Halliburton Co

Latest Halliburton Co News and Updates

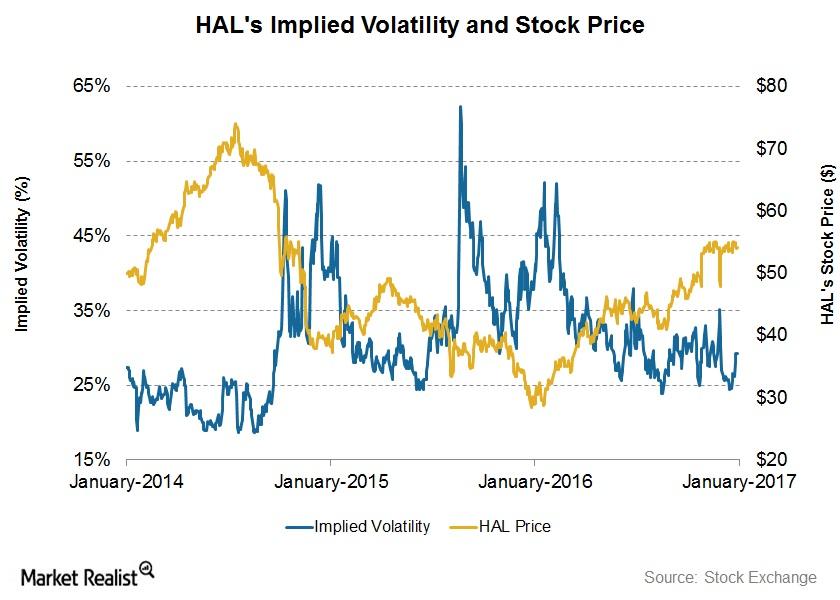

What Does Halliburton’s Implied Volatility Indicate?

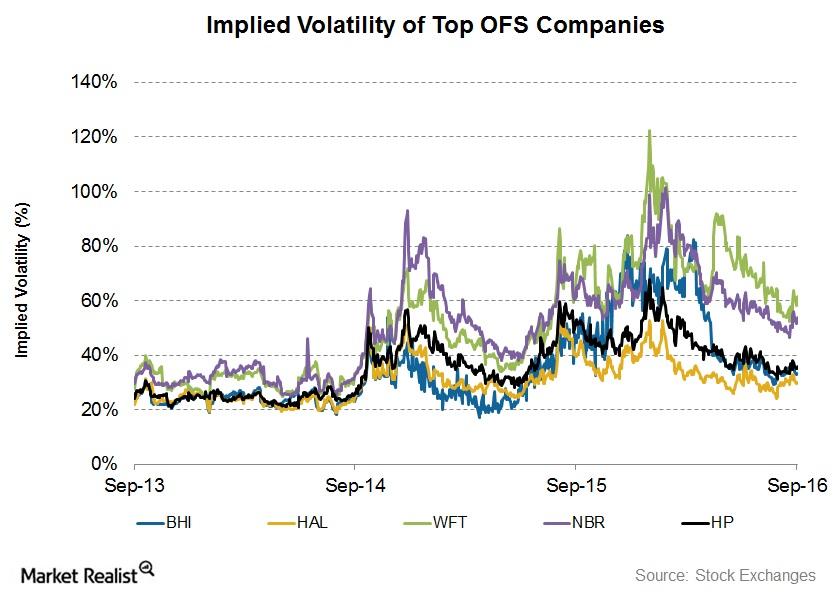

On January 3, 2017, Halliburton (HAL) had implied volatility of ~29%. Since HAL’s 3Q16 financial results were announced on October 19, 2016, its implied volatility has remained nearly unchanged.

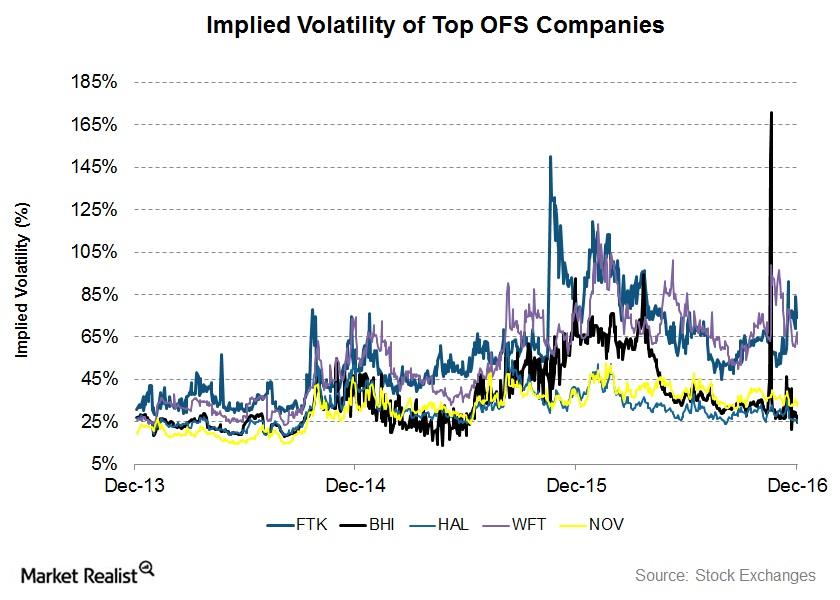

Top Oilfield Service Stocks: Analyzing Implied Volatility

In this article, we’ll compare implied volatility fr the top oilfield services (or OFS) companies, as rated by Wall Street analysts, for 4Q16.

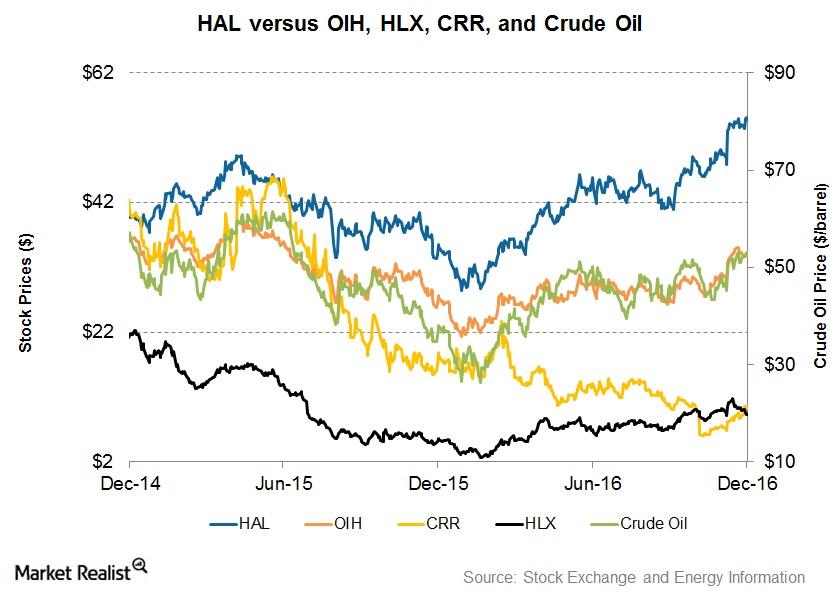

Analyzing Halliburton’s Stock Price Returns

From December 2014 to December 2016, Halliburton’s (HAL) stock price reached the highest level in December 2016. It troughed at ~$28 in January 2016.

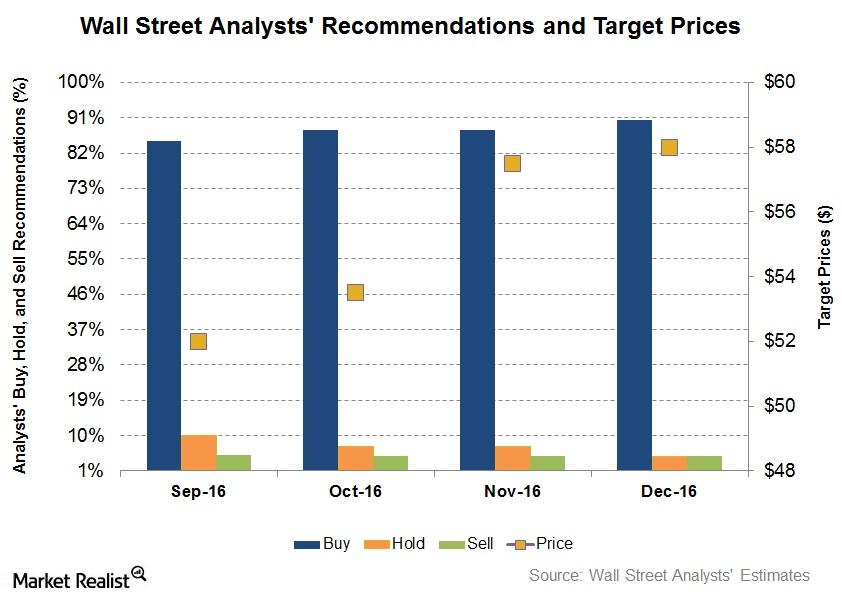

Are Analysts Changing Recommendations for Halliburton?

In December so far, 90% of the analysts tracking Halliburton rated it a “buy” or some equivalent.

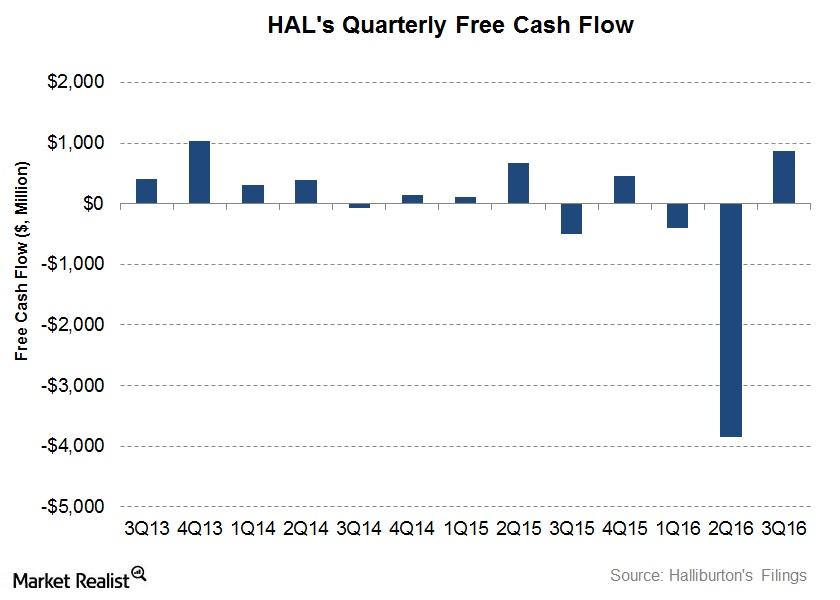

Why Did Halliburton’s Free Cash Flow Improve?

Halliburton’s cash from operating activities (or CFO) turned positive in 3Q16.

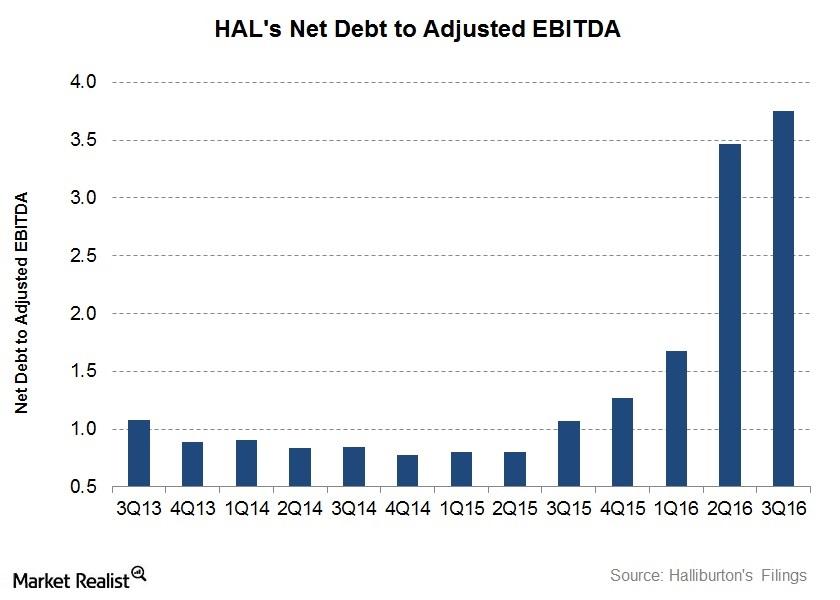

Is Halliburton’s Indebtedness on the Rise?

In 3Q16, Halliburton’s net-debt-to-adjusted-EBITDA multiple was ~3.8x, or 251% higher than it was a year ago.

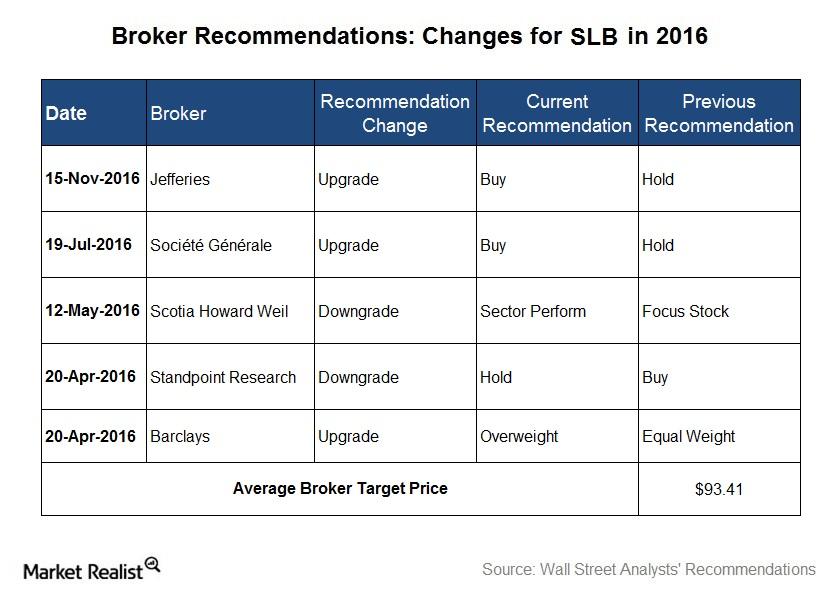

Wall Street Analysts’ Recommendations for Schlumberger

In November, 83% of the analysts tracking Schlumberger rated it a “buy” or some equivalent. The other 18% of the analysts recommended a “hold” or a “sell.”

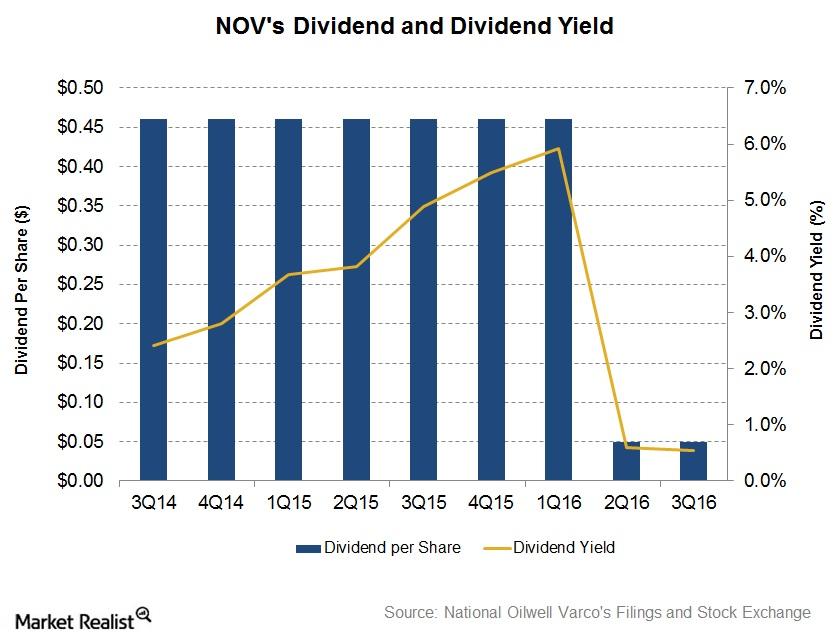

Analyzing National Oilwell Varco’s Dividend

On August 18, National Oilwell Varco (NOV) approved to pay a quarterly dividend of $0.05 per share to shareholders on September 30.

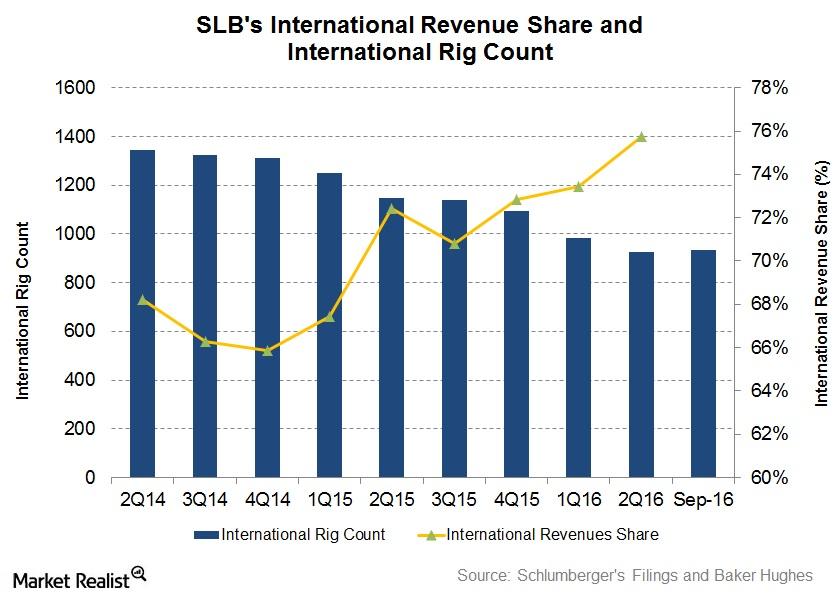

How Important Are International Rig Counts to Schlumberger?

SLB’s international revenues rose to 76% of its total revenues in 2Q16, as compared to 72% in 2Q15.

Implied Volatility: Analyzing the Top Oilfield Service Companies

On September 22, Halliburton’s implied volatility was ~28.5%. Since July 20, 2016, its implied volatility rose from ~27% to the current level.

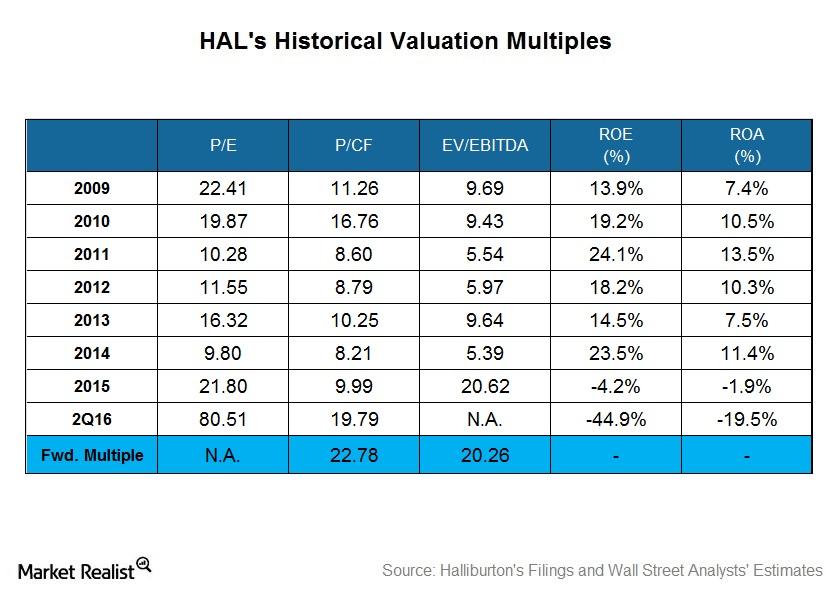

Explaining Halliburton’s Historical Valuation

A steeper earnings decline compared to the decline in its share price caused Halliburton’s (HAL) PE multiple to expand in 2015.

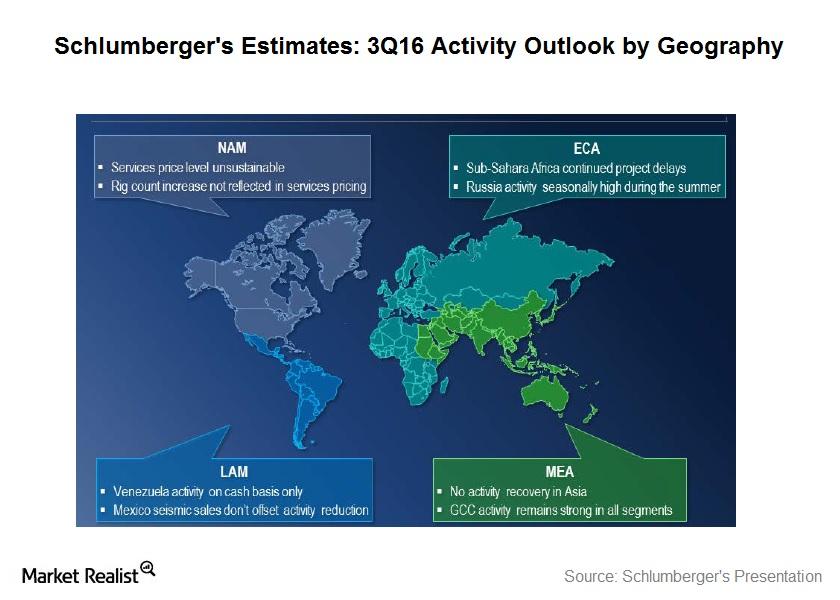

Which Geography Is Working the Best for Schlumberger?

Schlumberger’s business model is diversified and not overly dependent on any particular line of business, catering to upstream companies’ needs.

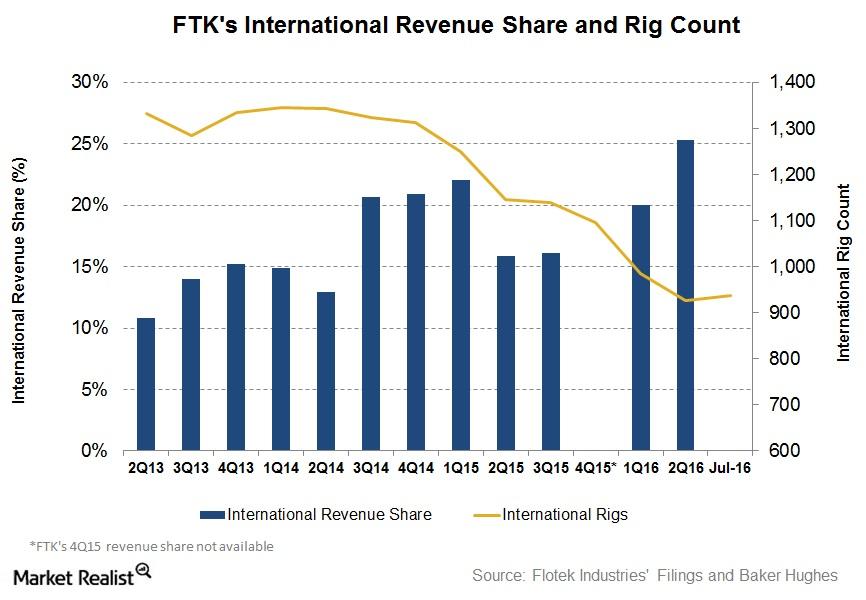

Does the Rig Count Affect Flotek Industries’ International Revenue?

In the past year, Flotek Industries’ (FTK) revenue share generated outside the United States has risen by nearly 10%.

Why Is Schlumberger’s Free Cash Flow So Remarkable?

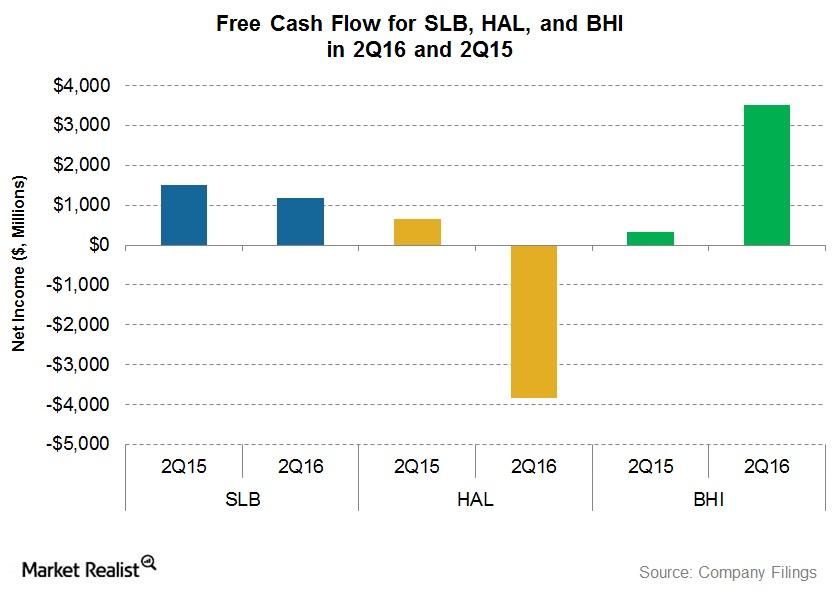

In this part of the series, we’ll take a look at free cash flow for Schlumberger (SLB), Halliburton (HAL), Baker Hughes (BHI), and FMC Technologies (FTI).

Wall Street’s Forecasts for Halliburton after 2Q16 Earnings

Approximately 82% of analysts tracking Halliburton rate it a “buy” or some equivalent. About 16% rate it a “hold” or equivalent, and 2% recommend a “sell.”

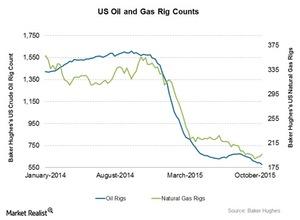

How the Late October Oil Rig Count Dip Hurt the Total US Rig Count

By October 30, 2015, the total US rig count fell by 16 crude oil rigs. The number of crude oil rigs has continued to fall in the past nine weeks.

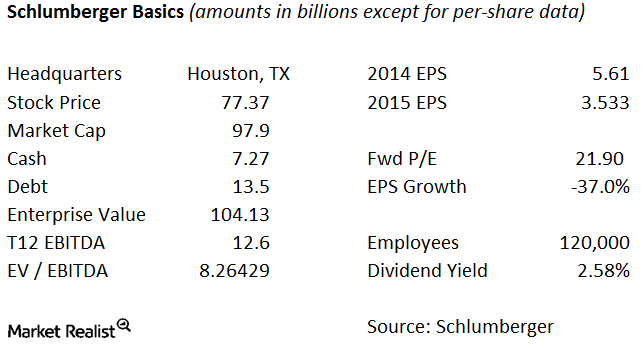

Basics of Schlumberger

Schlumberger (SLB) provides technology, project management, and information technology services to the oil and natural gas exploration and production industry.

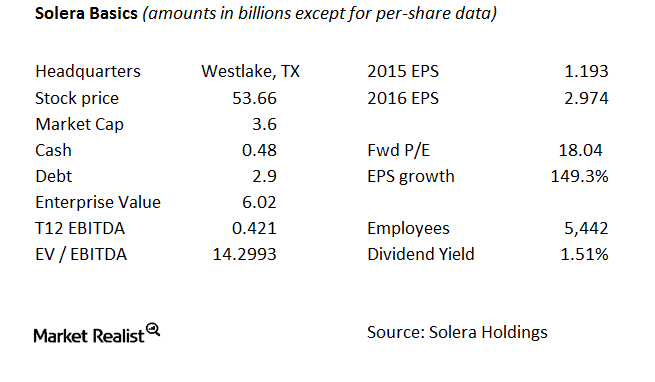

The Basics of Solera

Solera connects insurers and auto service providers. Its software is used by auto insurance companies, auto dealers, collision repair facilities, assessors, auto recyclers, and various other entities.

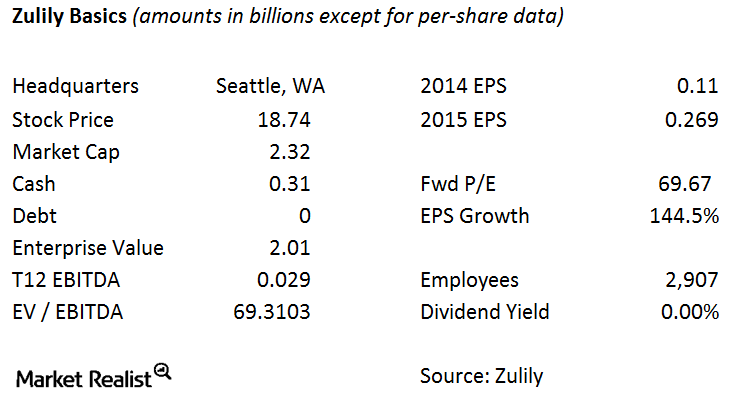

Basics of Zulily

With relationships with emerging and boutique designers, online retailer Zulily uses proprietary technology to match its customers with vendors. This technology is a major reason why Liberty Interactive is buying Zulily.

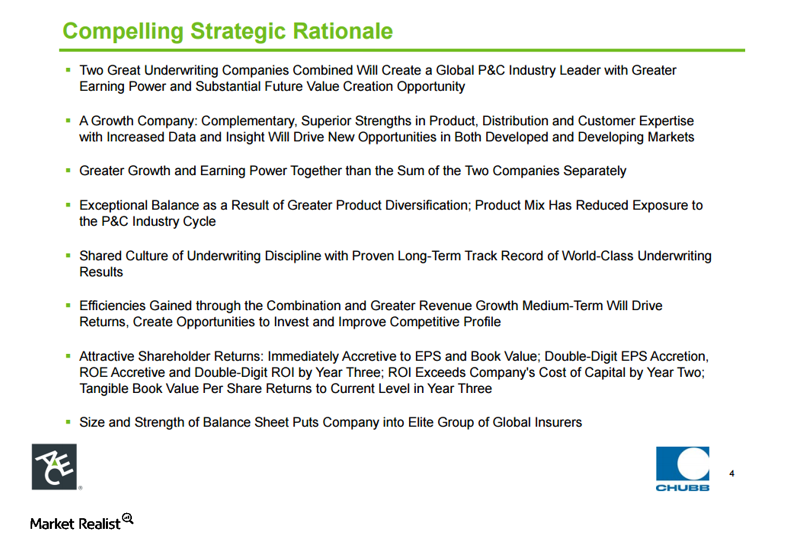

What Is the Rationale for the ACE–Chubb Merger?

The biggest rationale for the ACE–Chubb merger is the potential for cost-cutting. By combining with Chubb, ACE Limited is creating a leading player in property and casualty insurance.

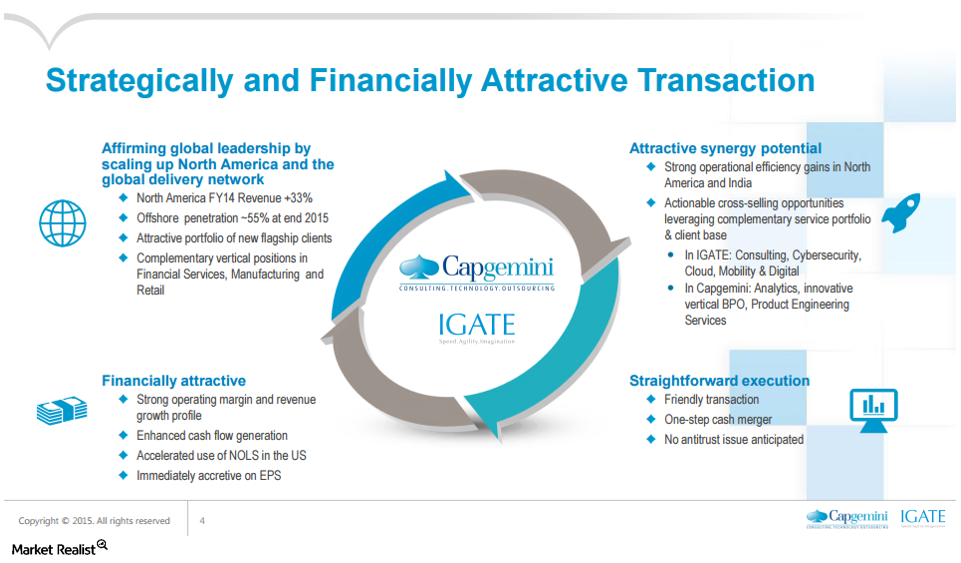

Rationale for Capgemini’s Acquisition of IGATE

The acquisition bolsters Capgemini’s exposure in the financial verticals—where IGATE is particularly strong—as well as manufacturing, retail, and healthcare.

Must-know: An overview of Halliburton

Halliburton (HAL) is a Texas-based energy company. It’s an oil and gas equipment and service provider. In the past year, Halliburton’s stock price went down ~22%.Consumer BP lost 55% shareholder value after the Deepwater Horizon incident

Deepwater Horizon was a deepwater, offshore oil drilling rig owned by Transocean (RIG) and operated by BP Plc. (BP). On April 20, 2010, while drilling at the Macondo Prospect, there was an explosion on the rig caused by a blowout that killed 11 crew members.