Monsanto Co

Latest Monsanto Co News and Updates

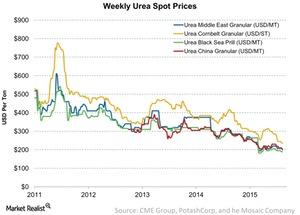

Urea Prices: The Continuing Decline Last Week

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week.

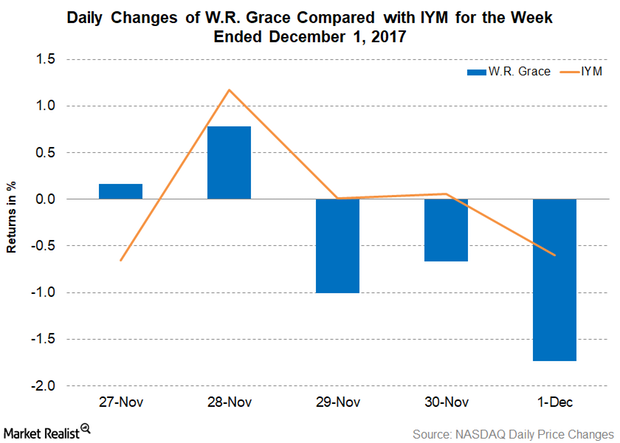

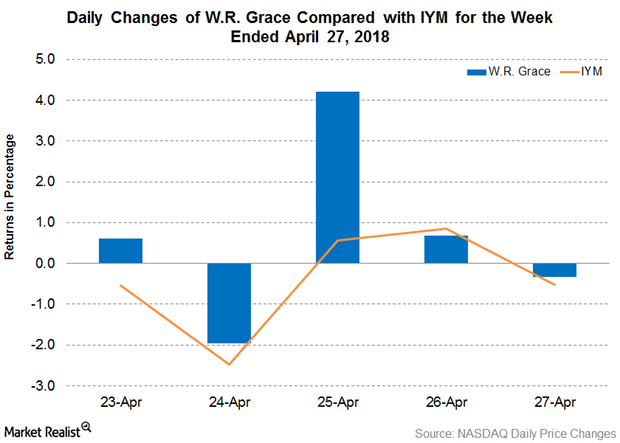

W.R. Grace Signs a Spree of New Contracts

On November 27 and 28, 2017, W.R. Grace (GRA) signed a spree of new contracts for its Unipol license.

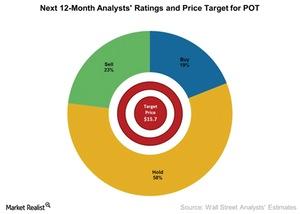

PotashCorp’s Price Target before It Reports Its 2Q16 Earnings

Since the beginning of 2016, analysts have revised their next-12-month price target for PotashCorp downward. The consensus price target now stands at $15.70.

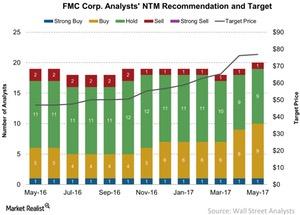

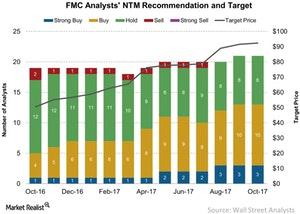

Analysts’ Price Target and Recommendations for FMC Corporation

Like Monsanto (MON), FMC Corporation (FMC) is in the business of crop protection products. The majority of FMC’s sales come from its Agricultural Solutions segment.

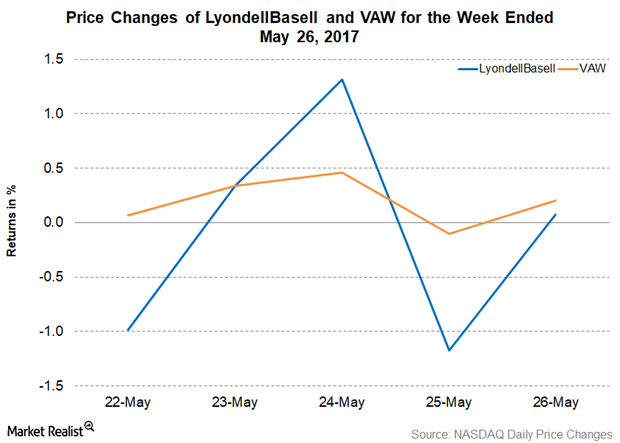

LyondellBasell Announces New Share Repurchase Program

On May 24, 2017, LyondellBasell’s (LYB) board authorized a new share repurchase program. It can repurchase up to 10% of its outstanding shares over the next 18 months.

Monsanto: Earnings Estimates and Target Price

As of December 25, 2017, Monsanto stock was covered by 18 analysts according to Reuters. The current consensus rating on the stock stood at 2.56.

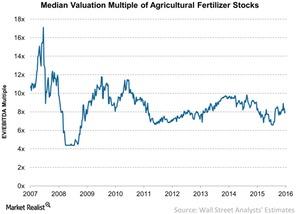

Valuation Multiples for Agricultural Chemicals after Brexit

In this part of the series, we’ll look at agricultural fertilizer producers’ valuations from their historical standpoints. Over the long run, valuation multiples impact a company’s share price.

Who Are the Biggest Players in the Fertilizer Industry?

There’s a handful of big players in the agricultural fertilizer industry. Setting up business requires huge capital, which makes for a high barrier to entry.

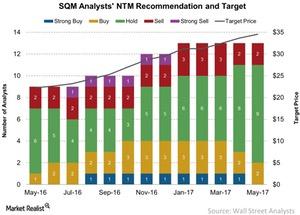

Analysts’ Recommendations and Price Target for SQM

Sociedad Química y Minera de Chile (SQM) has yet to announce its earnings, unlike most of the companies we’ve discussed so far in this series.

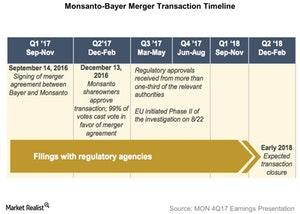

What Hurdles Could Monsanto-Bayer Deal Face?

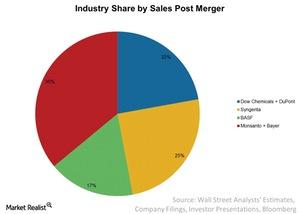

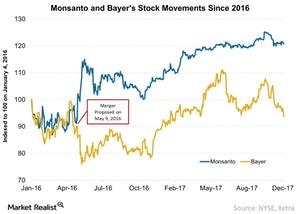

A few days ago, Monsanto (MON) agreed to Bayer’s takeover offer of $128 per share for a total deal value of $66 billion.

Corn, Soybean, and Wheat Prices Fall in August, but Why?

On August 13, the crop index stood at 89.9. It rose by 1% following the USDA’s latest stock-to-use ratio, which was published on August 12.

An Update on the Monsanto-Bayer Proposed Merger

Bayer recently filed for an extension with European Union regulators, which pushed back the merger with Monsanto to early 2018.

W. R. Grace Bags New UNIPOL Technology Client

On April 24, W. R. Grace (GRA) announced that it would be licensing its UNIPOL PP Process Technology to Inter Pipeline to be used in its Heartland Petrochemical complex in Alberta, Canada

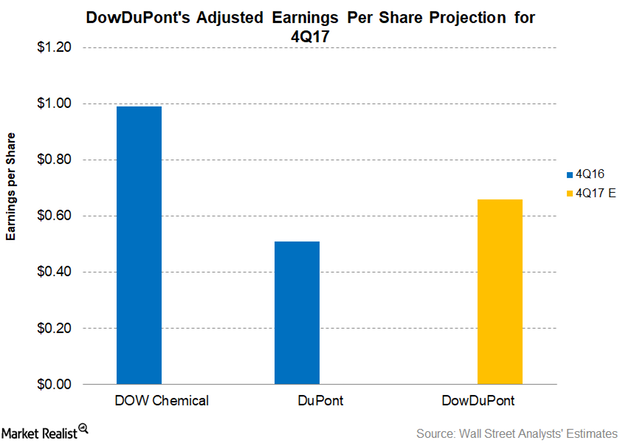

What Could Drive DowDuPont’s Adjusted Earnings in 4Q17?

DowDuPont (DWDP) is expected to post an adjusted EPS (earnings per share) of $0.66 in 4Q17. DowDuPont posted an adjusted EPS of $0.55 in 3Q17.

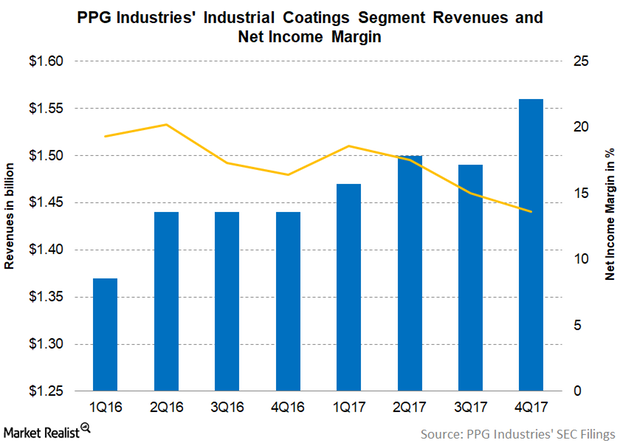

PPG’s Industrial Coatings Segment’s Margins Continue to Contract

PPG Industries’ (PPG) Industrial Coatings segment is its second reporting segment. The segment represented 42.3% of the company’s total revenue in 4Q17 compared to 42.0% in 4Q16.

Scotts Miracle-Gro: Ratings and Price Target for January

Nine Wall Street analysts are covering Scotts Miracle-Gro, They have a consensus mean rating of 2.3 on the stock with an overall “buy” recommendation as of January 10, 2018.

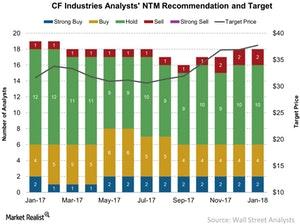

How Analysts View CF Industries in January 2018

Nineteen Wall Street analysts are covering CF Industries. They have a consensus mean rating of 2.7 on the stock with an overall “hold” recommendation as of January 10, 2018.

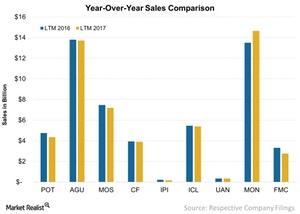

A Review of Key Agribusiness Companies’ 2017 Sales

Performance comparison In our series Comparative Analysis of Fertilizer Companies’ 3Q17 Earnings, we compared fertilizer companies’ 3Q17 performance. However, as the agriculture business is seasonal, we should also look at annual trends for a complete picture. Year-over-year sales In the above chart, we compare agribusiness companies’ sales over the last 12 months and the year prior. All […]

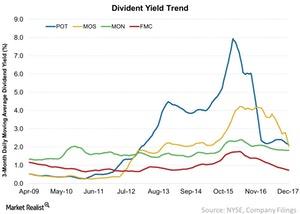

Digging Deeper into Agriculture Stocks’ Dividend Yields: Part 2

In this part of the series, we’ll look at the dividend yield trends for PotashCorp (POT), Monsanto (MON), Mosaic (MOS), and FMC (FMC).

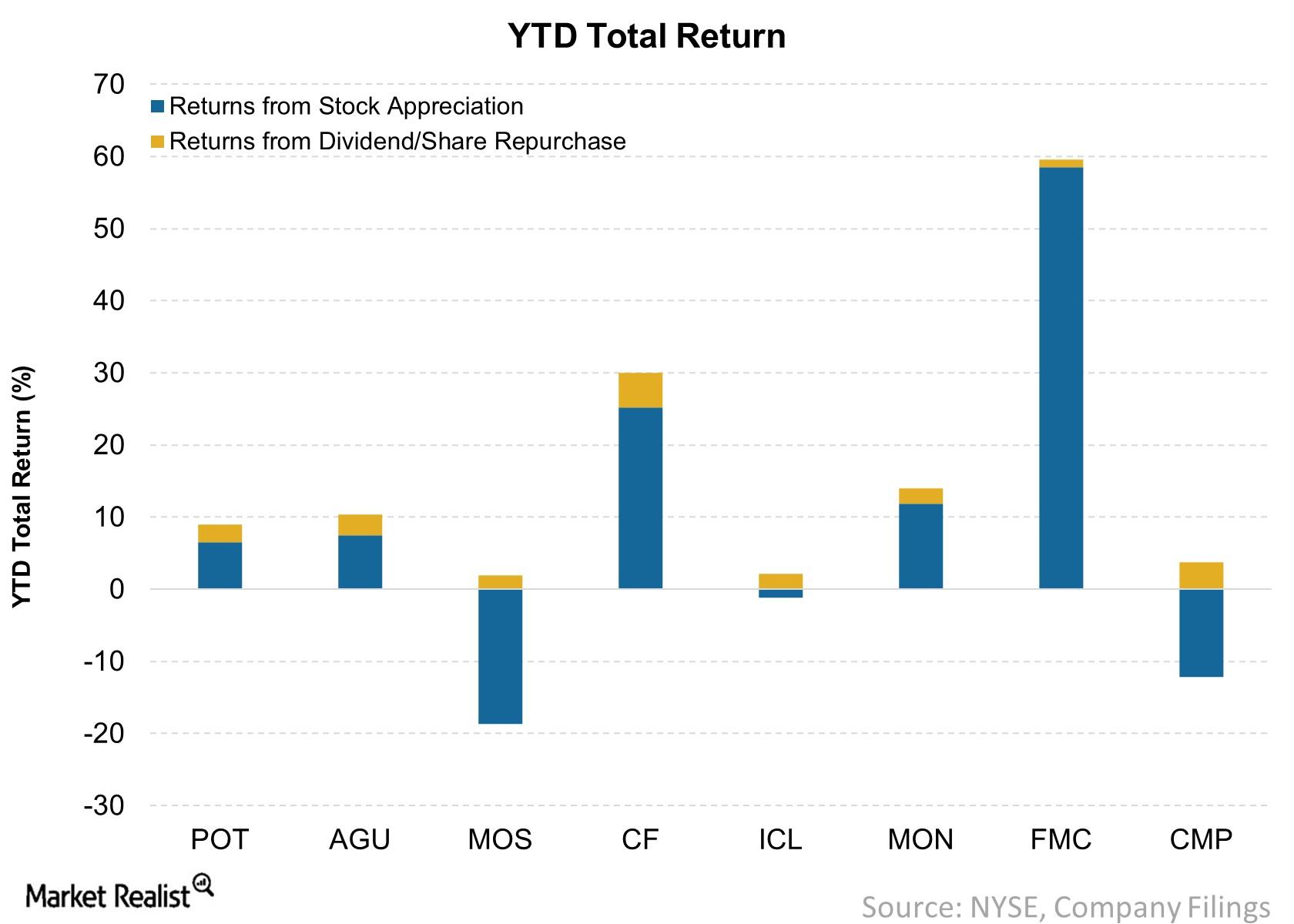

The Agriculture Industry: Our Top 4 Dividend Stocks

Among the companies that operate within the agriculture sector, FMC (FMC) has outperformed its peers with a total one-year return of 53.2% as of December 11, 2017.

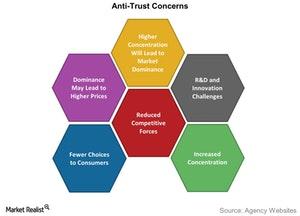

The Bayer-Monsanto Merger Concerns

Some anti-trust agencies have pushed back their merger approval deadlines over anti-competitive concerns the deal will likely create.

The Bayer-Monsanto Merger Deal: An Update

On September 14, 2016, Bayer signed an agreement with Monsanto (MON) to acquire it for $66 billion, or $128 per share. The offer represented a 44% premium over Monsanto’s stock price.

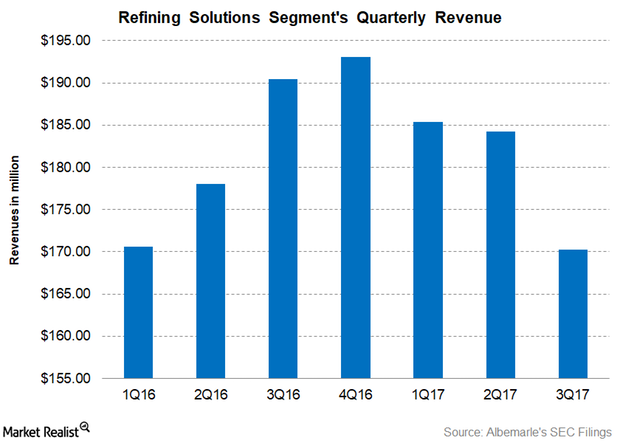

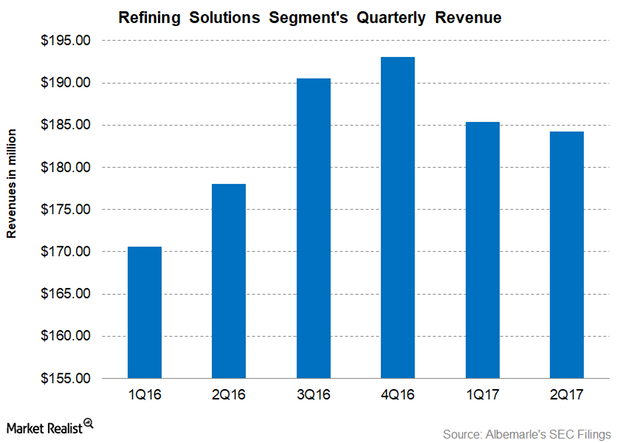

Why Albemarle’s Refining Solutions Segment Fell in 3Q17

Albemarle’s (ALB) Refining Solutions segment is the company’s lowest revenue generator, accounting for 22.6% of its total revenues in 3Q17 compared to 29.1% in 3Q16.

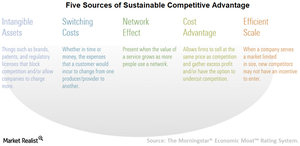

Efficient Scale Offers a Narrow Moat

Across the five moat sources (network effect, intangible assets, cost advantage, switching costs, and efficient scale), efficient scale is the most likely to drive a “narrow moat” rating from Morningstar.

October Update: What Analysts Think about FMC

FMC (FMC) stock has risen 6.0% over the past month. The stock has significantly outperformed the benchmarks (SPY) (MOO) YTD with a 68.0% rise.

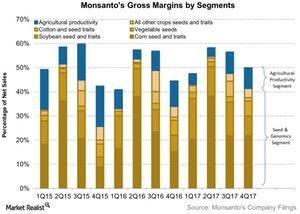

Monsanto’s 4Q17 Gross Margins by Segment

The Seed and Genomics segment’s gross margins expanded from 34.0% in 4Q16 to 41.4% in 4Q17.

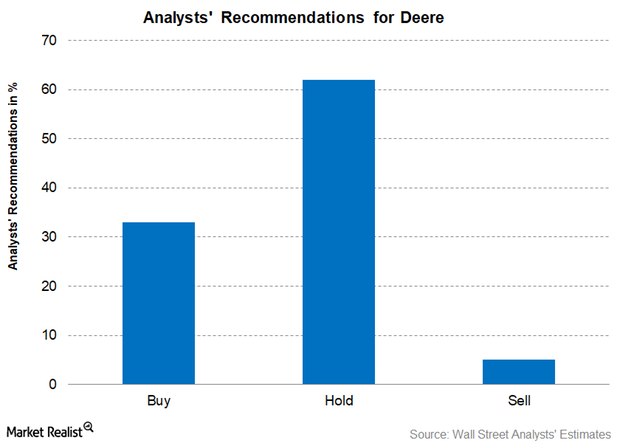

Deere: Analysts’ Recommendations and Target Prices

For Deere, 33% of the analysts recommended the stock as a “buy,” 62% recommended the stock as a “hold,” and 5% recommended the stock as a “sell.”

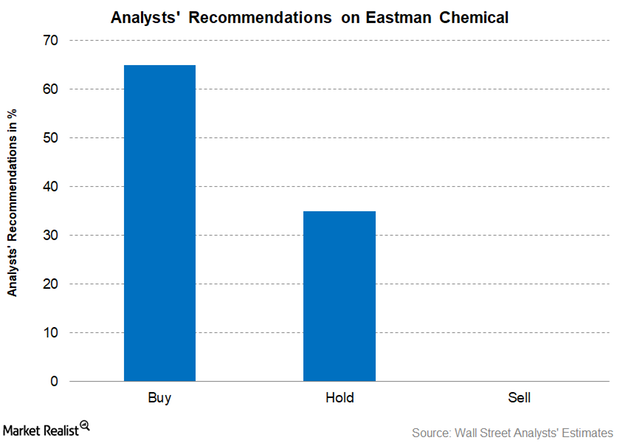

What Analysts Recommend for Eastman Chemical

Analysts’ consensus on EMN’s mean target price is on the rise from $89.92 in July to the current target price of $93.38 as of September 12, 2017.

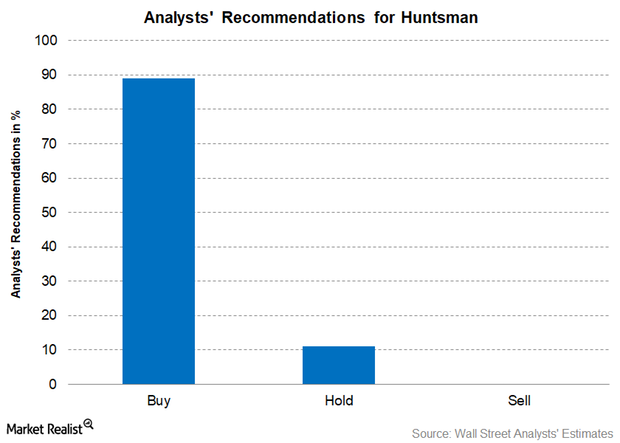

Why Most Analysts Recommend ‘Buy’ for Huntsman

Analysts’ consensus for Huntsman The number of analysts covering Huntsman (HUN) stock has increased from eight analysts to nine analysts in the last month. Among them, 89% of the analysts have recommended “buy,” and 11% have recommended “hold.” There were no “sell” recommendations. Analysts have raised Huntsman’s 12-month target price to $30.11 from $28.71, implying a potential […]

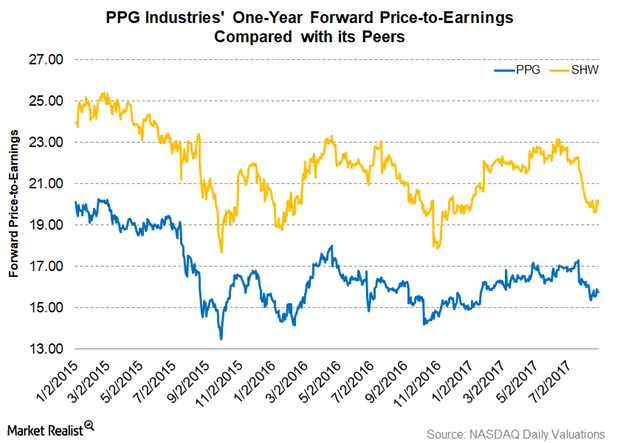

Why PPG Industries Is Trading at a Discount

As of August 25, 2017, PPG Industries’ one-year-forward PE (price-to-earnings) multiple stood at 15.80x.

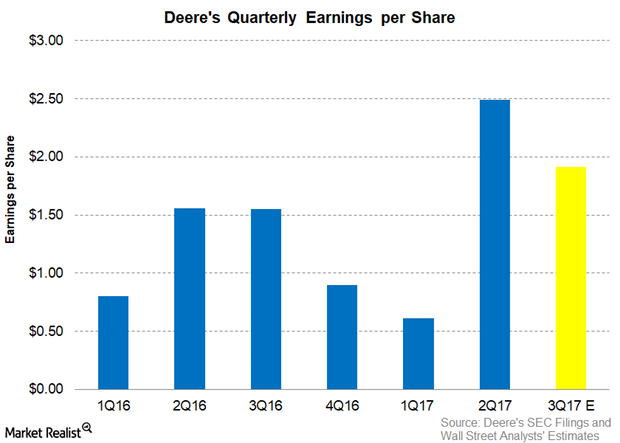

Can Deere Beat the Analysts’ Earnings Estimate Again in Fiscal 3Q17?

Analysts are expecting Deere (DE) to post EPS earnings per share of $1.91 for fiscal 3Q17, which would be an increase of 23.2% on a YoY basis.

How Albemarle’s Refining Solutions Segment Performed in 2Q17

Albemarle’s (ALB) Refining Solutions is the company’s lowest revenue generator, accounting for 25.0% of its total revenues in 2Q17 compared to 26.6% in 2Q16.

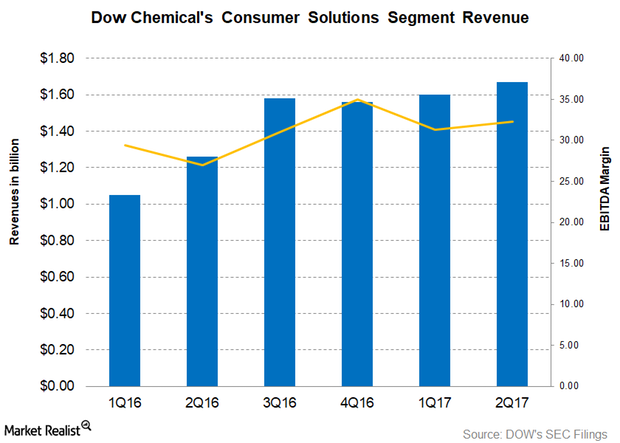

How Dow Chemical’s Consumer Solutions Segment Performed in 2Q17

Dow Chemical’s (DOW) Consumer Solutions segment is the fourth largest segment in terms of revenue.

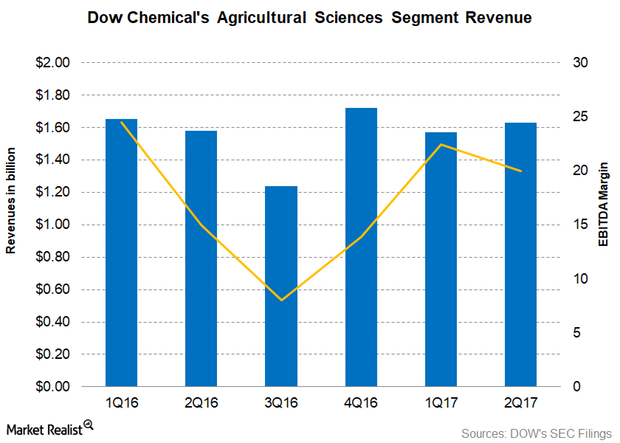

What Boosted DOW’s Agricultural Sciences Segment’s 2Q17 Revenues?

Dow Chemical’s (DOW) Agricultural Sciences segment accounted for 11.8% of DOW’s total revenue as compared to 13.2% in 2Q16.

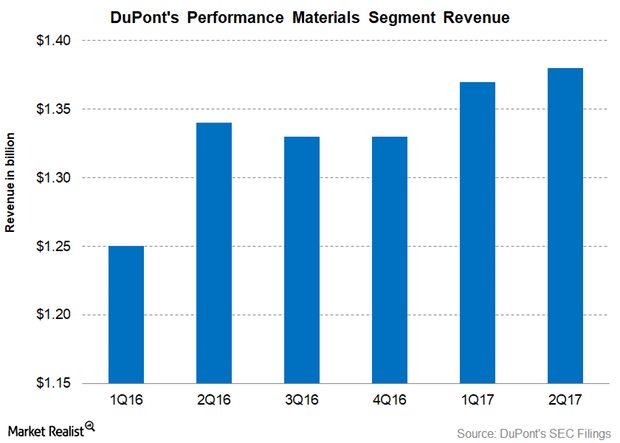

DuPont’s Performance Materials Segment’s Revenue Rose in 2Q17

In 2Q17, DuPont’s Performance Materials segment reported revenue of $1.38 billion—a increase of 3.40% on a YoY (year-over-year) basis.

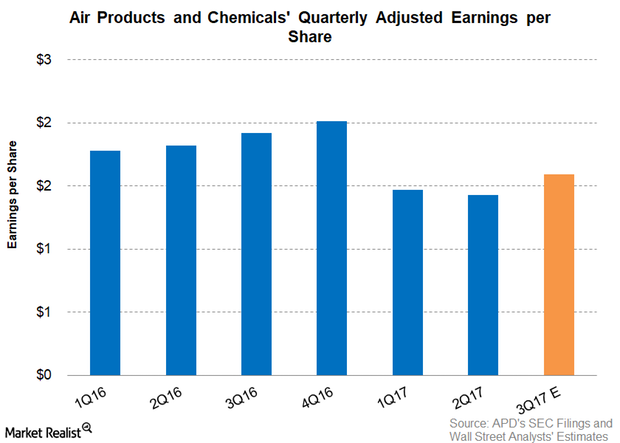

How Analysts View APD’s Fiscal 3Q17 Adjusted Earnings

On March 31, 2017, APD was left with $485.3 million from its share repurchase program.

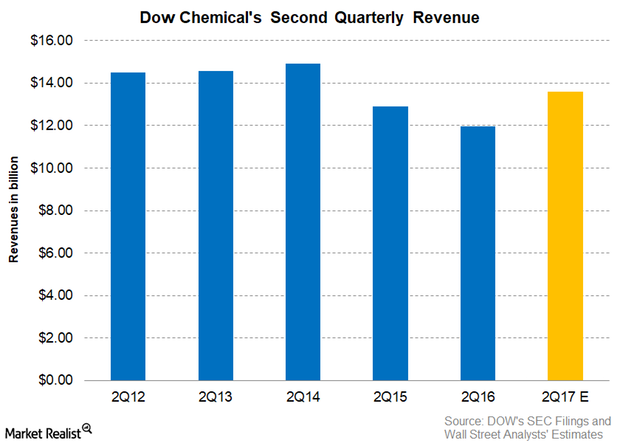

Understanding DOW’s High 2Q17 Revenue Hopes

As of July 21, 2017, analysts are expecting Dow Chemical (DOW) to post revenues of ~$13.6 billion for 2Q17, which would represent a 14.0% rise on a YoY basis.

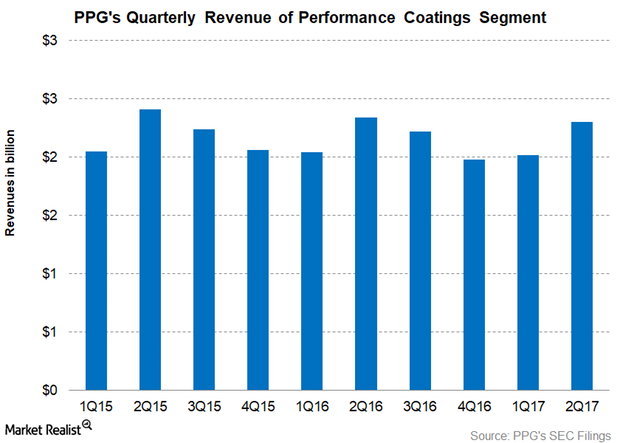

What Led to PPG’s Performance Coatings Segment’s Revenue Fall?

PPG Industries’ Performance Coatings segment is its largest revenue contributor. The segment’s contribution to PPG’s overall revenue fell from 61.8% in 2Q16 to 60.5% in 2Q17.

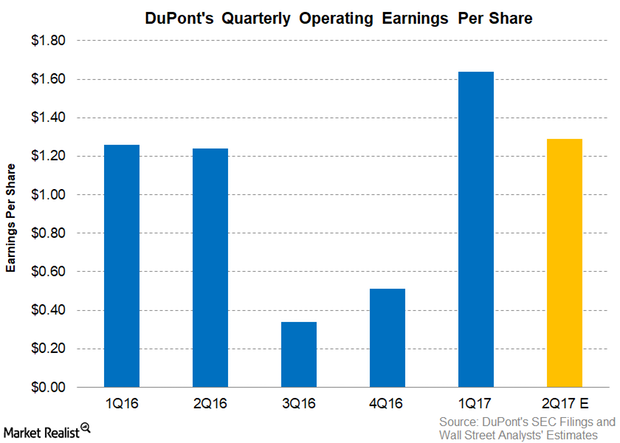

What Can We Expect for DuPont’s Earnings per Share in 2Q17?

DuPont’s earnings per share estimates for 2Q17 As of July 19, 2017, analysts expected DuPont (DDD) to post operating EPS (earnings per share) of $1.29, an increase of 4.0% YoY (year-over-year). In 2Q16, DuPont reported operating EPS of $1.24. The forecast increase in DuPont’s operating EPS is expected to be driven by improved SG&A (selling, general, […]

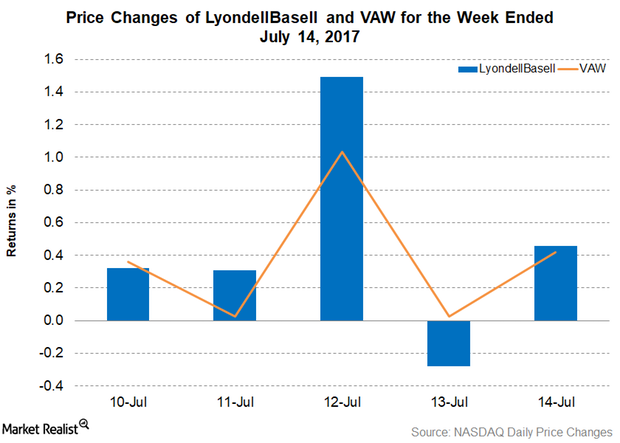

Who’s LyondellBasell Cooking up a License Deal with Now?

On July 12, 2017, LyondellBasell (LYB) granted its Spherizone and Lupotech T Licenses to Shaanxi Coal Yulin Energy and Chemical.

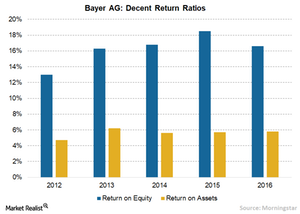

How Bayer Is Creating Value through Innovation

In 2016, Bayer owned ~51,000 valid patent applications and patents relating to ~5,000 protected inventions worldwide.

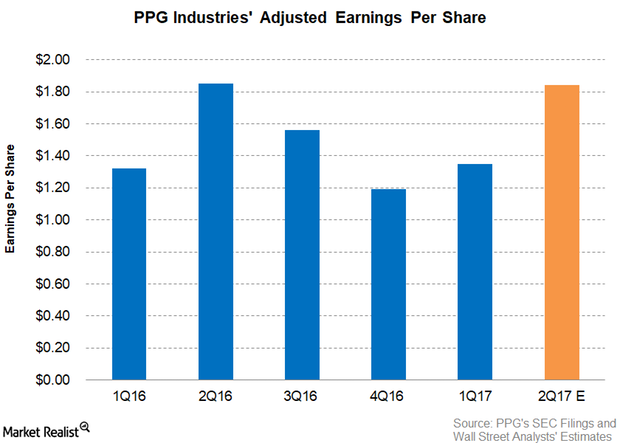

Can PPG Industries’ 2Q17 Adjusted EPS Beat Estimates?

Analysts are expecting PPG Industries (PPG) to post adjusted EPS of $1.84 in 2Q17, which implies a fall of 0.50% YoY.

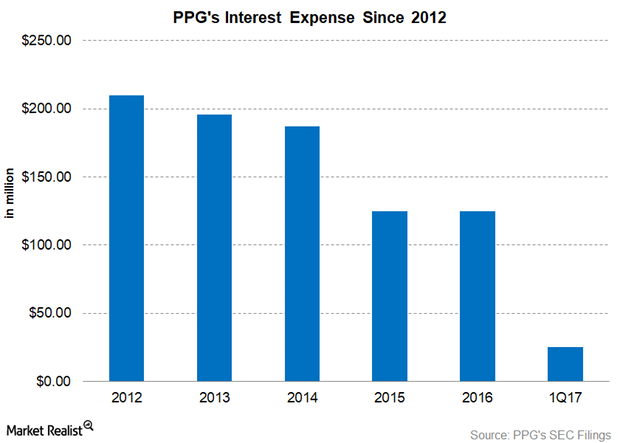

Why PPG Industries’ Interest Expense Is in a Declining Trend

In 2015, PPG’s interest expense dropped significantly. At the end of 2014, PPG refinanced $1.7 billion worth of notes that carried coupon rates of 9% and 7.7%, which reduced the interest expense.

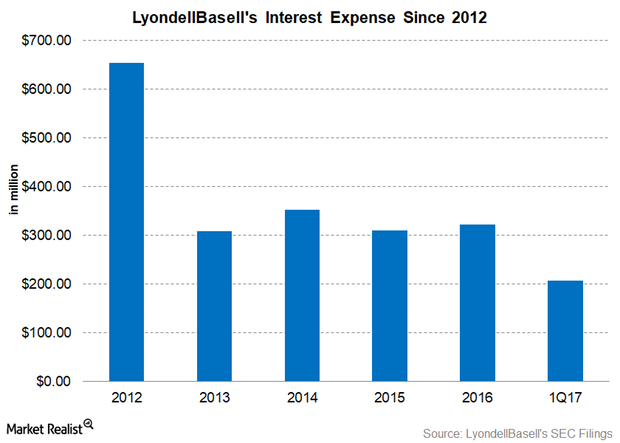

Is LyondellBasell Managing Its Interest Expenses Efficiently?

LyondellBasell’s (LYB) interest expense has been steady in the range of $309 million–$352 million since 2013, although debt has risen during the same period.

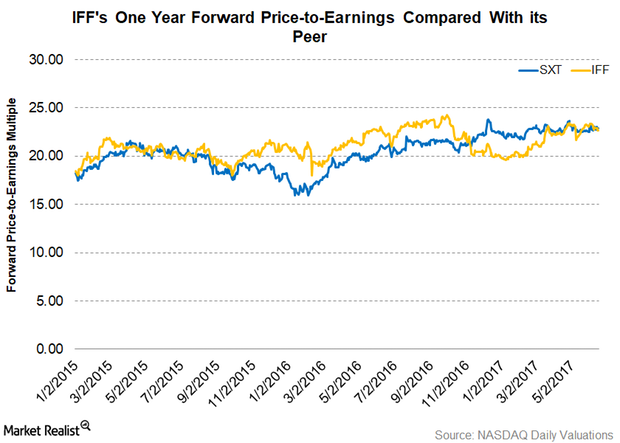

Where Does IFF’s Valuation Stand Compared to Its Peer?

As of June 15, International Flavors & Fragrances traded at a one-year forward PE ratio of 22.60x—marginally lower than Sensient Technologies.

Grace Signs New License Contract with Hengli Refinery

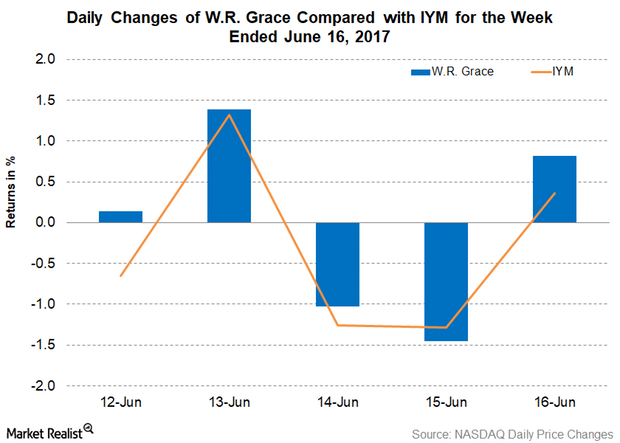

GRA closed at $70.53 with a fall of 0.2% for the week ended June 16, 2017.

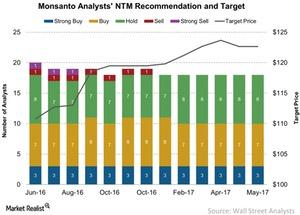

Monsanto’s Price Targets and Recommendations in June 2017

On June 9, Monsanto (MON) stock closed at $117.5 per share.

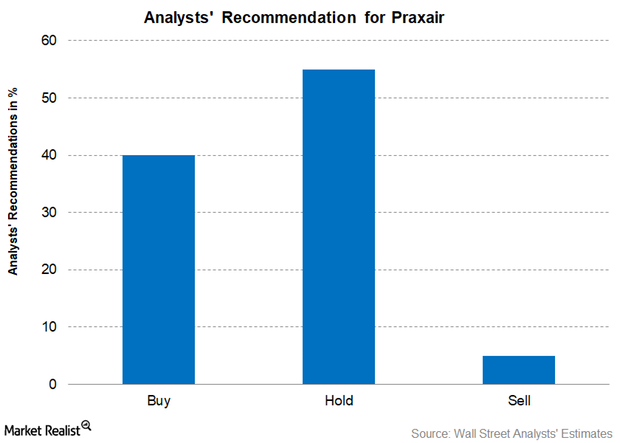

Praxair in the Crosshairs: Analyst Recommendations and Target Prices

On May 26, of the 20 firms tracking Praxair (PX) stock, about 40.0% recommended “buys,” while 55.0% recommended “holds.”

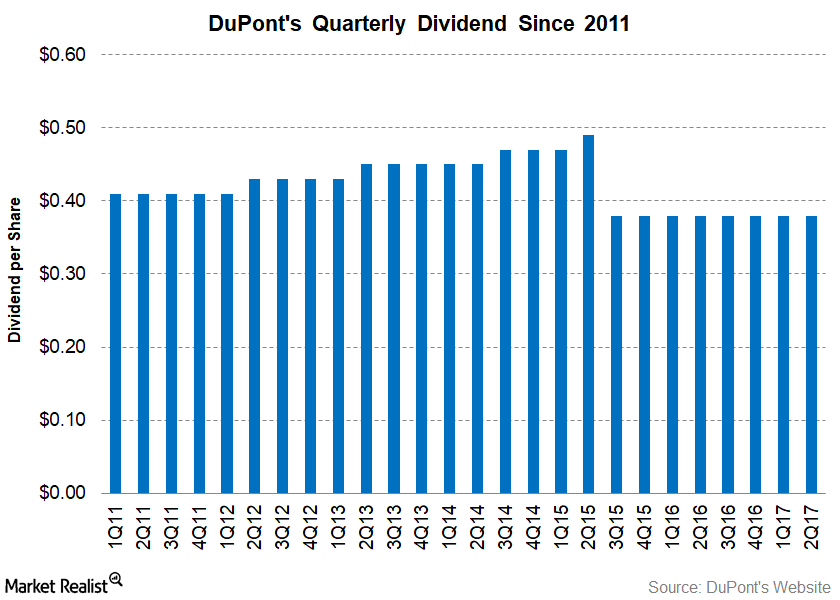

Are Investors Disappointed with DuPont’s Dividend Rate?

On April 26, 2017, DuPont (DD) declared a dividend of $0.38 per share on its outstanding common stock for fiscal 2Q17. The dividend will be payable on June 12, 2017.

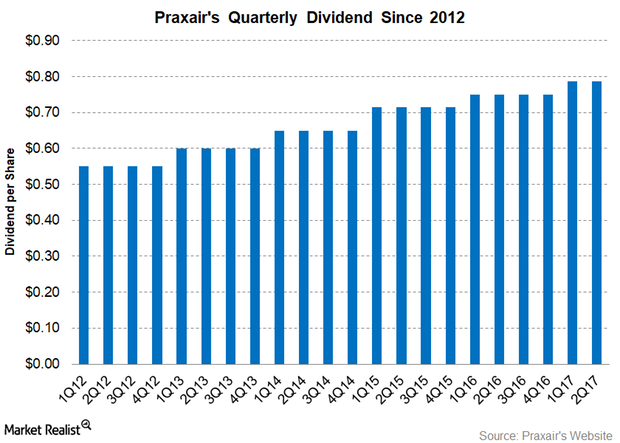

Will Praxair’s 2Q17 Dividend Inspire Investors?

On April 27, 2017, Praxair (PX) announced a dividend of ~$0.79 per share for 2Q17 on the company’s outstanding common stock.