Adam Rogers

Adam Rogers has worked at Market Realist since 2014, and his research focuses primarily on tech, media, and gaming stocks. He is enthusiastic about high-growth tech stocks, including IPOs, and tracks them on a regular basis.

Adam earned his post-graduate diploma in finance and marketing in 2014. Prior to joining Market Realist, he worked for a leading investment bank. Overall, he has close to eight years of work experience in financial services across research, content, and operations verticals.

In his spare time, Adam likes to watch sports (especially cricket) and read non-fiction books. He considers The Intelligent Investor by Benjamin Graham as one of the must-read books for every investor.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Adam Rogers

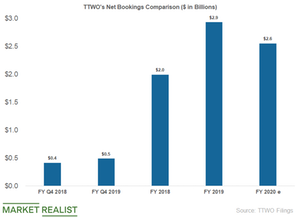

What Games Could Drive Take-Two’s Sales in 2020 and Beyond?

Take-Two’s 2K and Gearbox Software also released Borderlands: Game of the Year Edition for PC, PlayStation 4 (SNE), and Xbox One (MSFT).

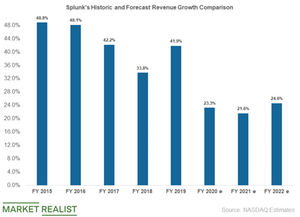

What Are Splunk’s Key Revenue Drivers?

Splunk (SPLK) is banking on its enviable portfolio of products and solutions to drive its revenue growth.

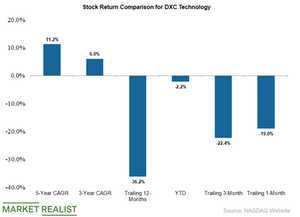

DXC Stock Is Trading at a Deep Discount to Analysts’ Price Target

DXC (DXC) stock has fallen 36.2% in the last 12 months, 19% in the last month, and 22.4% in the last three months.

Why Splunk Fell 5.4% despite Earnings Beat

Splunk (SPLK) announced its first-quarter results (year ending in January) yesterday.

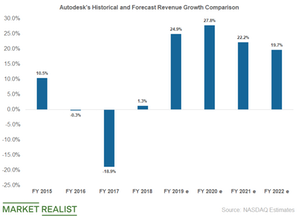

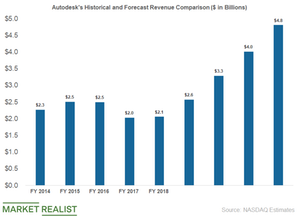

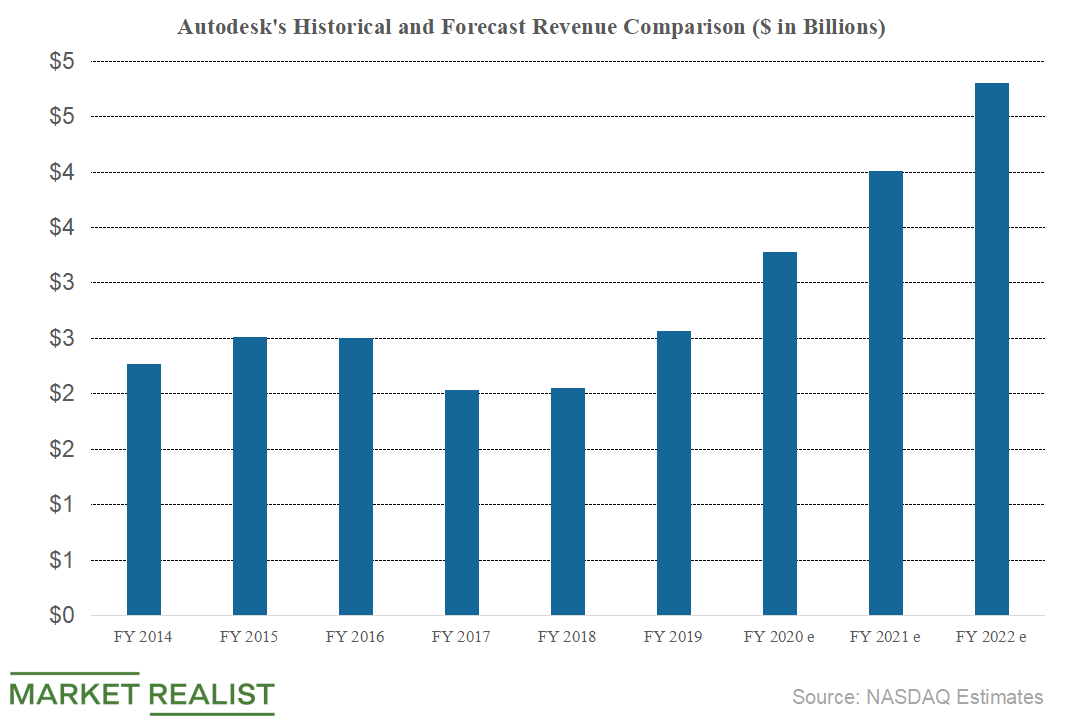

A Look at Autodesk’s Revenue and Earnings Growth

Autodesk’s (ADSK) sales declined at a compound annual growth rate (or CAGR) of 2.5% between fiscal 2014 and fiscal 2018.

A Look at the Key Revenue Drivers for Autodesk in 2020 and Beyond

Autodesk (ADSK) reported strong revenue growth in fiscal 2019.

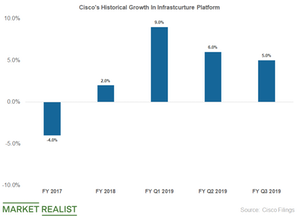

What Drove Revenue for Cisco’s Infrastructure Platform in Q3?

Cisco’s (CSCO) Infrastructure Platform segment is the company’s largest business segment in terms of revenue.

Cisco Stock Rises after Better-than-Expected Earnings and Revenue

Hardware networking giant Cisco (CSCO) announced its third quarter of fiscal 2019 results on May 15.

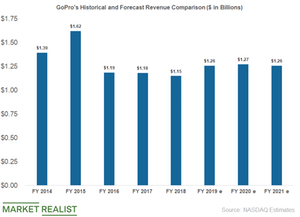

What’s Likely to Drive GoPro Sales Going Forward?

GoPro (GPRO) is optimistic about demand for its line of camera products.

A Look at Cisco’s Earnings and Revenue Growth

Cisco (CSCO) is a giant in the hardware networking space. It’s a leader in the switching, routing, applications, and security markets.

How Palo Alto Networks Stock Has Performed

Palo Alto Networks’ investors have had a stellar run over the past few years.

What Will Drive Revenue Growth for Roku in 2019 and Beyond?

The cord-cutting phenomenon has resulted in exponential growth for streaming media players such as Netflix (NFLX) and Amazon (AMZN).

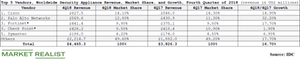

Fortinet Gains Market Share in Worldwide Security Segment

Fortinet managed to increase sales by 17.7% in the fourth quarter

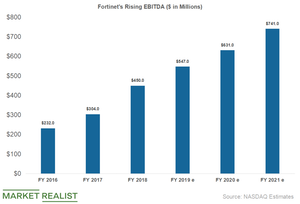

How Fortinet’s Earnings Growth Has Trended

Fortinet (FTNT) has managed to improve profitability over the years with sales growth.

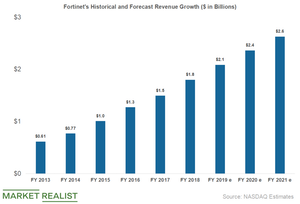

What Are Fortinet’s Key Revenue Drivers for 2019 and Beyond?

Analysts expect Fortinet’s sales to rise 16% in fiscal 2019 to $2.09 billion, 13.2% in 2020 to $2.37 billion, and 11% to $2.62 billion in 2021.

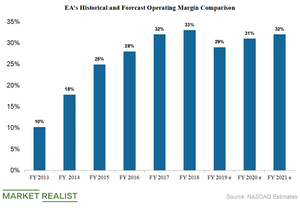

Electronic Arts: What to Expect from the Earnings Growth

The shift to digital gaming has driven the profit margins higher for Electronic Arts (EA) and its peers over the last few years.

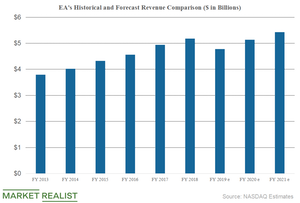

What Impacted Electronic Arts’ Revenues in Fiscal 2019?

Last year, Electronic Arts announced that it would delay the launch of its highly anticipated Battlefield V game to improve users’ experience.

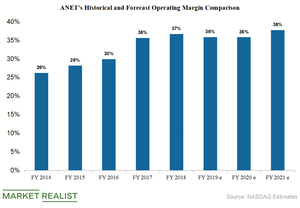

A Look at Arista’s Revenue and Earnings Growth in 2019 and Beyond

Arista Networks’ revenue growth has been impressive in recent years. The company is operating in the mature hardware networking segment.

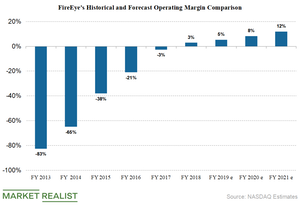

What Could Drive FireEye Shares Higher

FireEye (FEYE) is not yet GAAP-profitable. Though the company has managed to improve its net margin from -104% in 2014 to -29.3% in 2018, it’s likely to improve to -12.5% by 2021.

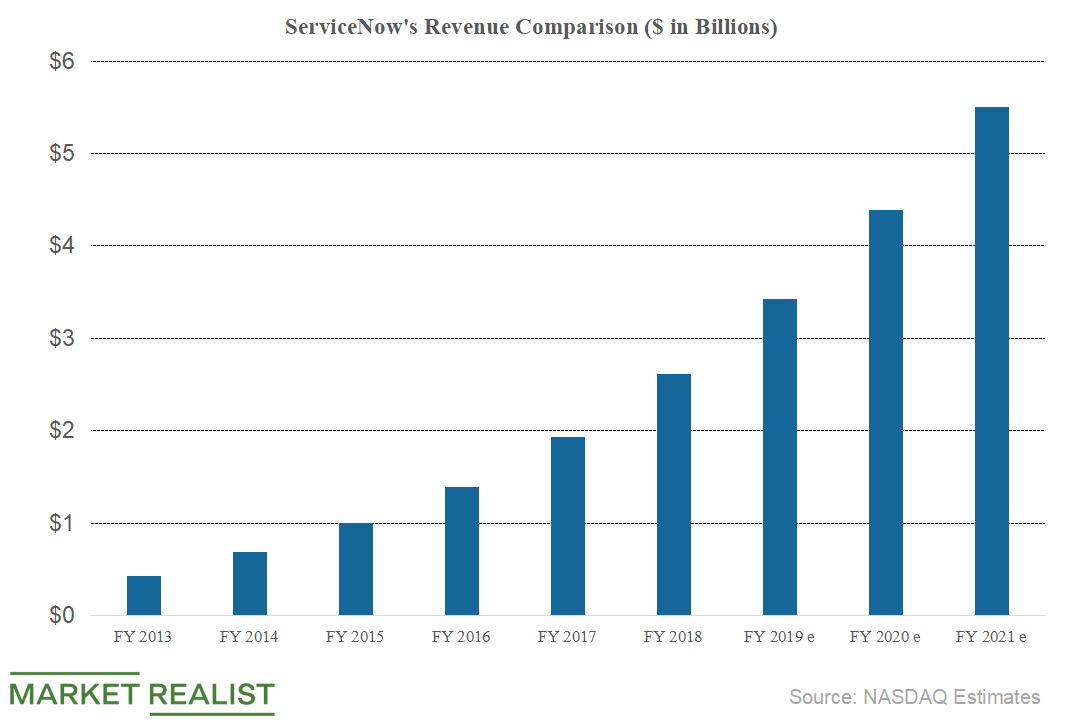

What to Expect from ServiceNow’s Revenue and Earnings Growth

ServiceNow (NOW) is banking on companies’ digital transformation to drive sales.

Why Autodesk Stock Might Move Higher despite High Valuation

The stock of software and services design company Autodesk (ADSK) has generated returns of 39% in the last 12 months.

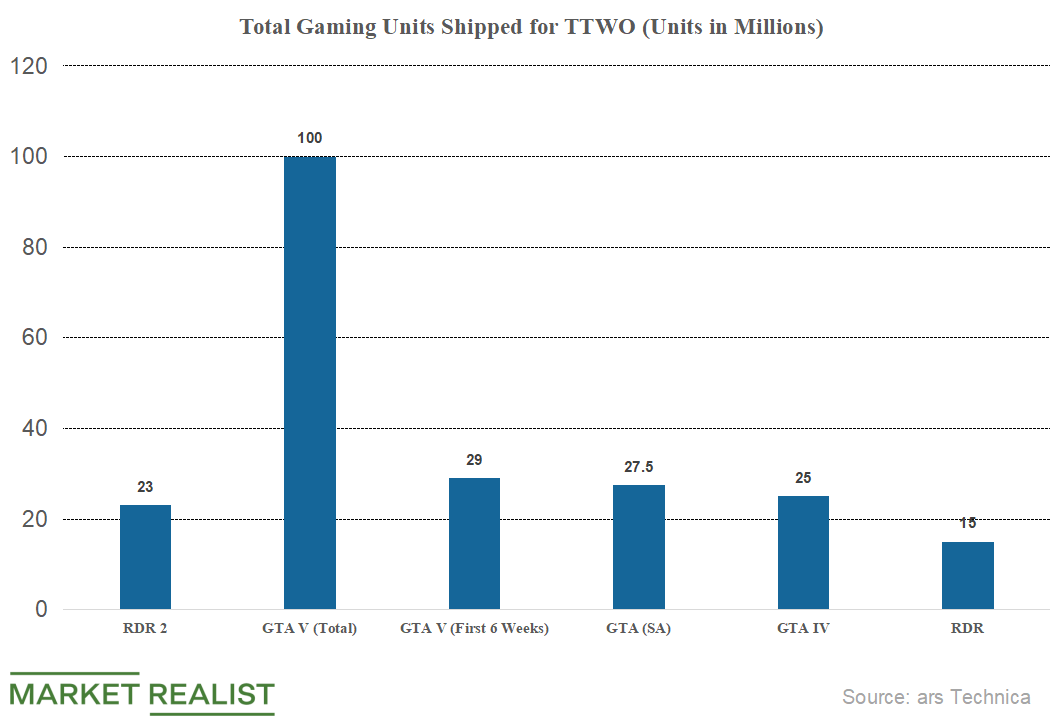

Red Dead Redemption 2 Is a Key Revenue Growth Driver for Take-Two

Gaming companies such as Take-Two Interactive (TTWO), Electronic Arts (EA), and Activision Blizzard (ATVI) are highly dependent on popular franchises to drive sales.

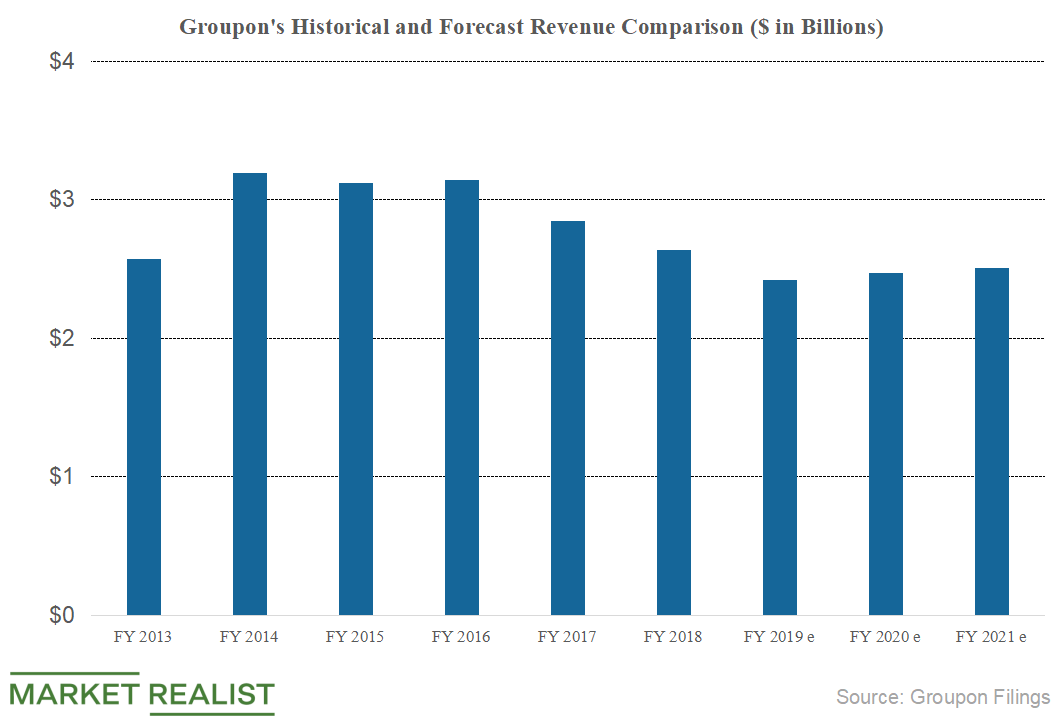

What to Expect from Groupon’s Revenue and Earnings Growth

Groupon’s (GRPN) sales have been falling over the last few years, as the company has exited unprofitable international markets.

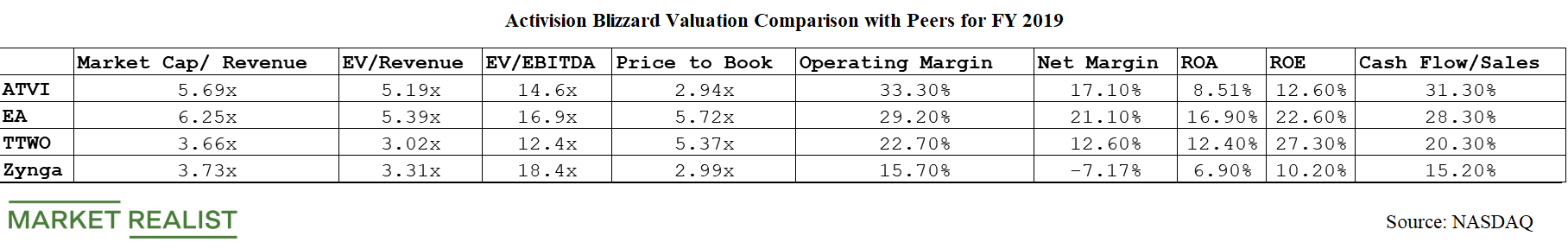

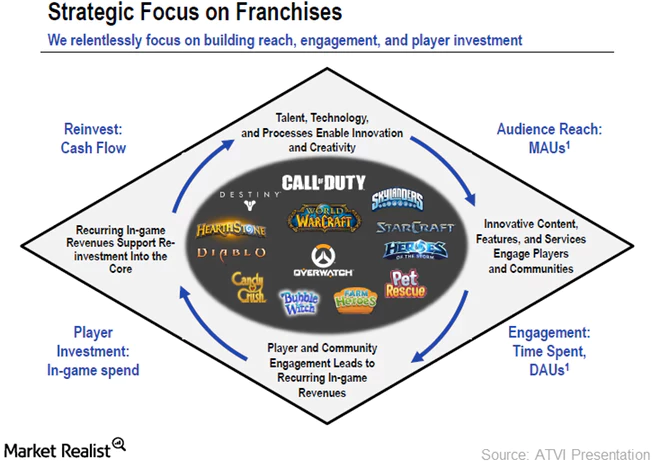

A Look at Activision Blizzard’s Valuation

Activision Blizzard (ATVI) has a forward PE ratio of 35.9x for 2019.

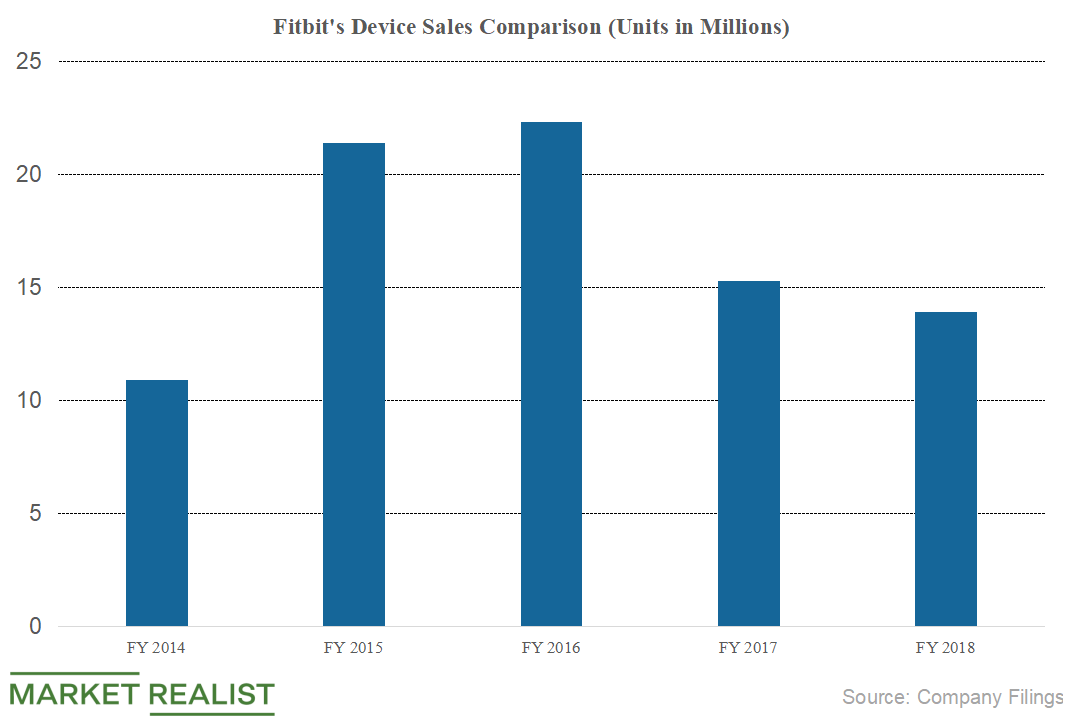

Fitness Trackers Are Likely to Hit Fitbit’s Sales in 2019

Though Fitbit’s smartwatch sales rose 437% in 2018, the company posted negative overall revenue growth.

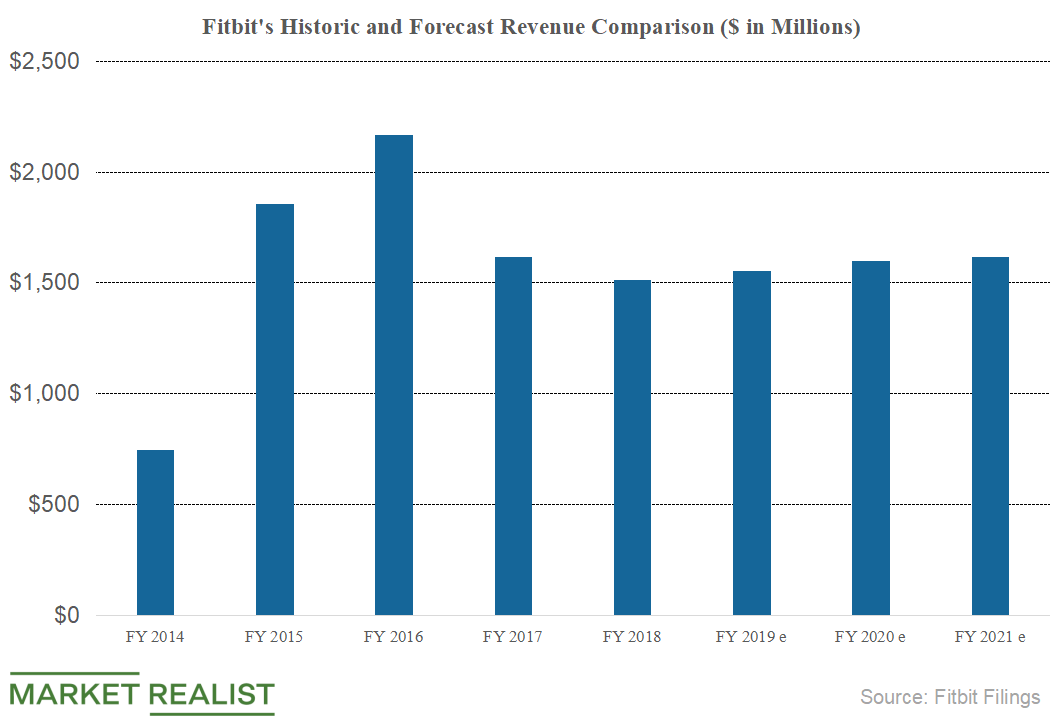

A Look at Fitbit’s Estimated Revenue and Earnings Growth in 2019

The entry of Apple, Xiaomi, Huawei, and Samsung into the wearables space has drastically reduced Fitbit’s market share.

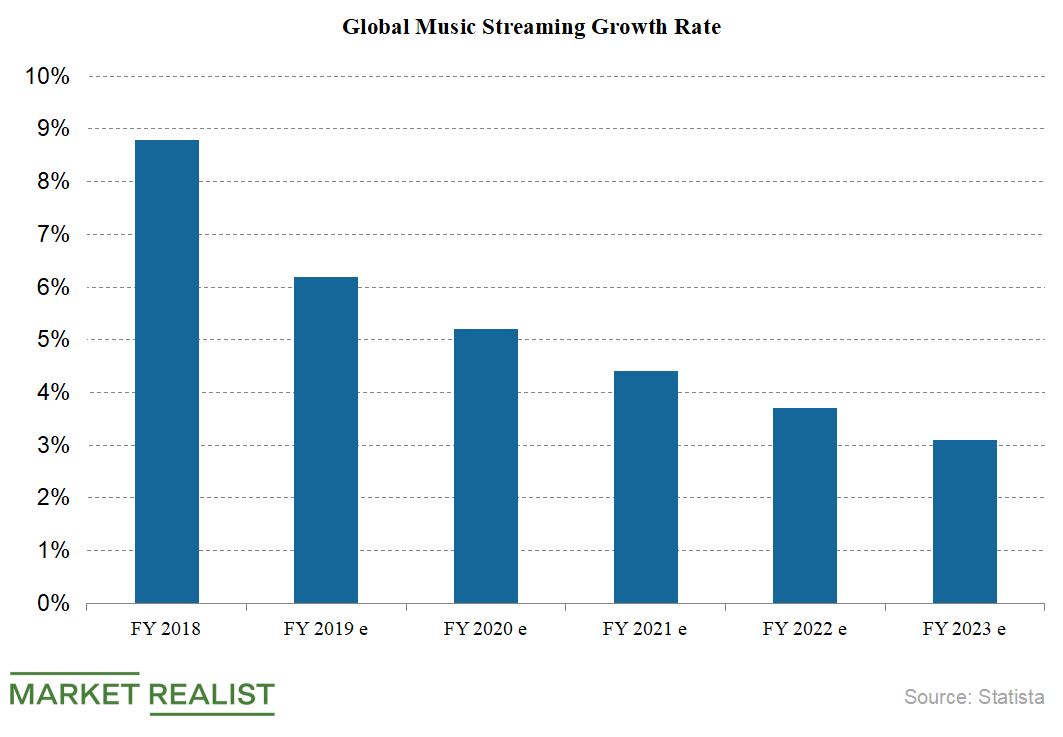

What Are the Challenges Facing Spotify in 2019 and Beyond?

Though Spotify is a leader in the global music streaming market with a presence in over 75 countries, the company competes with tech heavyweights.

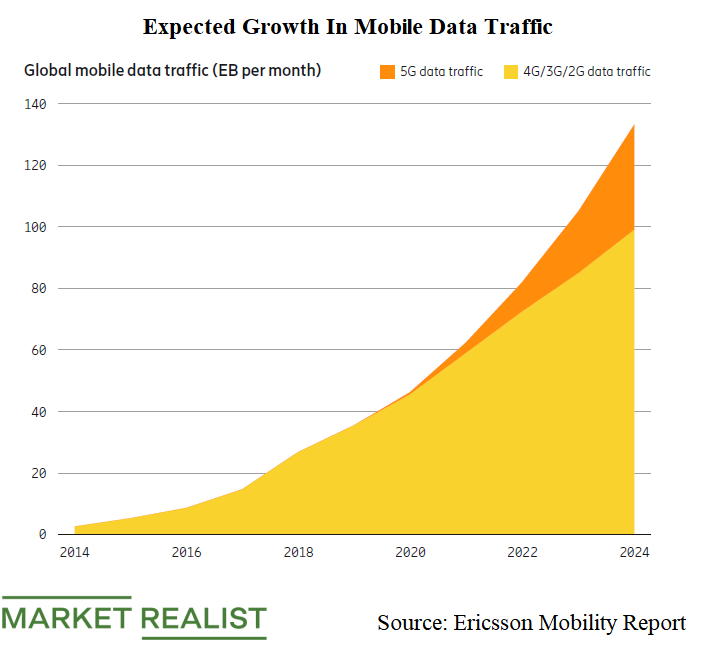

Ericsson Is Banking on 5G for Revenue Growth

Ericsson (ERIC) claims that the global 5G market is experiencing strong momentum.

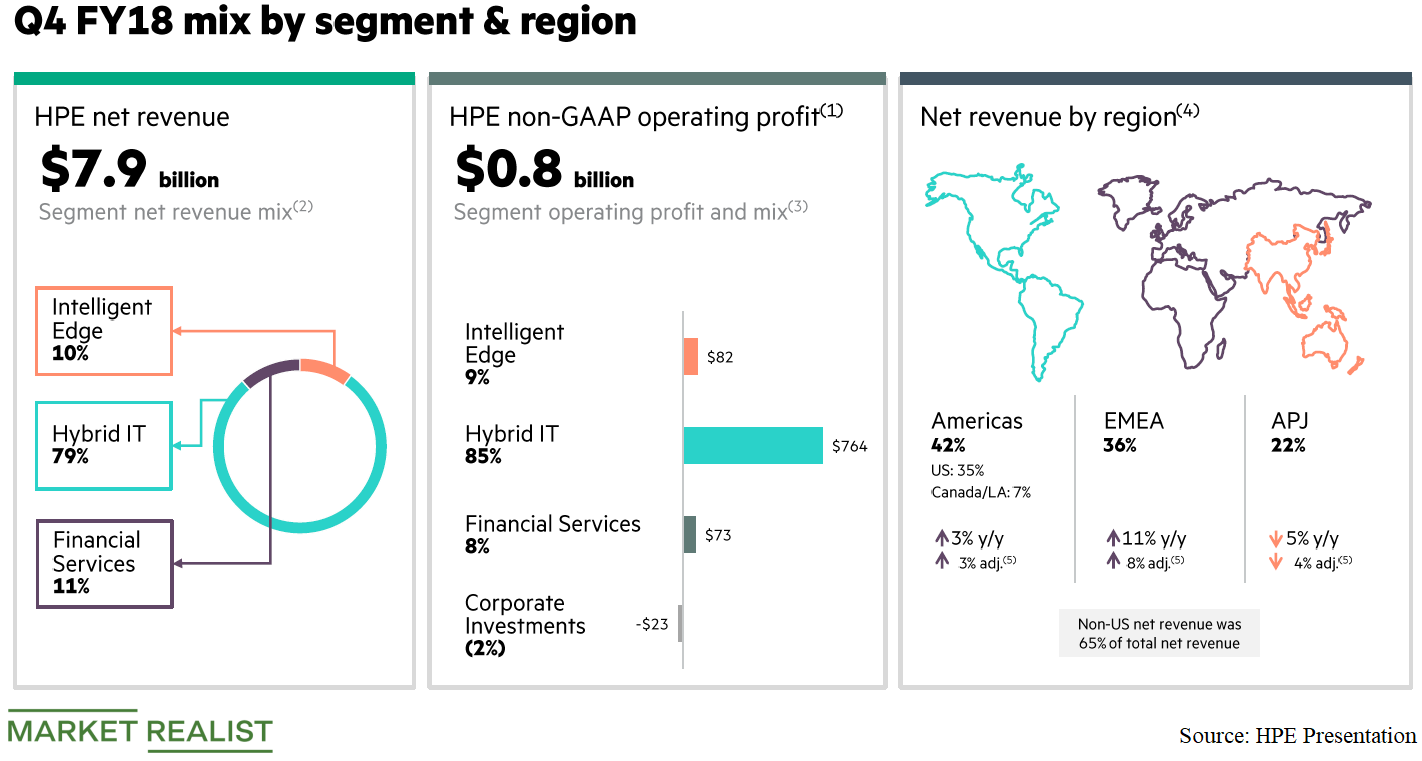

Which Business Segments Drove HPE’s Revenue in Q4 2018?

Hewlett Packard Enterprise (HPE) has three primary business segments: Intelligent Edge, Hybrid IT, and Financial Services.

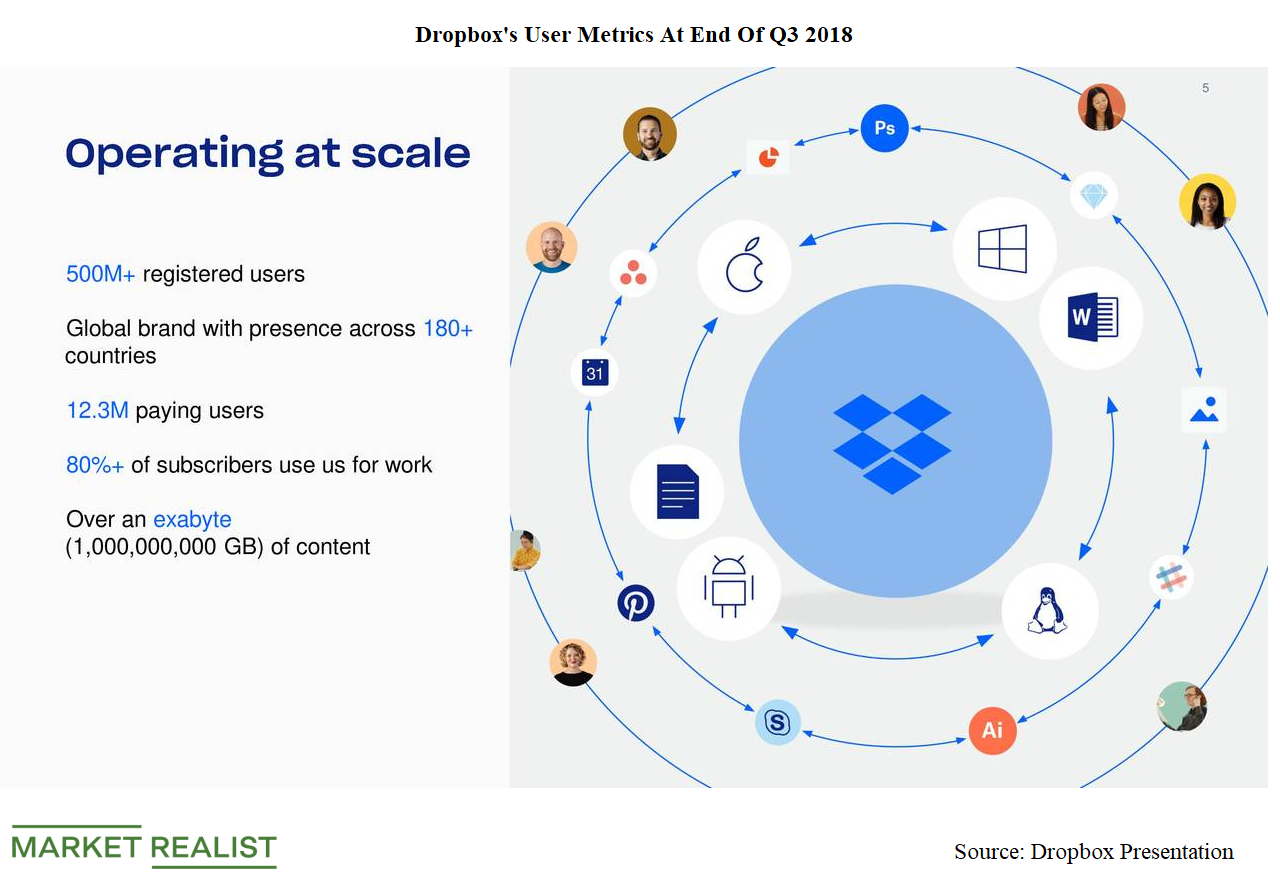

How Do Dropbox’s Key Metrics Look at the End of Q3?

Dropbox (DBX) increased revenue by 26% YoY to $360.3 million in the third quarter of 2018.

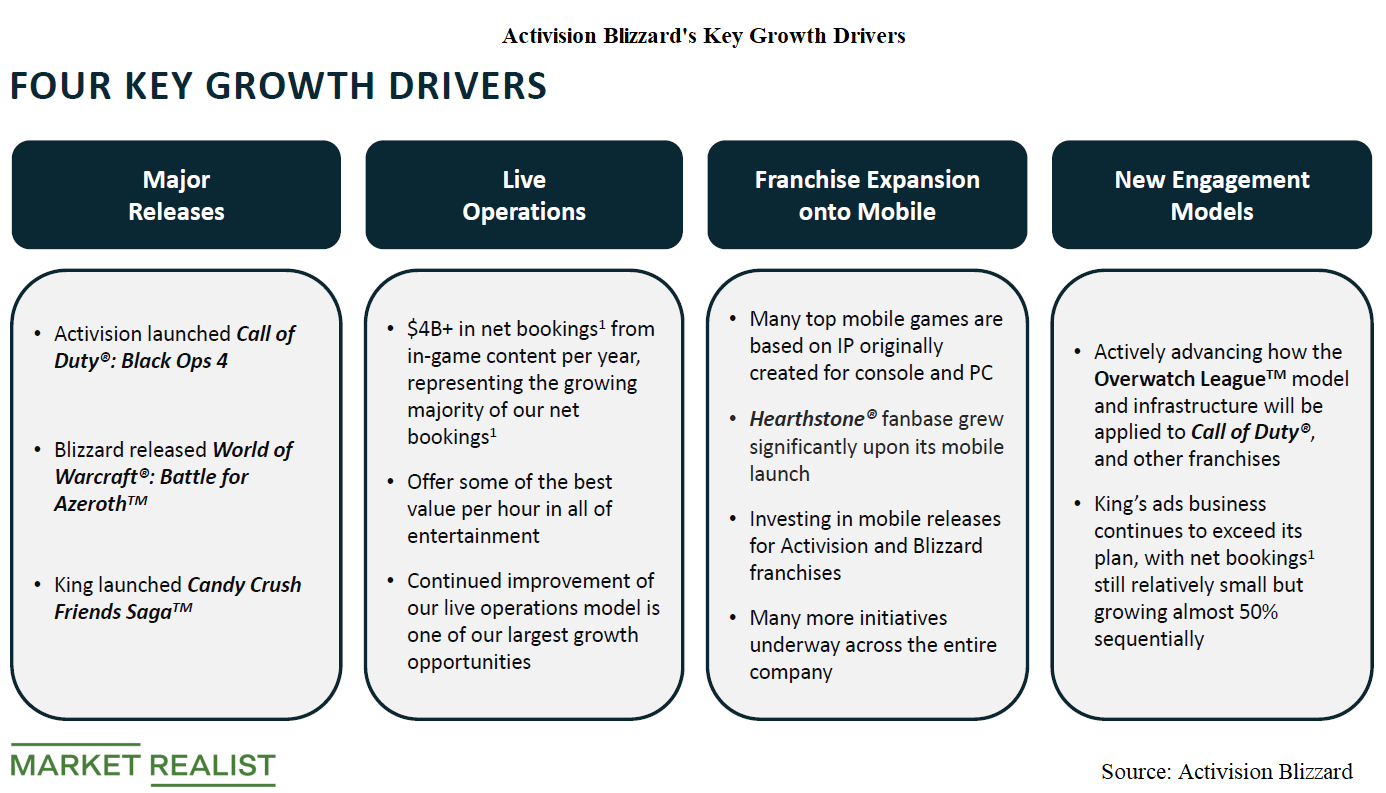

What Are Activision Blizzard’s Key Revenue Growth Drivers?

Activision Blizzard’s (ATVI) Call of Duty, World of Warcraft, and Candy Crush continue to be major drivers of its revenue growth.

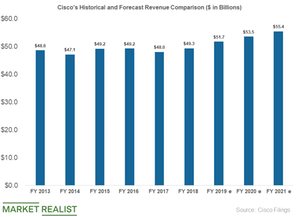

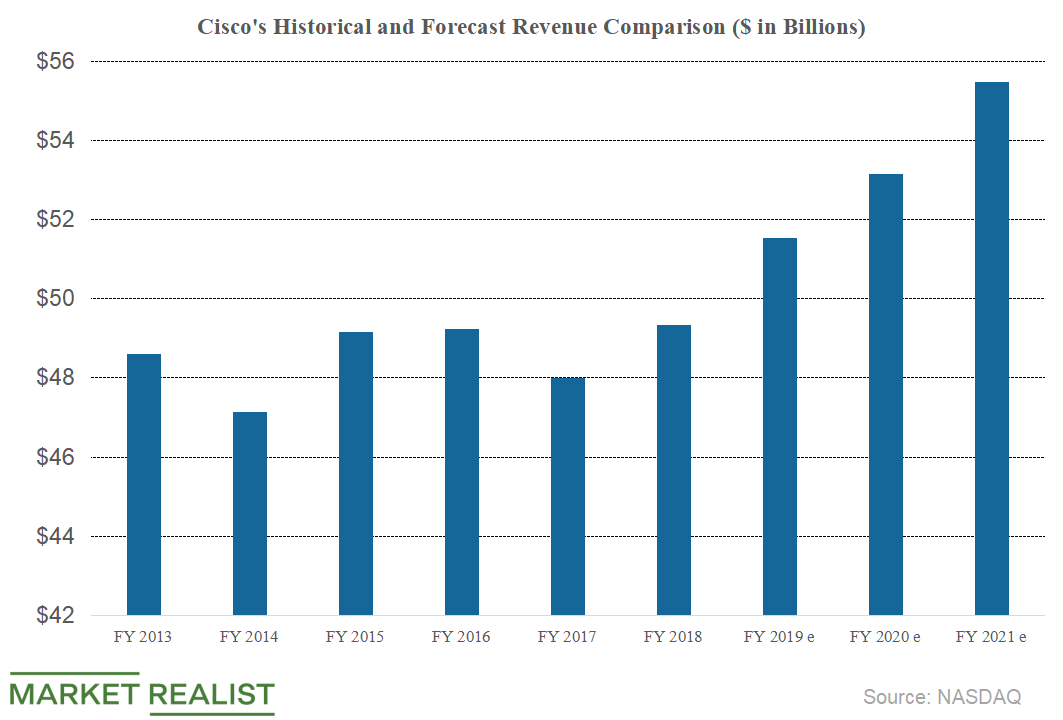

A Look at Cisco’s Future Earnings and Revenue Growth

While Cisco’s revenue is expected to rise in the single digits in percentage terms in the fiscal years 2019, 2020, and 2021, its EPS are expected to rise at a higher pace.

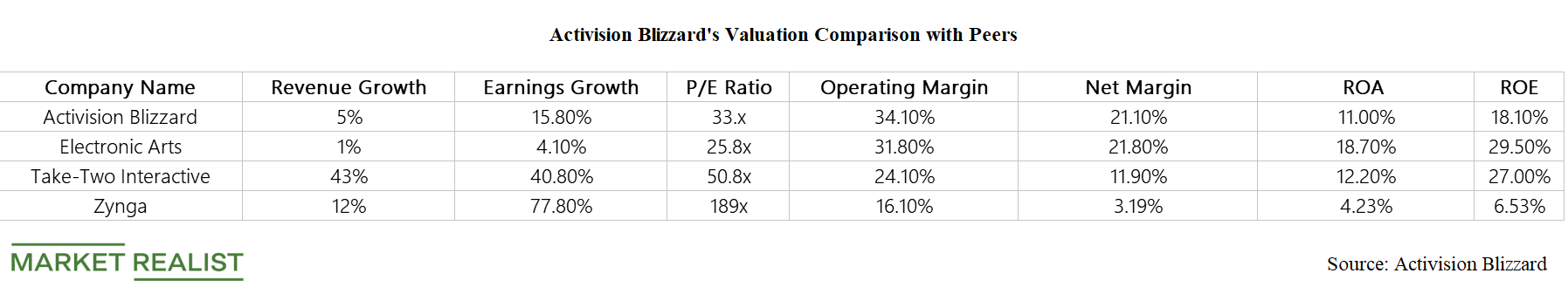

Activision Blizzard’s Valuation Compared to Its Peers’

We’ve already seen that Activision Blizzard’s’ (ATVI) revenues are expected to rise 4.6% in 2018 and 6.3% in 2019.

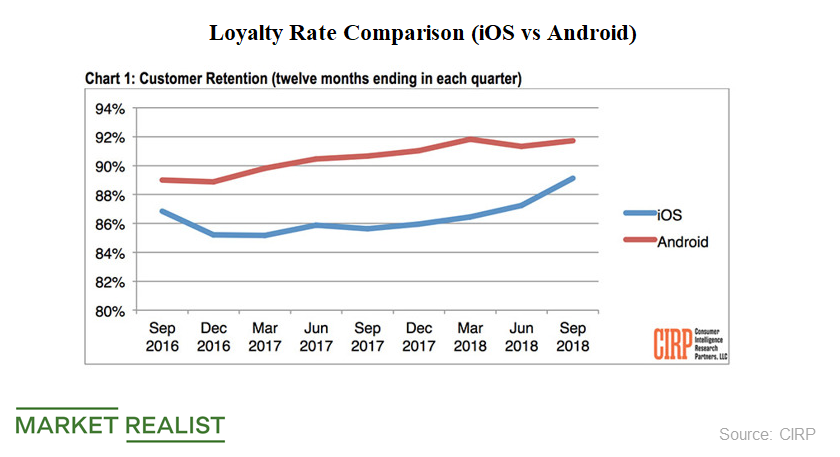

Apple’s iPhone Customer Loyalty Is on the Rise

Apple’s (AAPL) iOS is gaining traction in terms of customer loyalty.

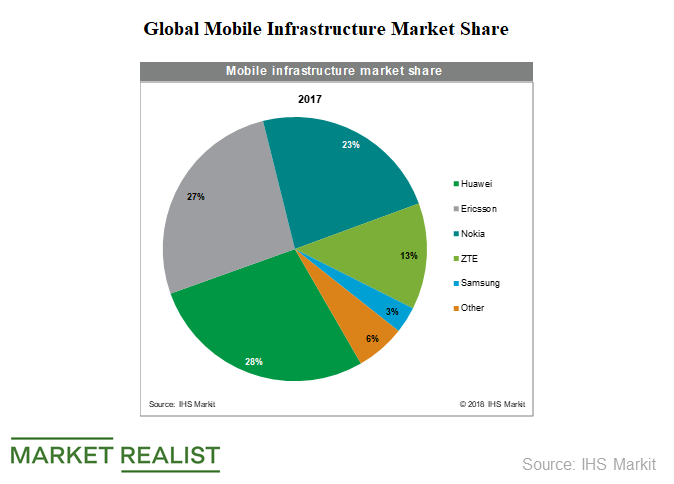

Ericsson, Nokia Lost Mobile Infrastructure Market Share to Huawei

Huawei is the largest telecommunications equipment manufacturer with a share of 28% at the end of 2017, up from 25% in 2016.

BlackBerry’s Optimism about Enterprise Software and Services

Revenues from BlackBerry’s (BB) Enterprise Software and Services business fell from $91.0 million in fiscal Q2 2018 to $88.0 million in fiscal Q2 2019.

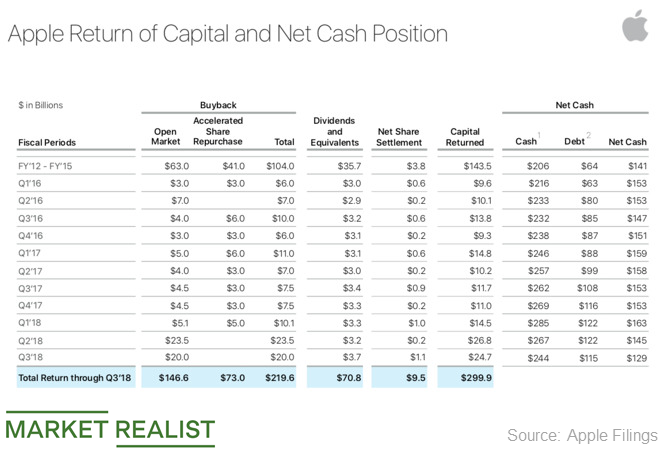

A Look at Apple’s Shareholder Returns

Apple (AAPL) returned close to $300 billion to its shareholders between fiscal 2012 and the fiscal third quarter.

Will Apple Beat Analysts’ Estimates in Fiscal Q3 2018?

In this series, we’ll look at analysts’ estimates for Apple’s fiscal third-quarter results, which it’s set to release on July 31.

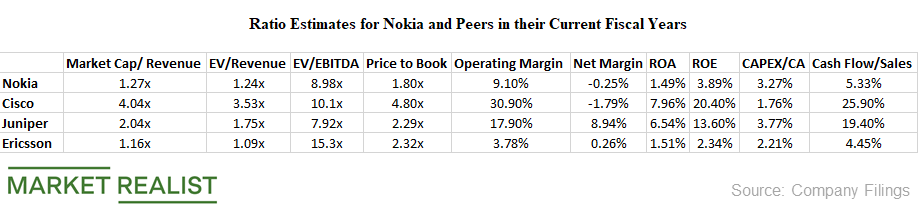

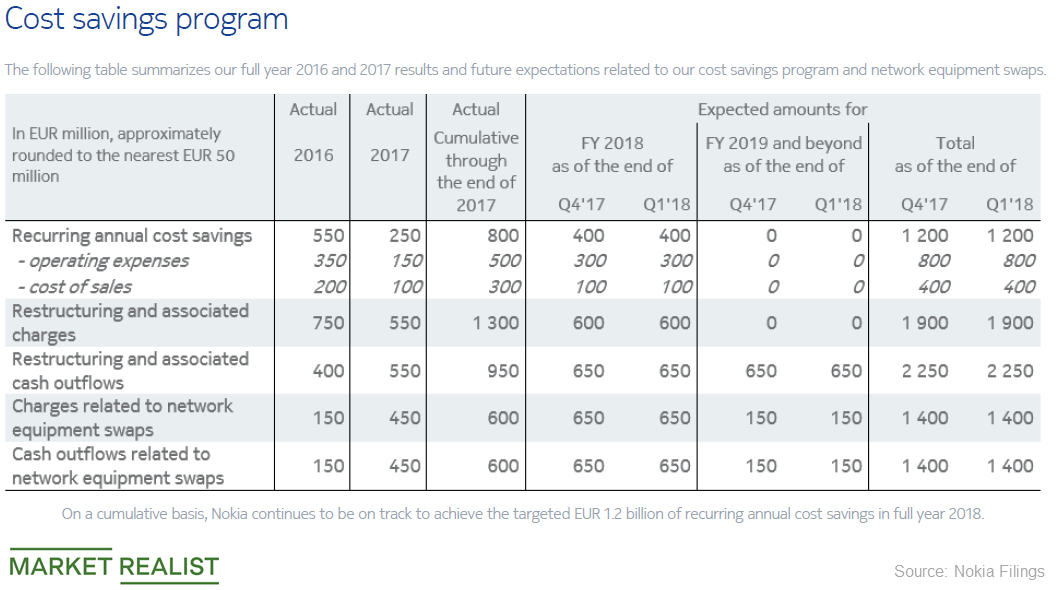

How Nokia Compares to Its Peers

Nokia’s (NOK) expected market-cap-to-revenue ratio is 1.27x for 2018 and 1.24x for 2019.

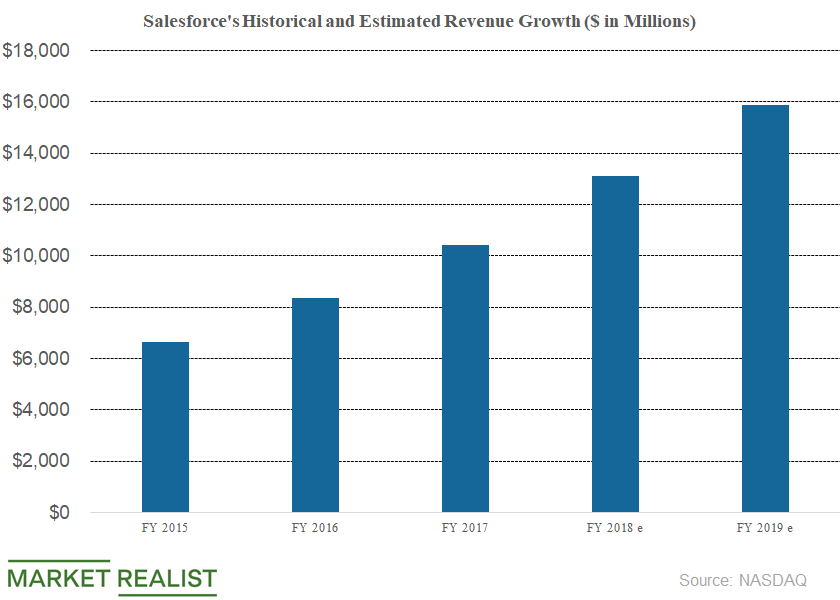

Dropbox Announces Partnership with Salesforce

Earlier this year, Dropbox (DBX) announced a strategic partnership with leading CRM (customer relationship management) firm Salesforce.

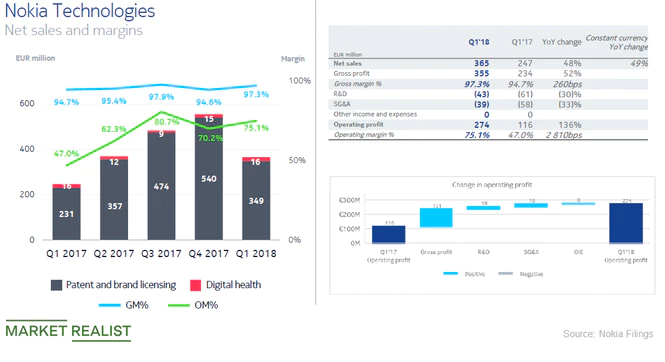

Nokia Stock Has Risen 28% in H1 2018

Nokia (NOK) stock generated returns of 28% in the first half of 2018.

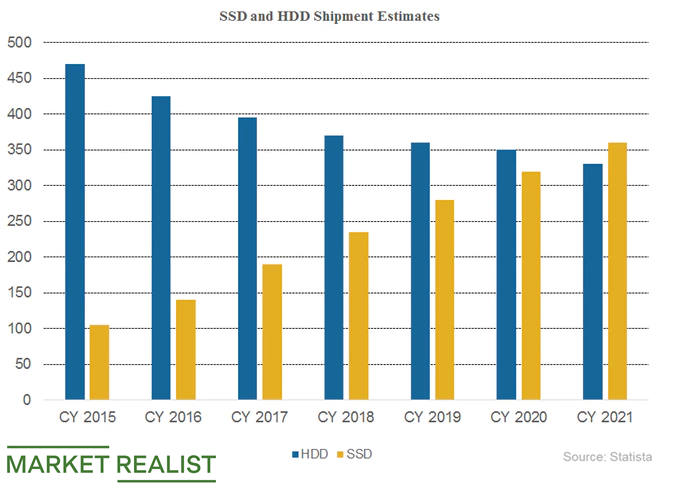

Seagate Is Banking on Enterprise Data Growth for Long-Term Sales

There has been an industry-wide transition in the storage space over the last few years.

Why Nokia Partnered with HCL Technologies

On June 21, Nokia (NOK) announced a five-year partnership with HCL Technologies. HCL is expected to transform and modernize Nokia’s IT infrastructure and applications landscape.

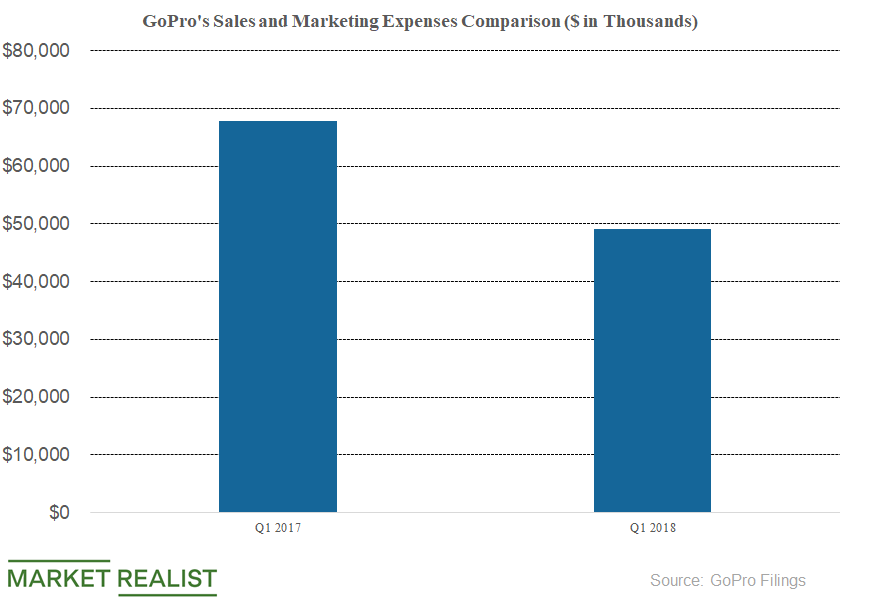

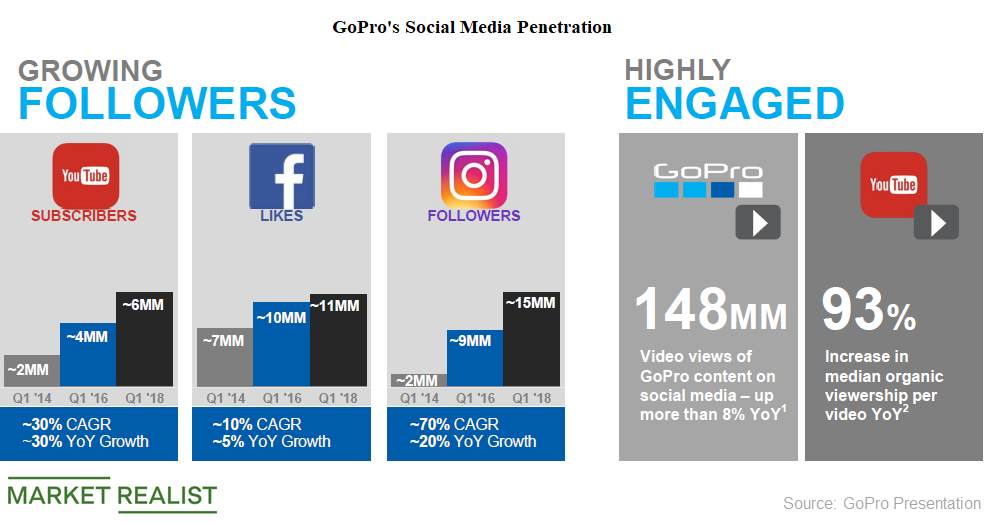

A Look at GoPro’s Marketing and Distribution Strategy

GoPro (GPRO) has a multichannel marketing strategy across social media platforms.

GoPro Is Focusing on Social Media to Leverage Customer Engagement

As the world continues to become more social, GoPro is looking at a significant opportunity to build its core camera application and cloud business.

How Does GoPro Aim to Improve Its Market Share?

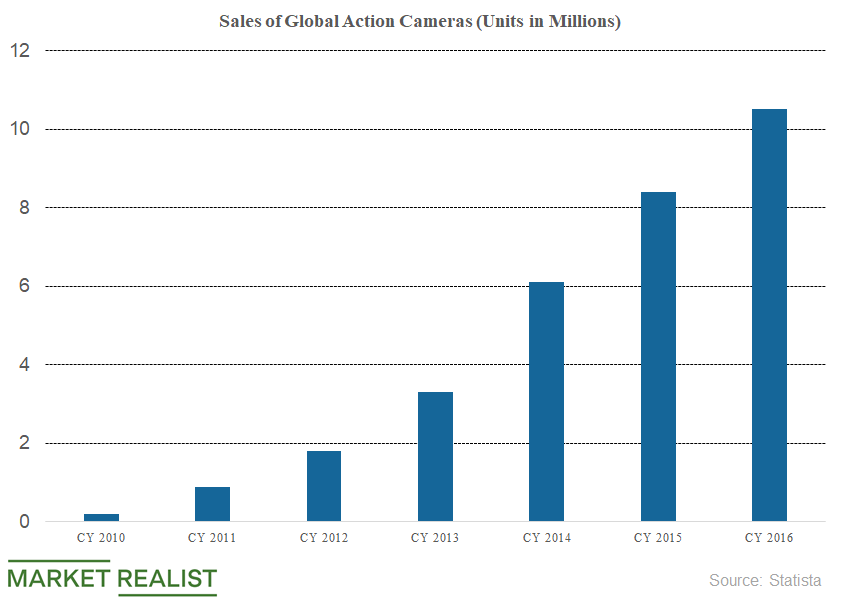

According to Statista estimates, unit sales of action cameras were 8.4 million in 2015 and 10.5 million in 2016.

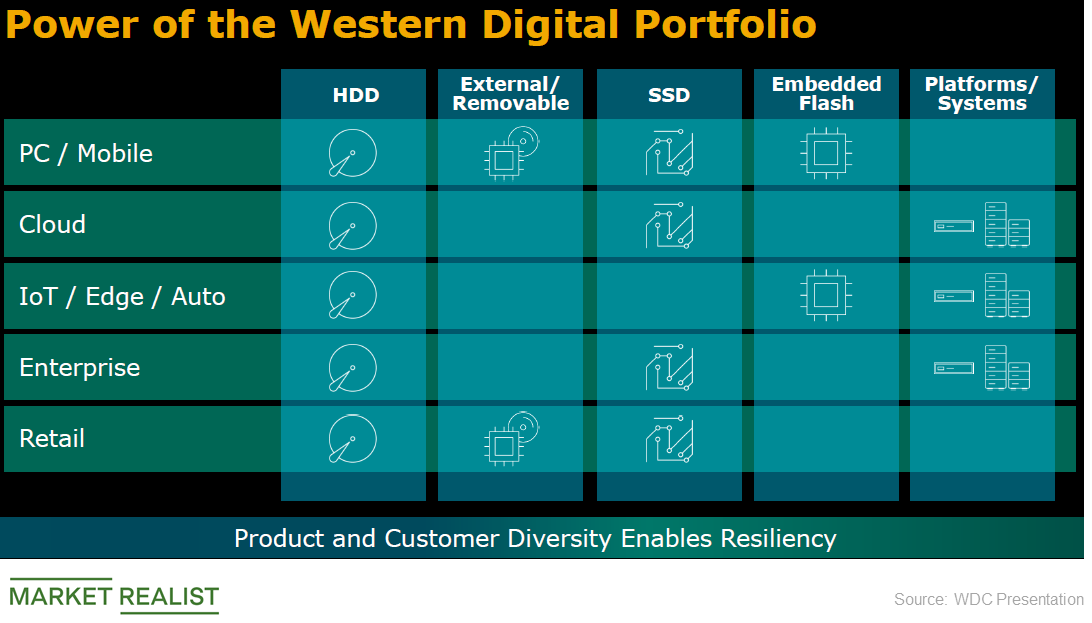

A Look at Western Digital’s Product Portfolio

WDC is optimistic about its technology leadership in storage and extensive IP (intellectual property) portfolio.

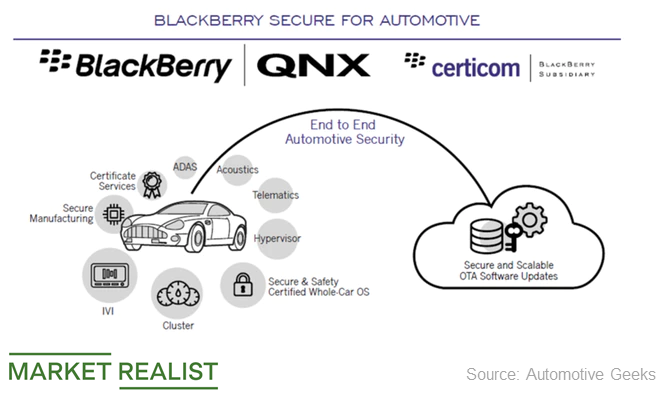

BlackBerry’s QNX Technology Now in 120 Million Vehicles

BlackBerry (BB) recently announced that its QNX software has been embedded in more than 120 million vehicles.

BlackBerry’s Performance Highlights in Fiscal 2018

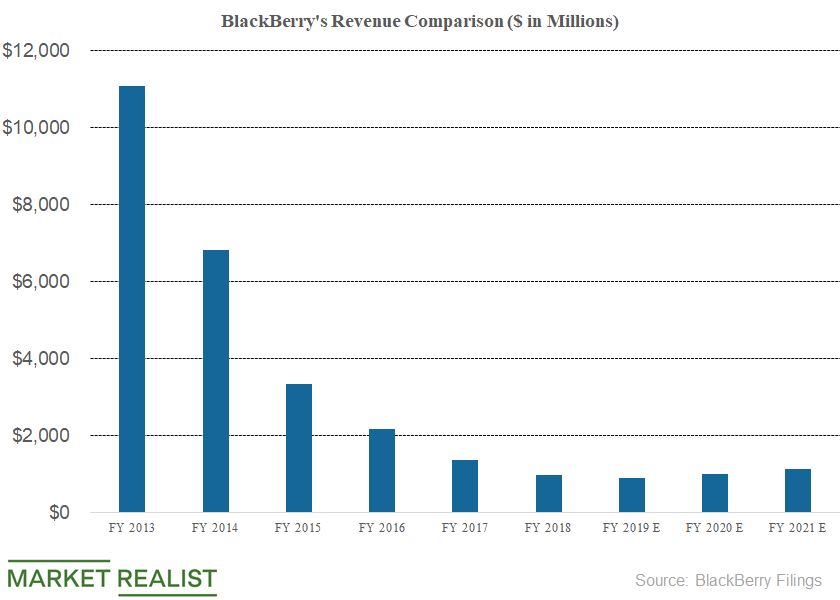

Due to BlackBerry’s business transition, its revenue fell from $2.2 billion in fiscal 2016 to $1.4 billion in fiscal 2017 and $967 million in fiscal 2018.

Why Activision Blizzard Aims to Target the Battle Royale Gaming Segment

In March, the stock prices of gaming companies Activision Blizzard (ATVI), Take-Two Interactive (TTWO), and Electronic Arts (EA) fell, driven by concerns over the tremendous success of Epic Games’ Fortnite.