Alex Chamberlin

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Alex Chamberlin

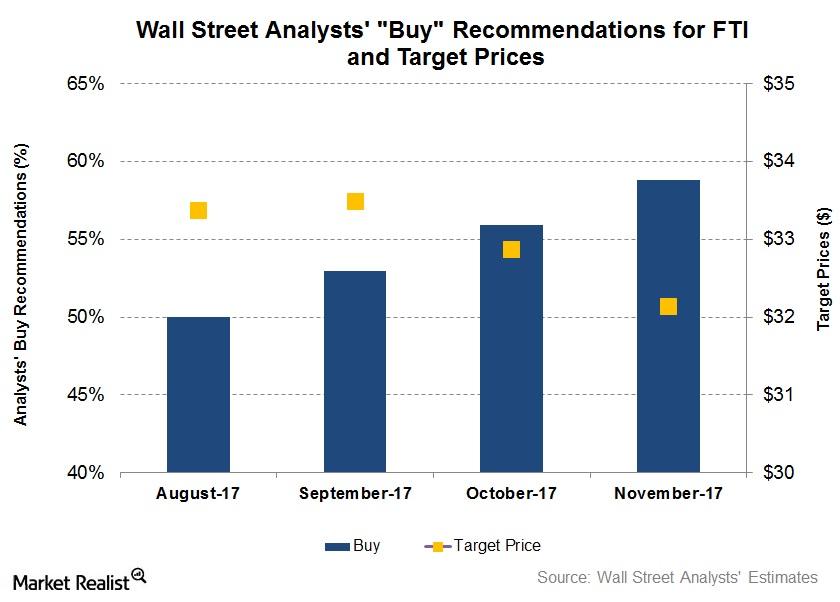

Wall Street Analysts’ Recommendations for TechnipFMC

In this article, we’ll look at Wall Street analysts’ recommendations for TechnipFMC (FTI) on November 9.

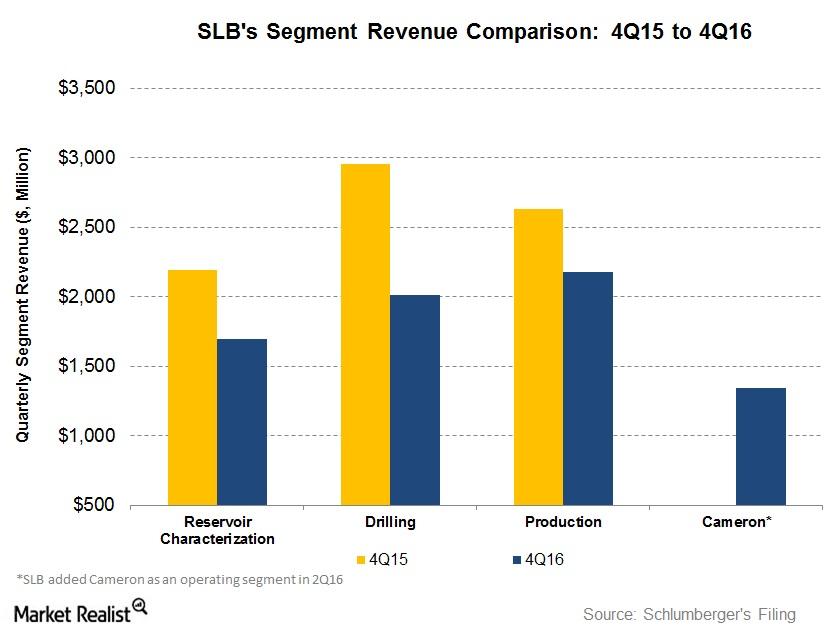

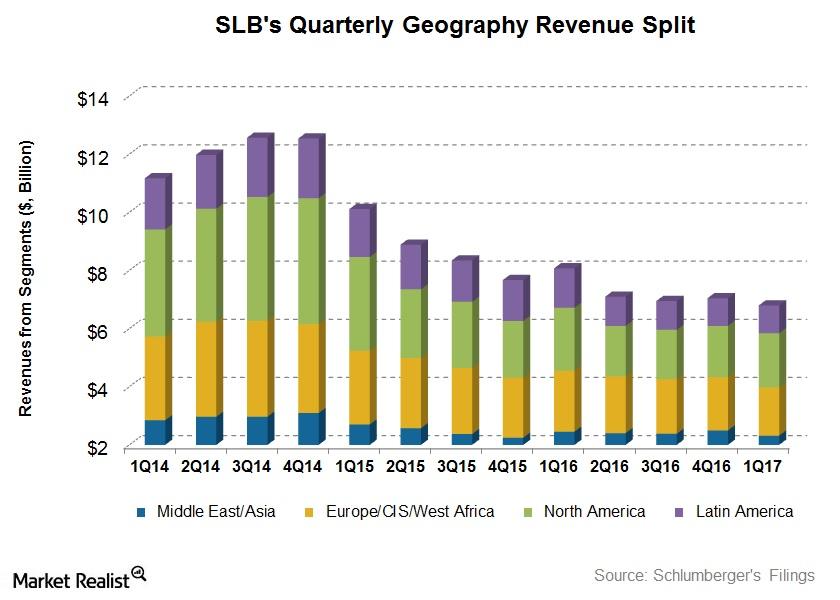

Analyzing the Factors Affecting Schlumberger’s Revenue

Schlumberger’s Drilling segment witnessed the highest revenue fall at 32% in 4Q16 compared to 4Q15. The segment was followed by the Reservoir Characterization and Production segments.

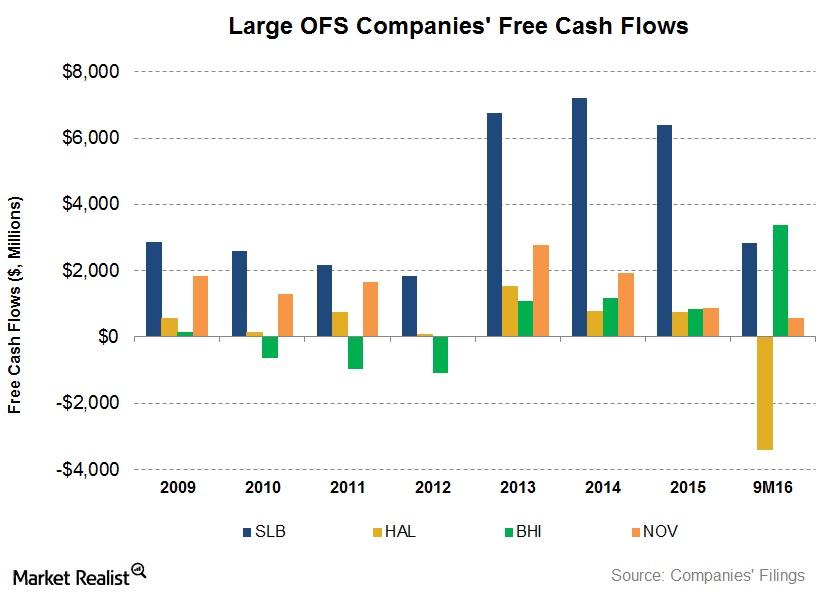

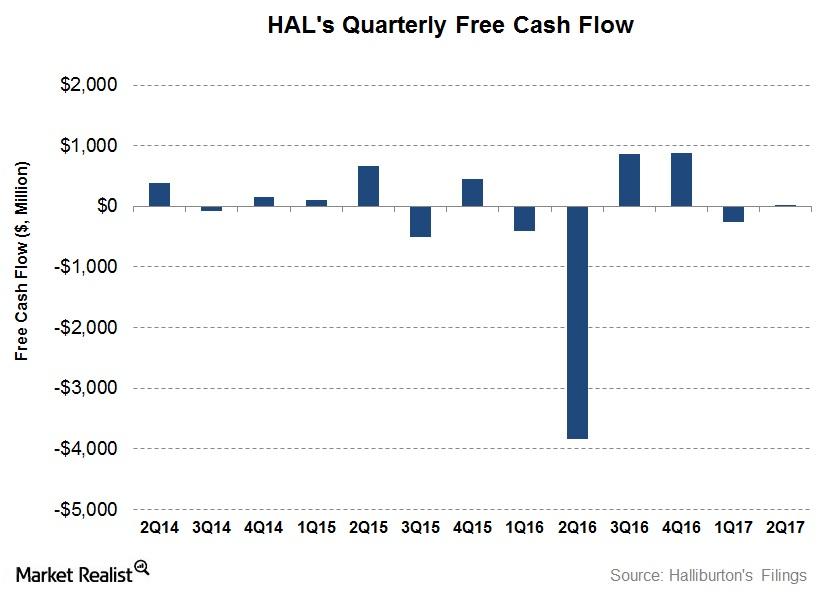

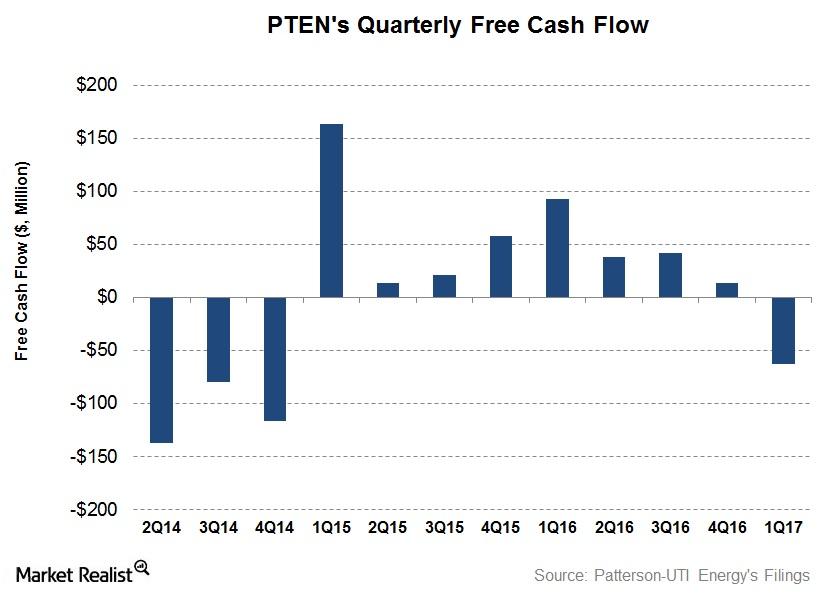

Free Cash Flow Trends: Are OFS Companies Burning Cash?

Many oilfield equipment and services (or OFS) companies’ cash flows have taken a beating following the energy price weakness in the past two years.

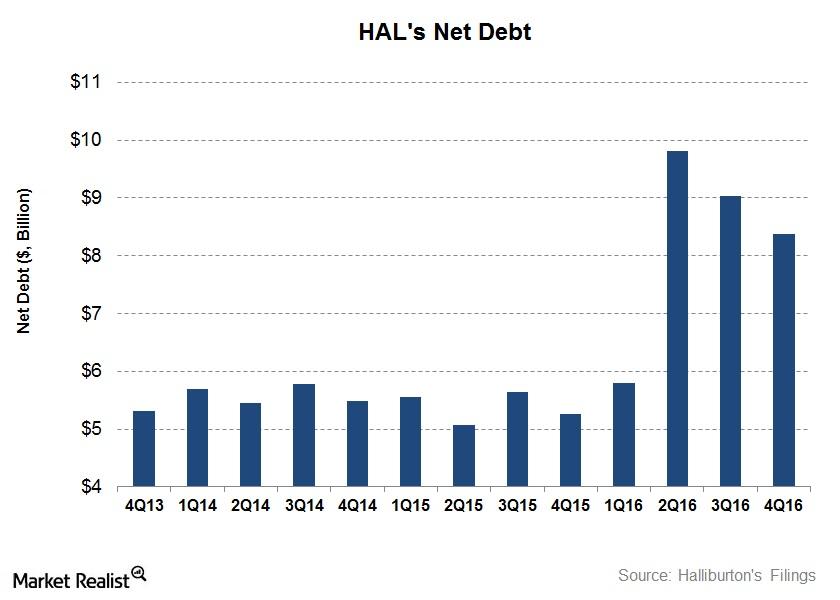

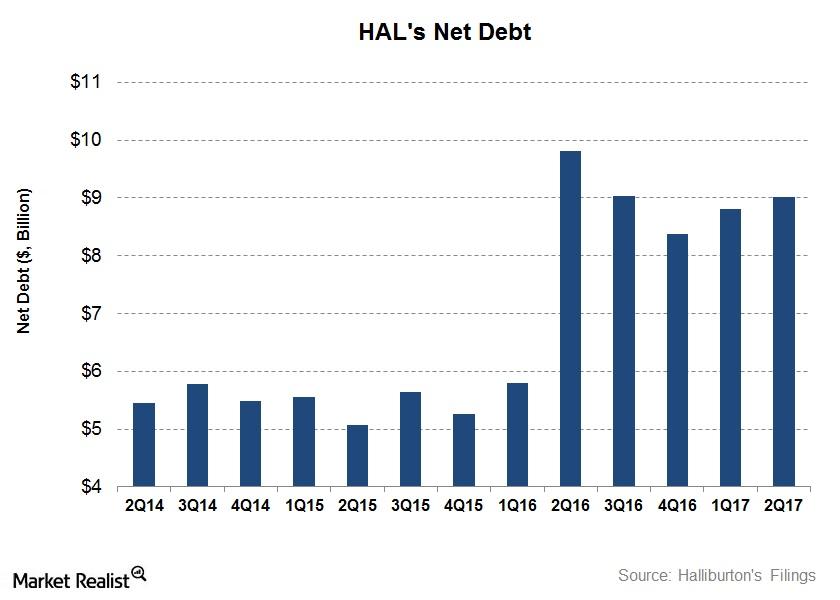

A Look at What’s Happening to Halliburton’s Debt

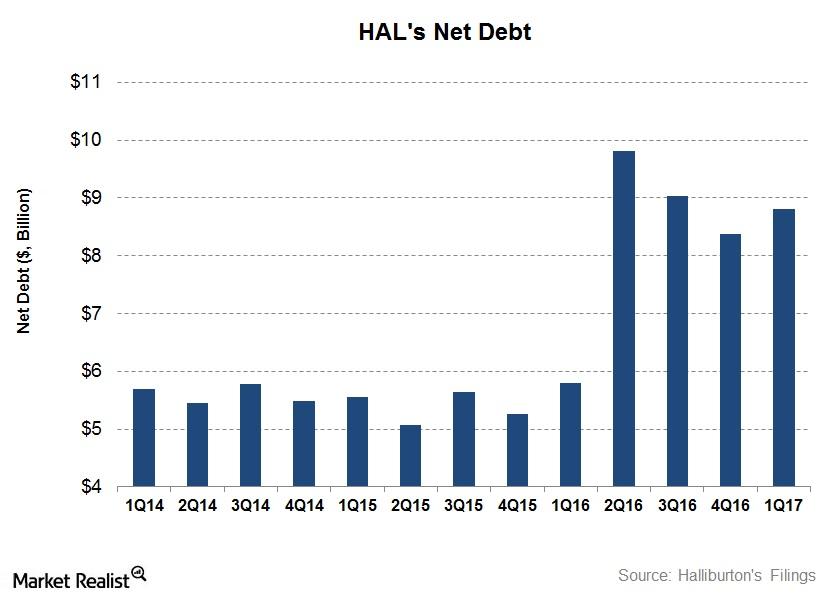

In 4Q16, Halliburton’s total debt fell 19% compared to a year earlier, and its cash and marketable securities fell 60%. In effect, its net debt rose 59% to ~$8.4 billion as of December 30, 2016.

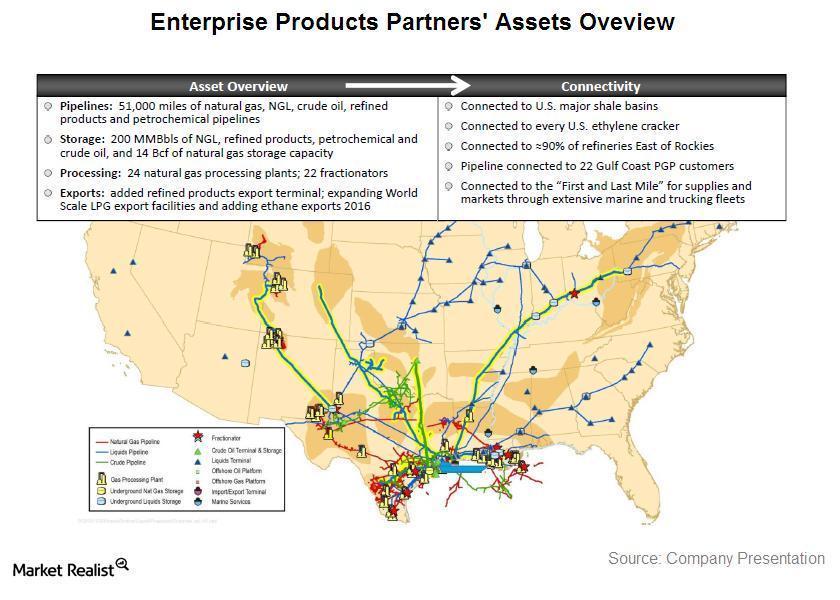

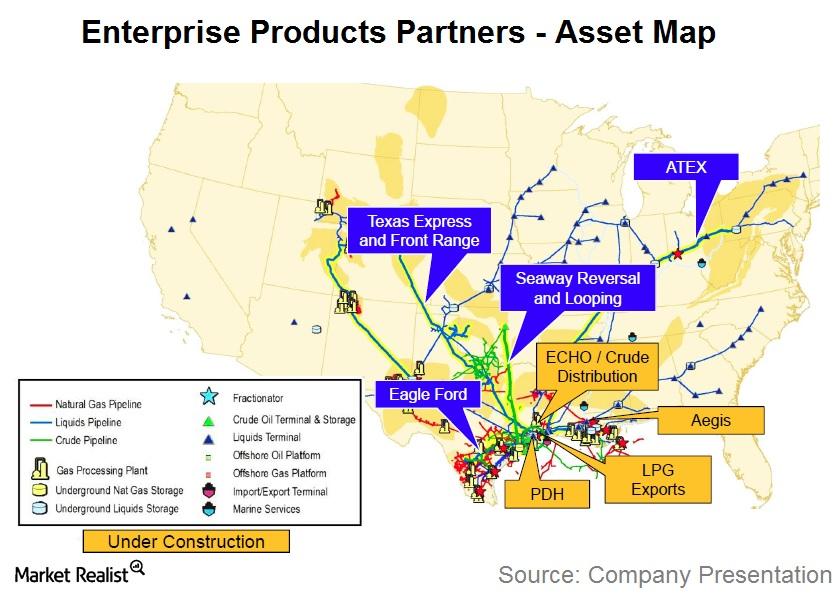

Why Enterprise Products Partners is important to investors

EPD is a leading midstream service provider in the natural gas, natural gas liquids (or NGLs), crude oil, petrochemicals, and refined products sectors.

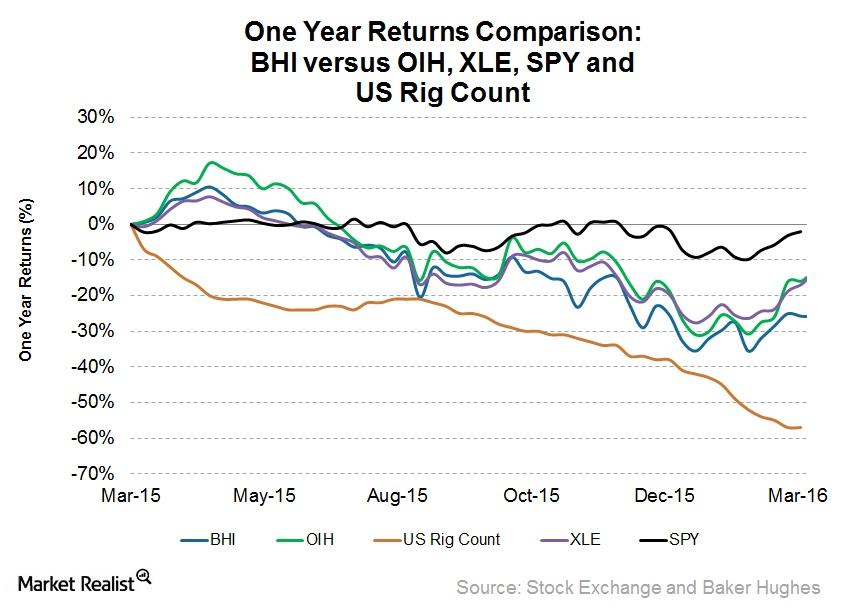

Why Did Baker Hughes Underperform the Industry ETFs?

Oilfield equipment and services companies like Baker Hughes (BHI) are affected by rig counts and energy prices. In the past year, West Texas Intermediate crude oil prices have dropped ~16%.

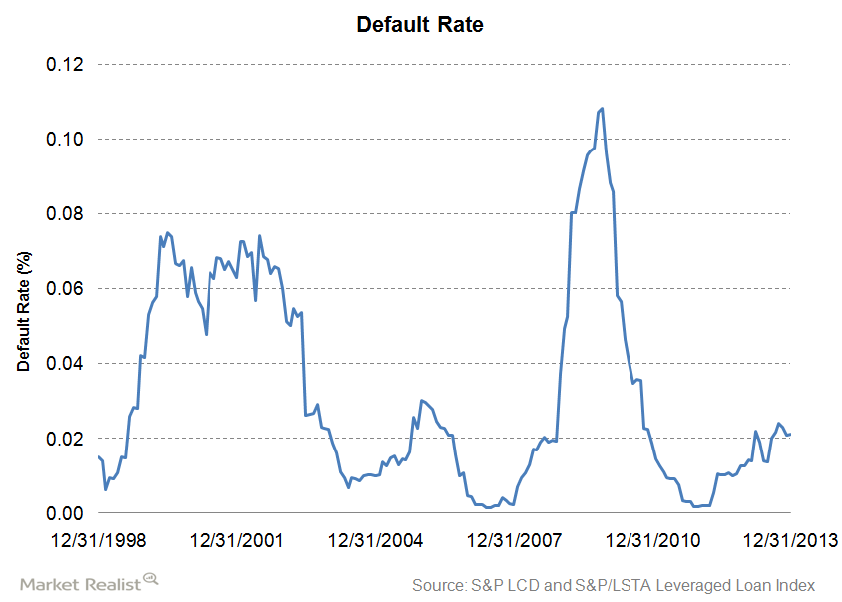

The default rate and its relation to bond and loan prices

Default rate is a key metric of credit risk and is defined as the risk that the counterparty will default on its financial obligations.

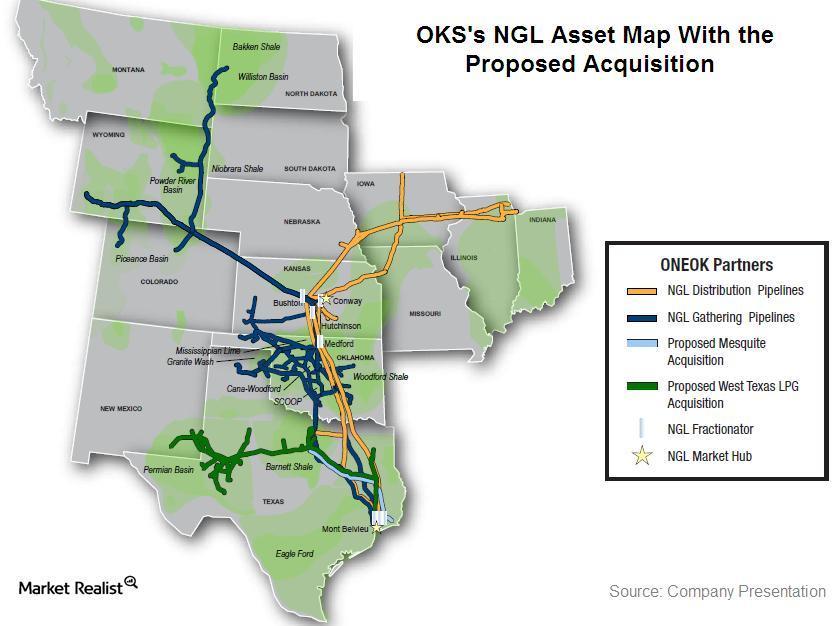

Why ONEOK Partners acquires Permian assets from Chevron

On October 27, ONEOK Partners (OKS) announced that it agreed to acquire Chevron Corporation’s (CVX) natural gas liquids (or NGLs) pipeline assets.

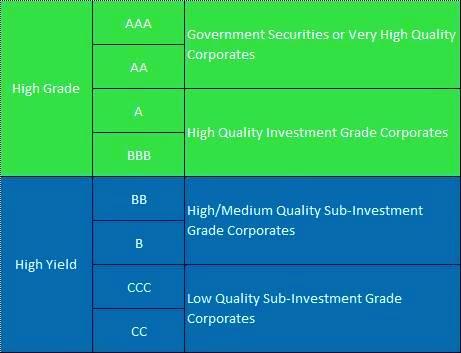

Must know: How credit rating affects default rate and bond price

A lower credit rating means higher risk, and therefore, higher yield as investors look for the premium to take the risk and vice versa.

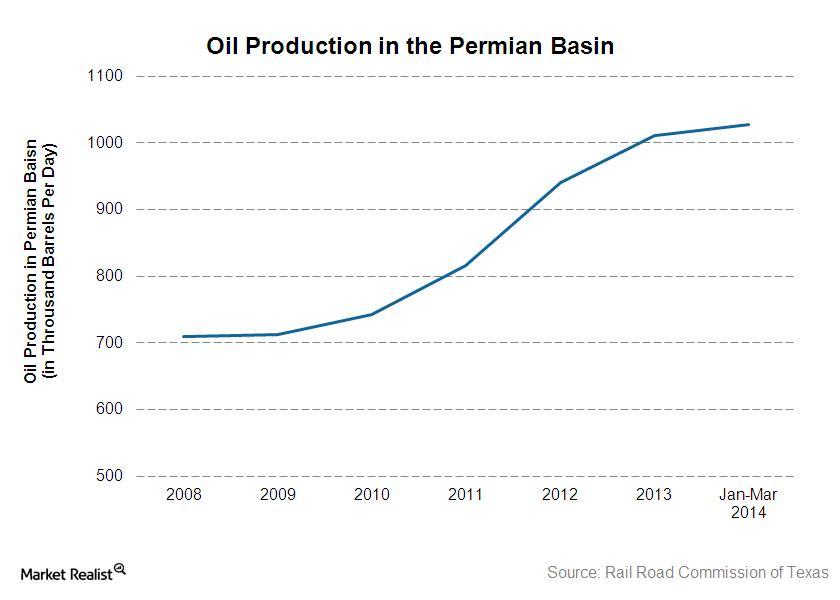

Why oil and natural gas production in the Permian should increase

According to the Energy Information Administration’s short-term energy outlook published in June 2014, crude oil production will average 8.4 million barrels per day in 2014.

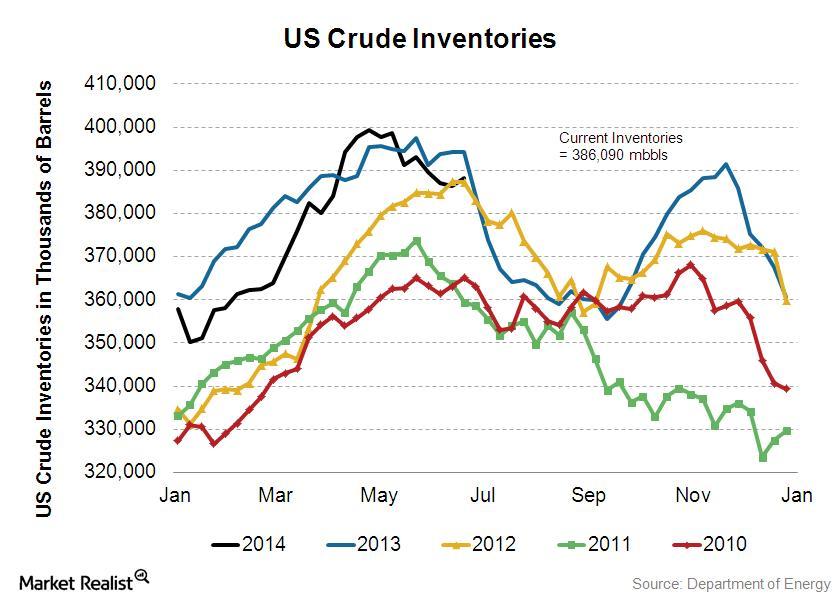

Must-know: Why crude oil inventories can affect prices

Every week, the U.S. Energy Information Administration (or EIA) reports figures on crude inventories, or the amount of crude oil stored in facilities across the United States.

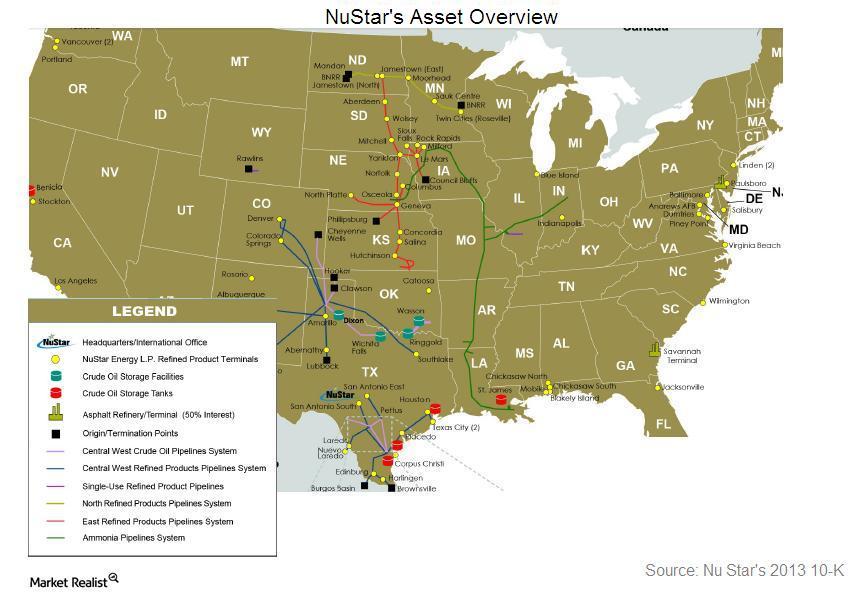

A must-know introduction to NuStar Energy and its assets

On April 24, 2014, NuStar Energy, a master limited partnership operating in the midstream energy space, presented its earnings for the first quarter of 2014.Financials Fixed income ETFs: The longer the duration, the higher the loss

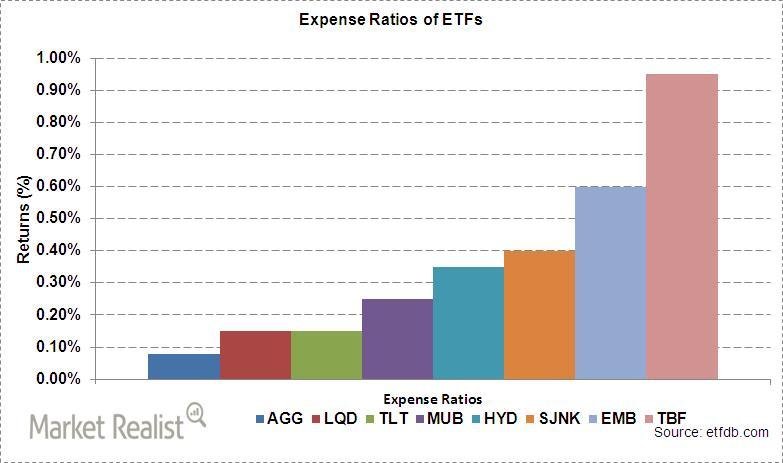

The higher the expense ratio, the deeper the decline in an investment’s value. Also, the higher the period of investment, the greater the impact of expense ratios due to the compounding effect.

Must-know: Important costs involved in owning an ETF

Owning an ETF comes with some fees. These fees are called “expense ratios” because they’re expressed as a percentage of a fund’s assets.Financials Why bid-ask spread costs are so important to ETF investors

Other than the operating costs of an ETF, the other hidden cost that affects the return for investors is the bid-ask spread.Financials Why expense ratios affect ETF investors’ returns

To see how expense ratios can affect investments over time, let’s compare the returns of several fixed income ETFs that differ only in expense ratio.Financials Must-know: Why expense ratios have affected TLT and MUB

We note that net or effective returns (that is, returns after expenses) fall to 7.95% versus perceived returns of 8.44% for TLT for the past three years.

Key points from Enterprise Products Partners’ analyst day meeting

Enterprise Products Partners (EPD) is one of the largest master limited partnerships operating in the midstream energy space.

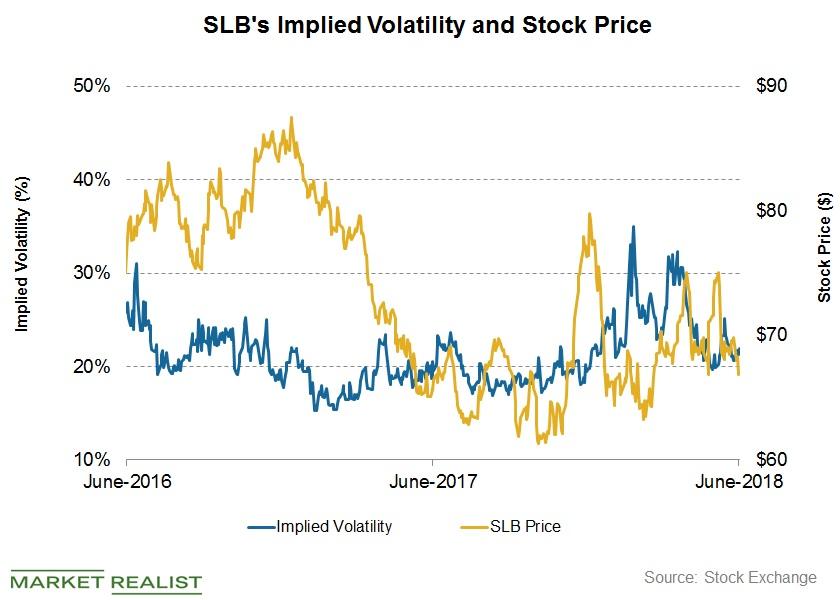

Schlumberger’s Stock Price Forecast this Week

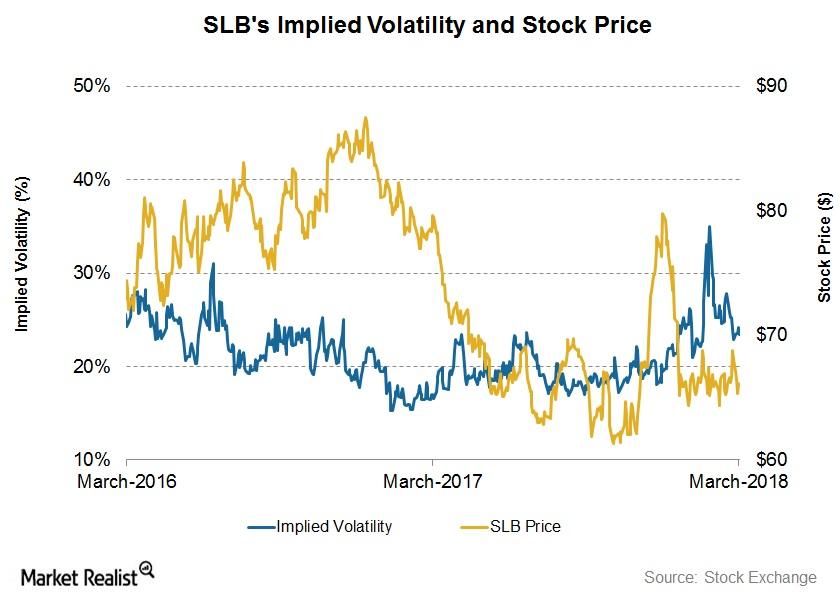

Schlumberger’s (SLB) first-quarter financial results were released on April 20. Between April 20 and June 15, Schlumberger’s implied volatility fell from 24.1% to 22%.

Why Weatherford’s 1Q18 Earnings Beat Estimates

Weatherford International released its 1Q18 earnings results today.

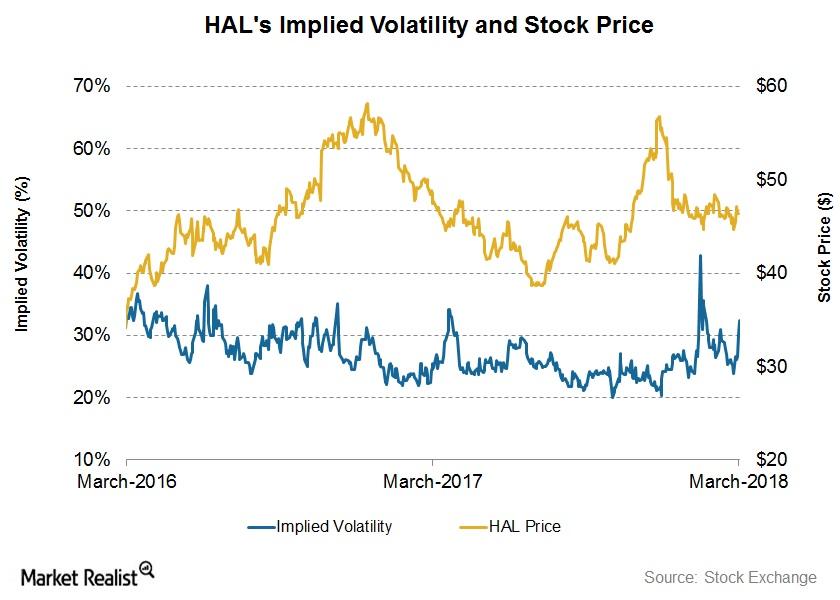

Halliburton’s Next 7-Day Stock Price Forecast

Halliburton stock will likely close between $48.52 and $44.36 in the next seven days—based on its implied volatility.

What’s Schlumberger’s 7-Day Stock Price Forecast?

On January 19, 2018, Schlumberger’s (SLB) 4Q17 financial results were released.

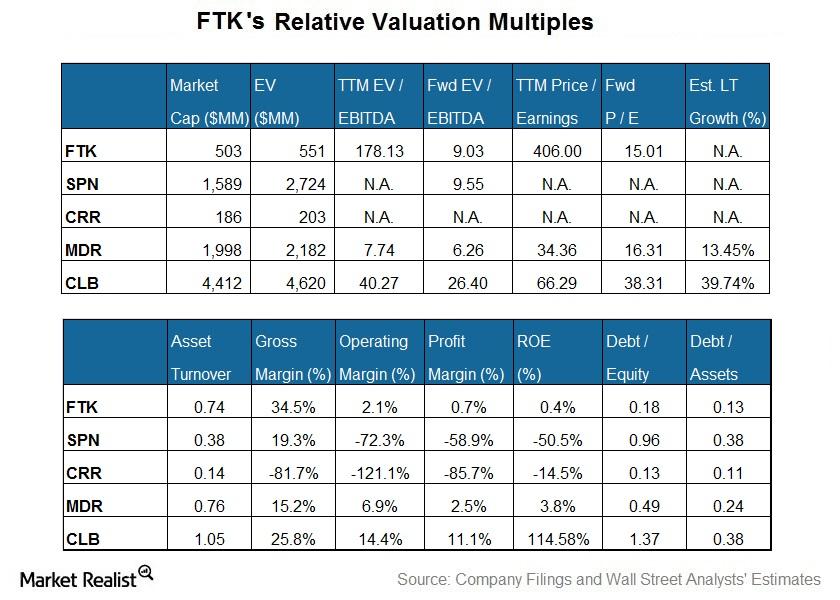

Ranking OFS Companies by Their Valuation Multiples

Flotek Industries’ (FTK) forward EV-to-EBITDA multiple is at the steepest discount to its current EV-to-EBITDA multiple on March 9, 2018.

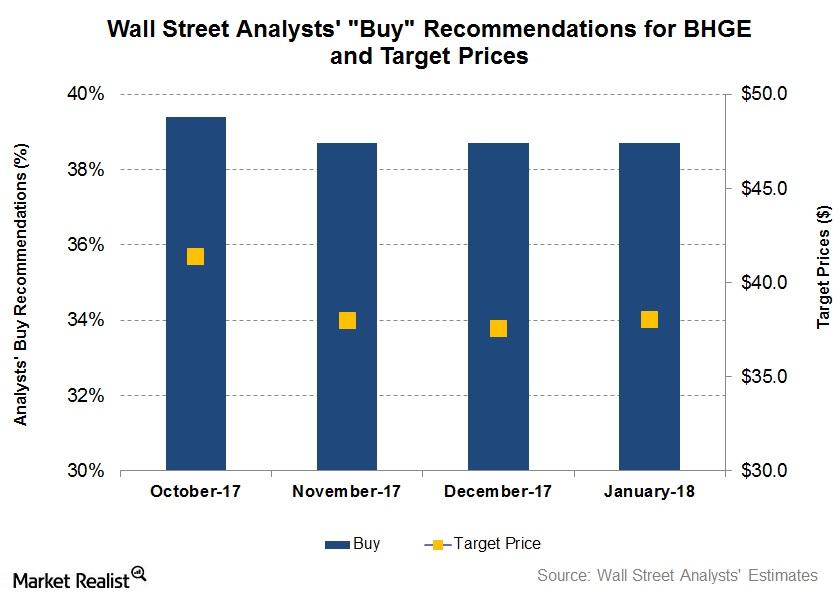

Wall Street’s Forecasts for Baker Hughes after Its 4Q17 Earnings

In this article, we’ll look at Wall Street analysts’ forecasts for shares of Baker Hughes, a GE company (BHGE) following its 4Q17 earnings release.

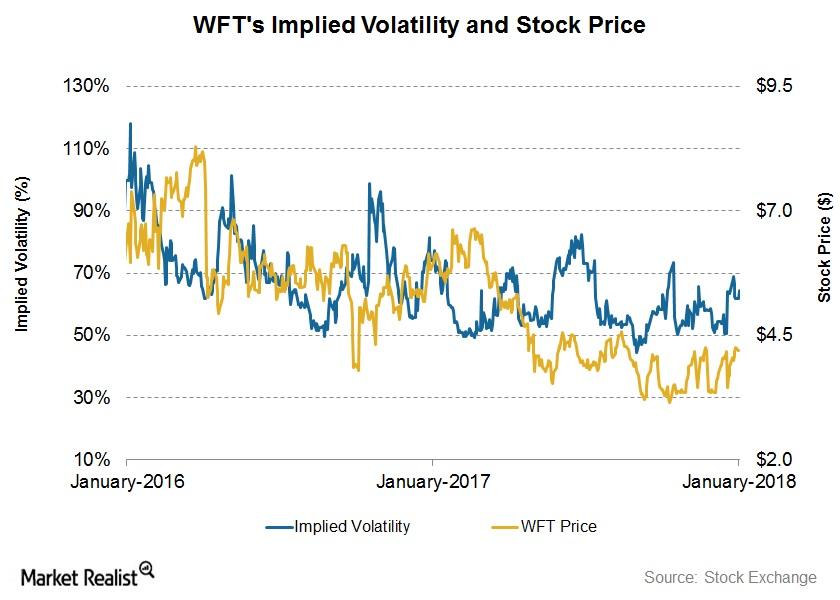

Weatherford’s Stock Price Forecast

On January 16, Weatherford International’s (WFT) implied volatility (or IV) was ~64%. Its 3Q17 earnings were announced on November 1, 2017. Since then, its implied volatility has increased from 54% to the current level.

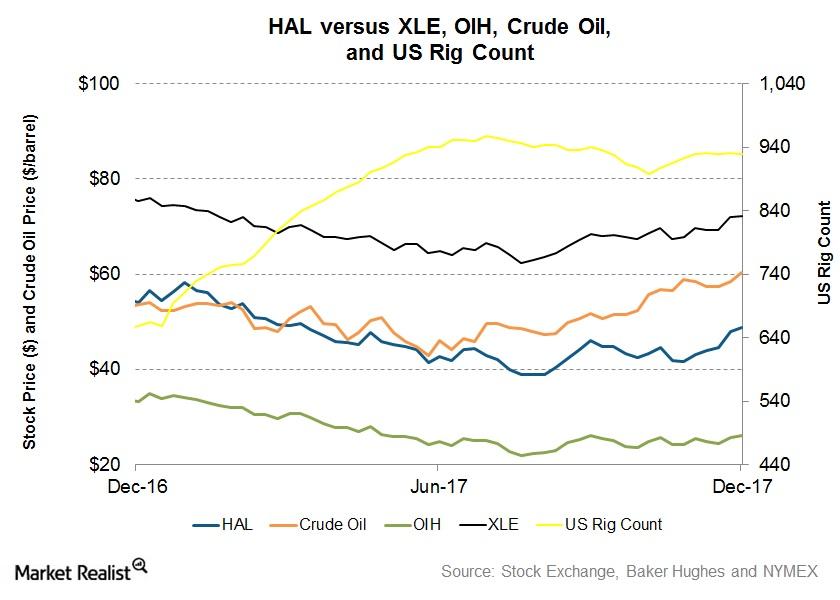

Halliburton’s 1-Week Returns on December 29

Halliburton’s (HAL) one-week stock price was 1.8% higher until December 29, 2017. Since December 22, the Energy Select Sector SPDR ETF (XLE) has risen 0.4%.

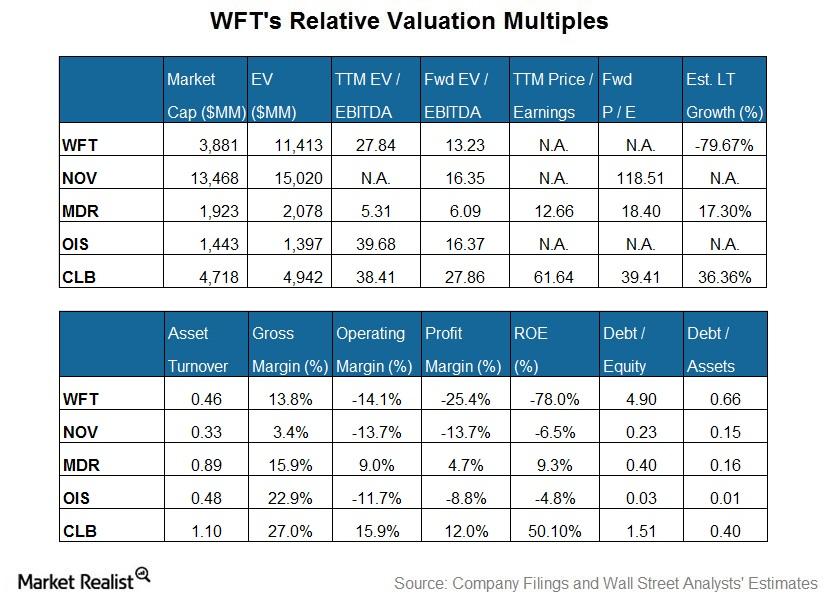

Weatherford International’s Valuation Compared to Its Peers

Weatherford International’s (WFT) EV (enterprise value) when scaled by a trailing 12-month adjusted EBITDA is close to the peer average in our group.

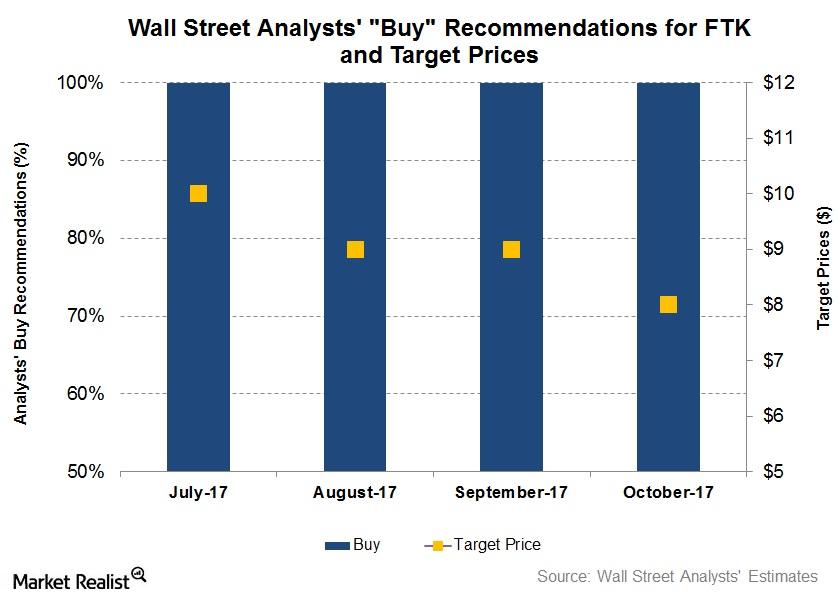

Wall Street’s Forecast for Flotek Industries before Its 3Q17 Earnings

On October 16, 2017, all analysts tracking Flotek Industries rated it as a “buy” or some equivalent.

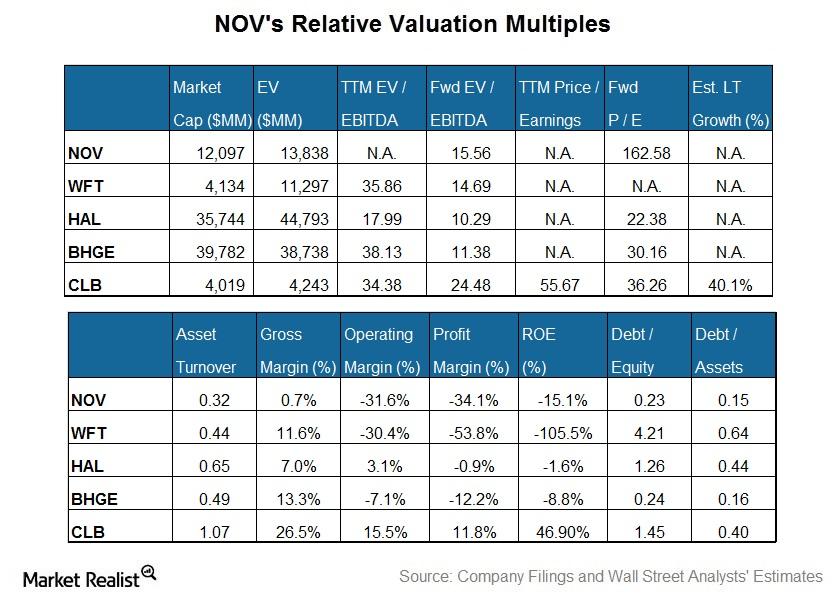

National Oilwell Varco’s Valuation Compared to Its Peers

National Oilwell’s valuation, expressed as the TTM PE (price-to-earnings) multiple, isn’t available due to its negative adjusted earnings.

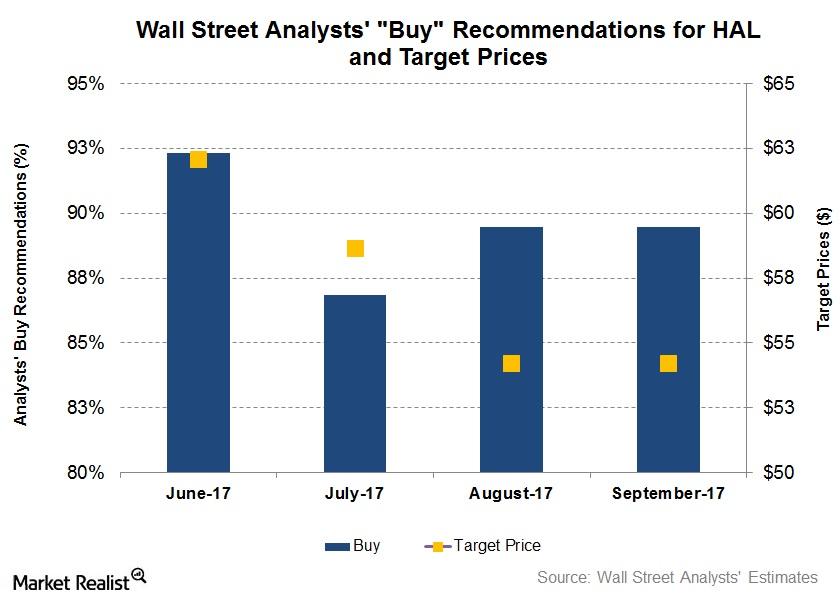

What Wall Street Analysts Are Recommending for Halliburton

On September 5, 2017, 89.0% of Wall Street analysts who are tracking Halliburton stock rated it a “buy” or some equivalent.

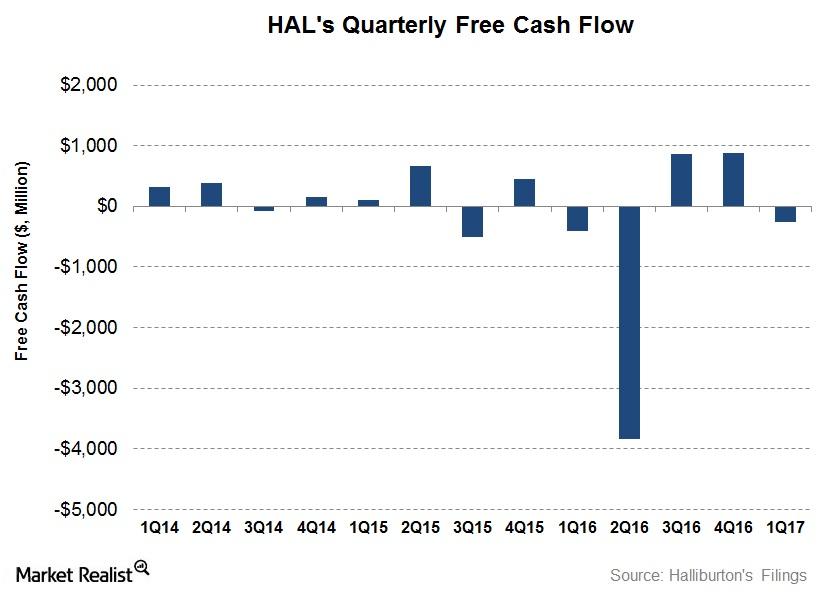

Behind Halliburton’s Free Cash Flow, Capex, and Acquisition Strategies

Halliburton’s (HAL) CFO (cash from operating activities) in 2Q17 showed a remarkable improvement over 2Q16. HAL’s CFO was a $346 million in 2Q17.

Understanding Halliburton’s Net Debt after 2Q17

In 2Q17, Halliburton’s (HAL) total debt fell 14% from 2Q16, while its cash and marketable securities fell 31%.

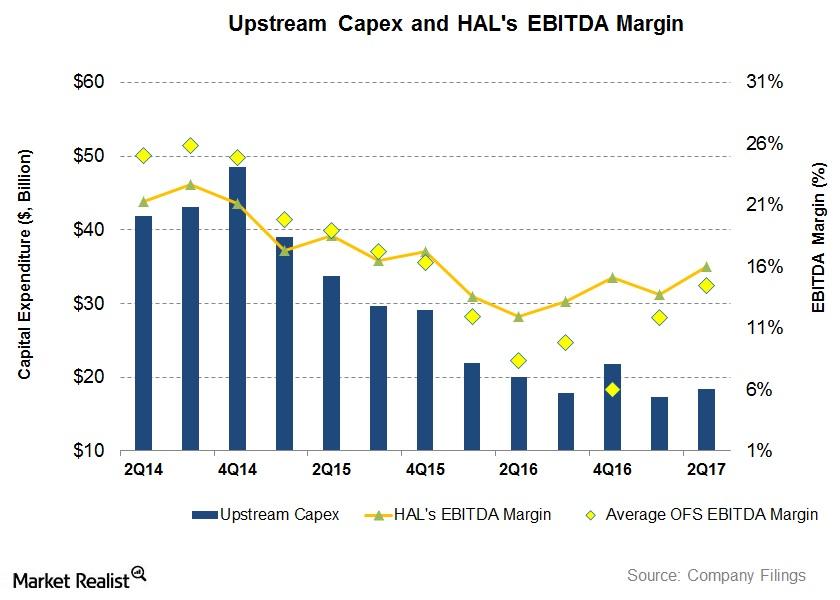

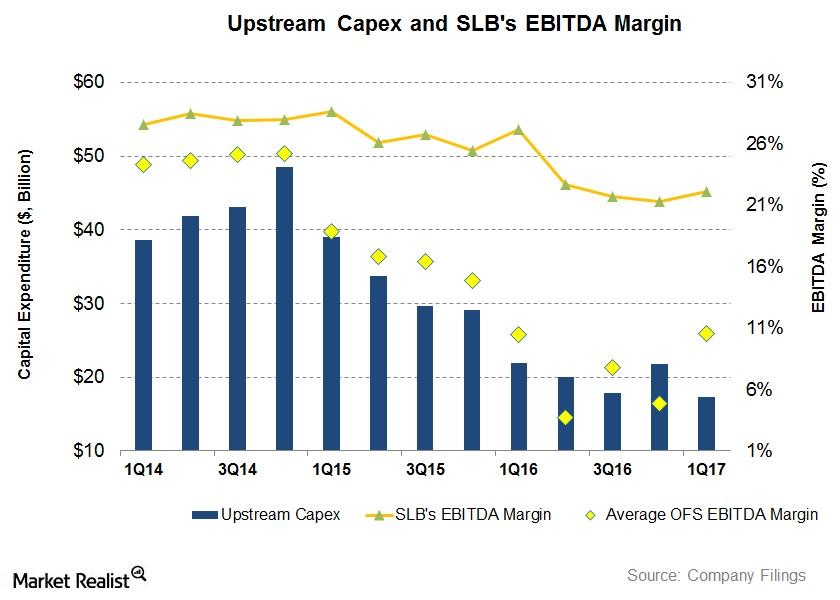

What Halliburton’s Margin Has to Do with Upstream Operators’ Capex

From 2Q16 to 2Q17, Halliburton’s (HAL) EBITDA margin (or EBITDA as a percentage of revenues) rose from 12% to 16%.

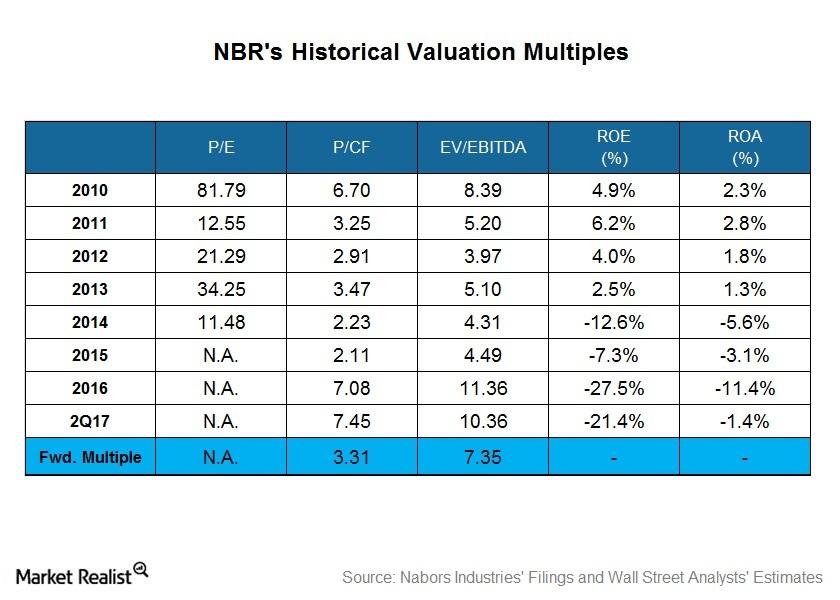

What Does Nabors Industries’ Historical Valuation Suggest?

Nabors Industries’ PE multiple was not meaningful in 2015 and 2016 as a result of negative adjusted earnings during this period.

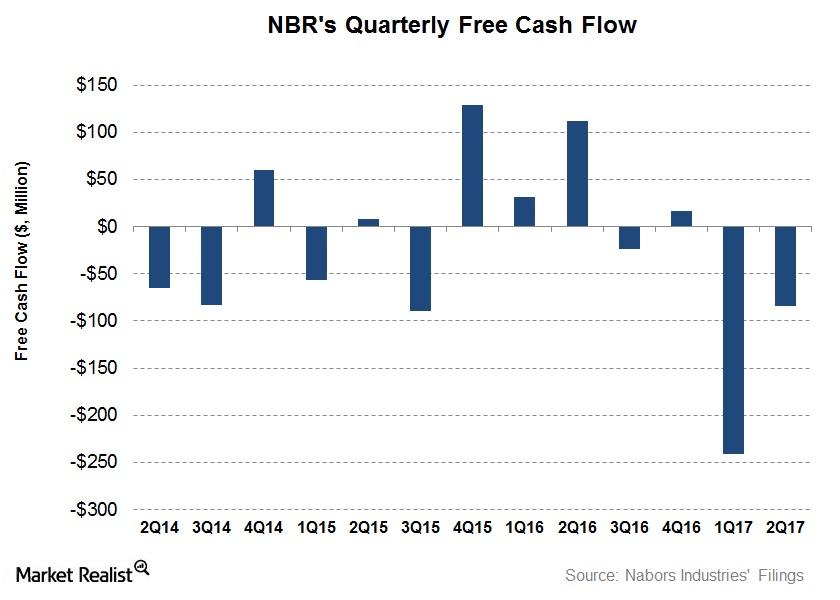

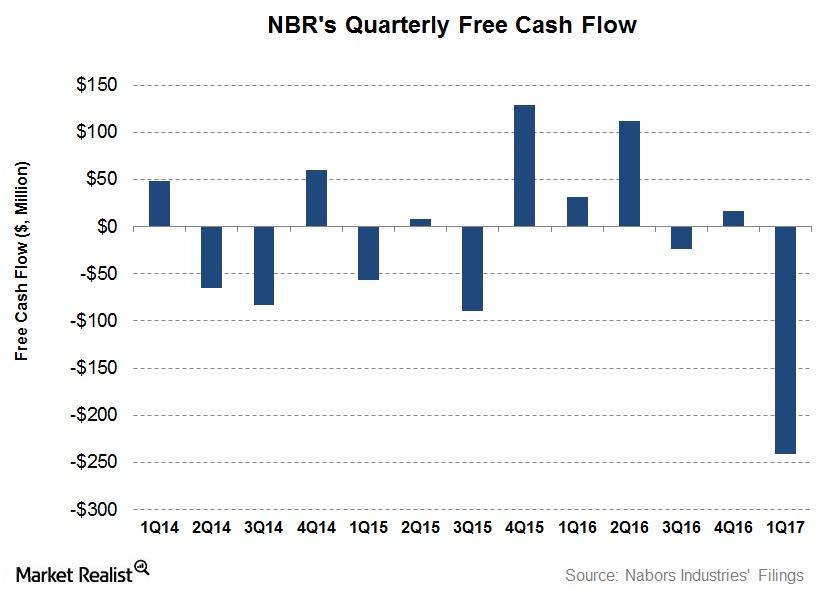

How Nabors Could Use Its Free Cash Flow This Year

Nabors Industries’ (NBR) CFO (cash from operating activities) turned positive in 2Q17, compared with its negative CFO in 1Q17.

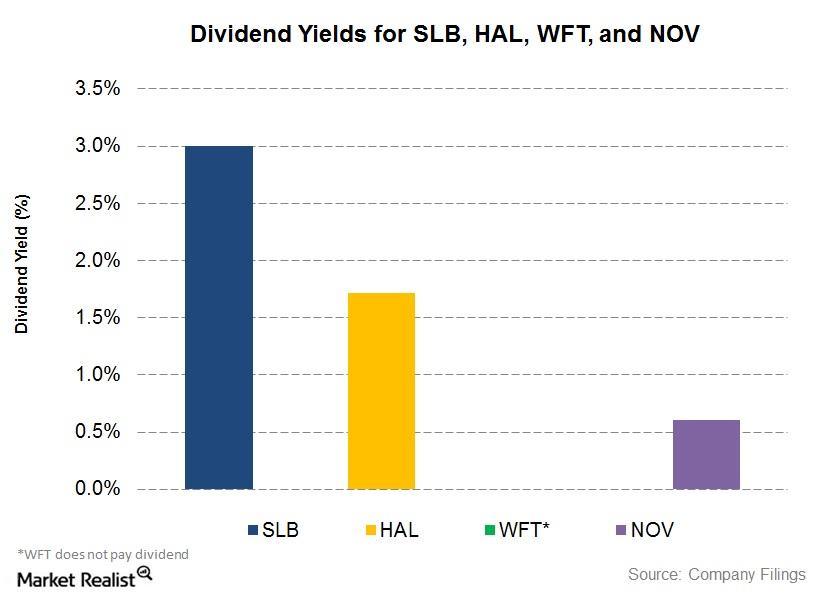

Dividend Yield in 2Q17: Comparing SLB, HAL, and NOV

Schlumberger’s (SLB) quarterly dividend per share remained unchanged from 2Q16 to 2Q17. In 2Q17, Schlumberger’s quarterly DPS is $0.50.

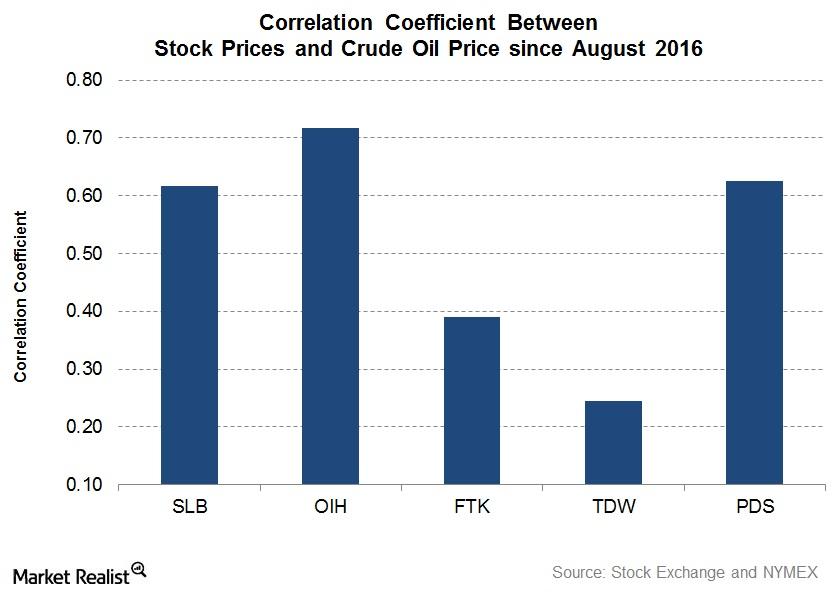

How Schlumberger Correlates with Crude Oil

The correlation coefficient between the West Texas Intermediate (or WTI) crude oil price and Schlumberger’s (SLB) stock price between August 4, 2016, and August 4, 2017, is 0.62.

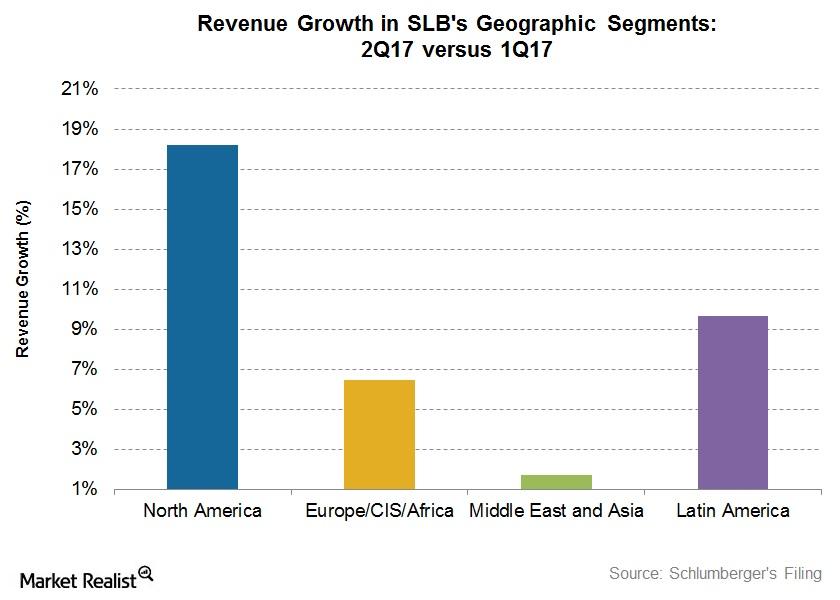

Analyzing Schlumberger’s Growth Drivers in 2Q17

Schlumberger’s (SLB) Production segment witnessed the highest revenue growth (17.6% rise) in 2Q17 over 2Q16.

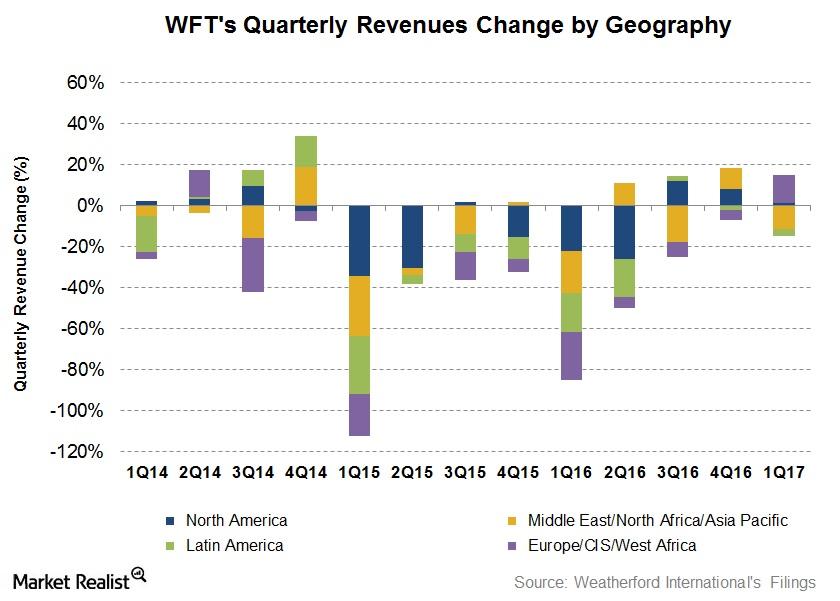

What Are Weatherford International’s Growth Drivers in 1Q17?

In 1Q17, Weatherford International’s net loss was $443 million.

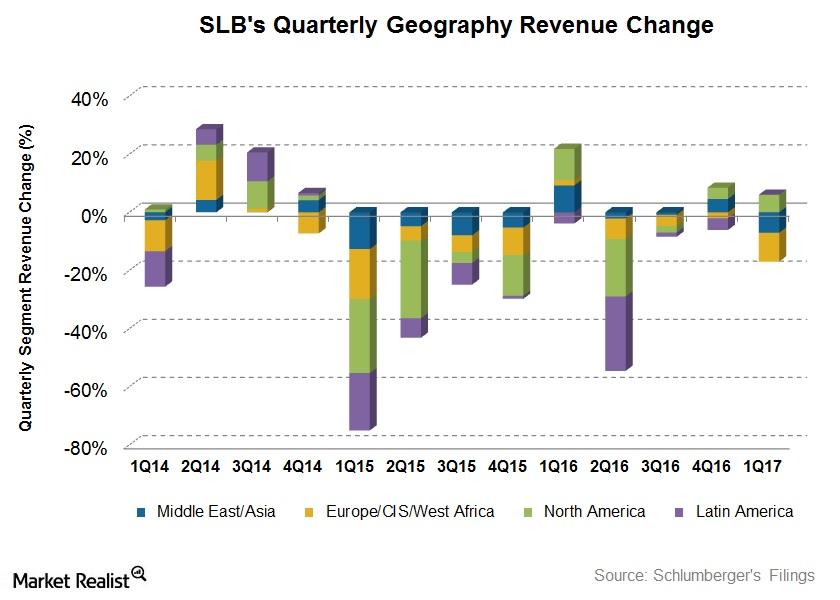

What Drove Schlumberger in 1Q17

Schlumberger’s 1Q17 revenue by geography From 4Q16 to 1Q17, Schlumberger (SLB) witnessed 6% revenue growth in North America, while it saw a steep revenue decline of ~10% in the Europe/CIS[1.Commonwealth of Independent States]/West Africa region. Schlumberger’s revenue from Latin America was resilient in 1Q17, remaining unchanged from 4Q16. Schlumberger accounts for 6.5% of the ProShares […]

Weighing Flotek’s Current Valuation against Peers

Sell-side analysts expect FTK’s adjusted EBITDA to rise more sharply over the next four quarters than those of its peers.

What Are Nabors Industries’ Capex Plans for 2017?

Nabors Industries’ (NBR) cash from operating activities (or CFO) turned negative in 1Q17, compared to its positive CFO a year earlier.

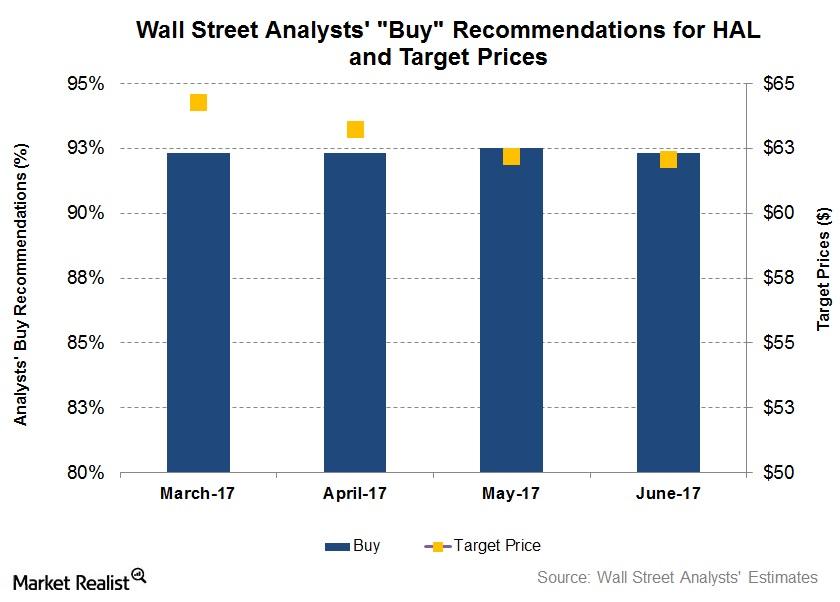

Analysts’ Recommendations for Halliburton

On June 12, 92% of the analysts tracking Halliburton rated it as a “buy,” ~3% of the analysts rated it as a “sell,” and the other 5% rated it as a “hold.”

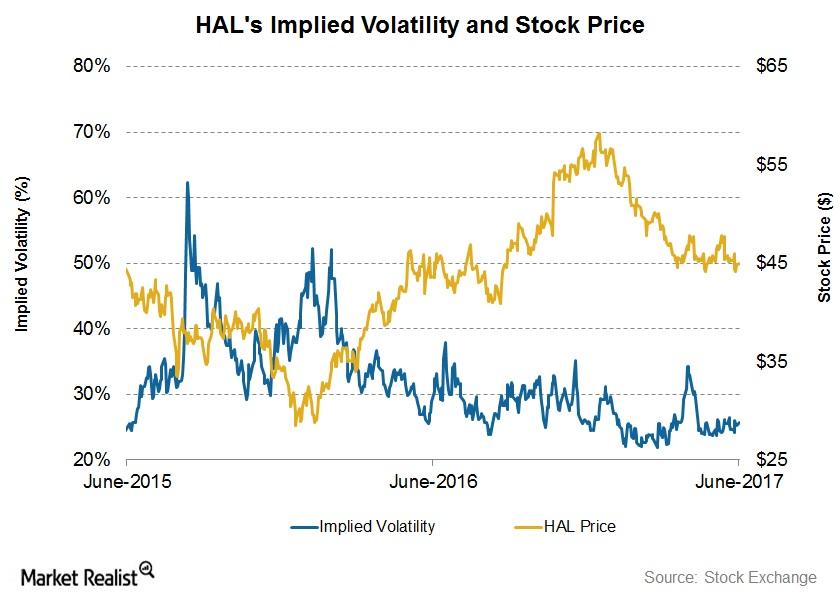

What Investors Can Expect from Halliburton

On June 13, Halliburton’s implied volatility was 24.1%. Since its 1Q17 financial results were announced on April 24, its implied volatility has fallen.

Analyzing Halliburton’s Free Cash Flow and Capex Plans

Halliburton’s cash from operating activities (or CFO) in 1Q17 was an improvement over 1Q16, although it was a steep deterioration compared to 4Q16.

What’s Happening to Halliburton’s Net Debt?

In 1Q17, Halliburton’s (HAL) total debt fell 29% compared to a year earlier, while its cash and marketable securities fell 78%.

A Look at Patterson-UTI Energy’s Higher 2017 Capex Plan

Patterson-UTI Energy’s capex budget for 2017 is $450.0 million. That’s 275.0% higher than its 2016 capex.

Upstream Operators’ Capex Could Impact Schlumberger’s Margin

Schlumberger’s EBITDA margin was impacted negatively as upstream companies slashed their budgets. From 1Q16 to 1Q17, Schlumberger’s EBITDA margin fell.

What Were Schlumberger’s Drivers in 1Q17?

Schlumberger’s (SLB) Latin America region witnessed the highest revenue decline (30% fall) in 1Q17—compared to 1Q16.

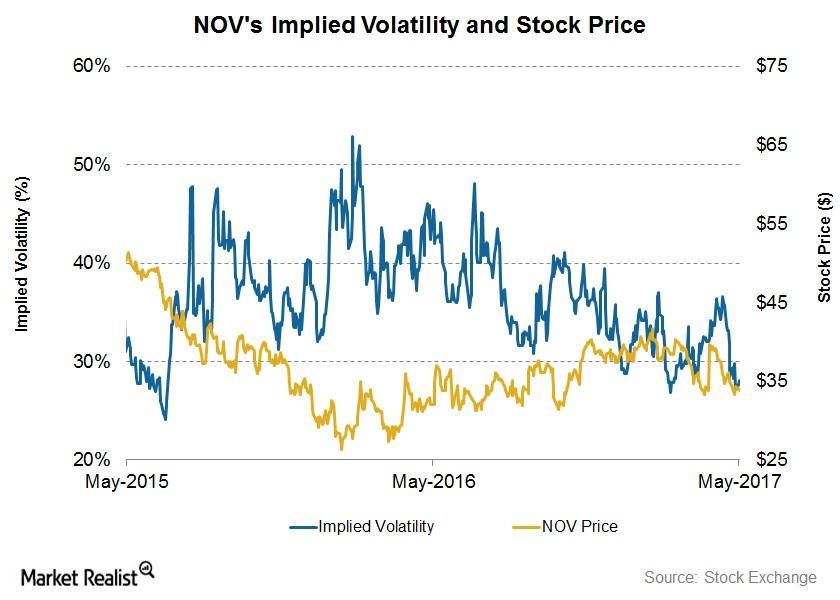

What’s National Oilwell Varco’s 7-Day Stock Price Forecast?

NOV stock will likely close between $35.11 and $32.49 in the next seven days. The stock was trading at $33.80 on May 11, 2017.