Exploring Applied Materials’s Applied Global Services

Applied Materials’s management is hopeful that the Wafer Fab Equipment spending is expected to increase to 20% in fiscal 2014, with much higher spending in 2015.

Jan. 15 2015, Updated 12:59 a.m. ET

AGS overview

Applied Materials’s (AMAT) Applied Global Services (or AGS) segment is composed of services, products, and integrated solutions that aim to optimize equipment and fab performance, as well as to enhance productivity. This segment enables companies to create integrated systems for the entire semiconductor chip-manufacturing process, along with automation software and maintenance of existing equipment.

If Applied Materials’s SSG segment posts good results, it will benefit exchange-traded funds (or ETFs) like the Technology Select Sector SPDR (XLK), the VanEck Vectors Semiconductor ETF (SMH), and the PowerShares QQQ Trust (QQQ). These ETFs have significant exposure to Applied Materials.

Contribution to overall revenues

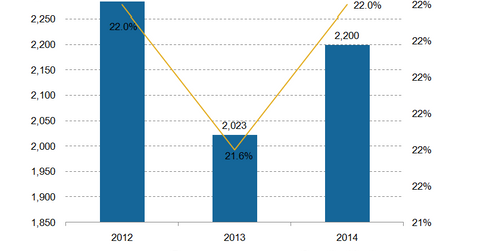

In 2014, AGS contributed 24% toward the company’s overall revenues. AGS revenues grew to $2.2 billion, an increase of 4.4% and 10% on sequential and year-over-year basis, respectively. As the above chart shows, it also contributes significantly toward operating income. AGS new orders grew $2.4 billion in 2014, as compared to $2.09 billion in 2013, an increase of 16% year-over-year.

In 2014, the segment’s book-to-bill ratio stood at 1.1, indicating $110 worth of orders were received for every $100 of product billed for the year. Increased wafer starts, capacity, and higher utilization rates across the industry were positive for AGS’s segment performance.

Increased WFE spending should create opportunities

Applied Materials’s management is hopeful that the Wafer Fab Equipment (or WFE) spending is expected to increase to 20% in fiscal 2014. It anticipates WFE spending to be much higher in 2015. This spending should be driven by the increased investment in 3D NAND and the transition to FinFET by its customers, such as TSM and Samsung (SSNLF), increasing DRAM spending. All these changes should lead to expanded opportunities for its AGS business, which reported its highest revenues in seven years in fiscal 2014.