Alex Chamberlin

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Alex Chamberlin

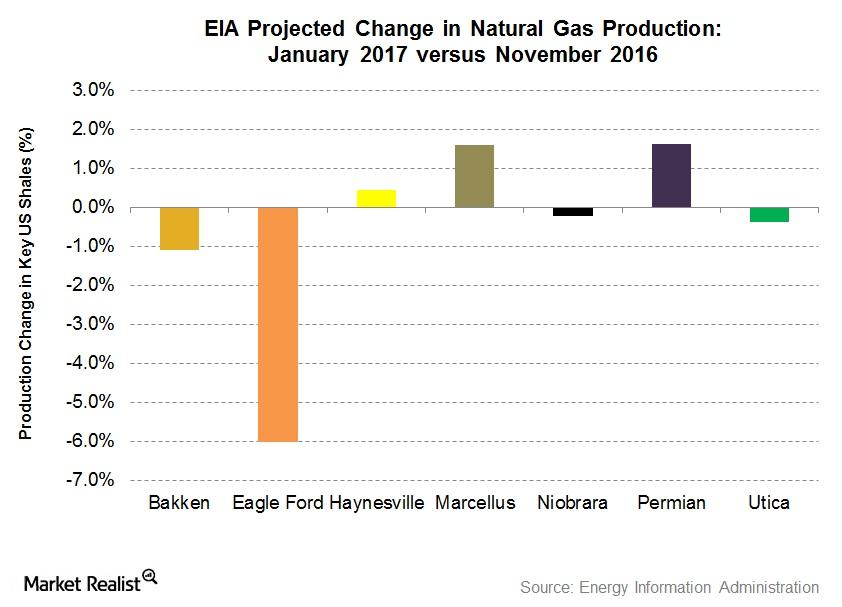

January 2017 EIA Estimates: US Shale Gas Production Could Fall

The EIA expects less natural gas production at four key US shales by January 2017 compared to November 2016. It expects production to rise at three key US shales.Materials Must-know: Why onshore rig counts are at a 2-year high

The U.S. onshore, or land-based, rig count increased by four rigs—from 1,865 to 1,869—during the week ending September 19. Land-based rigs include 13 inland water rigs. This is the highest onshore rig count in the past two years. It’s the highest rig count since August 17, 2012. This marks the eighth increase in the past ten weeks.

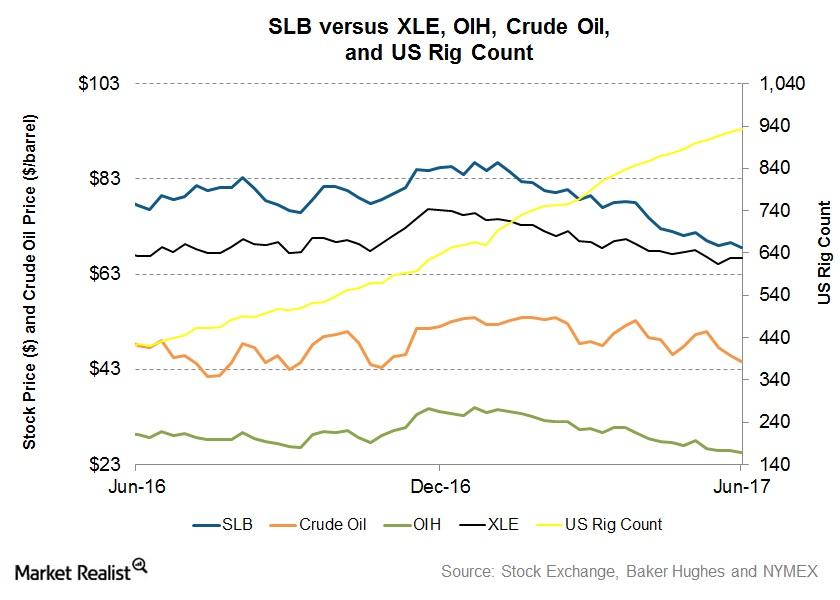

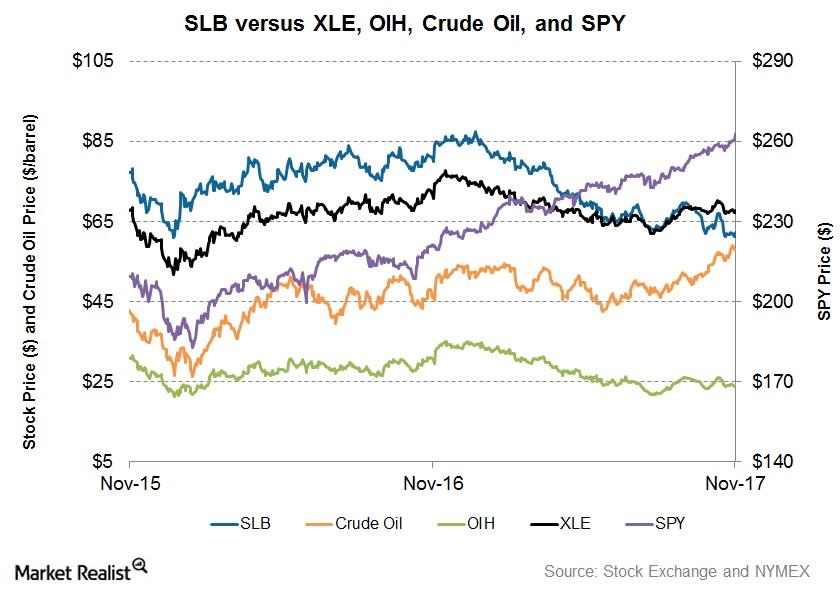

Inside Schlumberger’s 1-Year Returns as of June 16

Schlumberger’s trailing-one-year stock price has fallen 12% as of June 16, 2017, while XLE, the broader energy industry ETF, has fallen 3%.

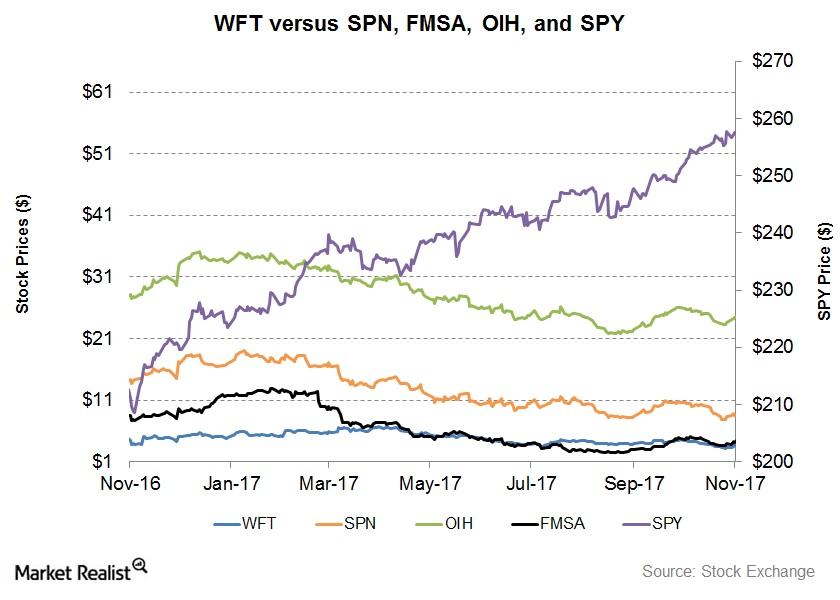

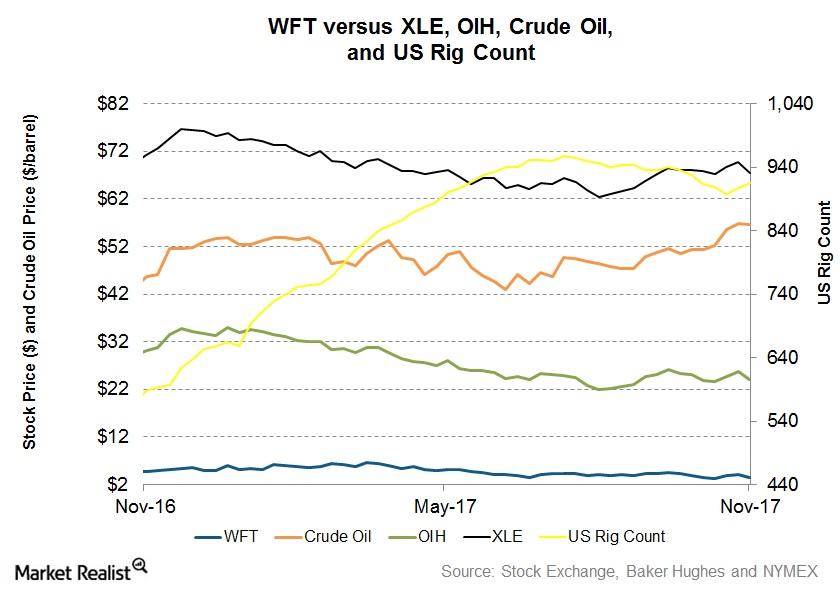

WFT, FMSA, and SPN: Returns and Outlook after 3Q17

WFT, SPN, and FMSA have significantly underperformed the SPDR S&P 500 ETF (SPY), which has produced 23.0% returns since November 3, 2016.Energy & Utilities Why improvement in Libya pushed down the crude price last week

For most of the last two years, WTI crude oil has been range-bound between ~$85 per barrel and ~$110 per barrel.

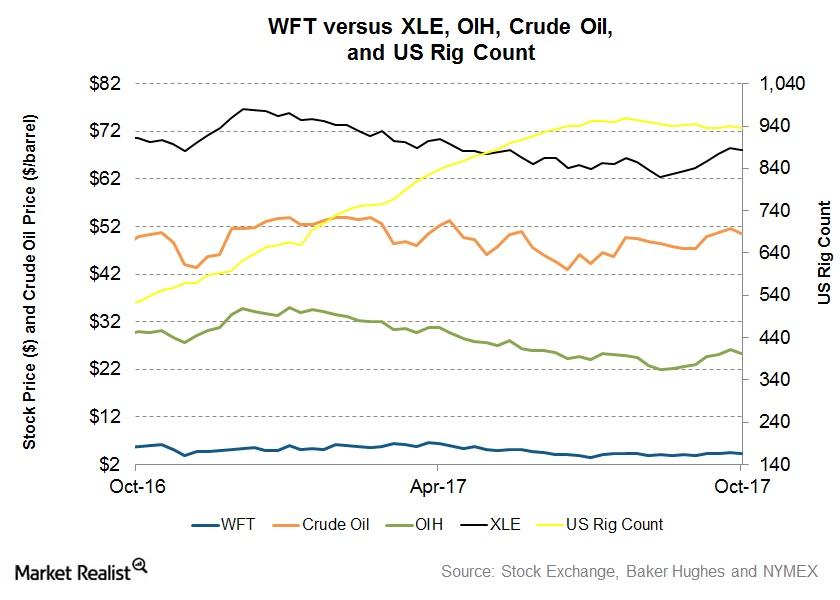

Did Weatherford Stock Fall in the Week to October 6?

Since the week ending September 29, 2017, Weatherford International stock has fallen 7% until October 6, 2017. OIH has generated -2% returns.

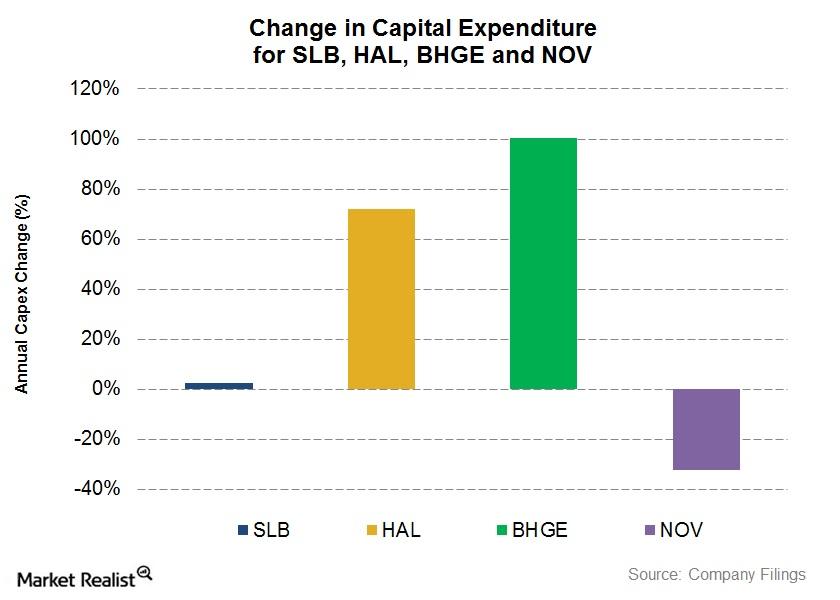

SLB, HAL, NOV, and BHGE: Comparing the Capex Growth

National Oilwell Varco’s (NOV) capital expenditure or capex fell ~32% in fiscal 2017—compared to its capex spend in fiscal 2016.

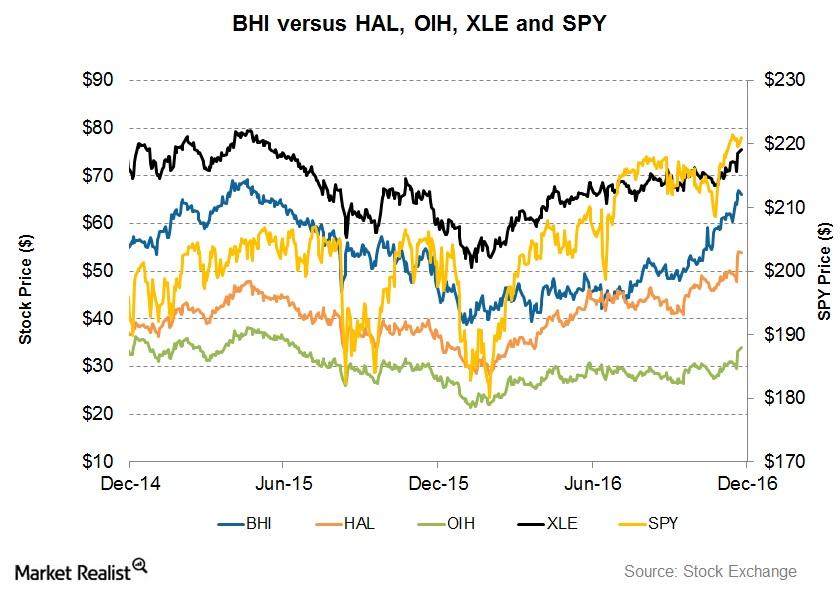

Will a Partnership with GE Improve BHI’s Returns?

Between December 2014 and December 2016, Baker Hughes (BHI) stock hit its peak in April 2015. It troughed at ~$39 in January 2016.

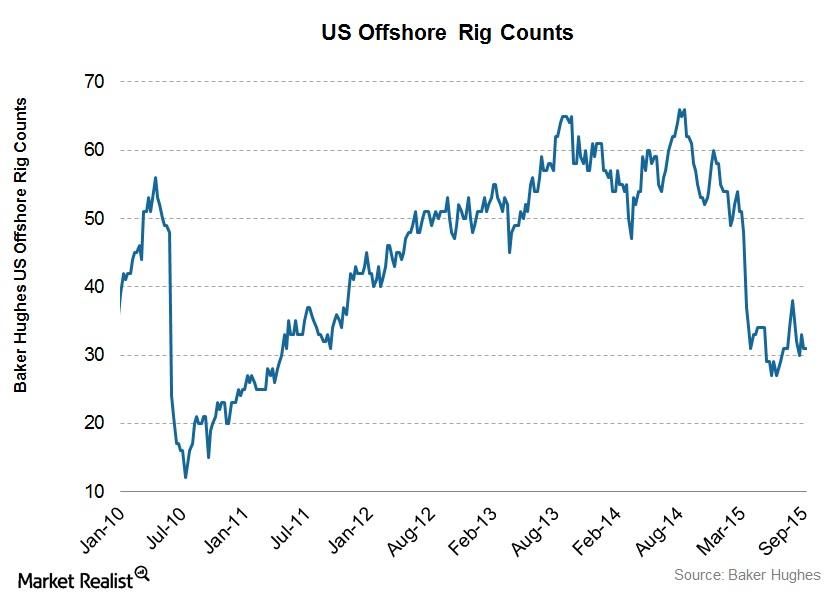

US Offshore Rig Count Was Steady in the September 18 Week

In the week ending September 18, 2015, the US offshore rig count didn’t change. The offshore rig counts have averaged 33 over the past eight weeks.Energy & Utilities Why Targa Resources’ segment operating margins changed in 1Q14

In 2013, the company processed an average of 780.1 million cubic feet per day of natural gas and produced an average of 91.9 thousand barrels per day of NGLs.

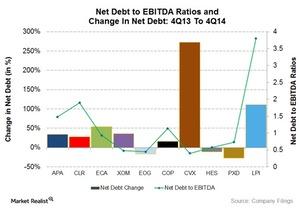

Who’s the energy company achiever, and who are the laggards?

Let’s see which energy company stands out as the most efficient in reducing debt loads and improving leverage ratios and which ones are laggards.

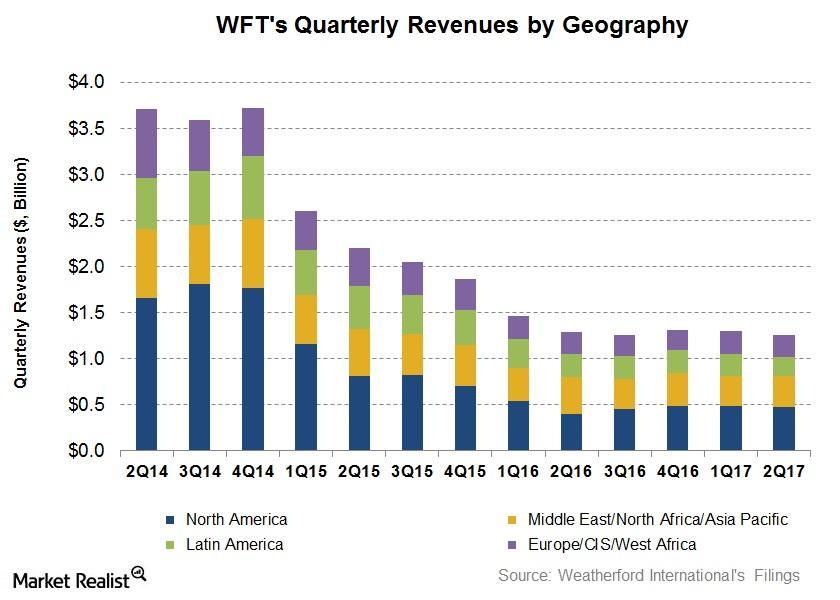

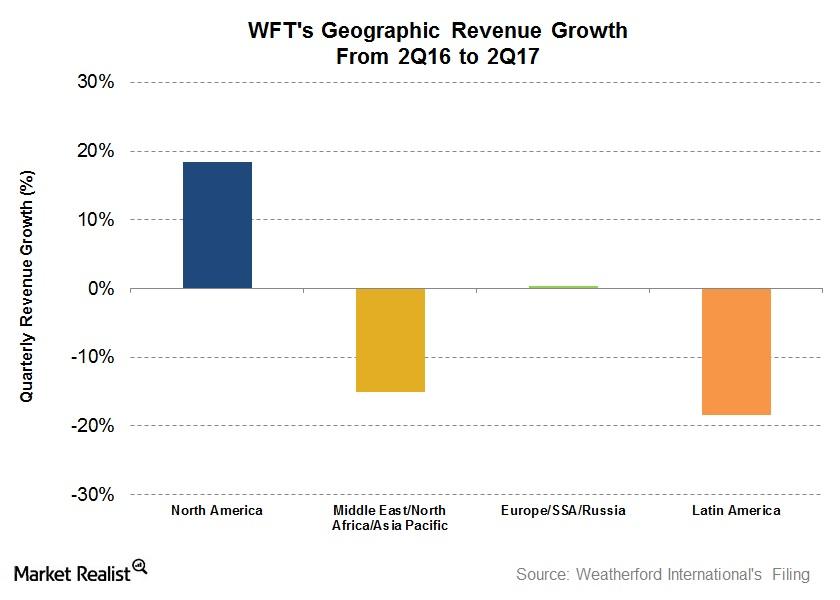

Weatherford International’s Value Drivers in 2Q17

Revenues from Weatherford International’s (WFT) Latin American region fell the most by 18.5% from 2Q16 to 2Q17.

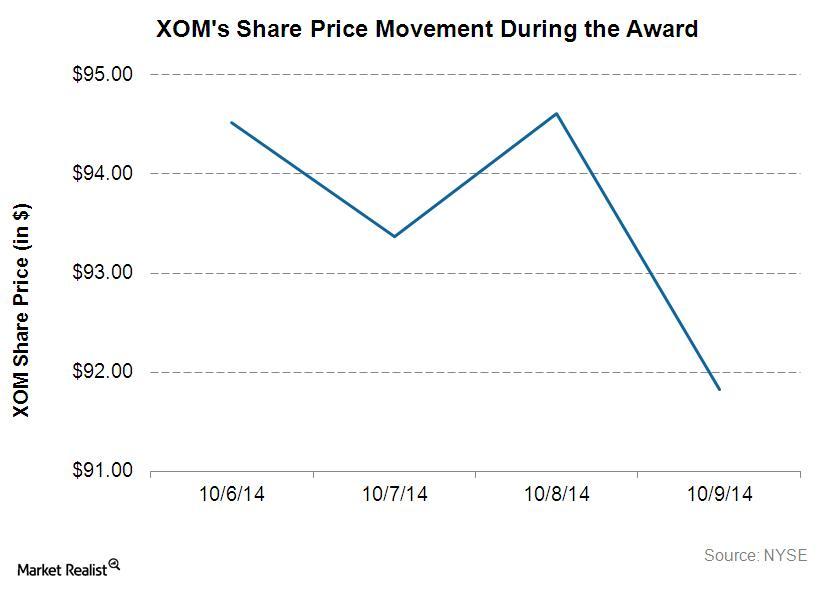

Exxon Mobil wins $1.6 billion in arbitration case against Venezuela

Exxon Mobil alleged that the Venezuelan government illegally expropriated its Venezuelan assets in 2007 and paid unfair compensation.

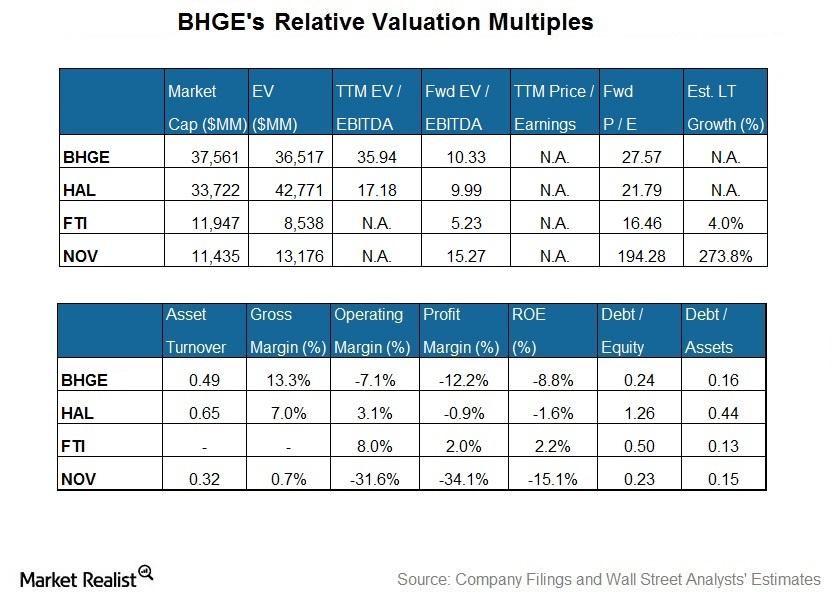

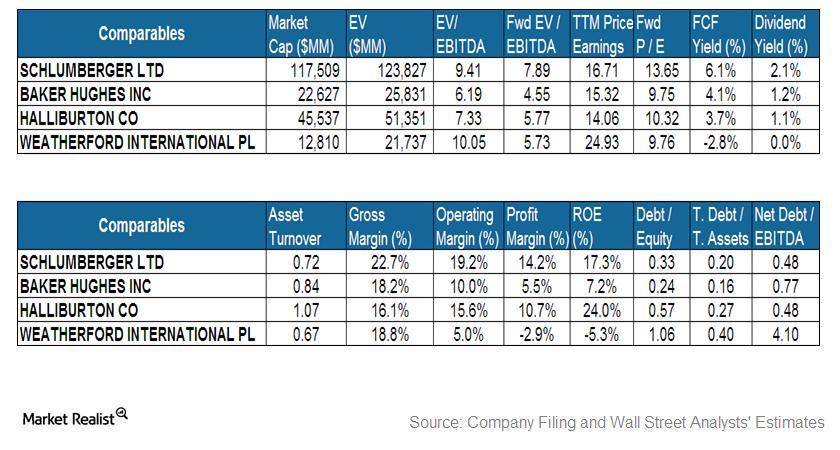

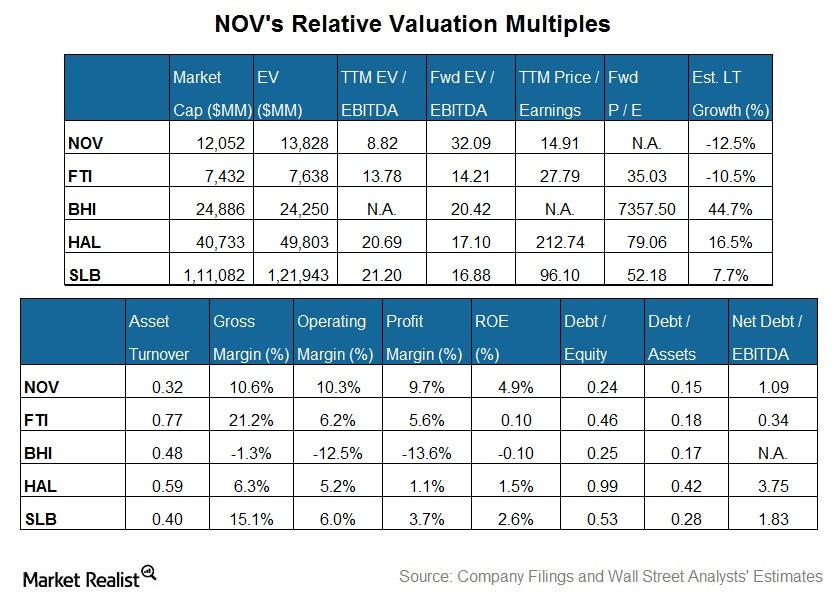

What’s Baker Hughes’s Current Valuation versus Peers?

Baker Hughes, a GE Company (BHGE), is the largest company by market capitalization in our select set of major oilfield services and equipment companies.

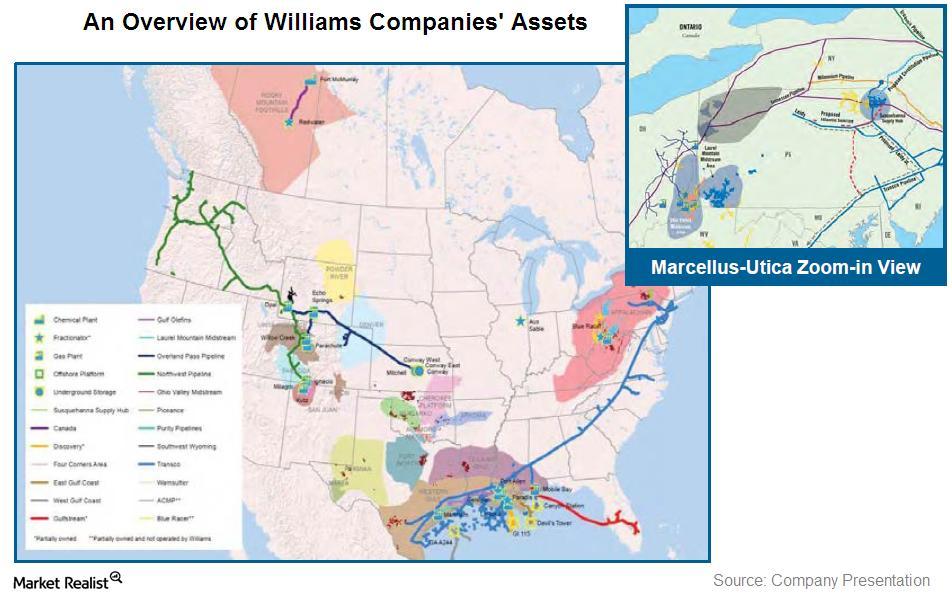

Must-know: An overview of Williams Companies

Williams Companies Inc. (WMB) engages in the energy transport and processing infrastructure business. WMB’s assets are mainly located in the U.S. However, it has operations in Canada.

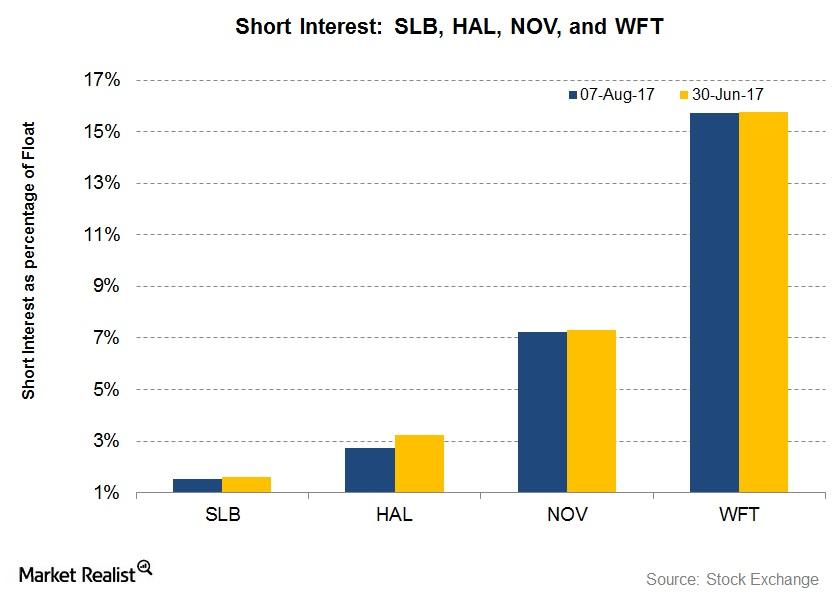

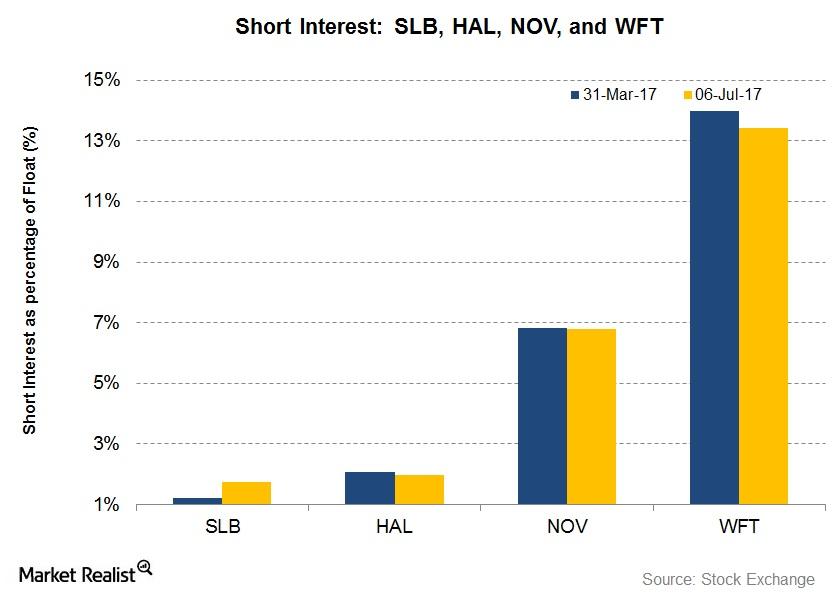

Short Interest in SLB, HAL, WFT, and NOV after 2Q17

The short interest in Schlumberger (SLB), as a percentage of its float, is 1.5% as of August 7, 2017—compared to 1.6% as of June 30, 2017.

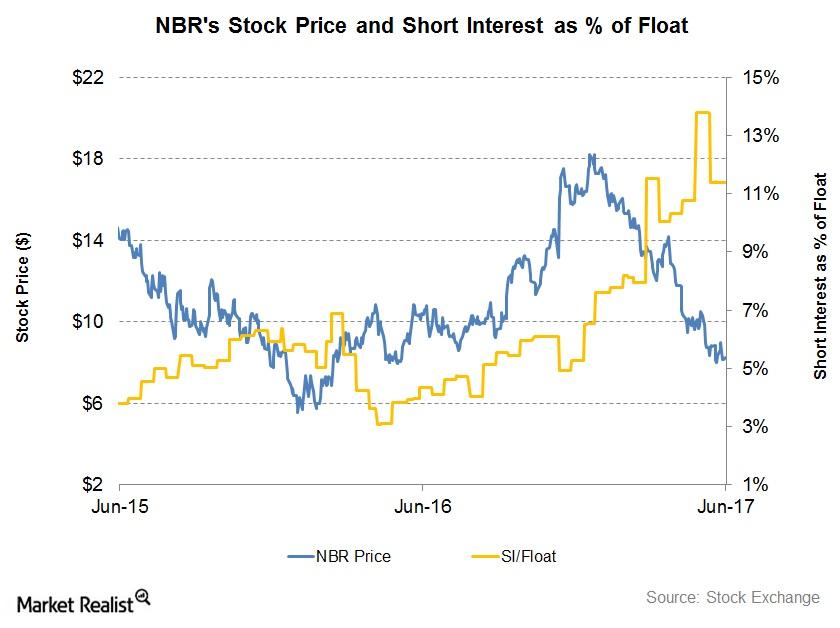

What’s Nabors Industries’ Short Interest as of June 19?

Short interest in Nabors Industries (NBR) as a percentage of its float was 11.4% as of June 19, 2017, compared to 10.1% as of March 31, 2017.

What Are Schlumberger’s SPM Project Plans?

In the past one year, SLB has performed nearly in line with the industry ETF and has hugely underperformed the broader market index.

A quick overview of oil and gas field services biz Schlumberger

Schlumberger Limited is a Houston-based energy company. It provides technology, integrated project management, and information solutions to oil and gas exploration and production (or E&P) companies around the world.

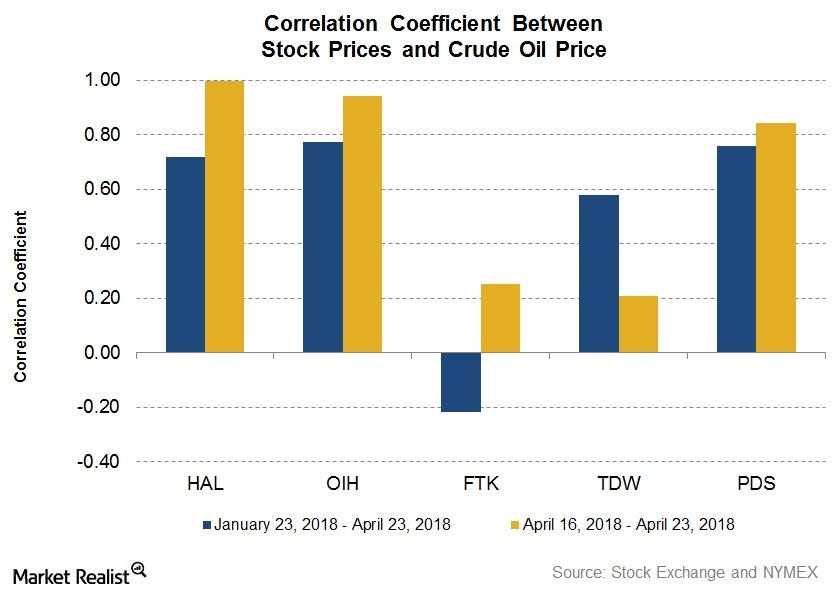

How Halliburton Has Reacted to Crude Oil Prices

Between April 16 and April 23, Halliburton (HAL) stock’s price correlation with crude oil was 0.99, showing that Halliburton and crude oil prices have been strongly correlated in the past week.

What Short Interest in Weatherford Indicates

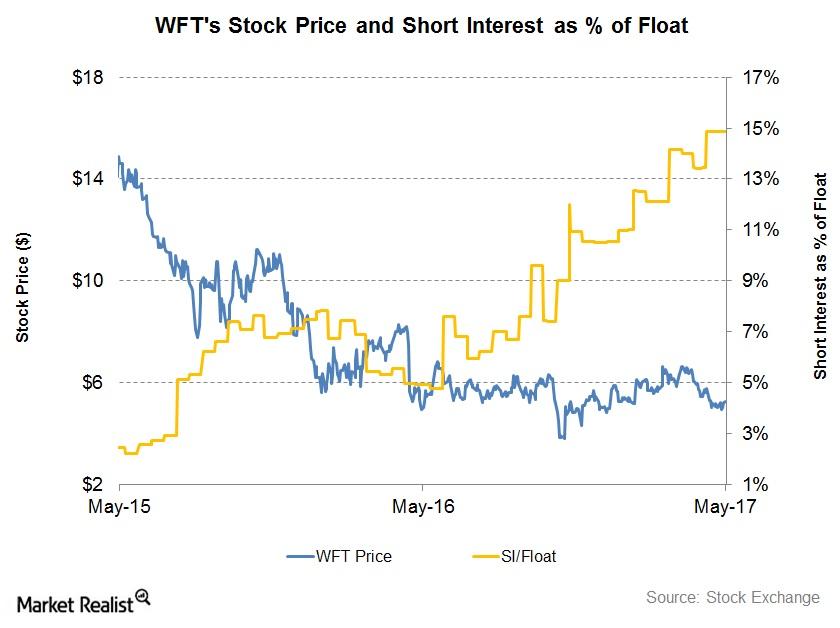

Weatherford International’s (WFT) short interest as a percentage of its float was 14.9% as of May 22, 2017, compared to ~14% as of March 31, 2017.

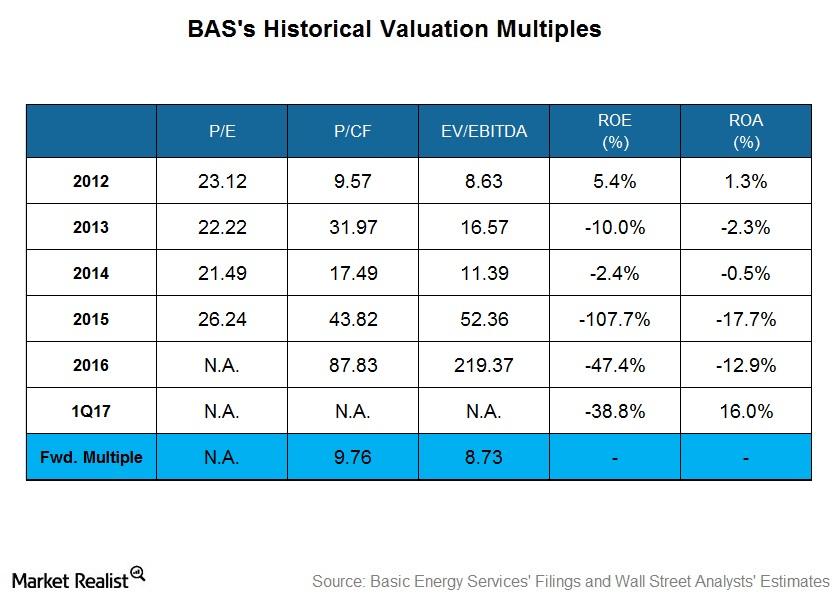

What Does Basic Energy Services’ Historical Valuation Suggest?

On March 31, 2017, Basic Energy Services’ (BAS) stock price had fallen 6% from December 30, 2016.

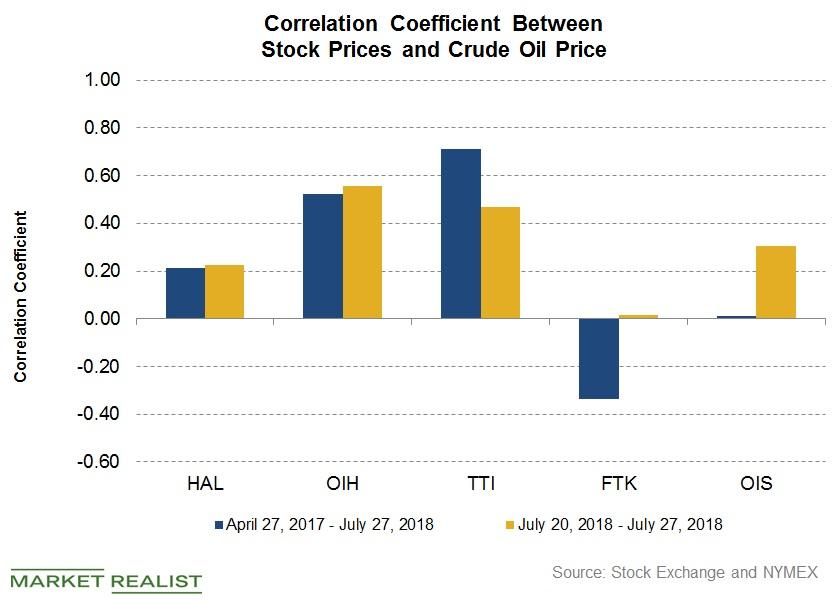

Halliburton Reacts to Changing Crude Oil Prices: Update

Halliburton’s (HAL) stock price correlation with crude oil on July 20–27 was 0.22—a moderately positive correlation.

Schlumberger and Halliburton Compared to the Industry

By market capitalization, Schlumberger is the largest OFS company. Schlumberger’s stock price has declined 4% since May 3, 2017.

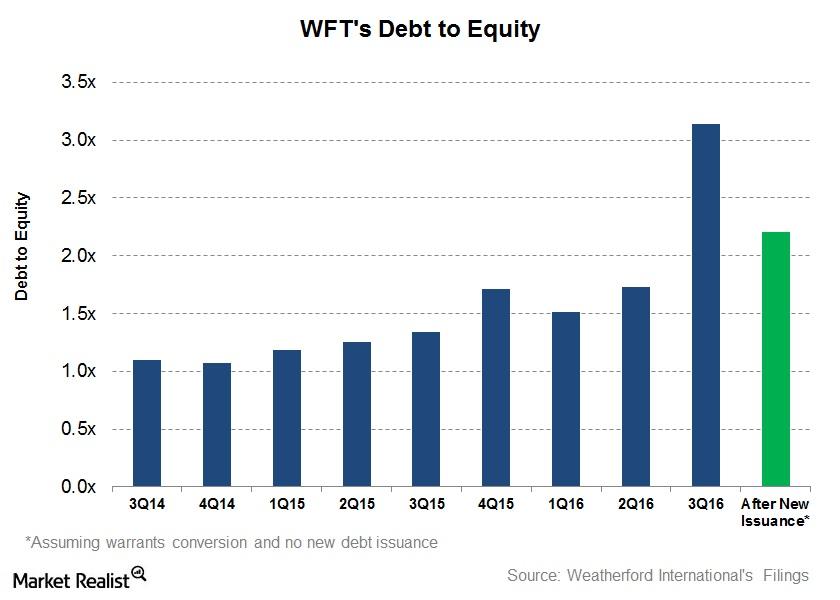

Weatherford International Issues Stocks Again

On November 16, Weatherford International (WFT), an oilfield equipment and services company, disclosed that it issued 84.5 million ordinary stocks.

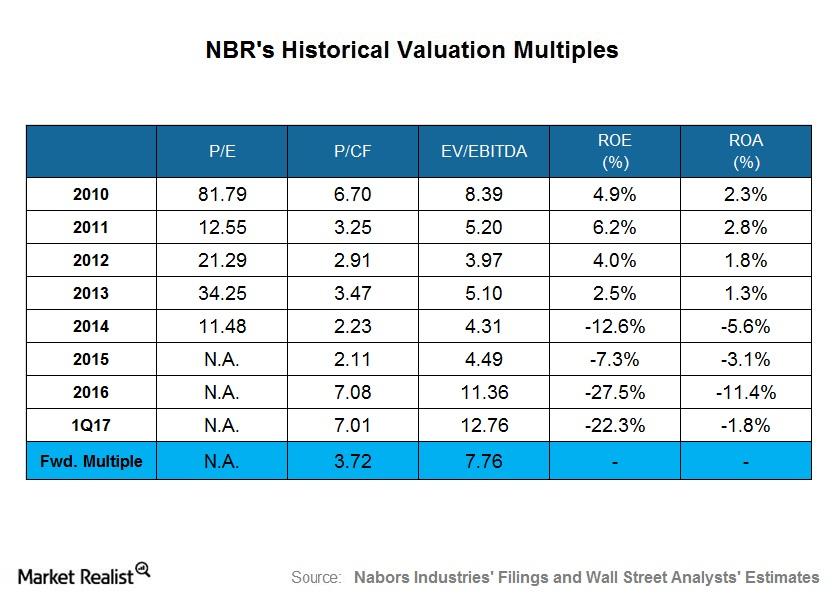

What Nabors Industries’ Historical Valuation Suggests

On March 31, 2017, Nabors Industries (NBR) stock was 20.0% lower than it was on December 30, 2016. In 1Q17, NBR’s adjusted earnings were negative.

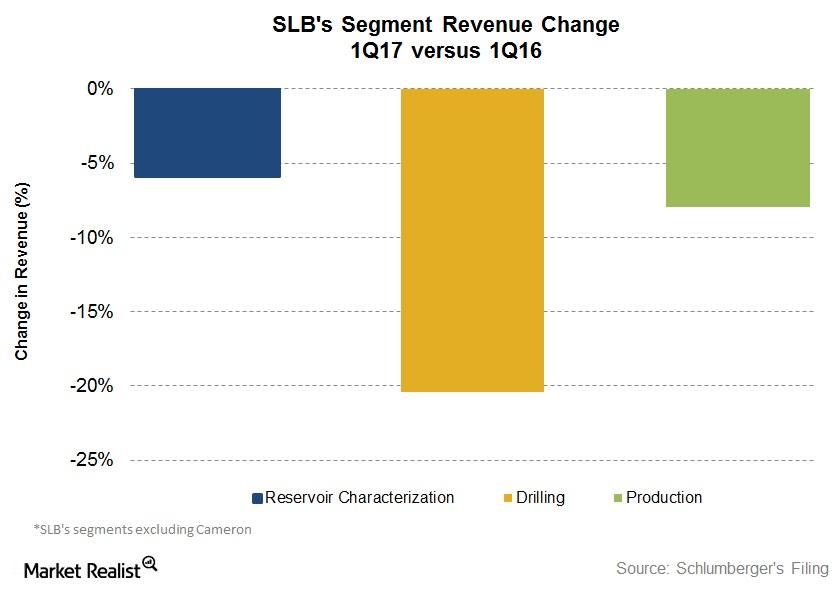

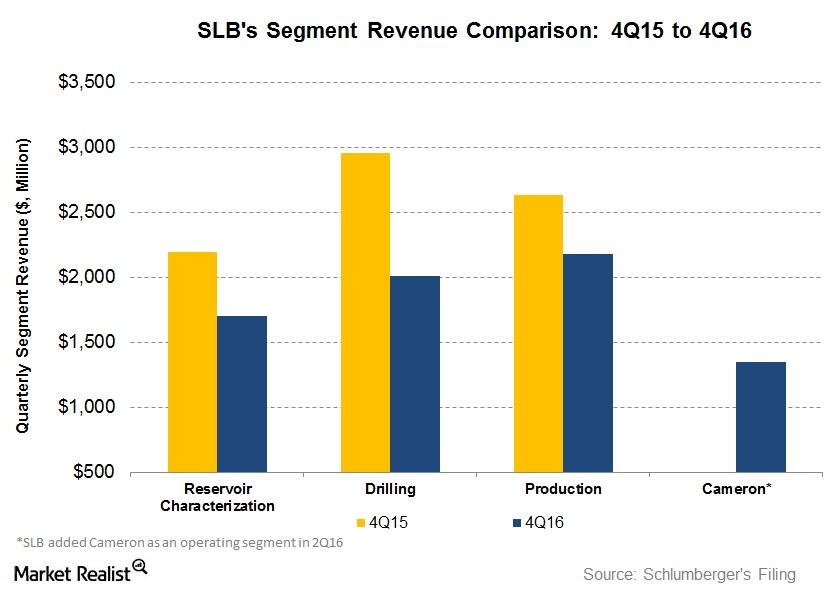

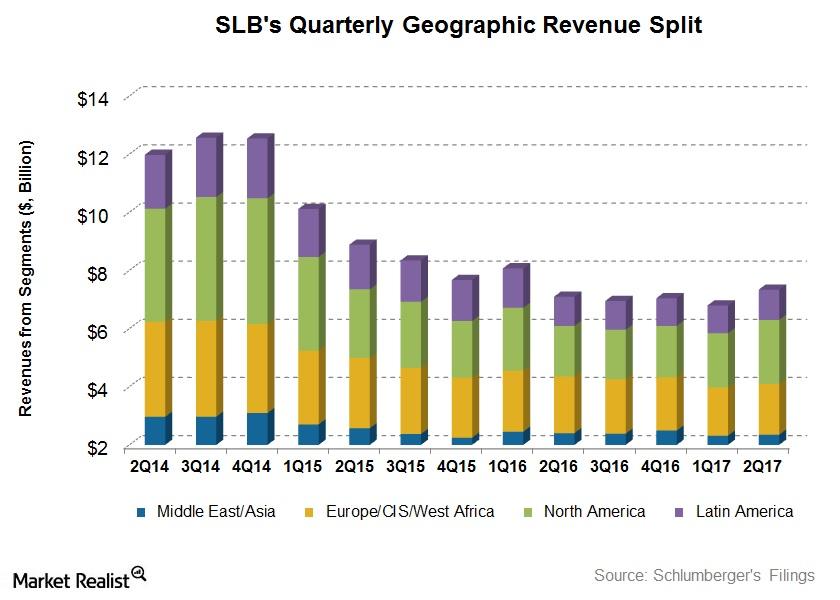

Analyzing Schlumberger’s Growth Drivers in 1Q17

Schlumberger’s (SLB) Drilling segment witnessed the highest revenue fall of 20% in 1Q17—compared to 1Q16. Its Production segment fell ~8%.

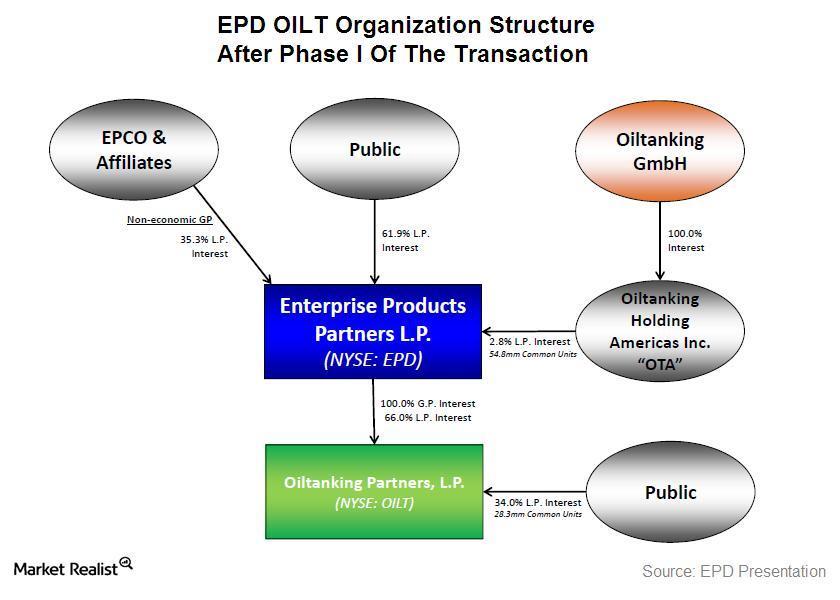

Enterprise Products Partners acquires Oiltanking Partners

On October 1, 2014, Enterprise Products Partners (EPD) announced its acquisition of Oiltanking Partners L.P. (OILT), a midstream energy master limited partnership

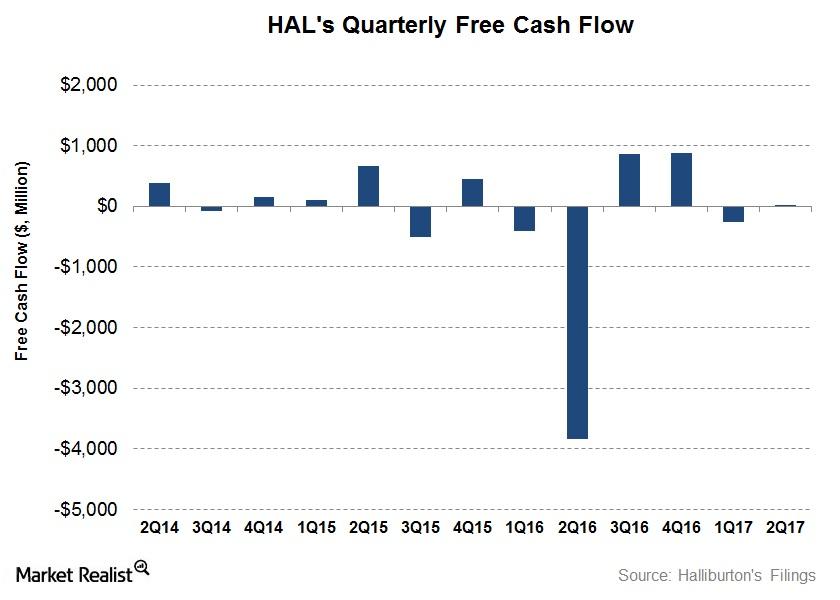

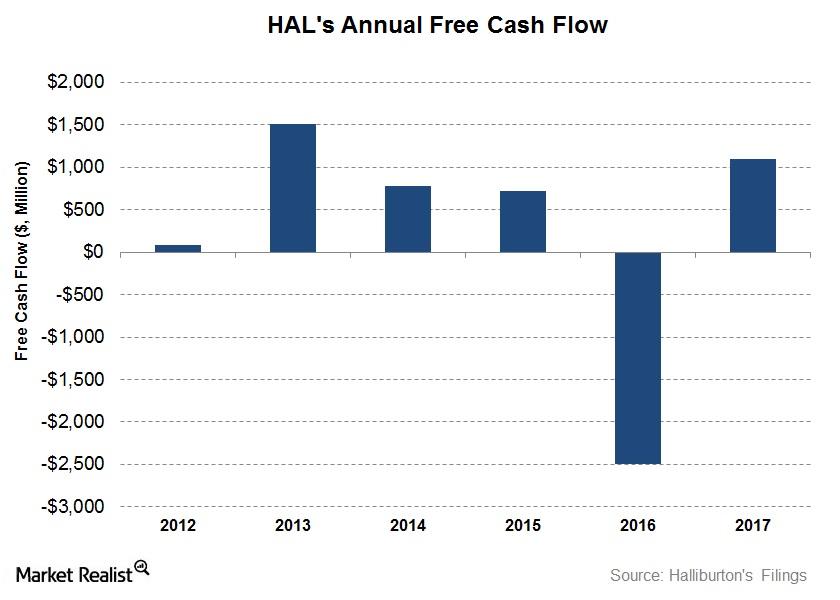

How Halliburton’s Free Cash Flow Turned Around in 2Q17

Halliburton’s (HAL) cash from operating activities (or CFO) in 2Q17 was a huge improvement over 2Q16 as well as an increase over 1Q17.

How Did Halliburton Turn Its Free Cash Flow Positive in 2017?

Halliburton’s (HAL) CFO (cash flow from operating activities) in 2017 was a significant improvement over 2016.

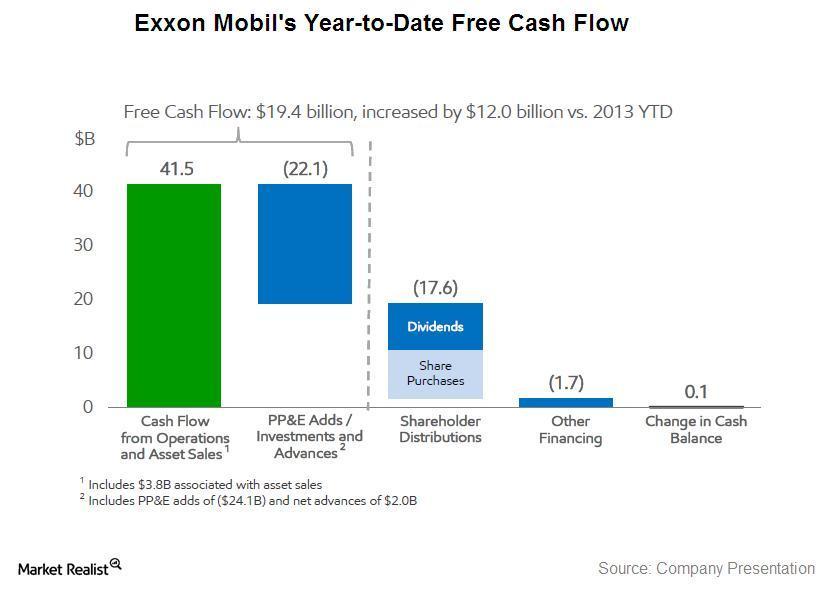

Positive and negative effects on ExxonMobil’s returns

Currently, the biggest concern affecting Exxon Mobil (XOM) and other energy companies is the falling crude price and falling oil and gas production.

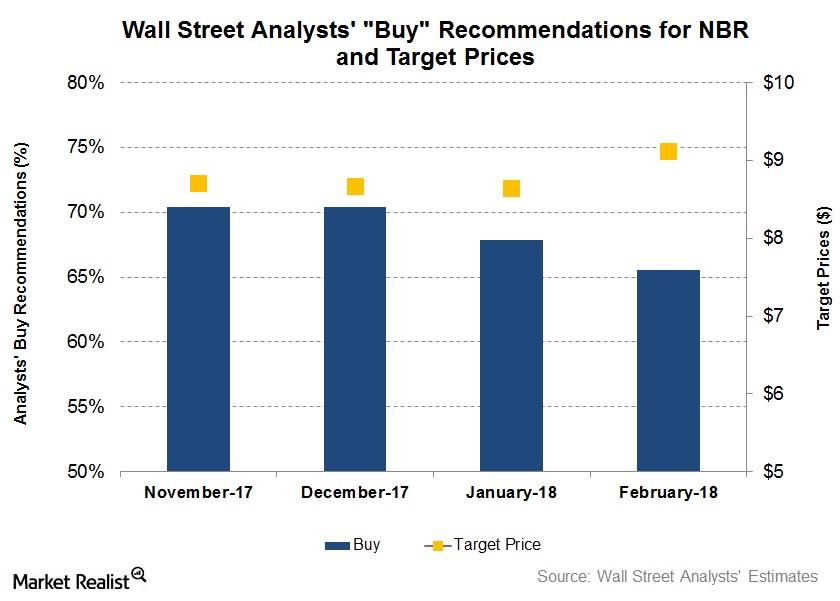

What’s Wall Street’s Forecast for Nabors Industries?

Approximately 66% of the Wall Street analysts tracking Nabors Industries rated it as a “buy” or some equivalent.

The Top 5 Oilfield Companies by Net Debt-To-Equity Ratio

In this series, we’ll analyze the top five OFS (oilfield equipment and service) companies by net debt-to-equity ratio in fiscal 2017.

What’s the Short Interest in Large OFS Companies on July 6?

Short interest in Schlumberger (SLB) as a percentage of its float is 1.2% as of July 6, 2017, compared to 1.2% as of March 31, 2017.

What Could Drive Schlumberger’s Performance in 1Q17 and Beyond?

Schlumberger’s (SLB) Drilling segment witnessed the highest revenue fall of 32% in 4Q16 compared to 3Q16.

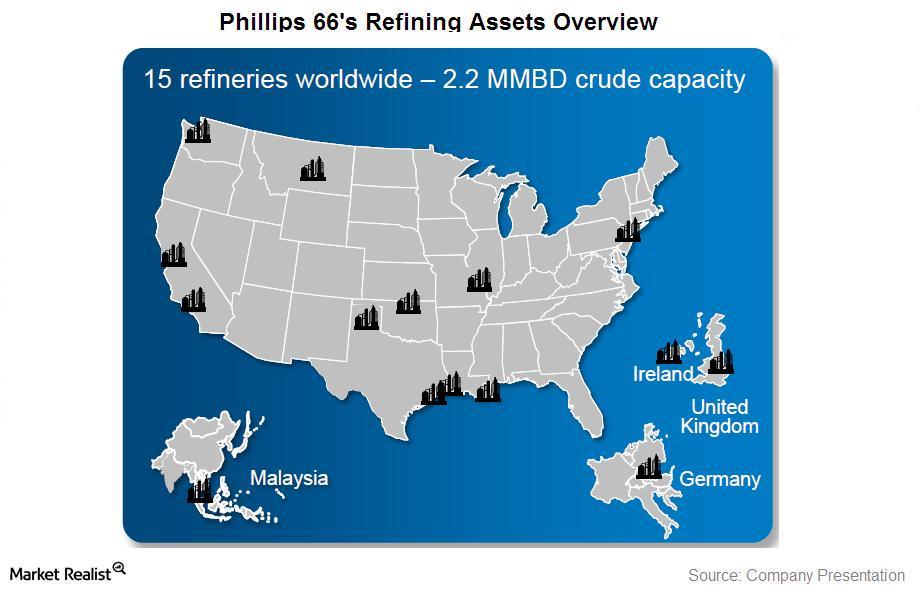

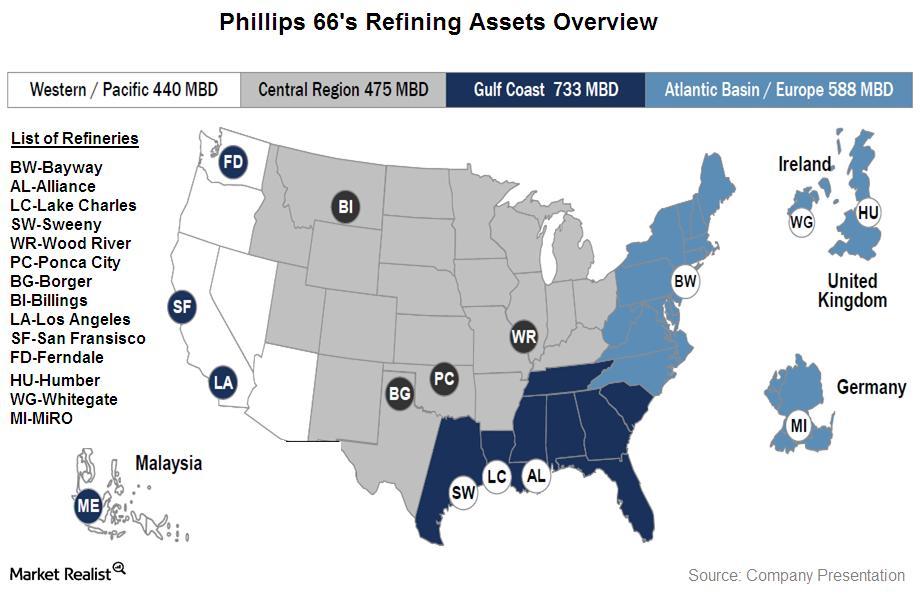

Phillips 66: An overview

In 2013, Phillips 66 generated 67%, 13%, and 6% of its revenues from the United States, the United Kingdom, and Germany, respectively. The company’s other foreign operations contributed ~16%.

Why Schlumberger’s Stock Price Is Bearish

In the past year, Schlumberger’s stock price rose until January 2017. Schlumberger’s revenue fell slowly in the four quarters leading up to 1Q17.

How Weatherford Stock Moved in the Week Ended November 17

Weatherford International (WFT) stock fell 16.0% in the week ended November 17, 2017. The VanEck Vectors Oil Services ETF (OIH) generated a return of -6.0% during this period.

Must-read comparison: Schlumberger and its peers

Schlumberger’s yearly price-to-earnings ratio is in line with the group. Haliburton has the lowest price-to-earnings ratio.

What Were Schlumberger’s Drivers in 2Q17?

In 2Q17, Schlumberger reported a net loss of ~$74 million—a sharp improvement compared to 2Q16 when it reported a net loss of $2.16 billion.

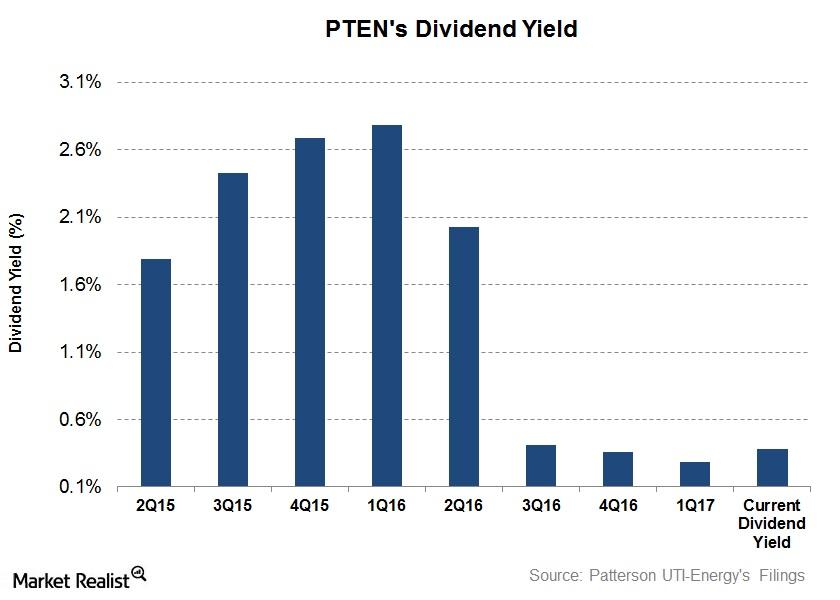

Patterson-UTI Energy’s Dividend Yield on June 2

Patterson-UTI Energy’s (PTEN) dividend yield fell to 0.29% on March 31, 2017. Since then, its dividend yield has risen to 0.38% as of June 2, 2017.

How National Oilwell Varco’s Valuation Stacks Up with Peers

National Oilwell Varco’s TTM PE (price-to-earnings) multiple of ~15x is lower than its peer average in the group.

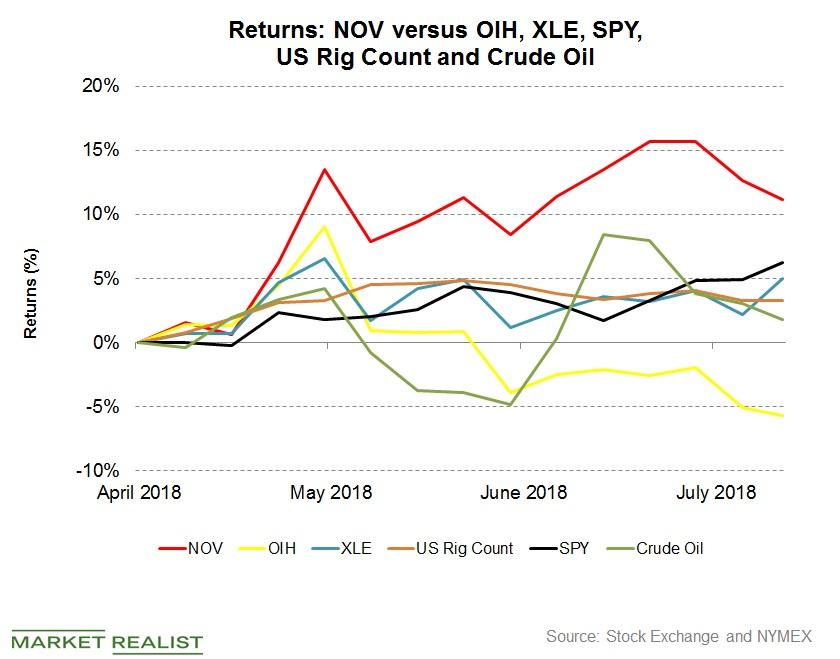

National Oilwell Varco’s Q2 2018 Earnings and the Market

Since April 26 when National Oilwell Varco released its Q1 2018 financial results, NOV stock has risen 10%.

Must-know: An introduction to Phillips 66

Phillips 66 (PSX) is an energy company. It’s based in Texas. Phillips 66 started operating independently as a publicly-traded company on April 4, 2012, when it separated from ConocoPhillips (or COP).

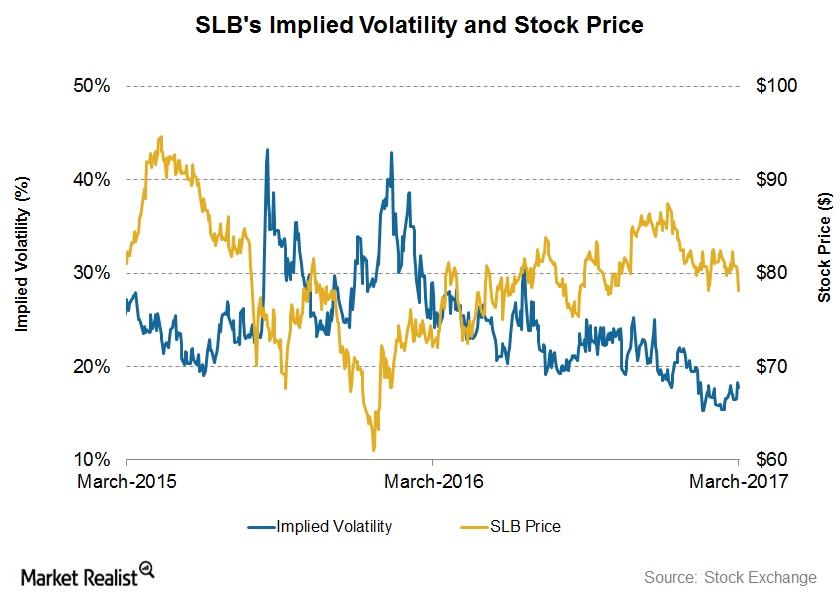

Schlumberger by Implication: Reading Implied Volatility

On March 10, 2017, Schlumberger’s (SLB) implied volatility was 17.7%, having fallen from 19% since its 4Q16 financial results were announced on January 20.

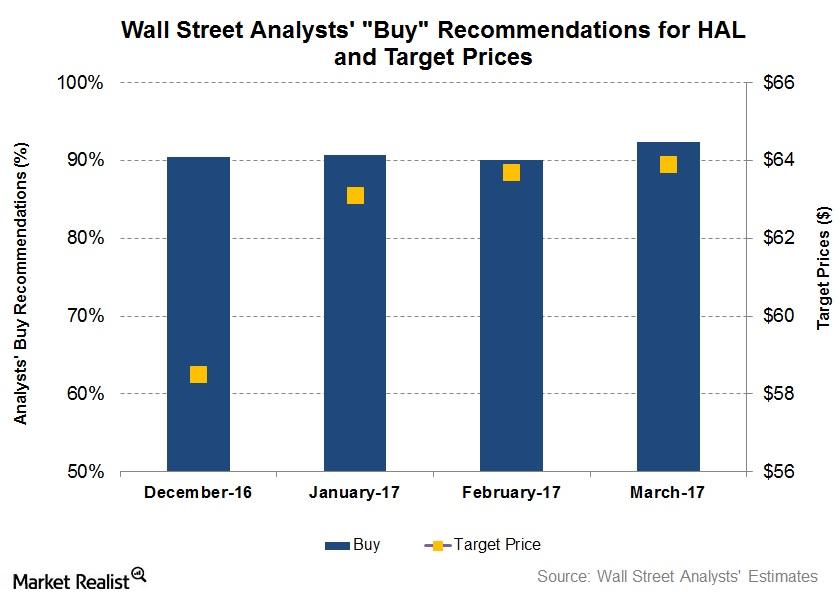

What Do Analysts Recommend for Halliburton?

On March 24, 92% of the analysts tracking Halliburton rated it as a “buy,” ~5% rated it as a “hold,” and 3% rated it as a “sell.”

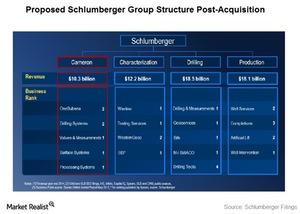

Schlumberger and Cameron International: a Complementary Team

Schlumberger and Cameron are contemplating a merger because their drilling and production systems would be integrated from “pore to pipeline.”

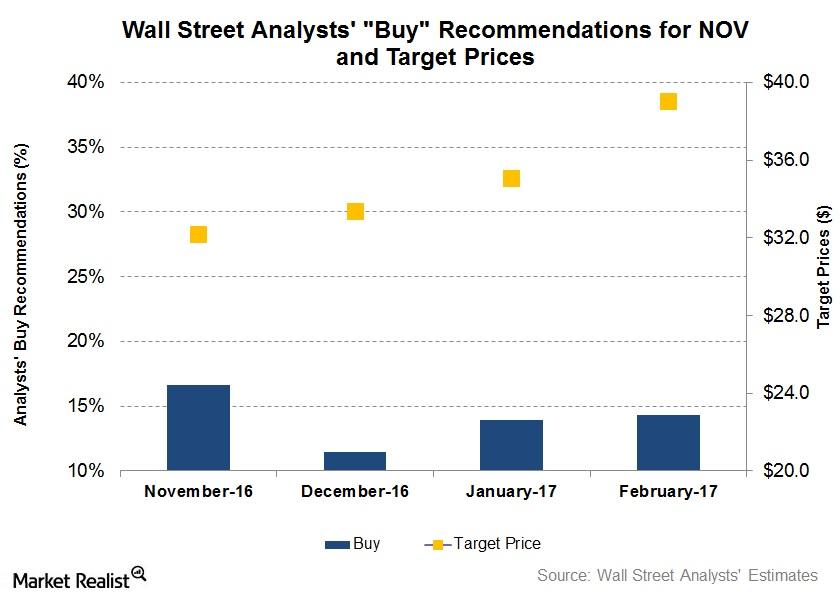

Wall Street Analysts’ Forecasts for National Oilwell Varco

On February 24, ~14% of the analysts tracking National Oilwell Varco rated it as a “buy,” ~74% rated it as a “hold,” and 12% rated it as a “sell.”

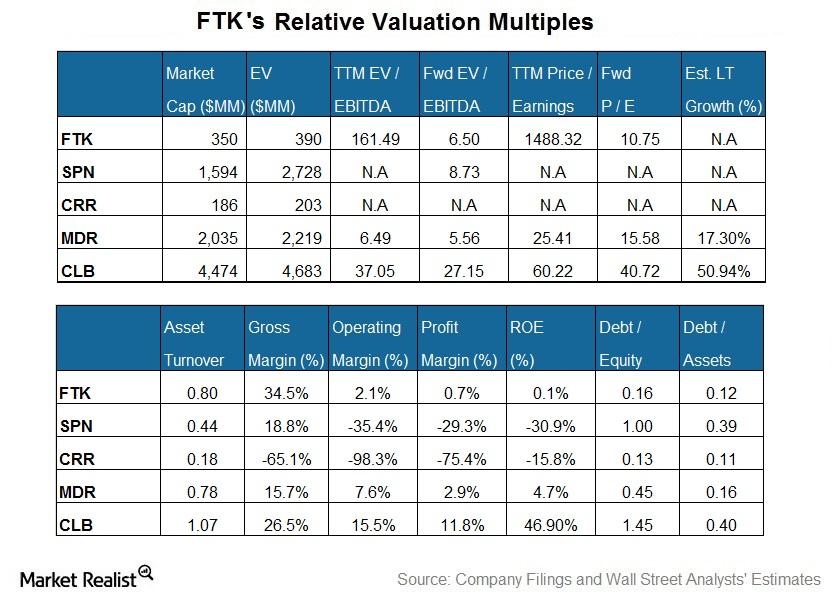

Flotek Industries’ Current Valuation versus Its Peers

Sell-side analysts expect Flotek’s adjusted EBITDA to rise sharper in the next four quarters compared to its peers.

Analyzing Weatherford International’s 2Q17 Performance

In 1H17, Weatherford’s revenues fell 8%—compared to 1H16. It managed to lower its net losses significantly during this period.