Halliburton Co

Latest Halliburton Co News and Updates

Oil Service Company Halliburton Is Owned By Its Shareholders

Multinational corporation Halliburton (HAL) is owned by its shareholders. The largest shareholder is The Vanguard Group, Inc., which has a 10.78 percent stake in the company.

Biden Might Change the Tide for Halliburton, Stock Looks Like a Buy

Halliburton stock rose 2.7 percent in pre-market trading session on Jan. 19 following its fourth-quarter earnings results. Is HAL stock a good buy?

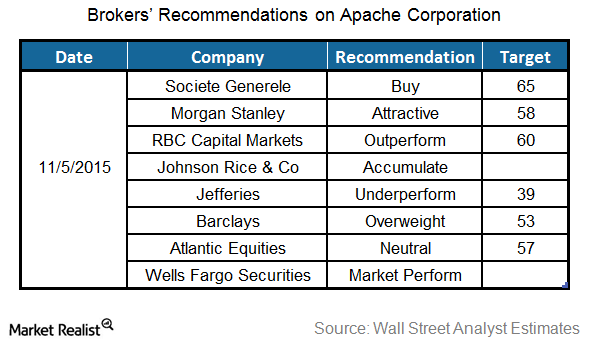

What Are Analyst Recommendations for Apache?

Wall Street analysts gave mixed recommendations after Apache’s quarterly results. Apache shares fell 5% on November 6, 2015, after the earnings release.

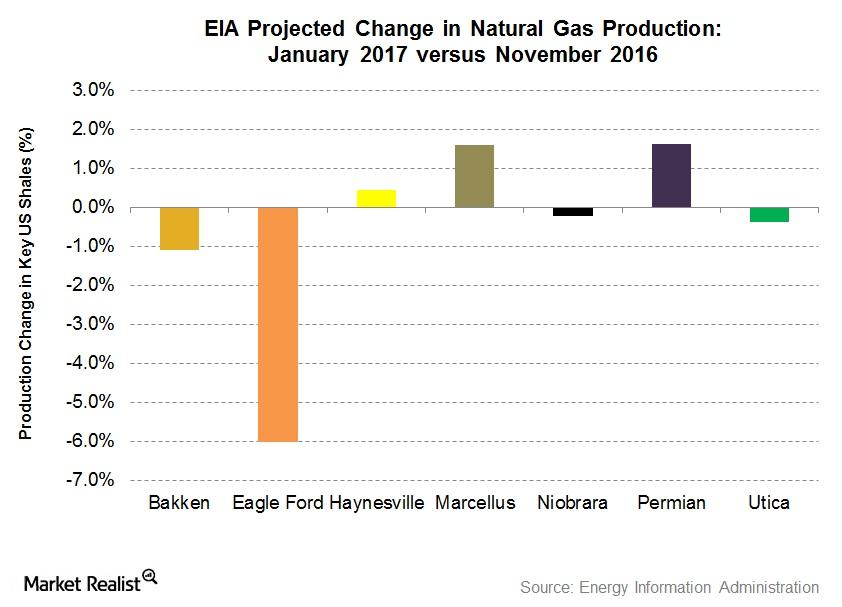

January 2017 EIA Estimates: US Shale Gas Production Could Fall

The EIA expects less natural gas production at four key US shales by January 2017 compared to November 2016. It expects production to rise at three key US shales.

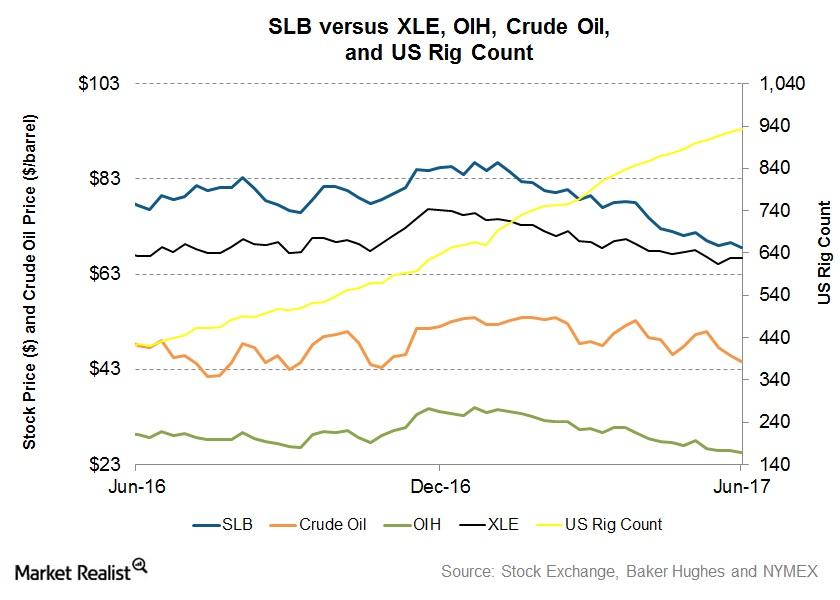

Inside Schlumberger’s 1-Year Returns as of June 16

Schlumberger’s trailing-one-year stock price has fallen 12% as of June 16, 2017, while XLE, the broader energy industry ETF, has fallen 3%.

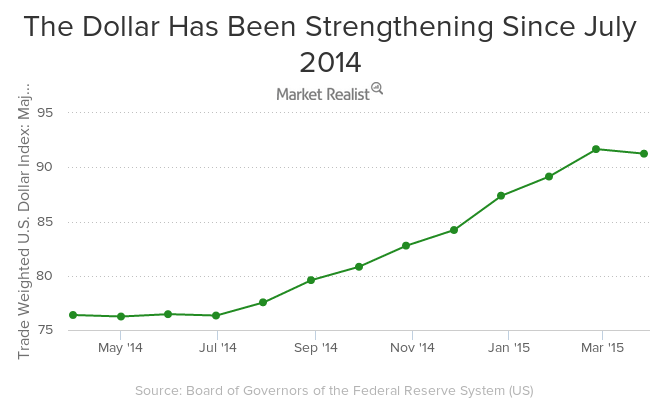

Why the US Economy Stalled in 1Q15

The US economy stalled in 2014 for several reasons, including seasonality, weather, strength of the dollar, the West Coast port strike, and the oil price slump.

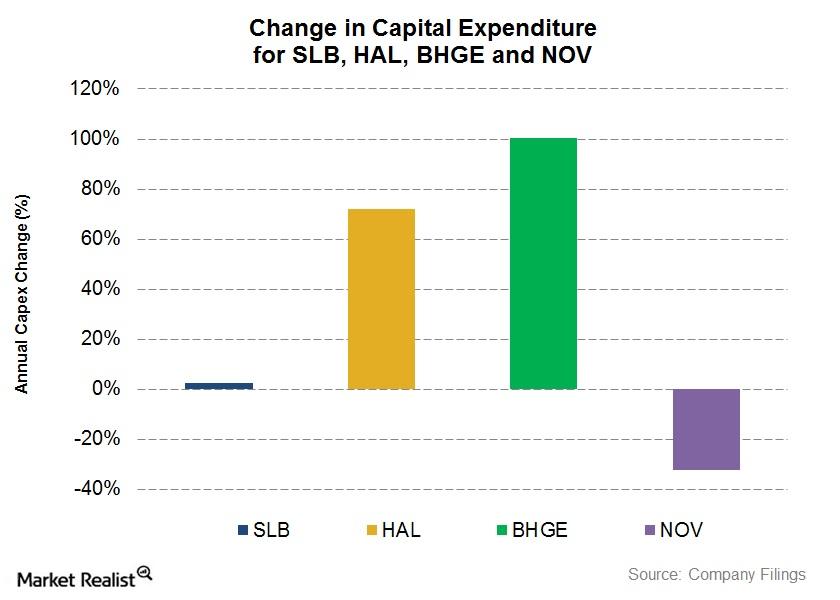

SLB, HAL, NOV, and BHGE: Comparing the Capex Growth

National Oilwell Varco’s (NOV) capital expenditure or capex fell ~32% in fiscal 2017—compared to its capex spend in fiscal 2016.

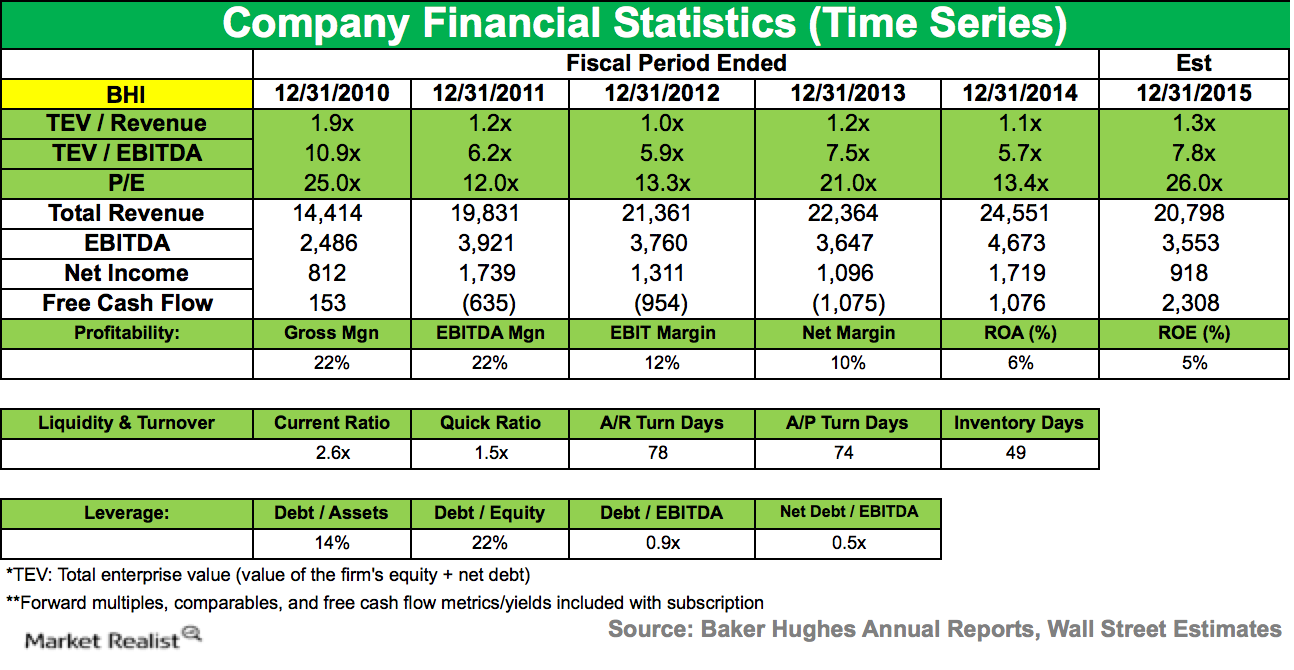

Will a Partnership with GE Improve BHI’s Returns?

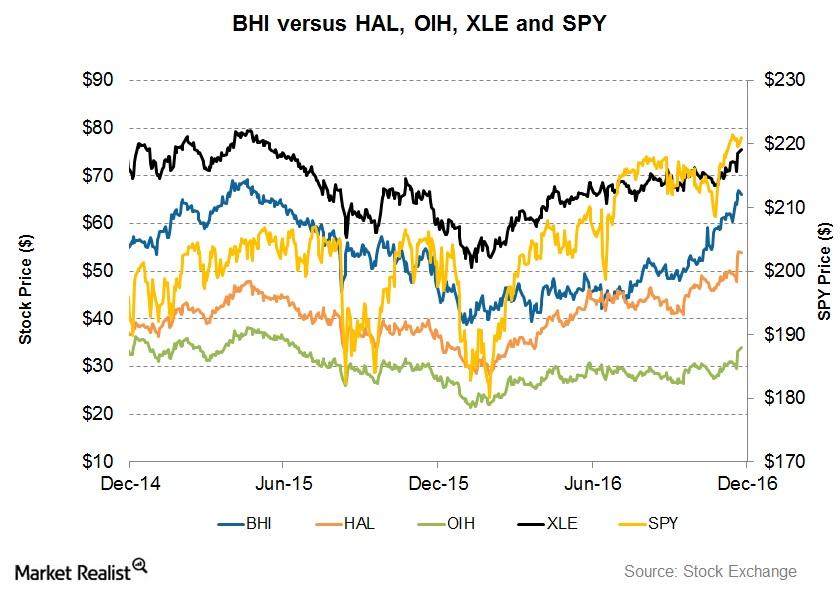

Between December 2014 and December 2016, Baker Hughes (BHI) stock hit its peak in April 2015. It troughed at ~$39 in January 2016.

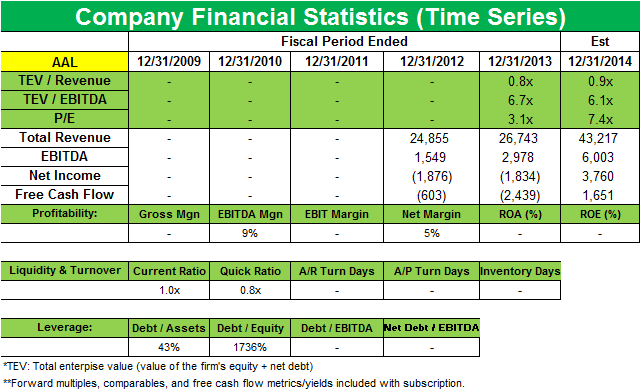

Appaloosa Management raises its stake in American Airlines Group

Appaloosa Management enhanced its position in American Airlines Group Inc. (AAL) last quarter that now accounts for 3.48% of Appaloosa’s total 1Q portfolio.

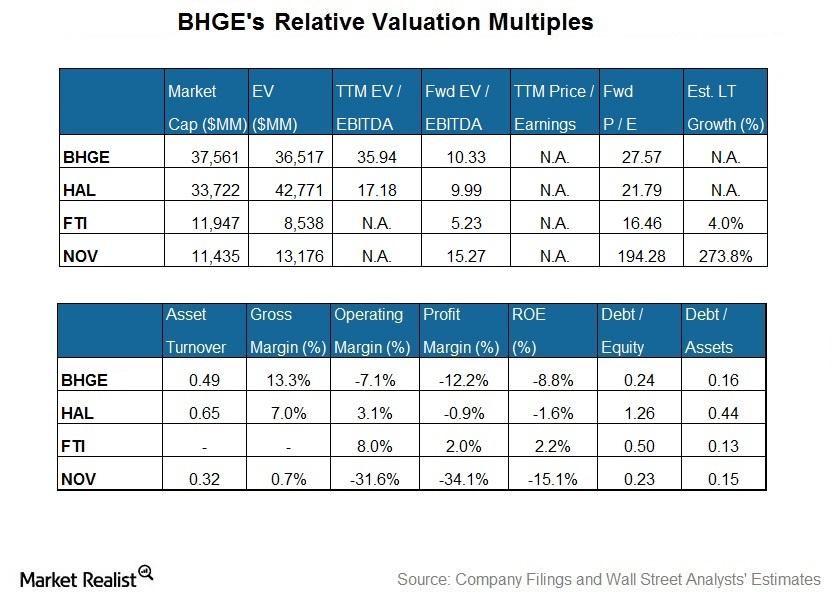

What’s Baker Hughes’s Current Valuation versus Peers?

Baker Hughes, a GE Company (BHGE), is the largest company by market capitalization in our select set of major oilfield services and equipment companies.

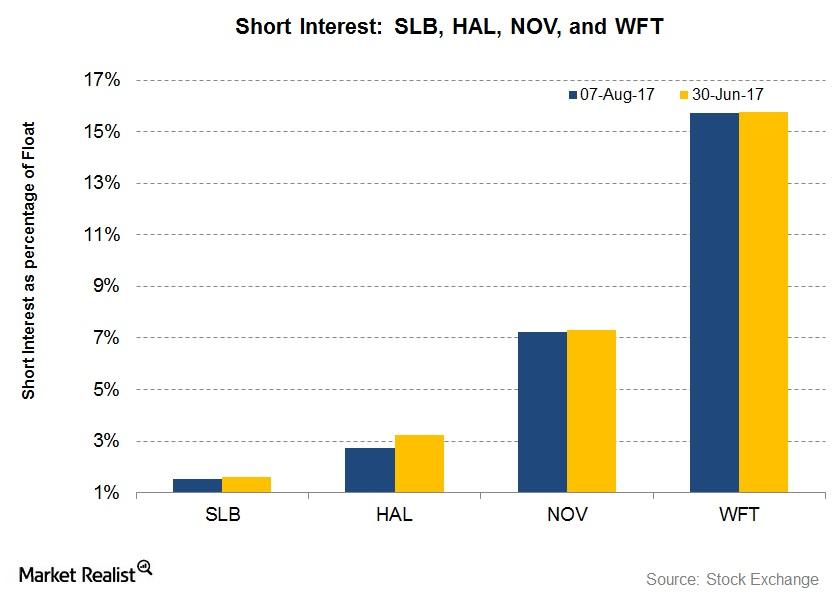

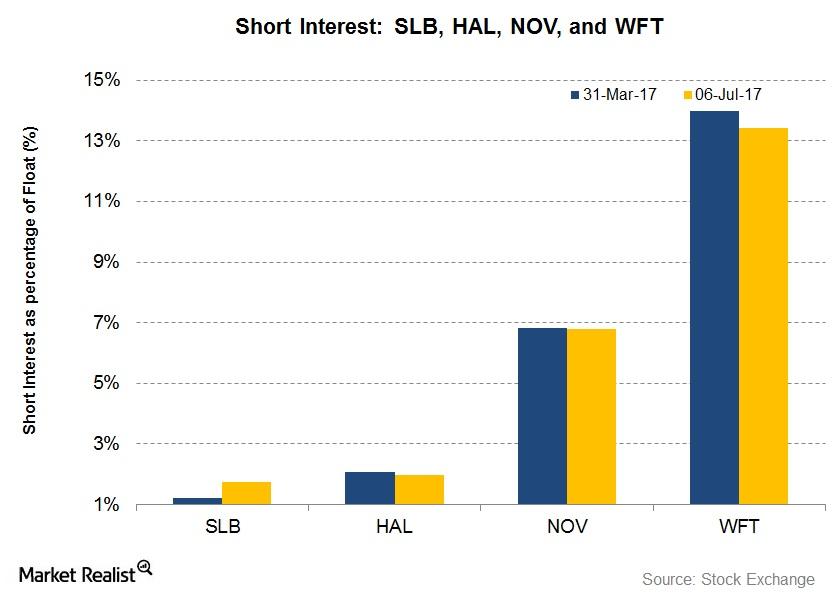

Short Interest in SLB, HAL, WFT, and NOV after 2Q17

The short interest in Schlumberger (SLB), as a percentage of its float, is 1.5% as of August 7, 2017—compared to 1.6% as of June 30, 2017.

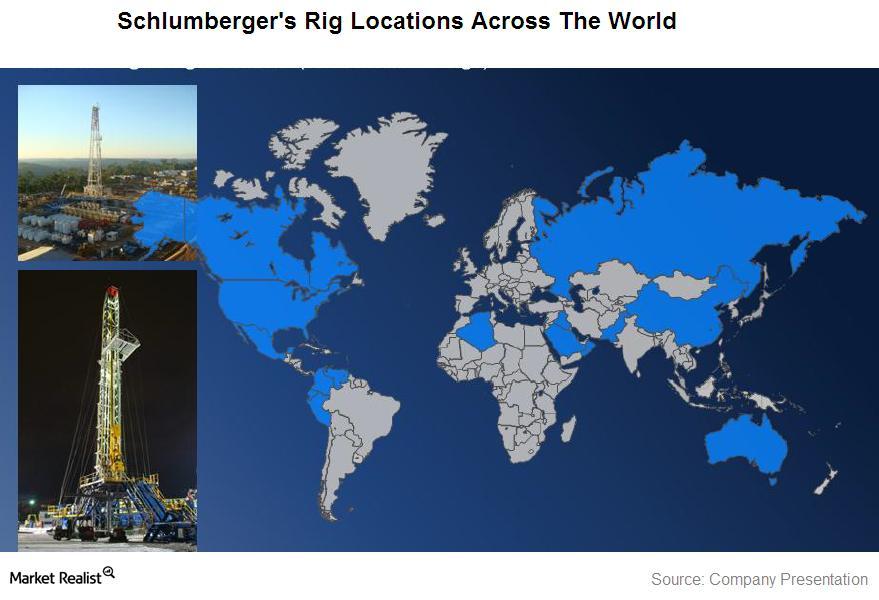

A quick overview of oil and gas field services biz Schlumberger

Schlumberger Limited is a Houston-based energy company. It provides technology, integrated project management, and information solutions to oil and gas exploration and production (or E&P) companies around the world.

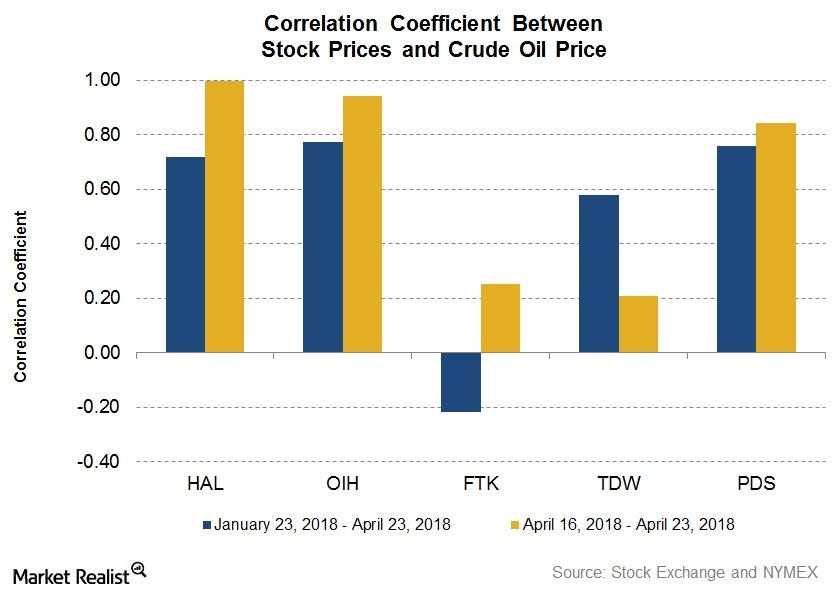

How Halliburton Has Reacted to Crude Oil Prices

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

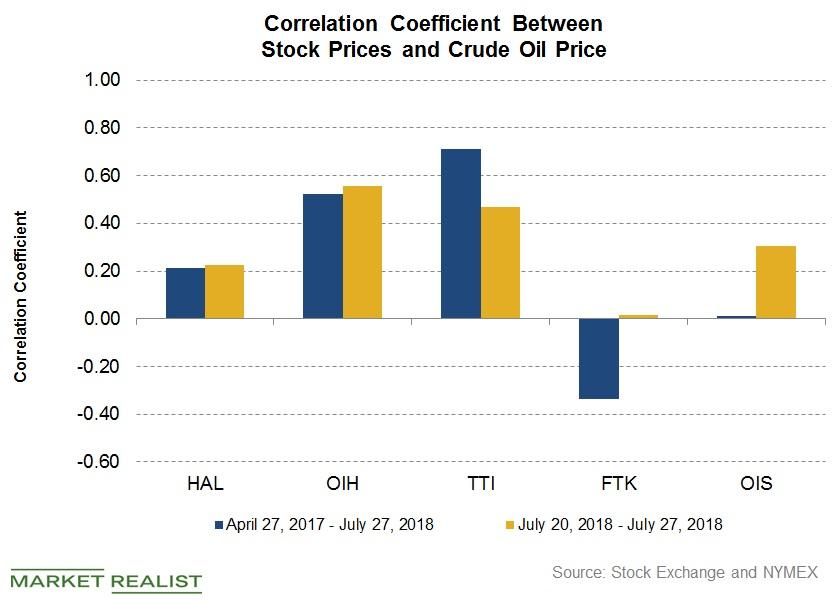

Halliburton Reacts to Changing Crude Oil Prices: Update

Halliburton’s (HAL) stock price correlation with crude oil on July 20–27 was 0.22—a moderately positive correlation.

Schlumberger and Halliburton Compared to the Industry

By market capitalization, Schlumberger is the largest OFS company. Schlumberger’s stock price has declined 4% since May 3, 2017.

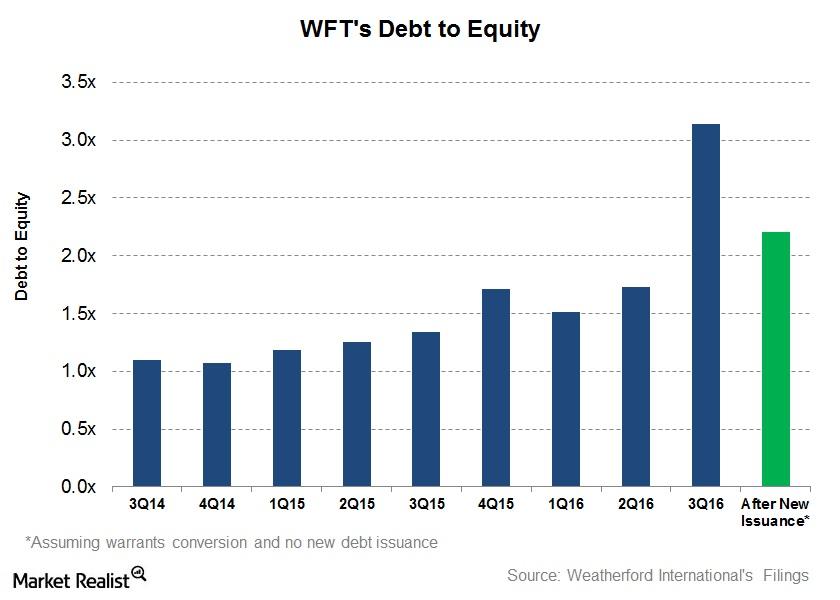

Weatherford International Issues Stocks Again

On November 16, Weatherford International (WFT), an oilfield equipment and services company, disclosed that it issued 84.5 million ordinary stocks.

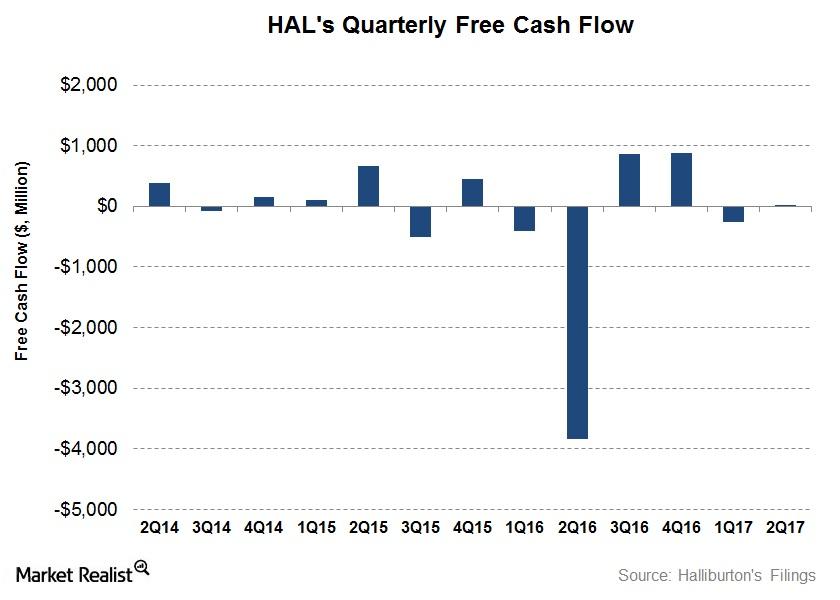

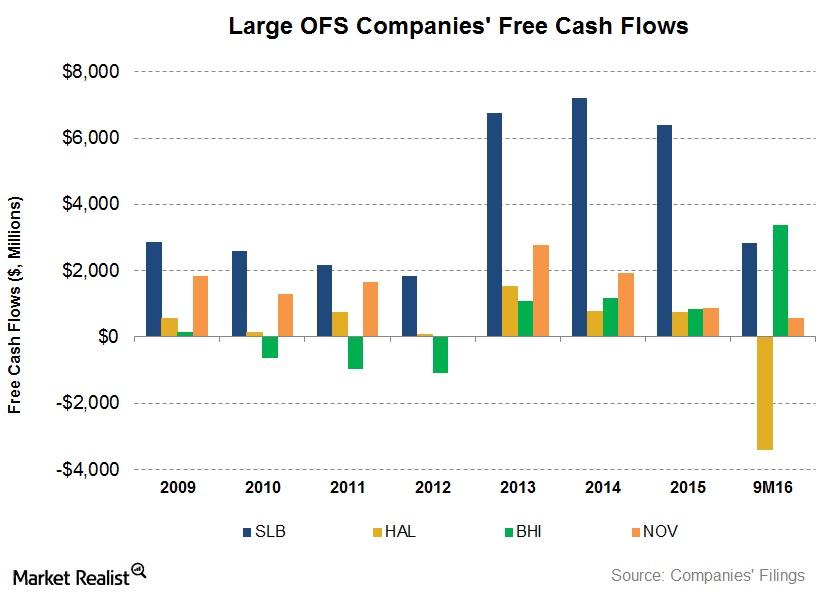

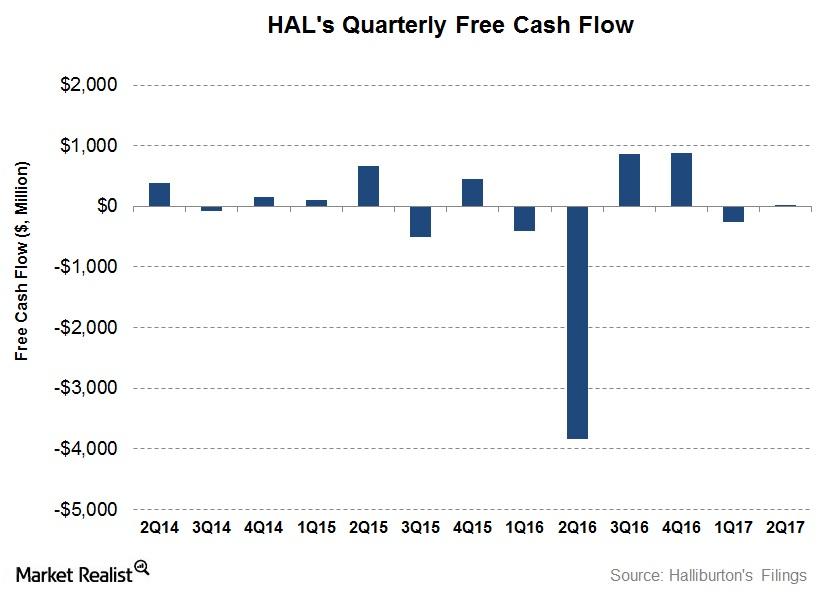

How Halliburton’s Free Cash Flow Turned Around in 2Q17

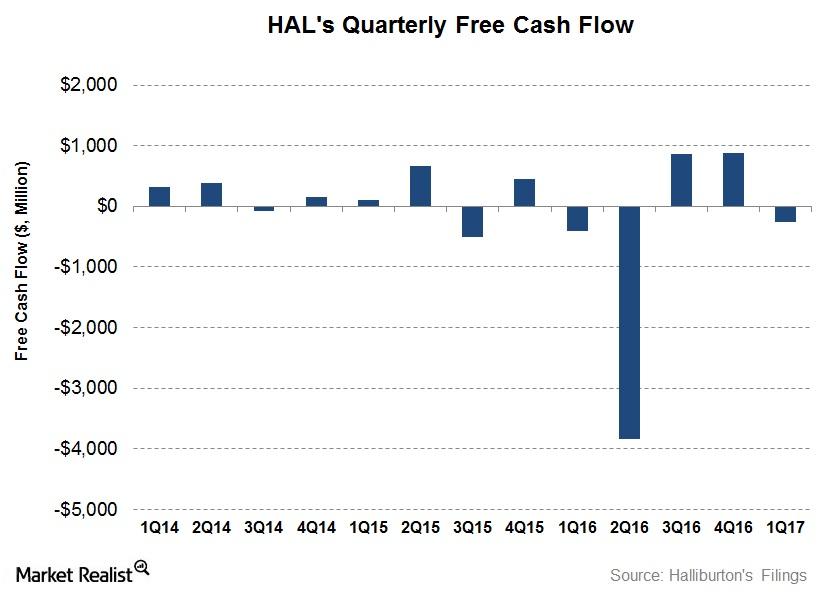

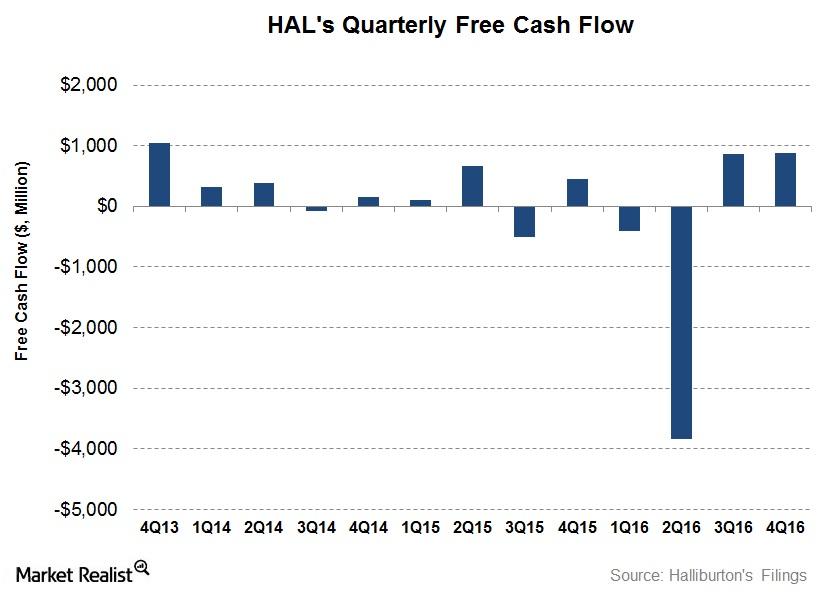

Halliburton’s (HAL) cash from operating activities (or CFO) in 2Q17 was a huge improvement over 2Q16 as well as an increase over 1Q17.

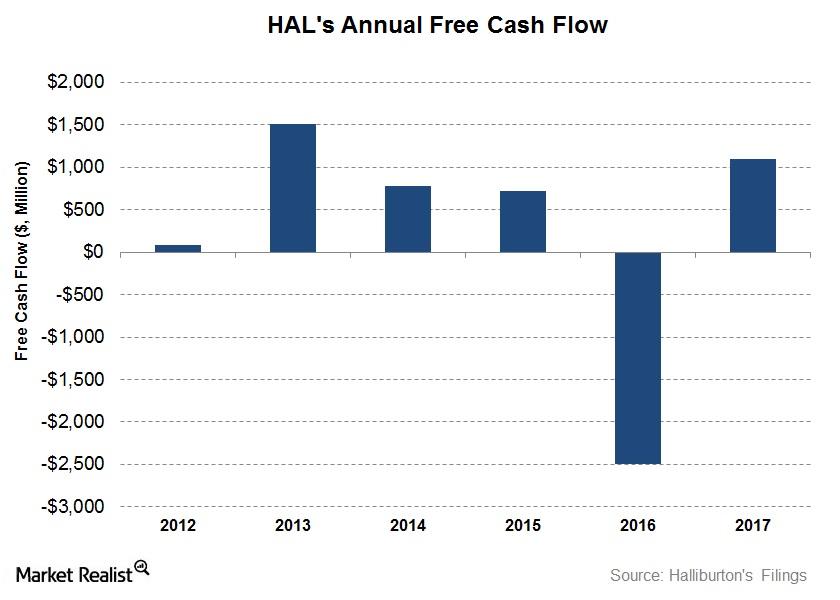

How Did Halliburton Turn Its Free Cash Flow Positive in 2017?

Halliburton’s (HAL) CFO (cash flow from operating activities) in 2017 was a significant improvement over 2016.

What’s the Short Interest in Large OFS Companies on July 6?

Short interest in Schlumberger (SLB) as a percentage of its float is 1.2% as of July 6, 2017, compared to 1.2% as of March 31, 2017.

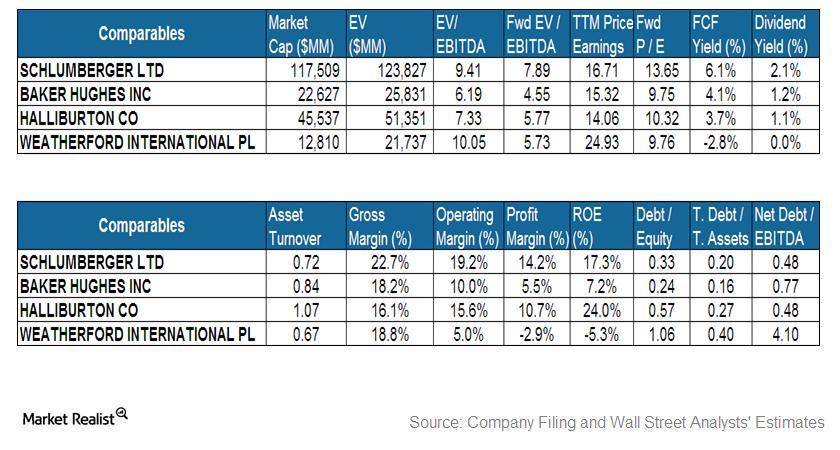

Must-read comparison: Schlumberger and its peers

Schlumberger’s yearly price-to-earnings ratio is in line with the group. Haliburton has the lowest price-to-earnings ratio.

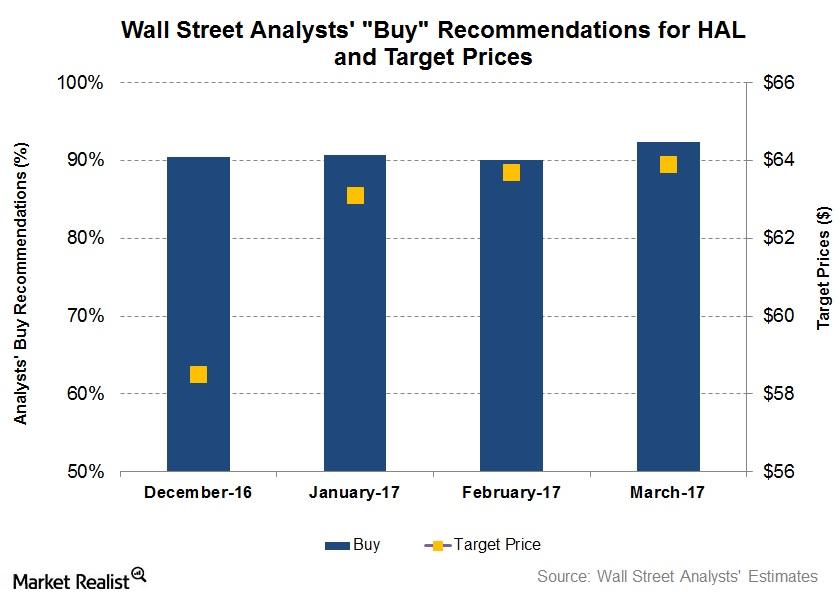

What Do Analysts Recommend for Halliburton?

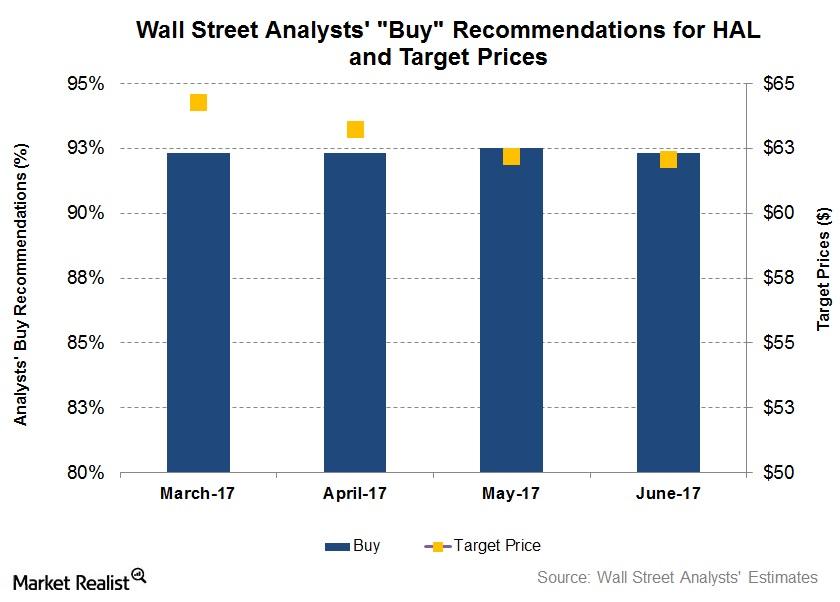

On March 24, 92% of the analysts tracking Halliburton rated it as a “buy,” ~5% rated it as a “hold,” and 3% rated it as a “sell.”

Schlumberger and Cameron International: a Complementary Team

Schlumberger and Cameron are contemplating a merger because their drilling and production systems would be integrated from “pore to pipeline.”

ValueAct Capital discloses activist stake in Baker Hughes

Activist hedge fund ValueAct Capital declared a 5.1% stake in Baker Hughes in its 13D filing on January 15, 2015.

Free Cash Flow Trends: Are OFS Companies Burning Cash?

Many oilfield equipment and services (or OFS) companies’ cash flows have taken a beating following the energy price weakness in the past two years.

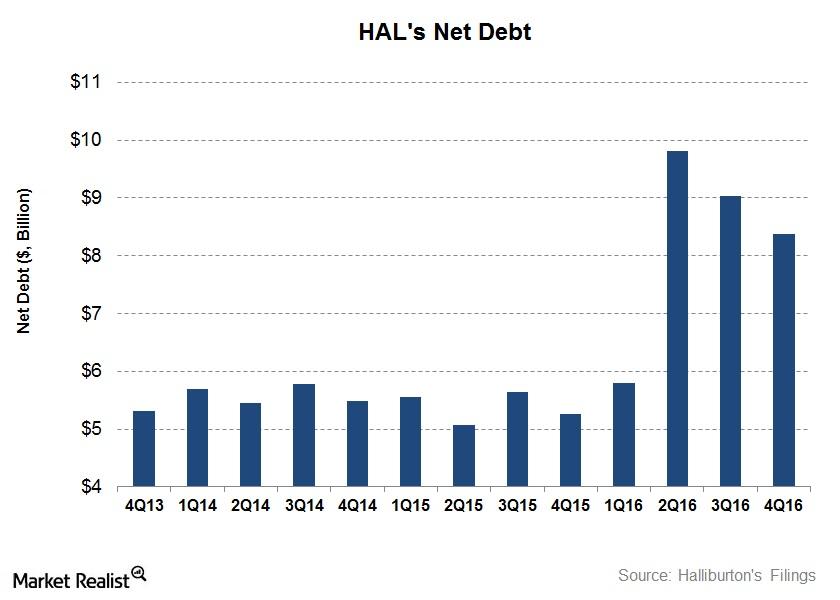

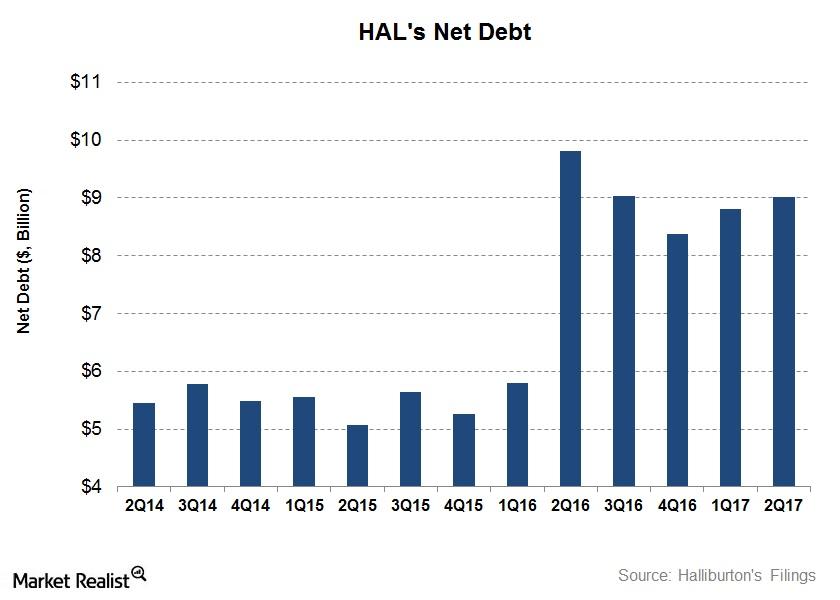

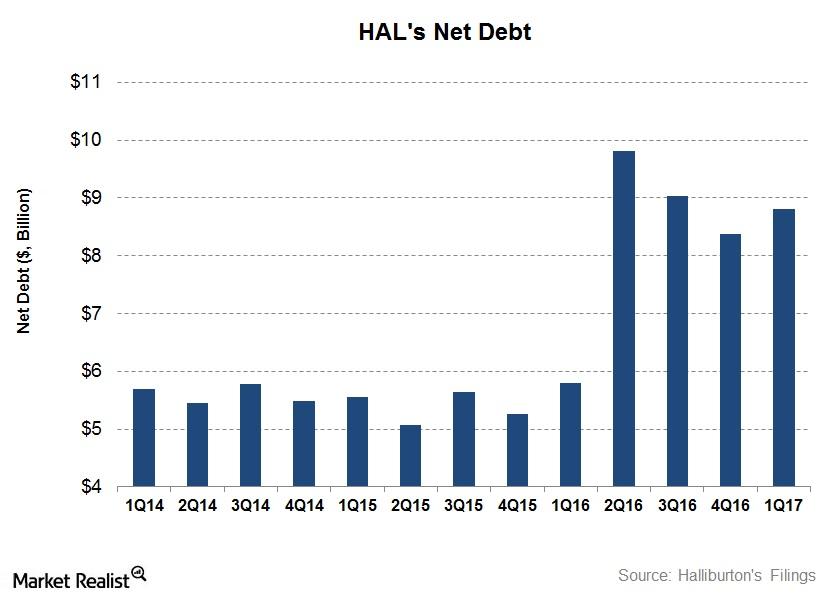

A Look at What’s Happening to Halliburton’s Debt

In 4Q16, Halliburton’s total debt fell 19% compared to a year earlier, and its cash and marketable securities fell 60%. In effect, its net debt rose 59% to ~$8.4 billion as of December 30, 2016.

The US Energy Sector: An Overview

To understand the US energy sector, it’s essential first to understand the country’s energy needs. The US uses various energy sources to meet its energy needs.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

How US Production Is Affecting WTI Crude Oil Prices

Between February 11, 2016, and July 15, 2019, WTI crude oil prices rose 127.3%. The United States Oil Fund LP (USO) gained 53.9% in the period.

Why Is Halliburton’s Valuation Attractive?

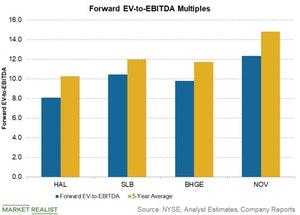

Halliburton (HAL) is trading at a forward EV-to-EBITDA multiple of ~8.1x, which is lower than its five-year average multiple of 10.2x.

SLB, HAL, BHGE, and NOV: Analyzing the Revenue Trends

Halliburton (HAL) and National Oilwell Varco (NOV) recorded 16% revenue growth in 2018—compared to 2017.

Why Weatherford’s 1Q18 Earnings Beat Estimates

Weatherford International released its 1Q18 earnings results today.

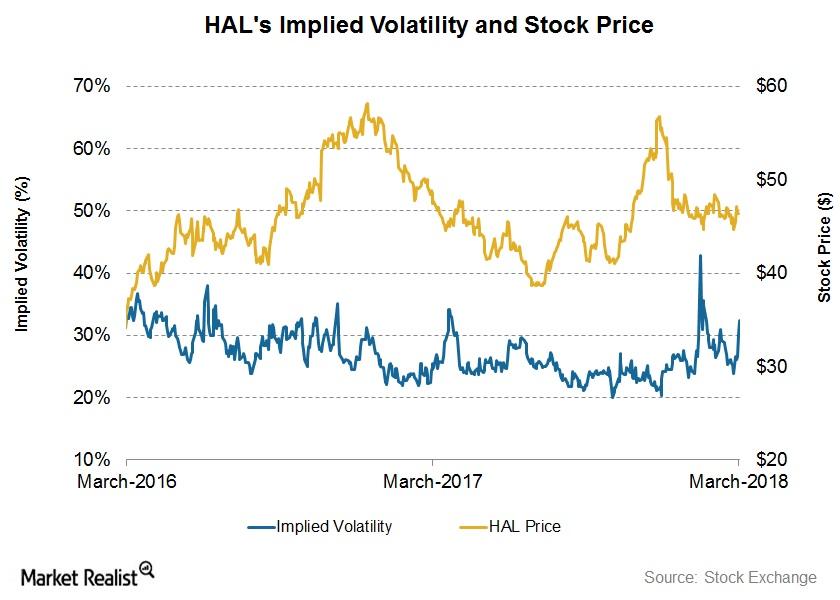

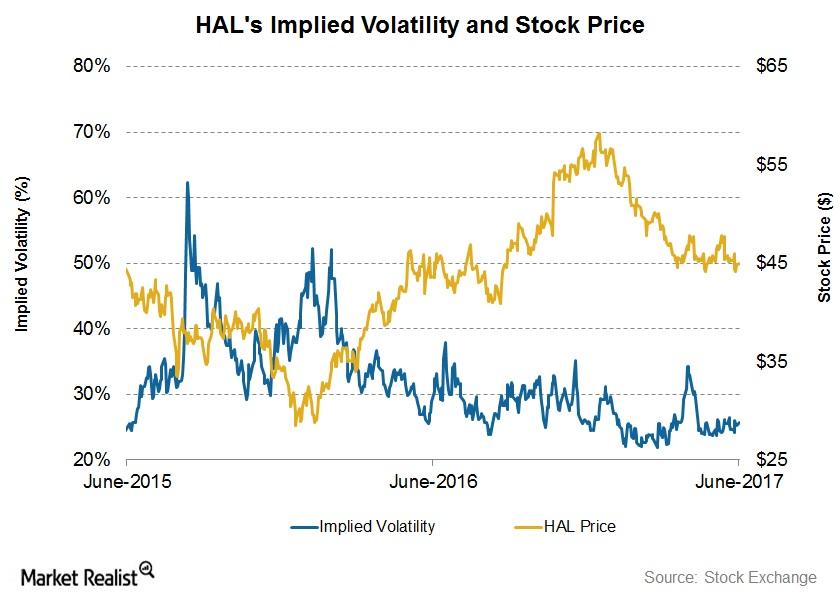

Halliburton’s Next 7-Day Stock Price Forecast

Halliburton stock will likely close between $48.52 and $44.36 in the next seven days—based on its implied volatility.

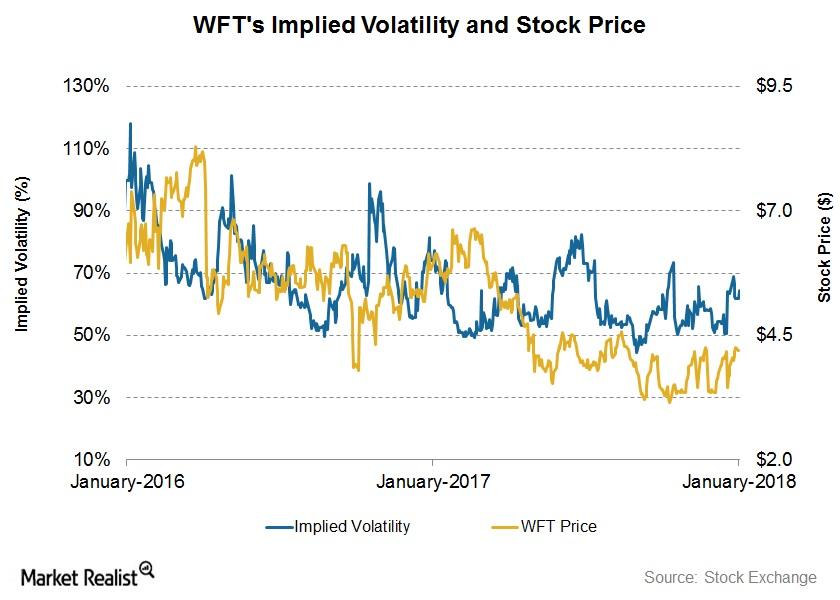

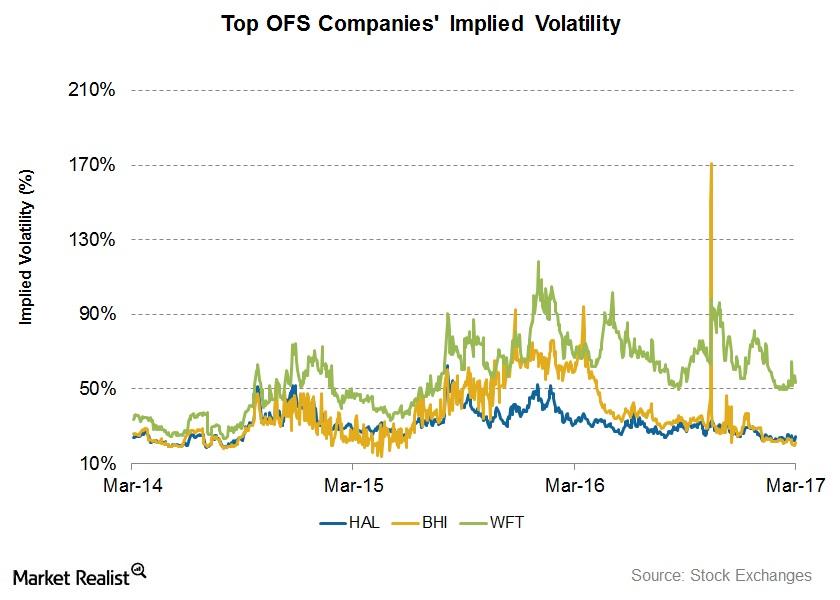

Weatherford’s Stock Price Forecast

On January 16, Weatherford International’s (WFT) implied volatility (or IV) was ~64%. Its 3Q17 earnings were announced on November 1, 2017. Since then, its implied volatility has increased from 54% to the current level.

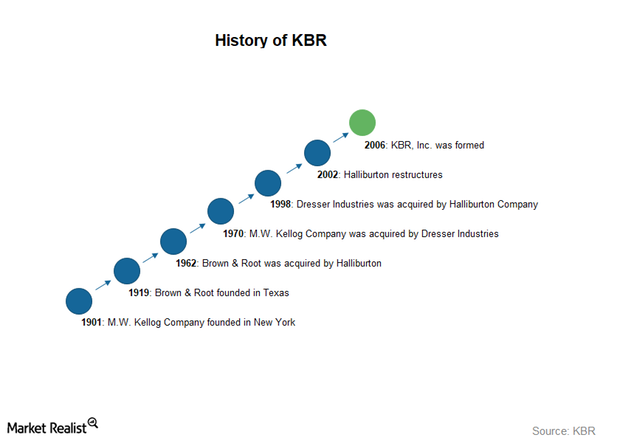

An Introduction to KBR

KBR (KBR), headquartered in Houston, Texas, is a comprehensive professional service and technology provider.

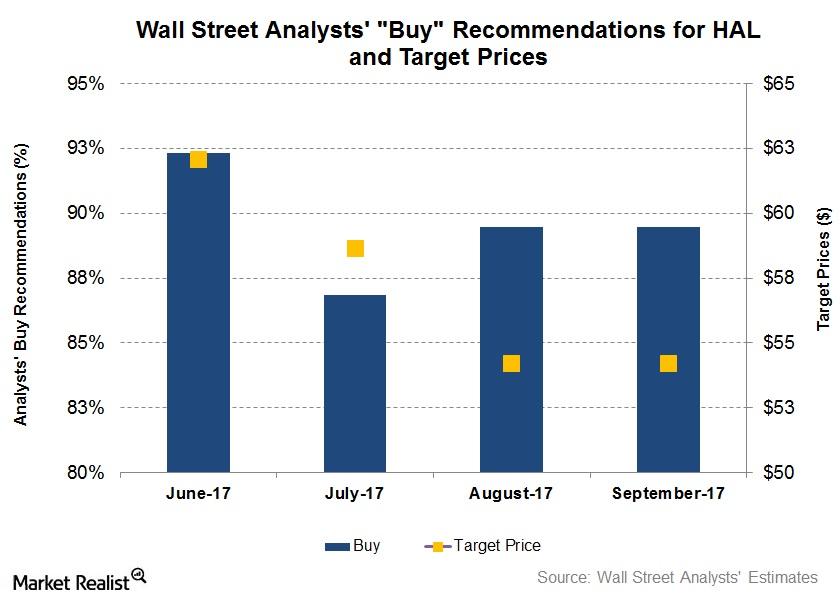

What Wall Street Analysts Are Recommending for Halliburton

On September 5, 2017, 89.0% of Wall Street analysts who are tracking Halliburton stock rated it a “buy” or some equivalent.

Behind Halliburton’s Free Cash Flow, Capex, and Acquisition Strategies

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17.

Understanding Halliburton’s Net Debt after 2Q17

In 2Q17, Halliburton’s (HAL) total debt fell 14% from 2Q16, while its cash and marketable securities fell 31%.

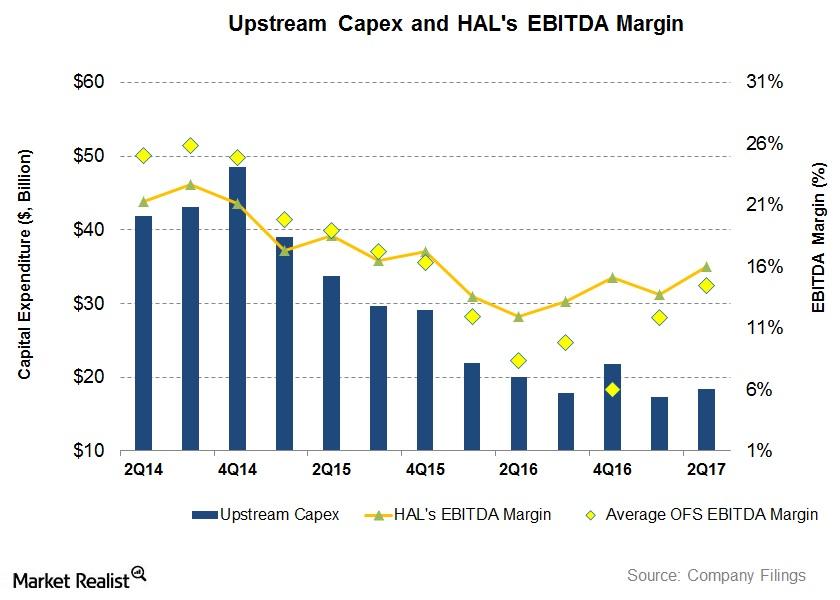

What Halliburton’s Margin Has to Do with Upstream Operators’ Capex

From 2Q16 to 2Q17, Halliburton’s (HAL) EBITDA margin (or EBITDA as a percentage of revenues) rose from 12% to 16%.

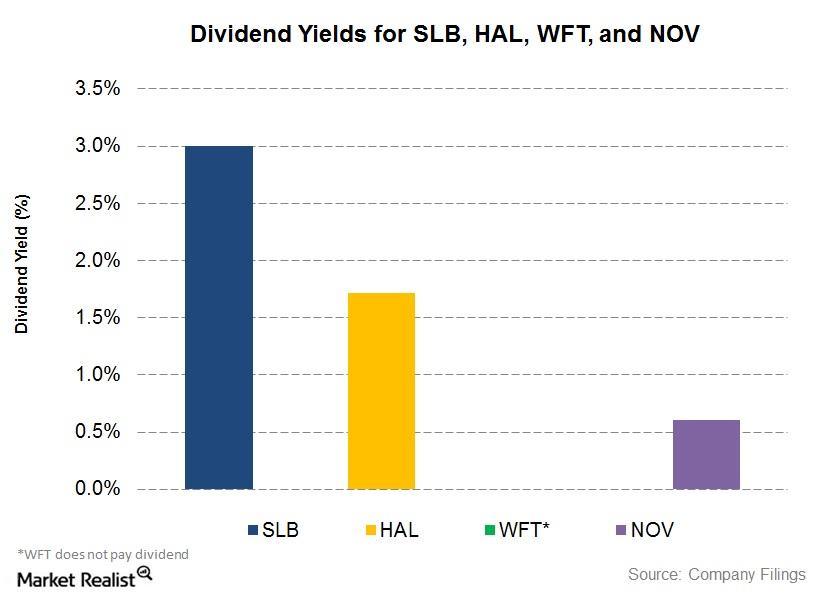

Dividend Yield in 2Q17: Comparing SLB, HAL, and NOV

Schlumberger’s (SLB) quarterly dividend per share remained unchanged from 2Q16 to 2Q17. In 2Q17, Schlumberger’s quarterly DPS is $0.50.

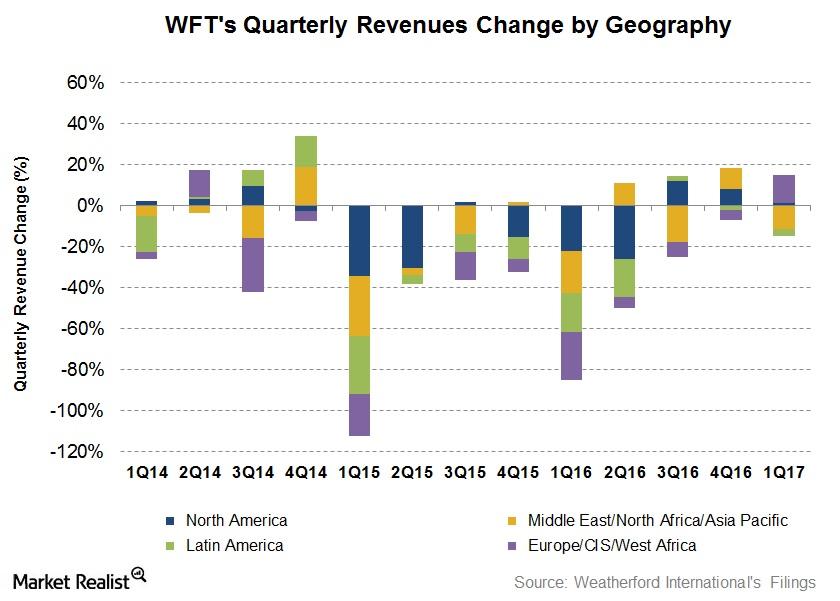

What Are Weatherford International’s Growth Drivers in 1Q17?

In 1Q17, Weatherford International’s net loss was $443 million.

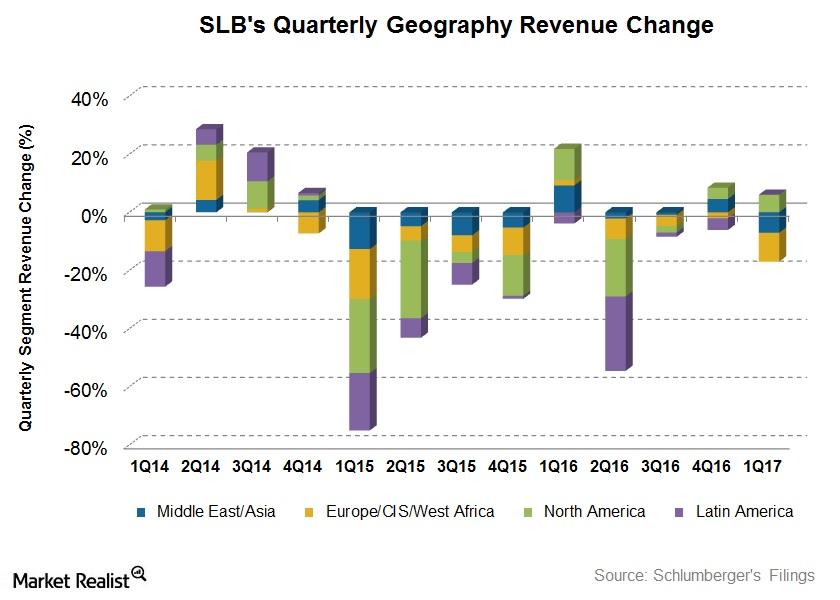

What Drove Schlumberger in 1Q17

Schlumberger’s 1Q17 revenue by geography From 4Q16 to 1Q17, Schlumberger (SLB) witnessed 6% revenue growth in North America, while it saw a steep revenue decline of ~10% in the Europe/CIS[1.Commonwealth of Independent States]/West Africa region. Schlumberger’s revenue from Latin America was resilient in 1Q17, remaining unchanged from 4Q16. Schlumberger accounts for 6.5% of the ProShares […]

Analysts’ Recommendations for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy,” ~3% of the analysts rated it as a “sell,” and the other 5% rated it as a “hold.”

What Investors Can Expect from Halliburton

On June 13, Halliburton’s implied volatility was 24.1%. Since its 1Q17 financial results were announced on April 24, its implied volatility has fallen.

Analyzing Halliburton’s Free Cash Flow and Capex Plans

Halliburton’s cash from operating activities (or CFO) in 1Q17 was an improvement over 1Q16, although it was a steep deterioration compared to 4Q16.

What’s Happening to Halliburton’s Net Debt?

In 1Q17, Halliburton’s (HAL) total debt fell 29% compared to a year earlier, while its cash and marketable securities fell 78%.

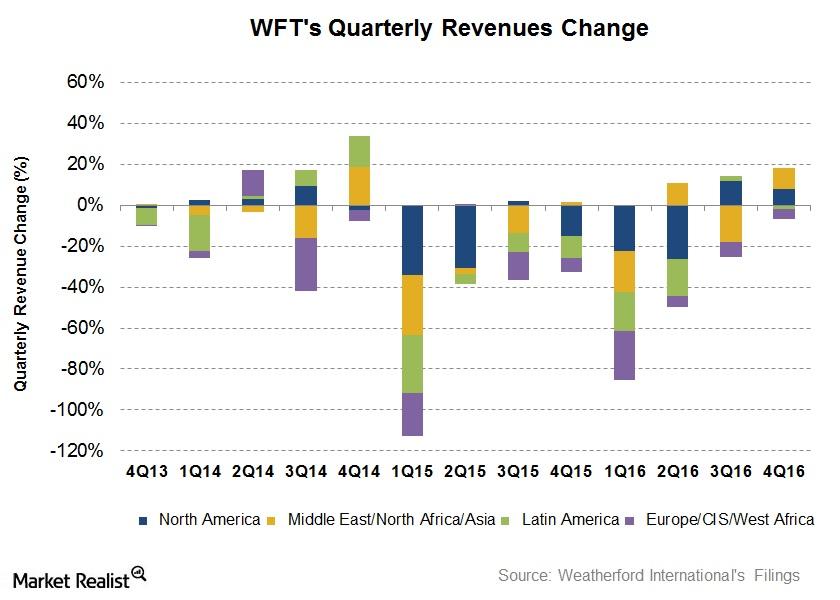

Analyzing Weatherford International’s Growth Drivers in 4Q16

Revenues from Weatherford International’s (WFT) Europe/Sub Saharan Africa/Russia region fell the most with a 36.5% fall from 4Q15 to 4Q16.

How Volatile Are the Top Oilfield Services Companies?

In this part of the series, we’ll compare the implied volatilities of the top OFS companies as rated by Wall Street analysts for 1Q17.

Analyzing Halliburton’s Free Cash Flow and Capex Plan

In this article, we’ll analyze how Halliburton’s (HAL) operating cash flows have trended over the past few quarters. We’ll also discuss its free cash flow (or FCF).

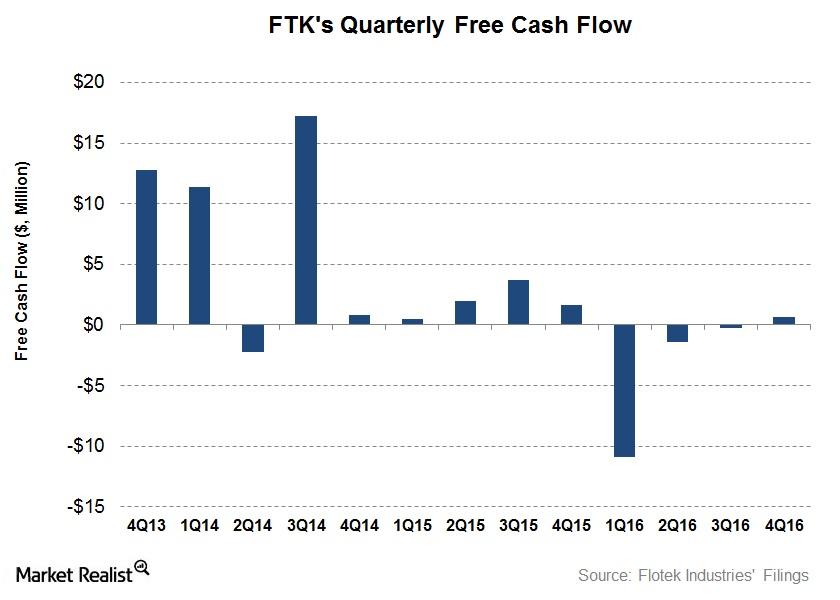

Flotek Industries’ Capex: Impact of a Credit Facility Agreement

In this article, we’ll analyze how Flotek Industries’ (FTK) operating cash flows trended over the past few quarters.

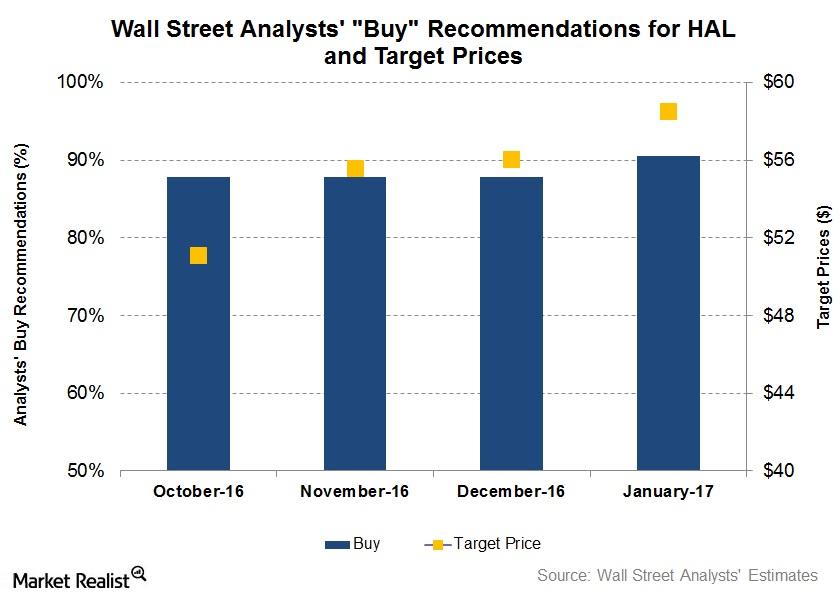

Wall Street’s Forecasts for Halliburton before Its 4Q16 Earnings

On January 3, 2017, 90% of the analysts tracking Halliburton (HAL) rated it a “buy” or some equivalent.