SS&C Technologies Holdings Inc

Latest SS&C Technologies Holdings Inc News and Updates

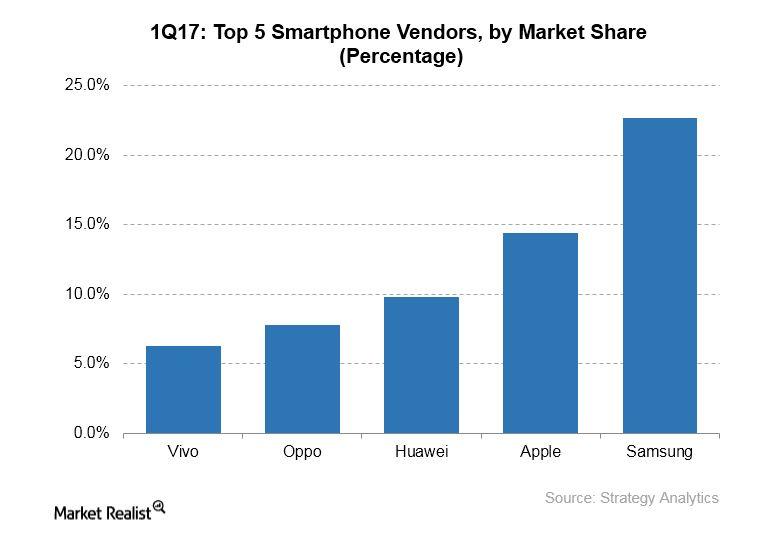

What Can Explain Apple’s Fluctuating Smartphone Ranking?

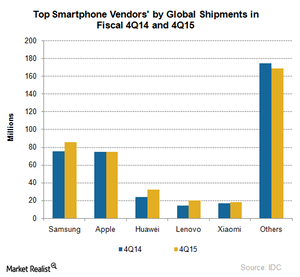

In the last two quarters, Apple and Samsung have swapped positions in terms of market leadership. Samsung, with its mix of premium and budget handsets, usually tops its competitors.

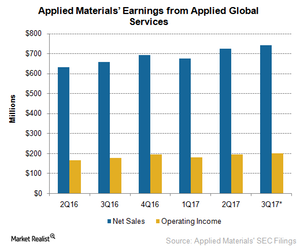

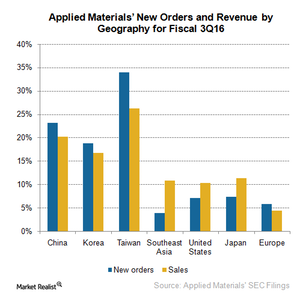

Applied Global Services Stabilizes Applied Materials’ Earnings

Applied Materials’ Applied Global Services segment Applied Materials’ (AMAT) Semiconductor Systems segment has seen strong growth as chipmakers transition to new material-intensive 3D NAND technology and 10-nm (nanometer) and 8-nm process nodes. The chipmakers may take some time to ramp up new technology and improve yield rates. Applied Materials’ AGS (Applied Global Services) team works in sync with […]

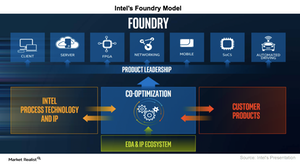

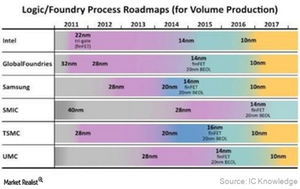

Behind Intel’s Foundry Business

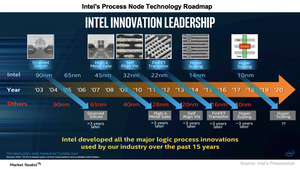

Intel’s process leadership is seemingly unbeatable. Its upcoming 10nm (nanometer) node will contain double the number of transistors compared to Samsung’s and TSMC’s 10nm nodes.

Will Intel Continue to Benefit from Moore’s Law?

Intel’s (INTC) gross margin hasn’t improved much over the last two years because it’s been manufacturing chips on the same 14nm (nanometer) node since 2014.

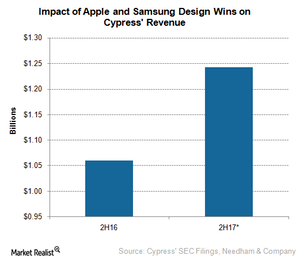

How Much Does Cypress Stand to Benefit from Apple’s and Samsung’s Latest Designs?

Cypress (CY) is rumored to be in the process of securing a smartphone design win for its USB type-C port from Apple (AAPL) and Samsung (SSNLF).

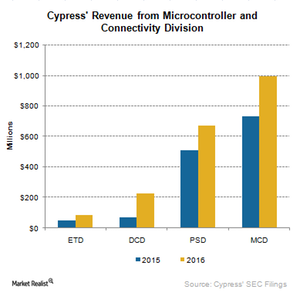

Why Cypress Semiconductor Restructured Its Business Segments

Cypress has combined its four business segments into two: MCD (Microcontroller and Connectivity Division) and MPD (Memory Products Division).

How Micron Technology Could Benefit from an Early Transition to 3D NAND

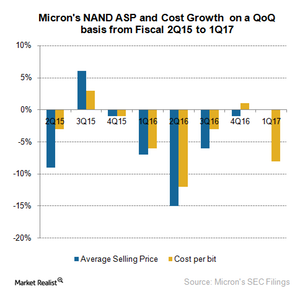

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline.

Micron Technology’s 3D NAND Roadmap for 2017

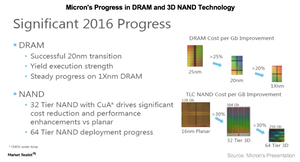

Micron Technology (MU) plans to spend ~$1.8 billion in capex on ramping up the 64-tier 3D NAND and developing the third-generation 3D NAND.

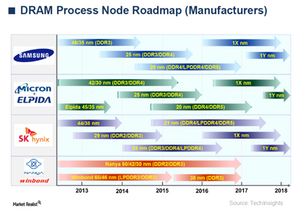

Micron Technology’s Competitive Position in the DRAM Market

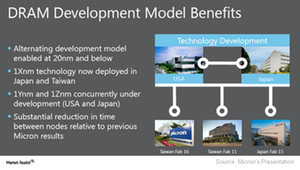

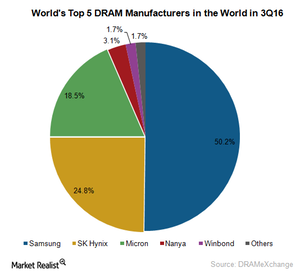

Micron Technology (MU) has achieved a 25% cost reduction by transitioning from 25nm to 20nm.

Could China Drive Qualcomm’s Fiscal 2017 Revenue?

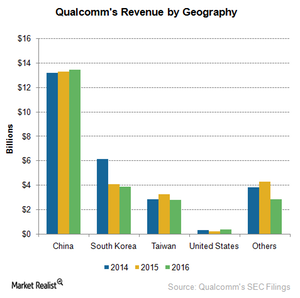

Qualcomm (QCOM) now earns 16.6% of its revenues from South Korea.

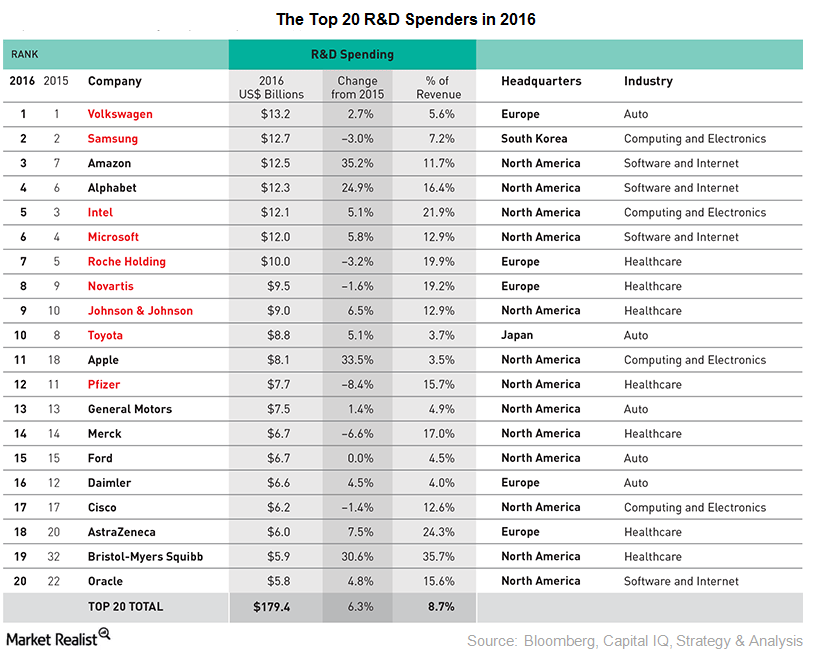

Why IBM Needs to Spend on Research and Development

IBM (IBM) spends ~6% of its annual revenue on R&D (research and development). In 2016, IBM spent $5.4 billion on R&D

Is Supply Shortage in the NAND Market Good for Micron?

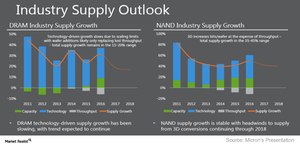

Micron expects the NAND industry’s supply to rise 38.0%–42.0% in 2017 as the transition to 3D brings technological challenges for manufacturers.

Micron Rebounds to Profits in Fiscal 1Q17

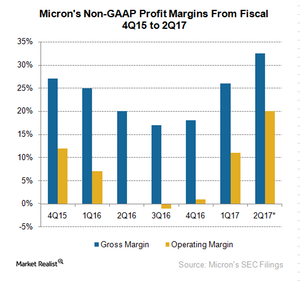

In fiscal 1Q17, Micron’s non-GAAP (generally accepted accounting principles) gross margin was 25.0%, a rise of seven percentage points from fiscal 4Q16.

The Inotera Deal: Micron’s Upcoming Earnings Highlight

The key highlight in Micron’s fiscal 1Q17 earnings will be the integration of Inotera, which should be quickly accretive to its gross margins, EPS, and FCF.

How Might the Inotera Acquisition Impact Micron’s DRAM Earnings?

Micron Technology will have to raise ~$2.5 billion to fund its joint venture acquisition of Inotera, and this move will add to its already high leverage.

What You Need to Know About the Micron-Inotera Deal

A major part of Micron Technology’s (MU) transition to the 20 nm node involves Taiwan’s (EWT) Inotera and its joint venture with Nanya Technology.

How Will Donald Trump’s Victory Impact AMAT?

AMAT is the world’s largest manufacturer of SME (semiconductor manufacturing equipment) and supplies to chipmakers around the world.

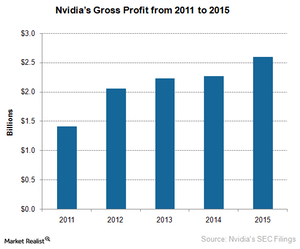

Nvidia May Accelerate Its GPU Roadmap to Compete with AMD

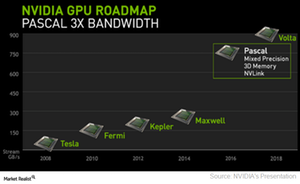

Nvidia (NVDA) is rushing to launch Volta in early 2017, which is the timeframe when AMD could release its next-generation GPU Vega.

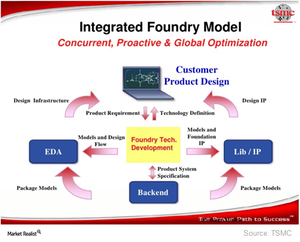

What Is Intel’s Strategy behind Its Foundry Model?

In fiscal 3Q16, Intel (INTC) partnered with ARM Holdings (ARMH) to provide foundry services for ARM-based chips. Intel announced another foundry partnership with Spreadtrum, but it did not identify the products that would be manufactured.

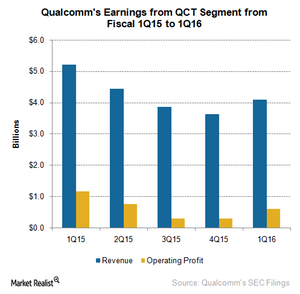

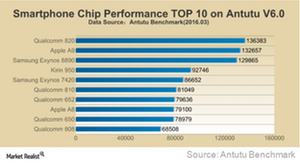

Why Qualcomm’s Revenues Are Unlikely to Improve in Fiscal 2Q16

Qualcomm earns revenue by selling mobile chips and by licensing its technology to other handset makers. Let’s first look at the core business of QCT.

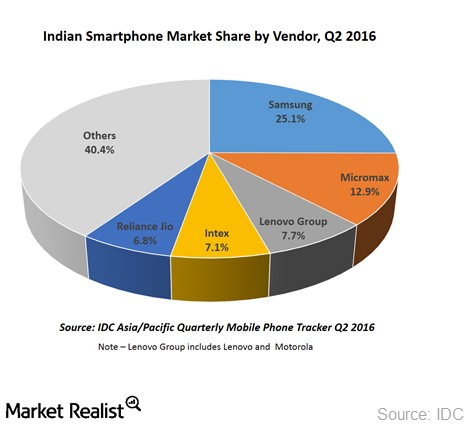

Why Apple’s iPhone SE Isn’t the Most Popular Choice in India

India has become a very important market for Apple, as the firm has reported declining revenues in China in the last two quarters.

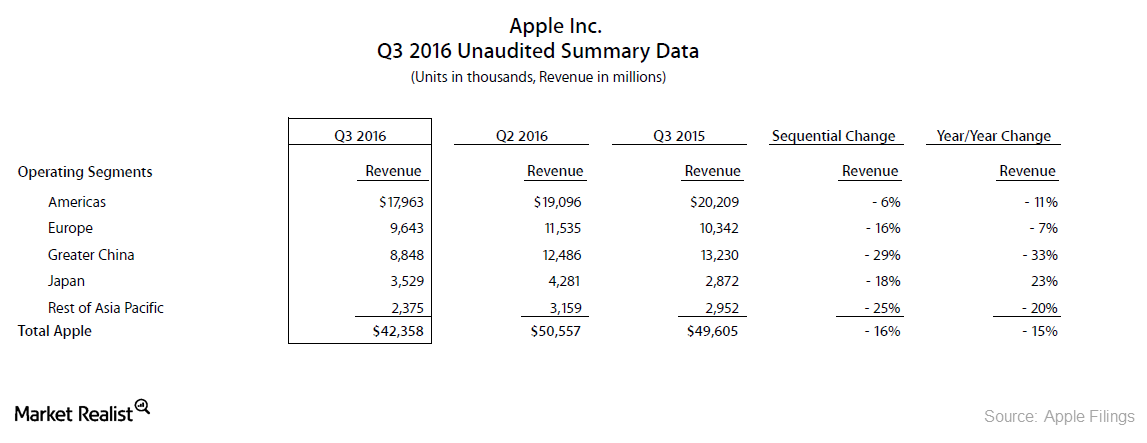

Apple’s Revenues from Sales in China Continued to Fall in 3Q16

Apple’s revenue from Greater China fell 33% YoY (year-over-year) from $13.2 billion in fiscal 3Q15 to $8.8 billion in fiscal 3Q16.

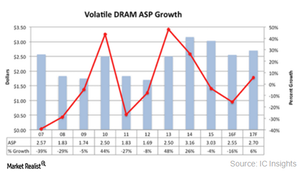

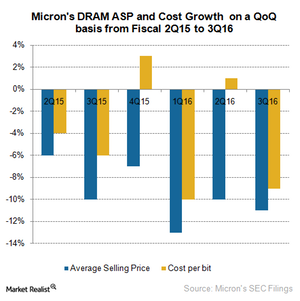

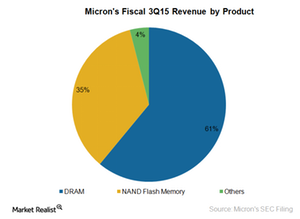

Falling DRAM Prices Reduce Micron’s DRAM Margin

The overall DRAM market is slowing and despite this, Micron increased its exposure in this space from 54% in fiscal 2Q16 to 60% in fiscal 3Q16.

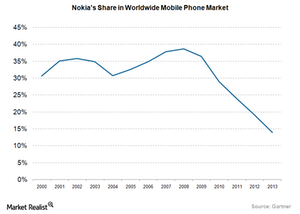

How Nokia Lost Its Mobile Brand Value so Quickly

Nokia clearly ruled the mobile phone market from the late 1990s until 2011. Then Nokia began to decline, and Samsung emerged as the leader in mobile phones.

NVIDIA Upgrades Its GPU Portfolio to Capitalize on Future Trends

NVIDIA (NVDA), a popular name among PC gamers, made news at the GTC (GPU Technology Conference) 2016 from April 4 to 7, 2016.

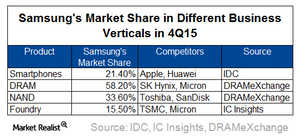

Samsung: A Semiconductor Foundry, Competitor, and Customer

Through its foundry business, Samsung provides chip manufacturing services to companies such as Qualcomm (QCOM), NVIDIA (NVDA), and Apple (AAPL).

Opportunities and Challenges for Samsung in the Smartphone Market

The slowdown in smartphone sales has impacted the revenues of both Samsung and Apple. Both expect a significant slowdown in smartphone sales in fiscal 2016.

What Is Samsung’s Growth Strategy in the Smartphone Market?

South Korea–based (EWY) Samsung (SSNLF) is making efforts to boost revenue and maintain a double-digit margin amid slowing smartphone sales.

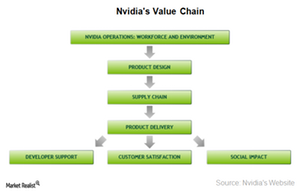

What External Risks Pose Threats to Nvidia?

Any defects found in Nvidia’s products would incur significant costs. Greater risks would arise if a defect were found after commercial shipment had begun.

How Product Design Wins Impact Nvidia’s Revenues

Nvidia’s revenue depends on design wins. The company maintains strong relationships with customers to assist them in defining their new products.

Foundries to Grow Faster than Integrated Circuits in 2016

Taiwan (EWT) is the largest semiconductor manufacturer, housing the world’s top two foundries, namely TSMC (TSM) and UMC (United Microelectronics).

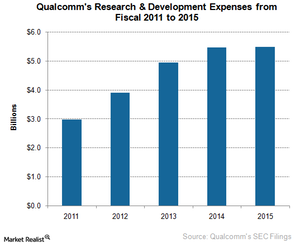

What’s Qualcomm’s Plan for Its QCT Business?

QCT is Qualcomm’s (QCOM) core business, generating close to 67% of revenues in fiscal 2015. But the capital-intensive nature of the business makes it less profitable.

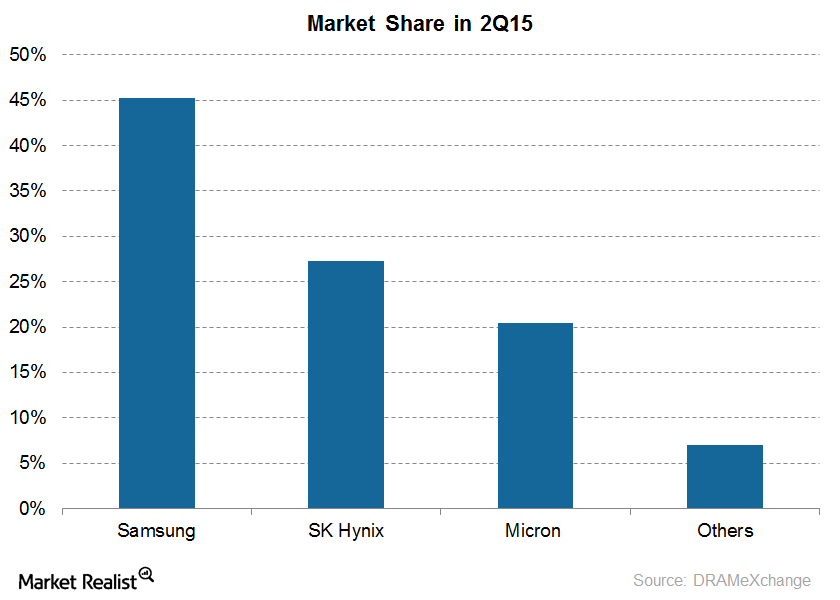

Samsung’s Market Share Is Expected to Increase in Fiscal 2016

Samsung’s market share for the quarter was 45.2%, a gain of 1.1 percentage point YoY compared to 2Q14. It was Samsung’s best ever quarterly performance.

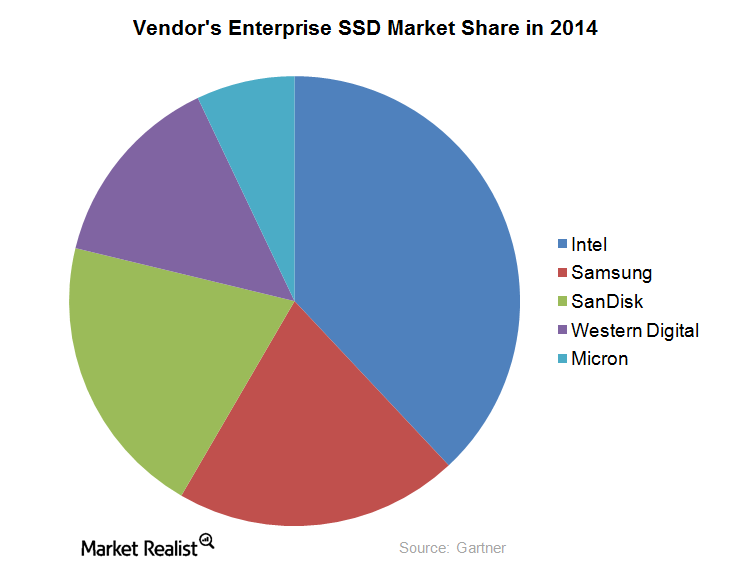

With SanDisk Purchase, Western Digital Will Pass Samsung in SSD

With the action on the acquisition front, including the SanDisk acquisition, Western Digital is geared up to increase and enhance its presence in the SSD arena.

Micron’s Strategy for Coping with Declining DRAM Prices

Micron’s strategy for coping with competition is to reduce its manufacturing costs. It currently has higher manufacturing costs than Samsung and SK Hynix.

Micron’s Product Portfolio at a Glance: Must-Knows

Micron expanded its product portfolio from 64-kilobit DRAM chips in 1980 to NAND Flash Memory devices in 2004, to SSDs in 2007, to NOR Flash Memory in 2011.

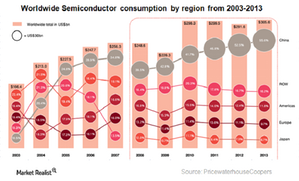

China Emerges as New Competition in Semiconductor Industry

China is looking to reduce its dependence on foreign technology. Its government plans to invest up to $161 billion over the next decade to promote domestic chip manufacturers.

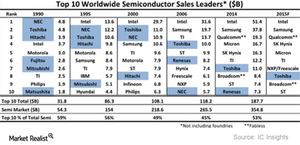

Why Did Japan’s Semiconductor Industry Fall?

In 1990, Japan led the semiconductor industry, with six companies named in the top ten semiconductor sales leaders. In 2014, only two companies made the list.

South Korea: Second Largest Global Semiconductor Manufacturer

After memory chips, LEDs comprise the second most produced semiconductor products in South Korea. The country accounts for ~13% of the global LED market.

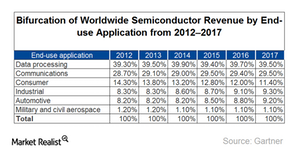

An Overview of the Semiconductor Industry

According to IDC, YoY growth in worldwide semiconductor revenues should slow from 7.1% in 2014 to 3.6% in 2015. Semiconductor revenues are estimated to reach $389.4 billion in 2019.

Exploring Applied Materials’s Applied Global Services

Applied Materials’s management is hopeful that the Wafer Fab Equipment spending is expected to increase to 20% in fiscal 2014, with much higher spending in 2015.

Applied Materials: A detailed business overview

According to Gartner, Applied Materials is the world’s largest maker of semiconductor equipment by revenues.

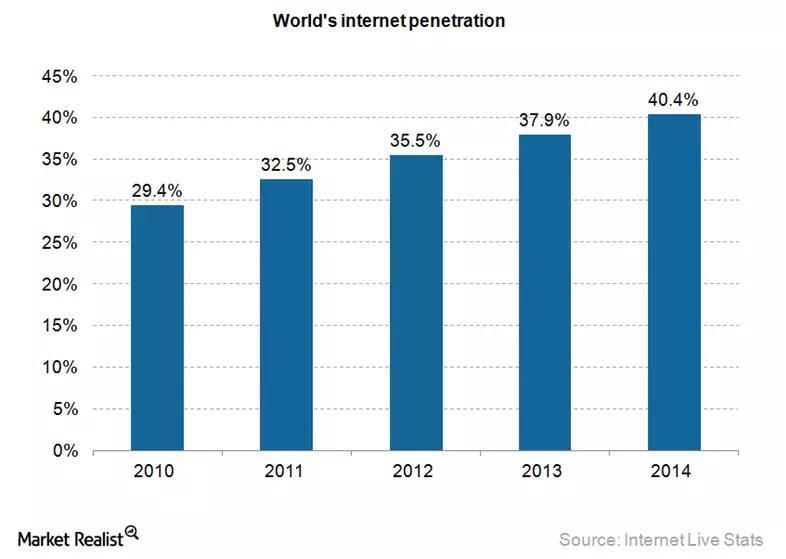

Online advertising growth is aided by increased internet users

In 2013, globally mobile internet user penetration was 73.4%. It will be more than 90% in 2017. Internet users had mobile internet usage on smartphones and tablets.Company & Industry Overviews Qualcomm acquires Wilocity to meet huge mobile data traffic needs

Qualcomm (QCOM) recently acquired Wilocity to boost its portfolio of mobile chipsets. Wilocity operates high-speed wireless technology WiGig, which works at a higher frequency and promises faster data speeds.