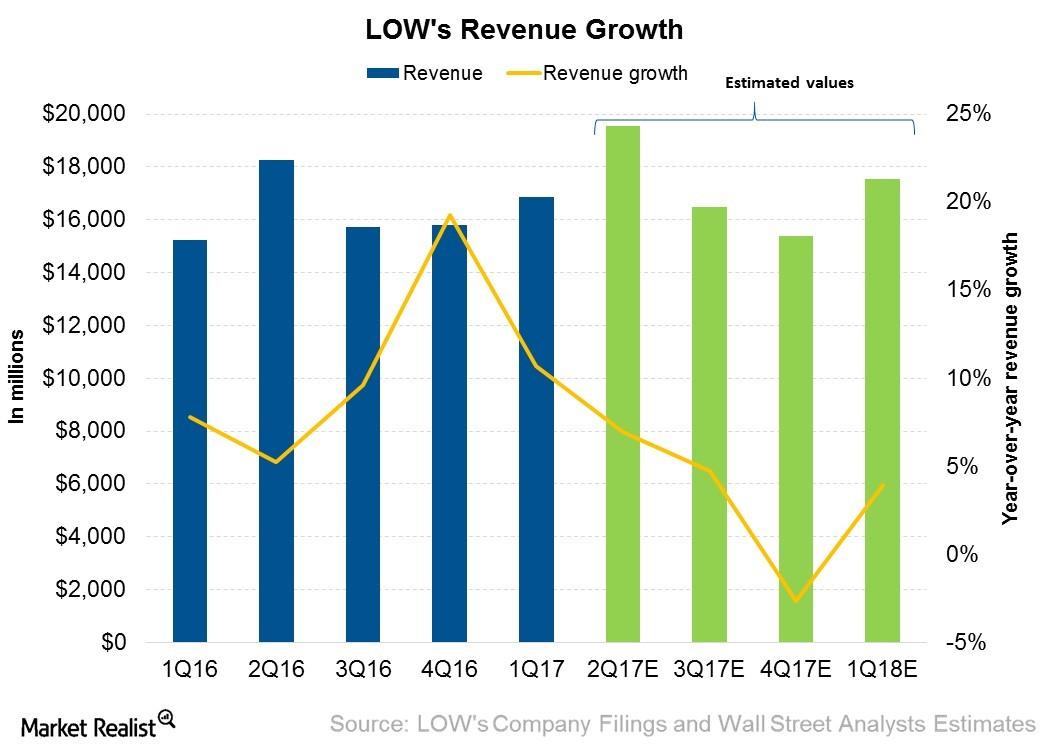

What Wall Street Expects for Lowe’s 4Q17 Revenue

Analysts expect Lowe’s (LOW) to post revenue of $15.33 billion in 4Q17, which represents a fall of 2.9% from $15.78 billion in 4Q16.

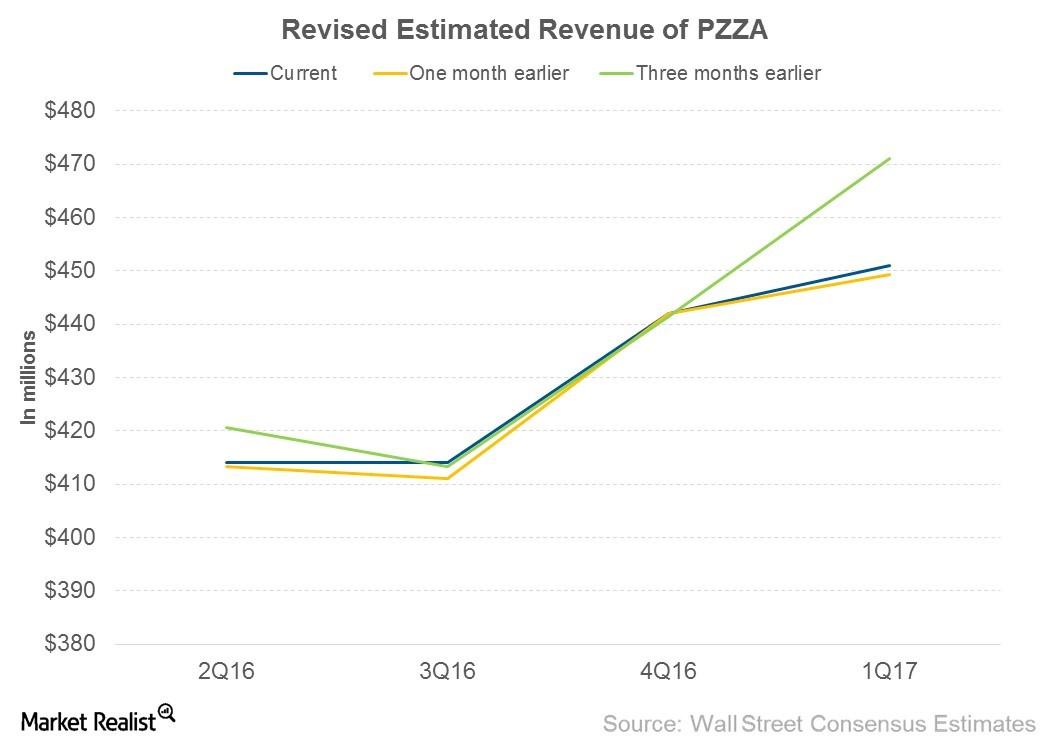

Why Have Analysts Raised their Revenue Estimates for Papa John’s?

In 1Q16, PZZA’s domestic company-owned restaurants generated nearly 48% of Papa John’s revenue, while domestic commissaries and others generated 39.4%.

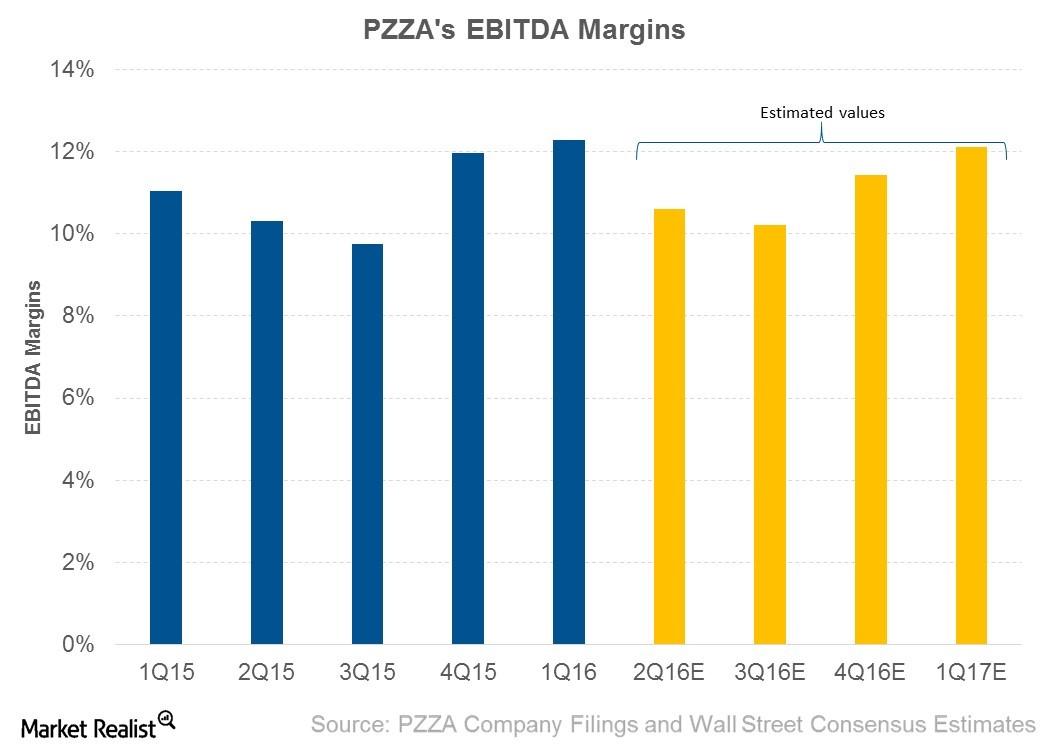

Why Are Analysts Expecting Papa John’s EBITDA Margins to Expand in 2Q16?

Analysts expect Papa John’s (PZZA) to post EBITDA of $43.9 million in 2Q16. This represents an EBITDA margin of 10.6%, compared to 10.3% in 2Q15.

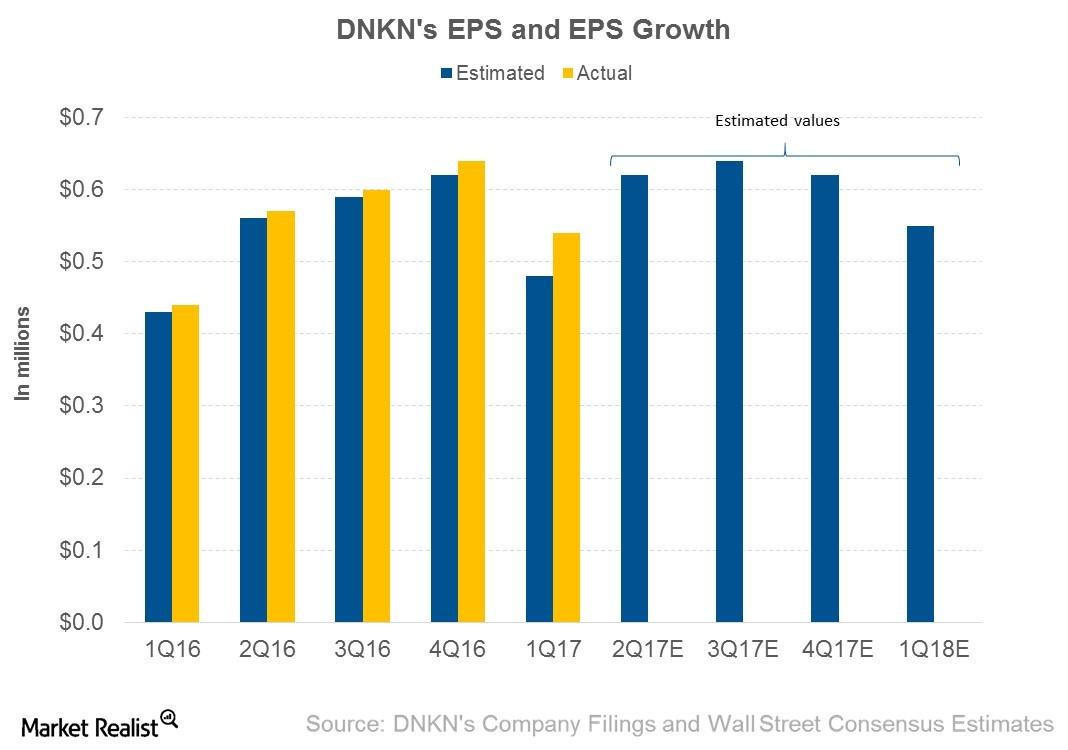

What Will Drive Dunkin’ Brands’ 2Q17 Earnings?

In 2Q17, analysts expect Dunkin’ Brands (DNKN) to post EPS (earnings per share) of $0.62, which represents a rise of 8.8% from its EPS of $0.57 in 2Q16.

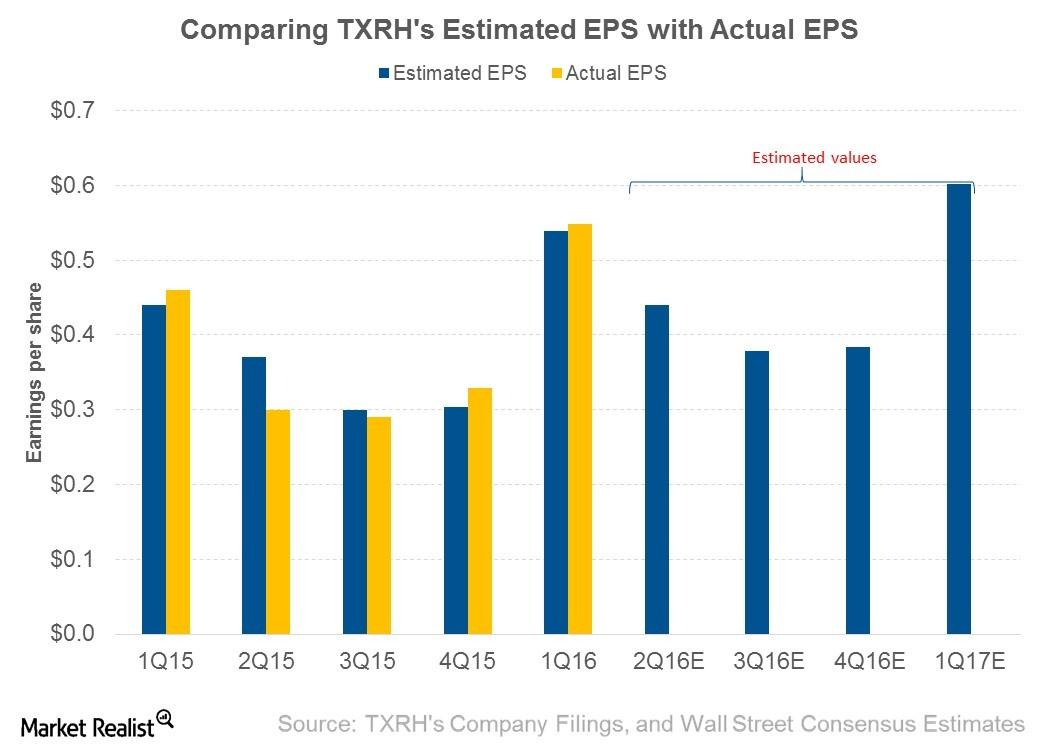

Texas Roadhouse’s 1Q16 EPS Was below Analyst’s Expectations?

In 1Q16, Texas Roadhouse posted EPS of $0.5. This was lower than analysts’ estimate of $0.54. The adjusted EPS was above analysts’ estimate at $0.55.

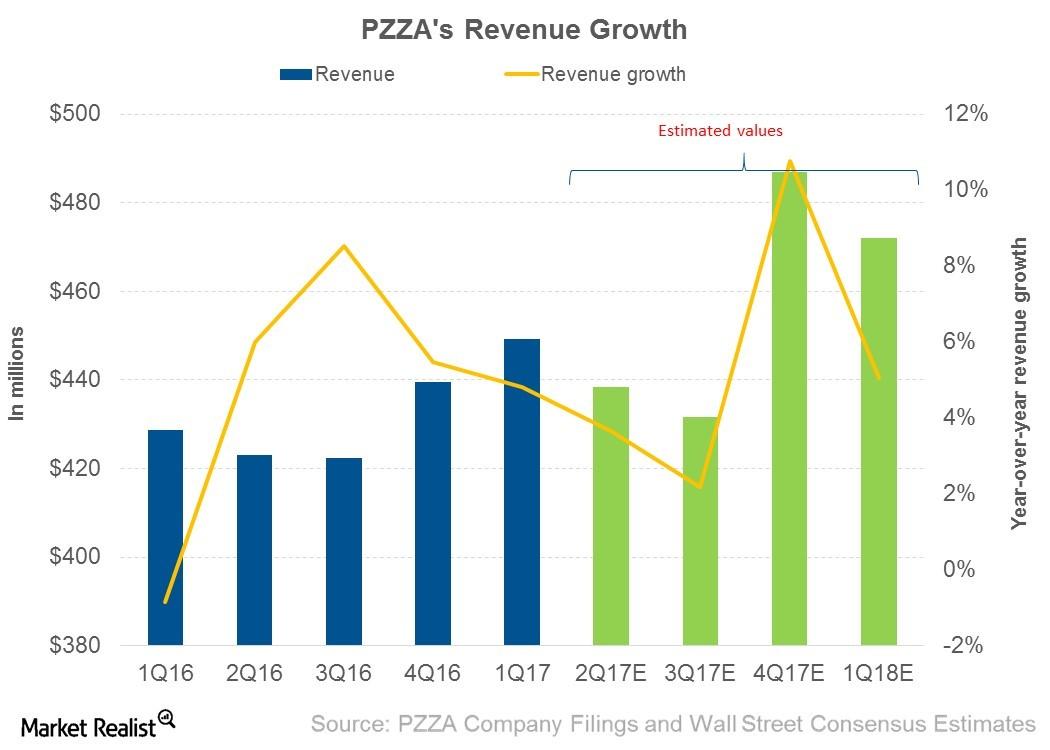

Papa John’s Revenue Estimates for the Next 4 Quarters

For the next four quarters, analysts expect Papa John’s (PZZA) to post revenue of $1.83 billion, which represents growth of 5.5%.

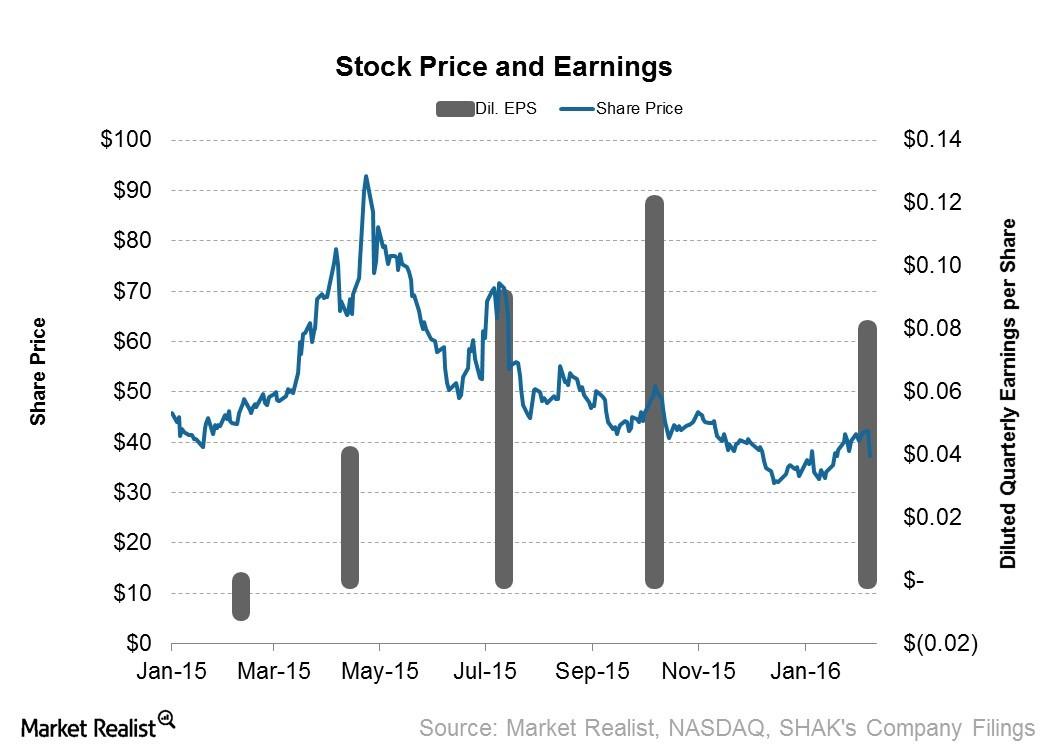

What Is the Outlook for Shake Shack in 2016?

A New York–based fine casual restaurant chain, Shake Shack (SHAK) announced its 4Q15 results on March 7, 2016. SHAK reported an overall revenue of $51.1 million and earnings per share of $0.08.

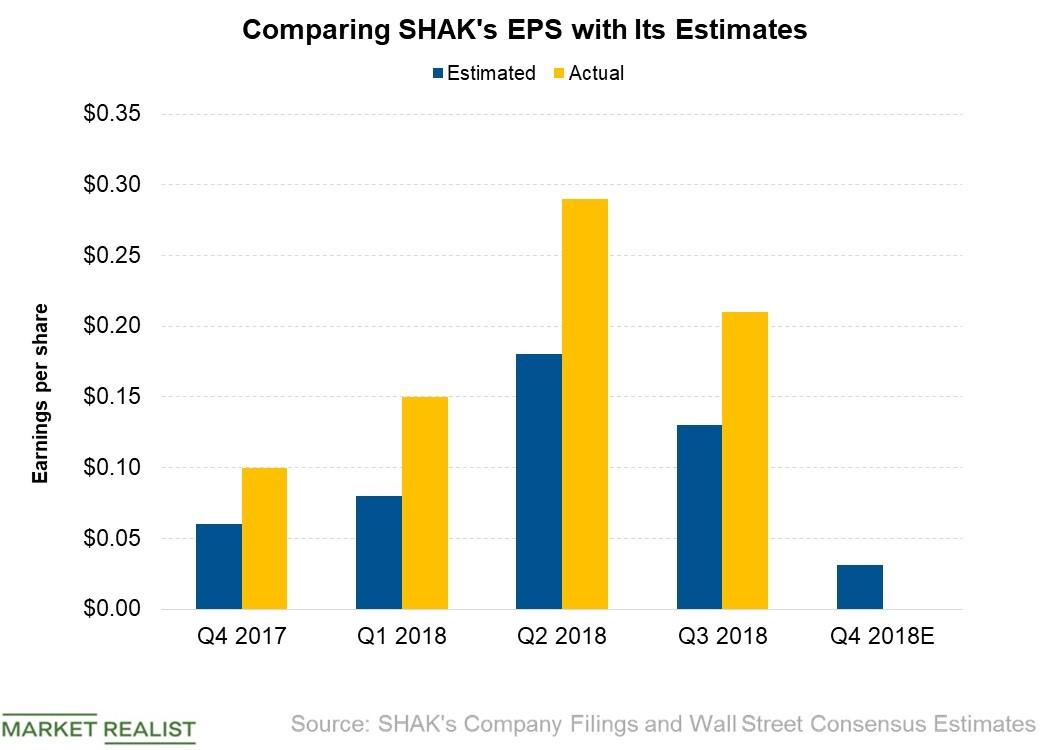

Why Analysts Expect Shake Shack’s EPS to Fall in Q4

In the fourth quarter, analysts expect Shake Shack (SHAK) to post adjusted EPS of $0.03, a fall of 69% from $0.10 in the corresponding quarter of 2017.

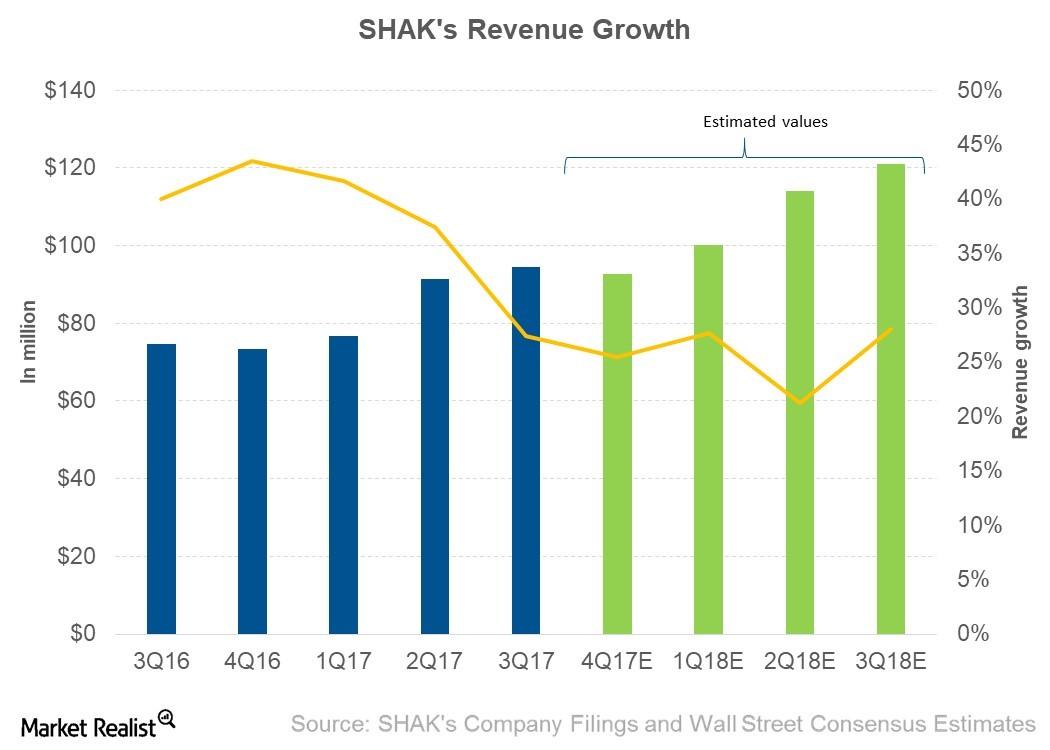

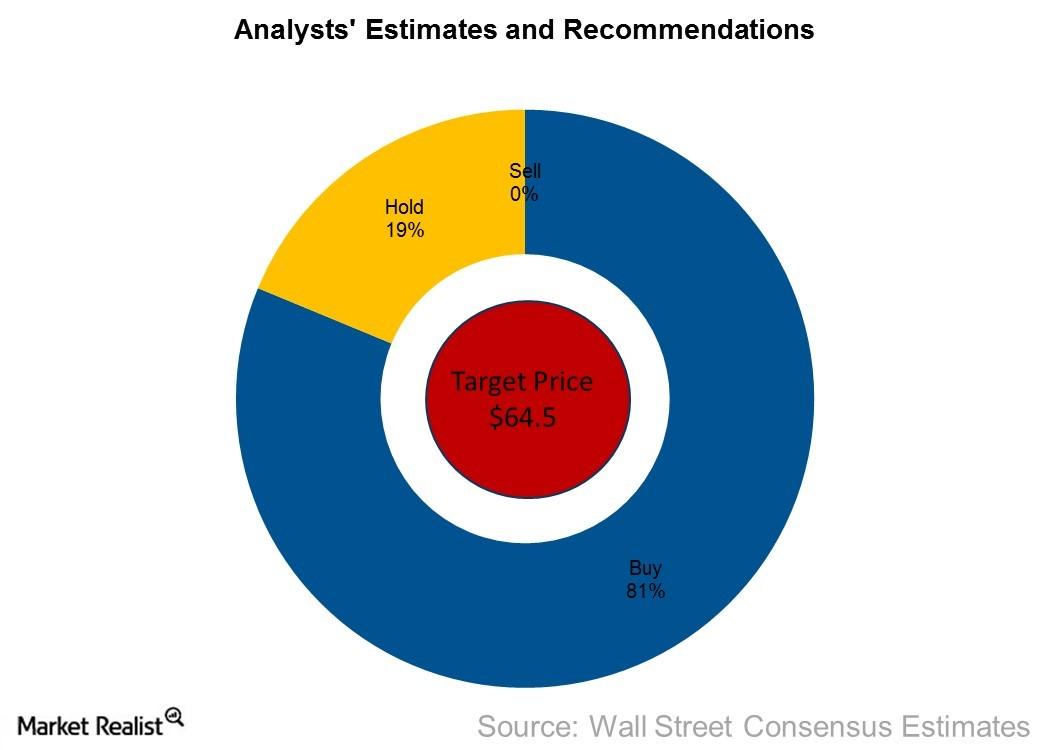

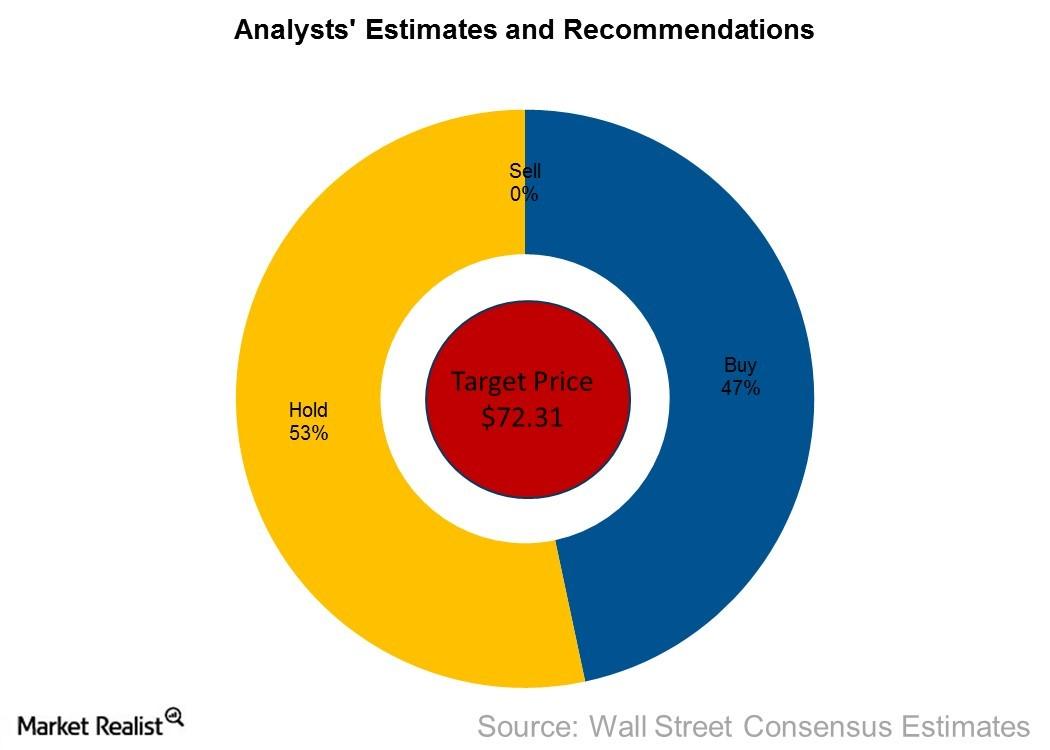

Why Analysts Are Expecting Shake Shack to Rise over the Next 4 Quarters

For the next four quarters, analysts are expecting Shake Shack (SHAK) to post revenues of $427.9 million, which would be a 27.4% YoY (year-over-year) rise.

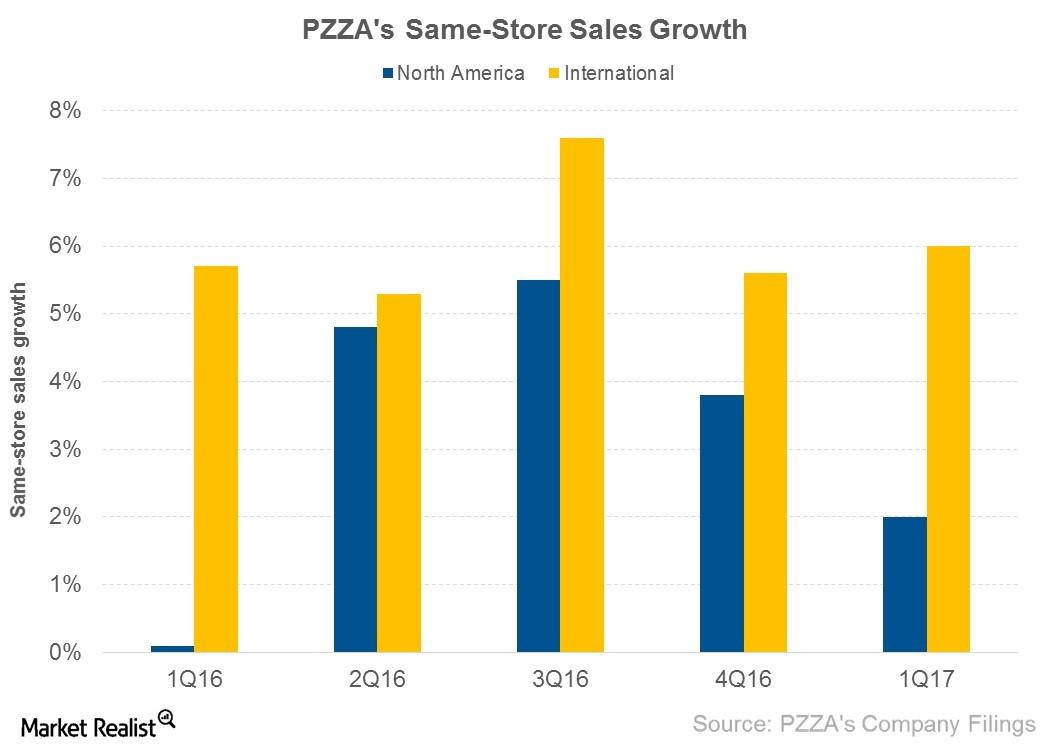

Factors That Drove Papa John’s Same-Store Sales Growth in 1Q17

In 1Q17, Papa John’s (PZZA) restaurants in North America posted SSSG of 2%. Company-owned restaurants posted SSSG of 3%, and franchised restaurants posted SSSG of 1.7%.

Why Analysts Are Recommending “Buy” for Starbucks

Target price On January 13, 2017, Starbucks (SBUX) was trading at $57.85. The company’s share price may already have been factored into the estimates we’ve discussed in this series. In this article, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months. Despite Starbucks posting strong 4Q16 earnings […]

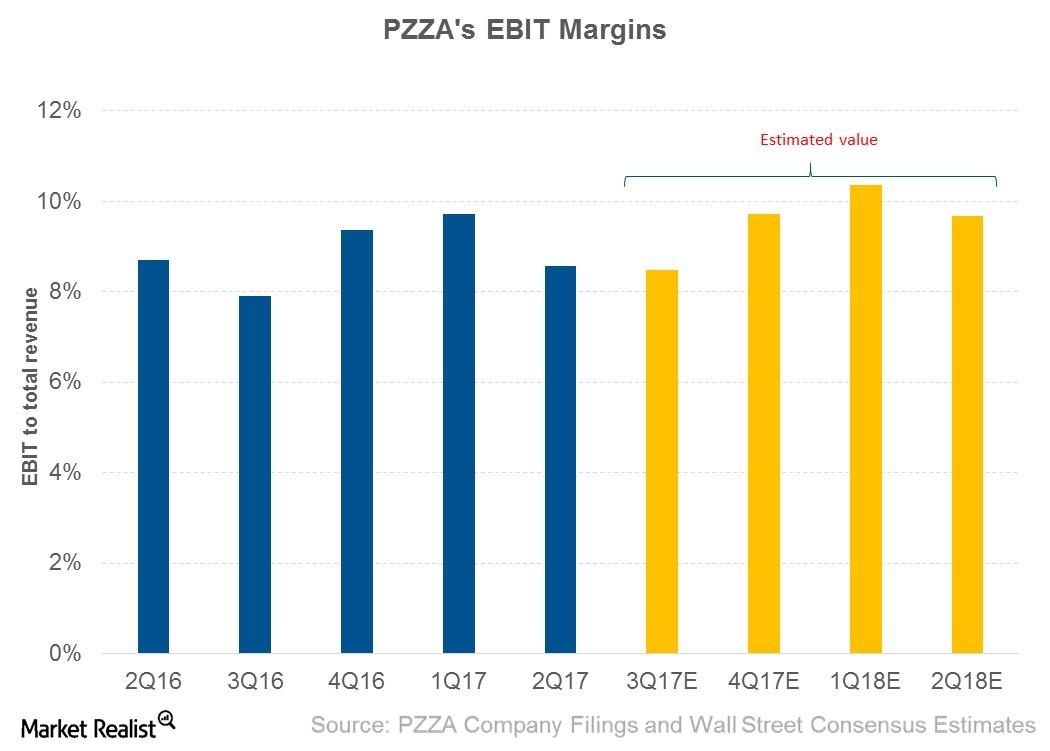

Why Papa John’s Earnings Margin Narrowed in 2Q17

Performance in 2Q17 In 2Q17, Papa John’s International (PZZA) posted EBIT (earnings before interest and tax) of $37.2 million, which represents an EBIT margin of 8.6%. In comparison, the company posted an EBIT margin of 8.7% in 2Q16. Why Papa John’s margins narrowed Papa John’s EBIT margins were impacted by a rise in the cost of […]

Why Investors Are Confident in YUM ahead of Its 3Q16 Results

Yum! Brands develops, operates, franchises, and licenses the Pizza Hut, KFC, and Taco Bell brands. It’s set to announce its 3Q16 results on October 5, 2016.

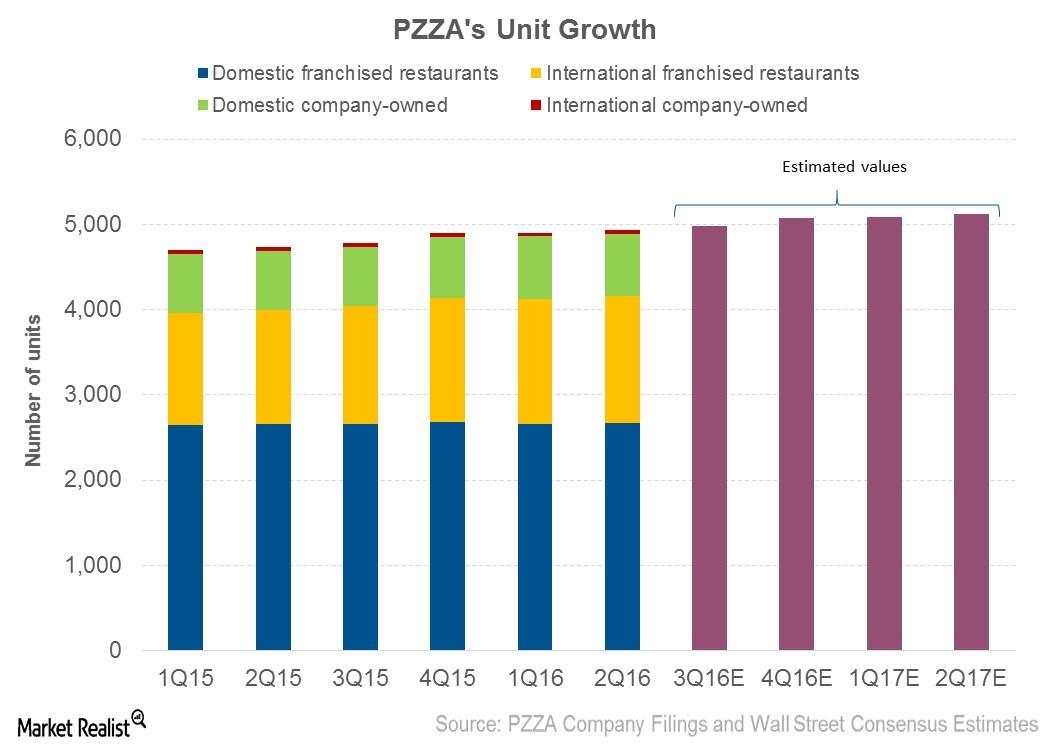

Franchising Dominates Papa John’s Expansion Plans

With 42 units added in the first two quarters of 2016, Papa John’s has maintained its 2016 guidance for unit growth at 180–200 units.

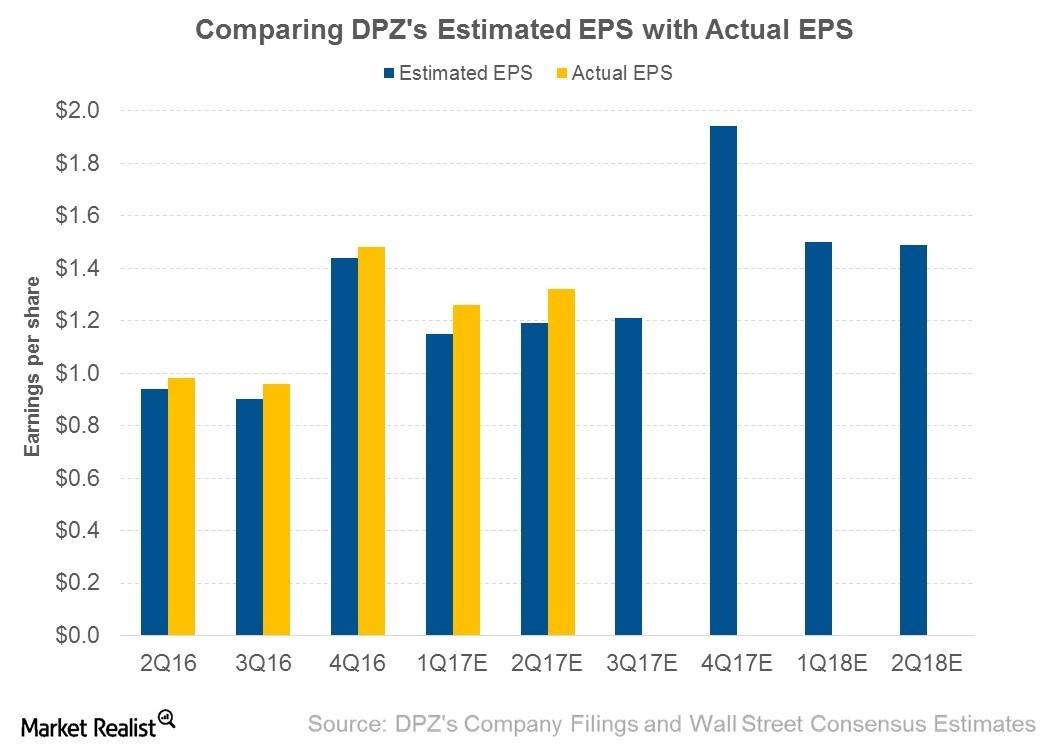

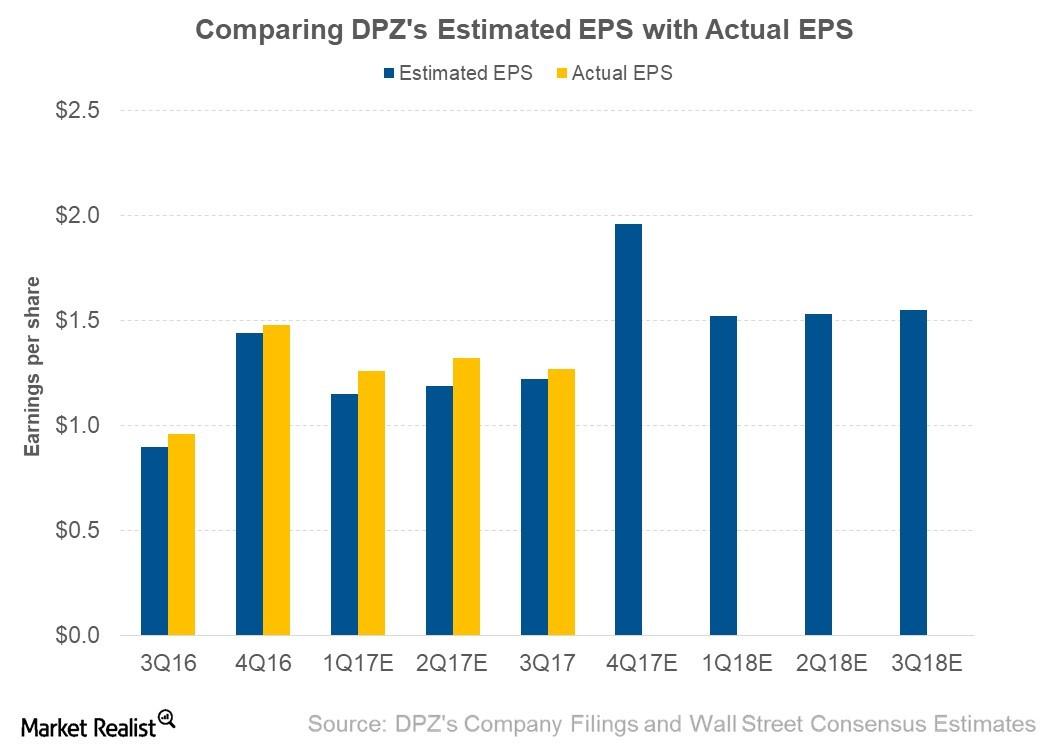

Could Domino’s Earnings Rise in the Next 4 Quarters?

Earnings expectations For the next four quarters, analysts expect Domino’s Pizza (DPZ) to post EPS (earnings per share) of $6.14, which represents a growth of 22.3% from the EPS of $5.02 seen in the four quarters prior. EPS growth Domino’s EPS growth is expected to be driven by higher revenue, EBIT (earnings before interest and tax) […]

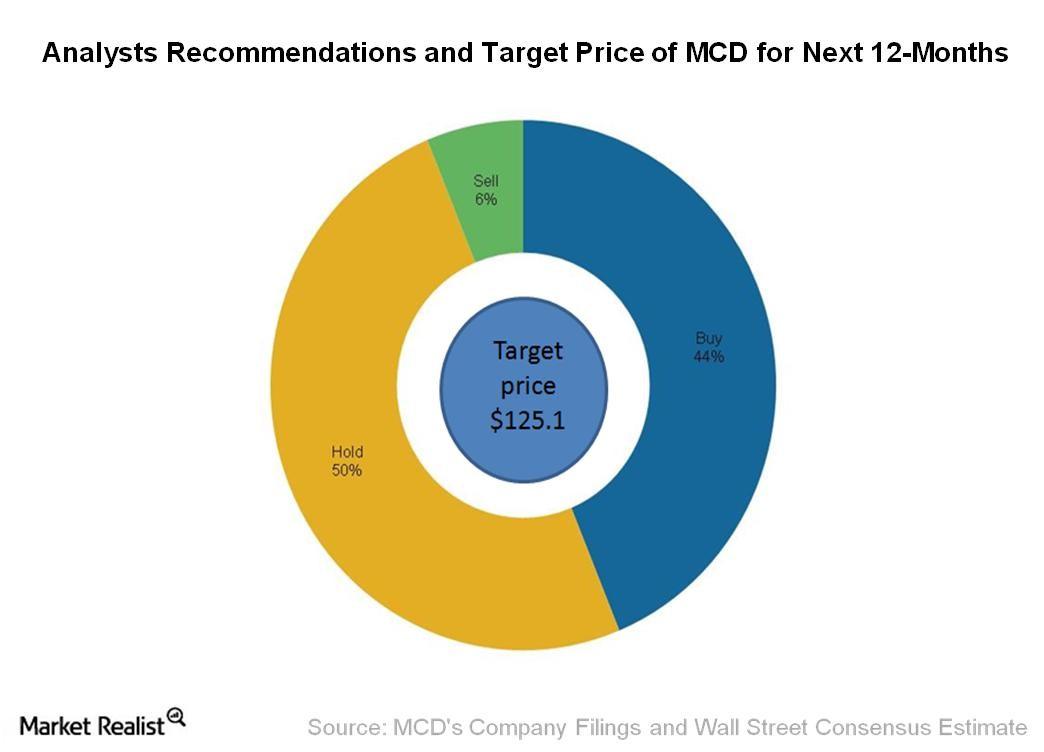

Analysts Revised the Price Target after McDonald’s Earnings

Wall Street analysts set a price target of $125.1 for the next 12 months with a return potential of 5% from the closing price of $119.2 on January 25.

Inside Lowe’s Analyst Expectations for Revenue over the Next Four Quarters

For the next four quarters, analysts are expecting Lowe’s to post revenue of $68.9 billion—a growth of 3.4% over its ~$66.6 billion from the last four quarters.

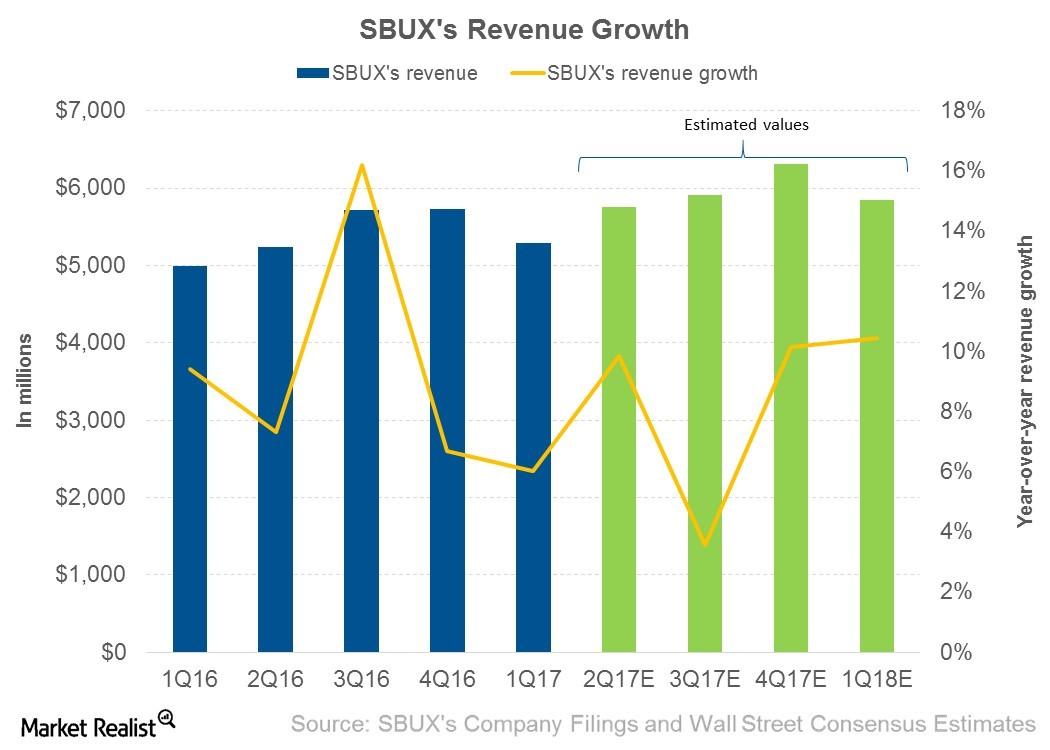

Why Investors Weren’t Impressed by Starbucks’s Fiscal 2Q17

Starbucks (SBUX) posted its fiscal 2Q17 earnings after the market closed on April 27, 2017. Its EPS was $0.45 on revenues of $5.3 billion.

What to Expect from Starbucks’s Revenue in Next 4 Quarters

In the next four quarters, analysts are expecting Starbucks (SBUX) to post revenue of $23.8 billion, which represents an increase of 8.4% from $22.0 billion in the corresponding quarters of the previous year.

This Likely Drove Domino’s 3Q17 EPS

For 3Q17, Domino’s Pizza (DPZ) posted adjusted EPS (earnings per share) of $1.27, which represents a 32.3% YoY (year-over-year) rise from $0.96 in 3Q16.

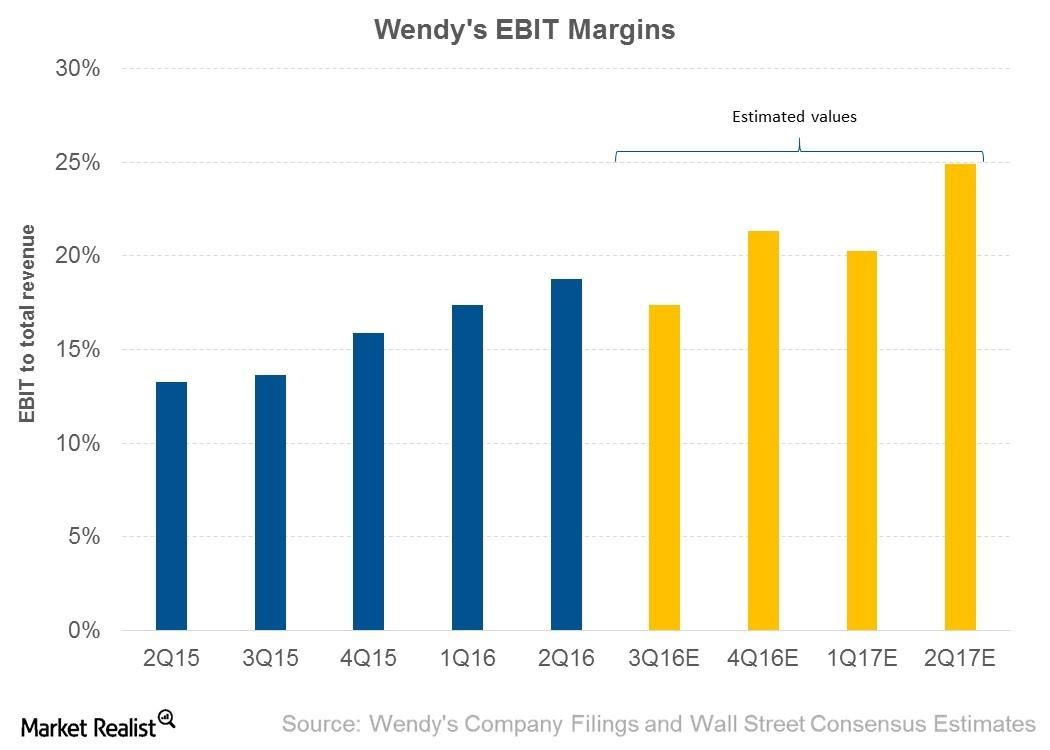

Why Did Wendy’s EBIT Margins Expand in 2Q16?

In 2Q16, Wendy’s posted EBIT of $71.7 million—an EBIT margin of 18.7% compared to 13.3% in 2Q15. Analysts expected the EBIT margin to be 16.7%.

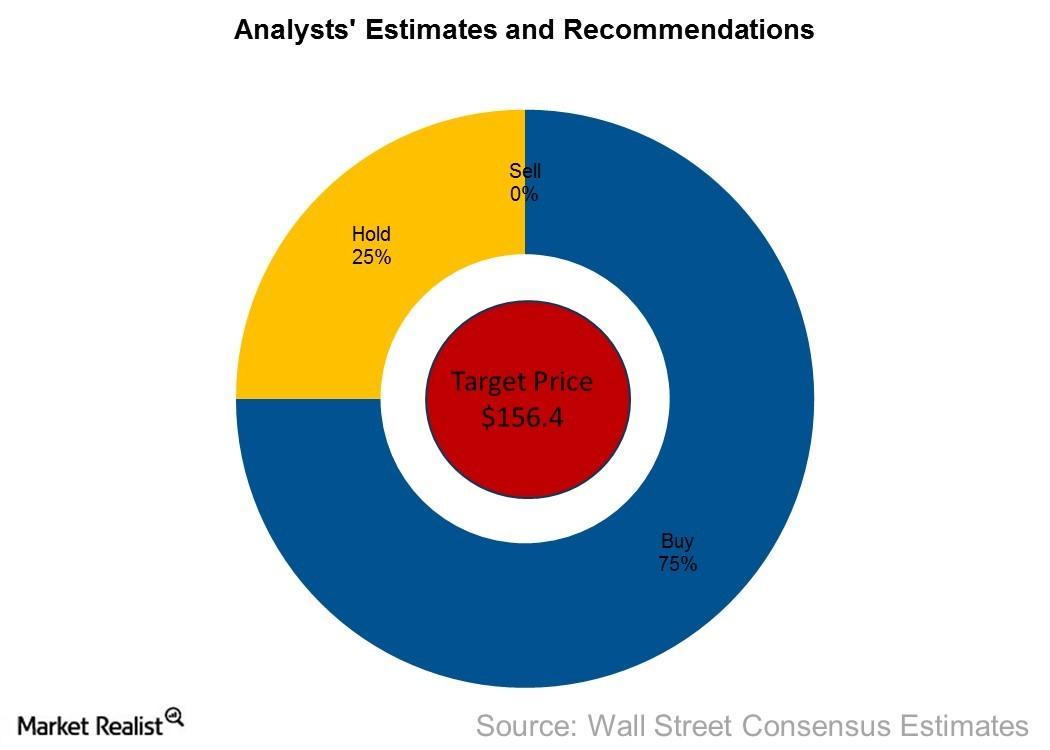

Home Depot on the Street: How the Analysts Are Leaning

As of April 27, 2017, analysts are expecting Home Depot’s stock price to touch $156.4 in the next 12 months, which represents a return potential of 0.2%.

Cannabis Legalization: Four Governors Met in New York

The Day reported that New York, New Jersey, Connecticut, and Pennsylvania’s governors met and agreed on basic guidelines for legalizing marijuana.

What Do Analysts Recommend for Canopy Growth?

On December 16, Canopy Growth was trading at 26.79 Canadian dollars, implying a rise of 9.6% since its fiscal 2020 second-quarter earnings release.

Can Canopy Beat Q2 Estimates and Boost the Sector?

This week is important for the cannabis sector, as Canopy Growth and Aurora Cannabis are both set to report their earnings results on November 14.

Canopy Growth: Key Takeaways from Its Investor Call

Yesterday, Canopy Growth CFO Mike Lee seemed optimistic when he presented at the Barclays 2019 Global Consumer Staples Conference.

Marijuana Vape Products Expected in Alberta Stores

AGLC will allow retail stores in Alberta to sell marijuana vape products. Consumers will likely be able to purchase cannabis vape products in the next two weeks.

Big News: Cannabis Edibles in Alberta Stores

Many people expected the Cannabis 2.0 products, including cannabis edibles, to hit the markets by mid-December 2019. However, the products got delayed.

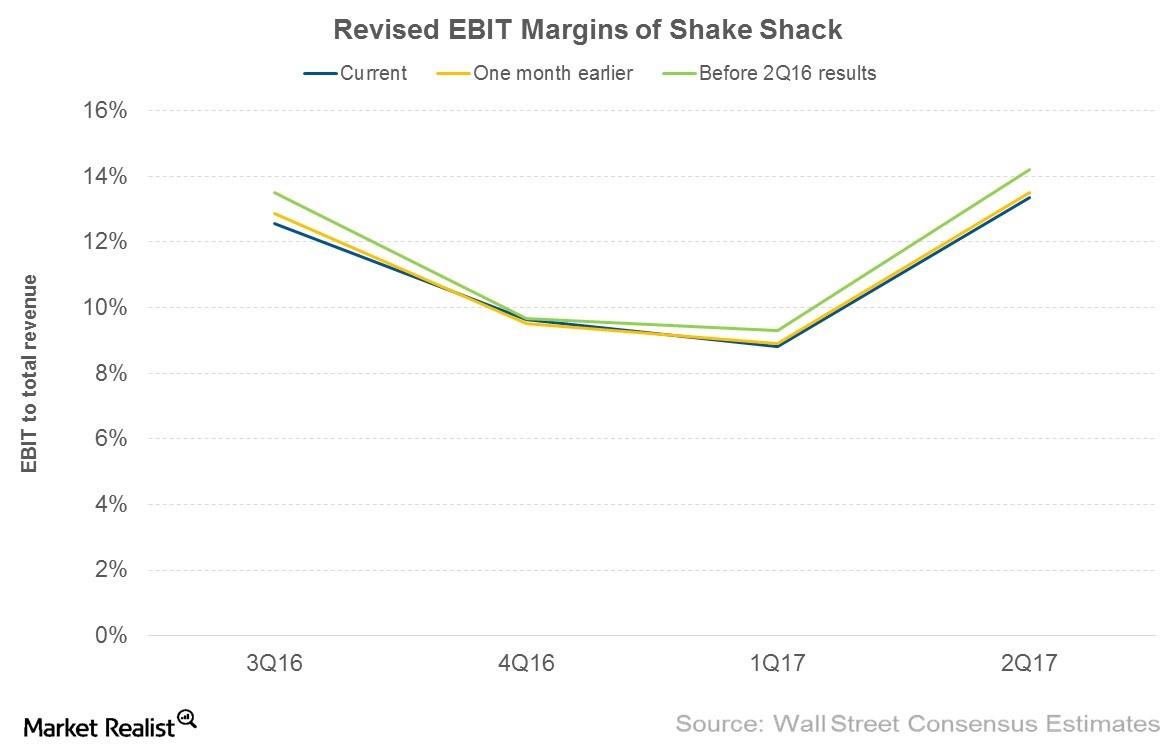

Why Analysts Dropped Their Estimates for Shake Shack’s Earnings

Currently, analysts are expecting Shake Shack (SHAK) to post EBIT margins of 12.6%, 9.6%, 8.8%, and 13.3% in 3Q16, 4Q16, 1Q17, and 2Q17, respectively.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

What Are Analysts Recommending for Altria?

The FDA’s (Food and Drug Administration) recent announcement could have compelled analysts to lower their 12-month target price for Altria Group (MO).

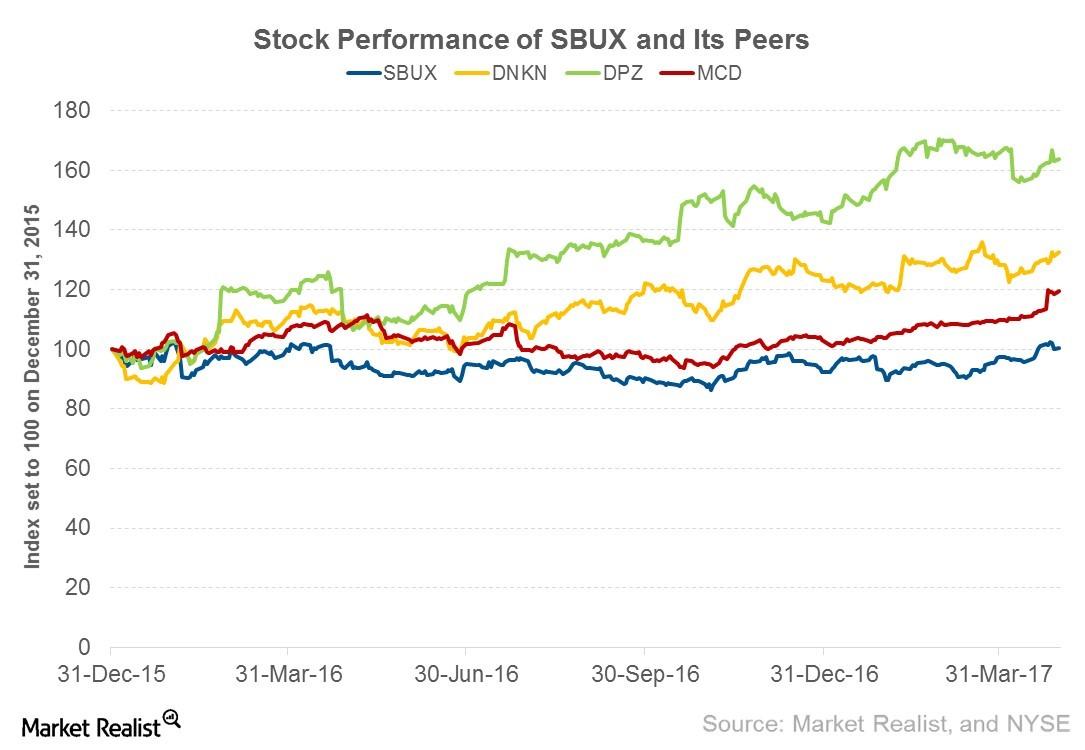

What’s Behind the Decline in Starbucks Stock Price

After posting its fiscal 2Q17 earnings on April 27, 2017, Starbucks (SBUX) stock rose 5.3% to reach $64.57 on June 2, 2017. The aggressive expansion plans in the CAP (China and Asia-Pacific) region and its implementation of technological advancements led Starbucks stock price to rise. However, since then, the stock has seen downward momentum.

Can Starbucks Deliver Double-Digit EPS Growth in Q1?

Starbucks will report its first-quarter earnings after the market closes on Tuesday. Analysts expect the company to report double-digit EPS growth.

Why Does Jim Cramer Prefer CGC versus CRON?

Canopy Growth (NYSE:CGC) lost 25.4% in 2019. The company reported weak sales and higher-than-expected operating losses in the last two quarters.

The Word on the Street: What Analysts Are Recommending for Fast-Food and Pizza Companies after 1Q16

JACK, PZZA, and QSR are the most favored stocks in our group of eight fast-food restaurants, with no analyst recommending a “sell” for their stocks.

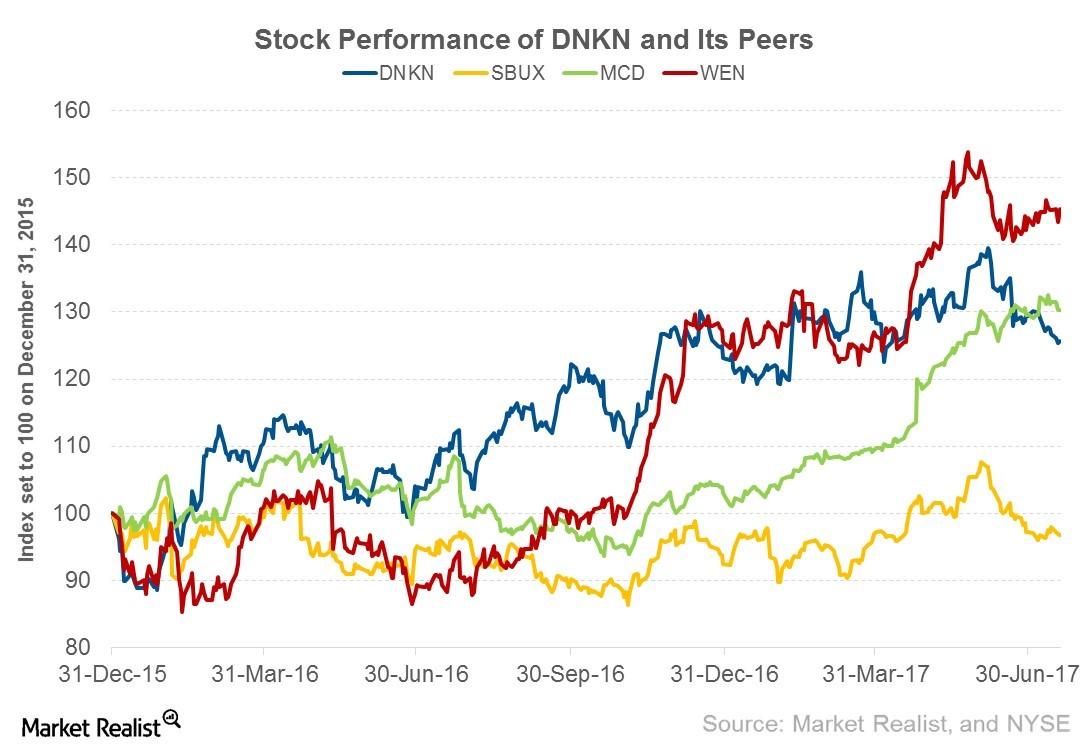

Will Dunkin’ Brands’ 2Q17 Earnings Boost Its Stock Price?

Dunkin’ Brands, the owner of the Dunkin’ Donuts and Baskin-Robbins brands, is scheduled to announce its 2Q17 earnings before the market opens on July 27, 2017.