Dominion Energy Inc

Latest Dominion Energy Inc News and Updates

What Investors Should Know about Dominion Energy’s Dividends

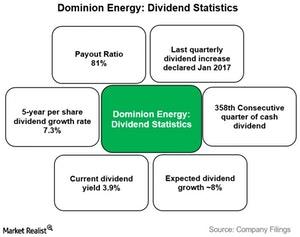

Dominion Energy’s (D) payout ratio (the percentage of profit that it gave away in the form of dividends) was 81% in 2016, which is higher than the industry average and slightly on the lower side of its five-year payout average of 85%.

An Overview of US LNG Production and Exports

Investors may be seeing a lot of reports about rising US LNG (liquefied natural gas) exports. Let’s review the basics of LNG.

What’s in Store for Dominion Energy Stock?

Dominion Energy (D), one of the laggards among top utilities this year, seemed strong lately and is currently trading close to an eight-month high.

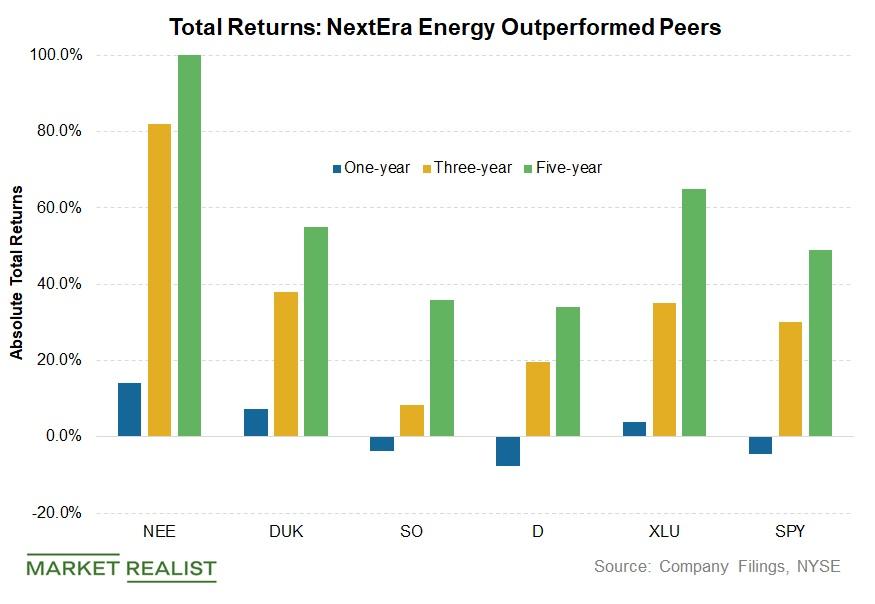

NEE, DUK, SO, and D: Comparing Top Utilities’ Total Returns

NextEra Energy (NEE) beat its peers in terms of returns in the last few years. NextEra Energy returned 14% in 2018.

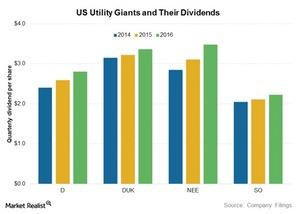

D, DUK, NEE, and SO: Top Utilities’ Dividends

Dominion Resources (D) paid annual dividends of $2.80 in 2016. Duke Energy (DUK) paid dividends of $3.36 per share last year.

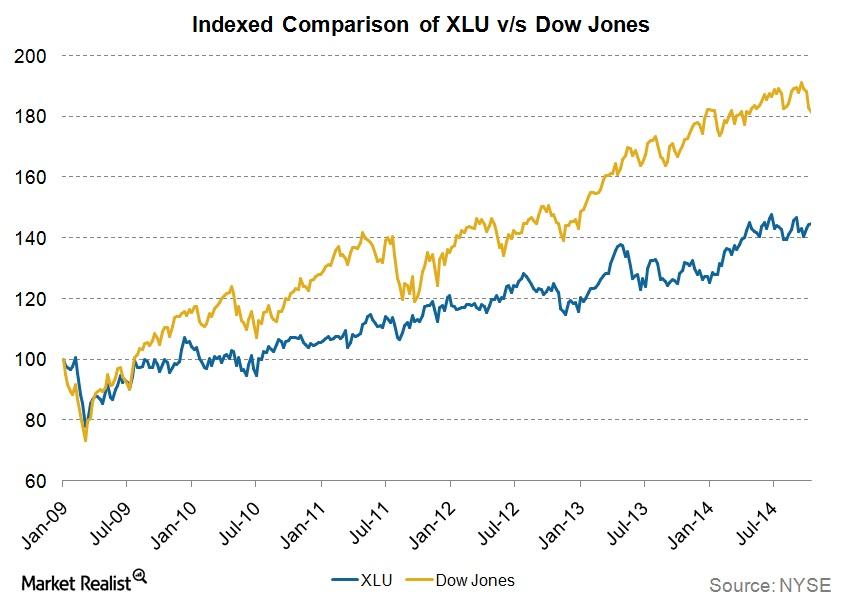

Must-know: US power sector and its indicators

The power sector is the backbone of any economy. All of the other industries depend on it. In the U.S., the power utilities business is characterized by steady dividends and stable earnings.

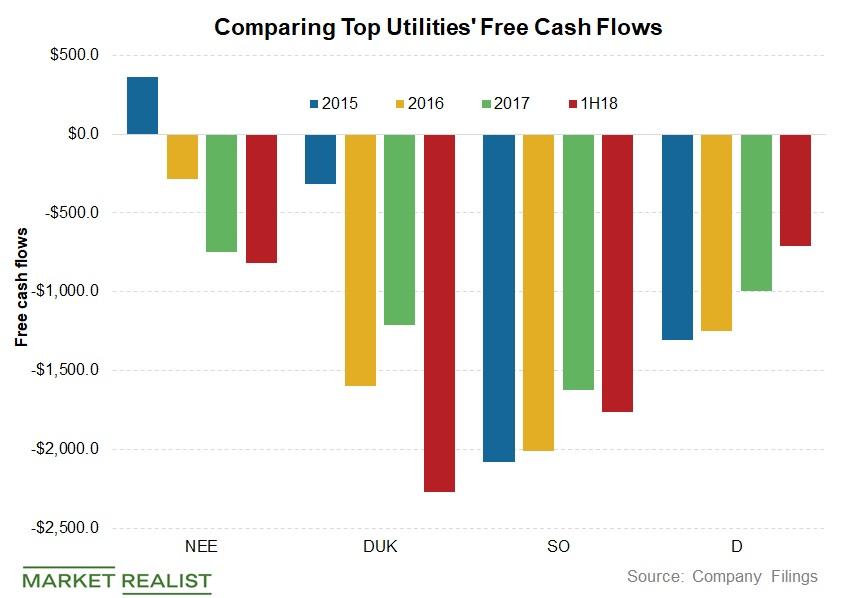

Analyzing Top Utilities’ Free Cash Flow Trends

The top four utilities have failed to generate positive free cash flows in the last few years.

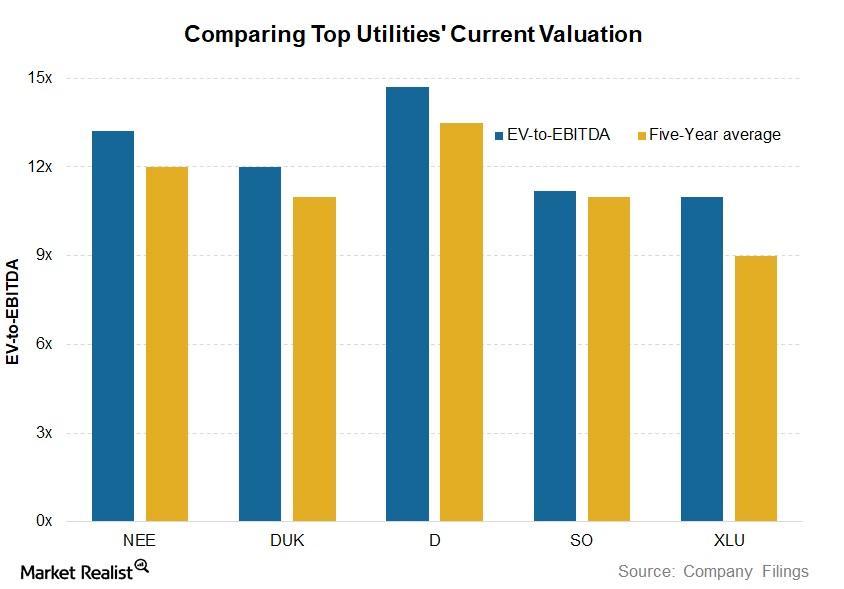

Not All Utility Stocks Are Overpriced

Utility stocks seem overvalued. Utilities have reached record levels. They have been trading at inflated valuations for months.

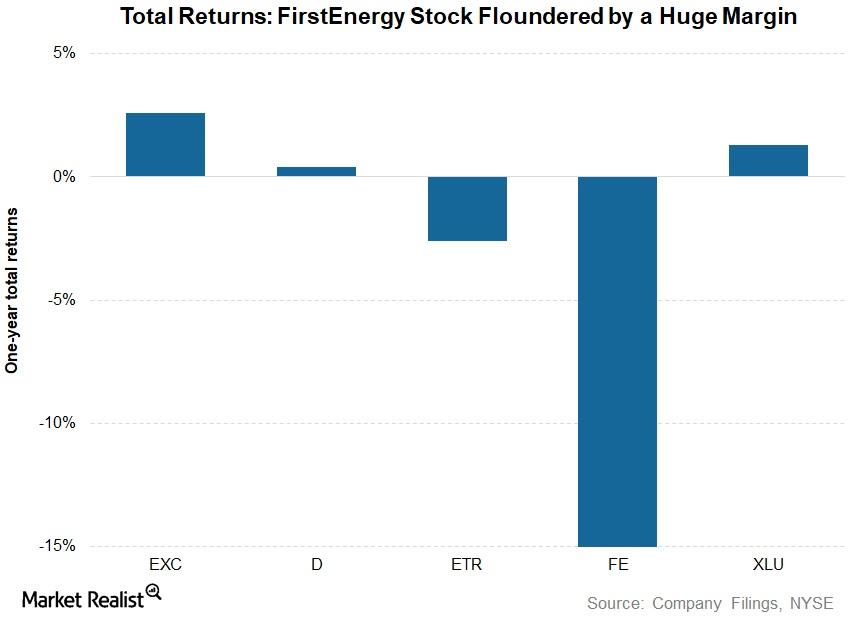

FE, D, EXC, or ETR: Which Utility Stock Stung Investors?

Exelon (EXC) stock has corrected nearly 2% in the last year. Including dividends, its returns have come in at ~3%.

Dividend Faceoff: Southern Company vs Duke Energy

Dividend yields of Southern Company (SO) and Duke Energy (DUK) currently stand at multi-year lows because utility stocks had a solid run this year.

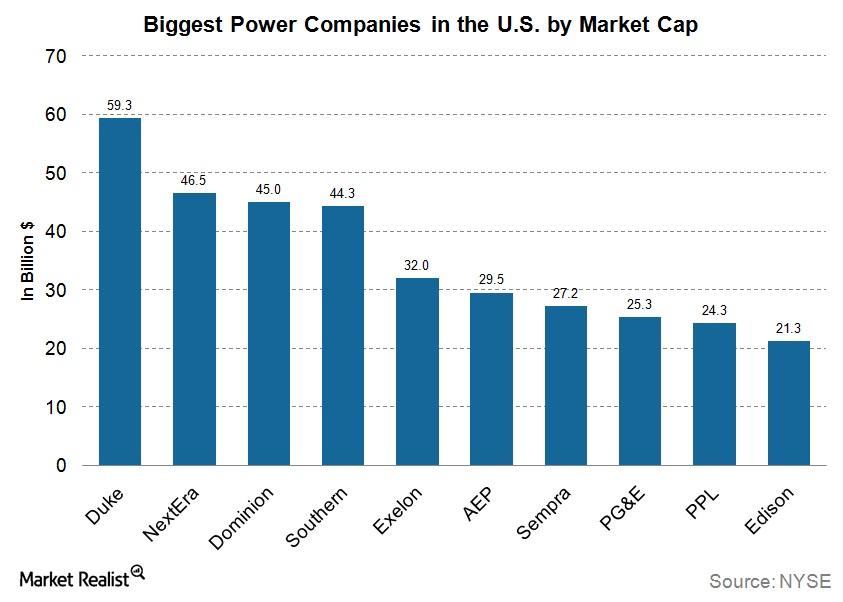

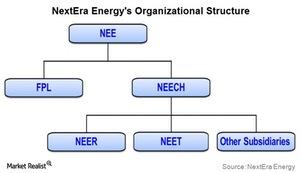

Utilities company overview: NextEra Energy

NextEra Energy (NEE) is the second-largest power company in the US after Duke Energy (DUK) in terms of market capitalization.

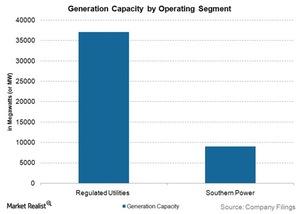

Regulated business is Southern Company’s strength

Southern Company manages its regulated utility business through the following four subsidiary companies: Alabama Power, Georgia Power, Gulf Power, and Mississippi Power. These subsidiaries have a combined power generation capacity of 37,000 megawatts (or MW).

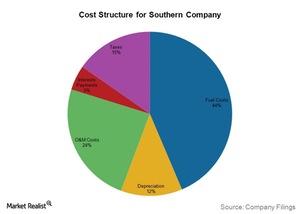

Cost structure sets Southern Company above its competitors

Fuel costs per kWh can be used to evaluate the efficiency of a power producer to produce electricity. Southern Company’s fuel cost per kWh is lower than its competitors’ in the regulated utility business.Energy & Utilities Must-know: Who owns Dominion?

Institutional investors hold most of Dominion Resources’ (D) outstanding shares. As of June 30, 2014, a total of 351.2 million shares were held by 1,069 institutions.Energy & Utilities Why electricity demand is linked to GDP

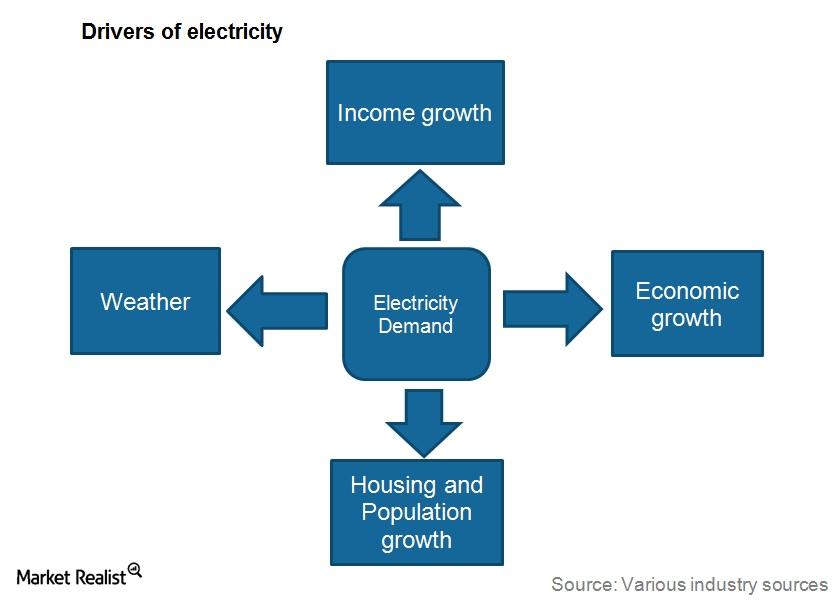

Electricity is the backbone of a nation’s progress. All of the industries need electricity to operate—directly or indirectly. When a business flourishes, the electricity consumption increases.

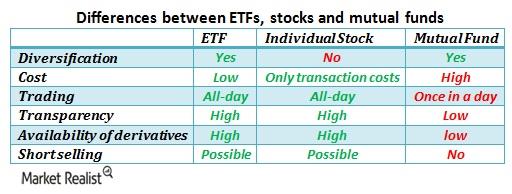

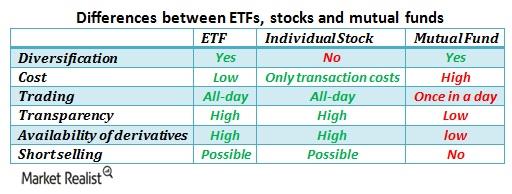

A closer look at the difference between ETFs and mutual funds

Before moving to inverse and leveraged ETFs in the next part of this series, we’d like to quickly discuss the differences between ETFs and mutual funds.

NextEra Energy plays in regulated and unregulated utility markets

NextEra Energy is a Florida-based power company. Its subsidiaries are Florida Light & Power and NextEra Energy Resources.

Why Utilities Could Keep Smashing in the Fourth Quarter

Despite valuation concerns, utility stocks seem relatively well placed at the moment, especially going into October, compared to broader markets.

Utilities Are Back in Focus as the Trade War Escalates

Investors turned to defensive utilities intensified yesterday after President Trump announced 10% tariffs on another $300.0 billion worth of Chinese goods.

Why Utilities Underperformed the Broader Market Last Week

The defensives and utilities sector fell more than 2% last week while broader markets fell just 0.3%. Here’s why.

Top Utilities’ Stock Price Targets Get Bumped Up

Many top utility stocks’ price targets were changed last week.

Natural Gas Prices: What to Expect in 2019

The EIA expects US natural gas prices to average $2.89 per MMBtu in 2019. For 2020, the forecast is $2.92 per MMBtu.

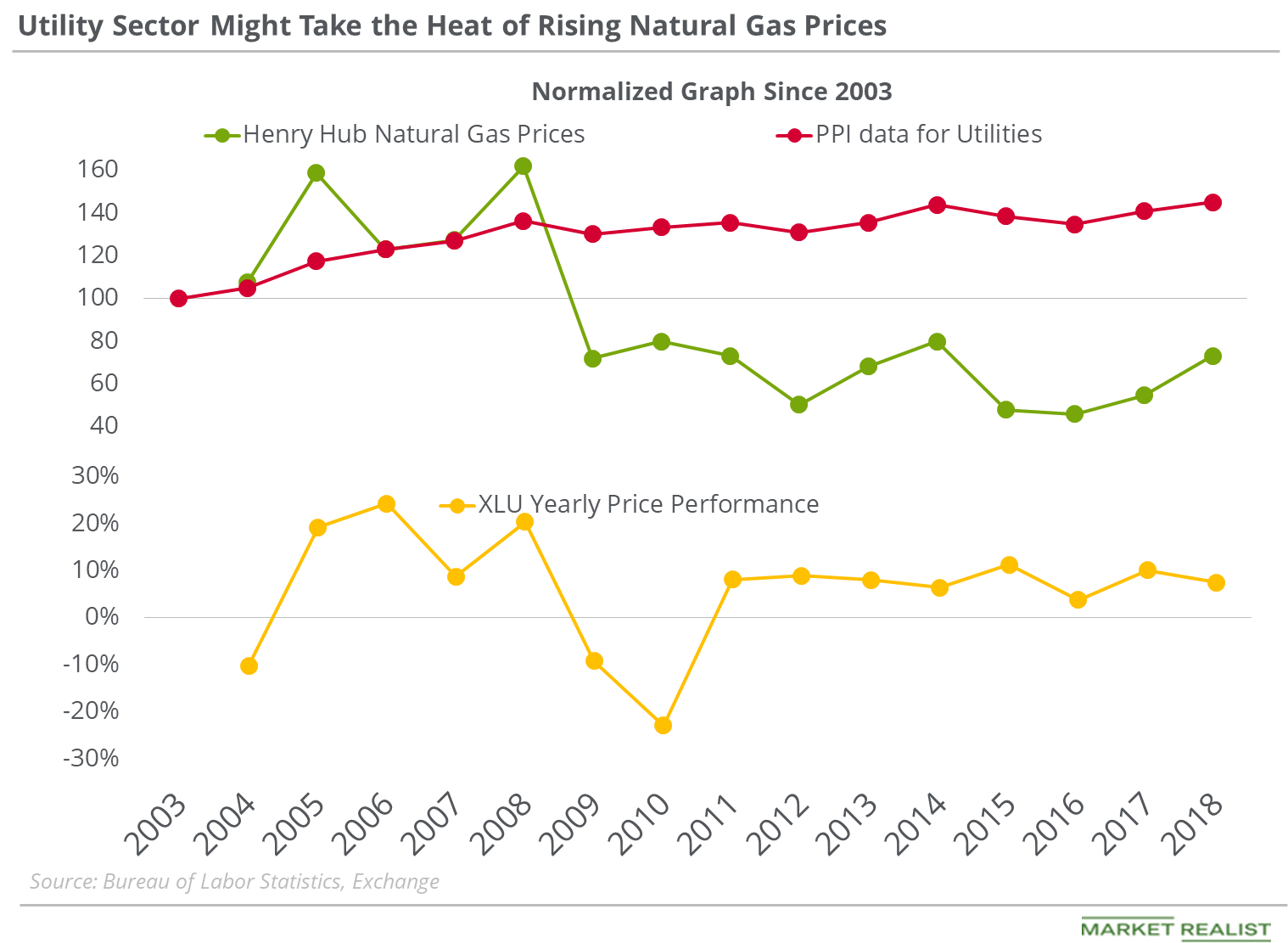

Utilities’ PPI Could Increase with Higher Natural Gas Prices

On March 3, 2016, natural gas active futures were at the lowest closing level in the last 17 years.

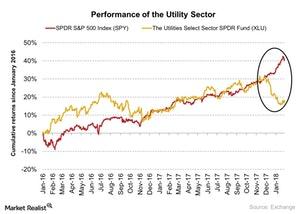

Why Utility Sector Had Inverse Correlation with S&P 500 in January

The Utilities Select Sector SPDR ETF (XLU), which tracks the performance of the utility sector, fell 3.2% in January 2018.

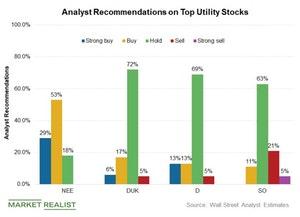

Analyzing Top Utilities’ Current Valuations

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations.

Dominion Resources Stock Approaches Peak: What’s Next?

Dominion Resources (D) continues to look interesting from an investor’s perspective as the stock approaches multiyear highs.

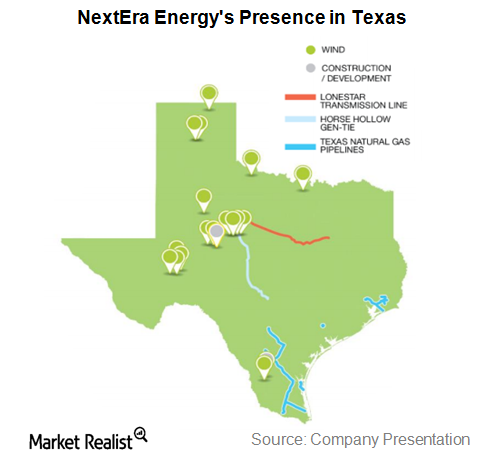

NextEra Energy to Extend Its Presence in Texas by Buying Oncor

Just a couple of weeks after withdrawing from the Hawaiian Electric deal, renewables giant NextEra Energy (NEE) announced its decision to buy Oncor on July 29.

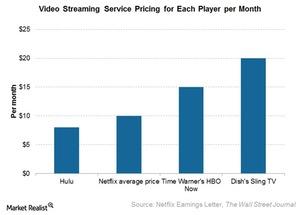

Hulu: Its Strategic Significance for Disney

Disney expects the equity loss from its investment in Hulu to accelerate since Hulu is increasing its investment in acquiring original content from media companies and producing original programming.

Disney’s Business Segments: Expectations for Fiscal 2016

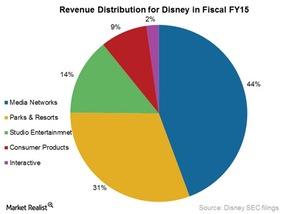

Disney’s Media Networks segment was the biggest contributor to its revenue at 44% with segment revenues of $23.3 billion in fiscal 2015.

Understanding Dominion Resources’ Corporate Structure

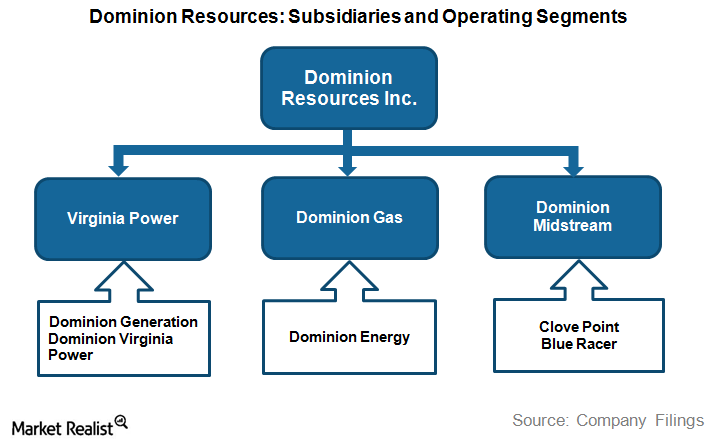

Dominion Resources engages in all stages of the energy value chain, including power generation, transmission, and distribution.

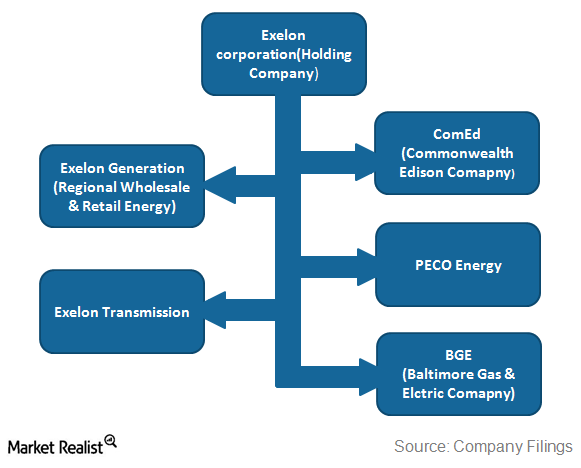

How Exelon’s Hybrid Business Model Provides Balanced Revenues

Exelon (EXC) manages end-to-end operations in the power utilities segment through its subsidiaries.

AES Corporation: Its Evolution Up until Now

AES Corporation is a global entity and operates through its six strategic business units, created based on the geographical areas they cater to.

Must-know: Factors that impact electricity demand

The most important factor that affects electricity demand is household income. According to the U.S. Energy Information Administration (or EIA), between 1981 and 2001, household real disposable income increased by 49%—from $17,217 to $25,698.

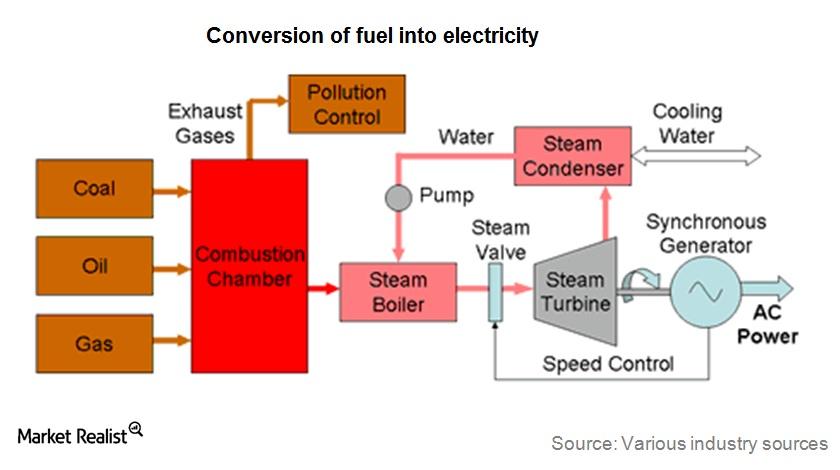

Must-know: Terminology used in the electric utilities industry

Electricity comes from energy sources that are found in nature. These sources are called primary energy sources. They’re the first form of energy. Primary energy sources include coal, gas, oil, wind, and water.

Overview: Key difference between ETFs and mutual funds

While actively managed ETFs are more expensive than passively managed ETFs, they tend to be less expensive than mutual funds due to structural differences between these two products. In the case of mutual funds, the investor interacts with the company while buying and selling mutual fund units.