What the Analysts Expect for Altria’s Revenues in 3Q17

In 2Q17, Altria’s (MO) Smokeable Products segment generated 86.1% of the company’s total revenues.

Oct. 19 2017, Updated 4:07 p.m. ET

MORevenue sources

Altria Group (MO) earns revenues from four main segments: Smokeable Products, Smokeless Products, Wine, and Other. In 2Q17, the Smokeable Products segment generated 86.1% of the company’s total revenues, while the Smokeless Products, Wine, and Other segments generated 10.5%, 2.9%, and 0.5%, respectively, of MO’s total revenues.

3Q17 revenue estimates

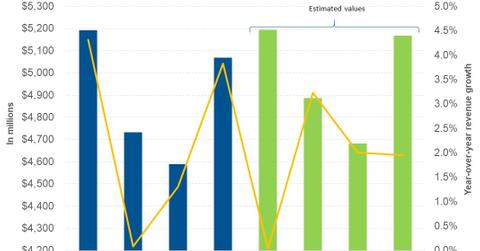

For 3Q17, analysts are expecting Altria to post revenues (net of excise taxes) of $5.20 billion, compared with $5.19 billion in 3Q16. Altria’s revenue is expected to be driven by the acquisition of Nat Sherman, the rise in products prices, and the introduction of new products. Altria acquired Nat Sherman, a super-premium cigarette brand manufacturer, in January 2017.

To drive sales, Altria has expanded the availability of its Marlboro Black Menthol 72s across the US. The company has also introduced three new MarkTen flavors—Winter Mint, Summer Fusion, and Smooth Cream—in April 2017, and has expanded the availability of its MarkTen products to 10,000 more stores.

Altria raised the price of Marlboro by $0.06 per pack in November 2016 and by $0.08 per pack in March 2017. The prices of L&M were raised $0.08 per pack in March 2017. The prices of cigar brands rose $0.10 per five-pack in May 2017.

Smokeless

In the Smokeless segment, the company raised the prices of USSTC (US Smokeless Tobacco Company) products by $0.07 per can in April 2017. In December 2016, the company raised the prices of Copenhagen and Skoal by $0.12 per can, while the prices of other products rose $0.07 per can.

Analysts expect the rise in the excise tax of $2 per pack in California from April 1, 2017, and the increase in excise taxes on the smokeless category in California from July 1, 2017, to offset some of the sales growth during the quarter.

Peer comparisons and outlook

During the same period, analysts are expecting Philip Morris International (PM) to post revenue growth of 10.6%.

For the next four quarters, analysts are expecting Altria to post revenues of $19.92 billion, which would represent a growth of 1.8% from its revenues of $19.58 billion in the corresponding four quarters of the previous year.

Next, we’ll look at Altria’s expected margins for 3Q17.