Rio Tinto PLC

Latest Rio Tinto PLC News and Updates

These Factors Could Affect Vale Stock in 2H17

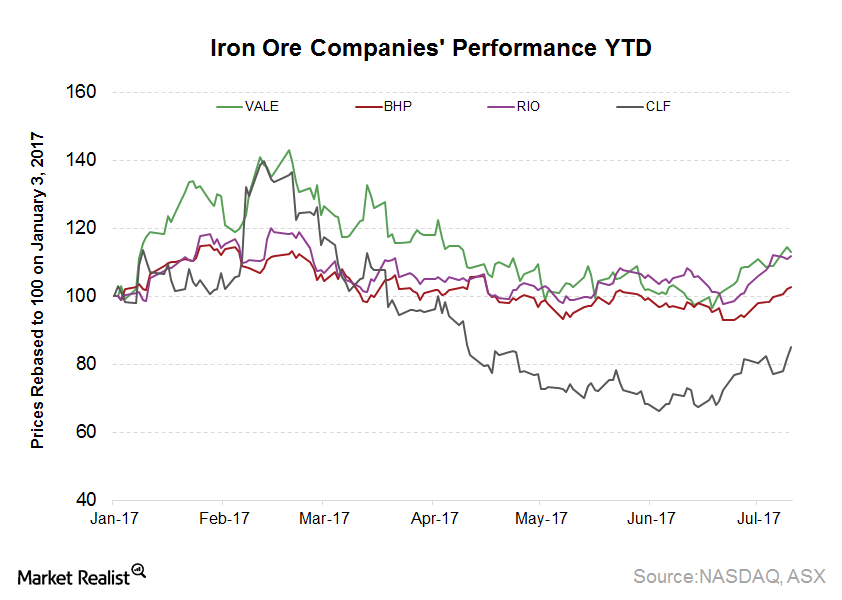

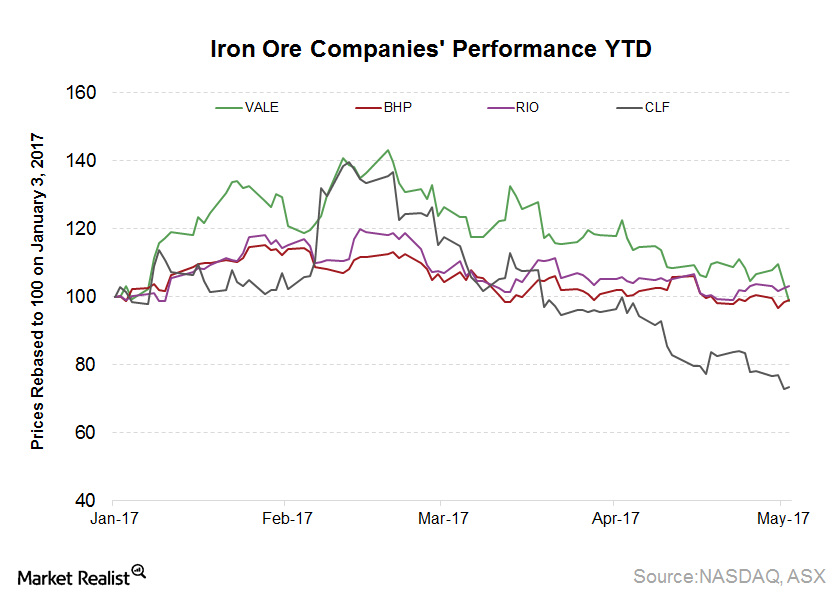

After significantly outperforming its peers in 1Q17, Vale’s (VALE) performance deteriorated in 2Q17.

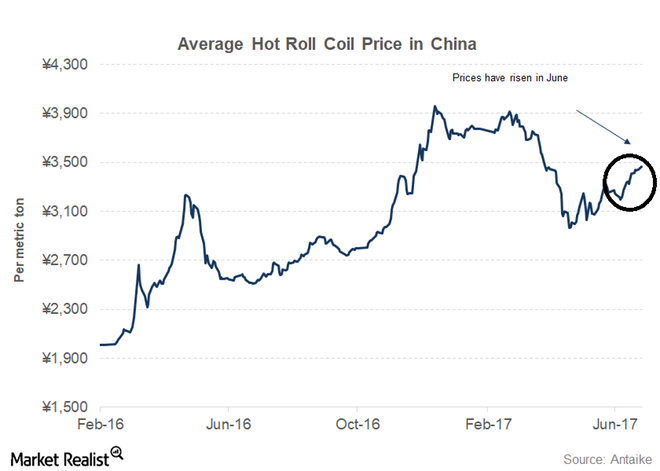

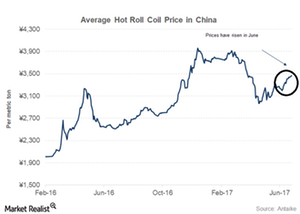

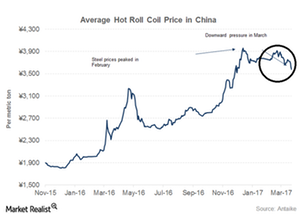

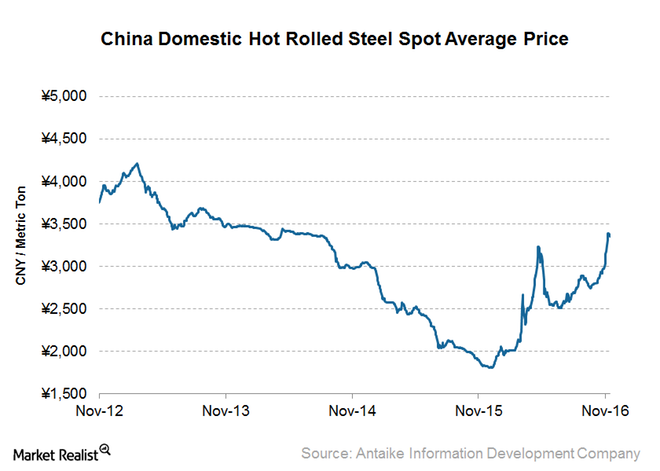

Chinese Steel Prices Are Surging—Can They Keep the Momentum?

Chinese steel production has been hitting one record after another. This renewed vigor in the Chinese steel industry is due to higher steel prices.

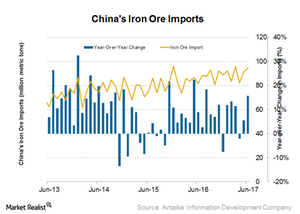

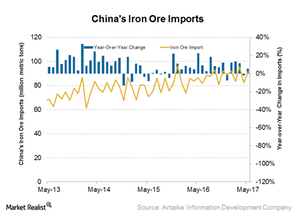

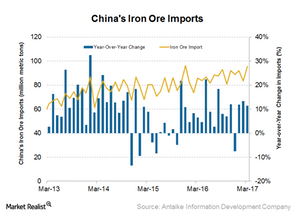

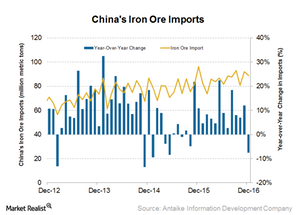

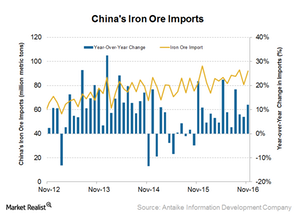

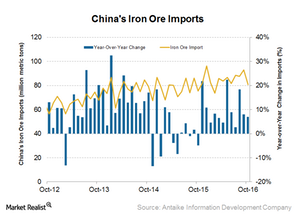

China’s Iron Ore Imports Surged in June—Where Will They Go Next?

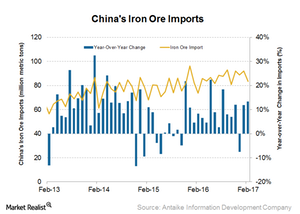

It’s important for investors to keep track of China’s iron ore import data because they provide a clue regarding the demand patterns for imported iron ore among Chinese mills and traders.

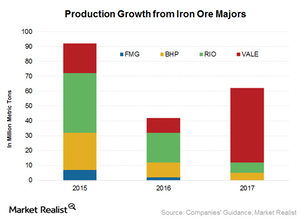

Can Iron Ore Miners’ Supply Discipline Lead to a Price Upside?

Rio Tinto (RIO) released its operational update for 1H17 on July 18, 2017. Rio’s iron ore shipments fell 6% year-over-year (or YoY) to 77.7 million tons in 2Q17.

Analysts’ Views: What Iron Ore Price Could Bring Balance?

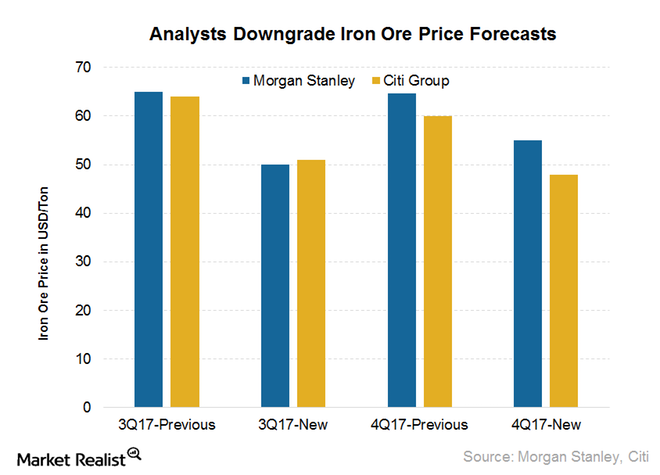

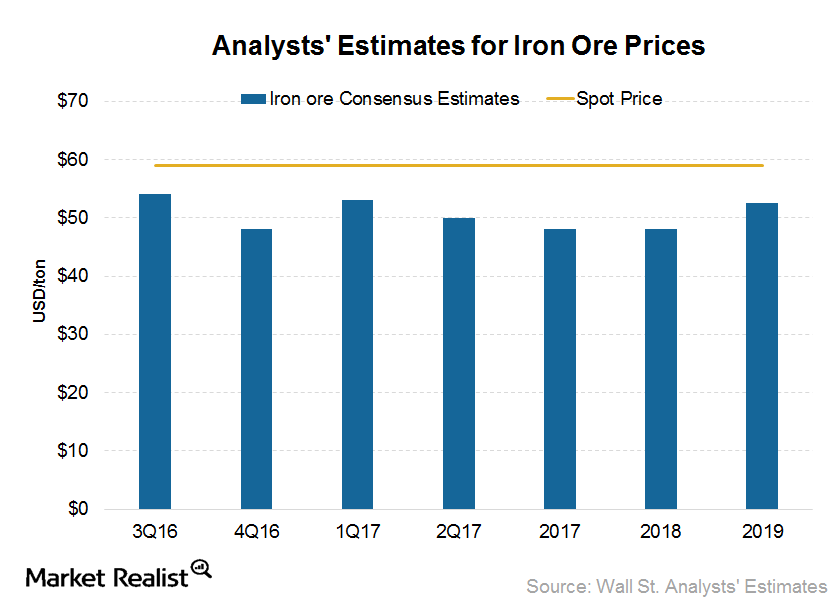

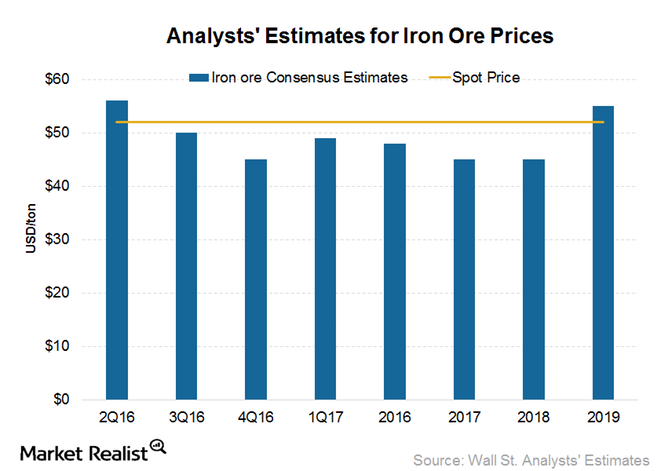

While iron ore prices have rebounded recently, analysts are still skeptical about the long term. Morgan Stanley has reduced its iron ore price forecast for 3Q17 by 23% to $50 per ton.

Can the Rebound in Chinese Steel Prices Support Iron Ore Miners?

One of the major factors that led to the iron ore price rally in 2016 and 1Q17 was stronger-than-expected Chinese steel prices.

Why China’s June Iron Ore Import Outlook Is Strong

China’s iron ore imports recovered from a six-month low in April by importing 91.5 million tons in May 2017.

Cliffs Natural Resources’ First HBI Plant: What You Need to Know

The estimated investment needed for Cliffs Natural Resources’ (CLF) HBI (hot briquetted iron) plant is ~$700 million.

What Will Drive Vale SA’s Iron Ore Division Going Forward?

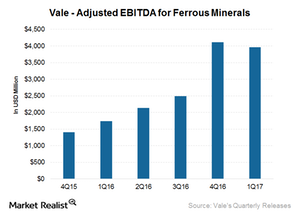

In 1Q17, Vale’s (VALE) ferrous division accounted for ~89.0% of its adjusted EBITDA (earnings before interest, tax, depreciation, and amortization).

These Factors Led to Weakness in Vale Stock after 1Q17

In 1Q17, Vale (VALE) significantly outperformed its major peers with a rise of ~25%.

Analyzing China’s Aluminum Production Data

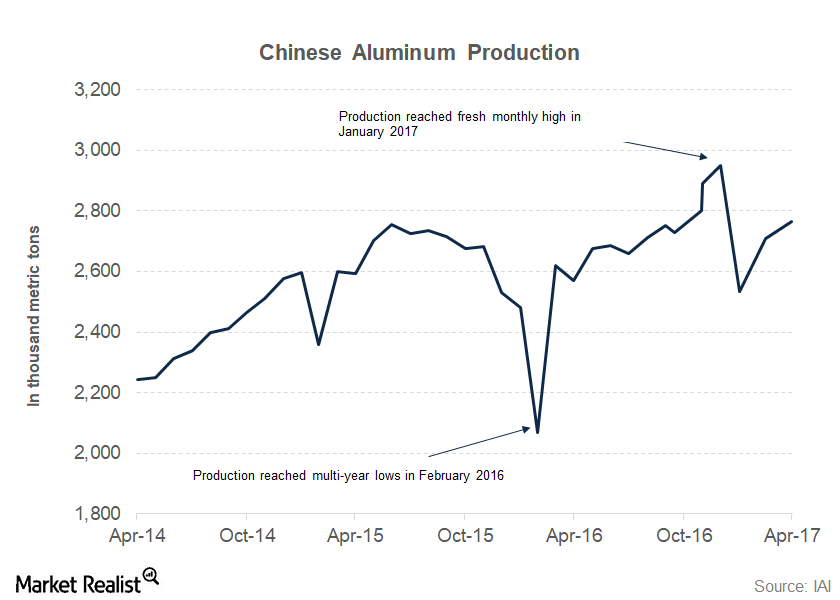

China produced ~2.76 million metric tons of aluminum in April—a YoY increase of 7.6%. Its production has risen 12.0% YoY in the first four months of 2017.

Could Wilbur Ross and Donald Trump Be Alcoa’s Saviors?

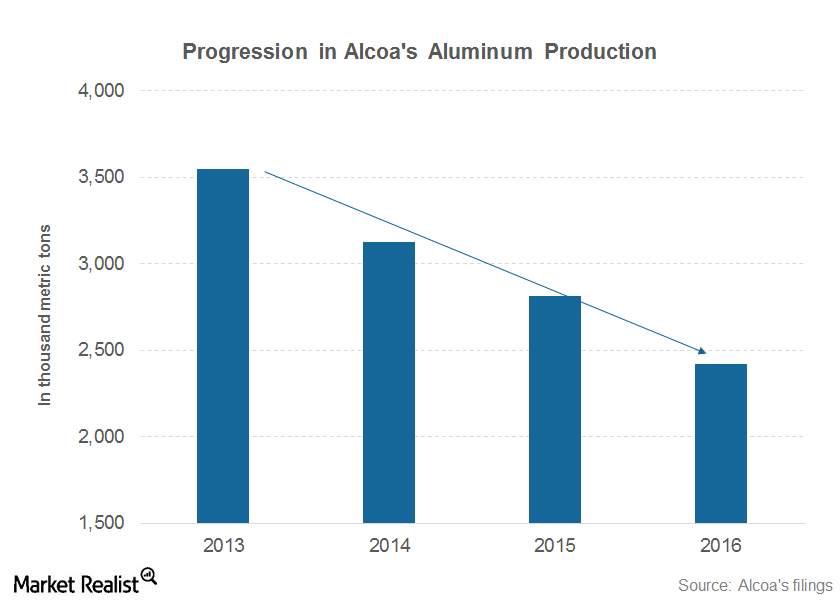

Alcoa and Century Aluminum (CENX) survives the commodity price slump by closing their high-cost capacities and negotiating better power deals for several operating plants.

China’s Iron Ore Imports Remain Strong: What’s the Outlook?

Strong Chinese iron ore imports China imported 95.6 million tons of iron ore in March, compared with 83.5 million tons in February 2017. This figure implies a strong growth of 11% year-over-year (or YoY). This number is also the second-highest monthly amount on record. China imported 96.3 million tons of iron ore in December 2015. […]

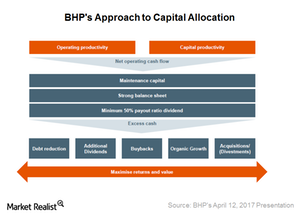

Cyclical Nature of BHP’s Business and Mechanistic Share Buybacks

The third element of Elliott Funds’ “value unlock” plan for BHP Billiton (BHP) (BBL) is the adoption of a policy of consistent and optimized capital returns to shareholders.

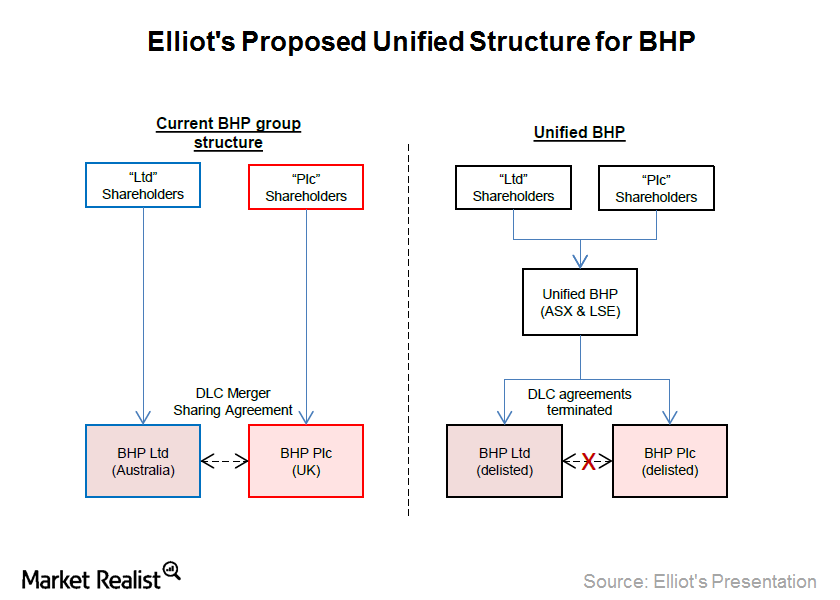

A Unified Structure for BHP: Do the Costs Outweigh the Benefits?

Elliott Funds has proposed unifying BHP Billiton’s (BHP) (BBL) dual-listing structure into a single Australian-headquartered and Australian tax resident–listed company.

Should Cliffs Worry about Chinese Steel Price Trends?

Among the most dominant factors driving the recent iron ore price rally are higher steel production and the rise of steel prices in China (FXI).

Inside Iron Ore Miners’ Price Targets: Gauging Their Upside Potential

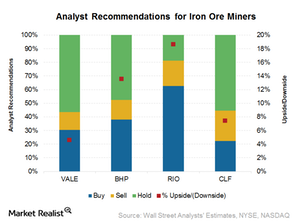

Among the iron ore miners (PICK), analysts are most bullish on Rio Tinto (RIO), with 63% “buy” and 19% “hold” ratings.

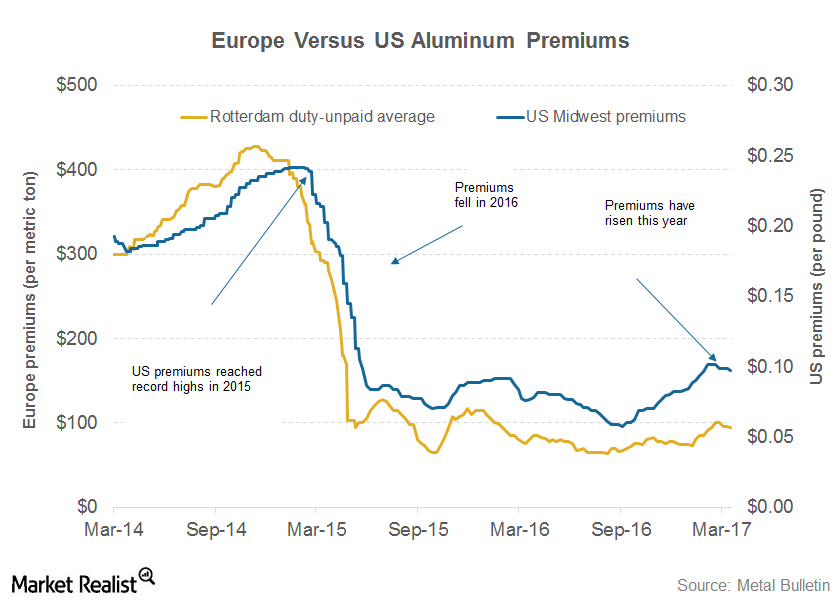

What Should Alcoa Investors Make of Aluminum Premiums?

Aluminum premiums are key indicators that investors in primary producers such as Century Aluminum (CENX), Norsk Hydro (NHYDY), and Rio Tinto (RIO) should track.

What China’s Resilient Iron Ore Imports Mean for Miners

China imported a total of 83.5 million tons of iron ore in February 2017, which represents a growth of 13% YoY (year-over-year) and -9.2% month-over-month.

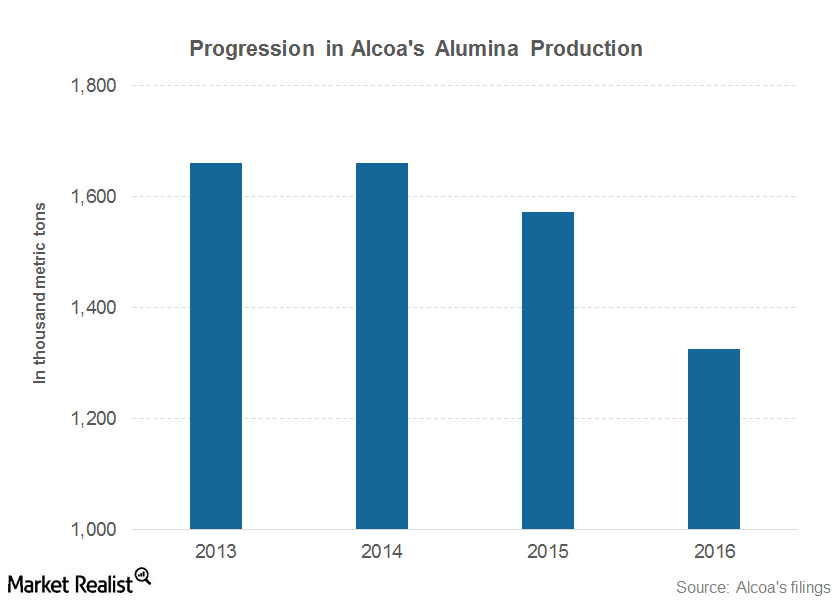

Alcoa’s 2017 Guidance: Everything You Need to Know

Alcoa (AA) expects its alumina shipments to range from 13.8 million–13.9 million metric tons in fiscal 2017 compared to 13.2 million metric tons in fiscal 2016.

China Imported Record Iron Ore in 2016: How’s the 2017 Outlook?

China’s iron ore imports were robust in 2016. While the country’s imports fell 7.6% year-over-year (or YoY) in December 2016, they hit a yearly record in 2016.

What Could Impact Chinese Steel Prices in 2017?

Since China is the world’s largest steel producer and exporter, it’s important for investors to keep track of Chinese steel prices.

What’s the Outlook for Chinese Iron Ore Imports?

Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In November, imports were 92.0 million tons.

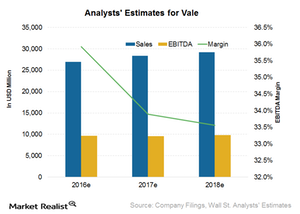

Why Analysts Significantly Raised Vale’s Earnings Estimates

Wall Street analysts covering Vale are projecting sales of $27.0 billion for 2016. That implies a revenue change of 4.4% year-over-year.

Why Were Chinese Iron Ore Imports Weak in October?

China’s weaker iron ore imports Contrary to what’s been suggested by many market participants, China’s iron ore imports have been robust in 2016. In October, however, the imports were at their lowest since February, at 80.8 million tons, down 13% month-over-month. On a year-over-year basis, the imports rose 7%. In the first ten months of […]

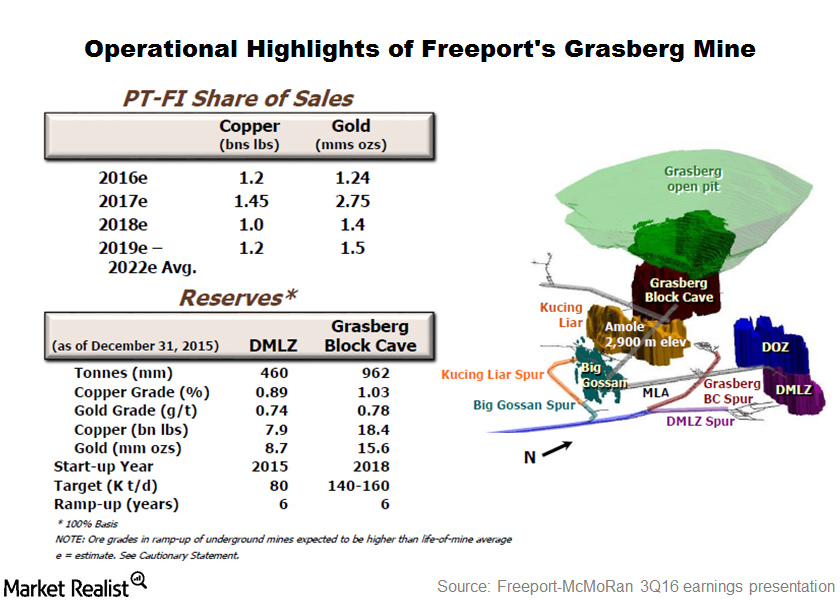

What Are Freeport’s Near-Term Growth Drivers?

Freeport expects its copper shipments to fall next year due to asset sales. The falling trend in its copper shipments could continue beyond 2017.

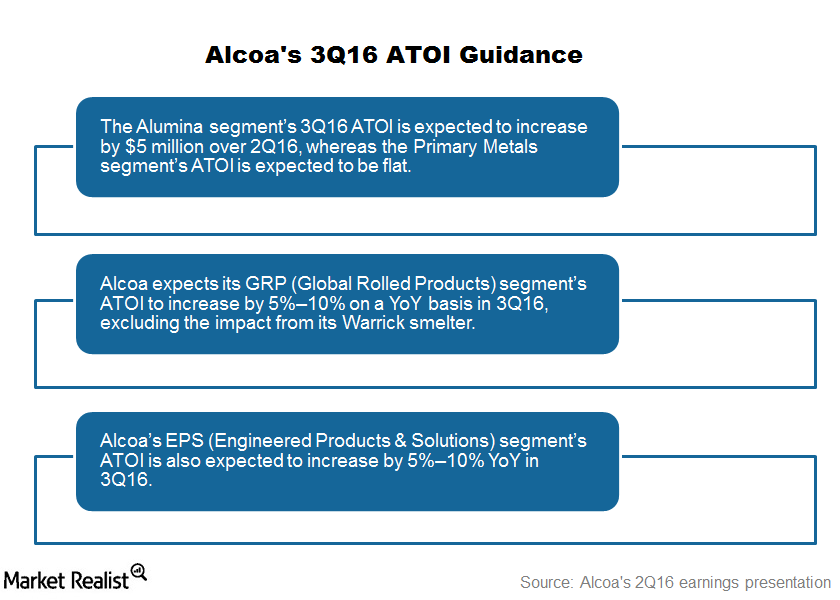

Alcoa’s 3Q16 Guidance: Everything You Need to Know

Alcoa’s 3Q16 guidance Previously, we looked at factors that could impact Alcoa’s (AA) 3Q16 revenues. In this part, we’ll look at the company’s profitability metrics. Note that there are several metrics you can use to measure an enterprise’s profitability. Alcoa releases a non-GAAP (generally accepted accounting principles) measure, the ATOI (after tax operating income). In […]

Could China’s Iron Ore Imports Pull Back in the Near Term?

In August 2016, China’s iron ore imports came in at 87.7 million tons, a rise of 18.3% compared to 74.1 million tons in August 2015 but a slight fall of 0.8% compared to July 2016.

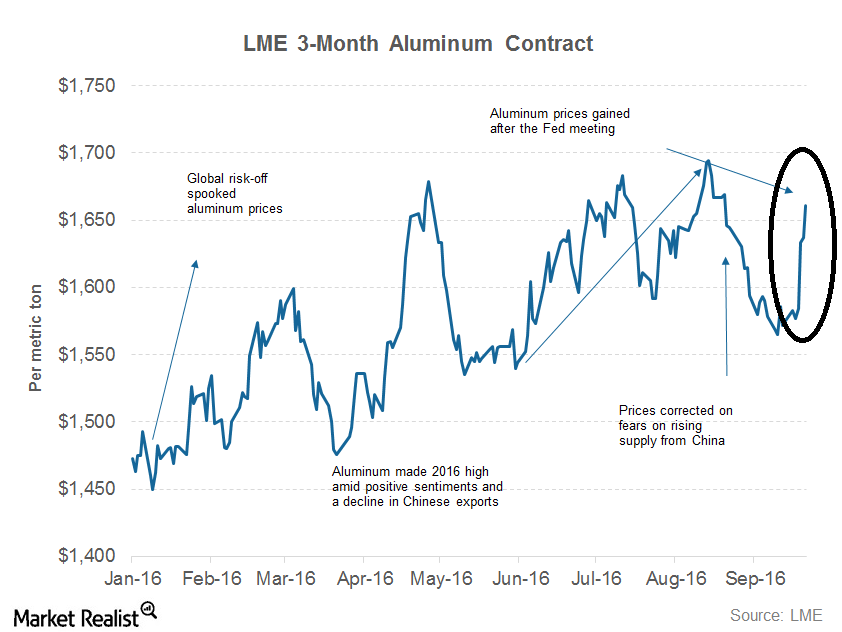

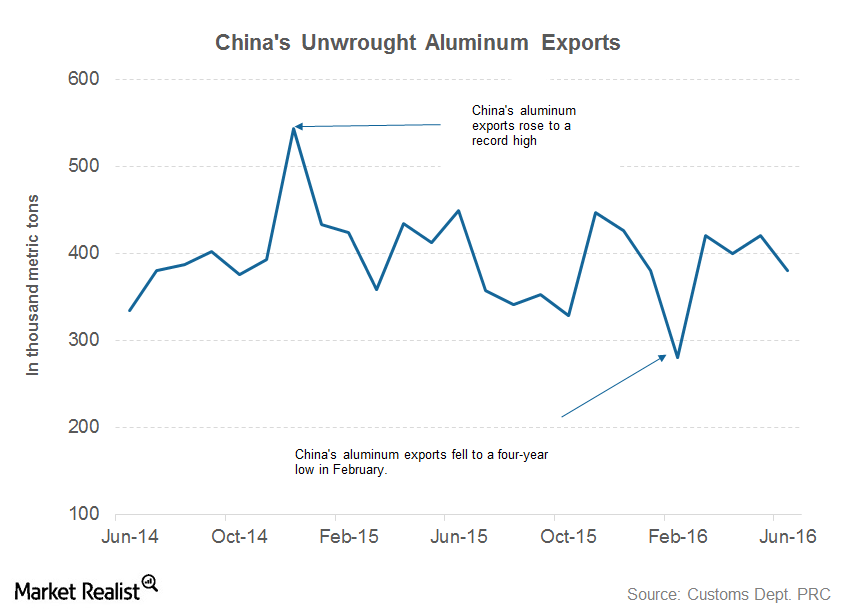

What’s Driving Aluminum Prices in 2016?

Aluminum prices have shown resilience this year. However, aluminum has been facing stiff resistance at $1,700 per metric ton.

How Do Chinese Copper Demand Indicators Look This Month?

It’s important for investors in companies such as Freeport-McMoRan, BHP Billiton, and Rio Tinto to track Chinese copper demand indicators.

Morgan Stanley, Citibank Doubt Longevity of Iron Ore Price Rally

Morgan Stanley is bearish on the future prospects of iron ore prices. The broker estimates that the iron ore prices will fall to $40 per ton in 2H16 and $35 per ton in 4Q16.

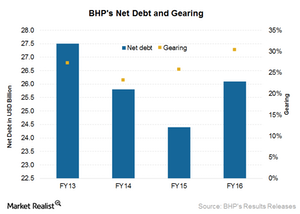

A Look at BHP Billiton’s Balance Sheet after Fiscal 2016

BHP has a strong balance sheet in this depressed commodity environment. Standard & Poor’s cut its rating by one notch from A+ to A in February 2016.

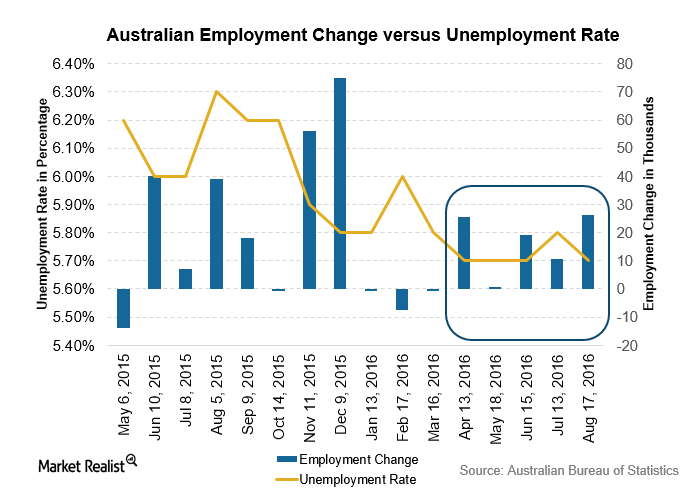

Australian Unemployment Fell: Is More Easing Needed?

The Australian Bureau of Statistics published the employment report for July on August 18, 2016. The unemployment rate fell by 0.1% to 5.7%.

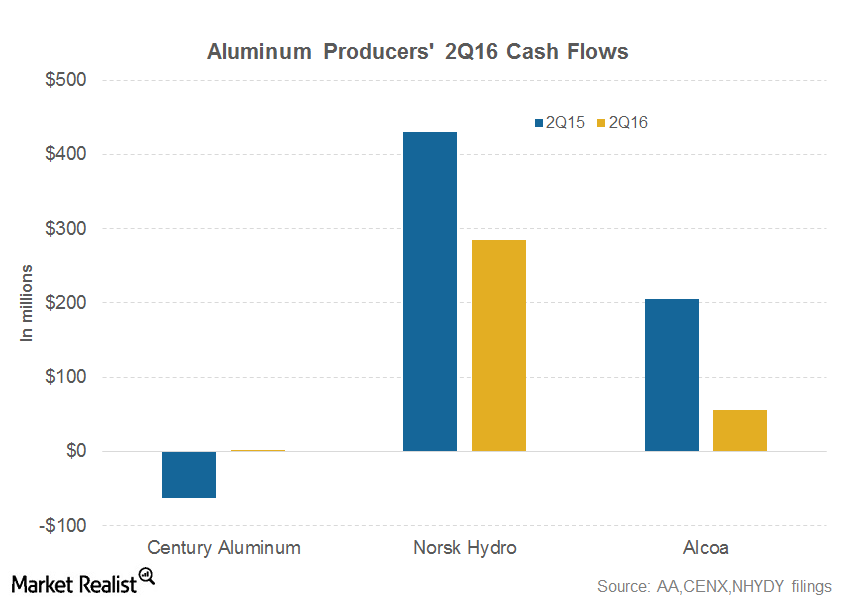

Can Alcoa Generate Positive Free Cash Flows in 2016?

Alcoa (AA) generated free cash flows of $55 million in 2Q16—compared to $205 million in the same quarter last year.

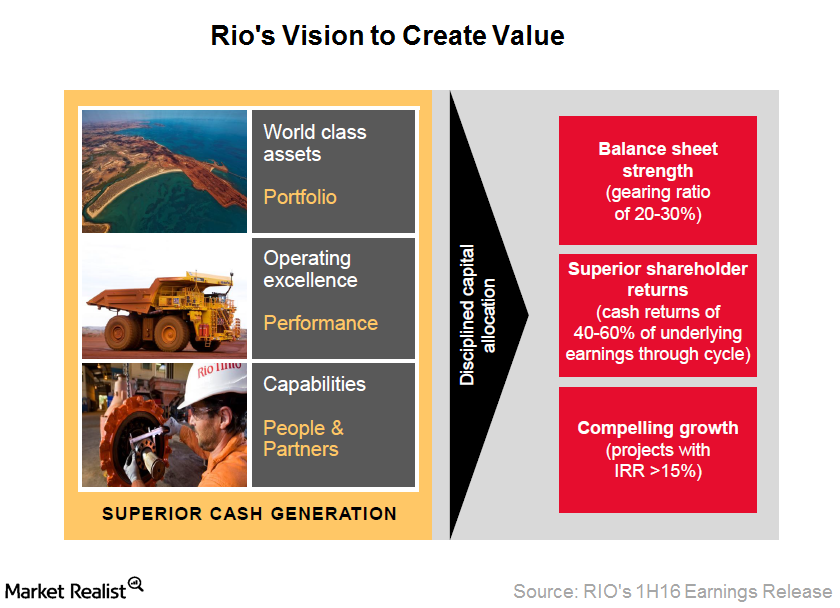

Rio Tinto’s Earnings during 1H16 Were Driven by This

Rio Tinto reported its 1H16 results on August 3, 2016. Its underlying earnings came in at $1.6 billion, 7% ahead of consensus expectations of $1.5 billion.

What Analysts Have to Say about Iron Ore Prices

Analysts have increased their short-term iron ore price forecasts due to stronger-than-expected temporary factors.

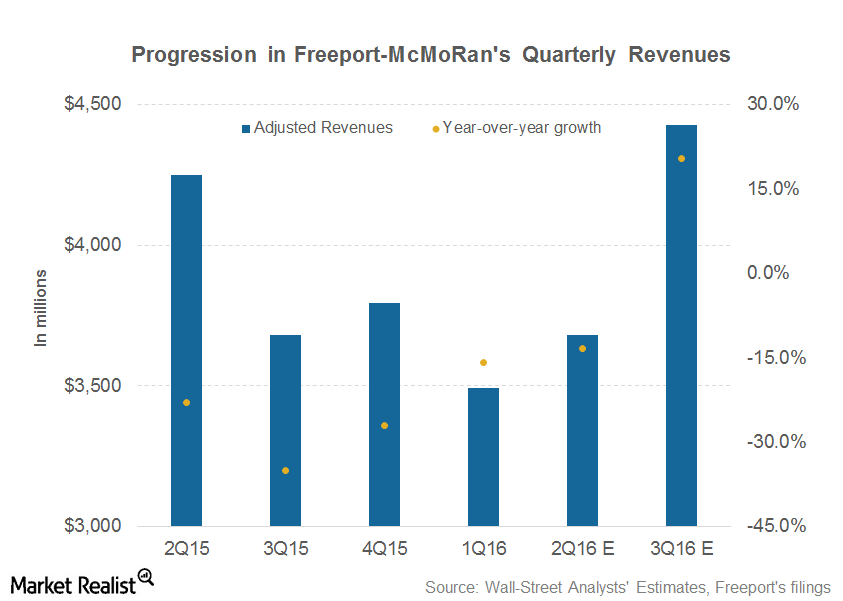

Can 2Q16 Mark a Turnaround for Freeport-McMoRan’s Revenues?

Analysts expect Freeport-McMoRan (FCX) to post revenues of ~$3.7 billion in 2Q16 and $4.4 billion in 3Q16.

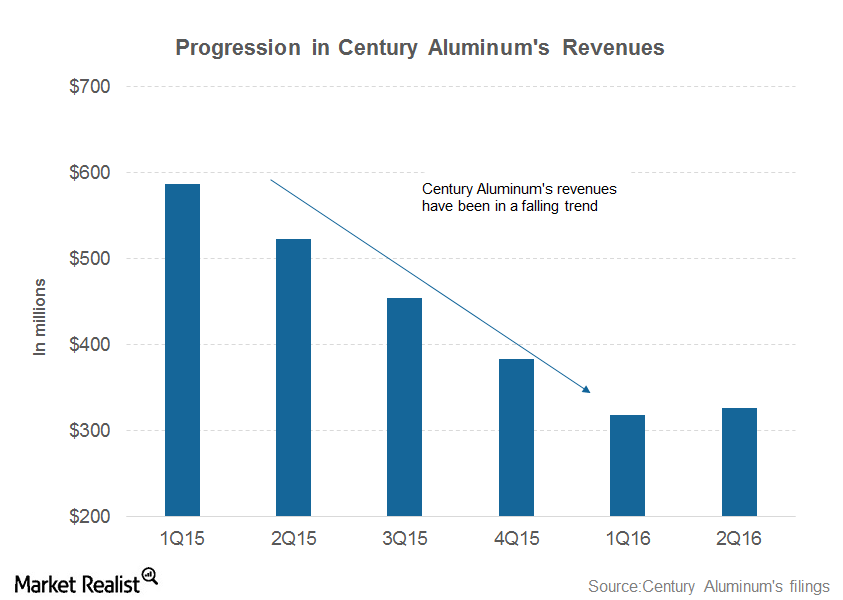

Century Aluminum Misses 2Q16 Revenues: Should You Be Concerned?

Century Aluminum reported revenues of $326 million in 2Q16. The revenue miss shouldn’t be a major concern given its performance on other metrics.

Can Higher Commodity Prices Boost Alcoa’s 3Q16 Earnings?

Alcoa expects its fiscal 2016 net income to rise by $160 million for every $100 per metric ton rise in aluminum prices.

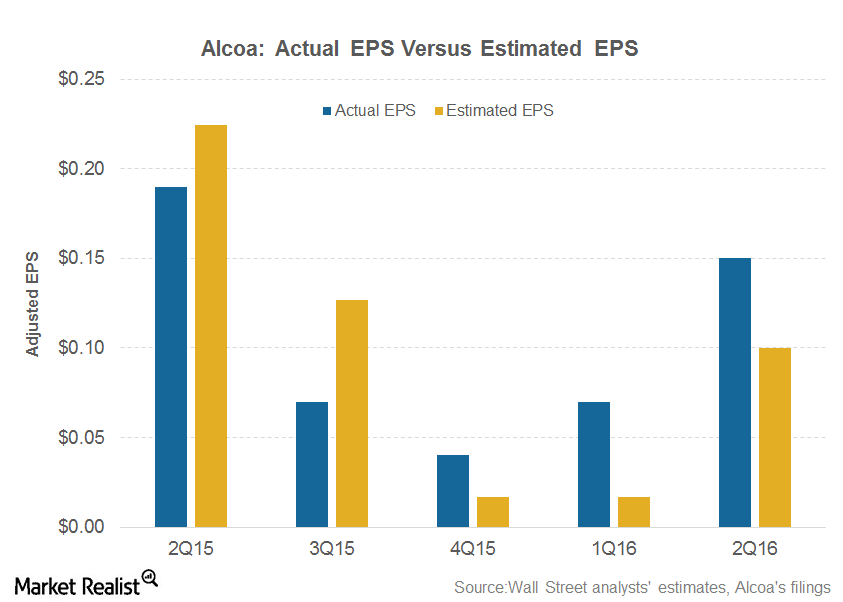

Alcoa’s 2Q16 Earnings: Everything You Need to Know

Alcoa (AA) reported its 2Q16 earnings yesterday after the market closed. Here’s what you should know.

Chinese Copper Demand Indicators: Not That Worrisome So Far

Since China (PGJ) is the largest copper consumer, it’s important for investors to keep track of Chinese copper demand indicators.

Why Is the Iron Ore Price Rally Losing Steam?

In this series, we’ll analyze the demand-supply fundamentals for iron ore and see whether the recent surge was a one-off phenomenon or the start of a more sustained uptick in prices.

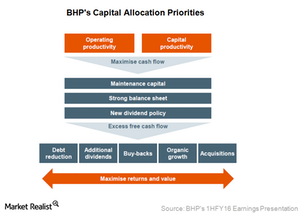

A Look at BHP Billiton’s Capital Allocation Priorities

BHP Billiton (BHP) (BBL) has reframed its capital allocation priorities, including sustaining capex, maintaining balance sheet strength, and cutting dividends.

Rio Tinto Surprised the Markets with Dividend Policy Change

Rio Tinto’s 2015 results were mostly in line with market expectations. Underlying EBITDA and underlying profits were $12.6 billion and $4.5 billion, respectively.

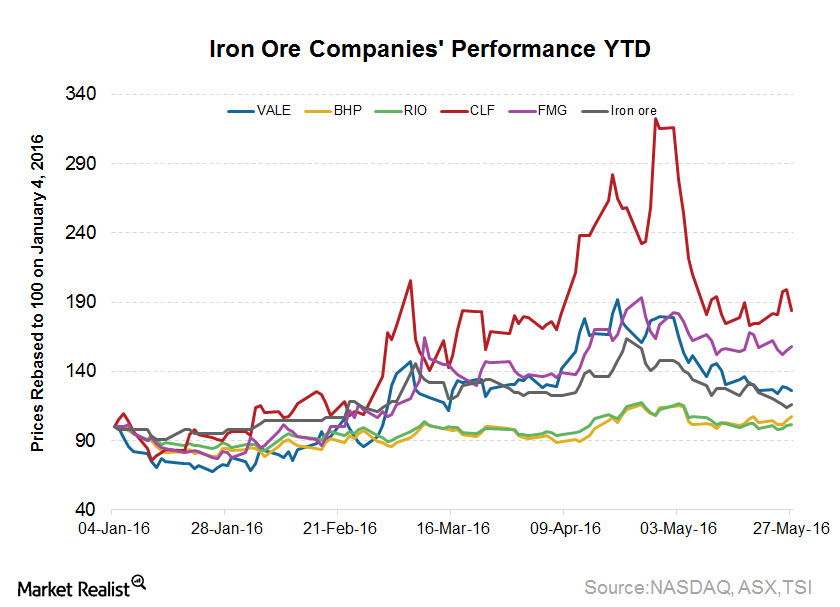

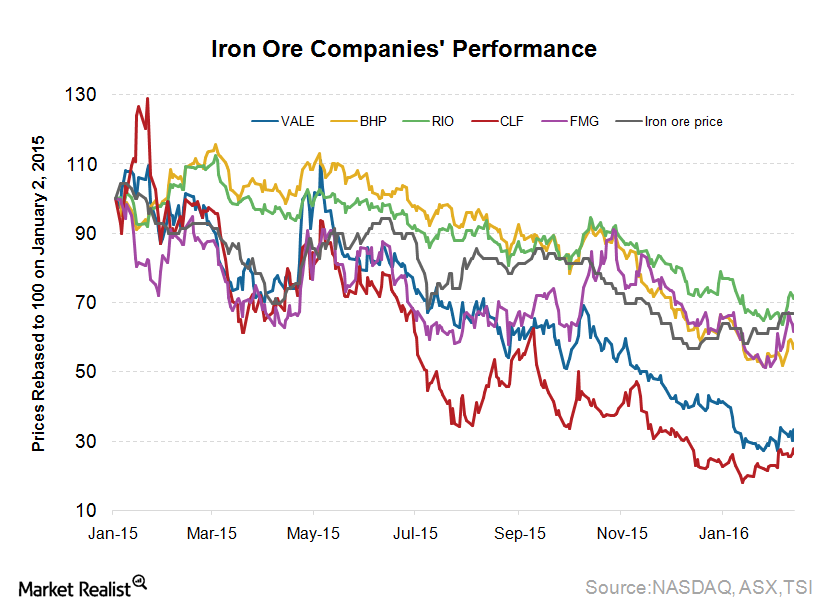

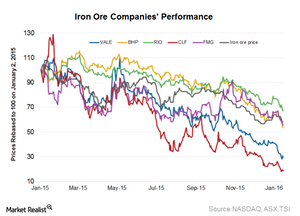

So Far, 2016 Has Been an Unhappy New Year for Iron Ore Stocks

Just a few weeks old, 2016 started where 2015 left off for the iron ore industry. The benchmark seaborne iron ore prices were trading at $40 levels as of January 14, 2016, down 9% for the year.

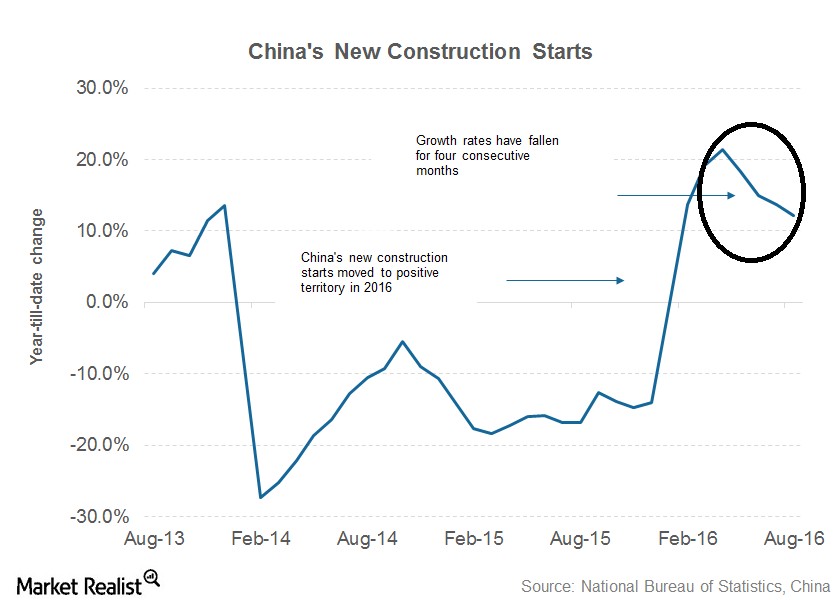

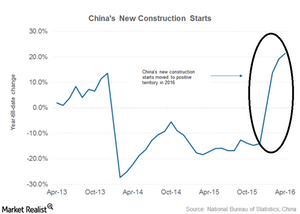

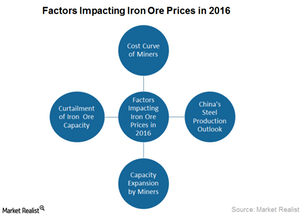

Factors Impacting Iron Ore’s Performance in 2016

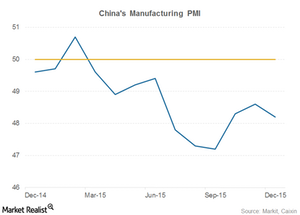

China’s (MCHI) economic slowdown is the biggest challenge for global metal and mining companies, which is why iron ore investors should keep a close eye on the Chinese economy.

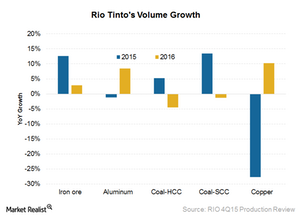

Rio Tinto Reported Overall Strong Production Results for 4Q15

Rio Tinto’s copper production was a slight miss, falling short ~1% of the fiscal 2015 guidance. This was mainly due to weaker throughput at Escondida.

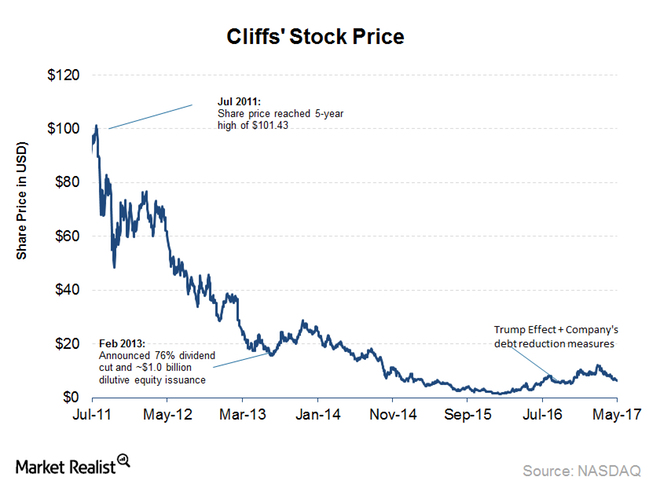

Cliffs Natural Resources’ Woes Continued in the Fourth Quarter

In 2015, Fortescue Metals Group (FSUGY) and Cliffs Natural Resources (CLF) fell 35% and 78%, respectively.

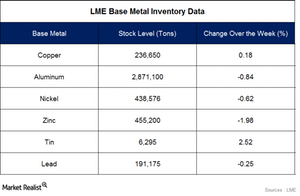

Base Metal Inventories Fell Last Week: How Much?

In the week ended January 9, copper and tin inventories increased. Levels for other base metals fell.

Are Curtailments Enough to Offset New Capacity in Iron Ore?

The Nullagine joint venture, where BC Iron owns 75% and Fortescue Metals (FSUGY) owns 25%, will cease production in 2016 due to weak iron ore prices.