Thermo Fisher Scientific Inc

Latest Thermo Fisher Scientific Inc News and Updates

Materials Sector Stocks Weigh Market Down, Might Be Time to Buy

The materials sector has been among the worst hit in the market. Is now the time to invest for long-term growth?

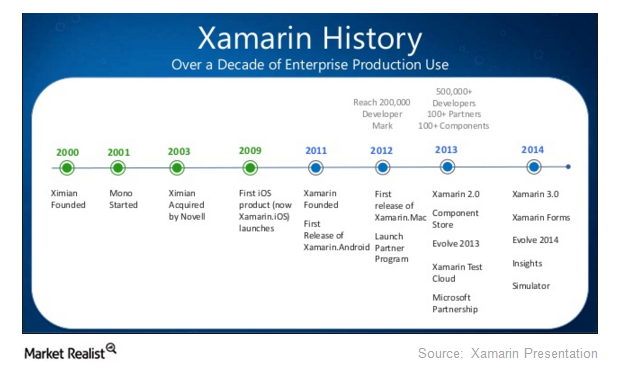

Microsoft Infiltrates the Mobile App Space: The Xamarin Acquisition

On February 24, Microsoft announced that it will acquire Xamarin, a mobile app platform provider. Financial details of the deal were not disclosed.

What Are Leon Cooperman’s Top Holdings?

In Q3 2020, billionaire investor Leon Cooperman’s top five holdings were Fiserv, Mr. Cooper Group, Alphabet, Cigna, and Trinity Industries.

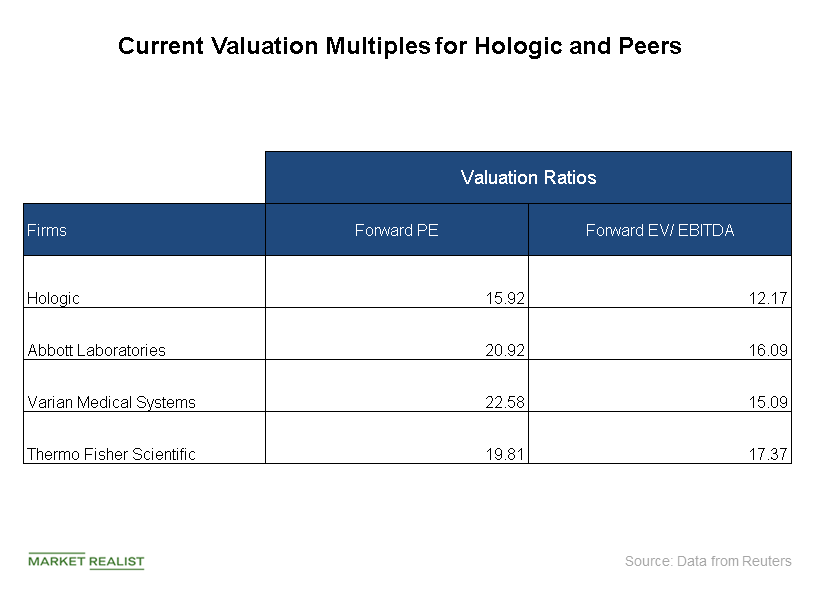

How Hologic’s Valuation Stacks Up with Peers

The company has delivered a robust financial performance in recent quarters. However, the stock has been on a bearish trend during the recent period.

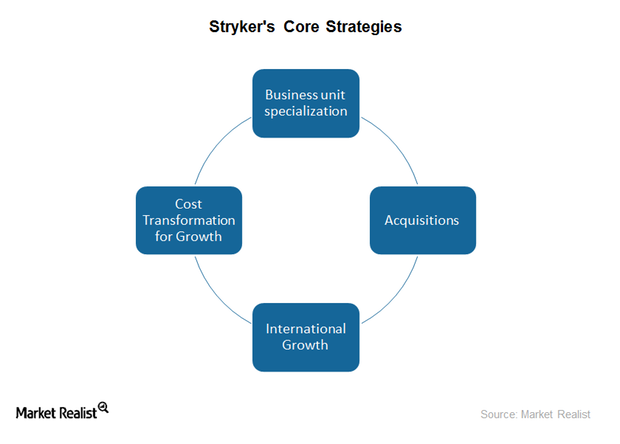

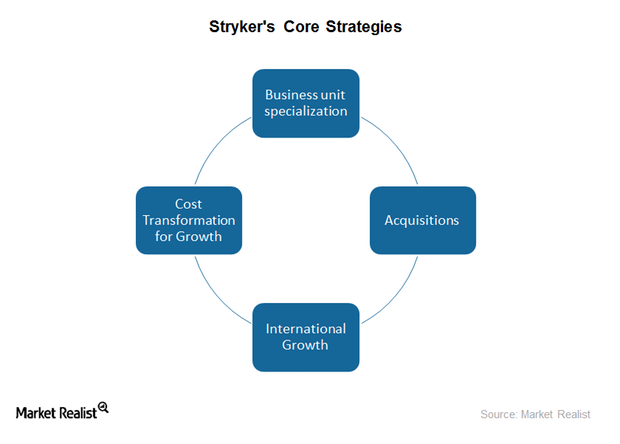

How Are Stryker’s Core Strategies Working Toward Its Growth?

Stryker (SYK) registered strong 3Q16 earnings on October 27, 2016. The company’s reported earnings exceeded analysts’ estimates.

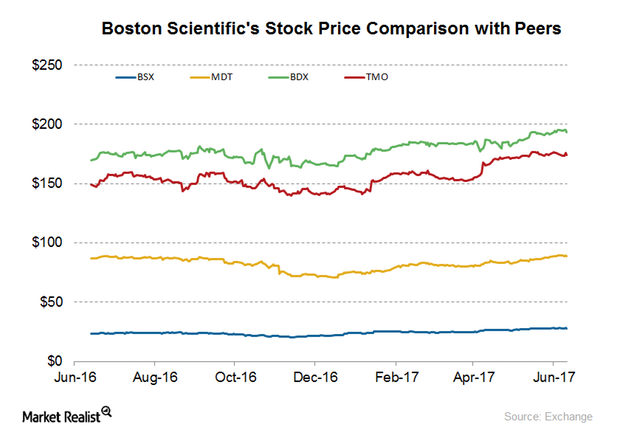

How Has Boston Scientific Stock Performed Recently?

Boston Scientific (BSX) was trading at $27.9 on June 29, 2017.

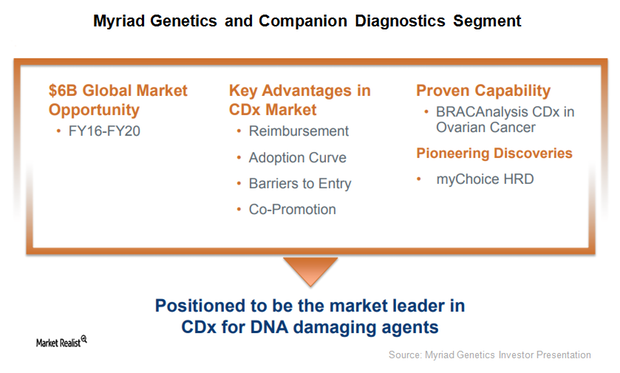

This Could Be a Solid Growth Driver for Myriad Genetics in 2018

Myriad Genetics (MYGN) announced the U.S. Food and Drug Administration’s (or FDA) acceptance of its supplementary premarket approval application for BRACAnalysis CDx, a DNA sequencing companion diagnostic test.

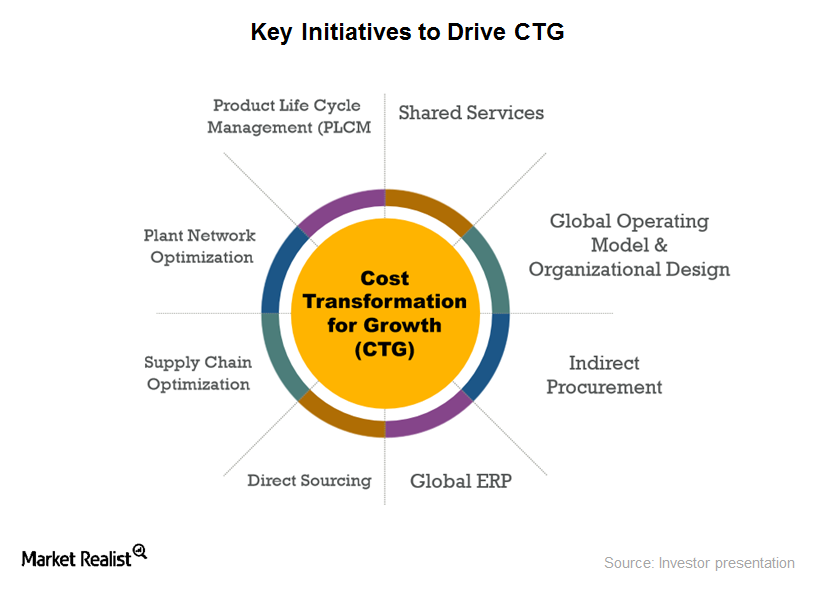

How Stryker’s Margins Are Driven by Its CTG Program

Cost transformation for growth (or CTG) is Stryker’s program that focuses on driving leveraged growth by structural cost optimization.

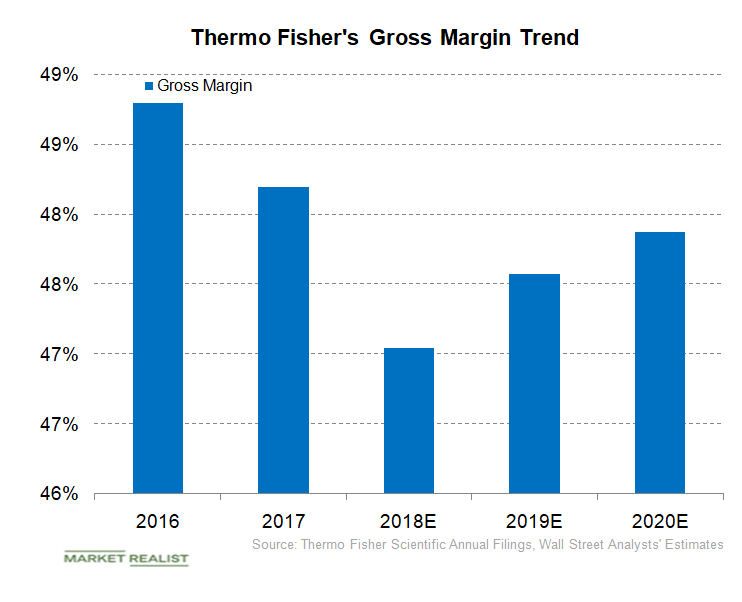

Thermo Fisher Scientific’s Gross Margin Trends

In fiscal 2018 and fiscal 2019, Thermo Fisher Scientific (TMO) is expected to generate revenue of $24.08 billion and $25.19 billion, respectively, compared with revenue of $20.92 billion in fiscal 2017.

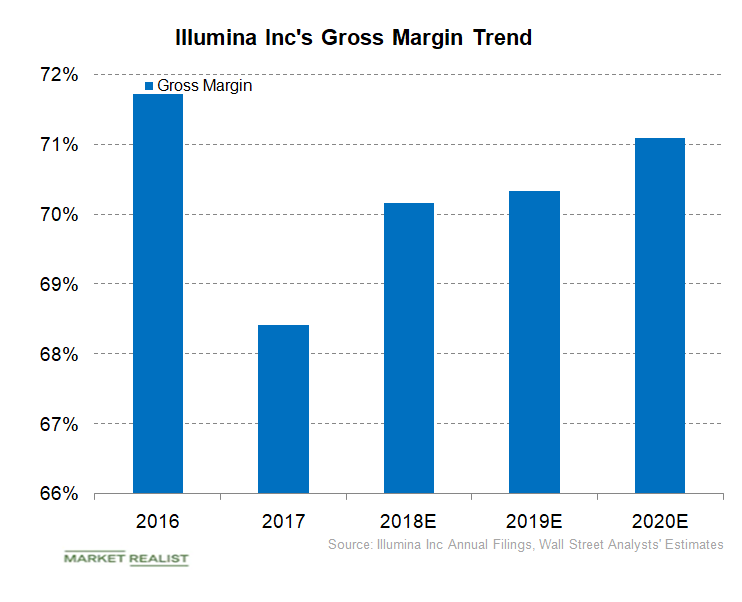

Understanding Illumina’s Gross Margin Trend

Illumina’s cost of product revenue increased from $173.0 million in the third quarter of 2017 to $184.0 million in the third quarter of 2018.

Is Abbott Laboratories Trading at a High Valuation in September?

Abbott stock has been gaining momentum recently, and its valuation has improved.

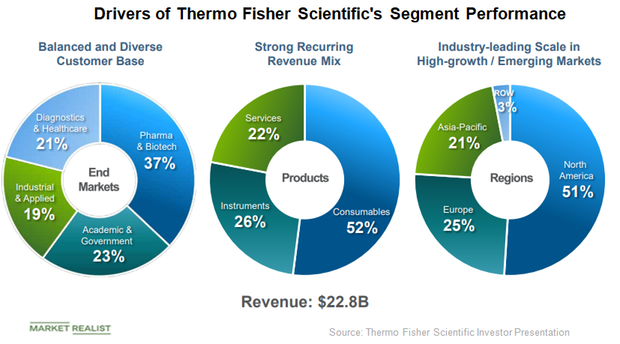

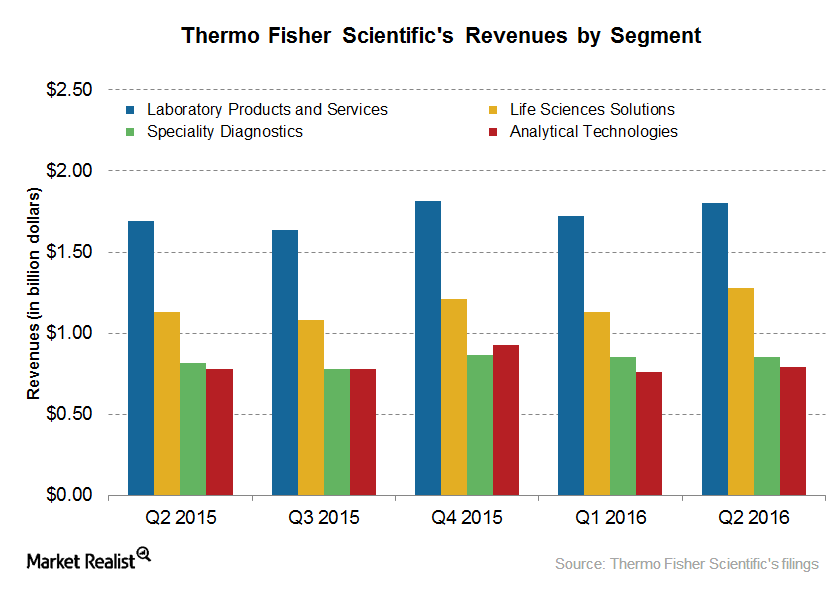

What’s Driving the Growth in Thermo Fisher Scientific’s Segments?

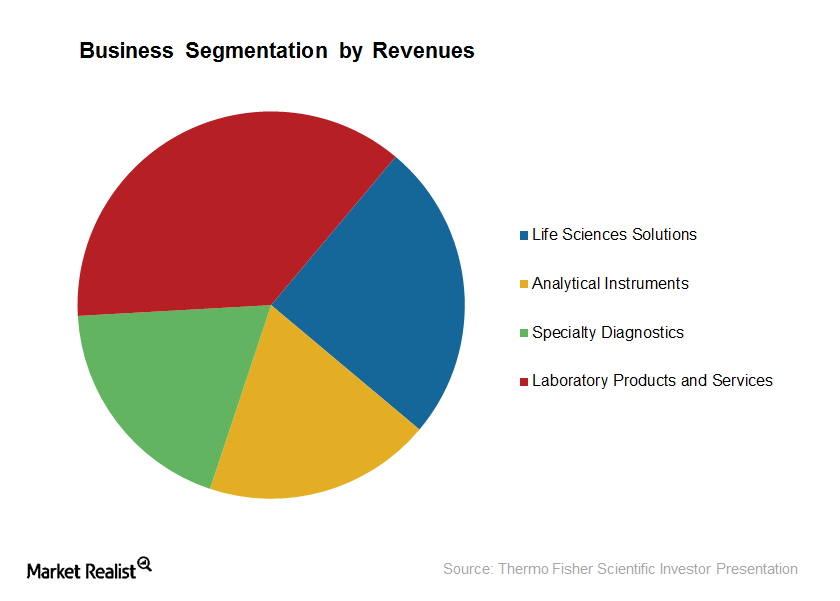

Thermo Fisher Scientific (TMO) operates in four business segments.

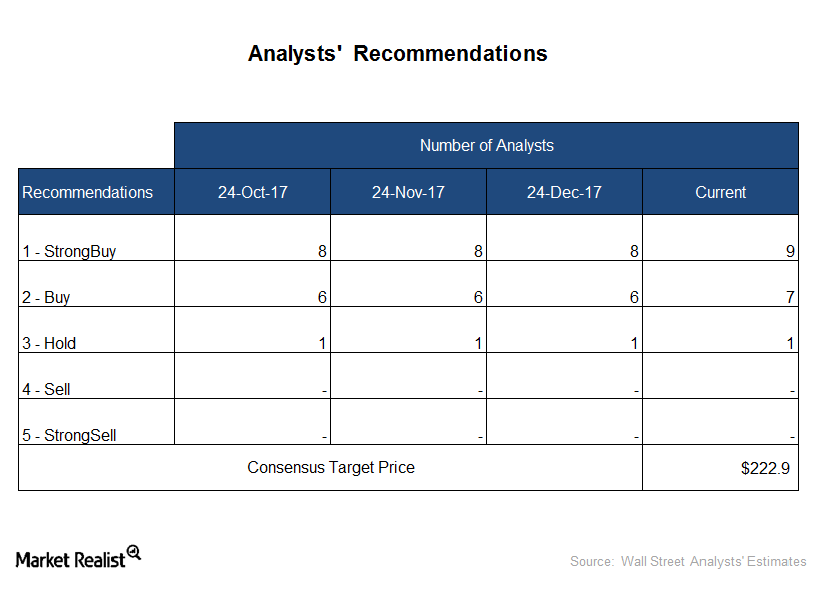

Analyst Ratings for Thermo Fisher Scientific before 4Q17 Results

Thermo Fisher Scientific (TMO) will announce its 4Q17 and fiscal 2017 results on January 31, 2018. It has launched some innovative products and entered into strategic collaborations and partnerships.

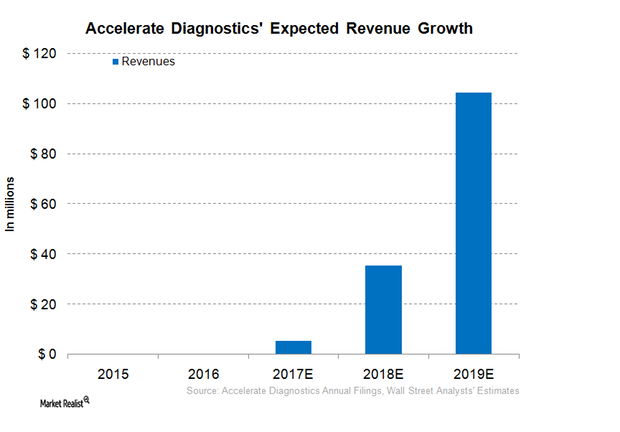

Does Accelerate Diagnostics’ Financial Performance Bode Well?

The net sales of Accelerate Diagnostics (AXDX) increased from $24,000 in 3Q16 to $828,000 in 3Q17.

Thermo Fisher Expands Its Partnership with Genome Diagnostics

In December 2017, Thermo Fisher Scientific (TMO) expanded its partnership with Genome Diagnostics (or GenDx), a Netherlands-based firm offering molecular diagnostics solutions.

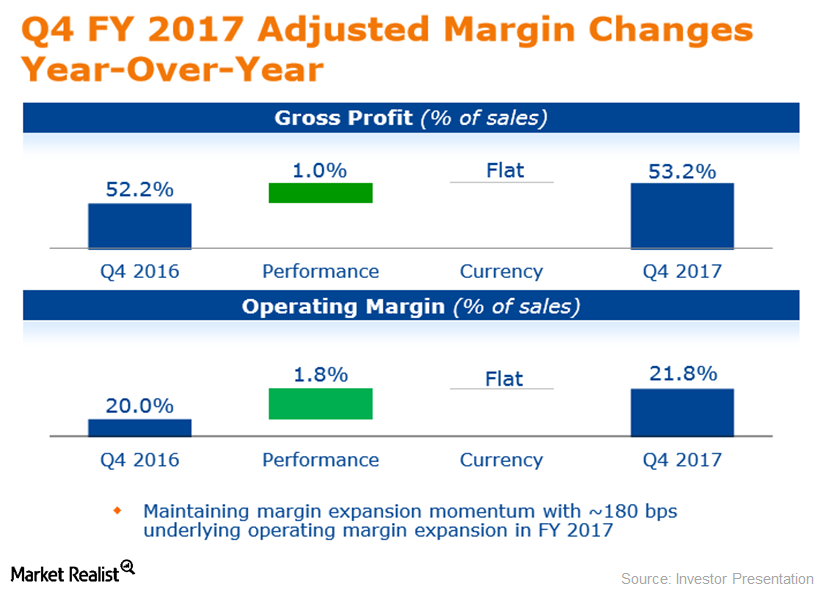

What’s Driving BD’s Operating Margin Expansion

Overview BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points. In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s […]

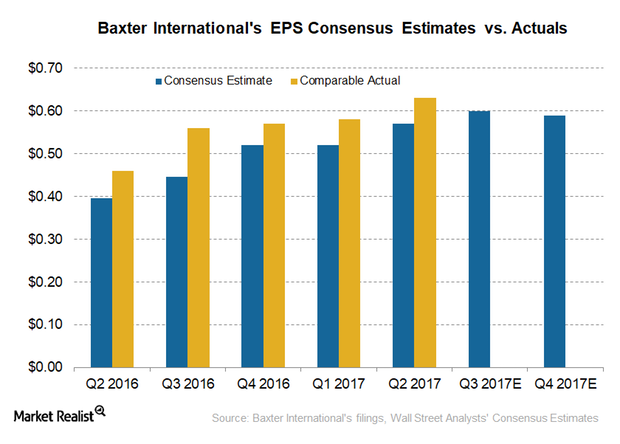

Inside Baxter International’s Stock Price Performance

On September 7, 2017, BAX stock closed at $62.84 per share. It has a 50-day moving average of $61.15 and a 200-day moving average of $57.14.

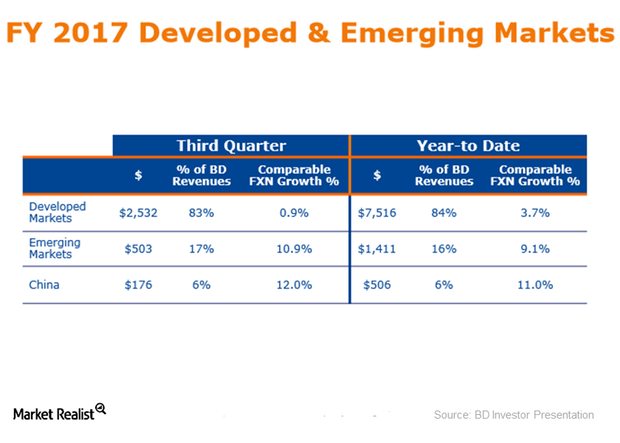

How Is Becton Dickinson Progressing with Emerging Market Growth?

Becton Dickinson’s (BDX) emerging markets registered a strong double-digit growth of 10.9% in 3Q17.

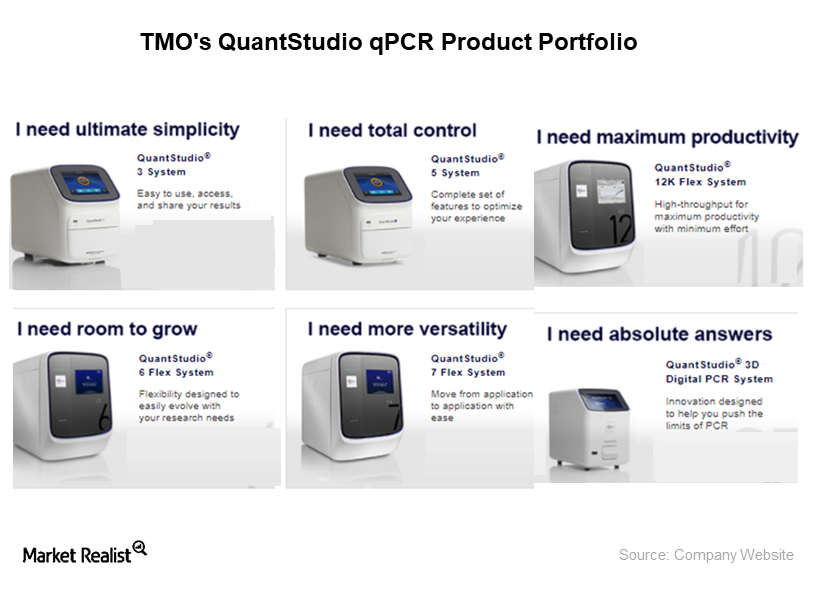

Thermo Fisher Scientific Accelerates Its Semiconductor Sequencing

On June 29, 2017, Thermo Fisher Scientific (TMO) announced the addition of three new products to its semiconductor failure analysis workflows portfolio.

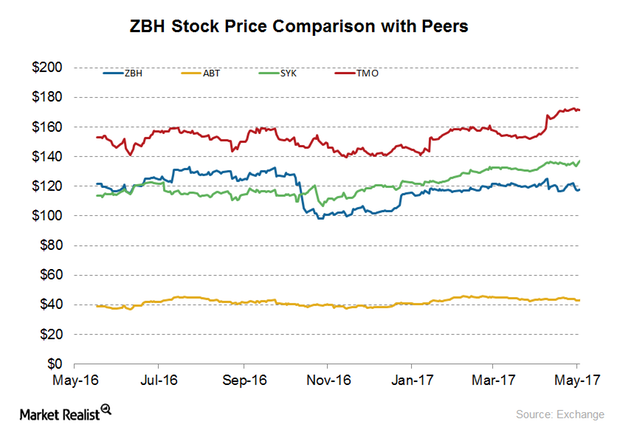

How Zimmer Biomet Stock Has Performed Recently

Zimmer Biomet Holdings (ZBH) was trading at $118.40 on May 30, 2017. It has a 50-day moving average of $119.70 and a 200-day moving average of $114.20.

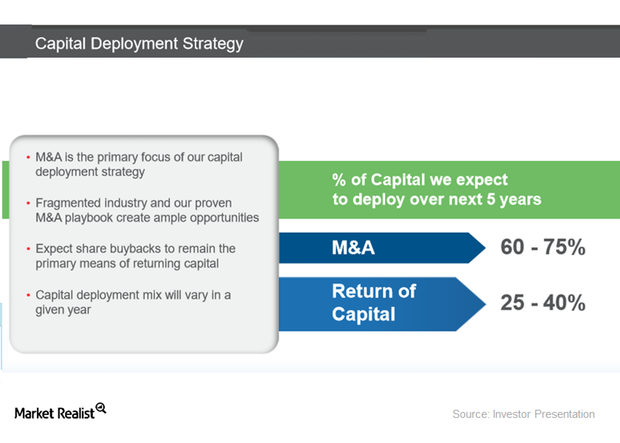

Understanding Thermo Fisher’s Capital Deployment Strategy

Thermo Fisher Scientific expects to deploy 60%–75% of its capital toward M&As (mergers and acquisitions).

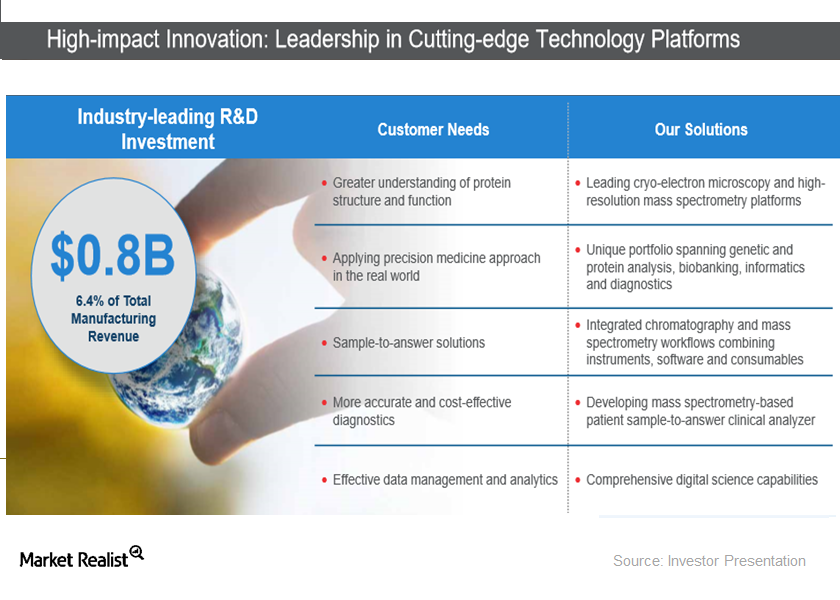

Understanding Thermo Fisher’s Growth Strategy

Thermo Fisher Scientific (TMO) has always focused on innovation as a key growth strategy.

How Long Can Thermo Fisher Scientific’s Asia-Pacific Growth Momentum Last?

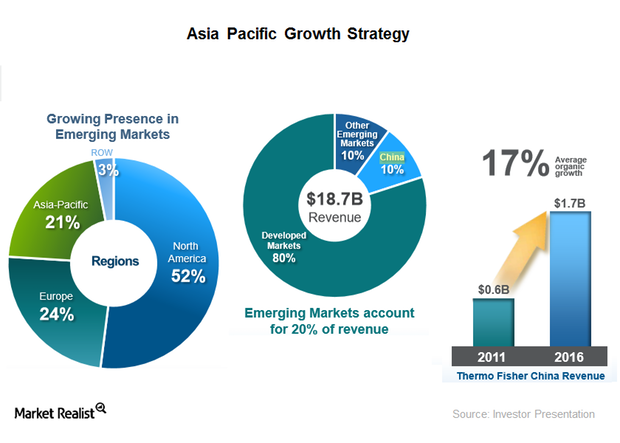

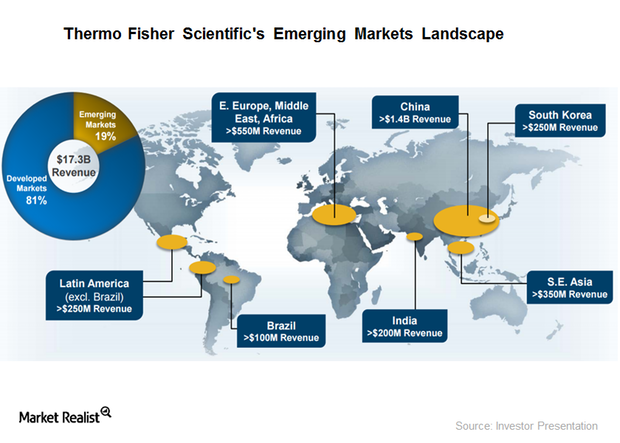

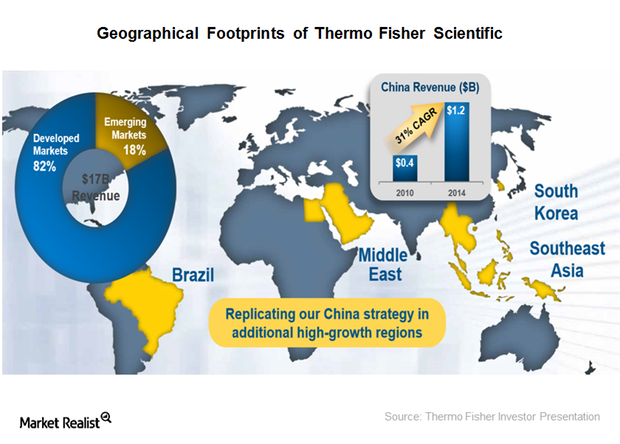

Thermo Fisher Scientific (TMO) has a presence around the globe, but around 80% of its revenues are generated from developed markets.

What Bio-Rad Laboratories Expects from Life Science

In 1Q17, Bio-Rad Laboratories’ (BIO) Life Science segment reported revenues of ~$174.3 million, which represents a YoY rise of ~5.1%.

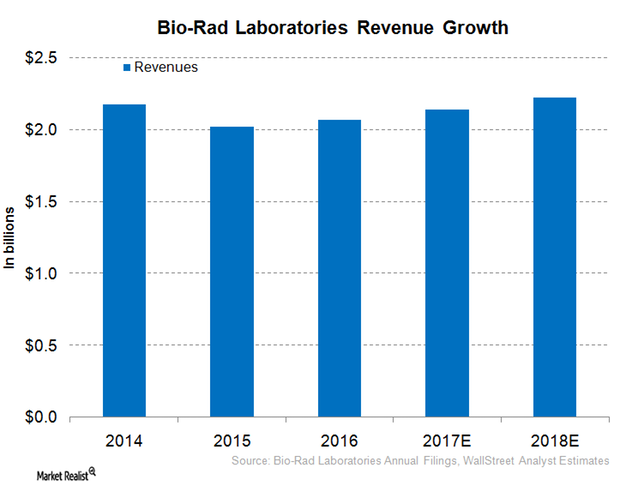

Inside Bio-Rad Laboratories’ Robust Revenue Growth Projection for 2017

On March 13, 2017, Bio-Rad Laboratories (BIO) provided a long-term, currency-neutral revenue growth target of around 3%–5%.

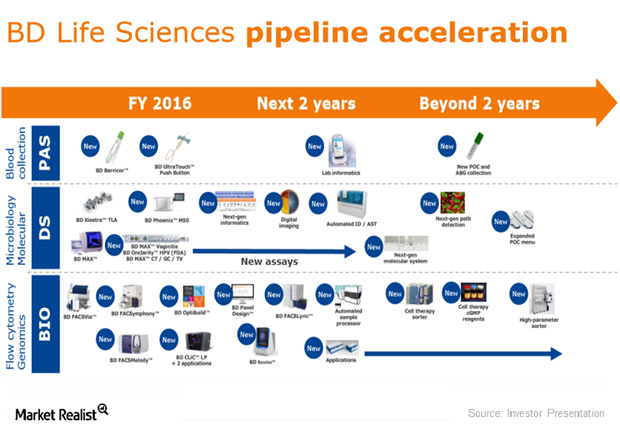

BD Lifesciences’s Product Pipeline Could Boost Its Fiscal 2017 Growth

Becton, Dickinson and Company (BDX) recently launched BD Barricor and BD Ultra Touch Push Button under its Pre-Analytical Systems division.

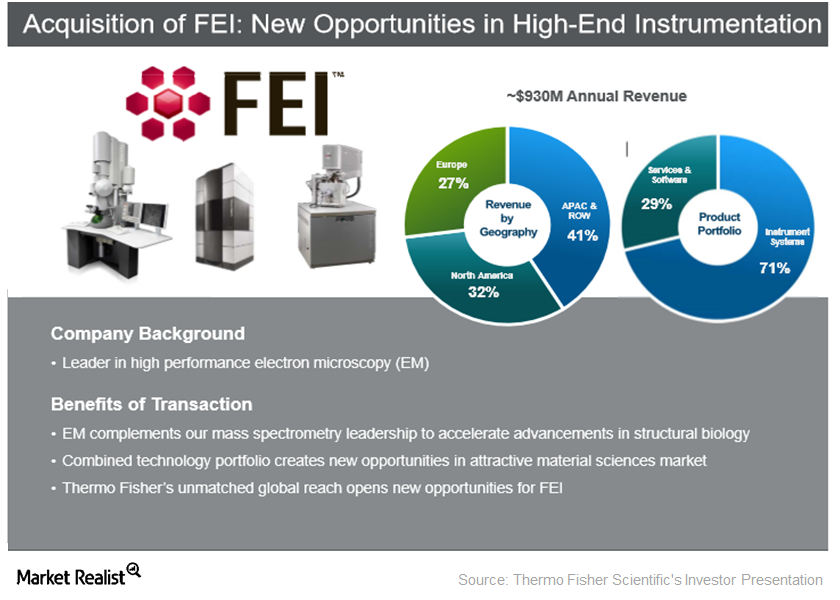

How Is Thermo Fisher Scientific’s FEI Integration Process Going?

Thermo Fisher Scientific (TMO) completed the acquisition of FEI Company on September 19, 2016.

Exploring the Nuances of Stryker’s Cost Transformation for Growth

Cost transformation growth is one of Stryker’s key strategies for driving growth. The company has come a long way from its decentralized structure prior to 2010.

Thermo Fisher Scientific’s Key Growth Strategy

Thermo Fisher Scientific reported ~$4.5 billion in revenues in 2Q16, representing YoY (year-over-year) growth of ~6%.

Can Thermo Fisher’s PPI Business System Continue to Drive Growth in 2016?

The PPI system has helped nourish strong top-line growth across Thermo Fisher’s businesses while boosting margins.

Inside Thermo Fisher Scientific’s Emerging Markets Strategy

Thermo Fisher has a presence in more than 50 countries. It generates ~19% of its revenues from emerging markets and the rest from developed markets.

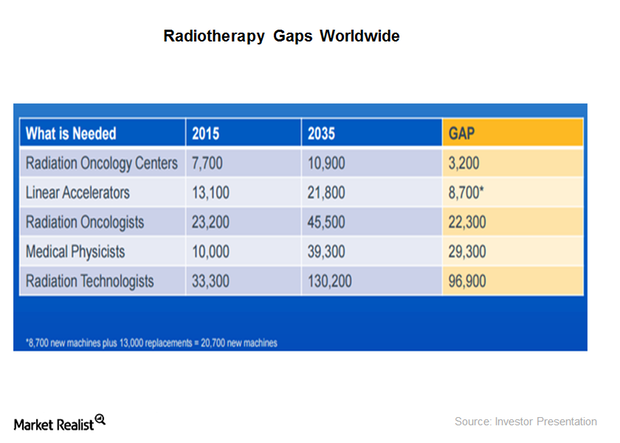

Varian Medical Systems’ Growth Potential in Radiation Oncology

Varian Medical Systems’ next big technology innovation will be high-definition radiotherapy, which is an intelligent treatment delivery system that aims to achieve 100% radiation exposure for the tumor.

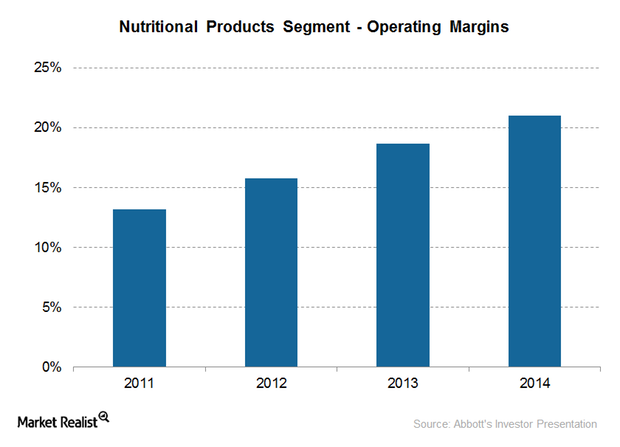

Why Abbott Laboratories Is a Leader in Nutritional Products

Abbott Laboratories’ Nutritional Products segment is the company’s leading segment, growing at a fast pace, with rapidly increasing margins and revenues.

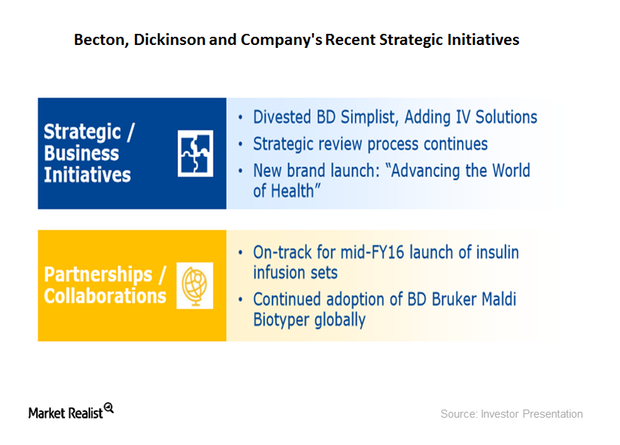

Behind Becton Dickinson’s Strategic Restructuring and Business Consolidation

To better position itself amid the changing medical device environment, Becton Dickinson has come to focus on restructuring and business model evolution.

The Geographic Strategy of Thermo Fisher Scientific

Thermo Fisher Scientific is a global company, but the majority of its revenues are generated from the developed markets. The US is its largest market, generating ~48% of the company’s total revenues.

An Overview of Thermo Fisher Scientific’s Business Model

Thermo Fisher Scientific (TMO) has made a number of acquisitions over the years, resulting in the expansion of the company’s product portfolio with the inclusion of a number of premium brands.

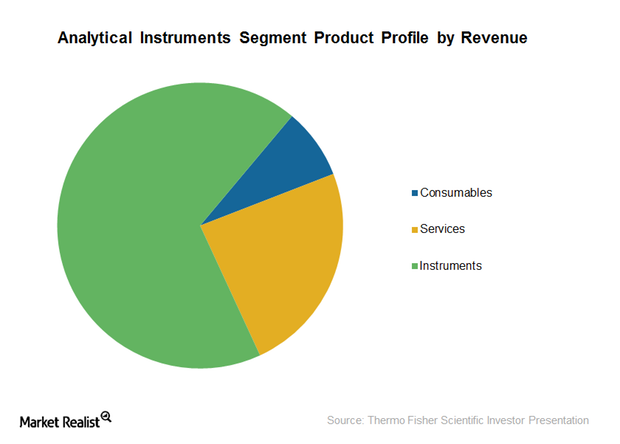

Thermo Fisher Scientific’s Analytical Instruments Business Segment

Thermo Fisher Scientific’s Analytical Instruments segment earned revenues of ~$3.3 billion in 2014, representing organic growth of around 4%.

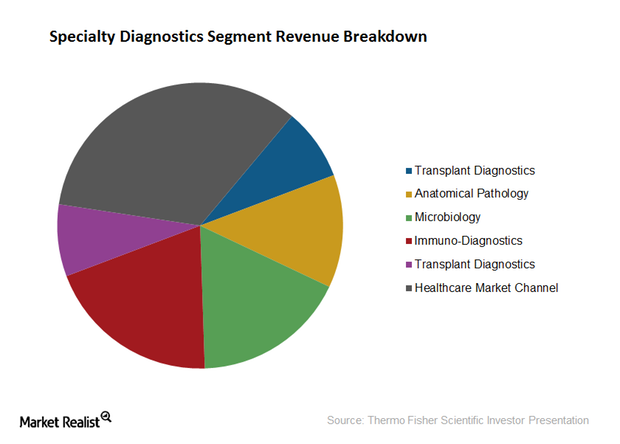

Specialty Diagnostics Segment of Thermo Fisher Scientific

A leading provider of diagnostic products and services, Thermo Fisher Scientific (TMO) has witnessed strong recurring revenues and high margins in the Specialty Diagnostics Segment over the years.

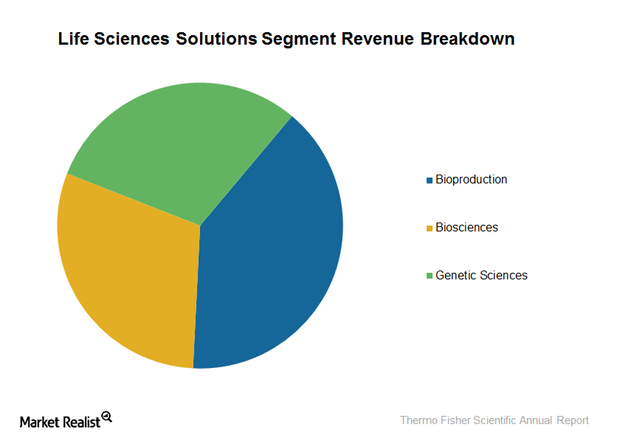

The Life Sciences Solutions Segment of Thermo Fisher Scientific

Thermo Fisher Scientific’s Life Sciences Solutions segment earned revenues of ~$4.2 billion in 2014, representing organic growth of around 4%.

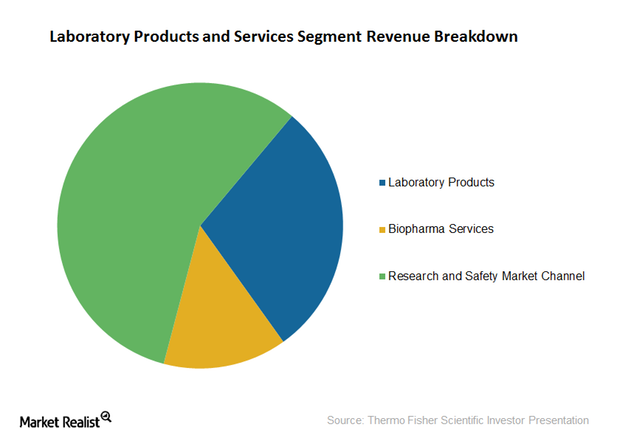

Thermo Fisher Scientific’s Laboratory Products and Services Segment

Thermo Fisher Scientific’s Laboratory Products and Services segment earned revenues of approximately $6.6 billion in 2014, representing organic growth of around 5%.

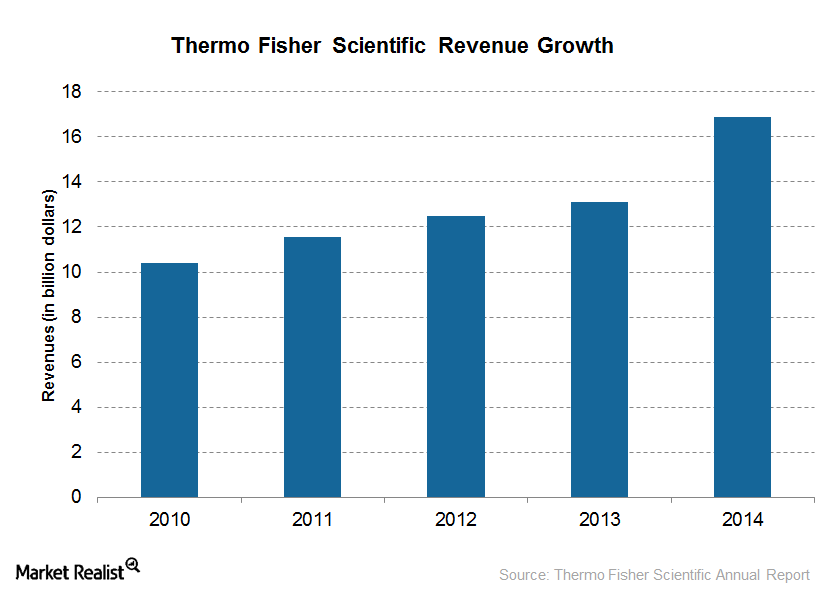

Thermo Fisher Scientific: A Leading Medical Technology Company

Thermo Fisher Scientific (TMO) is one of the leading medical technology companies in the world, providing a broad portfolio of laboratory equipment and services.

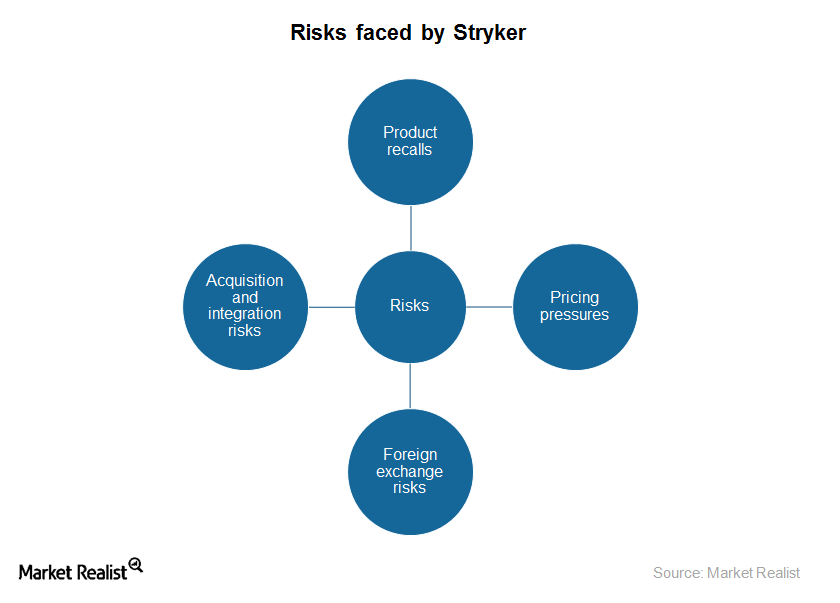

Assessing Stryker’s Major Risks at the Dawn of 2016

Stryker is a leading medical technology company and subject to big challenges impacting the medical technology industry, both systematic and unsystematic.

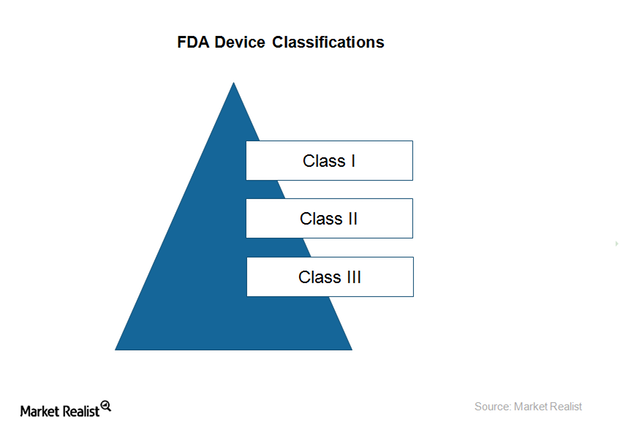

How Does the FDA Classify Medical Devices?

Medical devices are classified as per the level of control required by the Food, Drug, and Cosmetic Act (or FD&C Act).

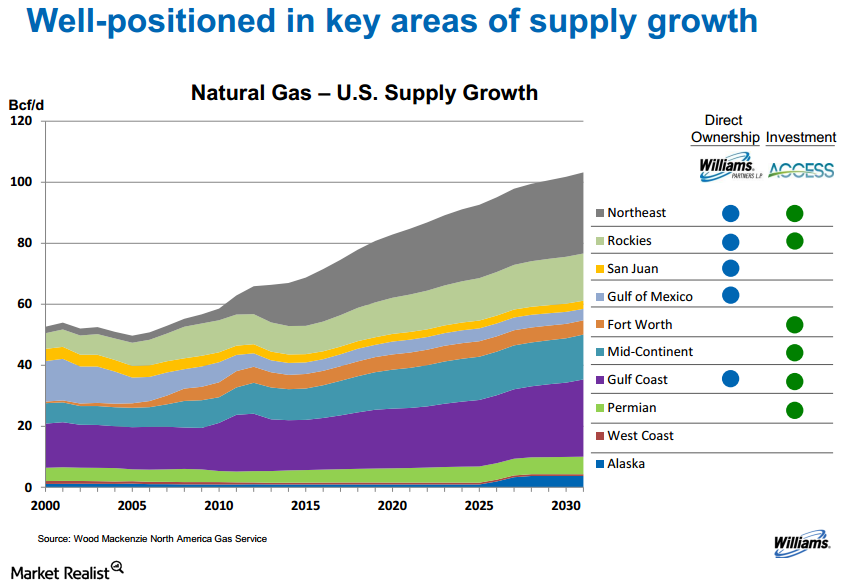

Why Third Point initiated a position in Williams Companies

Third Point started a new 2.83% position in gas pipeline operator Williams Companies, Inc.