Adam Rogers

Adam Rogers has worked at Market Realist since 2014, and his research focuses primarily on tech, media, and gaming stocks. He is enthusiastic about high-growth tech stocks, including IPOs, and tracks them on a regular basis.

Adam earned his post-graduate diploma in finance and marketing in 2014. Prior to joining Market Realist, he worked for a leading investment bank. Overall, he has close to eight years of work experience in financial services across research, content, and operations verticals.

In his spare time, Adam likes to watch sports (especially cricket) and read non-fiction books. He considers The Intelligent Investor by Benjamin Graham as one of the must-read books for every investor.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Adam Rogers

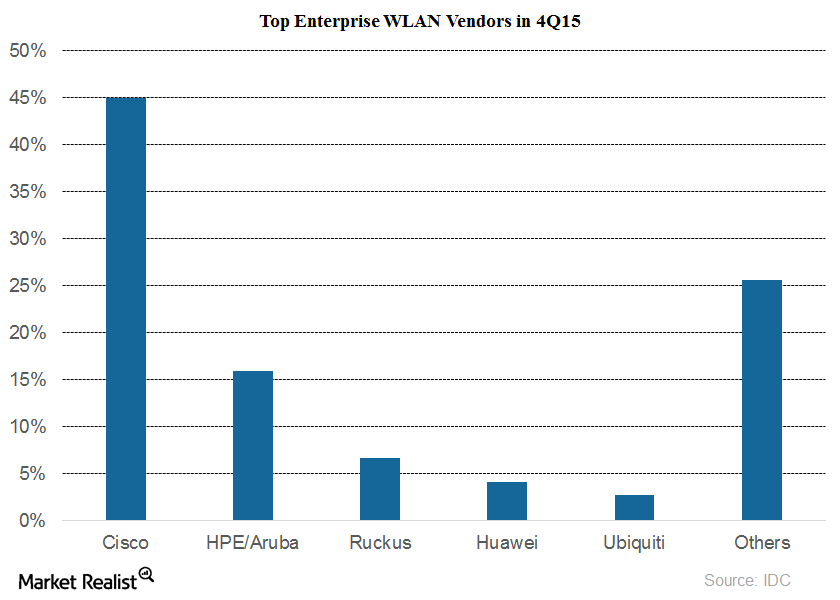

Who Are the Biggest Wireless Network Players in the Business?

A WLAN (wireless local area network) uses radio waves to connect devices such as laptops and smartphones to the internet.

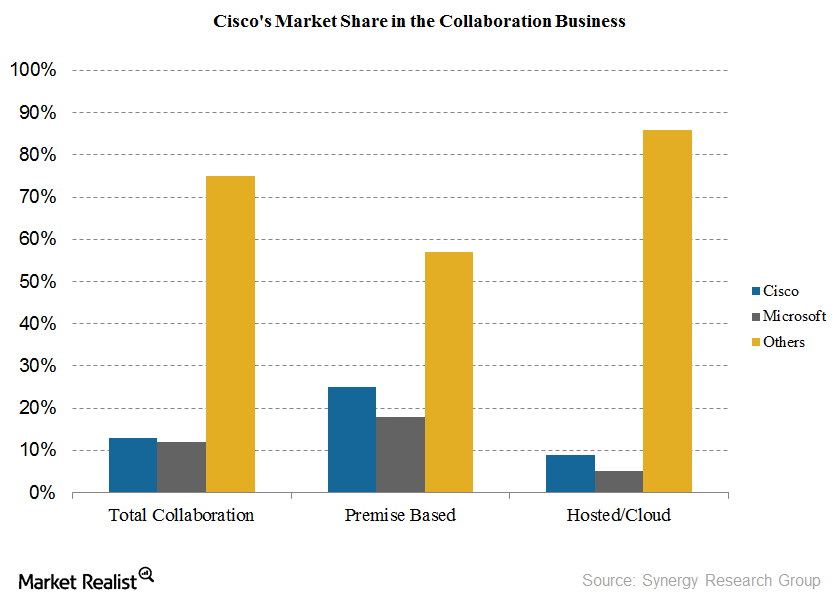

Why Did Cisco Recently Acquire Acano?

Last month, Cisco completed the acquisition of European (VGK) video conferencing startup Acano for $700 million in cash.

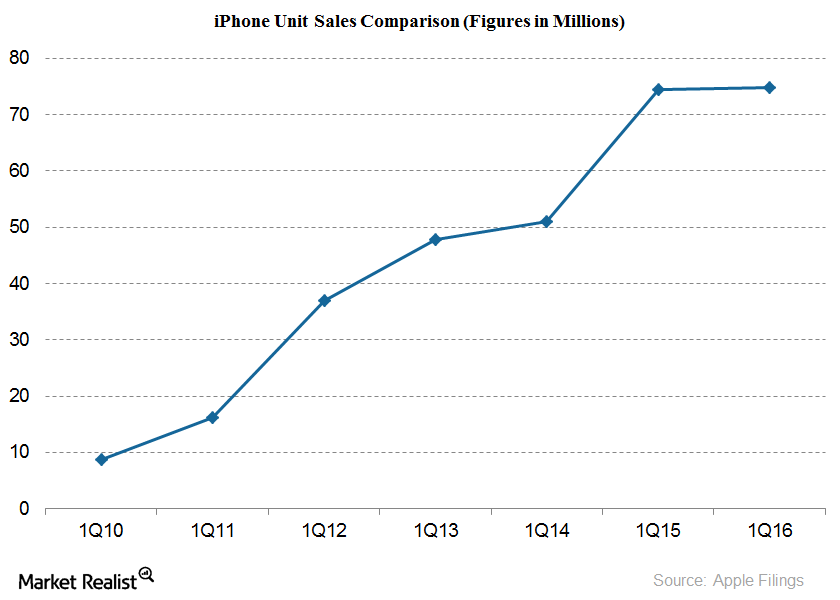

Customer Loyalty and Retention: Key Driver for Apple

Apple (AAPL) has repeatedly stated that it has a very satisfied and loyal customer base. In fiscal 1Q16, Apple experienced a high switch rate from Android (GOOG) to iPhone.

Why Is Apple So Concerned about Currency Fluctuations?

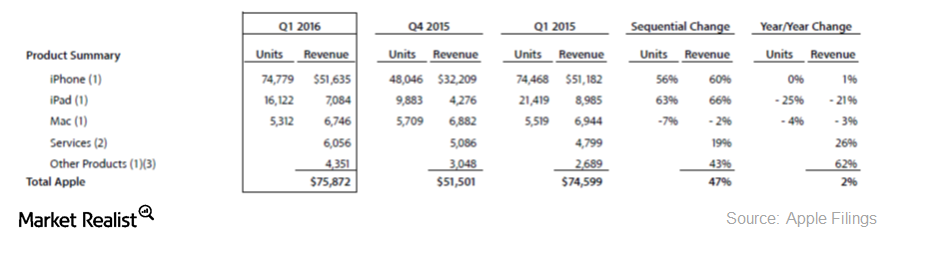

Last month, Apple (AAPL) declared its fiscal 1Q16 results, reporting revenues of $75.9 billion. Revenues rose 2% YoY (year-over-year) and 8% on a constant currency basis.

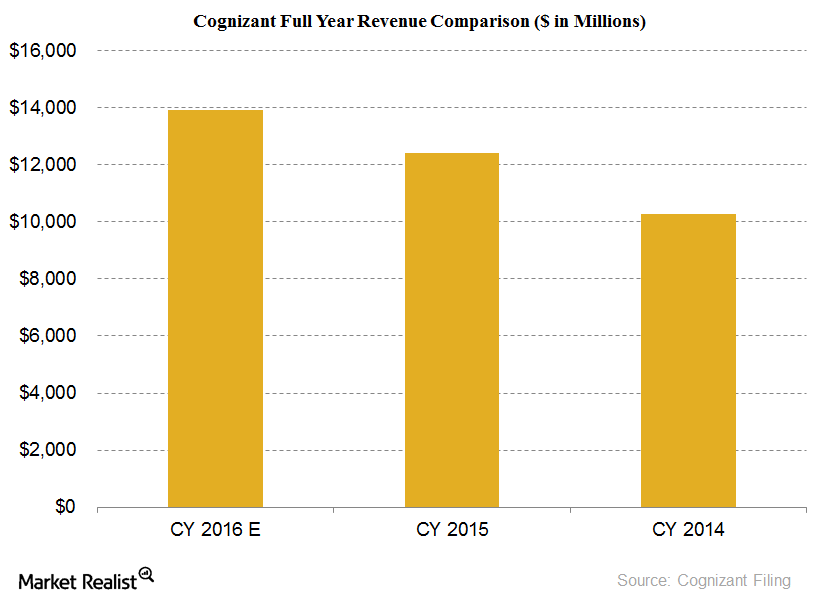

How Cognizant Hopes to Increase Market Share in 2016

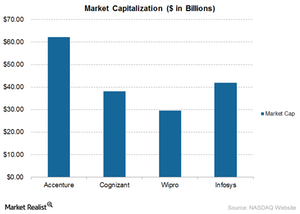

Cognizant’s (CTSH) revenues in 2015 rose by an impressive 21% to $12.4 billion from $10.3 billion in 2014.

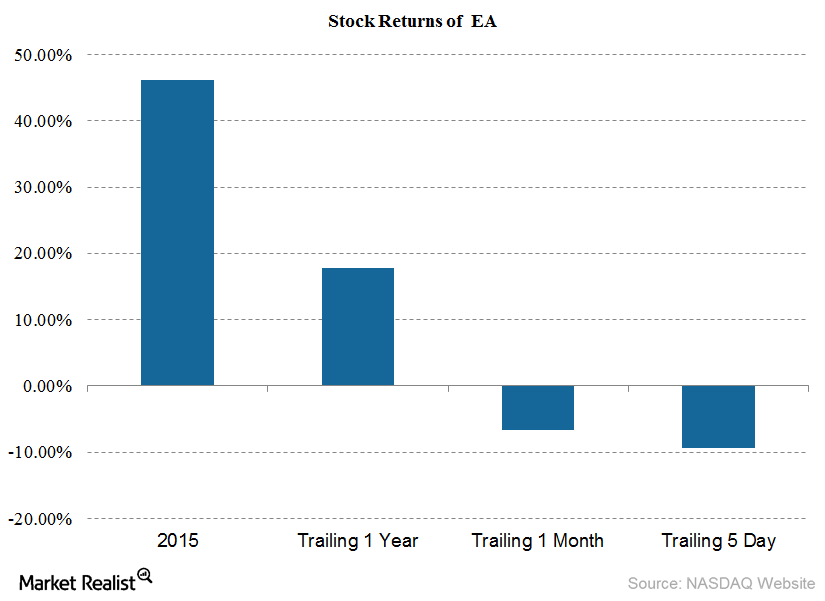

Why EA’s Trading below Moving Averages after Q3 Earnings

Electronic Arts (EA) generated investor returns of 17.8% in the trailing 12 months and -6.6% in the trailing one month

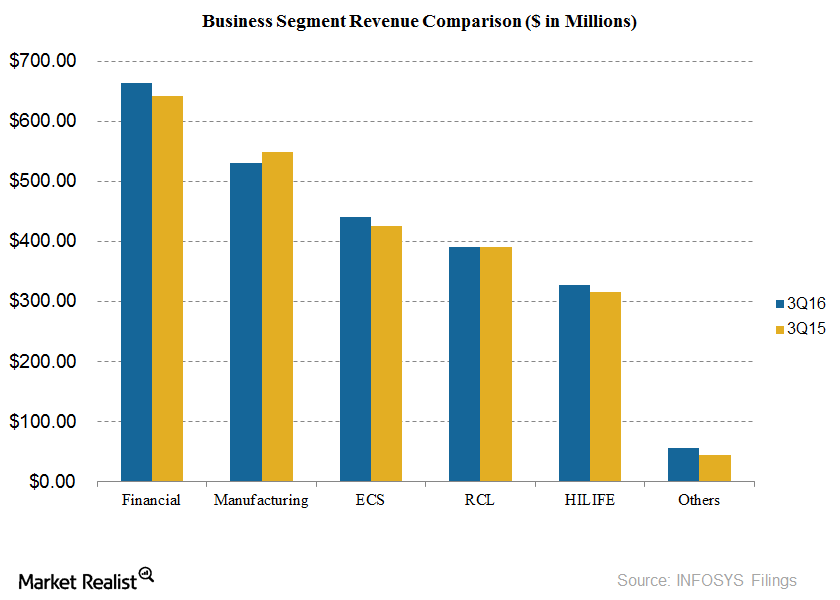

Infosys Revenues by Segment: Financial Services Take the Lead

Revenues from the financial services segment of the India-based (EPI) Infosys (INFY) were $663 million in fiscal 3Q16. This is 27.5% of total revenues.

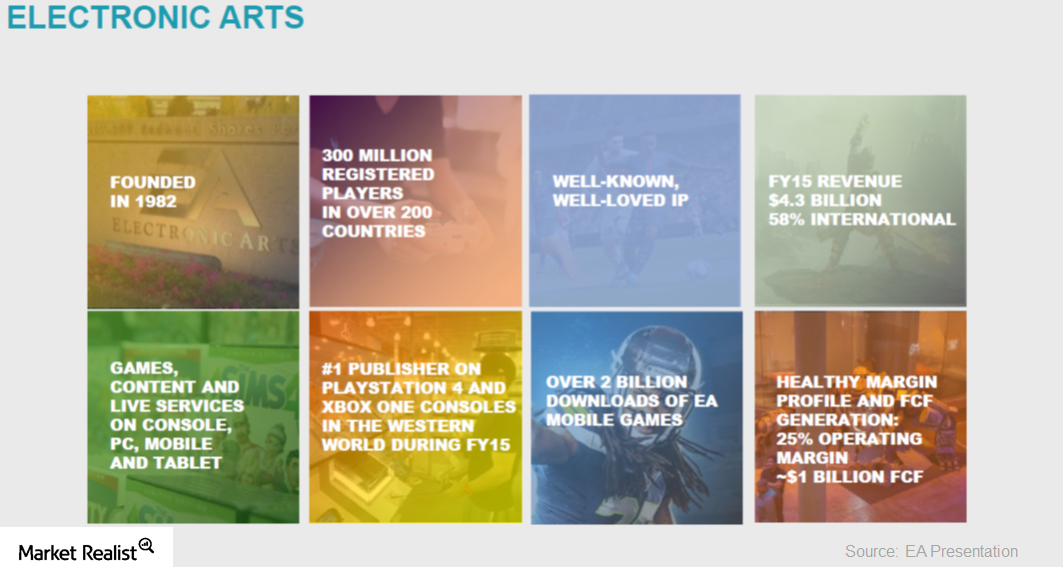

Electronic Arts: A Market Leader in the Gaming Space

Electronic Arts owns an enviable list of gaming franchises such as FIFA, Madden, Battlefield, and Battlefront. The just-released Star Wars game is free to download from Google Play and the App Store.

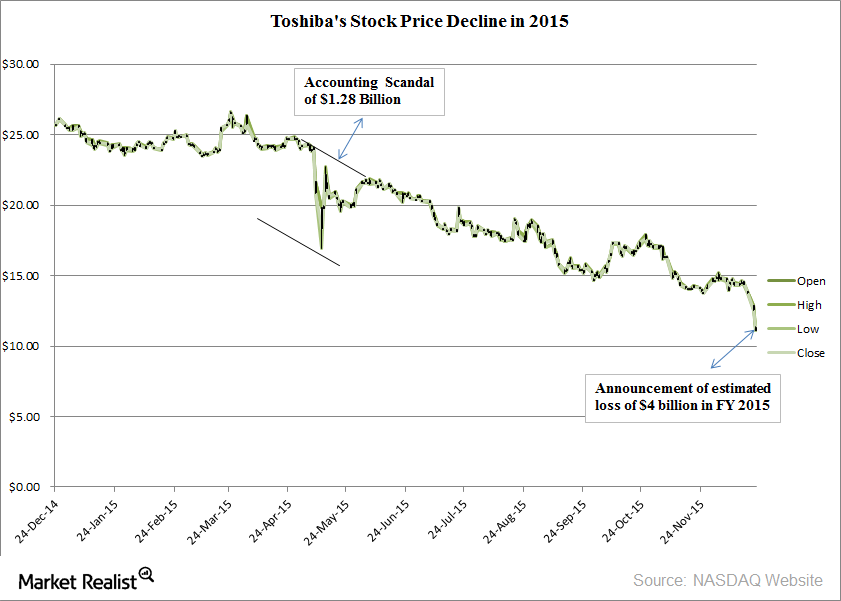

Toshiba to Implement Measures to Prevent Recurrence of Fraud

Toshiba is looking to start an evaluation system for the CEO and president of the company, in which 120 senior managers will hold a vote of confidence in January 2016.

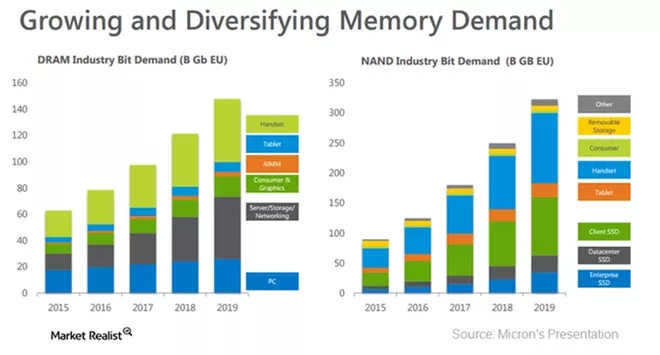

DRAM Prices Fall Due to Weak Demand

DDR4 (double data rate 4) has been consistently gaining market share in overall DRAM (dynamic random access memory) production.

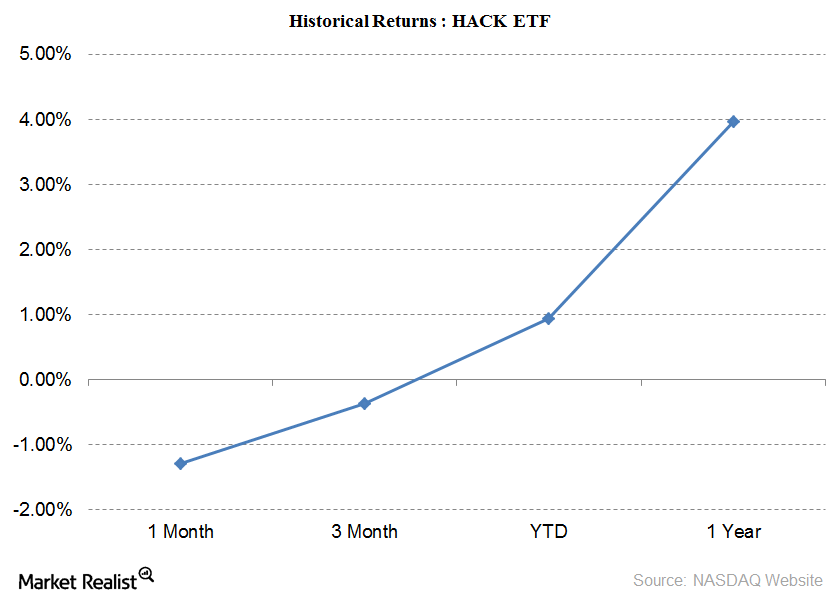

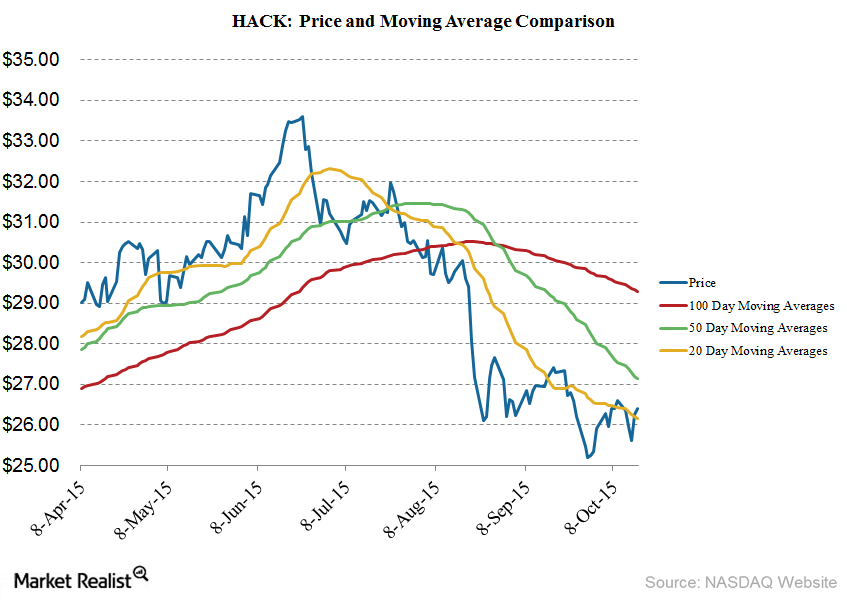

HACK Sees $1.17 Billion in Fund Inflows in Trailing Twelve Month Period

Overview of HACK The Purefunds ISE Cyber Security ETF (HACK) tracks a market-cap weighted portfolio of U.S. cyber security companies. This ETF tracks the performance of 34 publicly listed companies in the US cyber security sector. The market capitalization of the HACK is $1.08 billion with an expense ratio of 0.75% and average daily volume […]

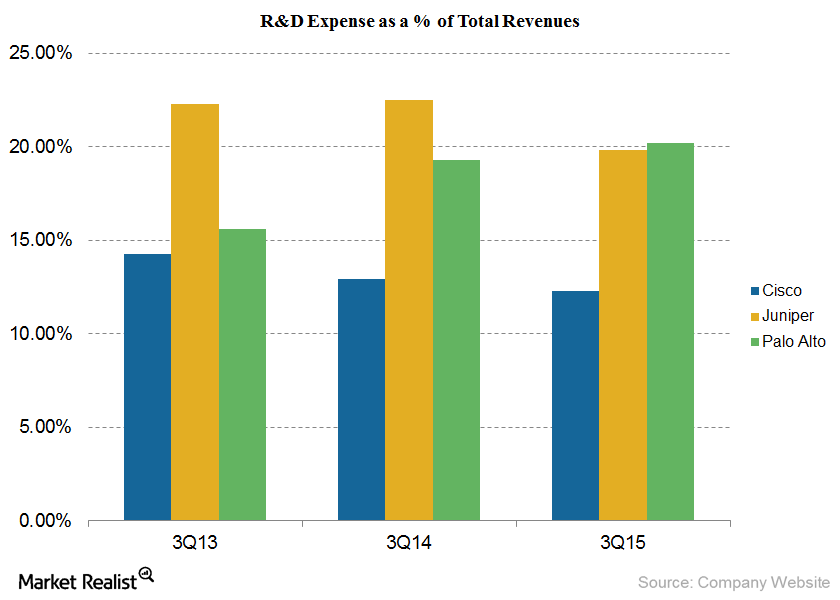

How Do R&D Expenses Compare for Cisco, Juniper, and Palo Alto?

In 3Q15, Palo Alto’s (PANW) research and development (or R&D) expenses increased to $60 million from $37 million in 3Q14 and $20 million in 3Q13.

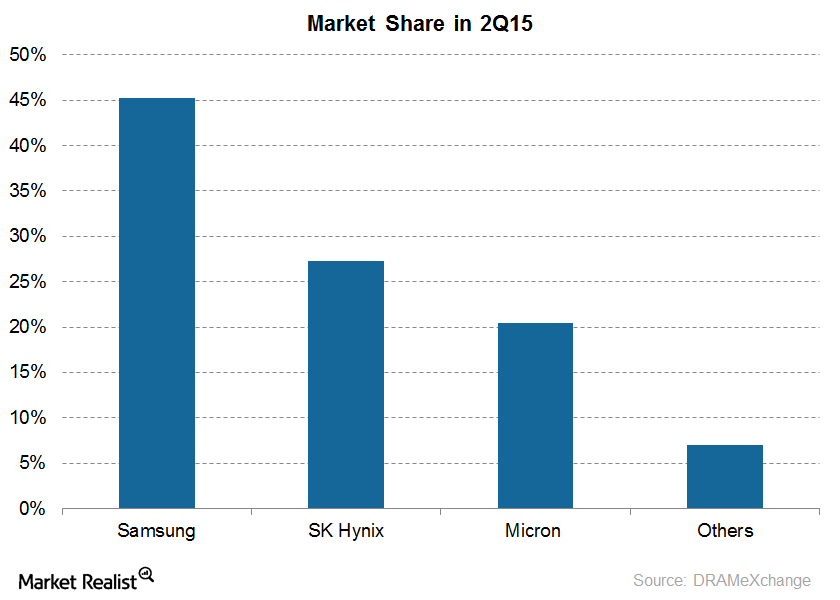

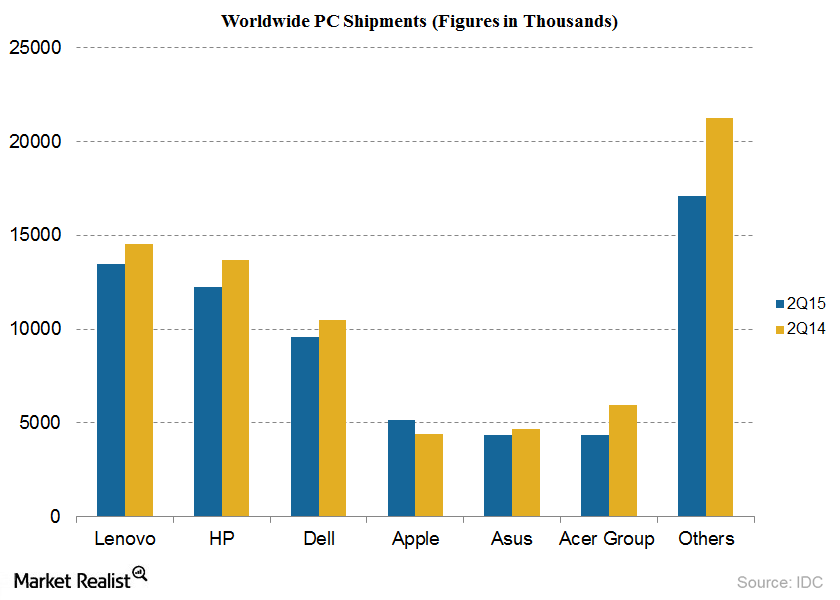

Samsung’s Market Share Is Expected to Increase in Fiscal 2016

Samsung’s market share for the quarter was 45.2%, a gain of 1.1 percentage point YoY compared to 2Q14. It was Samsung’s best ever quarterly performance.

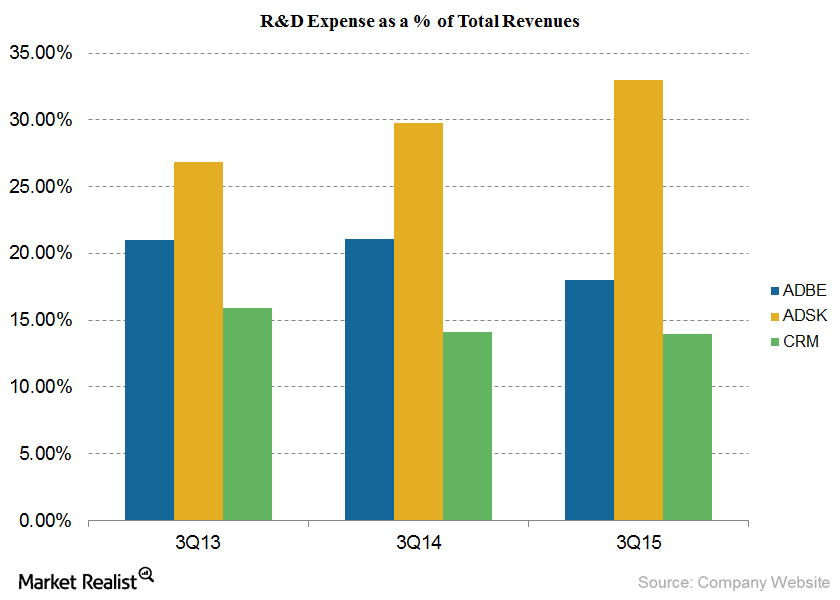

Comparing Adobe, Autodesk, and Salesforce’s R&D Expenses in 3Q15

In 3Q15, Adobe’s (ADBE) expenses for R&D increased to $219 million from $212 million in 3Q14 and $209 million in 3Q13. R&D expenses allocated comprised 17.98% of total revenues in 3Q15.

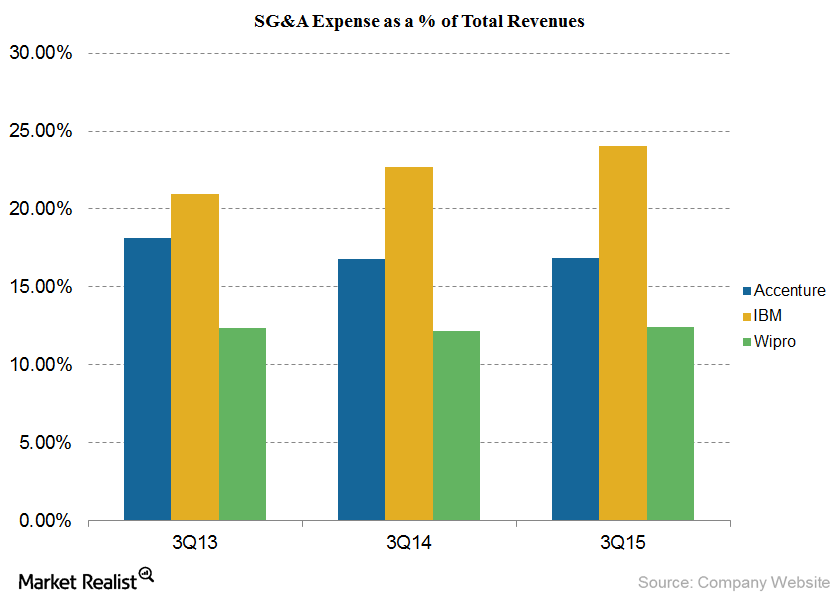

Comparing the SG&A Expenses of Accenture, IBM, and Wipro in 3Q15

In 3Q15, the selling, general, and administrative expenses for Accenture rose to $1.41 billion from $1.38 billion in 3Q14 and $1.36 billion in 3Q13.

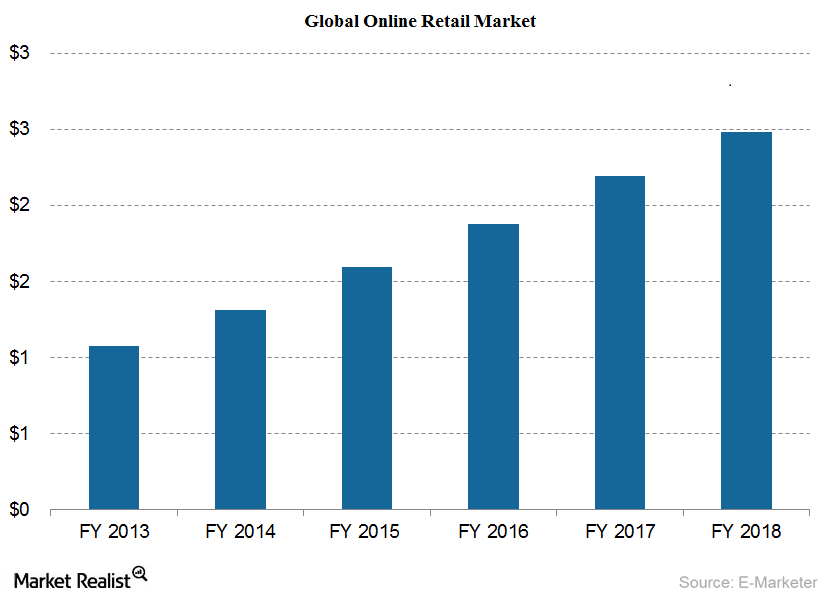

Huge Growth Potential in the Global e-Commerce Market

The global e-commerce market is expected to grow at a CAGR (compound annual growth rate) of 17 from $1.3 trillion in 2014 to $2.5 trillion by the end of 2018.

Macroeconomic Factors Affecting Microsoft’s Performance

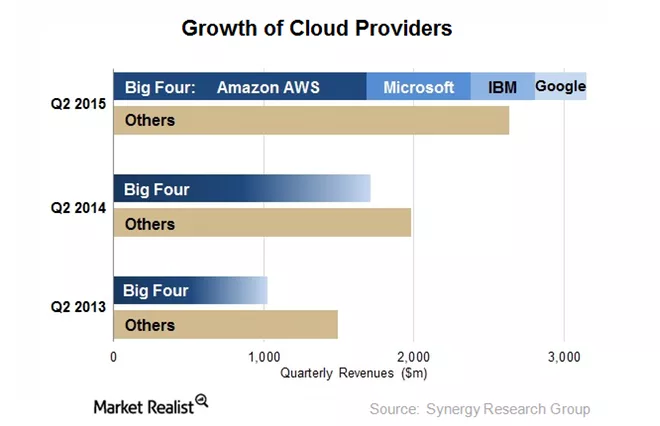

Competition in the technology sector Microsoft (MSFT) faces competition from a number of companies in the tech (technology) sector due to low barriers of entry and continuous evolution of the tech space. As seen in the above chart, Amazon (AMZN), IBM (IBM), and Google (GOOG) are Microsoft’s major competitors in the cloud business segment. Microsoft focuses on […]

HACK Sees $1.3 Billion in Fund Inflows Since Inception

The HACK ETF generated investor returns of 3.7% since inception, and -1.4% in the trailing-one-month period. In comparison, it generated returns of -0.57% YTD.

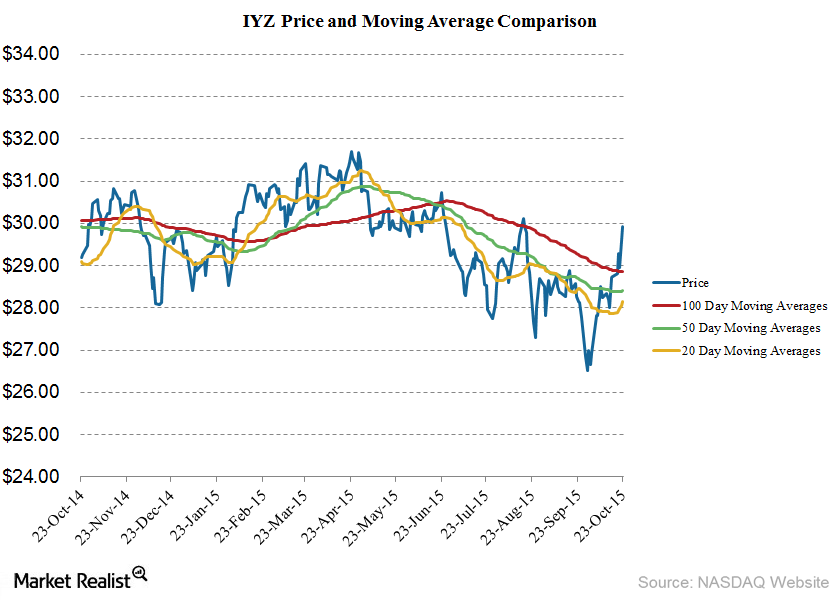

IYZ Sees -$143.8 Million in Fund Outflows in the Trailing 12 Months

The IYZ ETF generated investor returns of 4.3% in the trailing-12-month period, 5.2% in the trailing-one-month period, and 7.9% in the trailing three years.

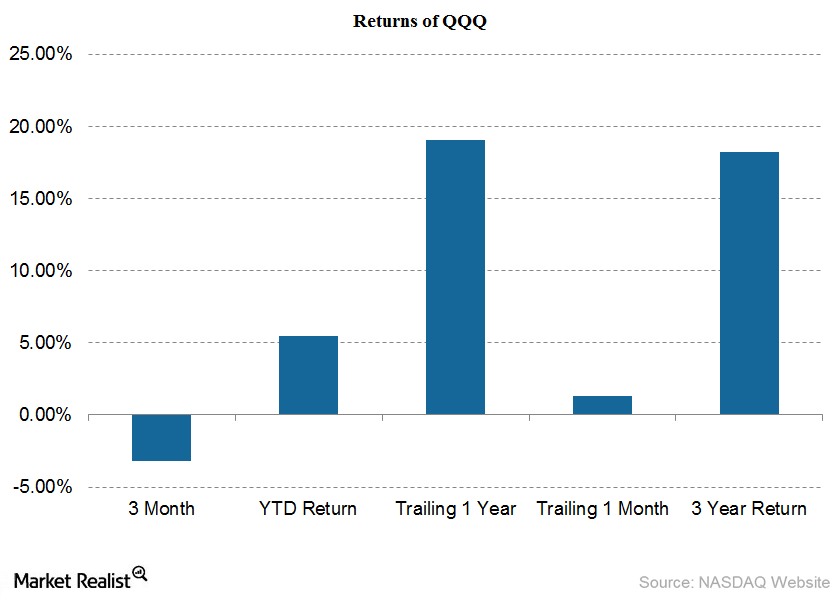

Overview of Stock Performance in PowerShares QQQ

The QQQ ETF has an expense ratio of 0.20%, and its average daily volume of shares traded is $4.7 billion. The price to-earnings ratio of QQQ is 18.53x.

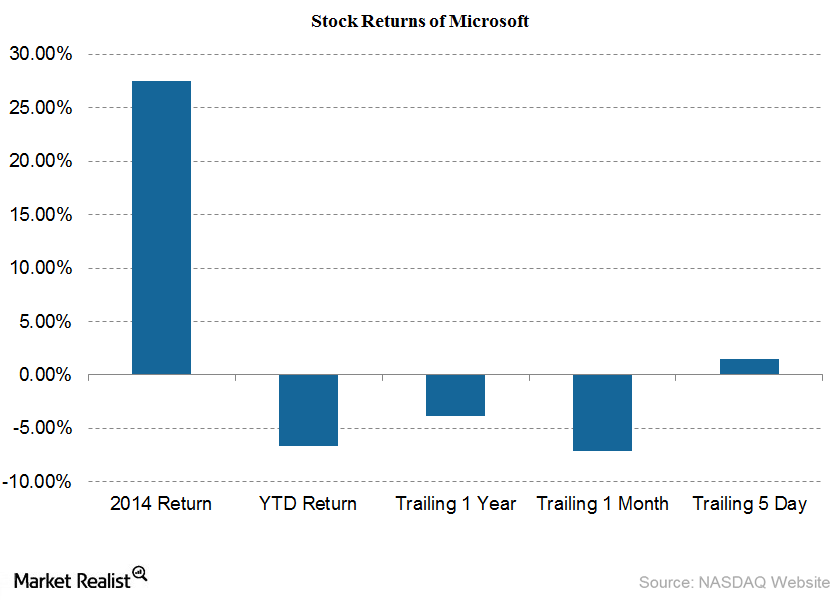

Microsoft Trades below Moving Averages in August

Out of 41 analysts covering Microsoft (MSFT), 22 have a “buy” recommendation on it, six have a “sell” recommendation, and 13 recommend “hold.”

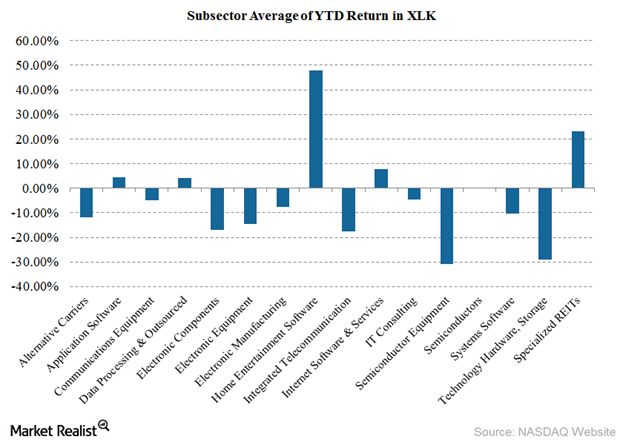

Macroeconomic Factors Affecting Technology Stock Performance in 2015

Macroeconomic factors like the Greek debt crisis, the declining Chinese stock market, and global growth issues have made tech stocks not so attractive.

Macroeconomic Factors Affecting Technology Stocks in 2015

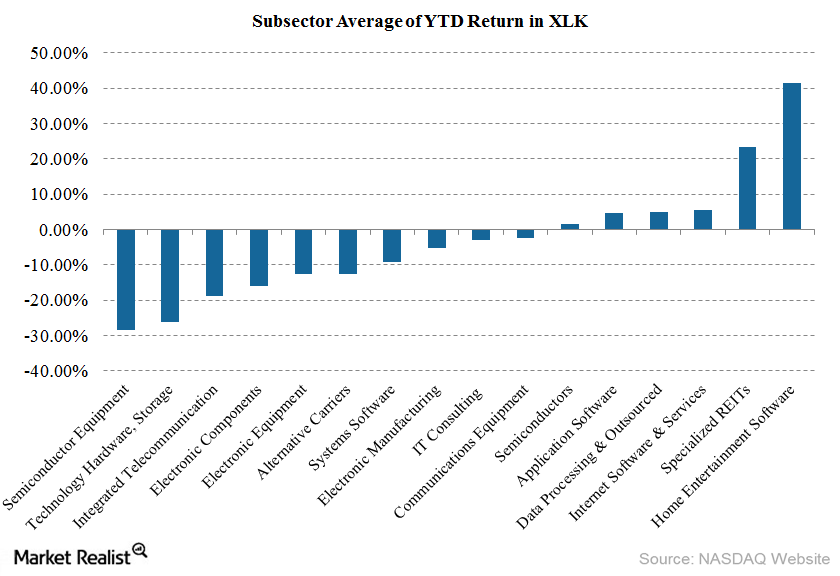

In this series, we’ll analyze the YTD performance of firms in the Technology, Hardware, and Storage subsector and that are a part of the Technology Select Sector SPDR ETF (XLK).

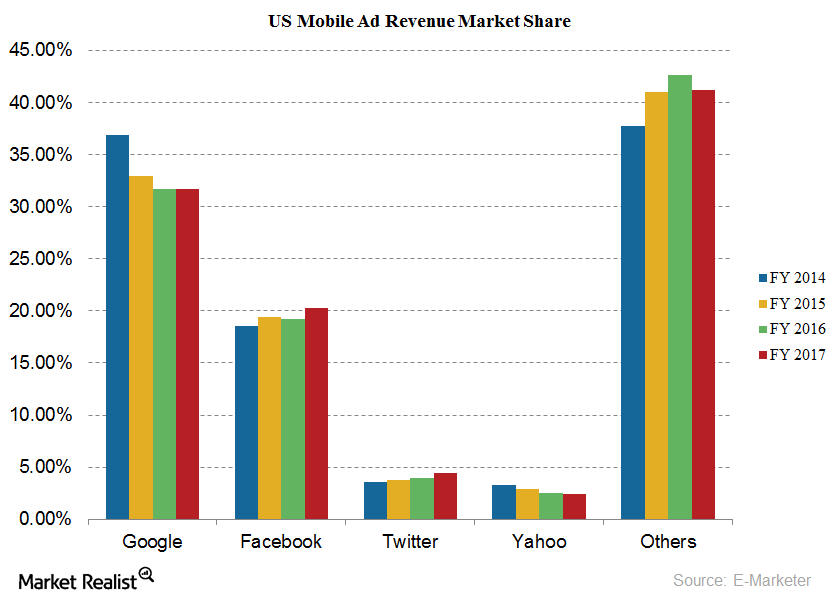

Mobile Advertising: Google Is Losing Market Share to Facebook

Google’s (GOOG) market share in the mobile ad space is expected to fall to 31.70% in 2017. In contrast, Facebook’s market share is expected to grow.

Introducing Accenture, the Largest Global IT Consulting Firm in Revenues

Accenture is one of the world’s largest multinational technology services, management consulting, and outsourcing companies and is headquartered in Dublin.

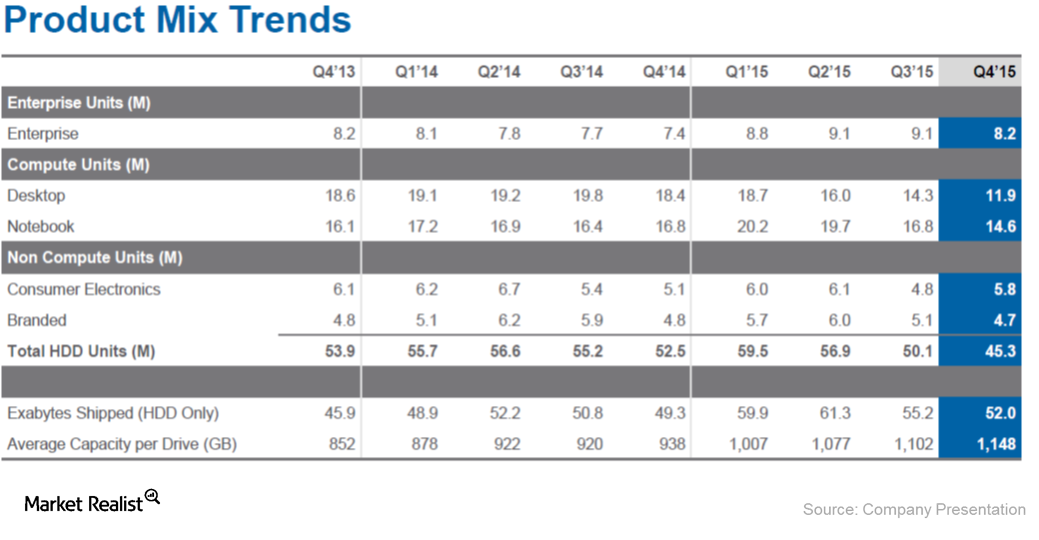

What Are Seagate’s Key Business Segments?

Seagate manufactures products for a variety of business segments, including enterprise applications, and client compute and non-compute applications.

Seagate Technology’s Enterprise Storage Segment Sees 4Q15 Growth

Net shipments for Seagate Technology (STX) declined by 14% in 4Q15 to 43.1 million units in comparison to 51.15 million units in 3Q15 on a quarter-over-quarter basis.

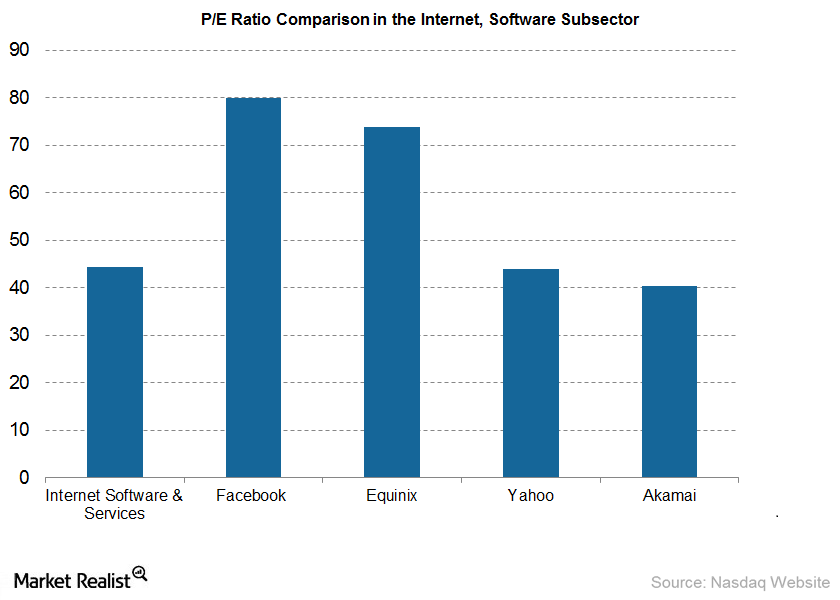

What Does Facebook’s High Price-to-Earnings Ratio in May Tell Us?

In May 2012, Facebook’s stock price was $38, and its PE ratio was 80.0 x. The ratio reached an all-time high of 7,930x, when net income dropped to $53 million that year.

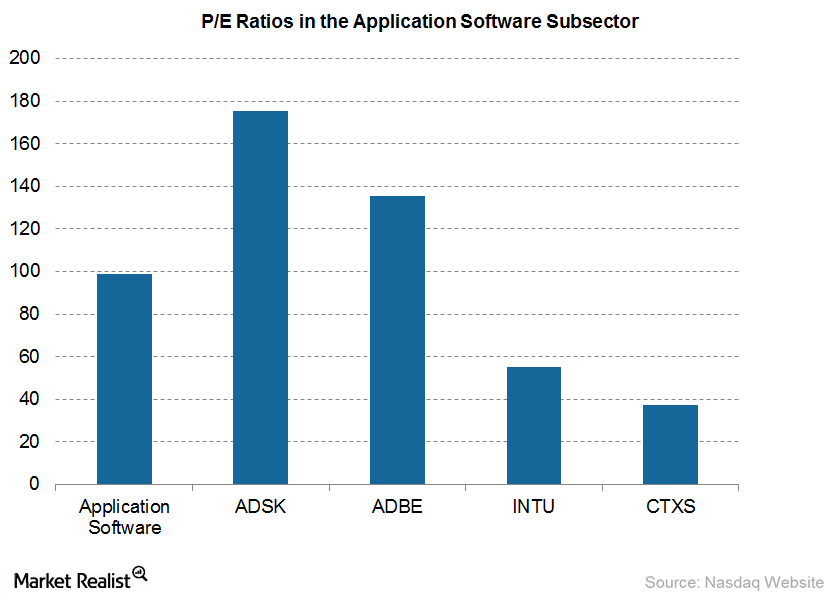

What Does Autodesk’s High Price-to-Earnings Ratio Mean in 2015?

In 4Q15, Autodesk’s subscription business grew 17% to $300 million, beating analysts’ estimates. ADSK’s cloud-based products, Fusion 360 and PLM 360, increased its customer base.

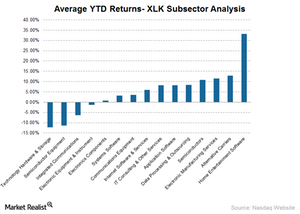

Analyzing the Subsectors in the Technology Select Sector ETF

The Technology Hardware & Storage subsector underperformed the most since the beginning of January 2015. The stocks have primarily generated negative returns.

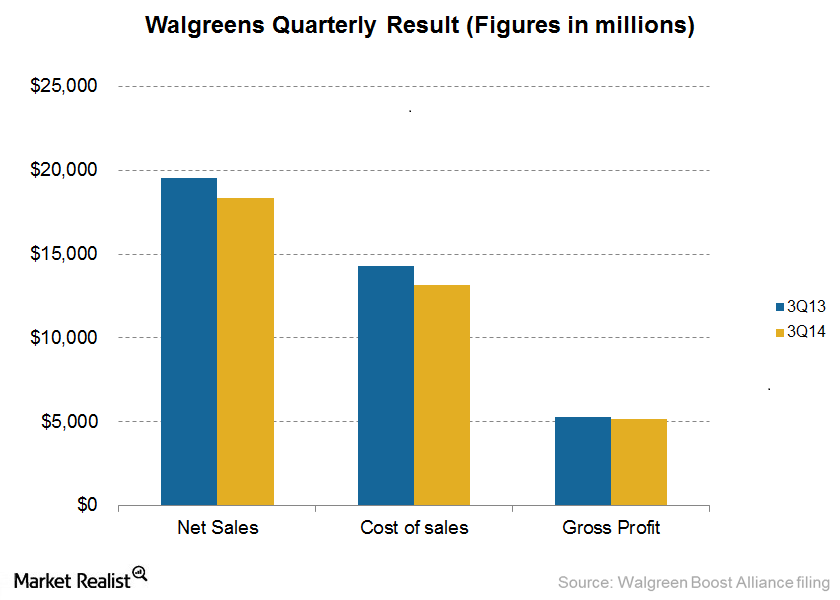

Blue Ridge Capital Opens New Position in Walgreens Boots Alliance

Walgreens Boots Alliance is a firm created by the merger of Walgreens and Alliance Boots in December 2014.

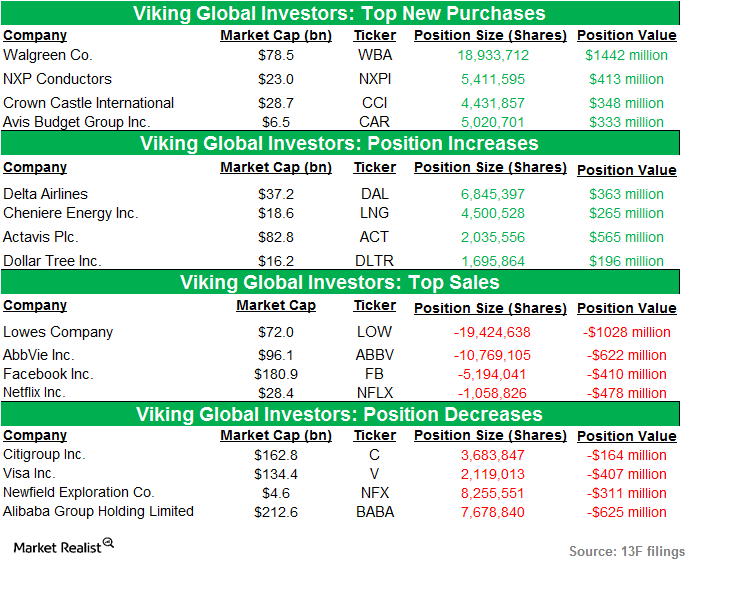

Analyzing Viking Global Investors’ Positions in 4Q14

Viking Global Investors is an US-based hedge fund. The total value of Viking Global’s US long portfolio decreased to $21.78 billion in 4Q14.

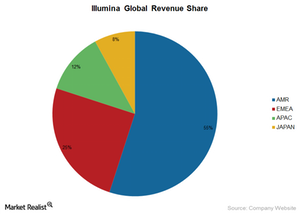

Why Illumina’s outlook is so bright

Illumina’s outlook is outstanding, as it has posted excellent 3Q14 results and its earnings continue to be bullish.

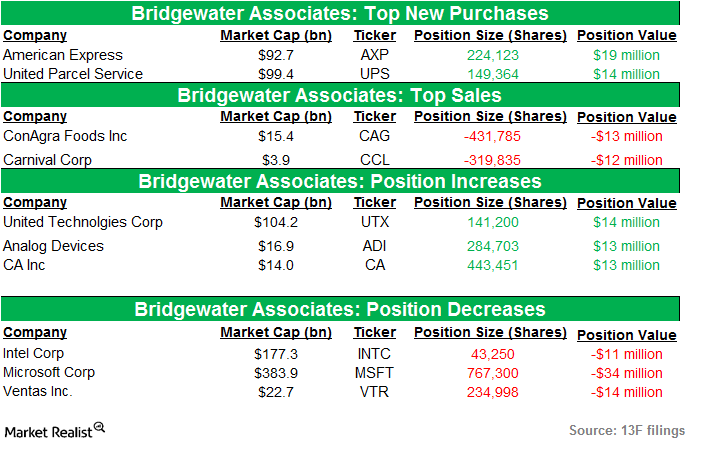

Analyzing Bridgewater Associates’ positions in 3Q14

Bridgewater Associates is an American hedge fund. It was founded in 1975 by Ray Dalio. The firm manages ~$157 billion in global investments.