Dunkin Brands Group Inc

Latest Dunkin Brands Group Inc News and Updates

Dunkin' Has a New Rewards Program — and Customers Aren't Happy With the Changes

Dunkin' Rewards is the overhauled loyalty program for Dunkin' Brands. Though it gives more points per dollar spent, customers aren't happy with getting less for their points.

Dunkin’s Frozen Coffee Isn’t Gone For Good, It’s Just in Short Supply

Several Reddit users have been complaining over a lack frozen coffee at their local Dunkin' while others say the product has been removed from their app.

Opportunities and risks that Dunkin’ Brands investors must know

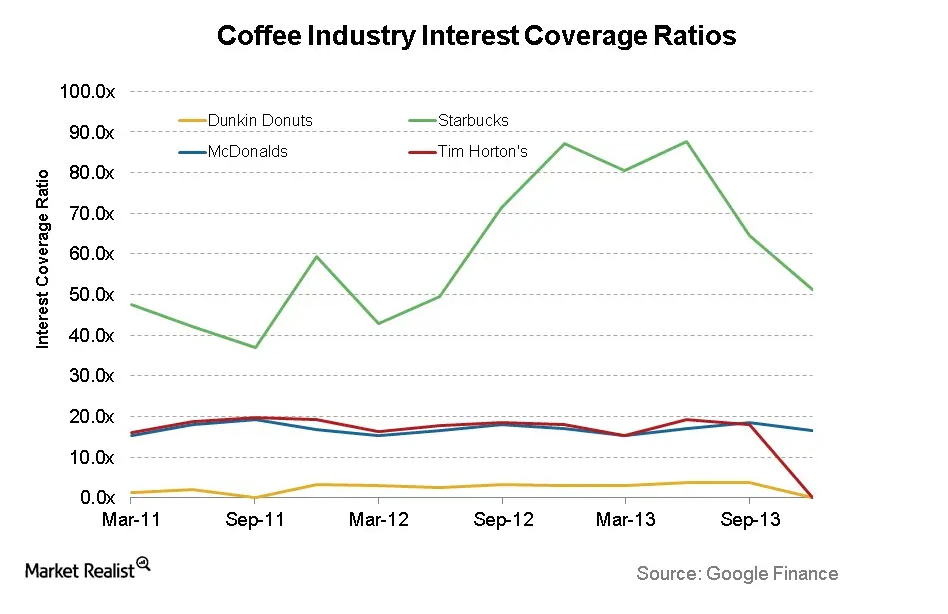

It’s no big secret that Dunkin’ Donuts has the highest relative leverage in the industry. Leverage comes with a number of risks— a substantial risk is the interest paid on debt.

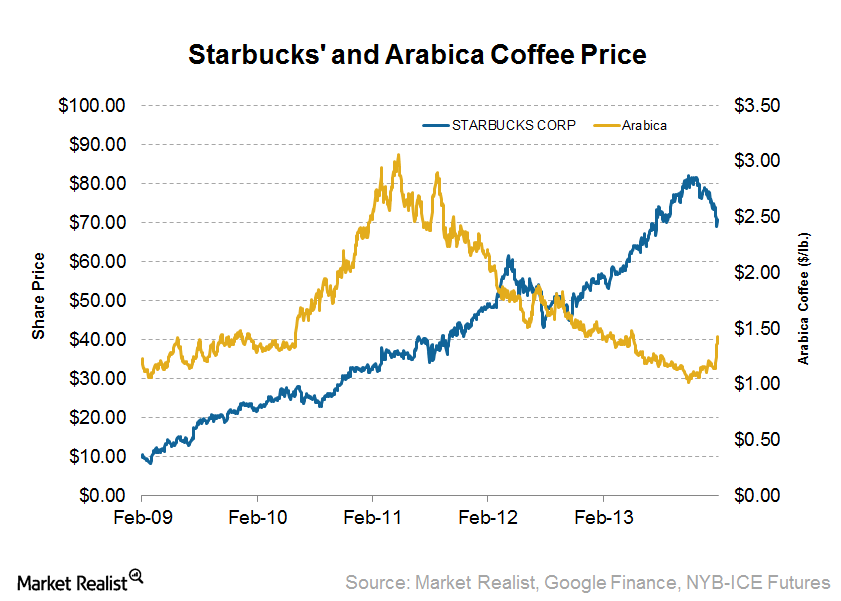

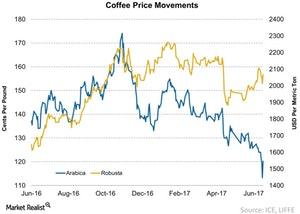

Understanding Starbucks’ cost structure and operating expenses

Starbucks’ main cost driver is its price per pound of coffee beans. The two most consumed coffee beans are Arabica and Robusta blends.

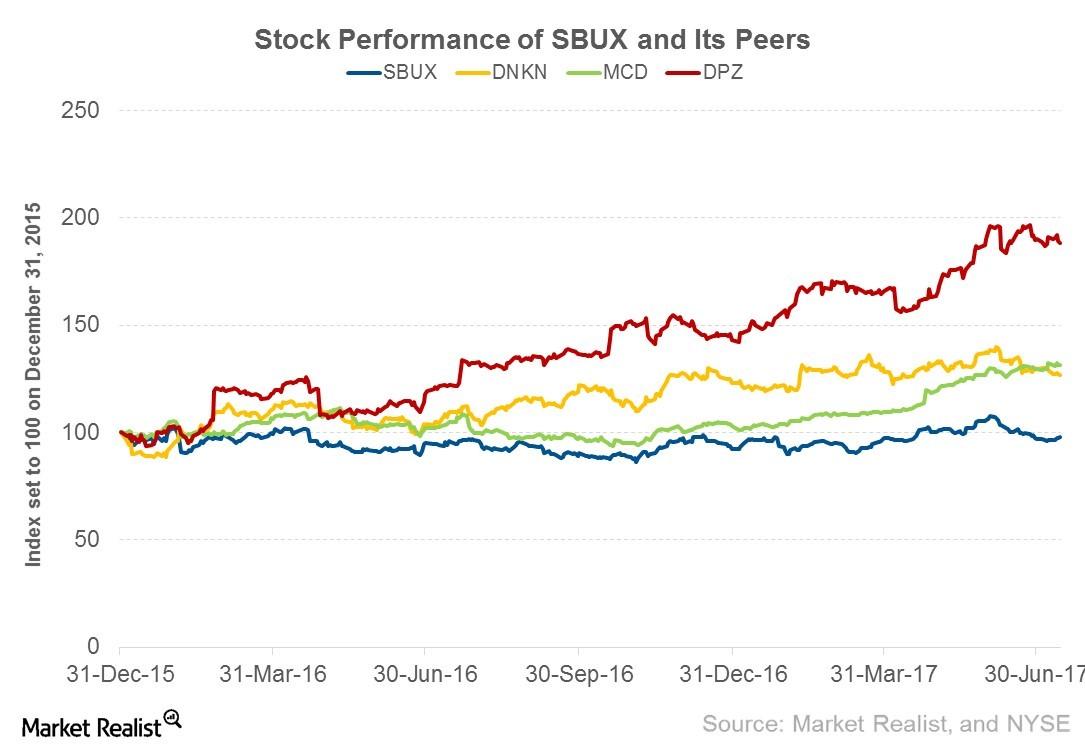

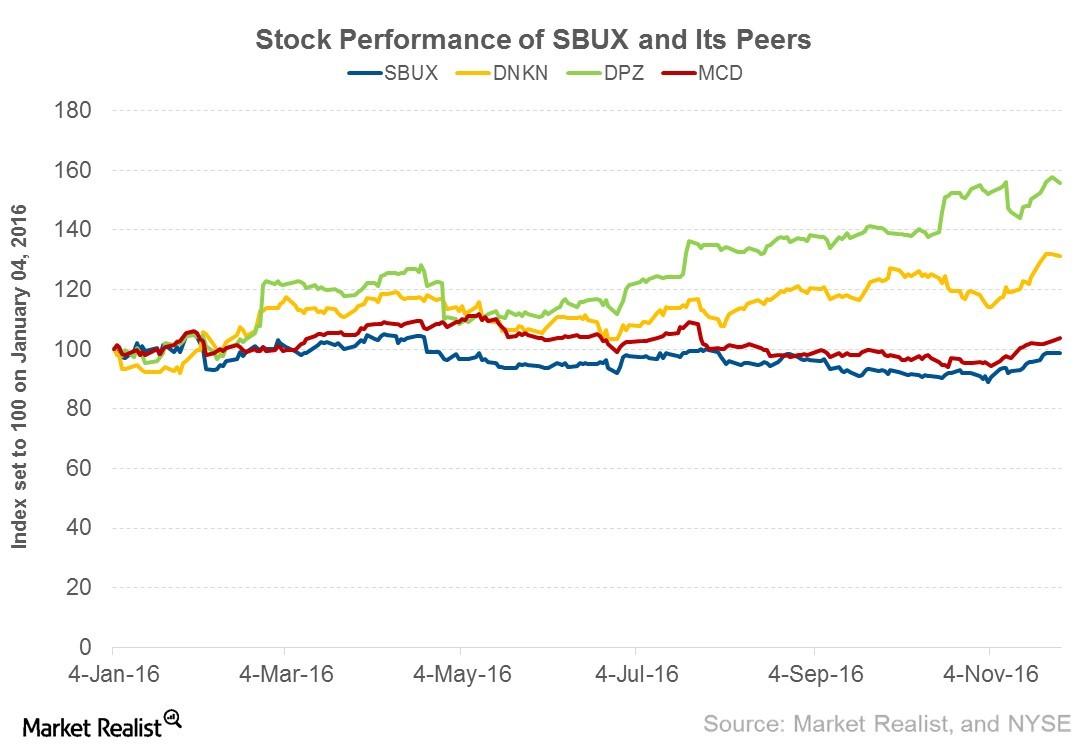

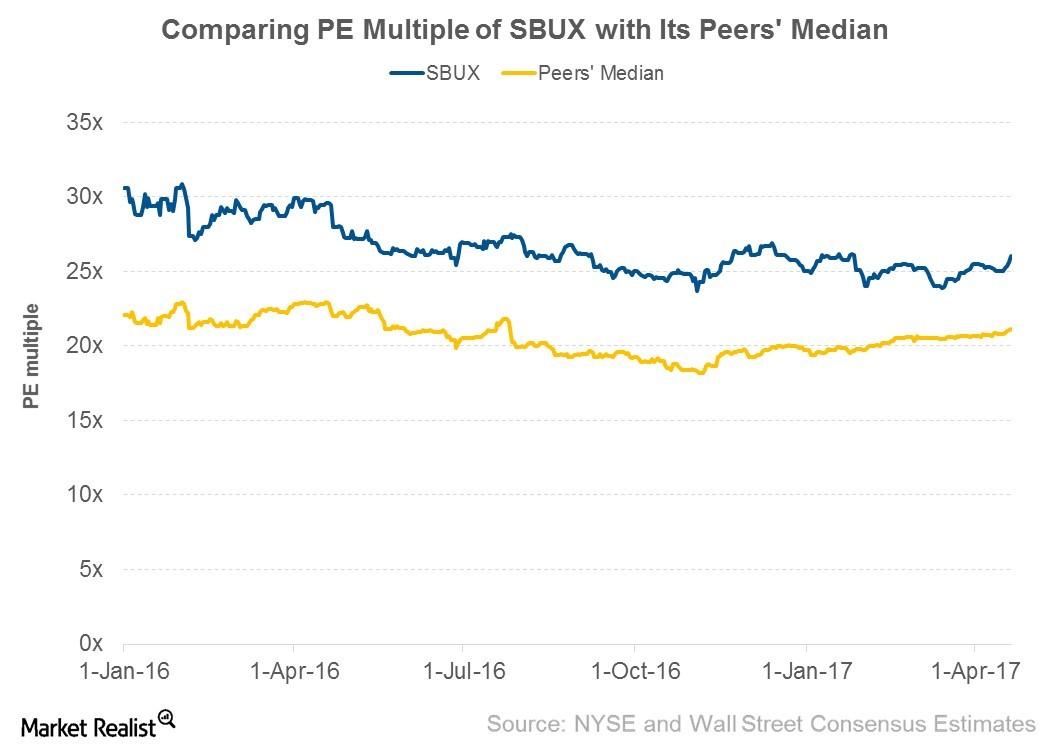

Weak Fiscal 3Q17 Sales Lower Starbucks’s Valuation Multiple

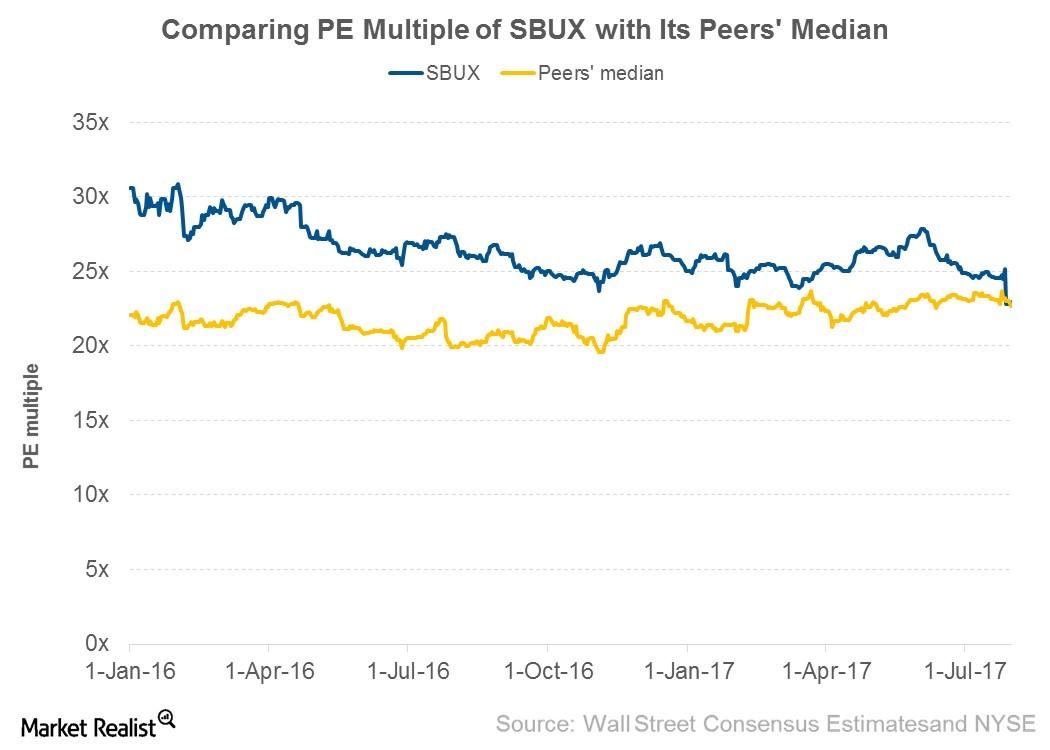

Valuation multiple We’ve used the forward PE (price-to-earnings) multiple for our analysis, due to its high visibility in Starbucks’s (SBUX) earnings. The forward PE multiple is calculated by dividing a company’s stock price by analysts’ earnings estimates for the next four quarters. Starbucks’s forward PE multiple Starbucks’ lower-than-expected SSSG (same-store sales growth) in fiscal 3Q17, lowering of […]

What Will Drive Dunkin’ Brands’ 2Q17 Earnings?

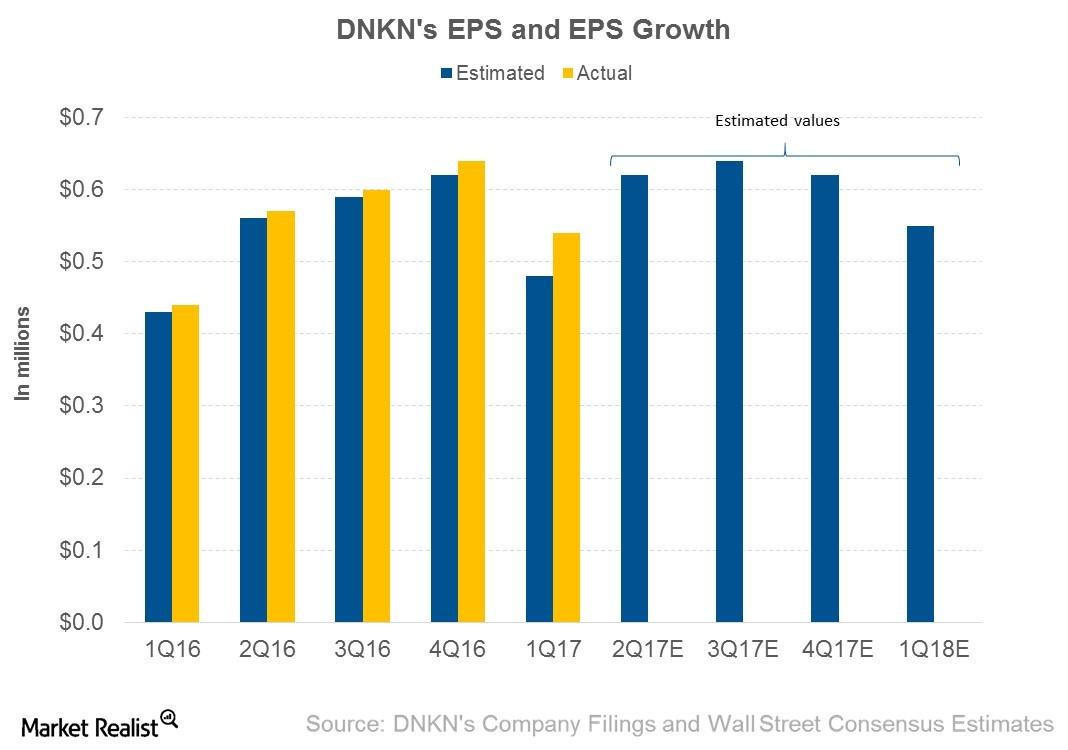

In 2Q17, analysts expect Dunkin’ Brands (DNKN) to post EPS (earnings per share) of $0.62, which represents a rise of 8.8% from its EPS of $0.57 in 2Q16.

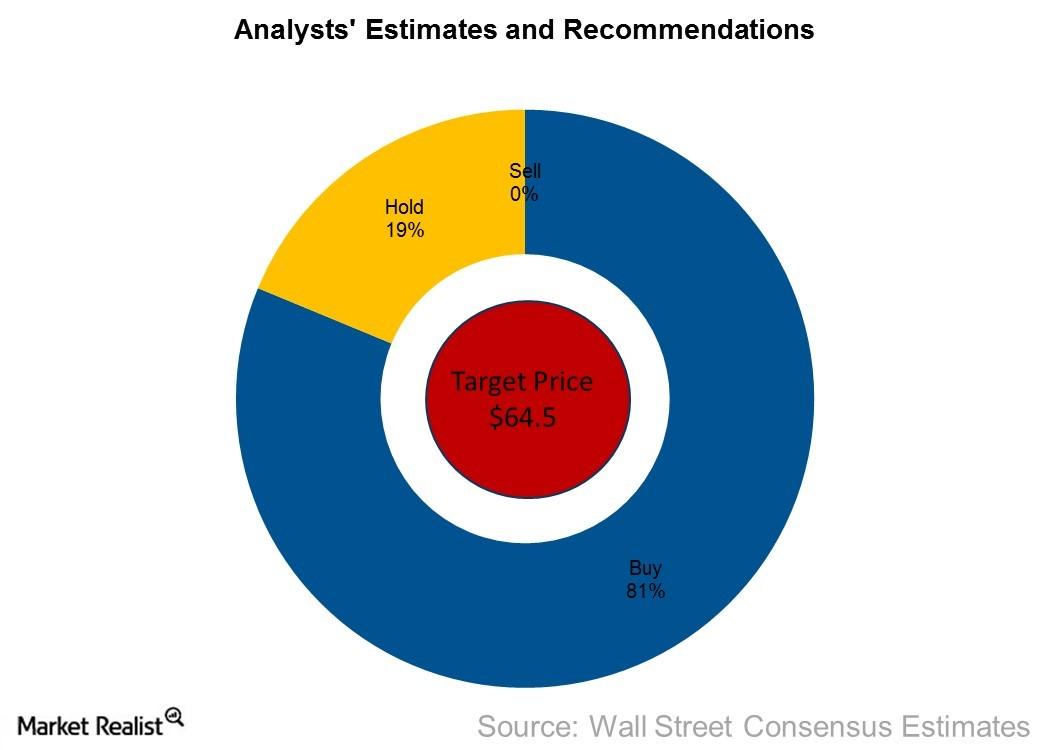

Why Analysts Are Recommending “Buy” for Starbucks

Target price On January 13, 2017, Starbucks (SBUX) was trading at $57.85. The company’s share price may already have been factored into the estimates we’ve discussed in this series. In this article, we’ll look at analysts’ recommendations and estimated target prices for the stock over the next 12 months. Despite Starbucks posting strong 4Q16 earnings […]

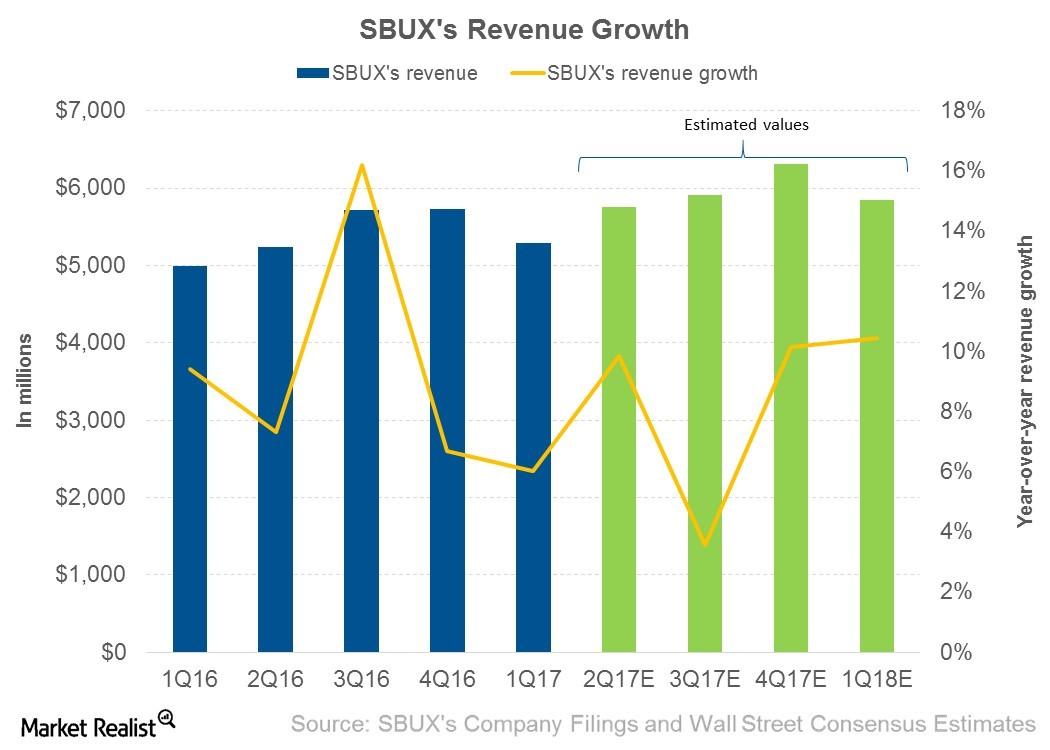

What to Expect from Starbucks’s Revenue in Next 4 Quarters

In the next four quarters, analysts are expecting Starbucks (SBUX) to post revenue of $23.8 billion, which represents an increase of 8.4% from $22.0 billion in the corresponding quarters of the previous year.Consumer Must-know: Dunkin’s major costs of operations

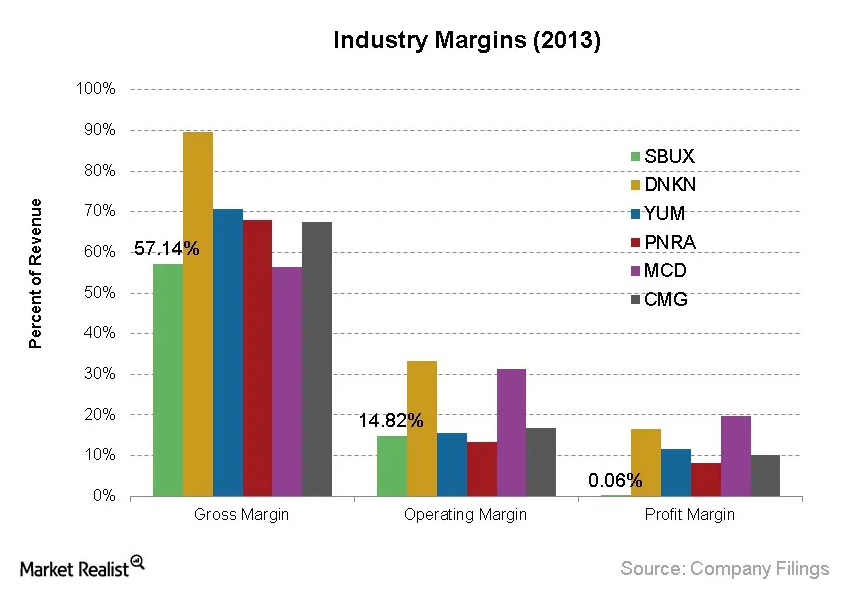

Dunkin’ Brands Group (DNKN) has three major costs of operations. The costs of operations include general and administrative expenses, cost of products sold, and occupancy expense. Dunkin’s general and administrative expenses accounted for $56 million in the second quarter. This was 30% as a percentage of sales—compared to $62 million, or 34%, as a percentage of sales.

Why high valuation and coffee prices drove Starbucks down ~13%

As store count grew over the past few years, Starbucks’ forward P/E valuation metric also expanded. What used to be just 17x gradually grew to roughly 27x, a 58% based solely on expansion in the valuations.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

What’s Behind the Decline in Starbucks Stock Price

After posting its fiscal 2Q17 earnings on April 27, 2017, Starbucks (SBUX) stock rose 5.3% to reach $64.57 on June 2, 2017. The aggressive expansion plans in the CAP (China and Asia-Pacific) region and its implementation of technological advancements led Starbucks stock price to rise. However, since then, the stock has seen downward momentum.

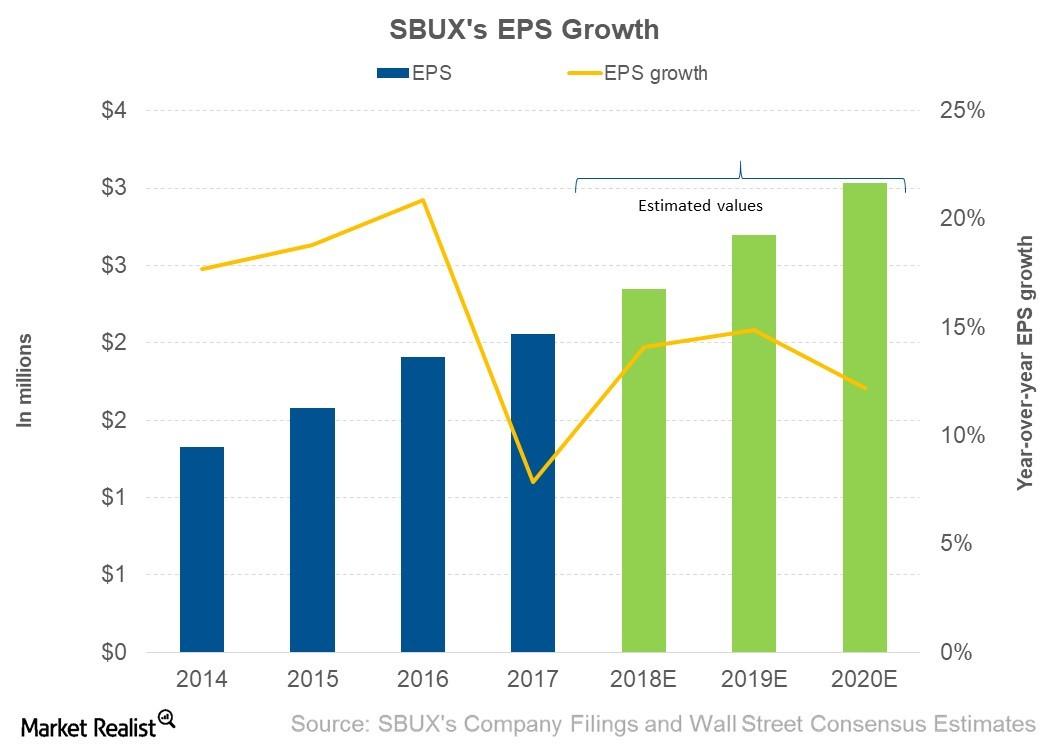

Can Starbucks Deliver Double-Digit EPS Growth in Q1?

Starbucks will report its first-quarter earnings after the market closes on Tuesday. Analysts expect the company to report double-digit EPS growth.

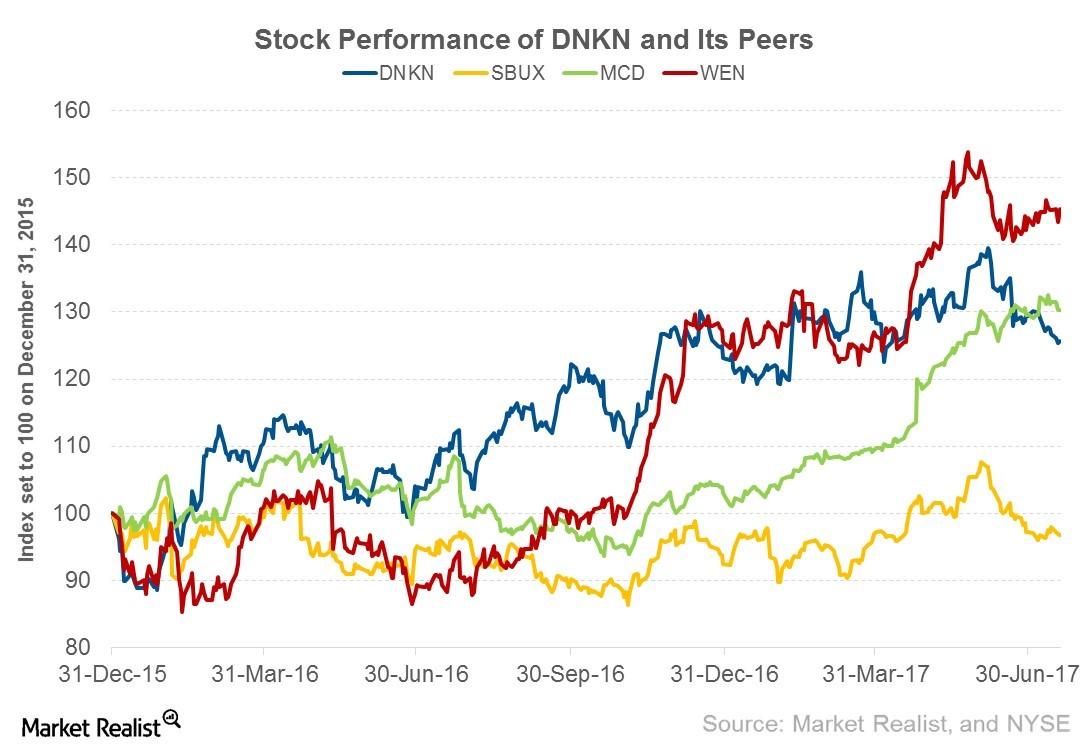

Will Dunkin’ Brands’ 2Q17 Earnings Boost Its Stock Price?

Dunkin’ Brands, the owner of the Dunkin’ Donuts and Baskin-Robbins brands, is scheduled to announce its 2Q17 earnings before the market opens on July 27, 2017.

Will Starbucks’s Fiscal 3Q17 Earnings Boost Its Stock Price?

Starbucks (SBUX) is scheduled to announce its fiscal 3Q17 earnings after the market closes on July 27, 2017. Starbucks’ fiscal 3Q17 extends from April 3, 2017.Consumer Why Dunkin’ Brands is a unique player in a maturing industry

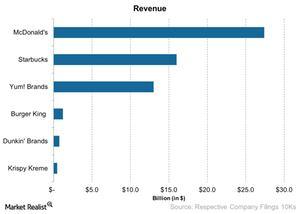

Dunkin’ Donuts’ main competitor on the coffee sales front is Starbucks, which sells coffee from its company-owned fleet of retail locations.

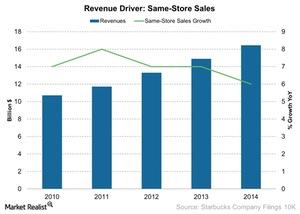

Starbucks’ Same-Store Sales Growth Is Declining

Same-store sales indicate the sales at the existing location over a period of time—usually one year. Same-store sales are driven by traffic and ticket.Consumer Starbucks revenues: Why customers are willing to pay a premium

Starbucks’ revenue mix is weighted in favor of beverages. This should come as no shock, considering the firm’s roots trace back to a single coffee shop at Pike’s Place Market in Seattle.

How Much Upside Is Left in Starbucks’s Stock Price?

Starbucks’s (SBUX) share price has been soaring since it announced its fiscal 4Q16 results on November 3, 2016. Let’s explore why.

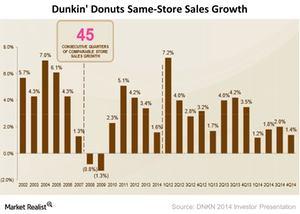

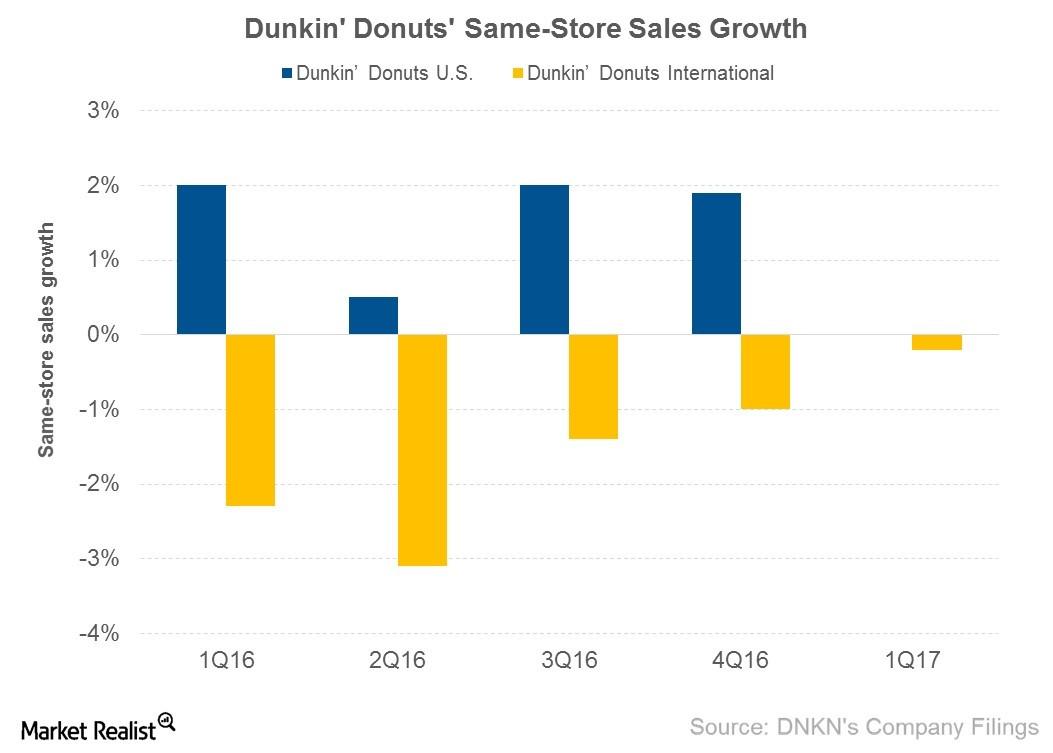

How Is Dunkin’ Donuts Doing in Same-Store Sales Growth?

Overall same-store sales growth for Dunkin’ Donuts has been declining. The company had negative same-store sales growth in 2008 and 2009.

Dunkin’ Brands’ Strategic Focus and Supply Chain

A strategic focus and balanced strategy for restaurant include a present in grocery chains to help diversify risks associated with a bad economic cycle.

The Starbucks Market Mystique

Starbucks stock began its ascent in late September 2014. Prices increased even more after the first-quarter 2015 earnings were released on January 22, 2015.

How Starbucks Obtained a Wide Economic Moat Rating

Cost Advantage in Action: Four Case Studies of Moat Companies To demonstrate the power of cost advantages in creating economic moats, we highlight four moat companies: U.S. based Starbucks and Compass Mineral, and international moat companies: Kao (Japan) and Ramsay Health Care (Australia). Starbucks Corp (SBUX US) boasts a “wide economic moat” rating from Morningstar from […]

Beyond Meat Stock Plunged despite Strong Q3 Results

Beyond Meat (BYND) stock fell 10.2% in after-market trading hours on October 28, even as the company reported better-than-expected third-quarter results.

The Restaurant Industry: An Overview

More Americans are eating out, and they’re eating out more often. The restaurant industry’s share of the food dollar is 51%, up from 25% in 1955.

Beyond Meat Stock Starting to Lose Some Steam

Although the S&P 500 and Nasdaq have recovered by 1.05% and 1.55% today, Beyond Meat stock (BYND) was down 9.6% this morning.

Starbucks to Report Double-Digit EPS Growth in Q3

Starbucks (SBUX) is scheduled to report its fiscal 2019 third-quarter earnings results after the market closes on July 25.

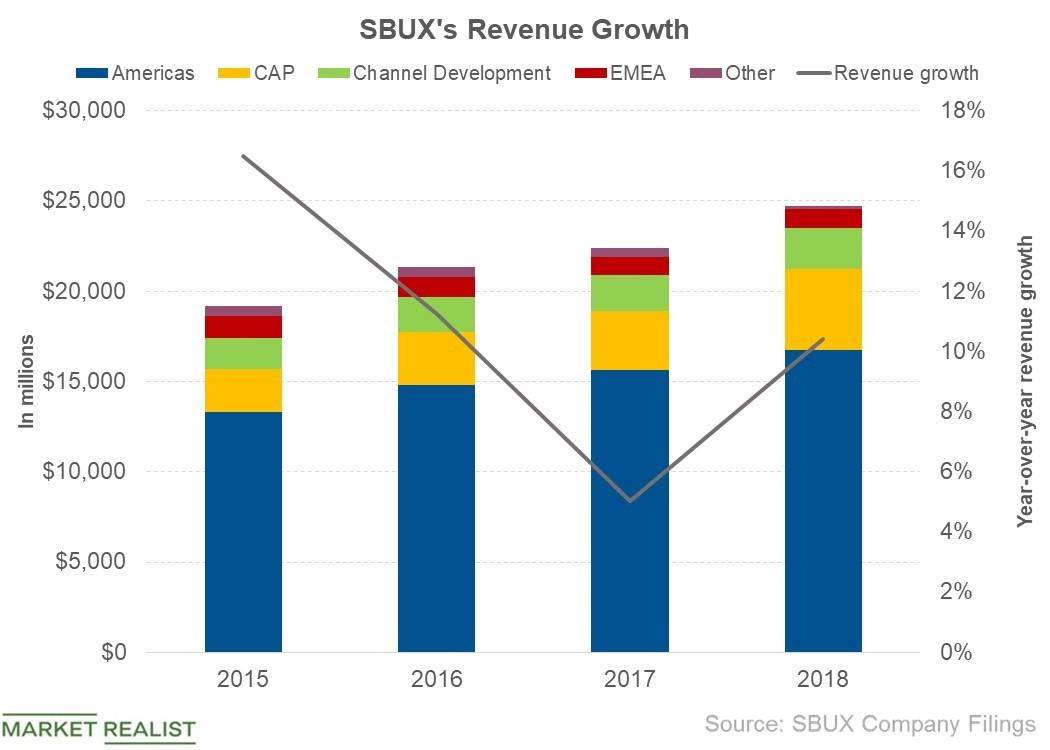

What Drove Starbucks’s Revenue in 2018?

In fiscal 2018, Starbucks (SBUX) posted revenue of $24.72 billion, a rise of 10.4% from $22.39 billion in fiscal 2017.

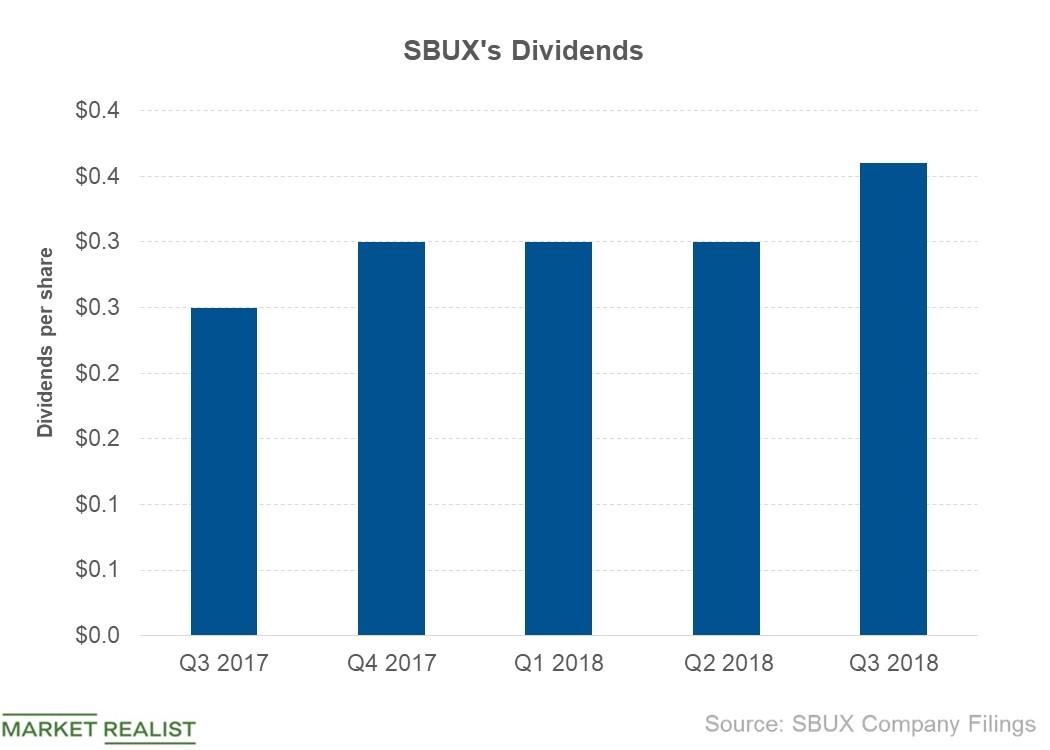

Understanding Starbucks’s Dividend Policy

On June 19, Starbucks (SBUX) announced a quarterly dividend of $0.36, which represents a 20% rise from its previous dividend of $0.30.

What Drove Starbucks’s Earnings per Share in Fiscal 2017?

In fiscal 2017, Starbucks (SBUX) posted adjusted EPS (earnings per share) of $2.06, which represents growth of 7.9% from its $1.91 in fiscal 2016.

Coffee Futures: Arabica Down, Robusta Up in the Week Ended June 23

In this series, we’ll explore the price movements of five soft commodities—coffee, sugar, cocoa, orange juice, and cotton. Arabica coffee, which is considered superior in flavor and quality to Robusta coffee, has seen its futures price falling during the past six months.

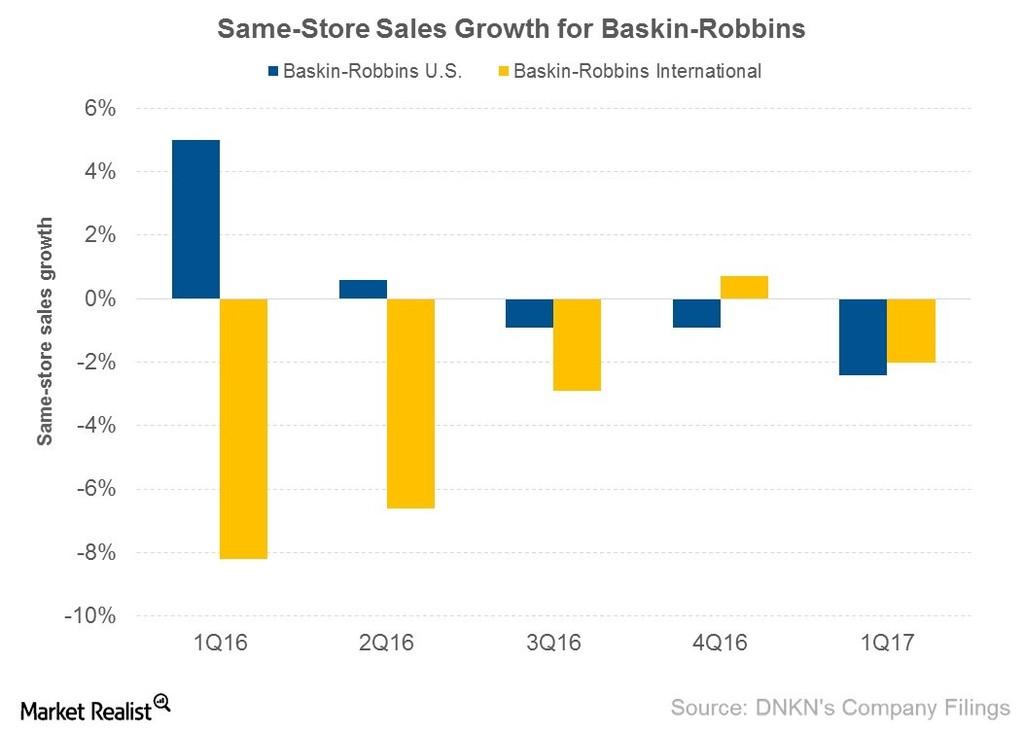

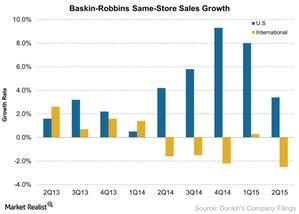

Why Baskin-Robbins Had Negative Same-Store Sales Growth in 1Q17

In 1Q17, Baskin-Robbins, which operates under the umbrella of Dunkin’ Brands (DNKN), had SSSG of -2.4% in the United States and -2.0% in international markets.

Dunkin’ Donuts: Same-Store Sales Growth Lower Than Estimates

In 1Q17, SSSG for Dunkin’ Donuts, which operates under the umbrella of Dunkin’ Brands (DNKN), was flat in the United States.

How Starbucks’s Valuation Compares to Peers

For the next four quarters, analysts are expecting Starbucks to post EPS growth of 12.8%.

Exploring The Cheesecake Factory’s Other Brands

The Cheesecake Factory (CAKE) created the Grand Lux Cafe brand at the request of Venetian Resort Hotel Casino in Las Vegas in 1999.

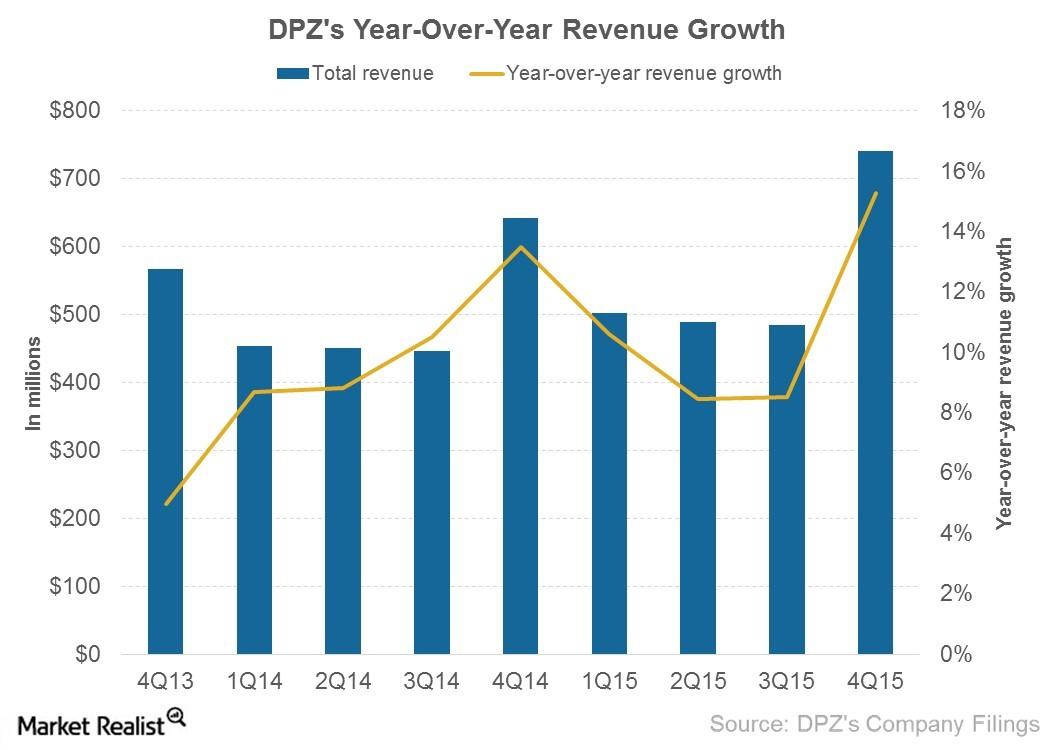

What Contributed to Domino’s Pizza’s Revenue Expansion in 4Q15?

In 4Q15, Domino’s Pizza (DPZ) recorded an overall revenue growth of $98.2 million from its 4Q14 revenues of $643 million.

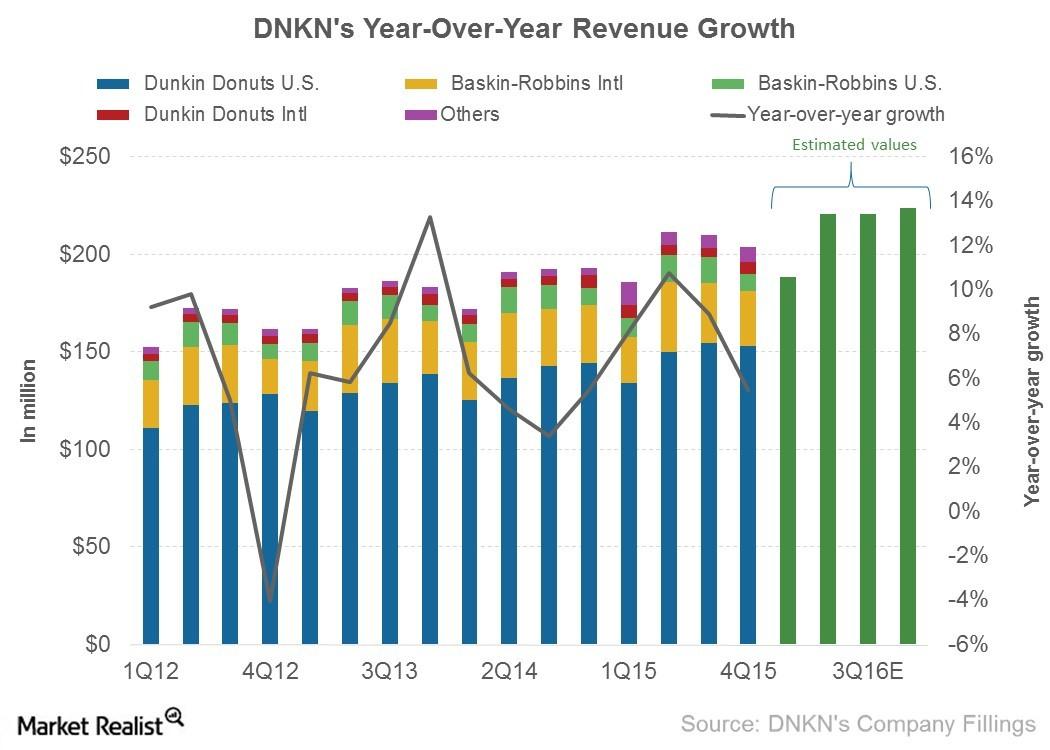

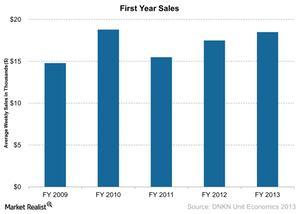

Unit Growth and Dunkin’ K-Cup Sales Drove 4Q15 Revenue Growth

Dunkin’ Brands (DNKN) earns its revenue from five different channels: Dunkin’ Donuts US, Dunkin’ Donuts International, Baskin-Robbins US, Baskin-Robbins International, and others.

What Challenges Has Keurig Green Mountain Been Facing?

Keurig Green Mountain (GMCR) has been facing struggles in the coffee market (XLP), as Keurig’s patent for K-Cup pods, the single-serve coffee containers, expired in September 2012.

Why a Weak 2Q15 for Baskin-Robbins May Not Be a Negative Signal

In 2Q15, Baskin-Robbins’s US same-store sales growth rate fell to 3.4% compared to 4.2% a year ago. This was driven by ongoing promotions and discounts and a 75% increase in online cake ordering.

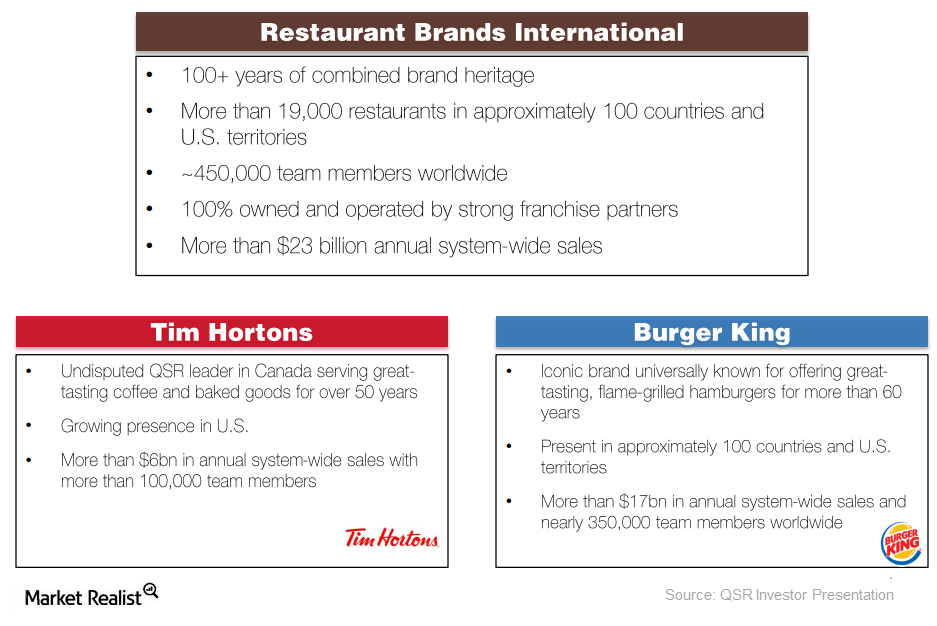

Magnetar Purchases New Stake in Restaurant Brands International

Magnetar Capital added new stake in Restaurant Brands International (QSR) in 4Q14. The position represented 0.73% of its holdings at the end of the year.

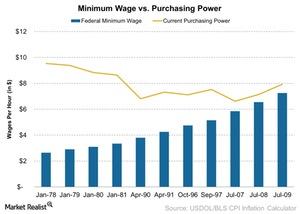

The Eroding Purchasing Power of the Minimum Wage Worker

While the absolute minimum wage has increased, when adjusted for inflation in 2015, its purchasing power has declined.

Dunkin’ Brands Diversifies Its Daypart Focus

Dunkin’ Brands is now expanding into the afternoon daypart in order to win customers in a different daypart and improve sales leverage.

How Dunkin Donuts Is Embracing Technology

Dunikin’ is embracing technology with a phone app that allows you to search Dunkin’ Donuts locations, see nutritional information, and gift Dunkin’ treats.

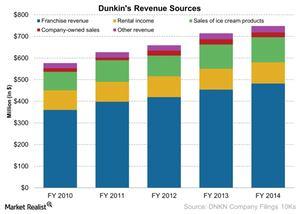

What are Dunkin’ Brands’ Five Sources of Revenue?

Dunkin’ Brands’ (DNKN) sources of revenue include franchise revenue, sale of ice cream products, company-owned sales, rental income, and other income.

Dunkin’ Brands Has a Nearly 100% Franchise Model

Benefits to a franchise model include low need for capital, more focus on brand in marketing and menus, and a potential to penetrate faster into the market.

Dunkin’ Brands’ International Development Plan

As of December 2013, Dunkin’ Brands had 5,736 points of distribution (or POD). In its International Development Plan, it plans to expand that to 9,500.

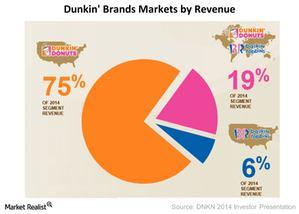

US Market Still the Biggest for Dunkin’ Brands

Dunkin’ Donuts is Dunkin’ Brands’ most important brand, with 77% of the revenue or $568 million in 2014. Of this, $548 million was from the US market.

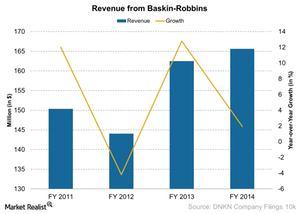

Baskin-Robbins’ Four Year Revenue Trend

As of 2014, there were about 2,500 Baskin-Robbins locations in the United States and about 5,000 locations in the international market.

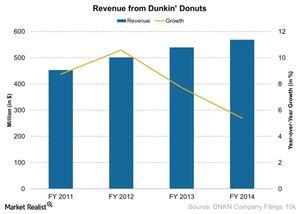

Dunkin’ Donuts’ National and International Sales

Dunkin’ Donuts’ combined revenue from national as well as international units was $569 million in 2014. Of that, $548 million came from the US market alone.

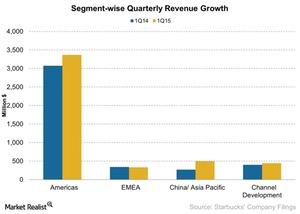

Starbucks China and Asia-Pacific Segment Reports Record Sales

The Starbucks China and Asia-Pacific segment grew 85% to $495 million, up from $266 million year-over-year.