Rio Tinto PLC

Latest Rio Tinto PLC News and Updates

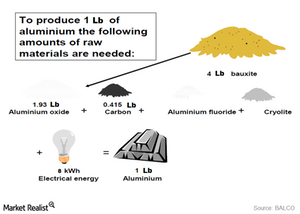

Why Are Alumina Prices a Key Driver for Aluminum Companies?

It can take almost two pounds of alumina to produce one pound of aluminum. Naturally, changes in alumina prices would impact aluminum’s production cost.

2015 Has Been Hard on Mining Companies

2015 has been tough for miners, especially due to the price rout in the commodities market. The commodities market has fallen about 24.3% since the start of the year.

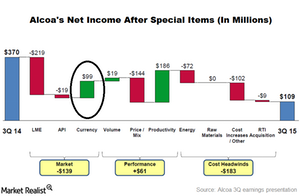

What Would a Stronger US Dollar Mean for Alcoa?

Alcoa’s value-add company will get a major portion of its revenues from Europe and is thus negatively impacted by a stronger US dollar.

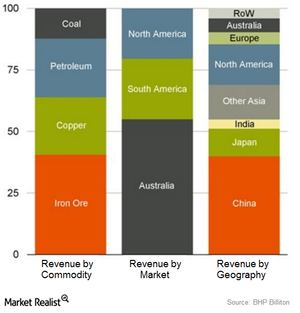

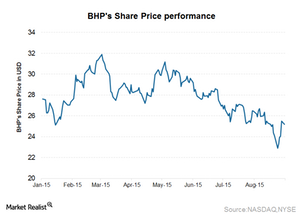

Depressed Iron Ore Prices Will Strain BHP Billiton’s Cash Flows

Iron ore forms the biggest chunk of BHP Billiton’s revenues and earnings. For its latest quarter, the company delivered 7% year-over-year growth.

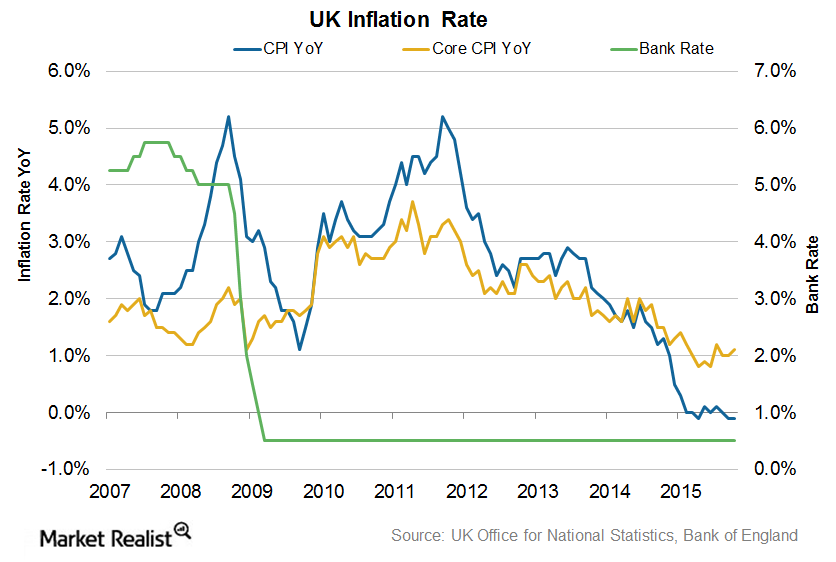

Falling Crude Oil Prices Keep UK Inflation in Check

The Bank of England or BoE is targeting an inflation rate at 2.0% in order to attain economic growth in the United Kingdom.

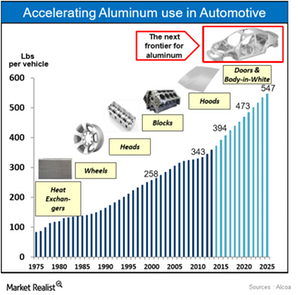

The Auto Industry’s Aluminum Usage Is Increasing

The usage of aluminum in automobiles has been gradually increasing, as it improves vehicle performance, reduces CO2 emissions, and boosts fuel economy.

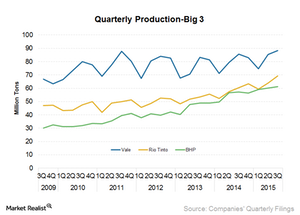

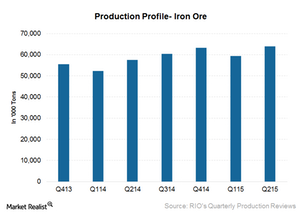

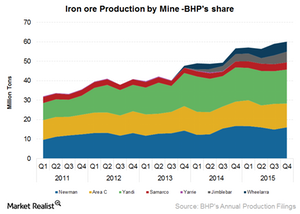

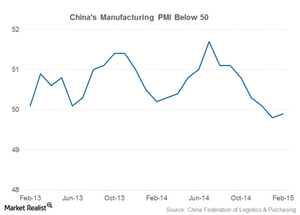

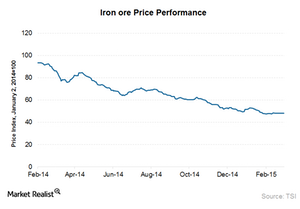

Iron Ore Companies’ Production Continues Unabated Growth

The weak demand from China is hurting iron ore prices. The supply side, on the other hand, remains quite strong.

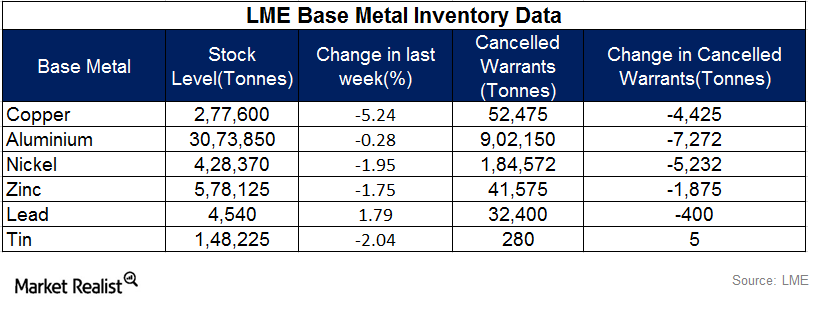

LME Warehouse Data Indicating Support For Metal Prices, But XME Collapses

Analysis of base metal inventories helps us understand the price and usage trends of the respective base metal, as well the price trends of base metal mining companies.

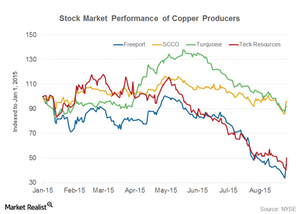

Why Aren’t BHP and RIO Cutting Copper Production?

While major mining companies like Freeport-McMoRan and Glencore are declaring copper production cuts, BHP Billiton says it is reluctant to decrease its copper production.

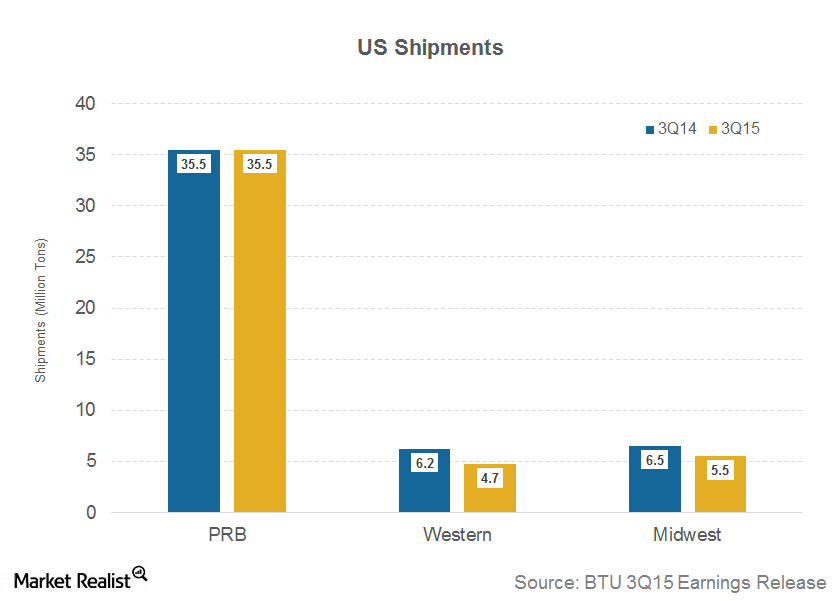

Natural Gas Weighed Heavily on Peabody Energy’s US Shipments

Peabody Energy’s (BTU) US operations sold 45.7 million tons of thermal coal (KOL) in 3Q15, 5.2% lower than 3Q14’s 48.2 million tons.

Must Know: How Did Glencore Take Shape?

Glencore (GLNCY) is a relatively new entrant in the metals and mining industry. The company was founded in 1974.

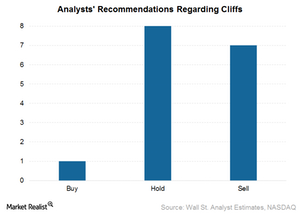

Cliffs Natural Resources: 3Q15 Market Expectations

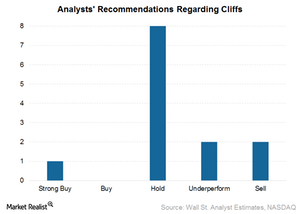

Market expectations for Cliffs Natural Resources (CLF) are varied. Of the analysts covering Cliffs, one has a “buy” recommendation, eight have a “hold,” and seven have a “sell.”

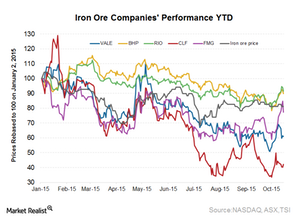

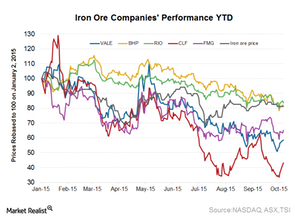

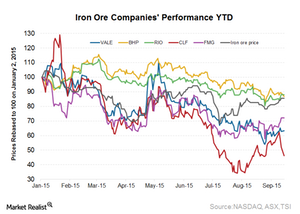

Cliffs Natural Resources Has Underperformed Iron Ore Peers So Far

The third quarter of 2015 hasn’t been good for iron ore equities. Most of them lost significant value during the quarter.

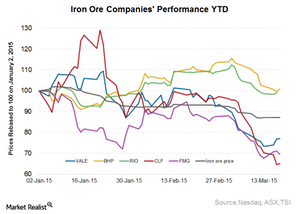

What is Driving the Iron Ore Miners’ Stock Price Performance?

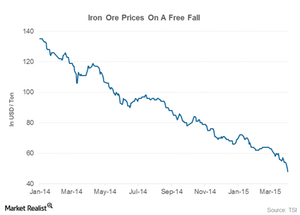

Iron ore prices fell 49% in 2014, which was reflected in the share price performance of major miners. In this series, we’ll discuss the position of various iron ore players on the cost curve relative to iron ore prices.

Why Rio Tinto May Not Pull Back Its Iron Ore Volume Growth

Iron ore volumes are key to Rio Tinto’s (RIO) iron ore segment’s revenue. The other factor, seaborne iron ore prices, is determined by demand and supply dynamics.

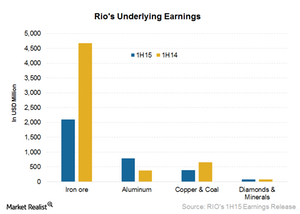

Will the Slide in Rio Tinto’s Underlying Earnings Continue?

Rio Tinto’s (RIO) underlying EBITDA (earnings before interest, taxes, depreciation, and amortization) was $7.3 billion for 1H15.

After 1H15, Rio Tinto Looks Forward to Further Cost Cuts

Within four trading days of its 1H15 results, Rio Tinto’s stock price rose 3%. This is despite a 1.7% fall in benchmark seaborne iron ore prices.

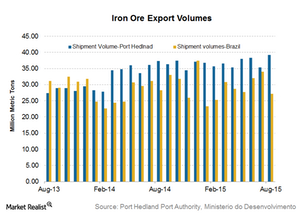

Iron Ore Shipments Remain Strong for August

Iron ore shipments through Port Hedland reached an all-time high of 39.2 million tons in August as compared to 35.3 million tons in July.

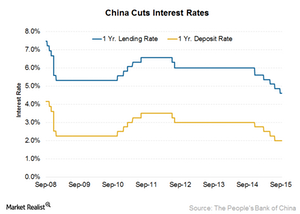

Will China’s Monetary Easing Impact Iron Ore Miners Favorably?

Chinese credit easing measures should positively impact the steel industry. This will help iron ore companies like Rio Tinto and BHP Billiton.

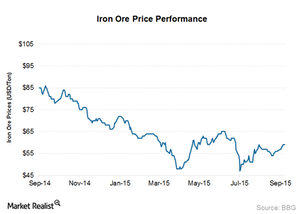

Iron Ore Prices Are Holding Steady Thus Far

Since the end of July, benchmark iron ore prices have been holding steady near $55–$57 per ton. This is despite the continuing slide in other commodities amid China slowdown worries.

A Comparative Analysis of the Aluminum Industry

Aluminum is the second most widely used metal after steel. Investors have a special liking for aluminum. There are several ways to play the industry.

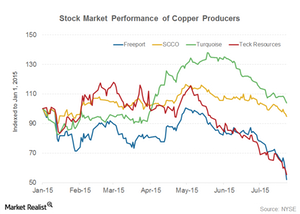

Is Freeport-McMoRan Worth a Look for Investors?

With the recent news of activist investor Carl Icahn taking an 8.5% stake in the company coupled with Freeport’s lower capital expenditure guidance, the stock has seen a smart up move.

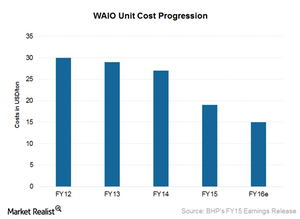

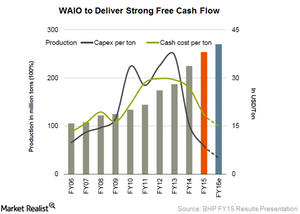

How Much Lower Can BHP’s Unit Iron Ore Costs Go?

Iron ore costs are key to determining BHP’s iron ore segment’s profitability, which ultimately impacts its stock price and relative performance.

Why BHP Delivered Record Iron Ore Production in Fiscal 2015

BHP Billiton’s iron ore production for fiscal 2015 was a record 233 million tons, a growth of 14% year-over-year.

Is Everything Going According to Plan for BHP Billiton?

BHP Billiton (BHP) (BBL), the world’s largest miner by market capitalization, reported its fiscal 2015 results on August 25. The results were mostly in line with market expectations.

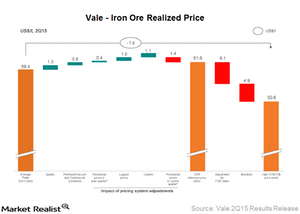

What Led to Vale’s Increased Realized Iron Ore Prices in 2Q15?

Vale’s (VALE) average CFR (cost and freight) realized price for iron ore fines increased by $3.30 per ton, from $58.20 per metric ton in 1Q15 to $61.50 in 2Q15.

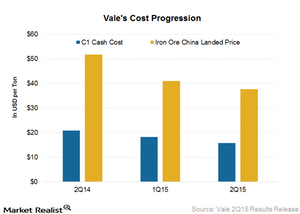

Vale’s 2Q15 Profitability Gets Boost from Iron Ore Cost Control

Vale’s (VALE) iron ore production for 1H15 was a record 159.8 million tons, 9.3 million tons higher than 1H14. For 2Q15, production was the second highest on record at 85.3 million tons.

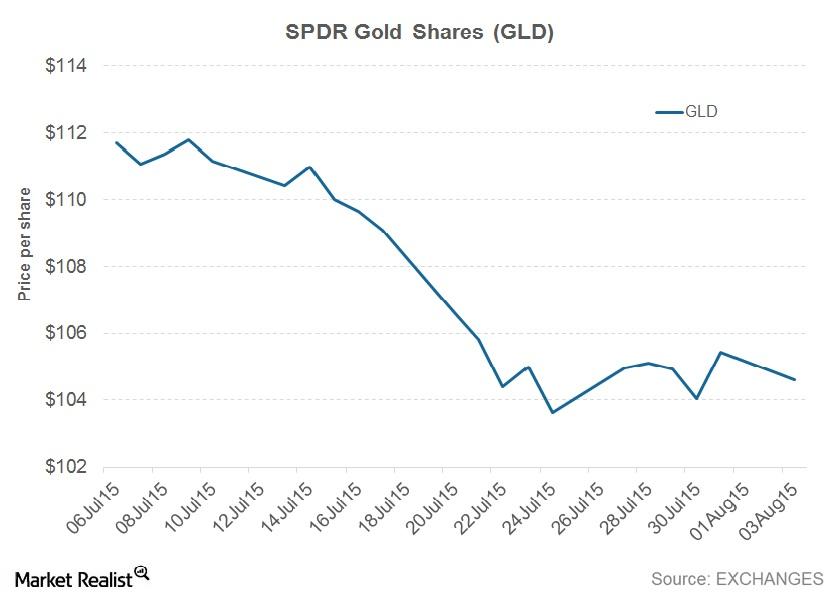

Why Is the SPDR Gold Shares ETF (GLD) Losing Its Sheen?

The SPDR Gold Shares ETF (GLD) is the world’s largest ETF. It’s also the highest-traded. Friday’s price for GLD was $104.39.

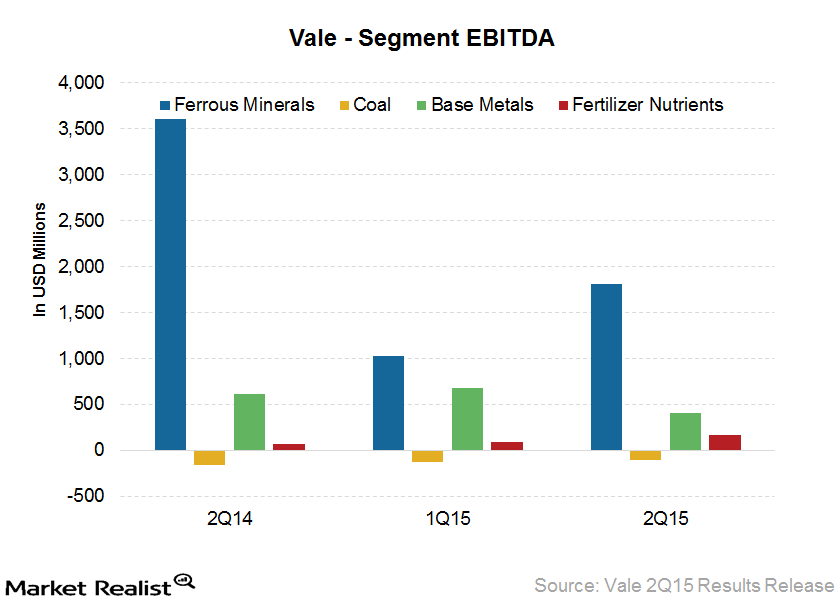

Why Did Vale Report a Beat on Market Expectations in 2Q15?

In this article, we’ll look at Vale’s (VALE) 2Q15 results and why they’re a beat on market expectations. Vale reported adjusted EPS of $0.19, which was 55% above consensus.

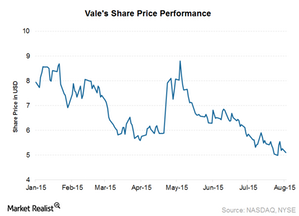

Vale Reports a Beat in 2Q15 Results, but Stock Falls

Vale S.A. (VALE) reported its 2Q15 results on July 30, 2015. Overall results were a beat on market expectations. However, Vale’s stock price fell 6.5% after Vale announced its results.

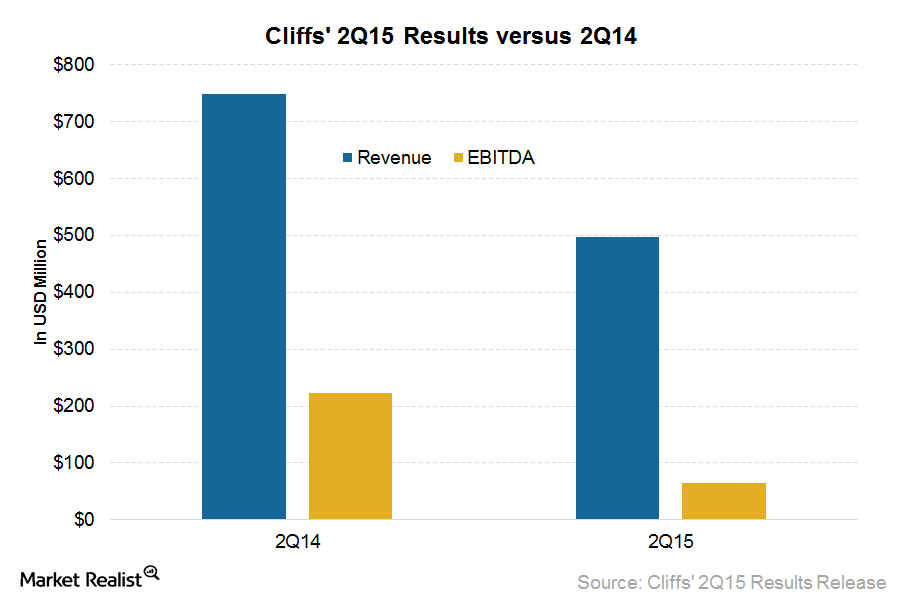

Key Highlights of Cliffs Natural Resources’ 2Q15 Earnings

Cliffs Natural Resources reported revenues of $498 million for 2Q15, a decline of 33% year-over-year.

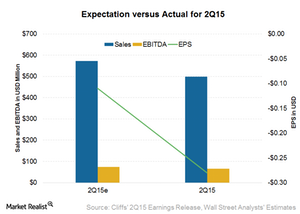

Cliffs Natural Resources 2Q15 Results Miss Estimates

Cliffs Natural Resources announced its 2Q15 earnings on July 29, and its results missed market expectations this time. Cliffs offered positive results six out of the last eight times.

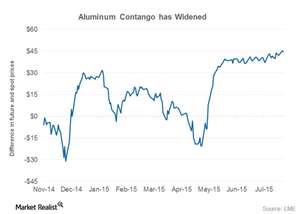

Aluminum Contango Widens as Market Expects Prices to Recover

A wider contango is generally associated with a short-term oversupply in the market. Aluminum market dynamics took a beating as China’s aluminum exports are reaching alarming levels.

Freeport-McMoRan: 2Q15 Earnings, Outlook Fail to Cheer Investors

Freeport-McMoRan (FCX) released its 2Q15 earnings on July 23. It reported a net loss of $1.85 billion, which was largely attributable to the $2 billion write-down of its oil and gas assets.

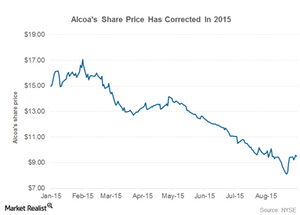

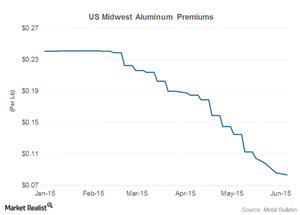

Alcoa Continues to Sag as Aluminum Prices Fall Further

Aluminum prices have been in a downtrend for more than a month.

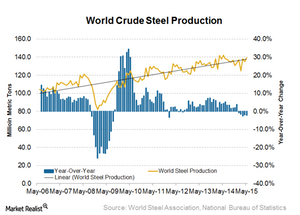

World Steel Production Falls for Five Straight Months

According to data released on June 22 by the WSA, world crude steel production totaled 139 million tons in May. This is a 2.1% decline year-over-year.

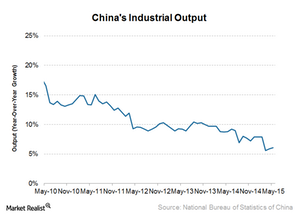

China’s Investment Data Down, Industrial Production Up in May

China’s industrial production grew by 6.1% year-over-year in May. Economists were expecting an increase of 6.0%. May’s growth is higher than the 5.9% year-over-year growth in April.

US Midwest Aluminum Premiums Are Still Caught in a Downtrend

Year-to-date, aluminum prices have lost ~9%, while physical aluminum premiums in the US have lost almost 60%.

Which Way Is the Chinese Copper Industry Headed This Year?

Over the last decade, China (FXI) has been the key driver of global commodity trade. This holds true for industrial metals like copper, iron ore, and aluminum.

Iron Ore Prices Fall Below $50 Per Ton

The iron ore price slide has been particularly pronounced in the last few weeks, as Chinese demand didn’t pick up as expected after the New Year holiday.

What’s the Current Market Sentiment for Cliffs Natural Resources?

As for market sentiment, Cliffs (CLF) seems to be on the receiving end. Most of it is due to the worsening current and future outlook for iron ore prices.

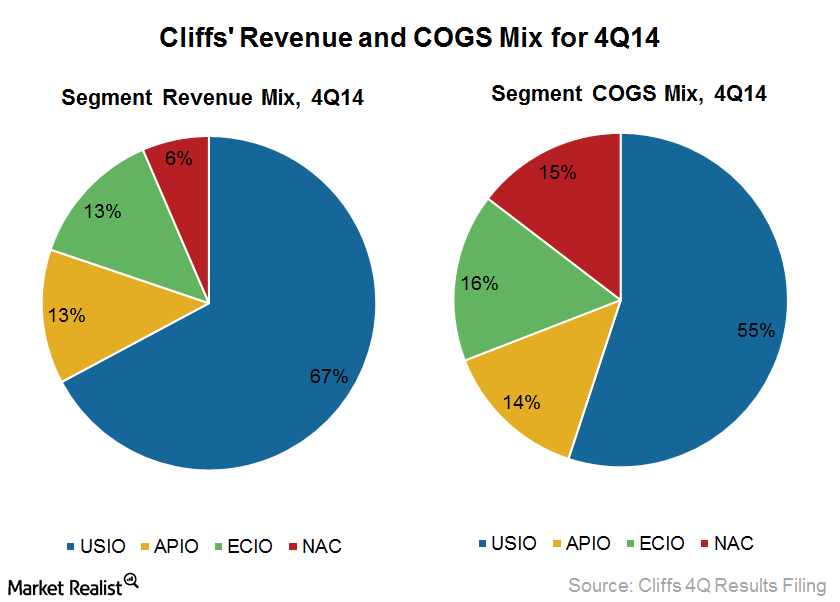

A Business Overview of Cliffs Natural Resources

Cliffs Natural Resources’ (CLF) key driver is global demand for the raw materials used to make steel.

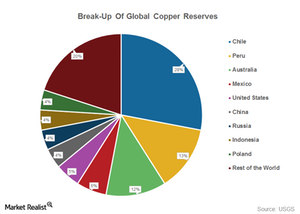

An Investor’s Guide to the Copper Supply Chain

Copper is also known as “Dr. Copper,” as analysts see the metal’s prices as a reflection of the global economy’s health.

Cliffs Natural Resources stock prices in a changing environment

Cliffs’ (CLF) stock prices fell to a fresh 52-week low of $4.24 on March 19, mostly due to an iron ore supply glut coupled with slowing Chinese demand.

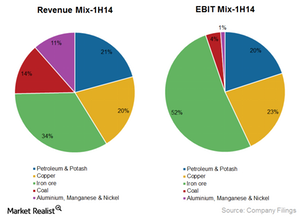

BHP Billiton: A critical business overview

BHP Billiton (BHP) is a leading global diversified resources company and is one of the world’s largest major commodity producers.

Why Vale’s Results Are a Miss on Expectations

Vale’s results were a miss on expectations with a reported adjusted EPS loss of $0.05 per share. This is below the consensus of $0.19 per share.

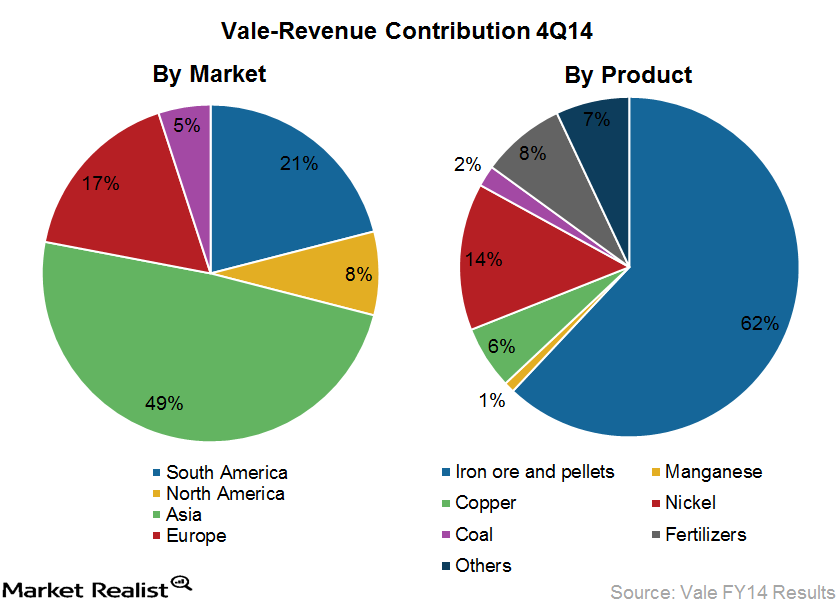

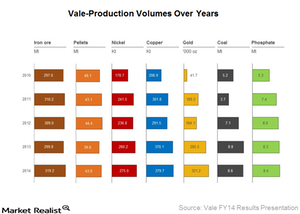

Vale SA – World’s Largest Iron Ore Company

Vale is the world’s largest producer of iron ore and iron ore pellets. It’s the second largest nickel producer.

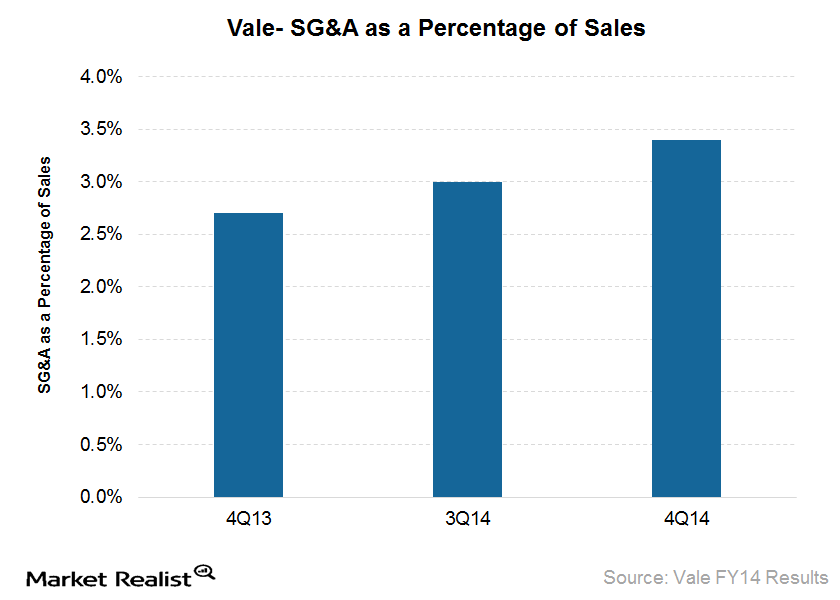

Key Earnings Takeaways from Vale’s FY14 Results

Key earnings takeaways from Vale’s results show cost of goods sold amounted to $25.1 billion in 2014, an increase of $819 million from 2013.

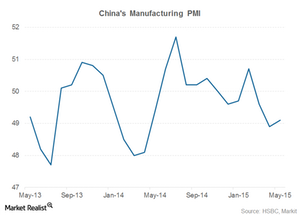

China’s manufacturing PMI below 50 for second consecutive month

China’s manufacturing PMI has been below 50 for two consecutive months. This reflects a slowdown in the Chinese economy and impacts industrial commodities.

Key iron ore indicators to consider

It’s important to look at iron ore indicators collectively because they give clues about the direction of iron ore prices.