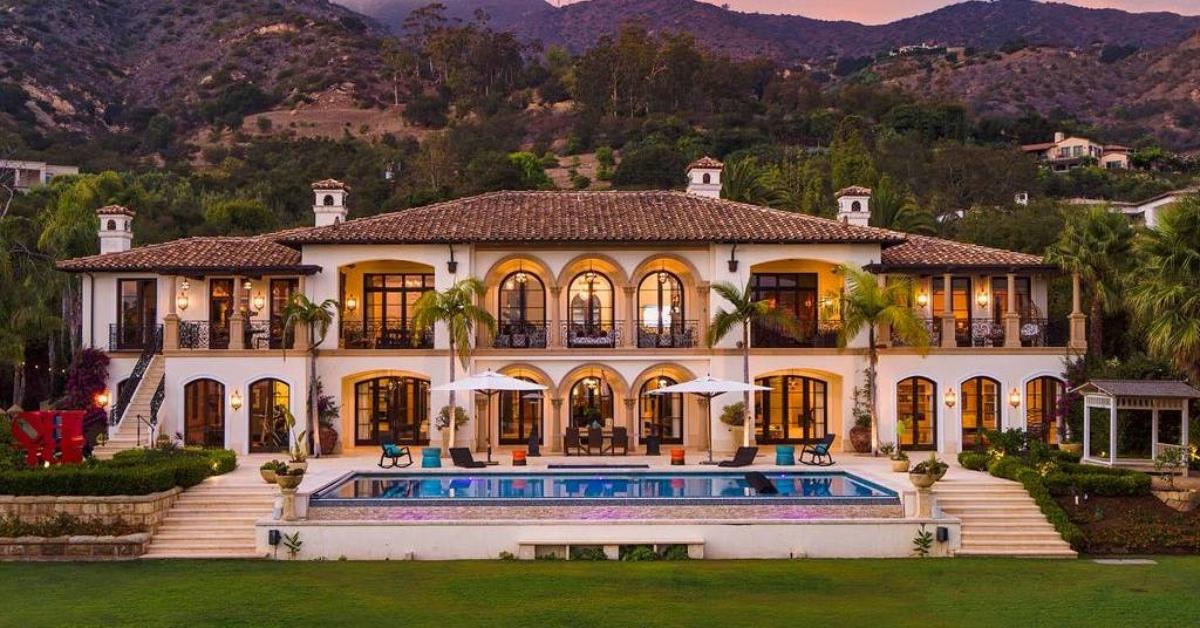

Buying Property in Dubai vs. U.S. Cities: What Investors Should Compare

Compare buying property in Dubai vs U.S. cities. Explore prices, rental yields, taxes, financing, and ROI to help real estate investors make informed decisions.

Looking for advice on personal finance? From the best credit card rewards programs to the best way to save for retirement, we'll help you get a better rein on your personal finance and tax questions.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.