Rajiv Nanjapla

Rajiv Nanjapla started working at Market Realist in 2015, covering the restaurant, home improvement, tobacco, and cannabis sectors. He has over seven years of experience in analyzing financial statements and writing financial research reports.

He also holds a post-graduate diploma in finance and operations. Prior to joining Market Realist, Rajiv worked with two other companies in various capacities.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Rajiv Nanjapla

Can We Expect an Upside Potential in Altria Stock?

As of September 17, Altria Group (MO) stock was trading at $62.44, which represents a 7.9% rise since July 26.

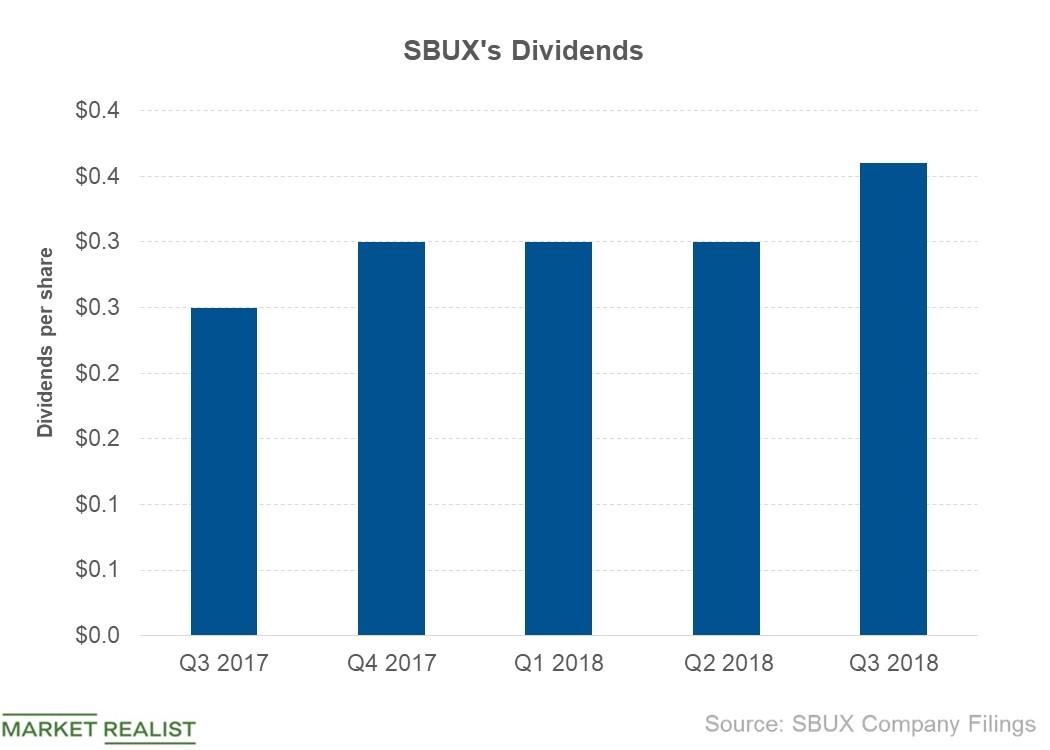

Understanding Starbucks’s Dividend Policy

On June 19, Starbucks (SBUX) announced a quarterly dividend of $0.36, which represents a 20% rise from its previous dividend of $0.30.

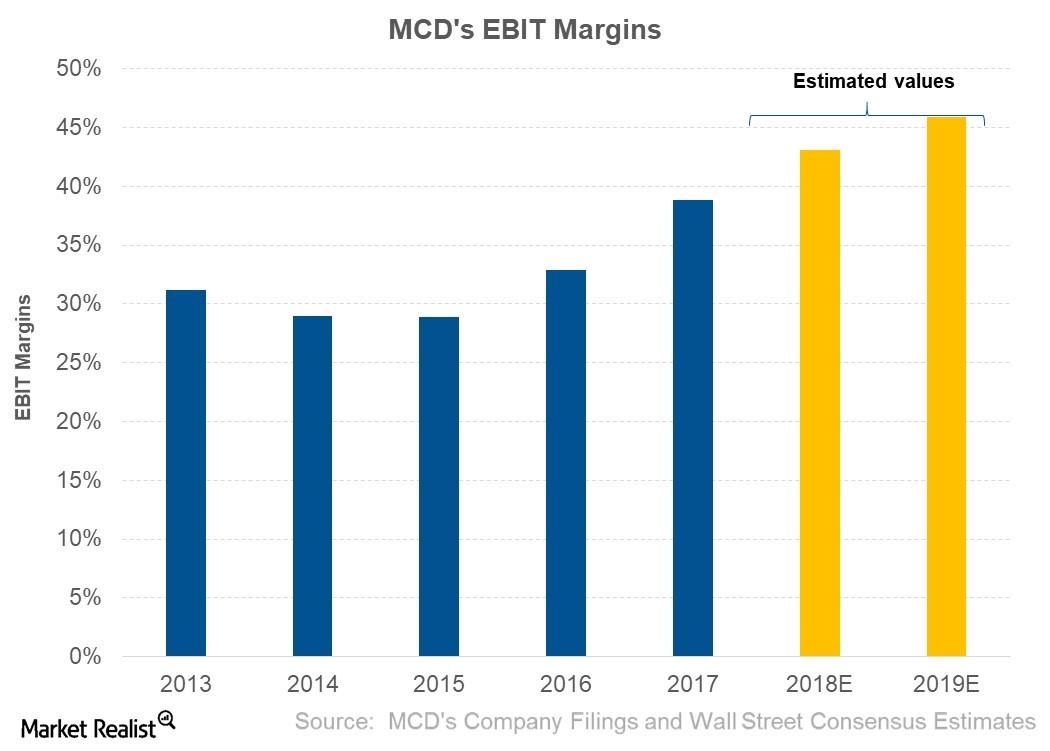

Why McDonald’s EBIT Margin Expanded in 2018

McDonald’s (MCD) has posted EBIT (earnings before interest and tax) of ~$8.9 billion, which represents an EBIT margin of 38.8%.

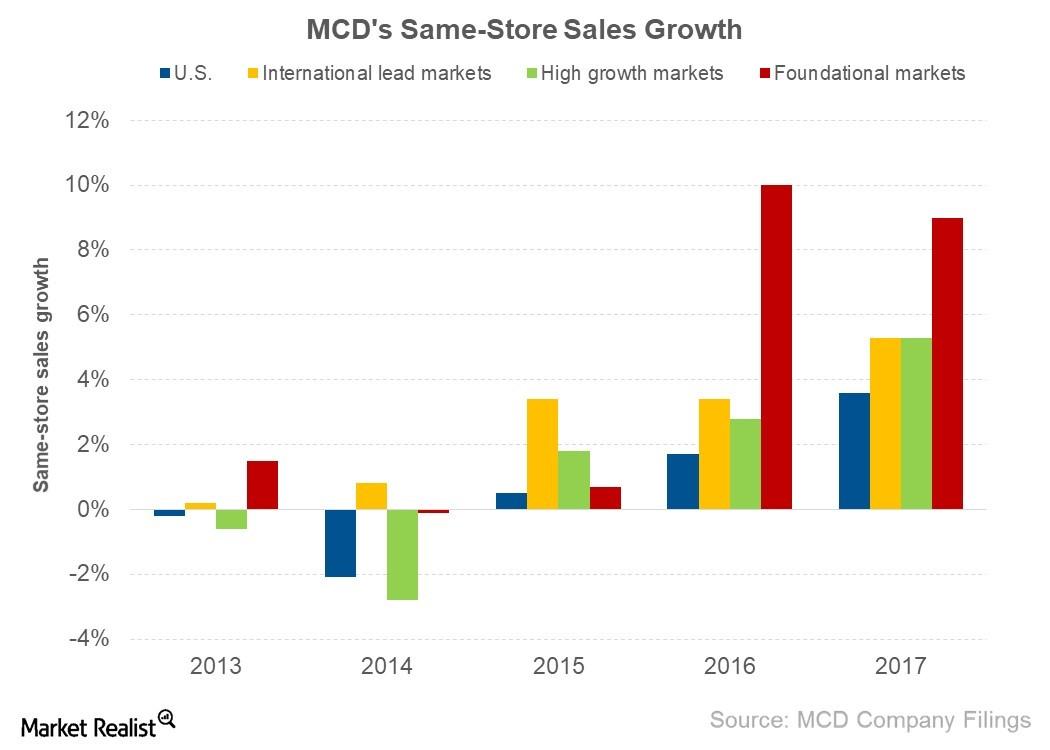

McDonald’s Posts Strong Same-Store Sales Growth in 2017

MCD posted SSSG of 3.8%, 1.5%, -1.0%, and 0.2% in 2016, 2015, 2014, and 2013, respectively.

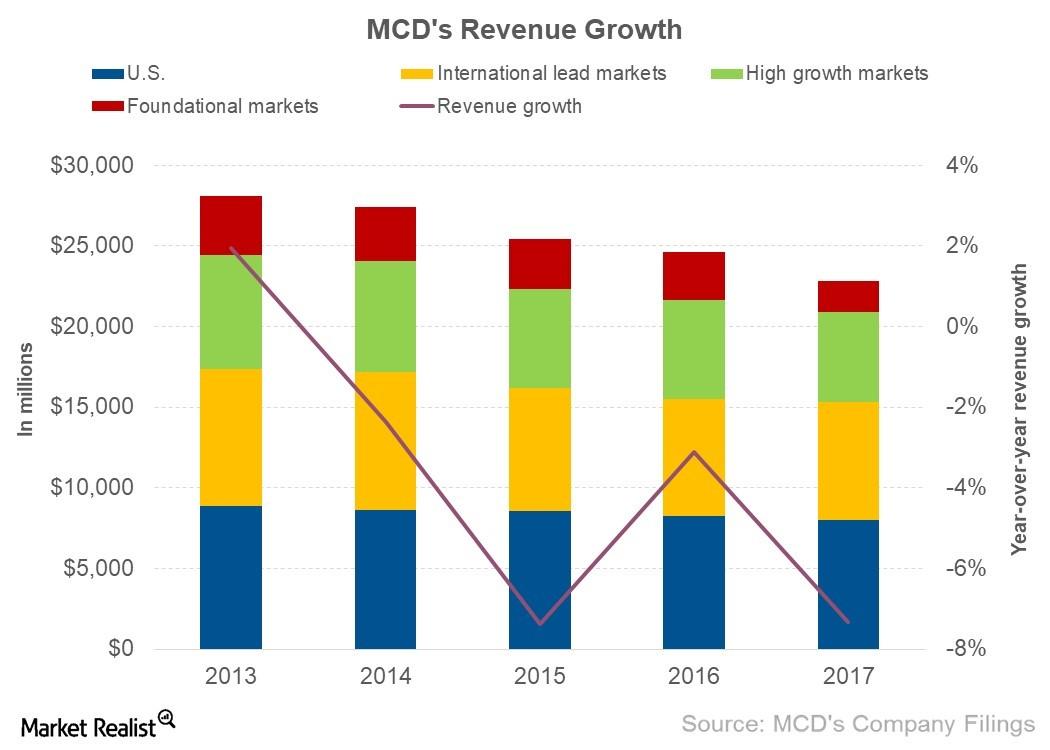

Why McDonald’s Revenues Declined in 2017

In 2017, McDonald’s (MCD) posted revenues of ~$22.8 billion, which represents a fall of 7.3% from ~$24.6 billion in 2016.

Will 2018 Be a Good Year for Pizza Companies?

All major pizza companies have announced their 4Q17 earnings, so it’s time to compare their performance.

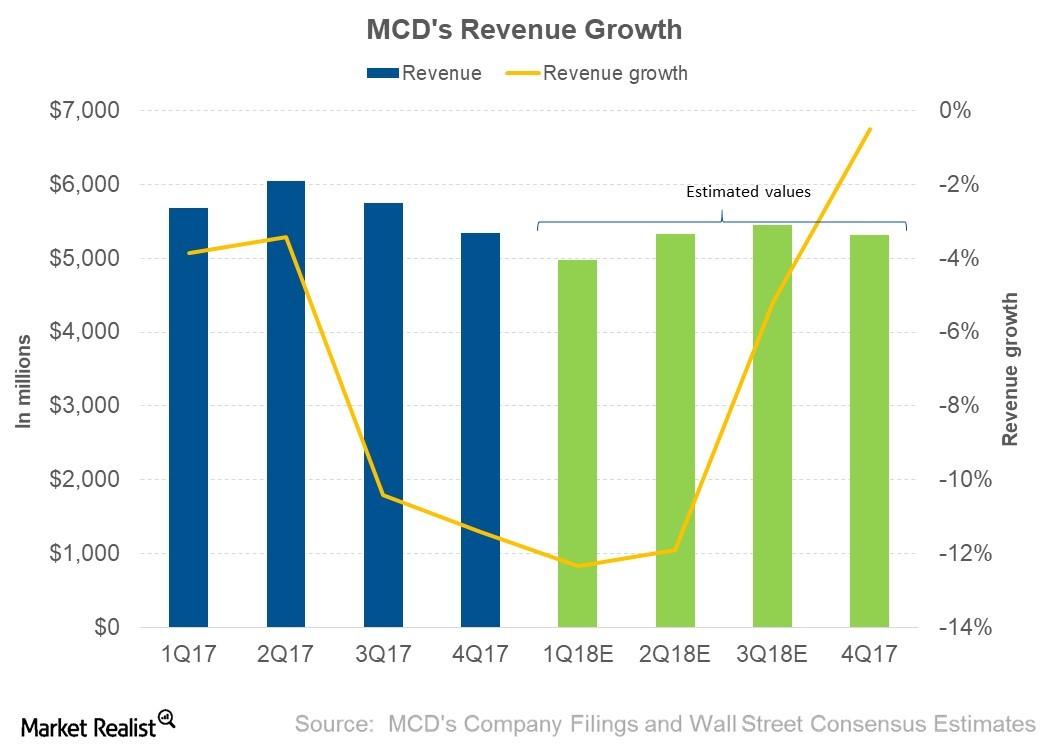

What Analysts Expect for McDonald’s Revenue in 2018

Revenue expectations In 2018, analysts expect McDonald’s (MCD) to post revenue of $21.1 billion, which represents a fall of 7.7% from its revenue of $22.8 billion in 2017. As part of its optimizing strategy, McDonald’s has been refranchising its company-owned restaurants. The refranchising is expected to lower the company’s revenue in 2018. However, some of […]

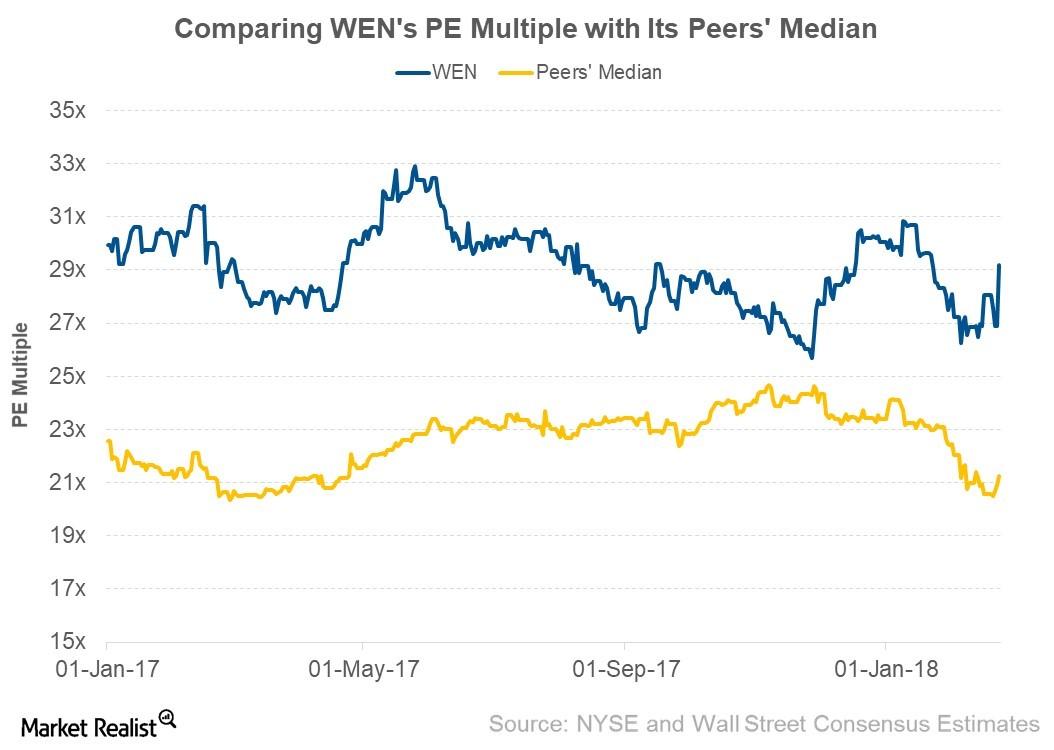

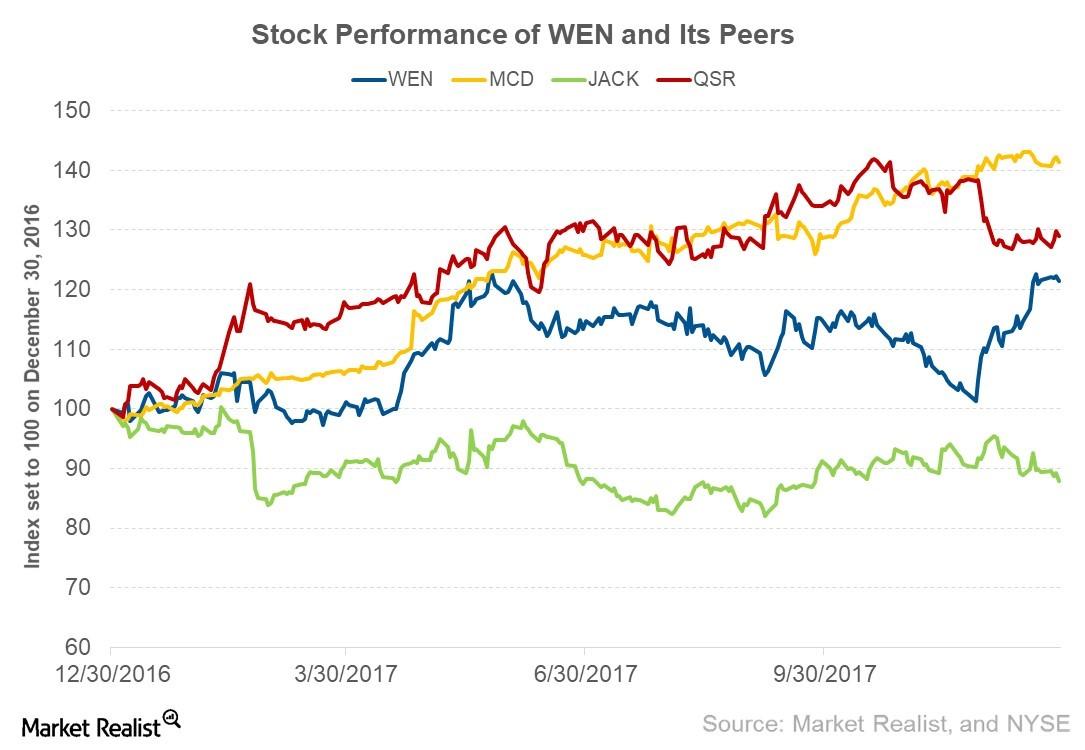

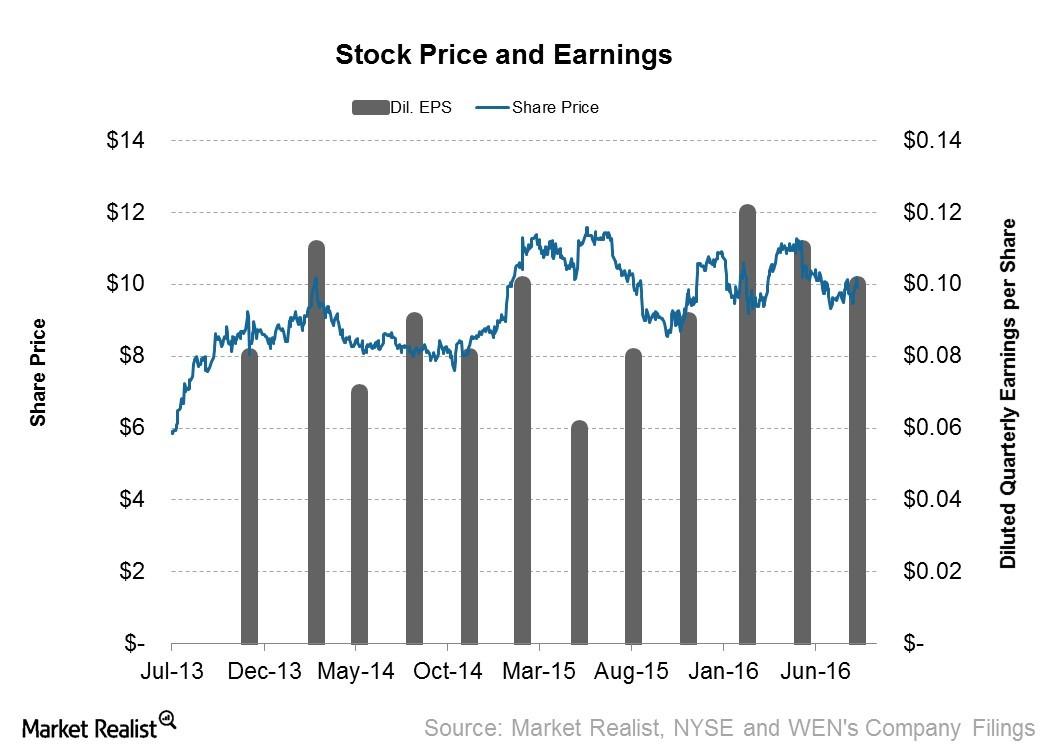

How Wendy’s Valuation Multiple Compares to Its Peers

The initiatives taken by Wendy’s management to drive SSSG appear to have led to a rise in WEN stock and a higher valuation multiple.

What Analysts Expect for Wendy’s Revenue in 2018

For 2018, analysts are expecting Wendy’s (WEN) to post revenue of $1.3 billion, which represents a growth of 2.6%.

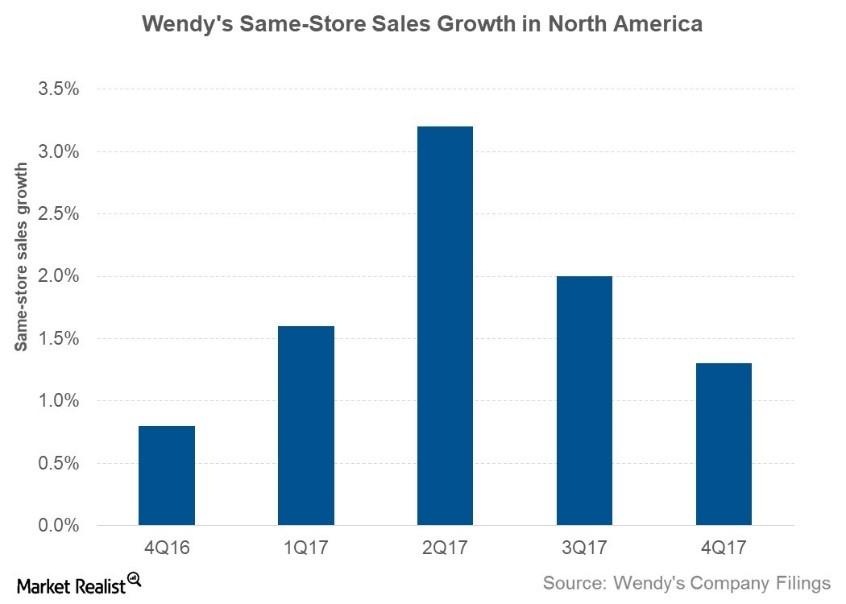

What Drove Wendy’s Same-Store Sales Growth in 4Q17?

Wendy’s (WEN) posted SSSG (same-store sales growth) of 1.3% in the North American region compared to 0.8% in 4Q16.

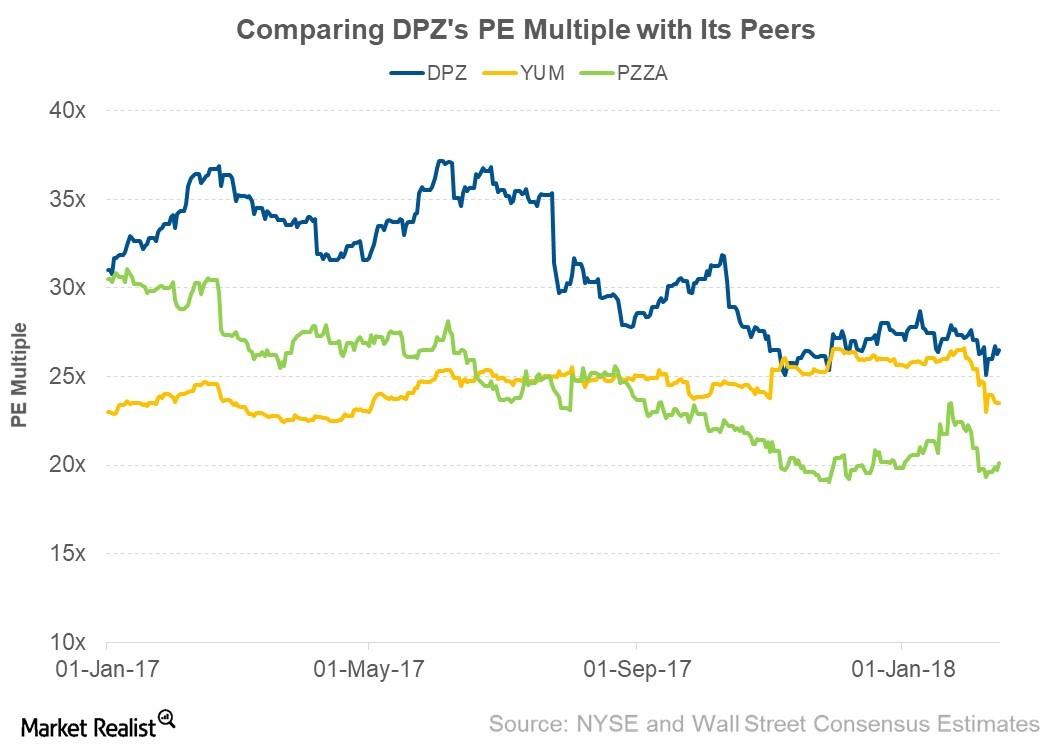

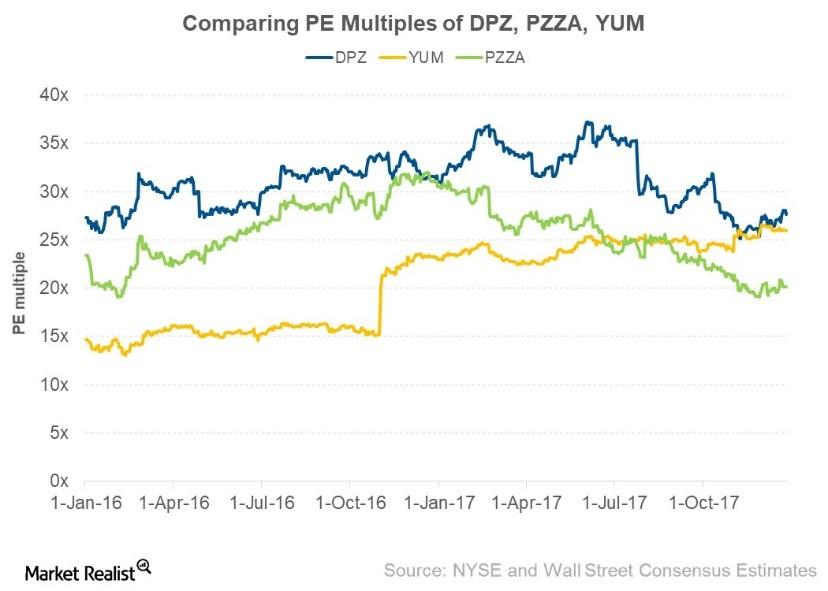

Domino’s Valuation Multiple Compared to Its Peers

As of February 14, 2018, Domino’s was trading at a forward PE multiple of 26.5x compared to 31.8% before the announcement of its 3Q17 earnings.

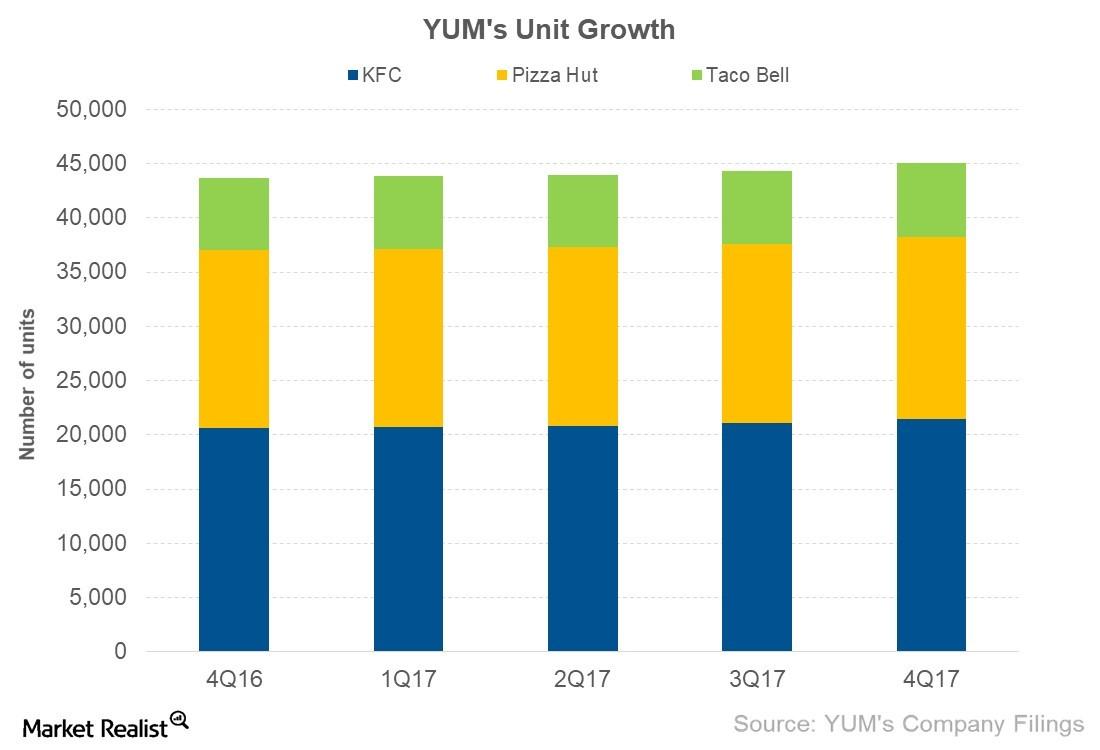

How Yum! Brands Is Expanding Its Business

At the end of 4Q17, Yum! Brands operated 45,804 restaurants, which included 21,487 KFC restaurants, 16,748 Pizza Hut restaurants, and 6,849 Taco Bell restaurants.

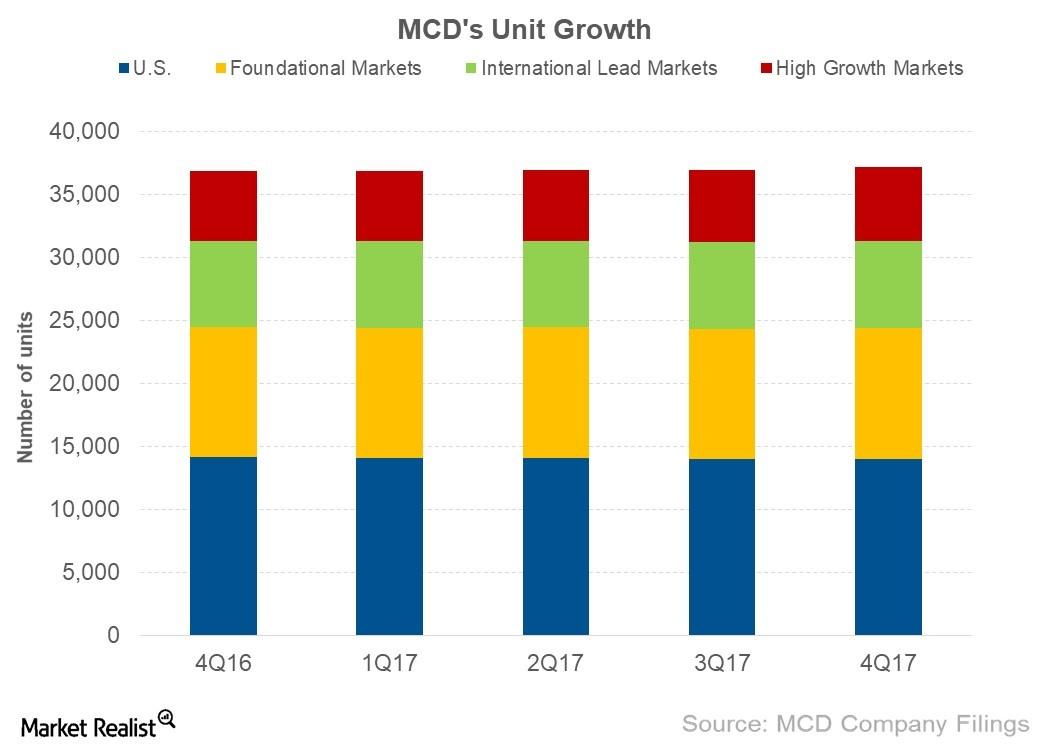

How McDonald’s Is Expanding Its Business

By the end of 4Q17, McDonald’s (MCD) operated 37,241 restaurants, which includes 3,133 company-owned restaurants and 34,108 franchised restaurants.

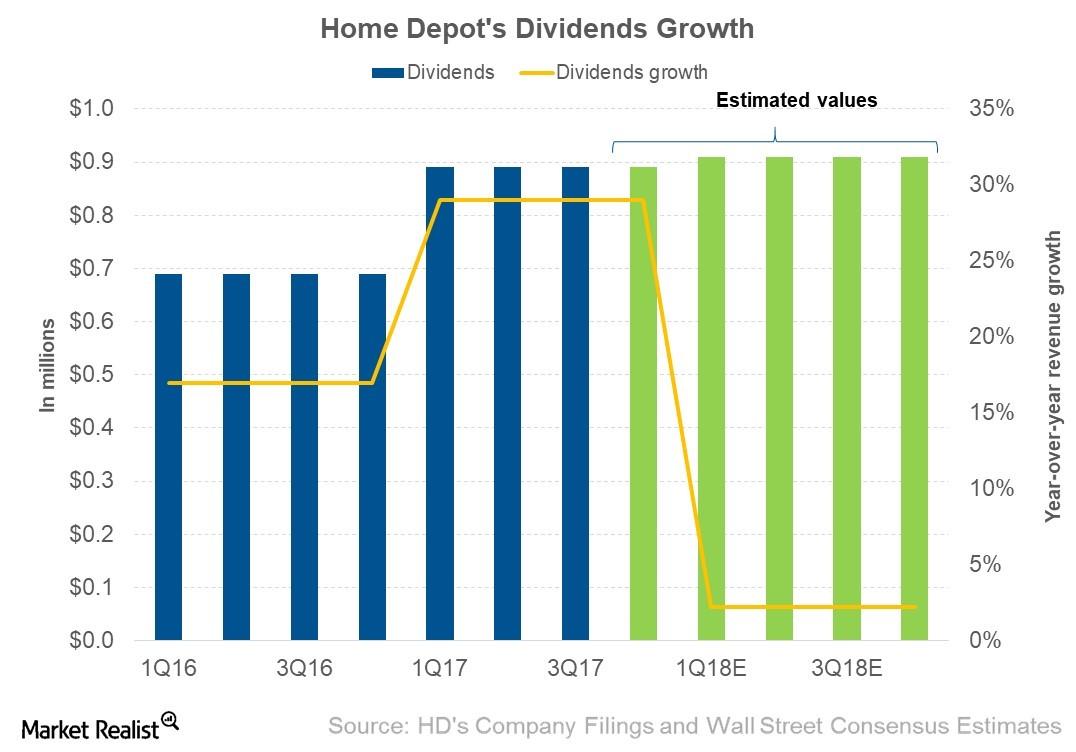

Understanding Home Depot’s Dividend Policy

In the first three quarters of 2017, Home Depot (HD) paid dividends of $0.89 per share. In 3Q17, it paid dividends at a payout ratio of 48.2%.

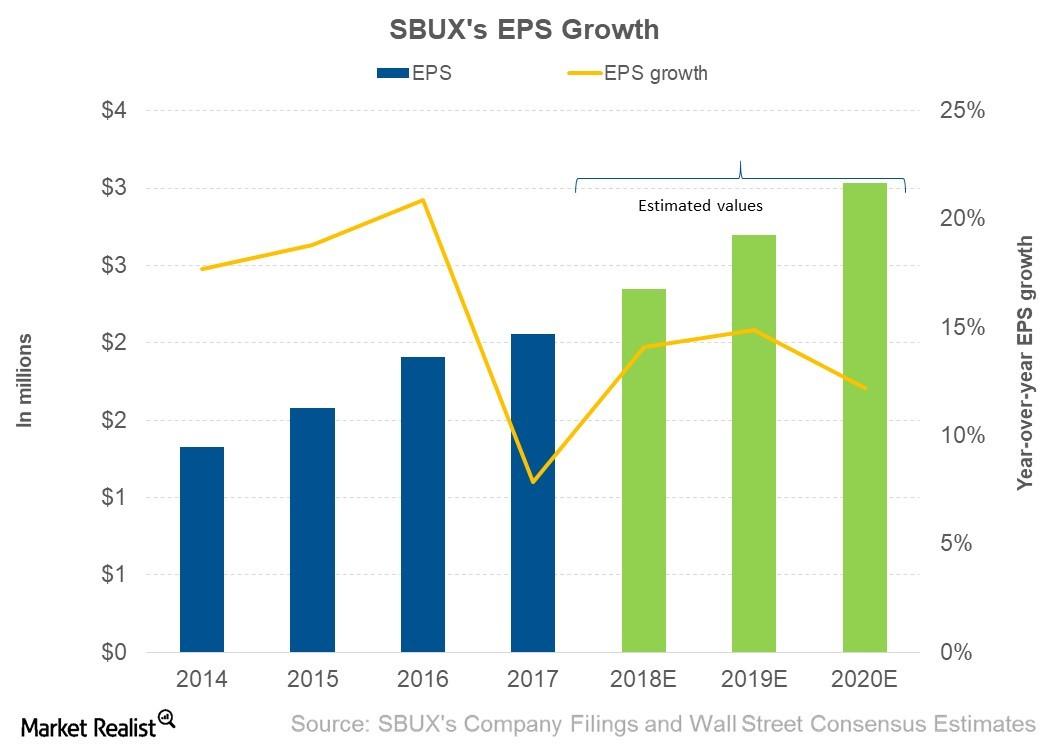

What Drove Starbucks’s Earnings per Share in Fiscal 2017?

In fiscal 2017, Starbucks (SBUX) posted adjusted EPS (earnings per share) of $2.06, which represents growth of 7.9% from its $1.91 in fiscal 2016.

What’s Driving Wendy’s Stock Price

In this series, we’ll look at analysts’ earnings and revenue estimates for the next four quarters. We’ll also review Wendy’s valuation and analysts’ recommendations.

How Do Pizza Companies’ Valuation Multiples Compare?

Due to the high visibility of their earnings, we’ve opted to use the forward PE (price-to-earnings) multiple for our valuation analysis of the pizza companies in this series.

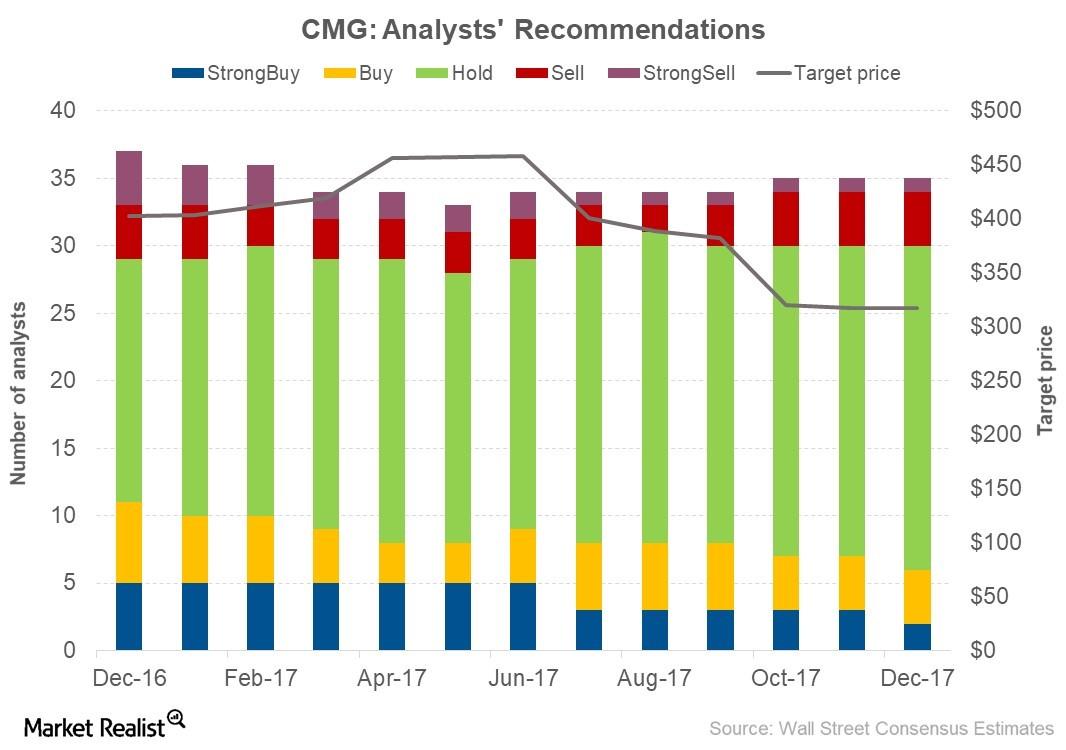

What Analysts Recommend for Chipotle

Target price As of December 28, 2017, Chipotle Mexican Grill (CMG) was trading at $294.06. On the same day, analysts were expecting the stock to reach $317.26 in the next four quarters, which represents a return potential of 7.9%. Before the announcement of Chipotle’s 3Q17 earnings, analysts had forecast a 12-month target price of $375.46. […]

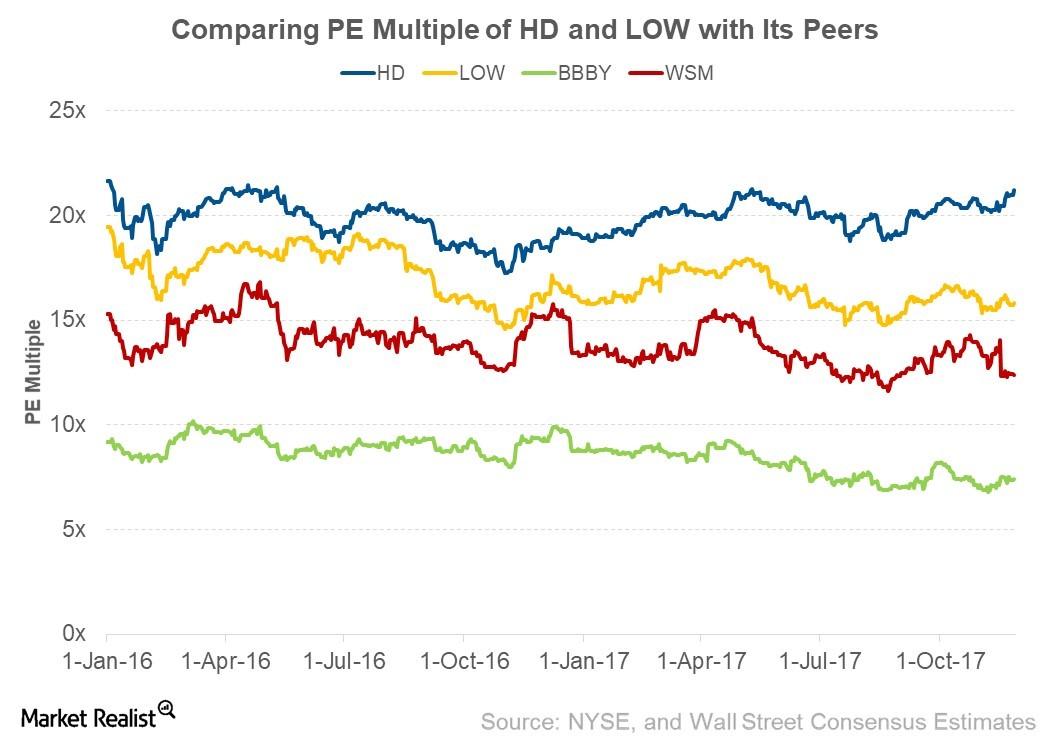

Valuation Multiples: Comparing Home Depot, Lowe’s, and Peers

Valuation multiples help investors determine market values for comparable companies. For our analysis, we consider forward PE (price-to-earnings) multiples due to high visibility in Home Depot (HD) and Lowe’s Companies’ (LOW) earnings.

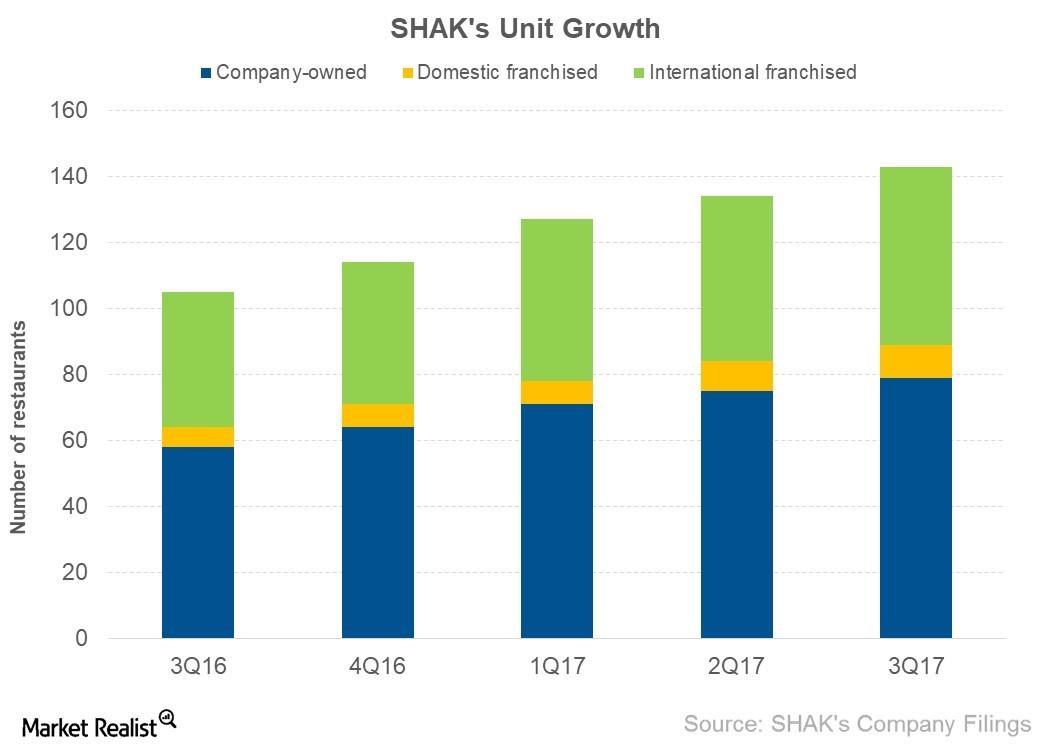

Shake Shack’s Business Expansion Strategy

Unit growth By the end of 3Q17, Shake Shack (SHAK) was operating 143 restaurants—79 domestic company-owned restaurants, ten domestic franchised restaurants, and 54 international franchised restaurants. Unit growth In the last four quarters, Shake Shack has increased its restaurant count by 38 units—21 company-owned restaurants and 17 franchised restaurants. In 3Q17 alone, the company added […]

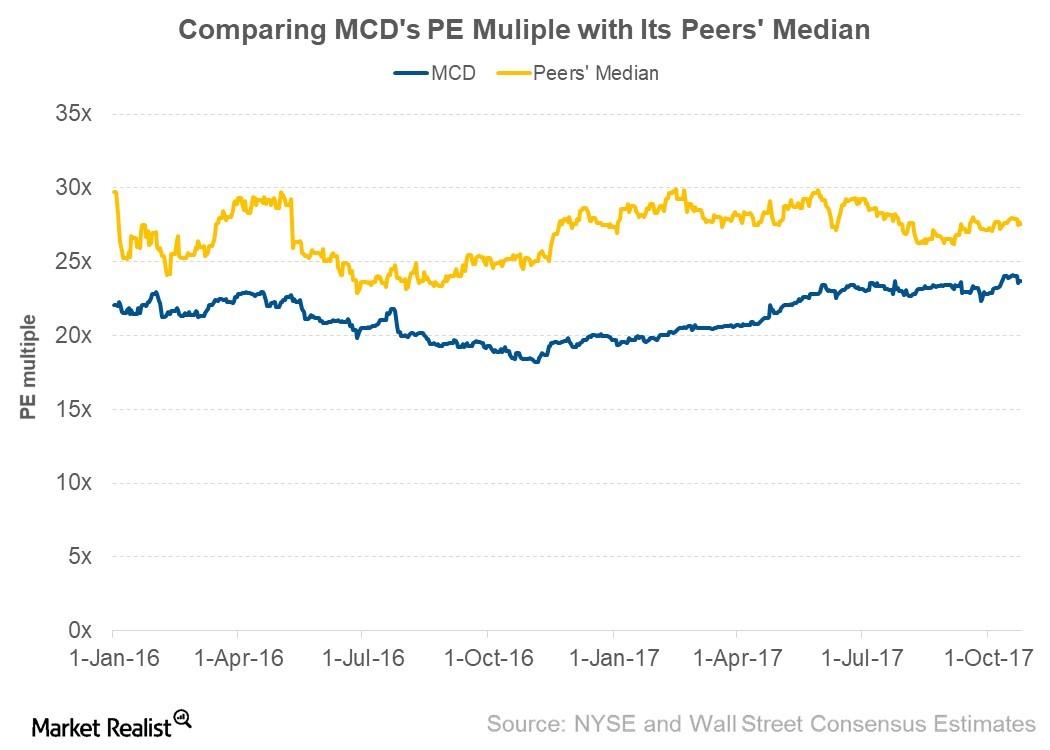

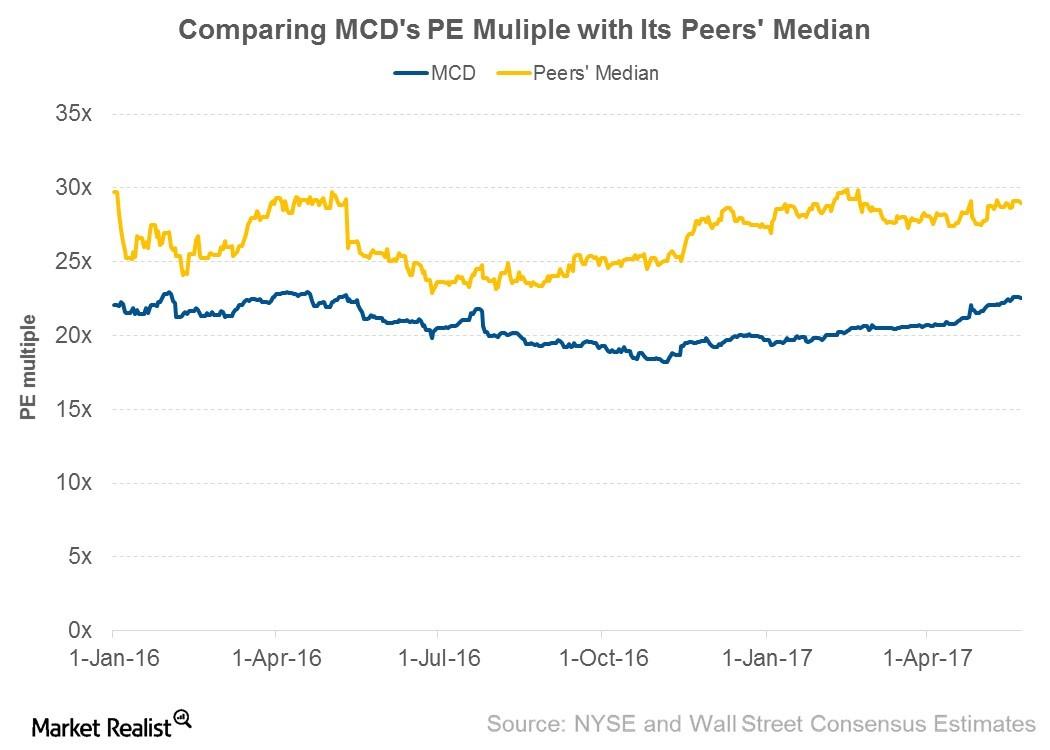

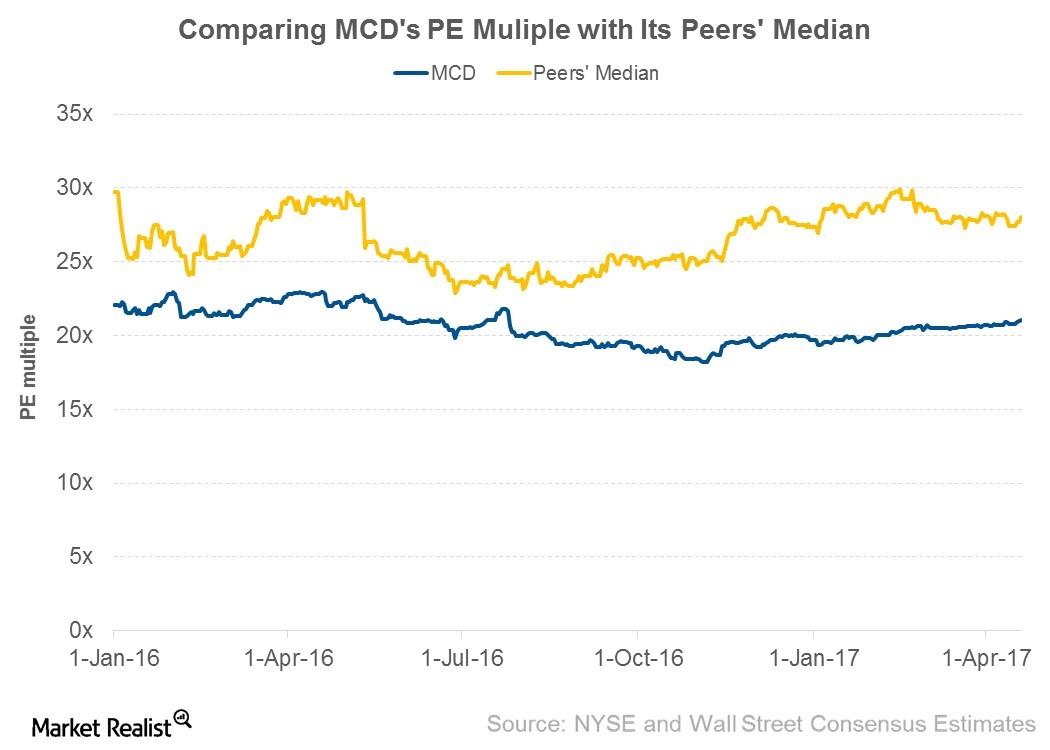

McDonald’s Valuation Multiple Compared to Its Peers

As of October 25, 2017, McDonald’s was trading at a forward PE multiple of 23.66x compared to 23.57x before the announcement of 3Q17 earnings.

What the Analysts Expect for Altria’s Revenues in 3Q17

In 2Q17, Altria’s (MO) Smokeable Products segment generated 86.1% of the company’s total revenues.

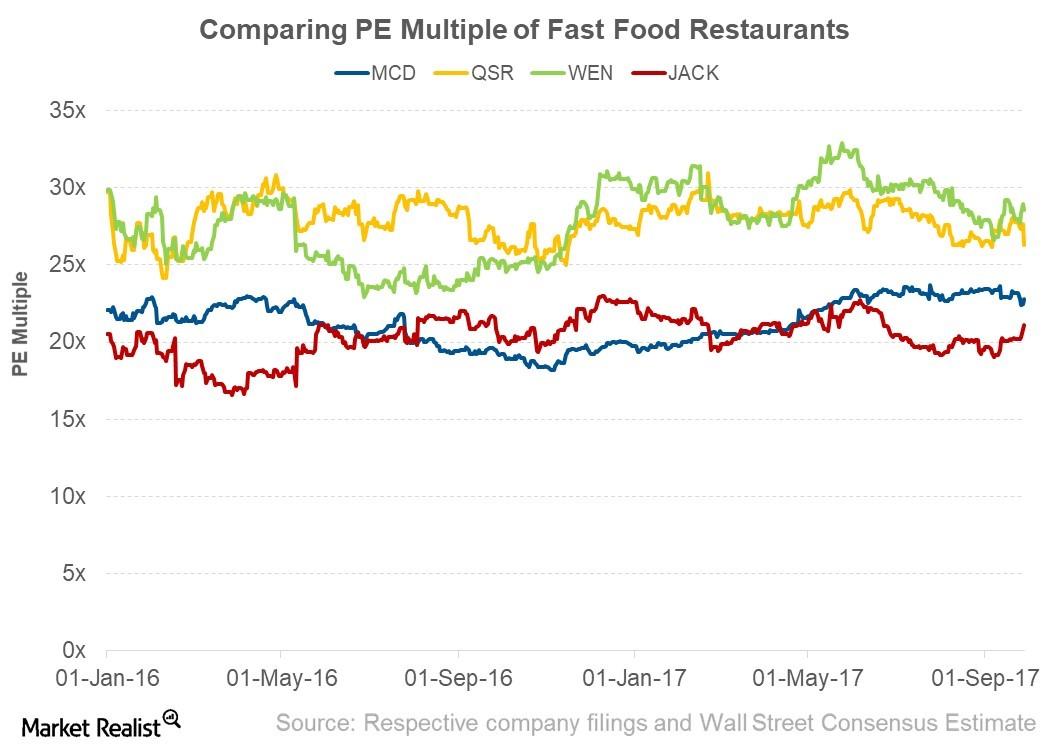

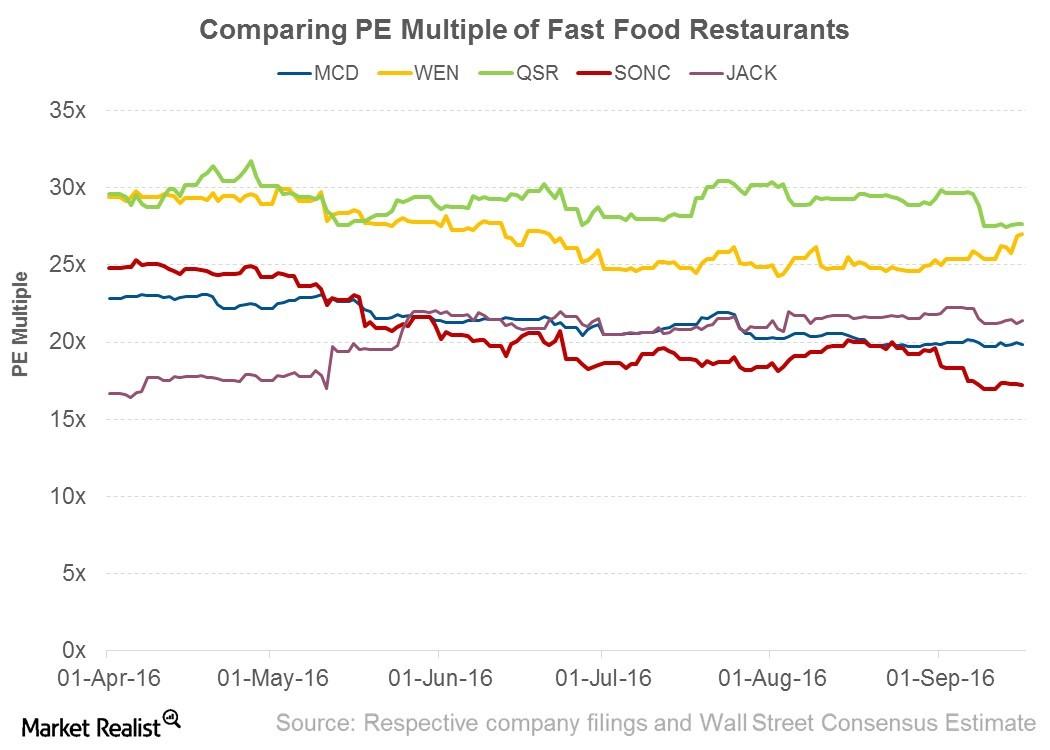

How Fast Food Restaurants’ Valuation Multiples Stack Up

Wendy’s (WEN) has been trading above its peers’ valuation multiple.

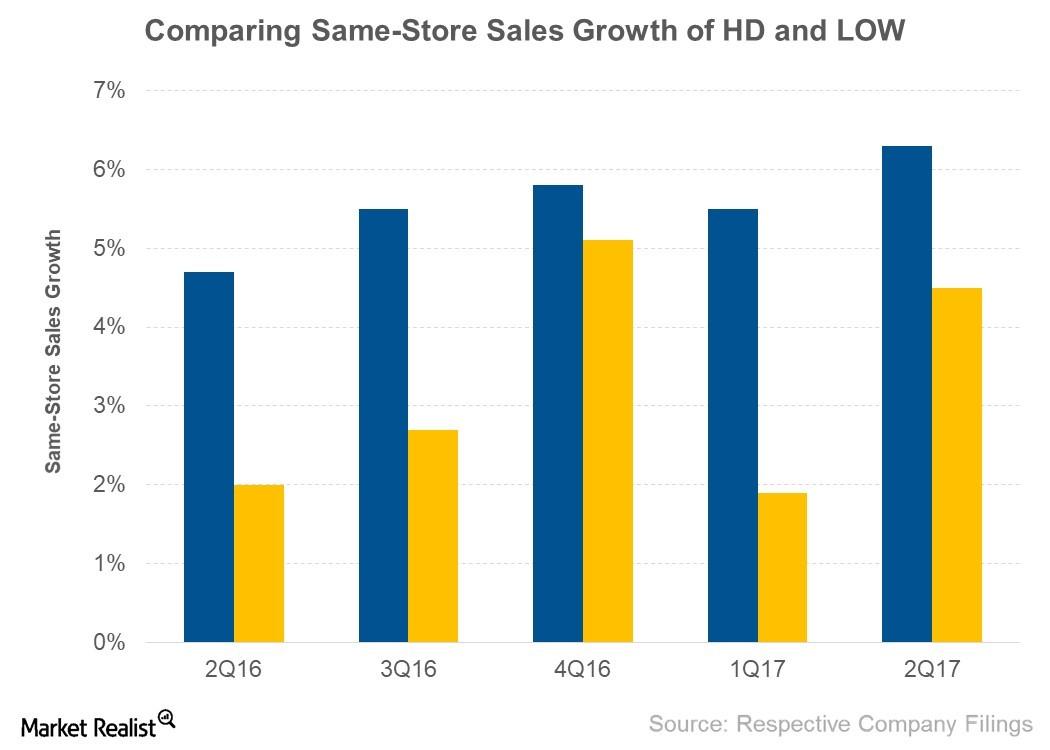

Home Depot’s Same-Store Sales Growth Was Higher than Lowe’s

Home Depot (HD) posted SSSG of 6.3%, while its US stores posted SSSG of 6.6%. Its stores in Mexico and Canada also posted positive SSSG.

Will RH’s 2Q17 Earnings Boost Its Stock Price?

Luxury home furnishings retailer RH (RH) will announce its 2Q17 earnings after the market closes on September 6, 2017.

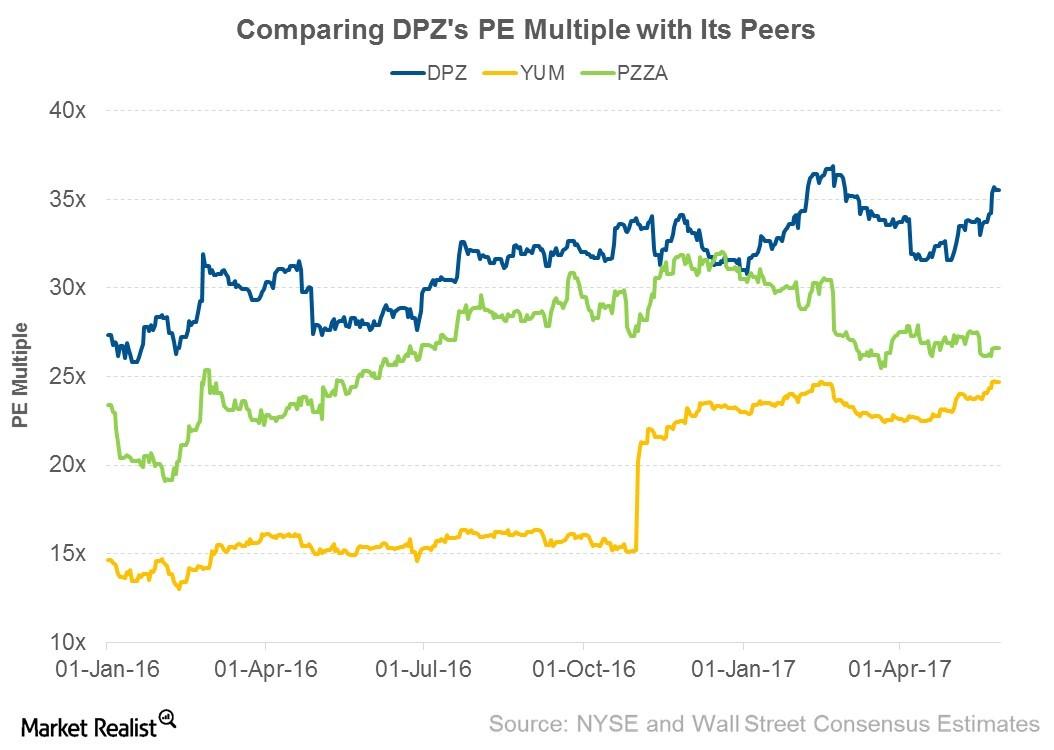

How Domino’s Pizza’s Valuation Multiple Compares to Its Peers

Domino’s better-than-expected SSSG and earnings in 1Q17 appear to have increased investor confidence, leading to rises in DPZ stock and its PE multiple.

Analyzing McDonald’s Valuation Multiple

As of May 24, 2017, McDonald’s was trading at a PE multiple of 22.6x—compared to 21.3x before the announcement of its 1Q17 earnings.

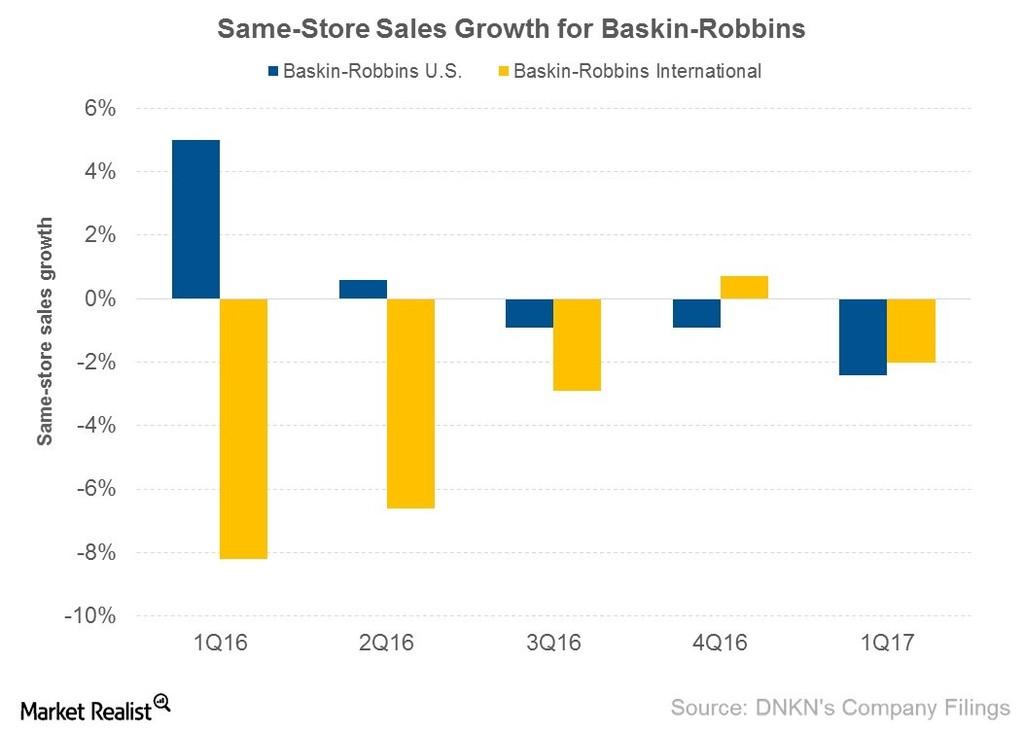

Why Baskin-Robbins Had Negative Same-Store Sales Growth in 1Q17

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), had SSSG of -2.4% in the United States and -2.0% in international markets.

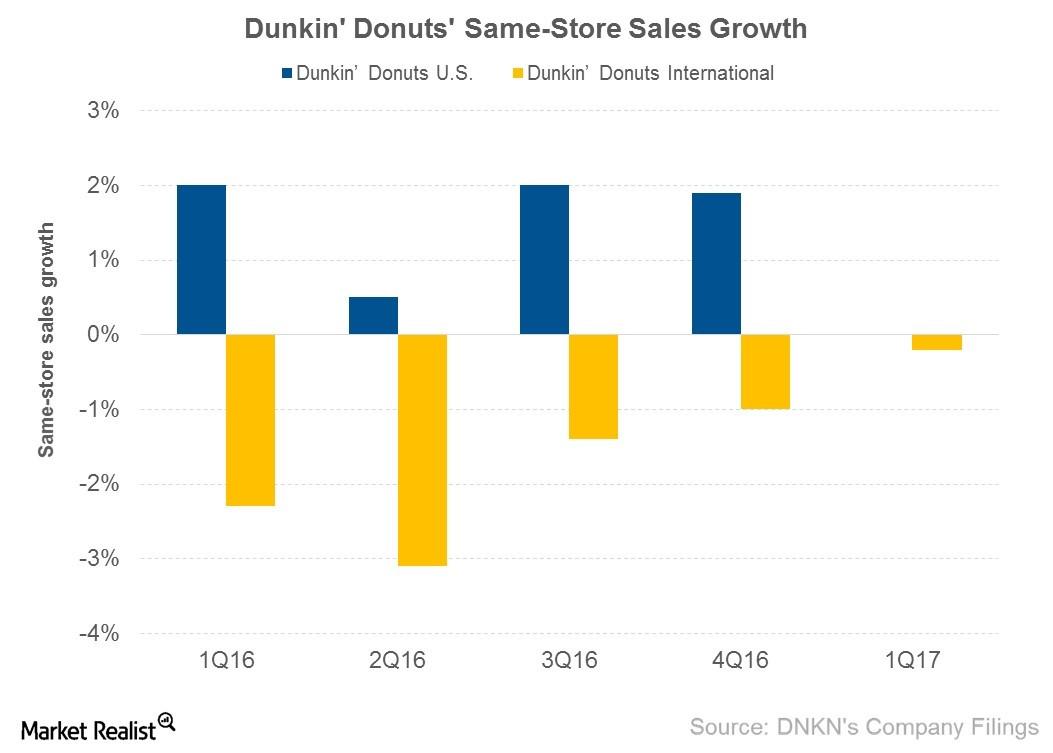

Dunkin’ Donuts: Same-Store Sales Growth Lower Than Estimates

In 1Q17, SSSG for Dunkin’ Donuts, which operates under the umbrella of Dunkin’ Brands (DNKN), was flat in the United States.

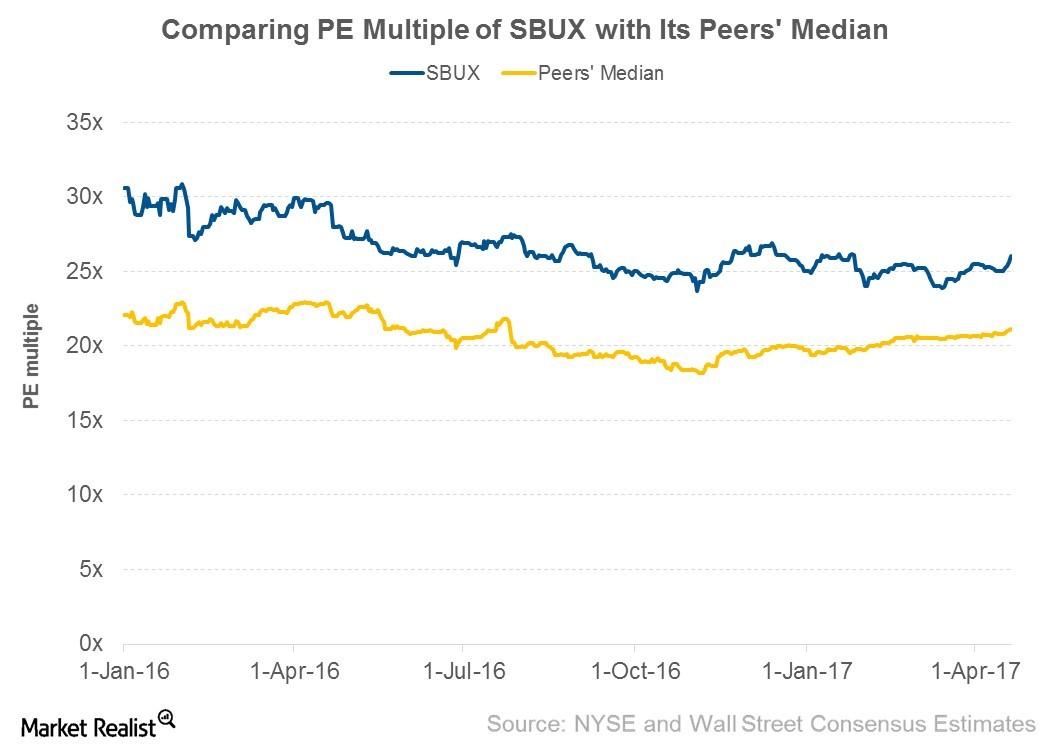

How Starbucks’s Valuation Compares to Peers

For the next four quarters, analysts are expecting Starbucks to post EPS growth of 12.8%.

Where McDonald’s Valuation Multiple Stands Next to Peers

As of April 19, 2017, McDonald’s was trading at a PE multiple of 21.1x, as compared to 19.9x before the announcement of its 4Q16 earnings.

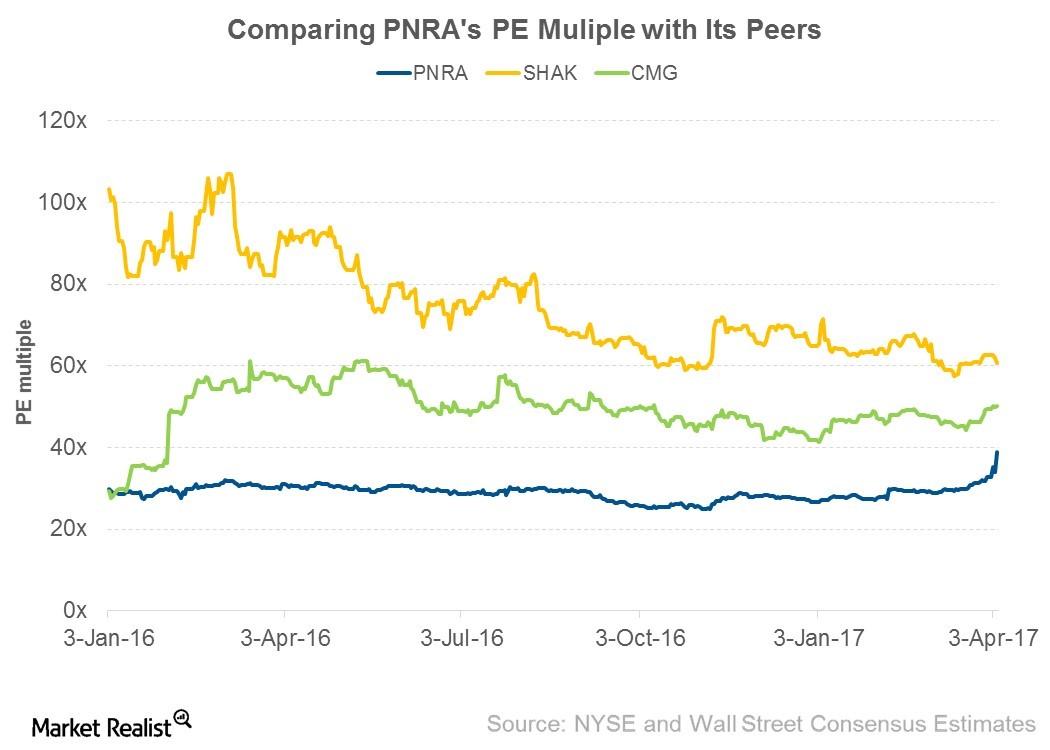

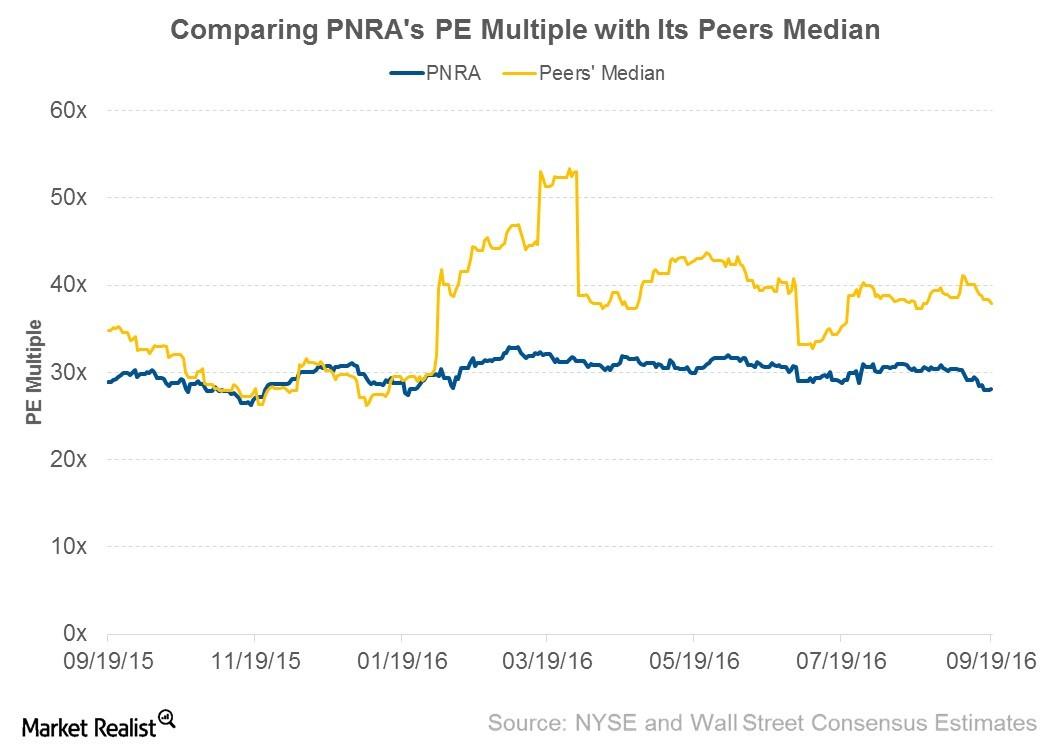

Why Panera’s Valuation Multiple Rose after JAB’s Offer

As of April 5, 2017, Panera was trading at a forward PE multiple of 38.8x—compared to 32.6x before the acquisition rumor started to surface on April 3.

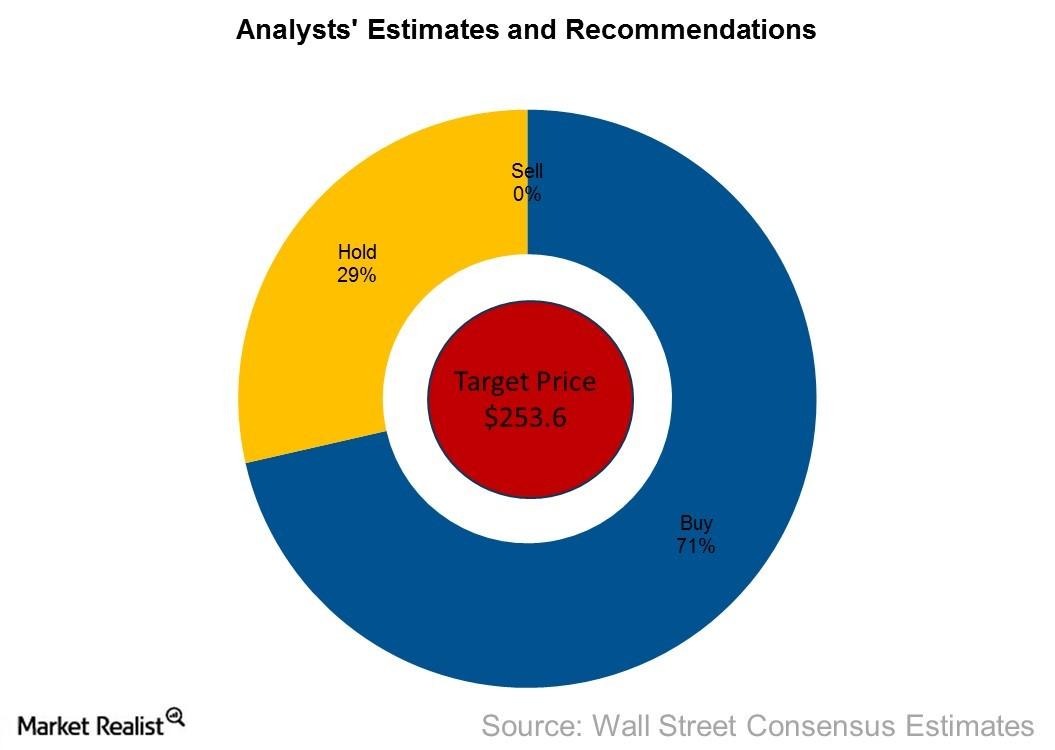

Recommendations for Panera: Why Analysts Favor a ‘Buy’

Of the 28 analysts covering Panera (PNRA), 71.4% have given it a “buy” recommendation, and 28.6% have given it a “hold.”

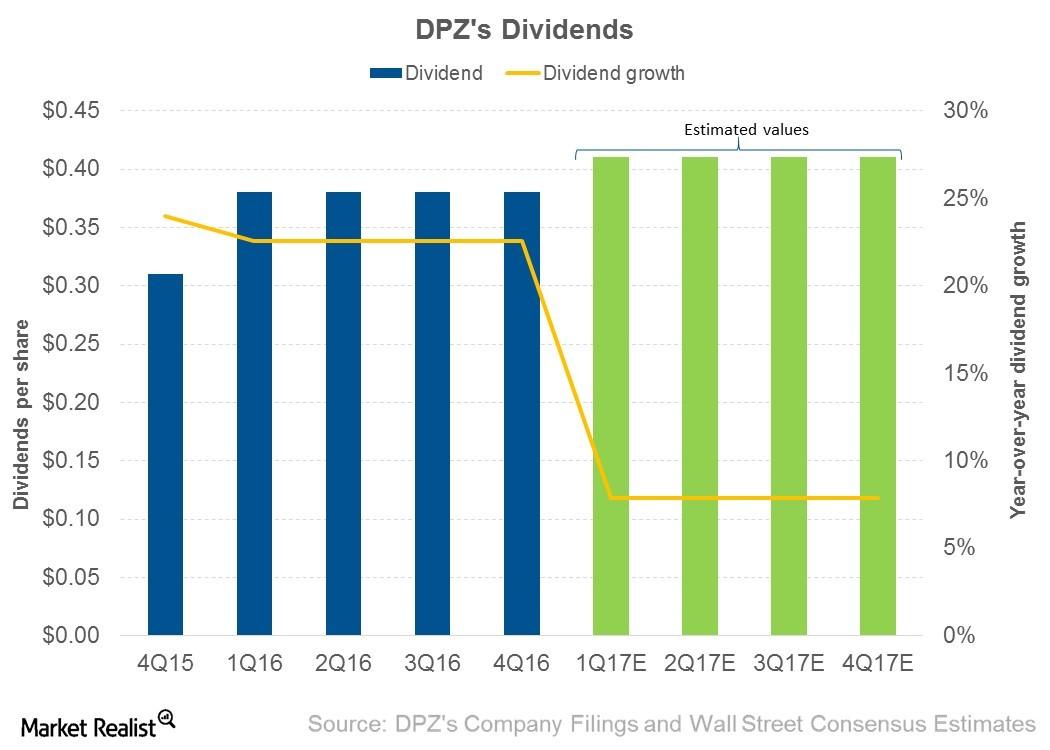

Why Domino’s Dividend Policy Is Important

In 2016, Domino’s Pizza (DPZ) paid dividends of $1.52—growth of 22.5% from $1.24 in 2015. In 2017, analysts expect its dividends to rise 7.9% to $1.64.

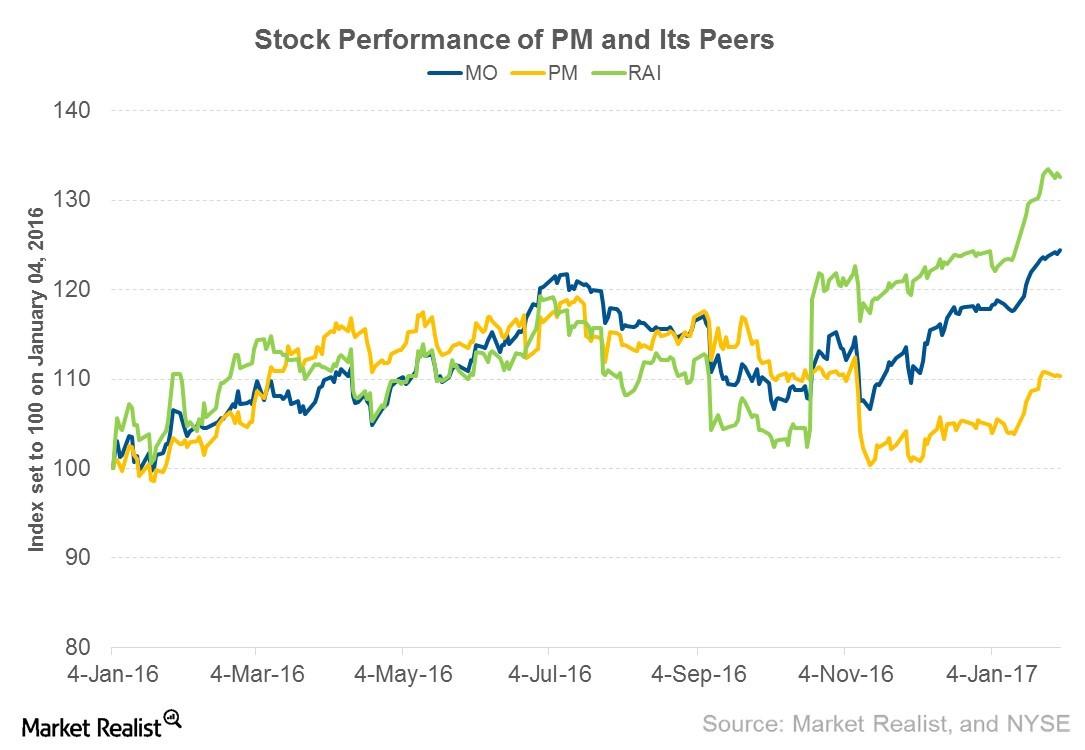

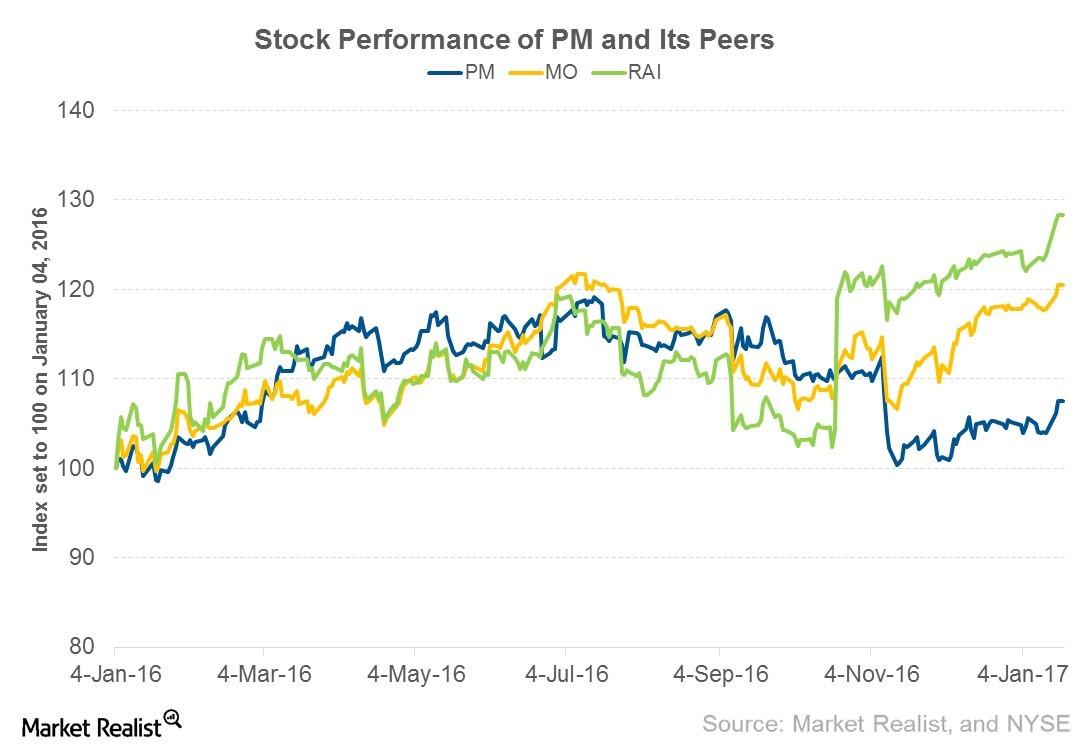

Altria Stock Rose on Strong 4Q16 Earnings

Altria Group (MO) announced its 4Q16 earnings on February 1, 2017. The company posted net revenue of $4.7 billion and EPS (earnings per share) of $5.27.

Will Philip Morris’s 4Q16 Earnings Results Boost Its Stock Price?

Philip Morris International (PM), a US-based tobacco company, is set to announce its 4Q16 earnings on February 2, 2017, before the market opens.

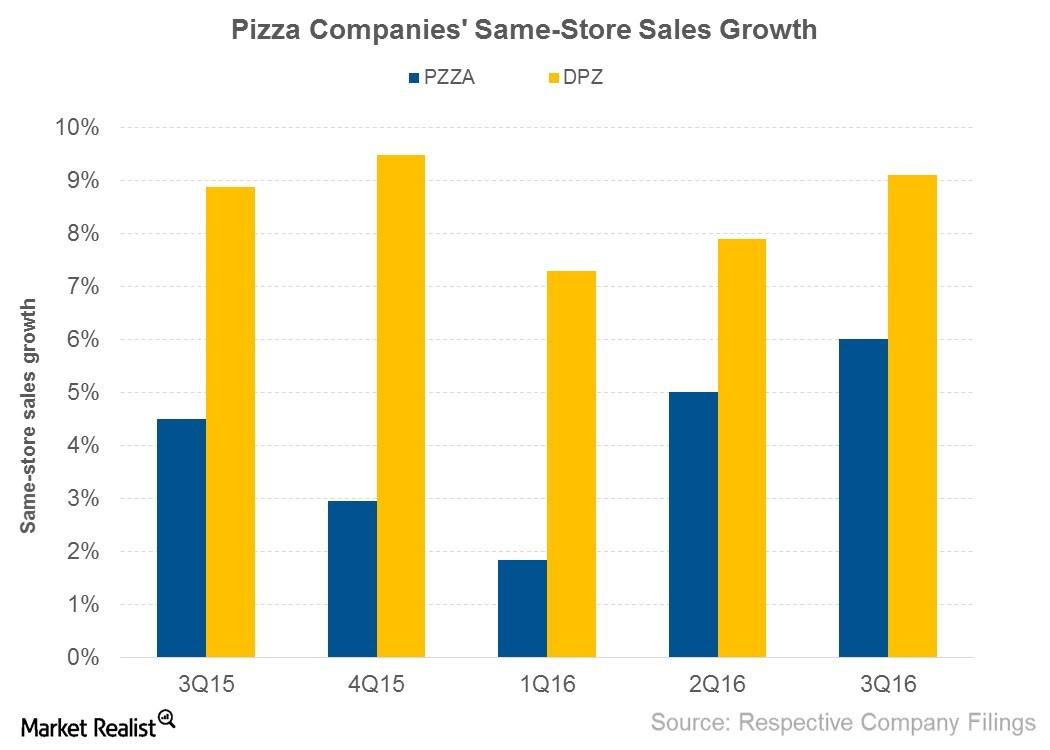

What Drove Domino’s and Papa John’s Same-Store Sales in 3Q16?

Same-store sales growth SSSG (same-store sales growth), which is expressed as a percentage, is a measure of revenue growth in existing stores over a certain period. SSSG is driven by ticket size and traffic. It’s an important metric for investors to monitor, as it increases a company’s revenue without increasing capital investment, and it’s a […]

Can Investors Expect Momentum from Altria’s 3Q16 Earnings?

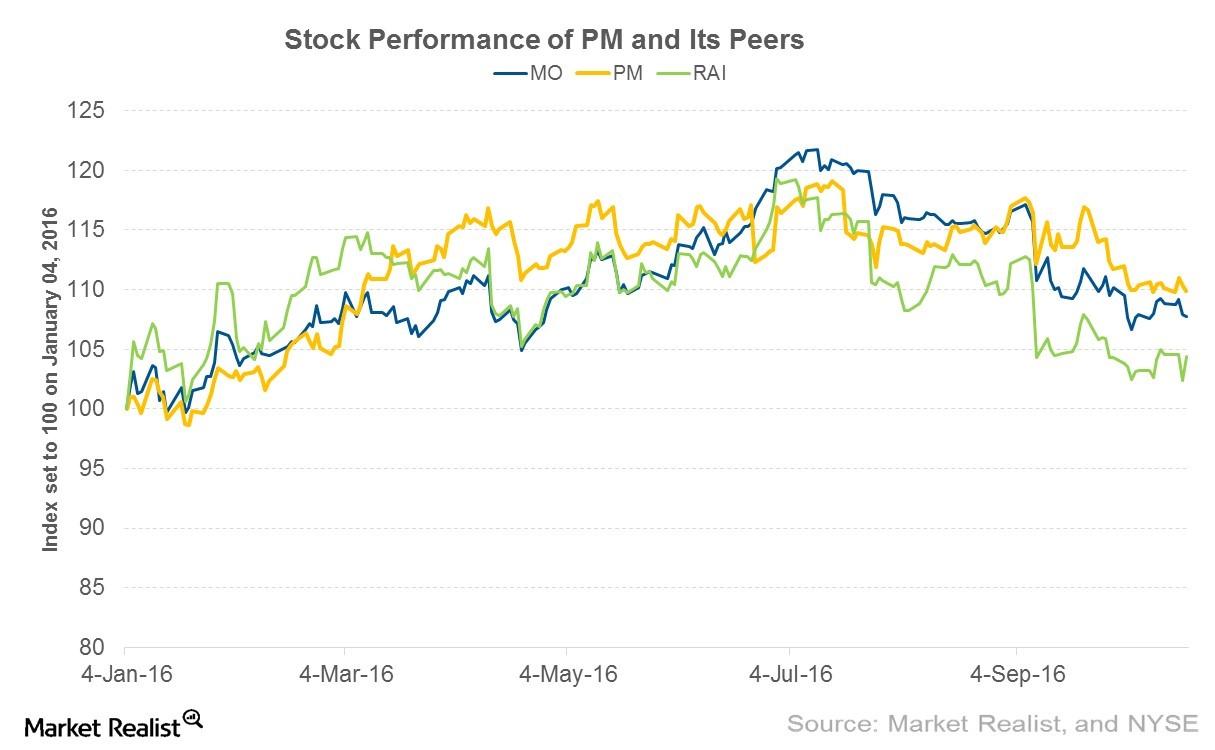

In 2016, Altria’s share price has risen 7.8% YTD. During the same period, peers Philip Morris and Reynolds American have risen 9.9% and 4.4%, respectively.

Why Philip Morris’s iQOS Sales in Japan Are Promising

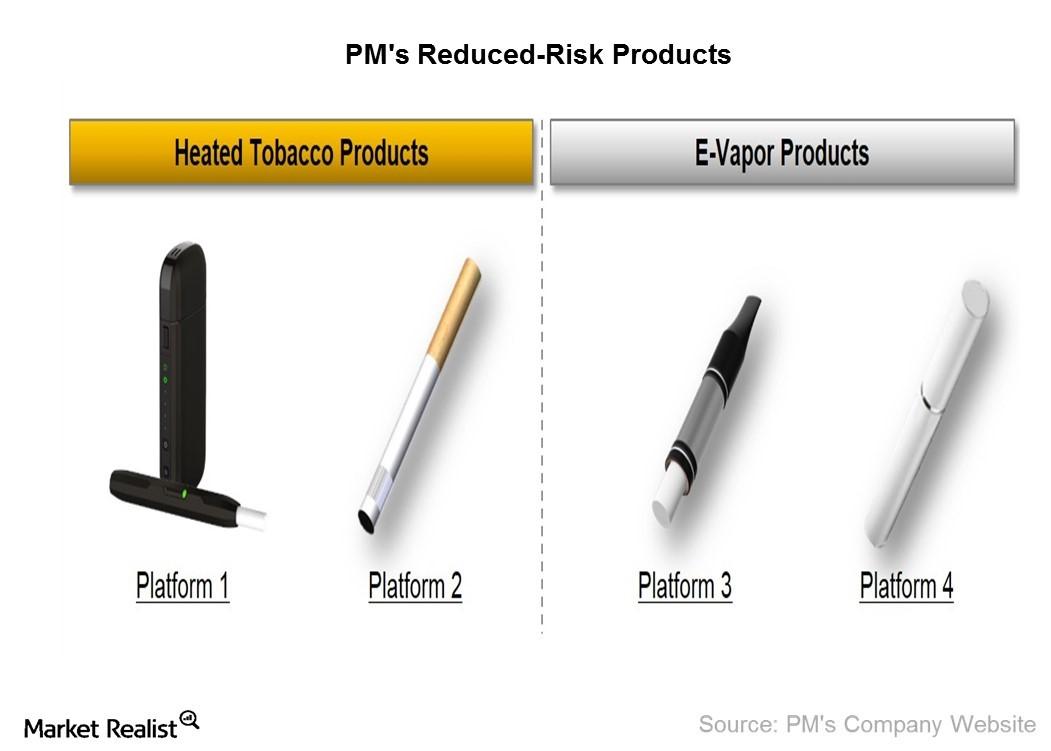

According to the WHO, under the current regulatory regimes, the percentage of the cigarette smoking population is expected to fall from 22% to 19% by 2025.

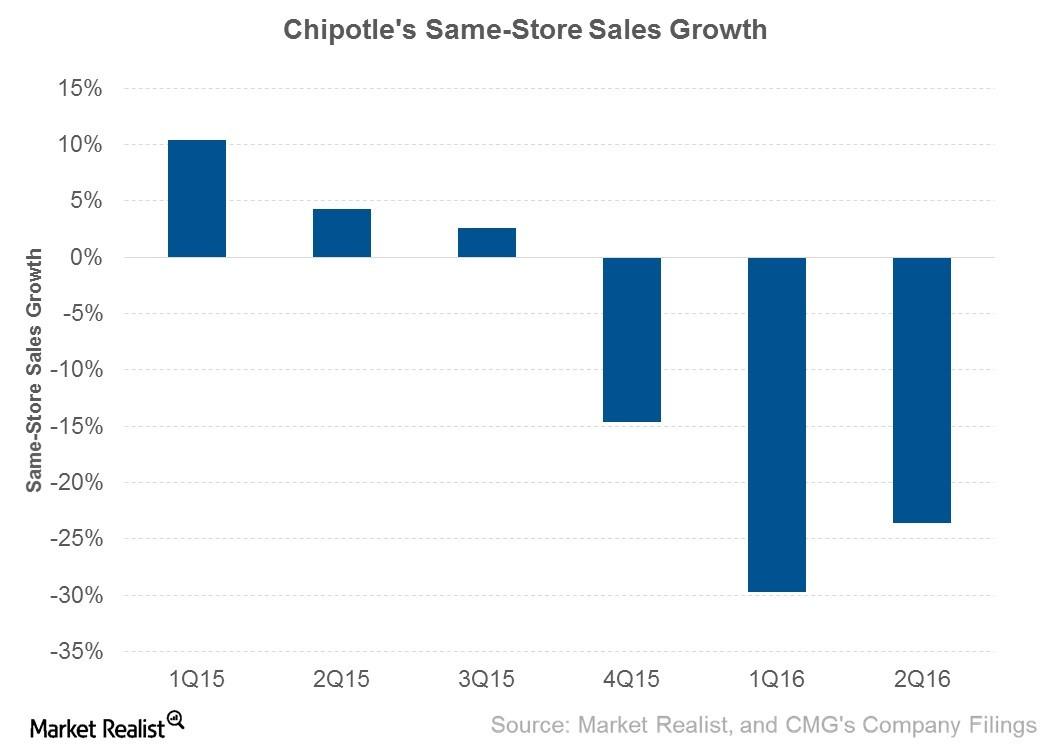

Will Europe Be Key to Chipotle Stemming Its Falling Revenue?

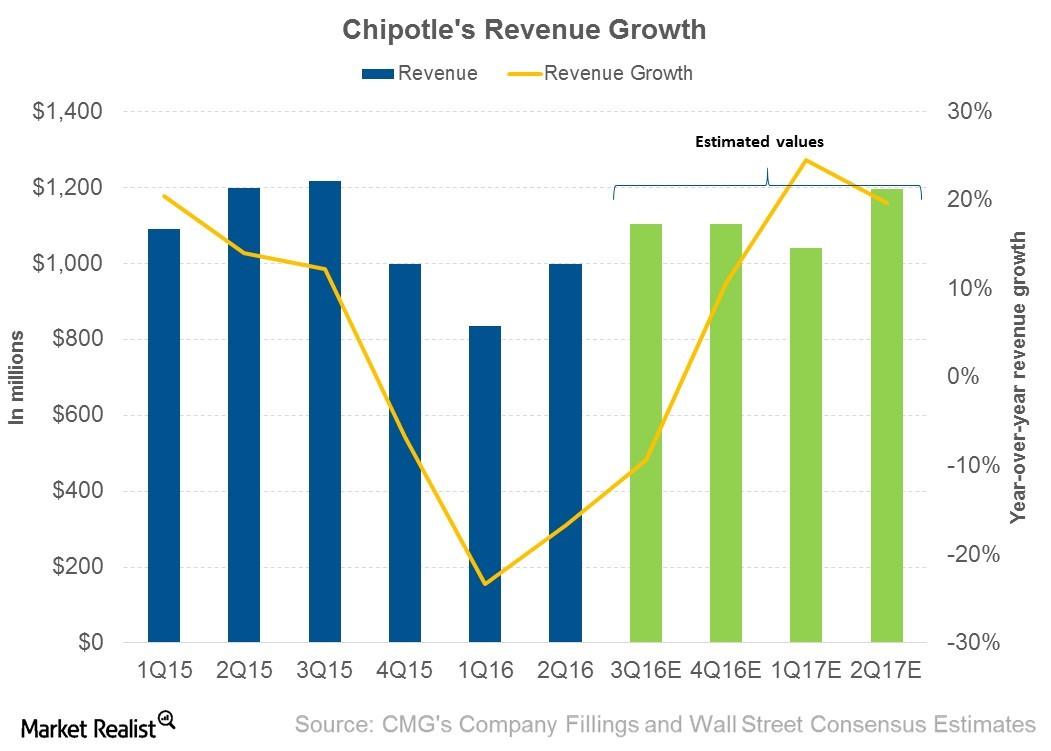

Since the E. coli outbreak in October 2015, Chipotle Mexican Grill’s (CMG) same-store sales growth has been falling. This led to negative revenue growth.

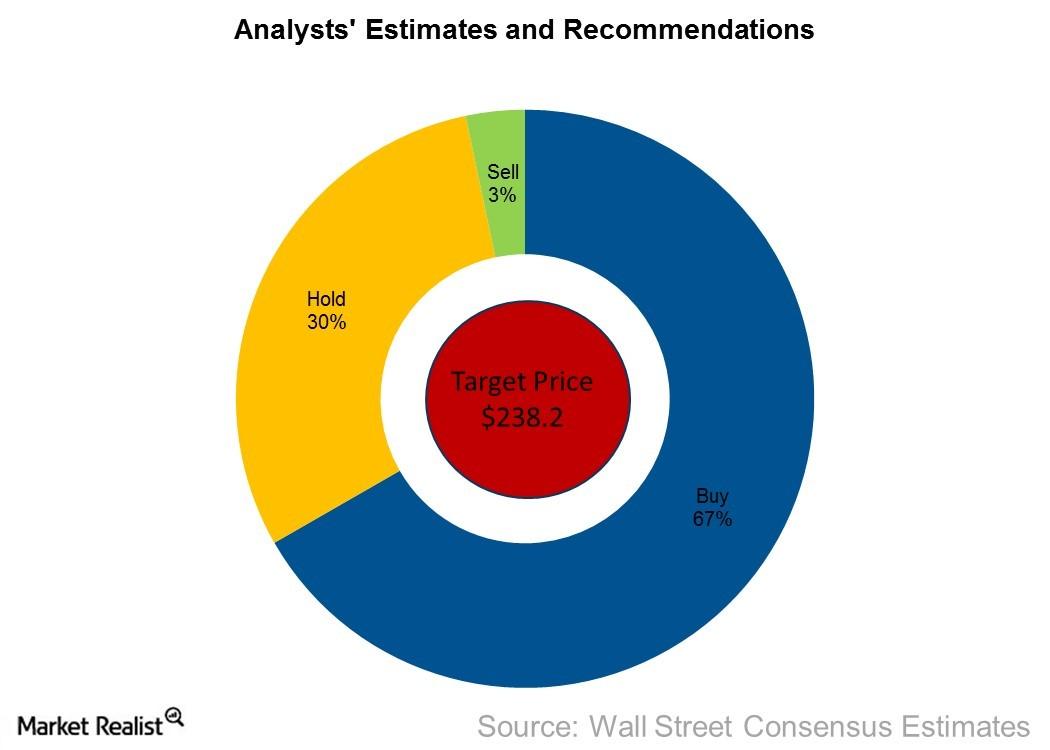

What Are Analysts’ Recommendations for Panera Bread?

Despite the recent fall in Panera’s share prices, analysts are still maintaining their price target of $238.2 for the next year—a return potential of 18.5%.

Behind the Valuation Multiples of Fast Food Restaurants

As of September 16, 2016, these five fast food restaurants were trading at a median PE multiple of 21.4x.

Analyzing Panera Bread’s Valuation Multiples

Lower revenue and EPS estimates made investors skeptical about investing in Panera. As of September 19, it was trading at 28.1x—down from 30.9x on July 28.

What is Chipotle Doing to Come Back from the E. Coli Crisis?

On August 29, 2016, Chipotle Mexican Grill (CMG) launched its latest promotional offer, targeting students in the back-to-school season.

Wendy’s Stock Fell Due to Declining Sales

Wendy’s (WEN) posted its 2Q16 results on August 10, 2016. The company posted adjusted EPS (earnings per share) of $0.11 on revenue of $382.7 million.

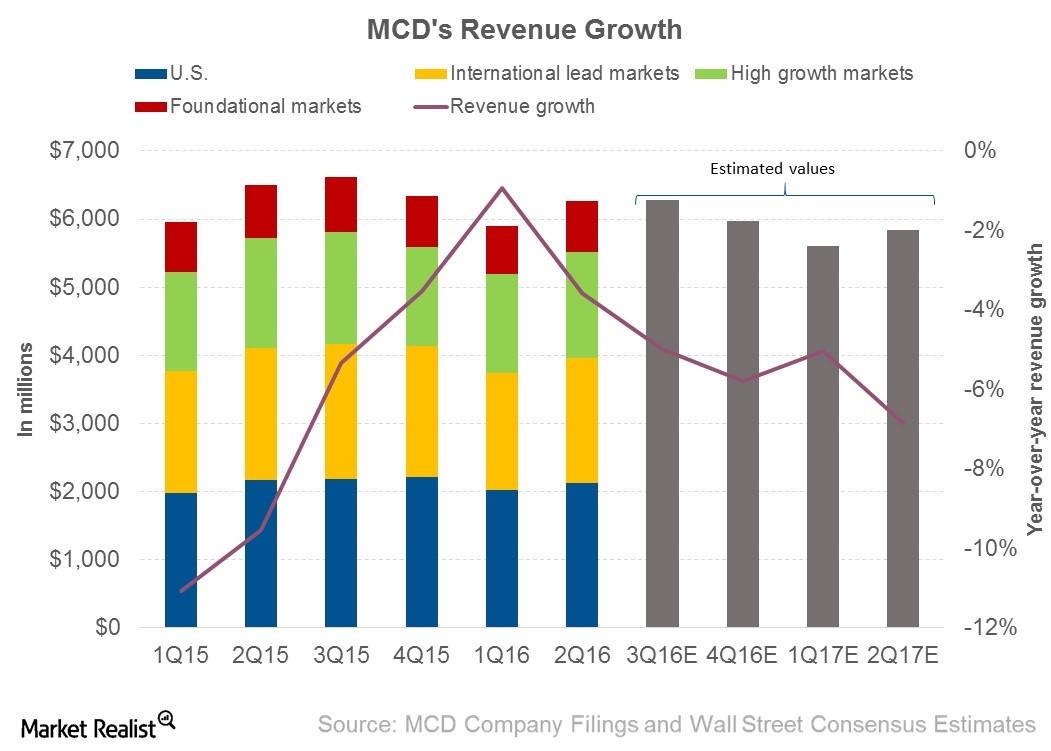

Why Did McDonald’s Revenue Decline in 2Q16?

In 2Q16, McDonald’s revenue declined by 3.6% from $6.5 billion to $6.3 billion.

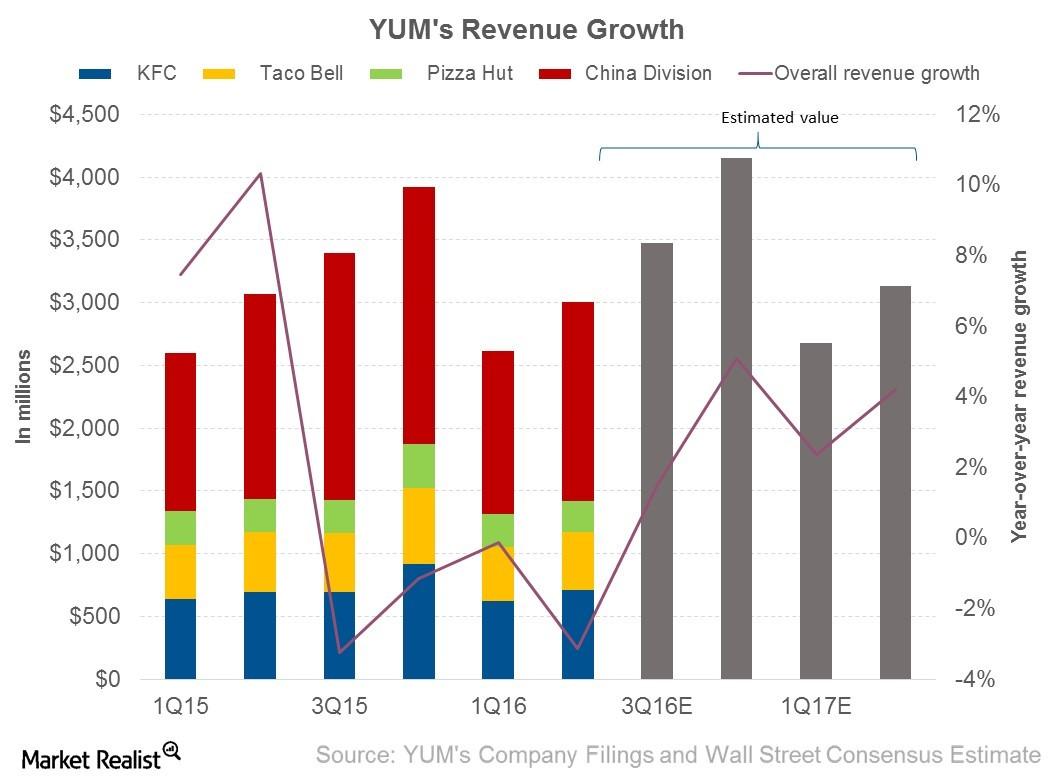

Why Did Yum! Brands’ Revenue Decline in 2Q16?

In 2Q16, Yum! Brands earned 84.9% of its revenue from company-owned restaurants and 15.1% from franchised restaurants.

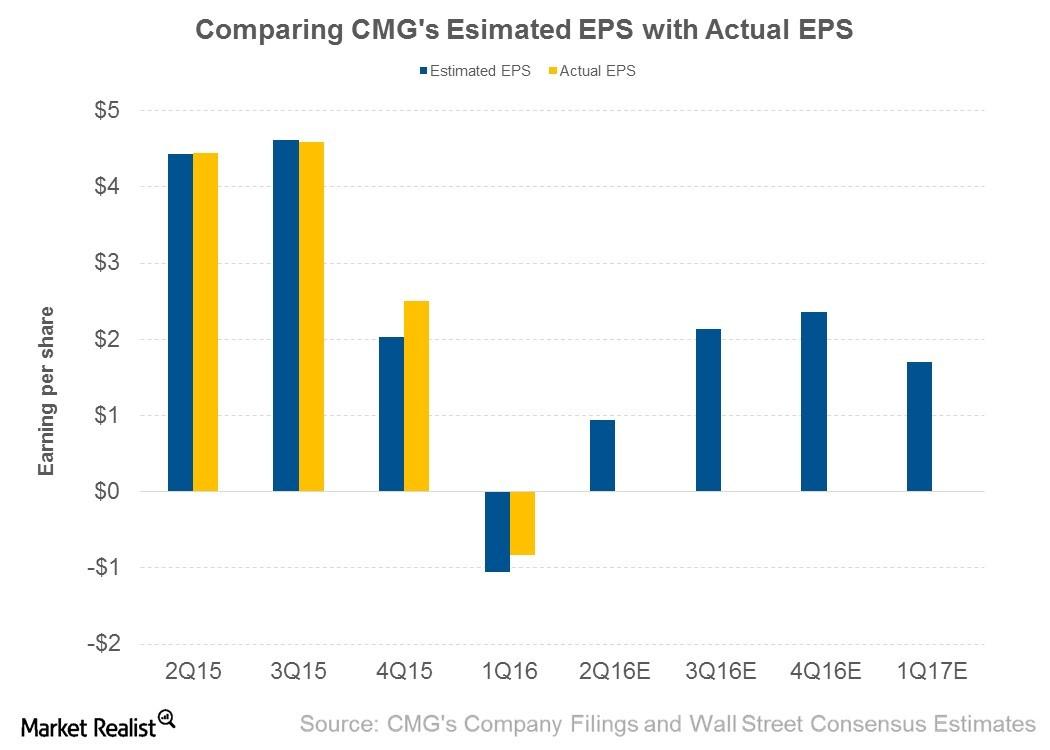

What Analysts Are Expecting from Chipotle’s 2Q16 Earnings

In last four quarters, Chipotle has beaten analysts’ estimates three times. Usually, when the company beats analysts’ estimates, the share price rises.

What Do Analysts Expect from Chipotle’s Revenue in 2Q16?

Revenue sources By the end of 1Q16, Chipotle Mexican Grill (CMG) owned and operated all of its 2,066 restaurants. In 2Q16, analysts are expecting the company to register revenue of $1.05 billion, a decline of 12.1% from $1.2 billion in 1Q15. Factors affecting Chipotle’s revenue Although Chipotle’s management had undertaken several measures to counter the […]

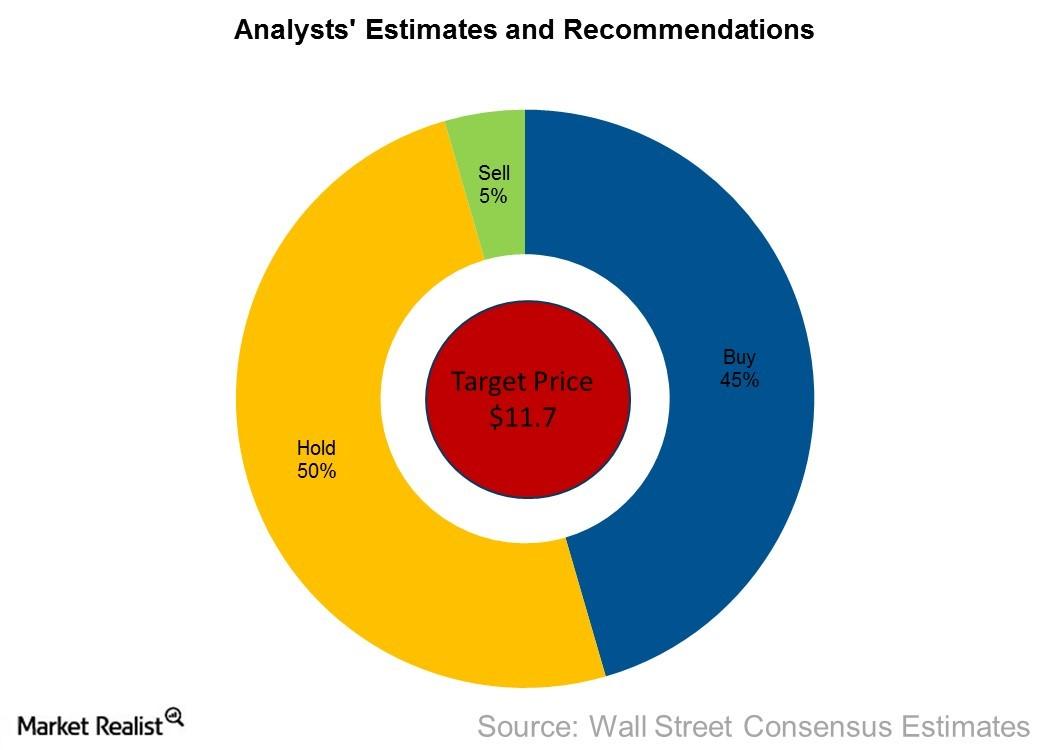

The Word on the Street: What Analysts Are Saying about Wendy’s

According to Bloomberg, of the ten analysts surveyed, 45.5% have issued “buy” recommendations for Wendy’s, while 50% have issued “hold” recommendations.